Table of Contents

Overview

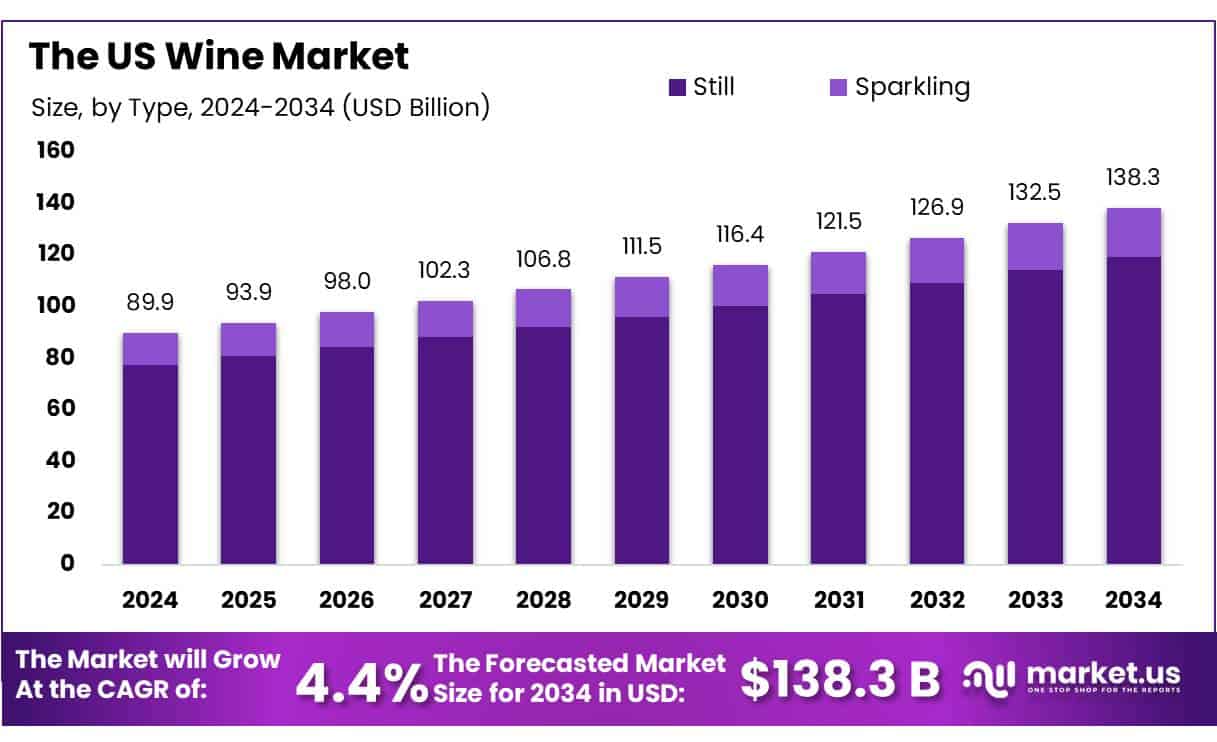

New York, NY – May 06, 2025 – The US Wine Market is poised for steady growth, with its value projected to rise from USD 89.9 billion in 2024 to approximately USD 138.3 billion by 2034, reflecting a compound annual growth rate (CAGR) of 4.4% over the forecast period.

Still wine led the US wine market in 2024, securing an 86.3% share. Its dominance stems from strong consumer preference for its traditional appeal and versatility, suitable for both everyday and special occasions. White wine dominated the US wine market in 2024 with a 52.2% share, driven by its refreshing taste and broad appeal. Cabernet Sauvignon captured an 18.4% share of the US wine market, favored for its rich, full-bodied flavor and versatility in blends and single-varietal wines. Females led the US wine market in 2024 with a 54.3% share, driven by their preference for wine across casual and formal settings.

US Tariff Impact on the US Wine Market

The U.S. is the fourth-largest wine-producing nation in the world, but still doesn’t produce enough to slake the thirst of American wine lovers. Instead, every year, the U.S. imports around 37% of the wine it consumes, about 5 times more than it exports. This analysis was conducted by Rafael del Rey, an international wine economist and founder of Del Rey Analysts of Wine Markets.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/us-wine-market/request-sample/

Headquartered in the EU and with more than 30 years of experience analyzing the global wine trade, he has recently published a report on the impact of the potential 200% tariffs the Trump administration has threatened on E.U. wine exports, as well as strategies businesses can adopt.

Given that 72.3% of the imported wine to the U.S. comes from EU countries, the potential 200% tariff increase would make it nearly impossible for distributors and consumers to continue purchasing them at the new prices, states del Rey in an online interview. For example, a bottle of Veuve-Clicquot Yellow Label Brut Champagne, the top-selling champagne in the U.S. market, which averages around USD 65 per bottle at retail, could soar to over USD 150 per bottle.

Key Takeaways

- US Wine Market size is expected to be worth around USD 138.3 billion by 2034, from USD 89.9 billion in 2024, growing at a CAGR of 4.4%.

- Still wine held a dominant position in the US wine market, capturing more than an 86.3% share.

- White wine held a dominant position in the US wine market, capturing more than a 52.2% share.

- Cabernet Sauvignon held a dominant market position in the US wine market, capturing more than an 18.4% share.

- Off-trade channels held a dominant market position in the US wine market, capturing more than a 68.5% share.

- Bottles held a dominant position in the US wine market, capturing more than a 93.7% share.

- 36-45 held a dominant market position in the US wine market, capturing more than a 34.5% share.

- Females held a dominant market position in the US wine market, capturing more than a 54.3% share.

Analyst Viewpoint

The US wine market in 2025 is a mixed bag of exciting opportunities and real challenges for investors. The market is massive and bottles, reflecting strong consumer trust in traditional formats. Investing in premium wineries, especially those producing Cabernet Sauvignon, that prioritize quality. The rise of e-commerce opens doors for direct-to-consumer models, while sustainable practices like organic wines appeal to eco-conscious Millennials and Gen Z.

However, climate change poses a big risk; unpredictable weather can hurt grape yields, especially for smaller vineyards. Pair that with potential tariffs, which could spike costs, and profitability gets tricky. Investors should focus on wineries with strong digital strategies and sustainable practices to stay competitive.

On the flip side, the regulatory environment is a hurdle that keeps me up at night. Stricter labeling laws and health warnings from federal agencies like the TTB are piling on costs, especially for smaller players who can’t absorb the hit. The “sober curiosity” movement is also gaining traction, U.S. consumers prioritizing low- or no-alcohol options, which could dent traditional wine sales. Yet, this creates a niche for dealcoholization tech, where innovative brands are crafting flavorful non-alcoholic wines.

Report Scope

| Market Value (2024) | USD 89.9 Billion |

| Forecast Revenue (2034) | USD 138.3 Billion |

| CAGR (2025-2034) | 4.4% |

| Segments Covered | By Type (Still, Sparkling), By Color (White, Red, Rose Wine), By Grape Variety (Cabernet Sauvignon, Merlot, Airen, Tempranillo, Chardonnay, Syrah, Grenache, Sauvignon Blanc, Trebbiano Toscana, Others), By Distribution Channel (On-trade, Off -trade), By Packaging Type (Bottles, Cans), By Age Group (18-25 Years, 26-35 Years, 36-45 Years, Above 46 Years), By End-User (Male, Female) |

| Competitive Landscape | The Wine Group, Treasury Wine Estates, Delicato Family Wines, Bronco Wine Company, Ste. Michelle Wine Estates, Jackson Family Wines, Deutsch Family Wine & Spirits, Viña Concha Y Toro (Fetzer Vineyards), Precept Wine, Bogle Vineyards, Vintage Wine Estates, WX Brands, The Family Coppola, C. Mondavi & Family, Foley Family Wines, J. Lohr Vineyards & Wines, Korbel Champagne Cellars, E & J Gallo Winery, Constellation Brands |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=145024

Key Market Segments

By Type

- Still wine led the US wine market in 2024, securing an 86.3% share. Its dominance stems from strong consumer preference for its traditional appeal and versatility, suitable for both everyday and special occasions. The segment has shown consistent year-over-year growth, supported by a diverse consumer base.

By Color

- White wine dominated the US wine market in 2024 with a 52.2% share, driven by its refreshing taste and broad appeal. Popular particularly in warmer months, it caters to varied consumer preferences and maintains robust sales. White wine is expected to continue its strong performance, retaining a significant share of sales. Its versatility and established popularity will likely keep it ahead, even as red and rosé wines gain traction.

By Grape Variety

- In 2024, Cabernet Sauvignon captured an 18.4% share of the US wine market, favored for its rich, full-bodied flavor and versatility in blends and single-varietal wines. Its deep color and complex profile make it a staple in retail and dining settings. Cabernet Sauvignon is anticipated to maintain its leading position, supported by a loyal consumer base and its reputation for quality. While other varieties may grow, its consistent appeal will keep it at the forefront.

By Distribution Channel

- Off-trade channels, including retail stores, supermarkets, and online platforms, held a 68.5% share of the US wine market in 2024. Their dominance is fueled by consumer demand for convenience and the rise of e-commerce, offering diverse wine selections for home consumption.

By Packaging Type

- Bottles overwhelmingly led the US wine market in 2024 with a 93.7% share, valued for their convenience, quality preservation, and universal presence in retail and hospitality. They remain the standard for wine packaging. Bottles are likely to maintain their dominance, with minimal shifts in consumer preference. Despite some growth in alternative packaging like cans and cartons, bottles’ traditional appeal and infrastructure will ensure their market leadership.

By Age Group

- The 36-45 age group commanded a 34.5% share of the US wine market in 2024, blending preferences for premium and everyday wines. Their purchasing power and interest in diverse wine experiences significantly boost market growth. This demographic is expected to remain the primary driver of wine demand, fueled by their engagement with wine trends, pairings, and social occasions. Their influence will continue to shape the market’s direction.

By End-User

- Females led the US wine market in 2024 with a 54.3% share, driven by their preference for wine across casual and formal settings. Social trends and diverse wine offerings tailored to their tastes strengthen their dominance. Females will likely retain their leading role, supported by growing participation in wine culture through tastings and online communities. Their enthusiasm for new varieties and brands will continue to drive market growth.

Top Use Cases

- Retail Strategy Development: Retailers can use market data to stock popular wines like Cabernet Sauvignon and White wine. Focusing on off-trade channels ensures convenience for home consumption, boosting sales through supermarkets and online platforms.

- Targeted Marketing Campaigns: Brands can target females. Creating campaigns for casual and social occasions, emphasizing still wine’s dominance, can drive engagement and loyalty among these key demographics.

- Product Innovation: Wineries can develop new still wine flavors or low-alcohol options. Introducing canned or boxed wines, despite bottles, can attract younger, eco-conscious consumers seeking sustainable and convenient packaging.

- E-commerce Expansion: With off-trade channels, wineries can invest in online platforms and subscriptions. Offering diverse selections like White wine and promoting direct-to-consumer sales can enhance accessibility and grow market reach.

- Event and Hospitality Planning: Restaurants and event planners can prioritize Cabernet Sauvignon and White wine, which hold strong market shares. Stocking bottled wines ensures quality and meets consumer preferences for traditional formats at gatherings.

Recent Developments

1. The Wine Group

- The Wine Group, owner of brands like Franzia and Cupcake Vineyards, has focused on sustainability and innovation. They recently expanded their premium wine offerings, including new organic and low-alcohol options. The company also invested in solar energy to reduce its carbon footprint. Additionally, they acquired new vineyards in California to secure high-quality grape supplies.

2. Treasury Wine Estates

- Treasury Wine Estates, known for Penfolds and Beringer, has been expanding its U.S. luxury wine segment. They launched new Napa Valley Cabernet Sauvignons under the Beringer brand and invested in direct-to-consumer sales. The company also rebranded its 19 Crimes line with augmented reality labels. Treasury continues to focus on premiumization amid shifting consumer trends.

3. Delicato Family Wines

- Delicato, famous for Gnarly Head and Bota Box, acquired the luxury wine brand DAOU Vineyards, strengthening its premium portfolio. They also expanded their sustainability initiatives, achieving certification for water and energy efficiency. Delicato introduced new canned wine options to cater to younger consumers. The company continues to grow through strategic acquisitions and innovation.

4. Bronco Wine Company

- Bronco Wine, producer of Charles Shaw Two Buck Chuck, has been expanding its distribution network. They introduced new varietals under their popular brands and focused on value-driven wines to attract budget-conscious consumers. Bronco also invested in sustainable packaging, including lightweight bottles, to reduce environmental impact.

5. Ste. Michelle Wine Estates

- Ste. Michelle, known for Chateau Ste. Michelle and 14 Hands were acquired by Sycamore Partners. The company has since refreshed its branding and expanded its premium offerings, including new red blends from Washington State. They also emphasized eco-friendly practices, such as regenerative viticulture.

Conclusion

The US Wine Market is evolving as major players adapt to changing consumer preferences, sustainability demands, and premiumization trends. Companies like The Wine Group and Bronco Wine are focusing on value-driven and eco-friendly innovations, while Treasury Wine Estates and Delicato are expanding their luxury portfolios through acquisitions and new product launches. Ste. Michelle Wine Estates, under new ownership, is reinforcing its premium offerings and sustainable practices.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)