Table of Contents

- Introduction

- Editor’s Choice

- Electric Toothbrush Market Statistics

- Types of Power Toothbrushes Used by Consumers

- Electric Toothbrush Ownership Trends Statistics

- Usage of Power Toothbrushes

- Electric Toothbrush Usage – According to Brand Statistics

- Electric Toothbrushes Usage – By Expenditure Statistics

- Sales Statistics of Electric Toothbrush

- Frequency Usage of Different Electric Toothbrush Statistics

- Comparison of Usage Between Manual and Automatic Toothbrushes

- Consumer Preferences and Trends

- Innovations and Developments in Electric Toothbrush Statistics

- Regulations for Electric Toothbrushes

- Recent Developments

- Conclusion

- FAQs

Introduction

Electric Toothbrush Statistics: Electric toothbrushes are powered devices that use rapid brush movements, like oscillating-rotating or sonic vibrations, to clean teeth more effectively than normal brushing.

They typically run on rechargeable batteries and feature timers to ensure users brush for the recommended 2 minutes.

Some models include pressure sensors to prevent brushing too hard, which can harm gums. Replaceable brush heads come in different types for specific needs like sensitive teeth or gum care.

Overall, electric toothbrushes offer better plaque removal and enhanced oral hygiene compared to manual brushes.

Editor’s Choice

- By 2033, the global electric toothbrush market is expected to achieve a size of USD 8.4 billion.

- In 2023, the global electric toothbrush market was dominated by adult users, who account for 75.5% of the total market share.

- In 2020, the U.S. population demonstrated a clear preference for electric rechargeable toothbrushes, with 72.42 million consumers using this type of power toothbrush.

- Consumer willingness to buy electric toothbrushes differs by gender. While 17% of males are interested, 42% of females are. However, 30% of females are unwilling, indicating greater interest among women.

- Consumer decisions on electric toothbrushes are influenced by various factors, with notable gender differences. Price sensitivity is a key barrier, with 11% of males and 21% of females citing high prices as a deterrent.

- Philips’ Sonicare 9900 Prestige is noted for its sophisticated real-time feedback and customizable settings that adjust to the user’s brushing technique, improving oral health over time.

- Internationally, compliance with standards such as IEC 60335-2-59 is mandatory for electric toothbrushes to ensure safety requirements and performance criteria are met.

Electric Toothbrush Market Statistics

Global Electric Toothbrush Market Size Statistics

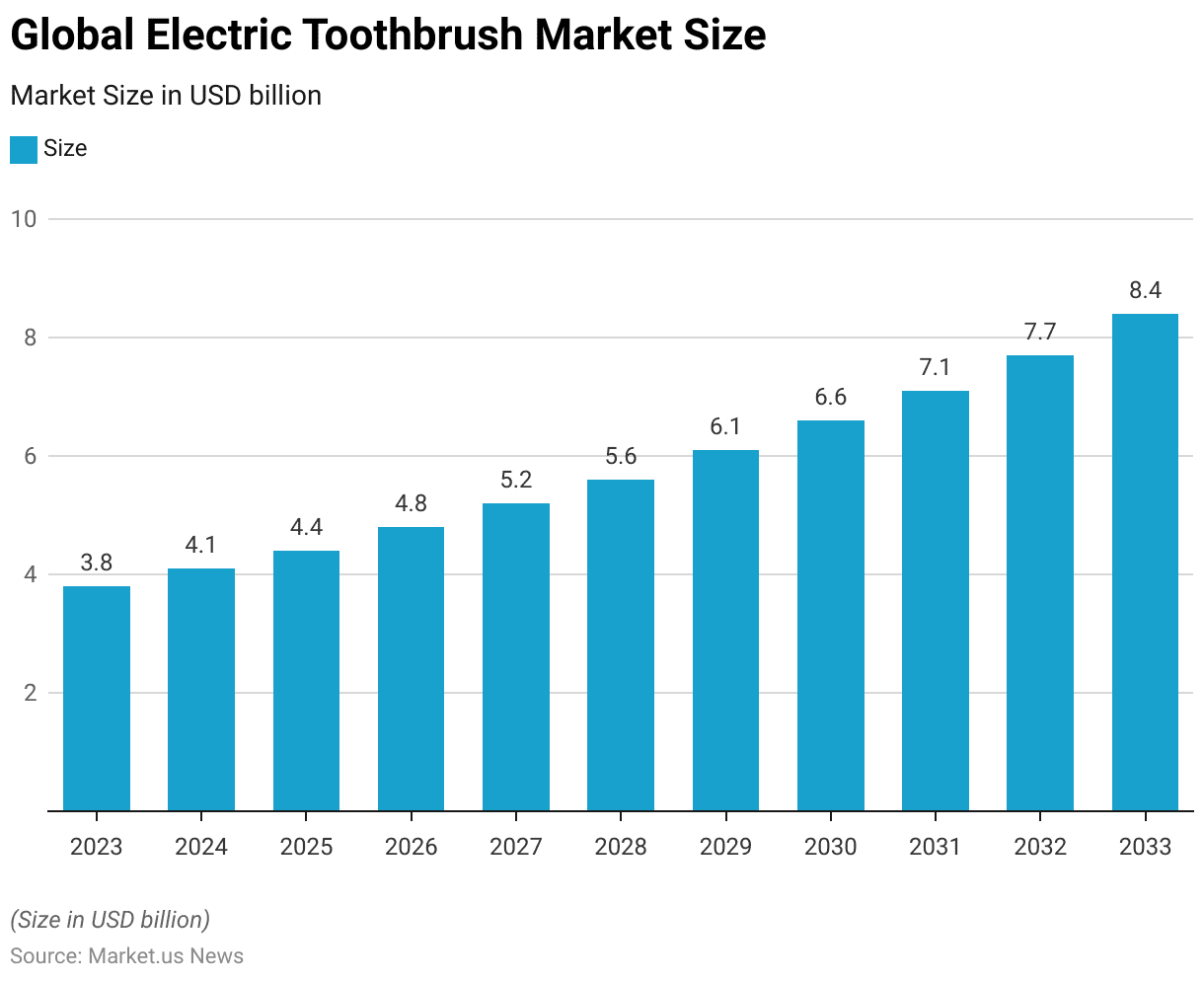

- The global electric toothbrush market is projected to experience steady growth over the coming years at a CAGR of 8.2%.

- In 2023, the market size is estimated at USD 3.8 billion and is expected to rise to USD 4.1 billion in 2024.

- By 2025, the market will continue to grow, reaching USD 4.4 billion, and it is forecasted to further expand to USD 4.8 billion by 2026.

- In the following years, the market will maintain a positive growth trajectory, increasing to USD 5.2 billion in 2027 and USD 5.6 billion in 2028.

- The market is anticipated to surpass USD 6 billion by 2029, with projections indicating a size of USD 6.6 billion in 2030.

- This upward trend will continue into the 2030s, with the market estimated to reach USD 7.1 billion in 2031 and USD 7.7 billion in 2032.

- By 2033, the global electric toothbrush market is expected to achieve a size of USD 8.4 billion.

(Source: market.us)

Global Electric Toothbrush Market Size – By Type Statistics

2023-2027

- The global electric toothbrush market, segmented by type into rechargeable and battery-powered toothbrushes, is expected to witness substantial growth over the forecast period.

- In 2023, the total market size is estimated at USD 3.8 billion, with rechargeable toothbrushes contributing USD 2.72 billion and battery-powered toothbrushes accounting for USD 1.08 billion.

- By 2024, the market is projected to grow to USD 4.1 billion, with rechargeable models at USD 2.93 billion and battery-powered variants at USD 1.17 billion.

- This growth continues in 2025, with the total market reaching USD 4.4 billion, of which USD 3.15 billion comes from rechargeable toothbrushes and USD 1.25 billion from battery-powered ones.

- In 2026, the market size is forecasted at USD 4.8 billion, comprising USD 3.43 billion from rechargeable and USD 1.37 billion from battery-powered toothbrushes.

- By 2027, the market is expected to grow to USD 5.2 billion, with rechargeable toothbrushes contributing USD 3.72 billion and battery-powered toothbrushes USD 1.48 billion.

2028-2033

- Further growth is anticipated, with the total market size reaching USD 5.6 billion in 2028 (USD 4.00 billion rechargeable, USD 1.60 billion battery-powered) and USD 6.1 billion in 2029 (USD 4.36 billion rechargeable, USD 1.74 billion battery-powered).

- By 2030, the market size is projected to hit USD 6.6 billion, with rechargeable models at USD 4.72 billion and battery-powered ones at USD 1.88 billion.

- The upward trend continues into the 2030s, with the market reaching USD 7.1 billion in 2031 (USD 5.08 billion rechargeable, USD 2.02 billion battery-powered), USD 7.7 billion in 2032 (USD 5.51 billion rechargeable, USD 2.19 billion battery-powered), and finally USD 8.4 billion in 2033, with rechargeable toothbrushes contributing USD 6.01 billion and battery-powered toothbrushes USD 2.39 billion.

- This steady growth underscores the increasing adoption of electric toothbrushes across the globe.

(Source: market.us)

Global Electric Toothbrush Market Share – By End-user Statistics

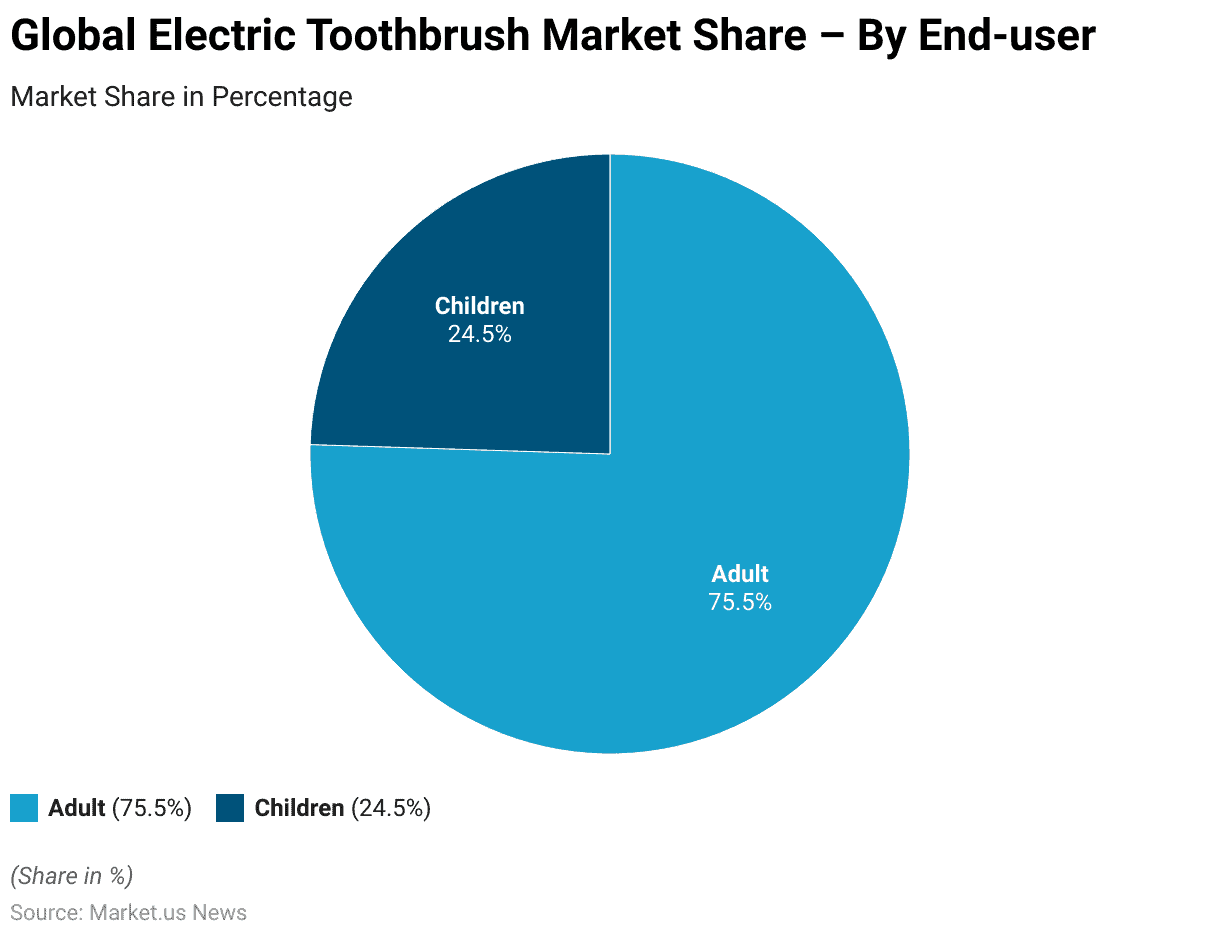

- In 2023, the global electric toothbrush market is dominated by adult users, who account for 75.5% of the total market share.

- This significant share highlights the widespread adoption and preference for electric toothbrushes among the adult population, driven by factors such as increased awareness of oral hygiene and the availability of advanced features tailored to adult needs.

- On the other hand, children represent a smaller but notable share of 24.5%, reflecting growing awareness among parents regarding the importance of oral care for children and the availability of child-friendly electric toothbrush designs.

- This segmentation underscores the market’s dual focus on catering to the distinct needs of both adults and children.

(Source: market.us)

Types of Power Toothbrushes Used by Consumers

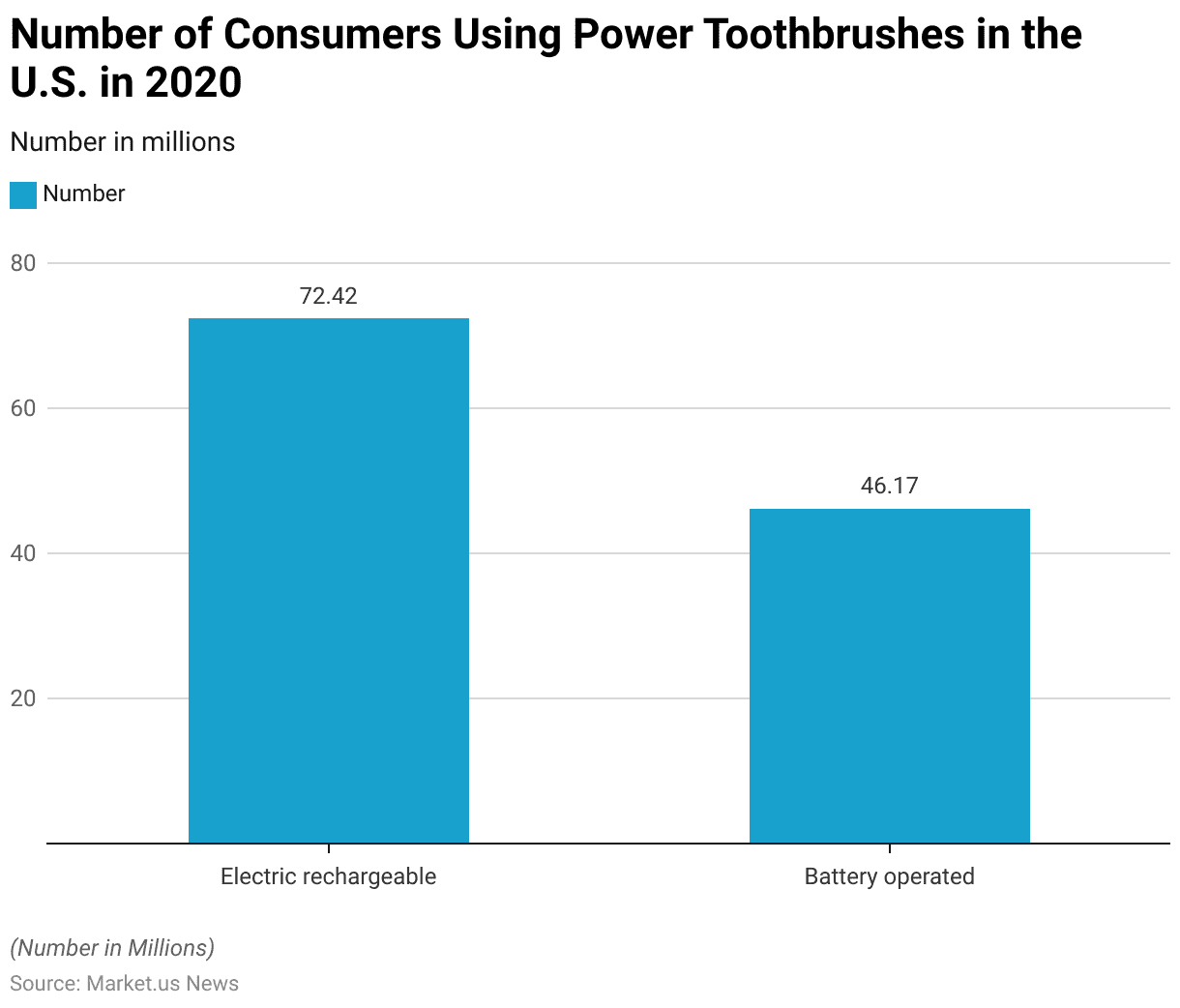

- In 2020, the U.S. population demonstrated a clear preference for electric rechargeable toothbrushes, with 72.42 million consumers using this type of power toothbrush.

- This popularity highlights the growing demand for rechargeable models, driven by their convenience, long-term cost-effectiveness, and advanced features. In comparison, battery-operated toothbrushes were used by 46.17 million consumers.

- While battery-operated models are more affordable and portable, their lower adoption compared to rechargeable ones reflects consumer preference for more durable and efficient alternatives.

- This data underscores the dominance of rechargeable toothbrushes in the U.S. power toothbrush market.

(Source: Statista)

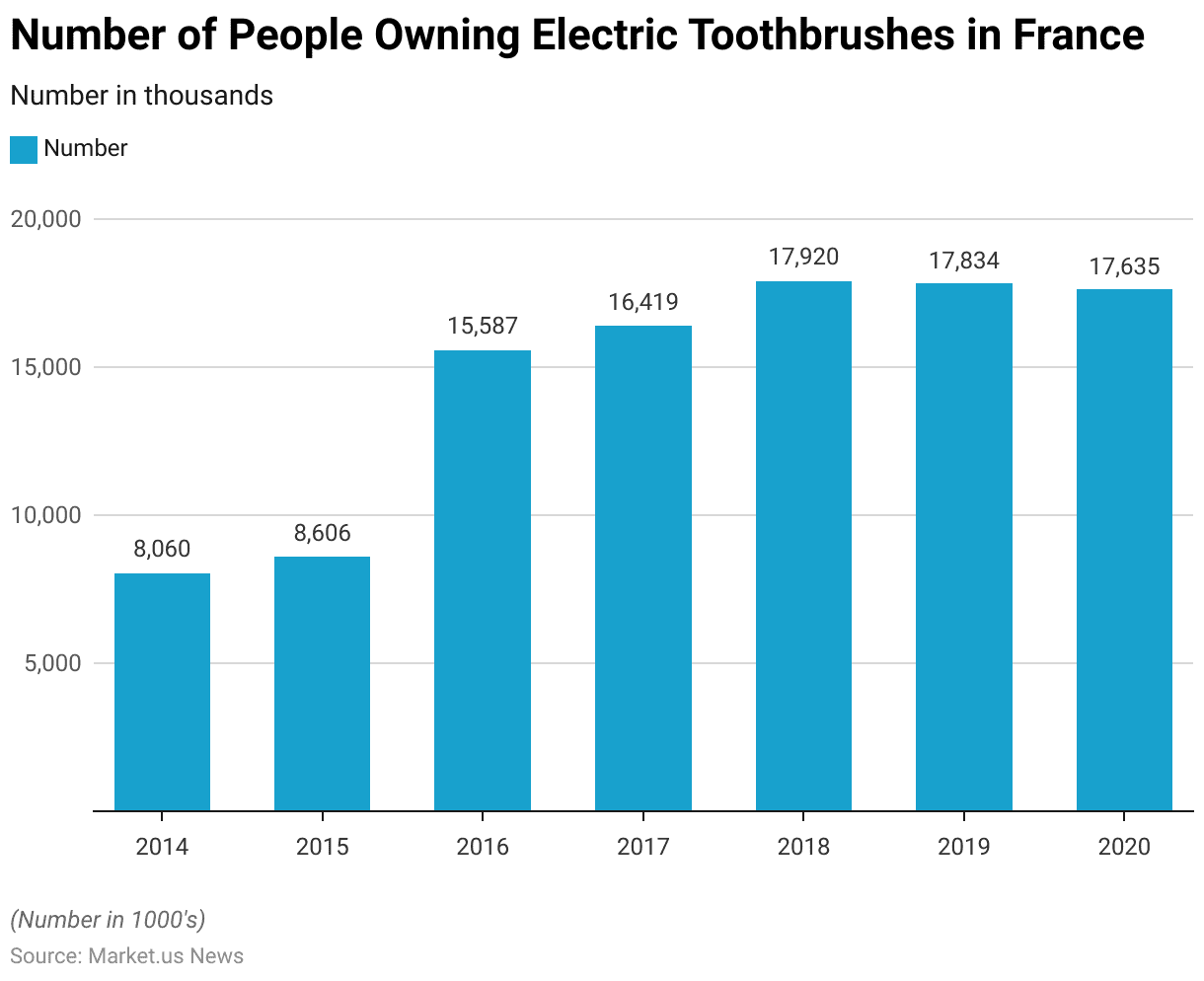

Electric Toothbrush Ownership Trends Statistics

- The ownership of electric toothbrushes in France experienced significant growth from 2014 to 2020, demonstrating a rising trend in the adoption of advanced oral hygiene solutions.

- In 2014, approximately 8,060 thousand individuals owned electric toothbrushes, marking the starting point of this upward trajectory.

- By 2015, the number increased modestly to 8,606 thousand, reflecting a gradual but consistent rise in consumer interest.

- A notable surge occurred in 2016, with ownership figures nearly doubling to 15,587 thousand, showcasing a significant shift in consumer preferences toward electric dental care products.

- This momentum continued into 2017, when ownership numbers climbed further to 16,419 thousand, maintaining strong year-on-year growth.

- By 2018, the number of people owning electric toothbrushes in France reached its peak at 17,920 thousand, indicating widespread acceptance and growing market penetration.

- However, a slight stabilization followed, with ownership figures marginally declining to 17,834 thousand in 2019 and slightly further to 17,635 thousand in 2020.

- Despite the small dip in 2019 and 2020, the overall trend from 2014 to 2020 highlights a significant increase in the adoption of electric toothbrushes, driven by factors such as greater awareness of oral hygiene, advancements in technology, and the availability of innovative products.

- This seven-year period reflects a transformative shift in consumer behavior, positioning electric toothbrushes as an essential part of modern dental care routines in France.

(Source: Statista)

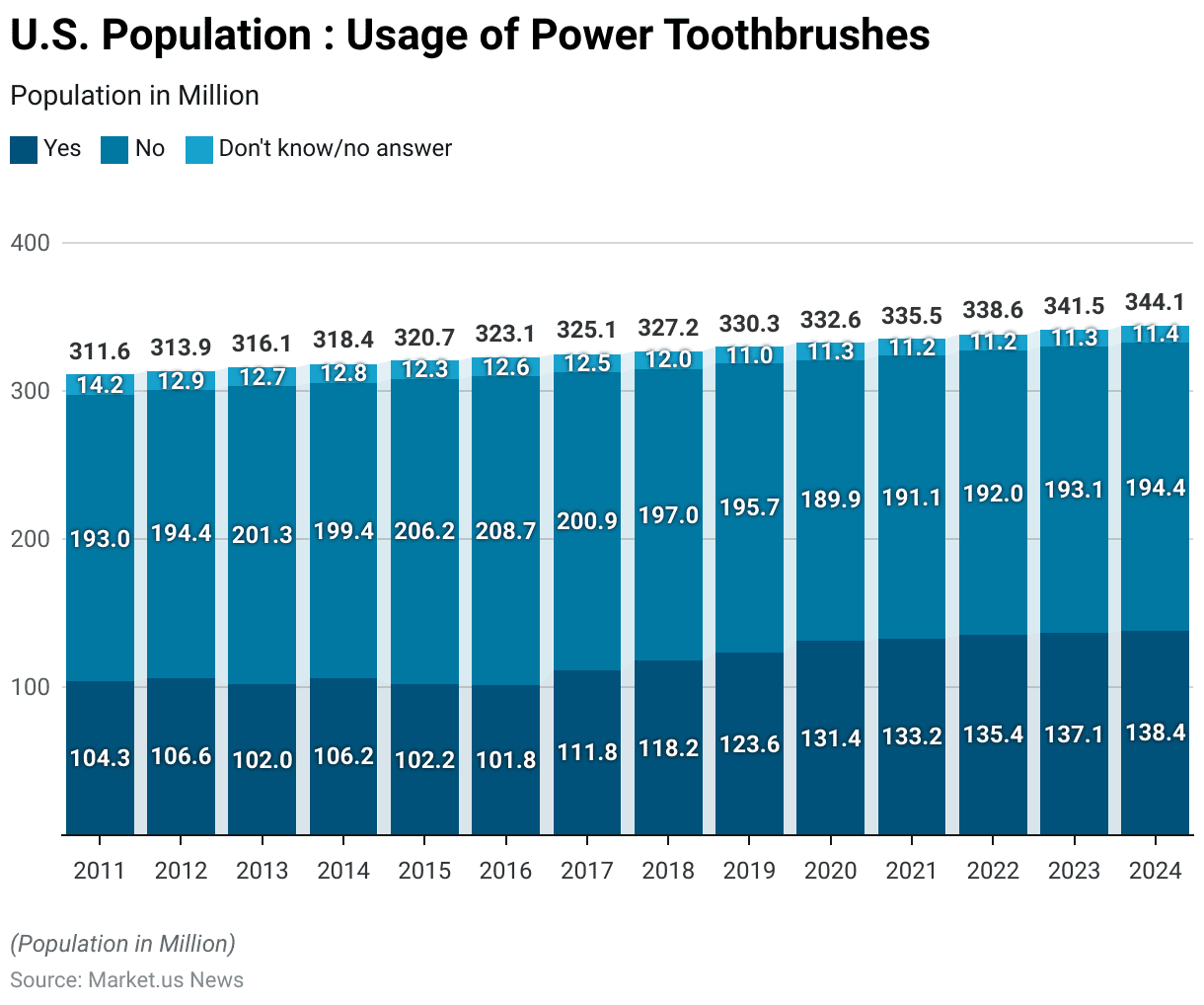

Usage of Power Toothbrushes

2011-2017

- The usage of power toothbrushes in the U.S. population has shown notable trends from 2011 to 2024, highlighting shifting consumer preferences and awareness of dental hygiene.

- In 2011, approximately 104.31 million individuals reported using power toothbrushes, while 193.03 million did not, and 14.24 million were uncertain or did not answer.

- This marked the beginning of a gradual increase in the adoption of power toothbrushes. By 2012, the number of users slightly rose to 106.56 million, while non-users increased to 194.4 million, with a decrease in the “don’t know” category to 12.91 million.

- In 2013, the number of users dropped to 102.02 million, with non-users peaking at 201.34 million and 12.69 million remaining uncertain.

- A recovery followed in 2014, with 106.16 million users, 199.41 million non-users, and 12.81 million unsure.

- However, 2015 and 2016 saw slight declines in users to 102.21 million and 101.82 million, respectively, while non-users reached 206.21 million and 208.7 million. Those uncertain remained relatively stable at 12.32 million in 2015 and 12.55 million in 2016.

- A significant shift occurred in 2017, as the number of users rose to 111.79 million, with non-users declining to 200.9 million and 12.45 million uncertain.

2018-2024

- This upward trend continued in 2018, with 118.16 million users, while non-users decreased further to 196.98 million, and those unsure dropped to 12.02 million.

- By 2019, the user base had expanded to 123.61 million, accompanied by a reduction in non-users to 195.68 million and 10.98 million uncertain.

- The growth in power toothbrush usage was most pronounced from 2020 to 2024. In 2020, users increased to 131.43 million, with non-users decreasing to 189.86 million and 11.34 million unsure.

- This trend continued in 2021, with 133.18 million users, 191.13 million non-users, and 11.18 million uncertain. By 2022, the user base grew to 135.4 million, while non-users stabilized at 191.97 million, and 11.22 million remained unsure.

- In 2023 and 2024, the number of users reached 137.06 million and 138.4 million, respectively, while non-users slightly rose to 193.11 million in 2023 and 194.35 million in 2024. The uncertain category remained steady at 11.29 million in 2023 and 11.36 million in 2024.

- These figures demonstrate a clear and consistent increase in the adoption of power toothbrushes, reflecting greater awareness of oral health and the availability of advanced dental care products in the U.S. over the years.

(Source: Statista)

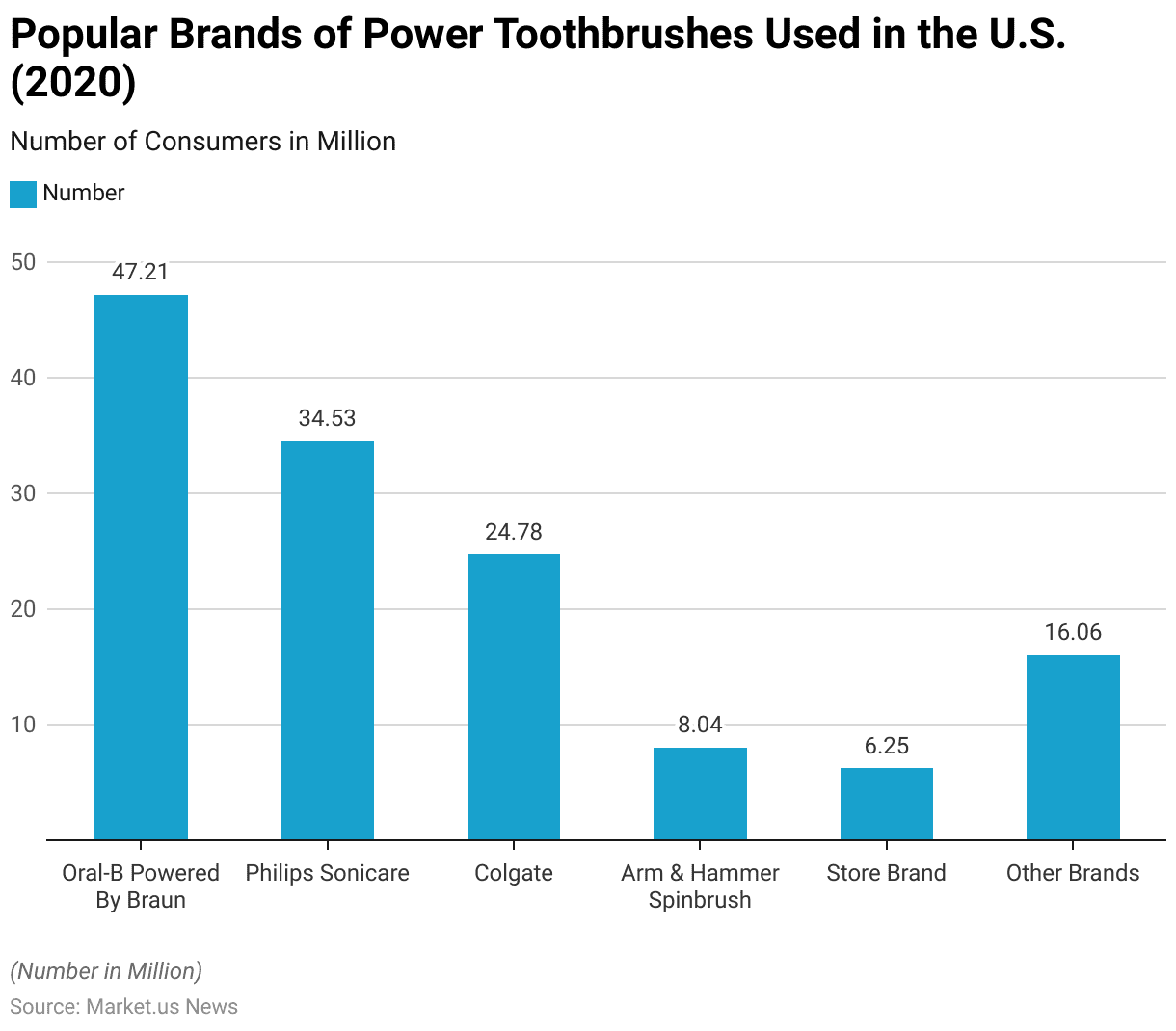

Electric Toothbrush Usage – According to Brand Statistics

- In 2020, the U.S. power toothbrush market was dominated by Oral-B Powered by Braun, which emerged as the most preferred brand, with 47.21 million consumers.

- This significant figure highlights the brand’s widespread popularity and strong presence in the market.

- Philips Sonicare followed as the second most popular choice, with 34.53 million users, indicating a substantial share of consumer preference driven by its advanced technology and premium features.

- Colgate secured third position with 24.78 million consumers, showcasing its longstanding reputation and affordability in oral hygiene products.

- Arm & Hammer Spinbrush, known for its affordability and convenience, was used by 8.04 million individuals.

- Store brands, often chosen for their cost-effectiveness, attracted 6.25 million users, reflecting a smaller but significant portion of the market.

- Lastly, other brands collectively accounted for 16.06 million users, emphasizing the diversity of consumer preferences and the presence of niche or less-established brands in the power toothbrush segment.

- This distribution underscores the competitive nature of the U.S. power toothbrush market, with leading brands catering to a wide array of consumer needs and preferences.

(Source: Statista)

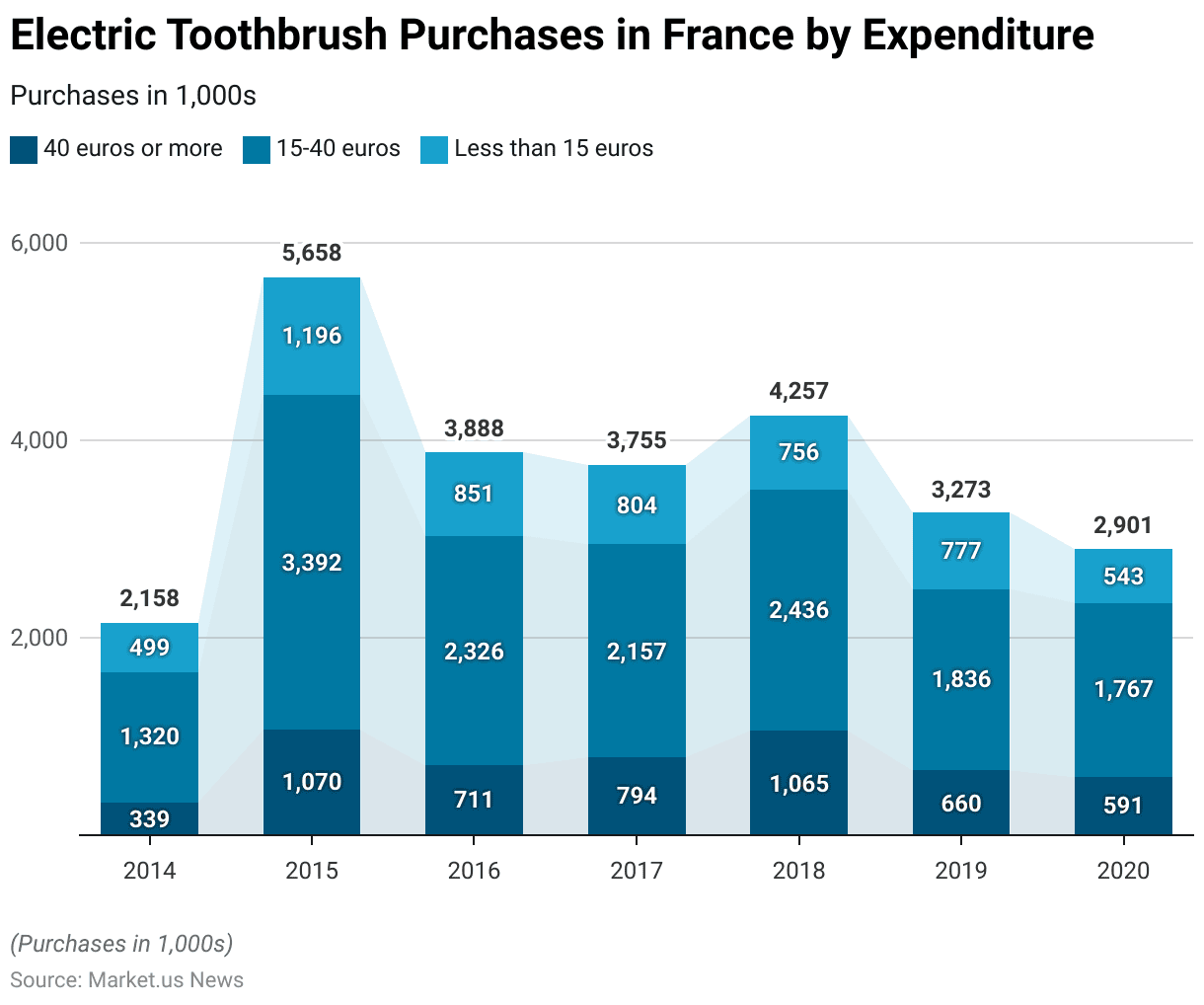

Electric Toothbrushes Usage – By Expenditure Statistics

- The purchasing patterns for electric toothbrushes in France, segmented by expenditure levels, experienced significant fluctuations between 2014 and 2020.

- In 2014, 339,000 individuals spent 40 euros or more on electric toothbrushes, while the majority, 1.32 million, opted for products priced between 15-40 euros. Additionally, 499,000 consumers purchased toothbrushes costing less than 15 euros.

- By 2015, there was a remarkable increase across all expenditure categories, with 1.07 million people spending 40 euros or more, 3.39 million purchasing in the 15-40 euros range, and 1.2 million choosing toothbrushes priced below 15 euros.

- However, 2016 saw a decline in higher and lower expenditure groups, with 711,000 spending 40 euros or more and 851,000 opting for less than 15 euros. Meanwhile, the mid-range category remained strong at 2.33 million.

- In 2017, 794,000 people spent 40 euros or more, while 2.16 million chose the mid-range, and 804,000 purchased budget options. The trend continued in 2018, with a notable increase in the higher expenditure category (1.07 million), 2.44 million for the mid-range, and a slight decline to 756,000 in the budget category.

- However, from 2019 onwards, all categories saw a decline. In 2019, 660,000 spent 40 euros or more, 1.84 million purchased mid-range products, and 777,000 opted for budget toothbrushes. By 2020, these figures further dropped to 591,000, 1.77 million, and 543,000, respectively.

- This data reveals that while mid-range products consistently dominated purchases throughout the years, higher and lower expenditure categories experienced fluctuations, reflecting shifting consumer preferences and economic factors influencing purchasing behavior in France.

(Source: Statista)

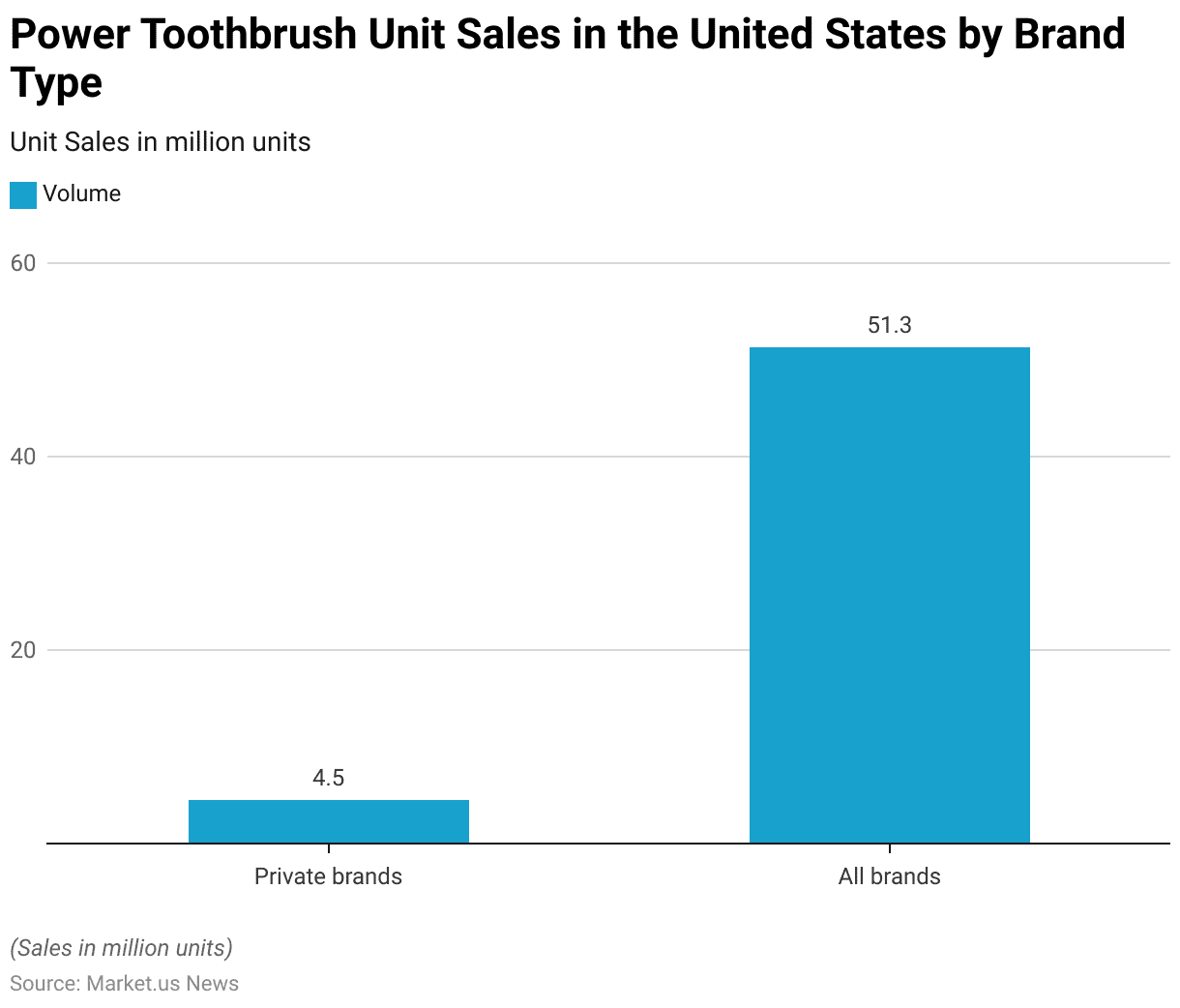

Sales Statistics of Electric Toothbrush

- In 2017, the total sales volume of power toothbrushes in the United States reached 51.3 million units across all brands.

- Of this, private brands contributed a relatively small portion, accounting for 4.5 million units sold. This indicates that branded power toothbrushes dominated the market, with private labels representing only a fraction of total sales.

- The disparity highlights the strong consumer preference for well-established brands, which are often associated with advanced features, higher quality, and stronger brand trust.

- Meanwhile, private brands catered to a niche market, likely driven by cost-conscious consumers or specific retailer promotions. This distribution reflects the competitive landscape of the U.S. power toothbrush market in 2017.

Frequency Usage of Different Electric Toothbrush Statistics

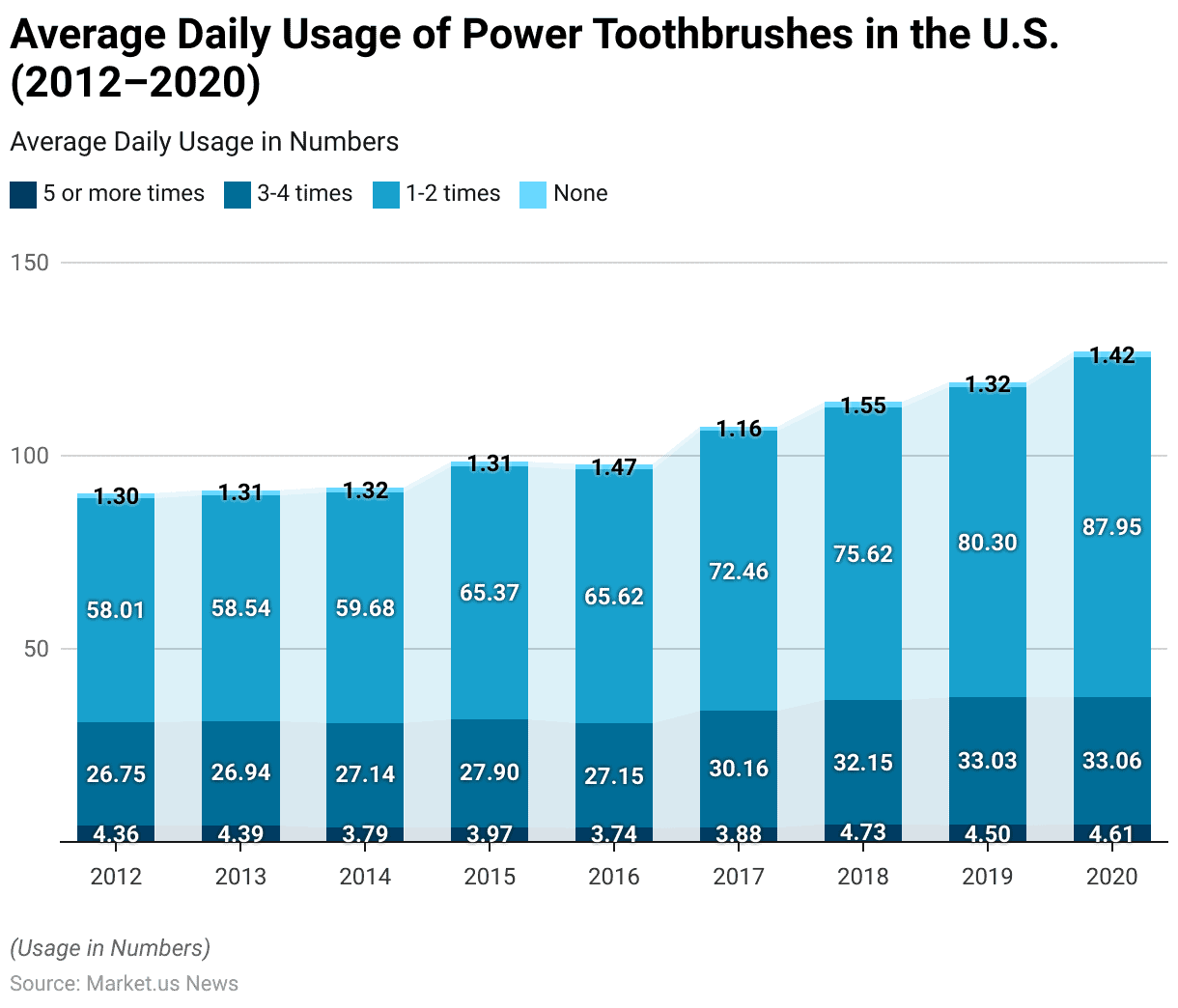

Usage Frequency of a Power Toothbrush on an Average Day

- From 2012 to 2020, the average daily usage frequency of power toothbrushes in the U.S. exhibited consistent patterns with gradual changes across different frequency categories.

- The majority of the population, each year, reported using a power toothbrush 1-2 times daily, adhering to recommended dental hygiene practices. In 2012, 58.01 million individuals fell into this category, which increased over the years to 87.95 million by 2020, demonstrating significant growth in regular use.

- The next largest group was comprised of those using their toothbrush 3-4 times daily. In 2012, this category included 26.75 million users, gradually rising to 33.06 million in 2020. This growth indicates an increasing number of individuals with a higher-than-average focus on oral care.

- A smaller but notable group reported using their power toothbrush five or more times daily. In 2012, 4.36 million individuals were part of this category, with minor fluctuations over the years, peaking at 4.73 million in 2018 and slightly decreasing to 4.61 million in 2020. This segment highlights those with intensive oral hygiene routines, possibly driven by specific dental needs.

- The number of individuals not using a power toothbrush on an average day remained consistently low throughout the period, starting at 1.3 million in 2012 and slightly fluctuating, reaching 1.42 million by 2020. This low figure reflects the widespread adoption and consistent use of power toothbrushes among the U.S. population.

- Overall, the data indicates a steady rise in the adoption and daily use of power toothbrushes, particularly among individuals maintaining regular brushing habits, underscoring the growing awareness and importance of oral hygiene across the country.

(Source: Statista)

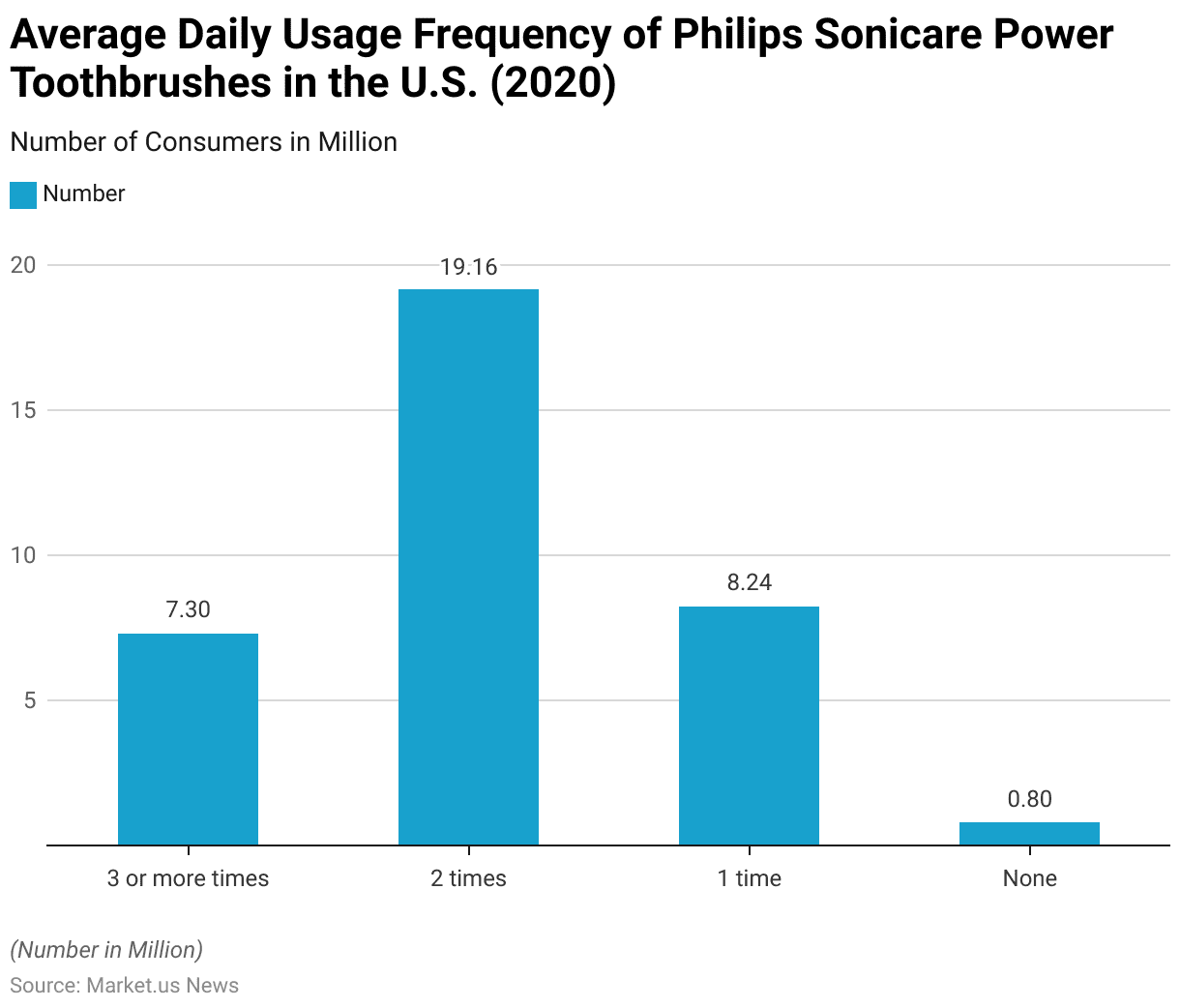

Philips Sonicare Power Toothbrush Usage Frequency

- In 2020, the daily usage patterns of Philips Sonicare power toothbrushes among U.S. consumers revealed significant variations.

- The majority of users, 19.16 million, reported using the toothbrush two times per day, aligning with standard dental hygiene recommendations for brushing twice daily.

- A smaller yet notable group of 7.3 million consumers used their Philips Sonicare toothbrush three or more times daily, indicating heightened attention to oral care or specific dental health needs.

- Conversely, 8.24 million users reported brushing only once per day, suggesting a less frequent but still regular usage pattern.

- Additionally, a very small segment of 0.8 million individuals indicated they did not use the toothbrush at all during the observed period.

- This data highlights the diverse usage behaviors of Philips Sonicare consumers in the U.S., reflecting varying levels of adherence to oral hygiene practices and personal routines.

- These patterns provide valuable insights into consumer habits, helping manufacturers better understand and cater to the needs of different user groups.

(Source: Statista)

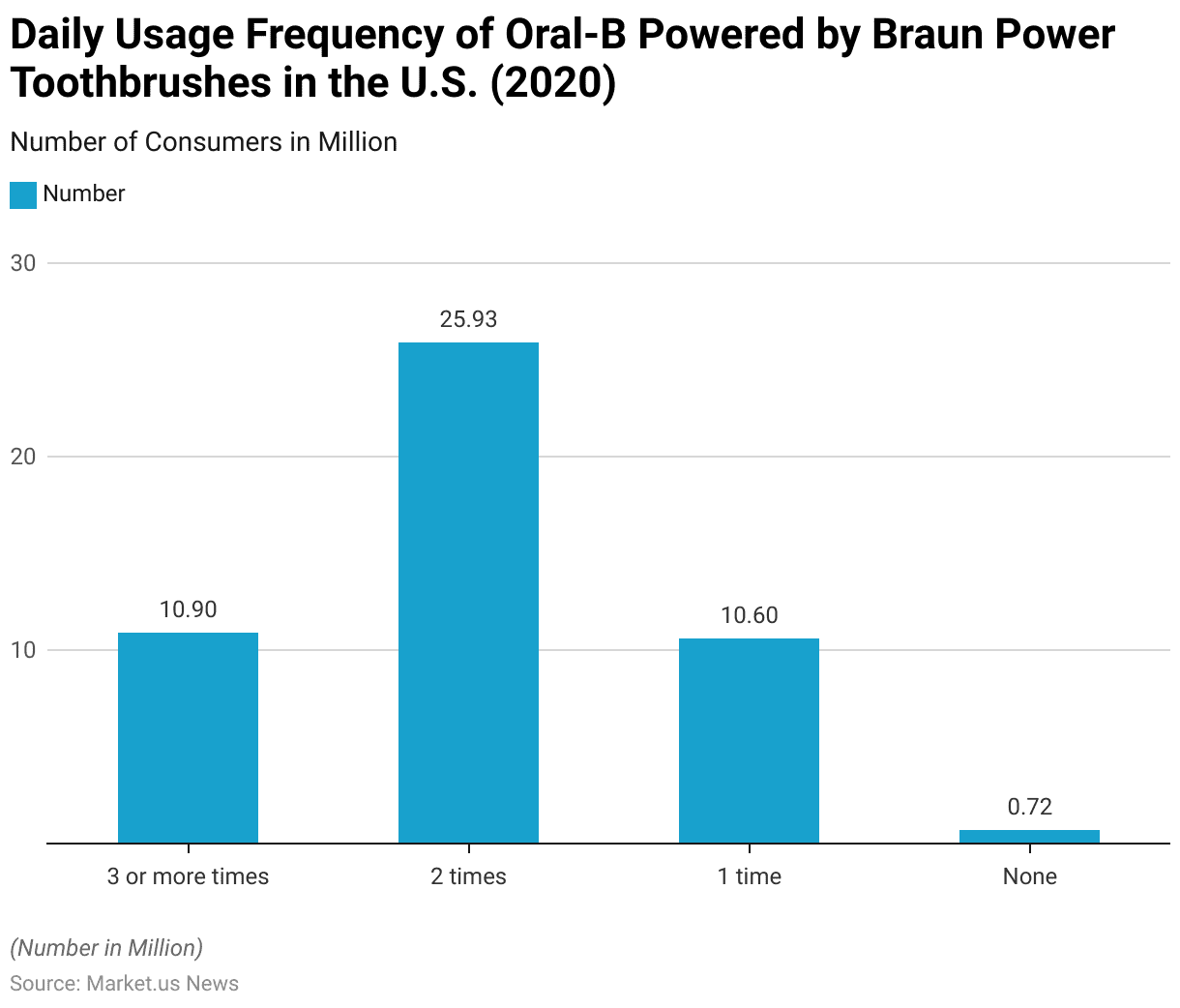

Usage Frequency of an Oral-B Powered by Braun Power Toothbrush

- In 2020, the daily usage patterns of Oral-B Powered by Braun power toothbrushes in the U.S. highlighted distinct consumer behaviors.

- The majority of users, totaling 25.93 million, adhered to the recommended brushing frequency of two times per day, reflecting a strong emphasis on maintaining good oral hygiene practices.

- A significant subset of 10.9 million consumers used their toothbrushes three or more times daily, indicating a heightened focus on dental care or possibly addressing specific oral health needs.

- Additionally, 10.6 million individuals reported using their Oral-B toothbrush only once per day, suggesting a more minimalistic but still regular approach to oral care.

- A very small group of 0.72 million consumers stated they did not use the toothbrush at all during this period.

- These data points illustrate the diverse usage patterns among Oral-B users, providing valuable insights into consumer habits.

- The variation in brushing frequency reflects differing lifestyle choices, health priorities, and adherence to dental care recommendations, showcasing the adaptability and appeal of Oral-B Powered by Braun toothbrushes across a wide spectrum of users.

(Source: Statista)

Comparison of Usage Between Manual and Automatic Toothbrushes

2011-2015

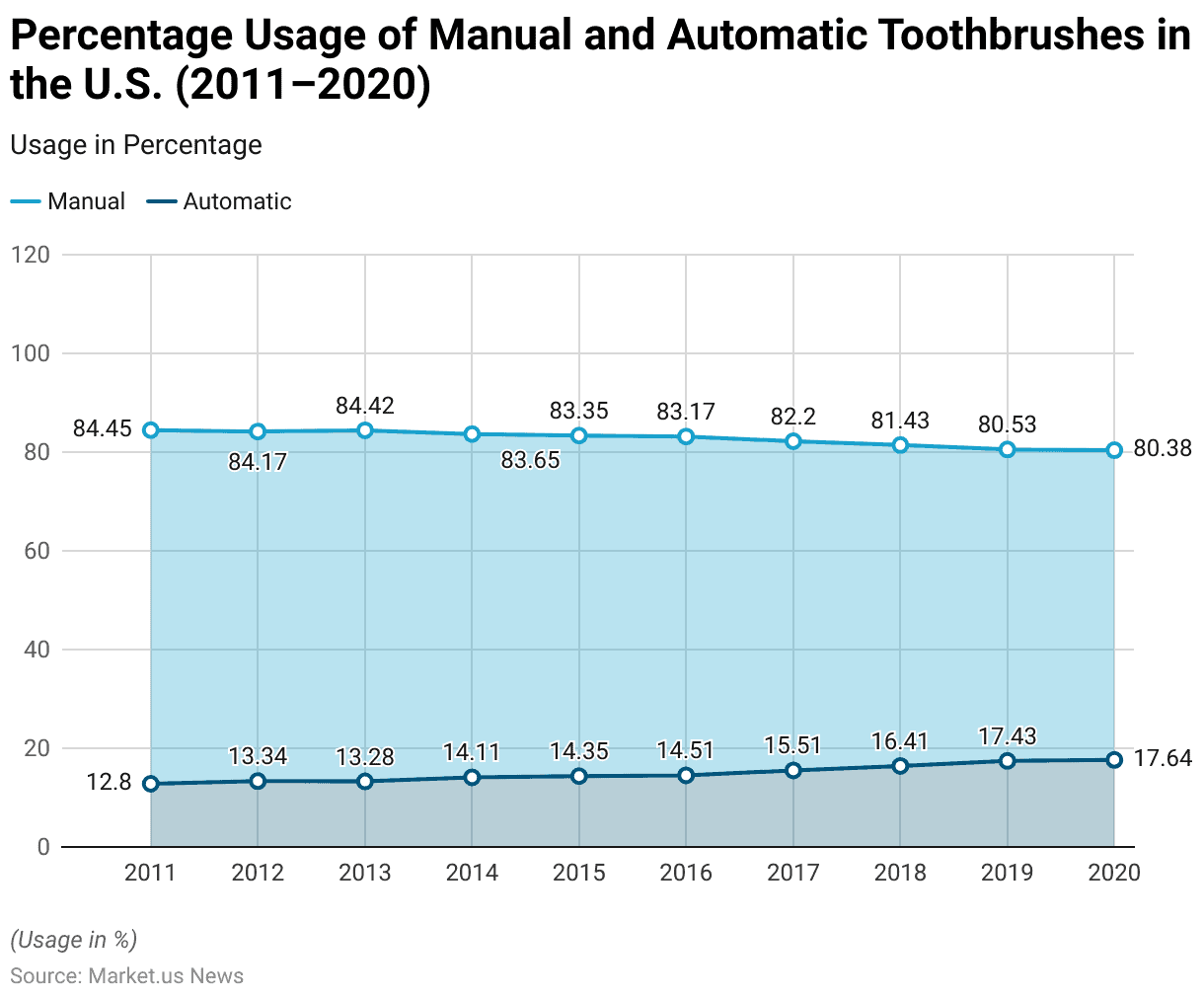

- From 2011 to 2020, the percentage usage of manual and automatic toothbrushes in the United States demonstrated a clear shift in consumer preferences, with an increasing adoption of automatic toothbrushes.

- In 2011, manual toothbrushes were overwhelmingly dominant, accounting for 84.45% of usage, while automatic toothbrushes made up only 12.8%. This trend began to change gradually over the subsequent years.

- By 2012, the share of manual toothbrush usage slightly decreased to 84.17%, while automatic toothbrushes saw an increase to 13.34%.

- The pattern continued in 2013, with manual toothbrushes at 84.42% and automatic toothbrushes at 13.28%.

- A more noticeable decline in manual usage was observed in 2014, with 83.65% opting for manual toothbrushes and 14.11% for automatic ones.

- By 2015, the figures further shifted to 83.35% for manual and 14.35% for automatic toothbrushes, showcasing steady growth in automatic toothbrush adoption.

2016-2020

- This trend accelerated in the latter half of the decade. In 2016, manual toothbrush usage fell to 83.17%, while automatic toothbrushes rose to 14.51%.

- By 2017, the gap began to narrow further, with manual usage dropping to 82.2% and automatic usage increasing to 15.51%.

- In 2018, the trend continued as manual toothbrushes accounted for 81.43%, while automatic toothbrushes climbed to 16.41%.

- By 2019, manual toothbrush usage dropped significantly to 80.53%, with automatic toothbrushes capturing 17.43% of the market.

- This shift continued into 2020, with manual toothbrushes at 80.38% and automatic toothbrushes reaching their highest adoption rate in the decade at 17.64%.

- The data highlights a gradual but consistent shift toward automatic toothbrushes, driven by increasing consumer awareness of their advanced features, efficiency, and effectiveness in oral hygiene. This transition underscores the growing acceptance of technology-driven solutions in dental care across the U.S.

(Source: Electrica)

Consumer Preferences and Trends

Consumer Willingness to Purchase an Electric Toothbrush Statistics

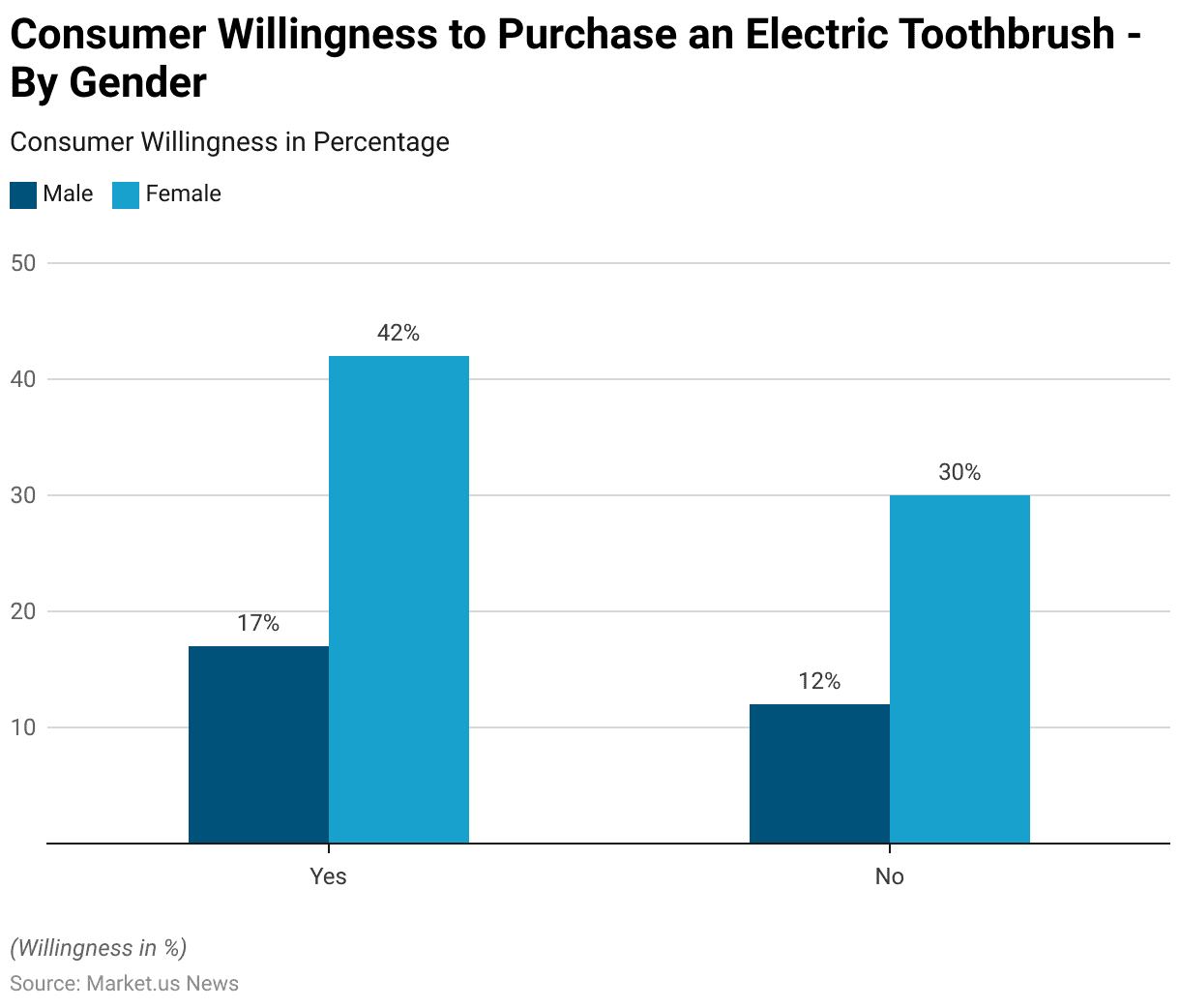

- The willingness of consumers to purchase electric toothbrushes reveals distinct differences based on gender.

- Among males, 17% expressed a willingness to buy an electric toothbrush, while 12% indicated they were not interested in purchasing one.

- In contrast, female consumers showed significantly higher levels of interest, with 42% stating they were willing to purchase an electric toothbrush.

- However, a notable 30% of females expressed unwillingness to make such a purchase. This data highlights that female consumers are generally more inclined to consider investing in electric toothbrushes compared to their male counterparts.

- The higher willingness among women may be attributed to greater awareness of oral hygiene benefits or a stronger preference for advanced dental care products. On the other hand, the lower percentages for both willingness and reluctance among males indicate a more neutral stance toward electric toothbrush adoption.

- Understanding these gender-based differences can help manufacturers and marketers tailor their strategies better to address the preferences and concerns of each demographic group.

(Source: International Journal of Biology, Pharmacy, and Allied Sciences (IJBPAS))

Factors Affecting the Purchase of an Electric Toothbrush Statistics

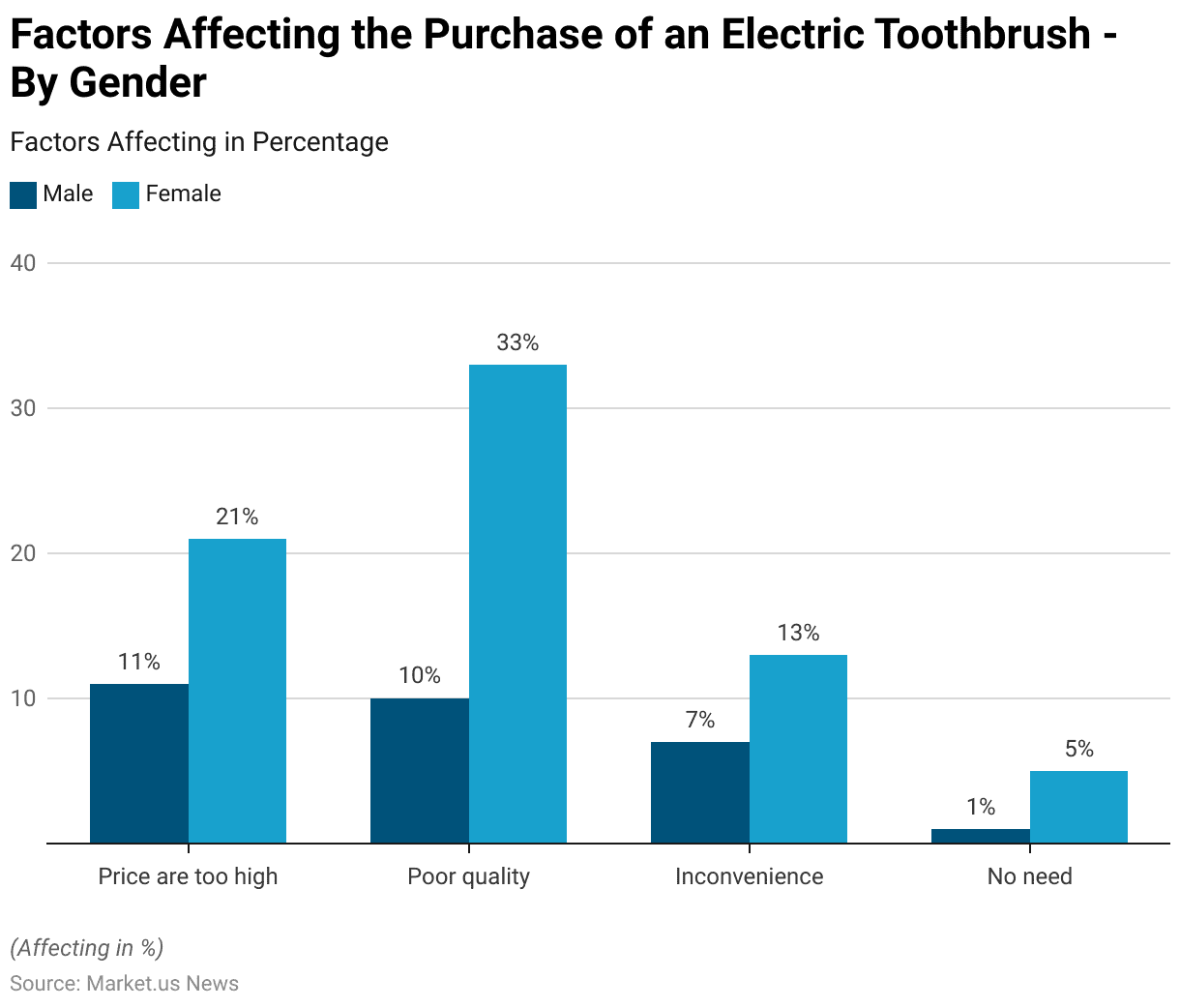

- Several factors influence consumer decisions when considering the purchase of an electric toothbrush, with notable differences observed between males and females.

- Price sensitivity is a significant barrier, as 11% of males and 21% of females cited “price is too high” as a deterrent.

- Poor quality was a concern for 10% of males but was a much greater issue for females, with 33% expressing dissatisfaction with product quality.

- The inconvenience was mentioned by 7% of males and 13% of females, highlighting logistical or usability challenges as another factor affecting their decisions.

- Additionally, a small percentage of respondents indicated a lack of perceived necessity for an electric toothbrush, with 1% of males and 5% of females stating “no need” as their reason.

- These insights indicate that while both genders are affected by similar concerns, females are more likely to be influenced by issues such as price and perceived quality.

- This data provides valuable guidance for manufacturers and marketers aiming to address these barriers by emphasizing affordability, enhancing product quality, and improving convenience to drive adoption rates among both male and female consumers.

(Source: International Journal of Biology, Pharmacy, and Allied Sciences (IJBPAS))

Preferences for Brushing with an Electric Toothbrush Statistics

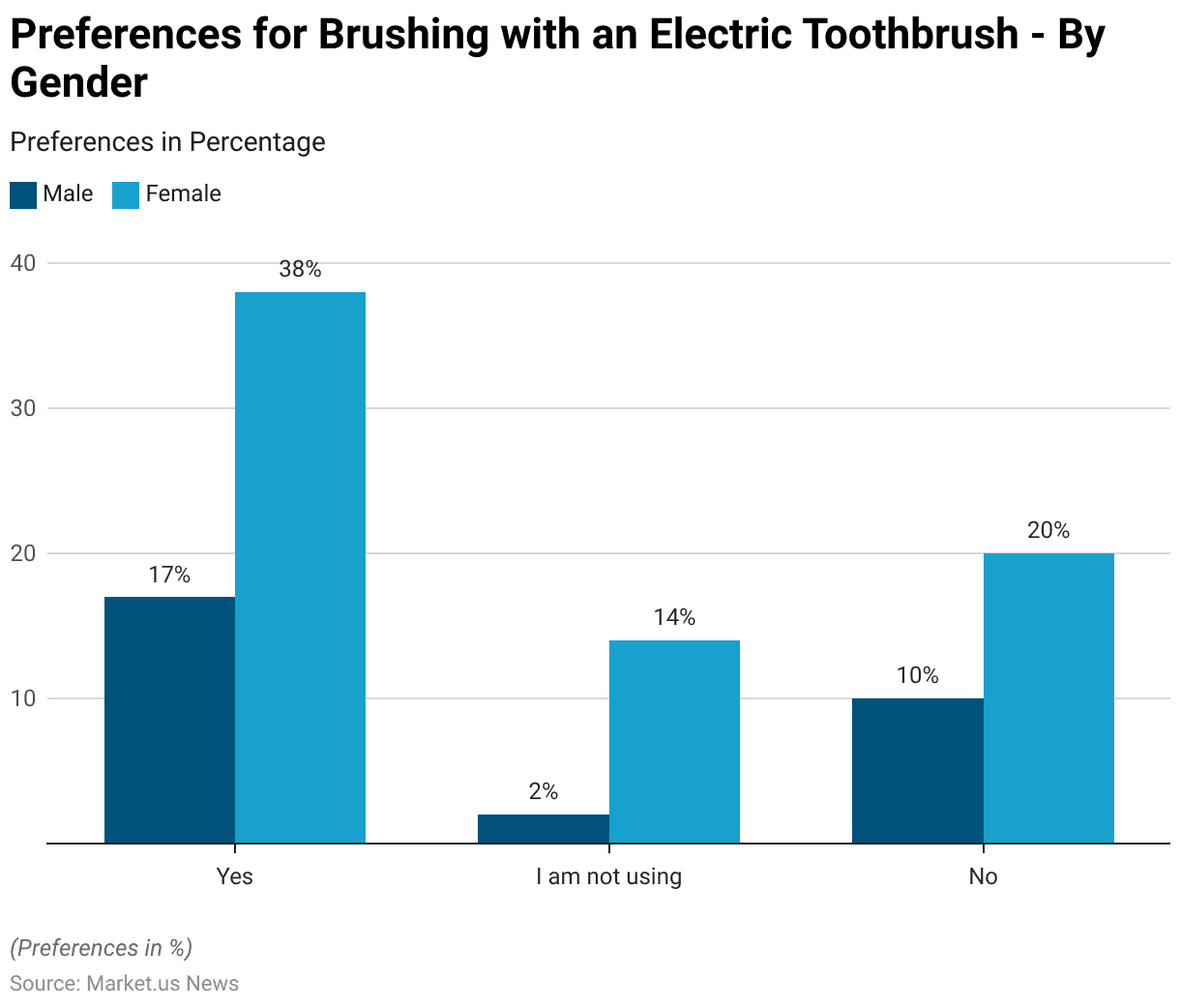

- Consumer preferences for brushing with an electric toothbrush vary significantly by gender, as shown in the responses.

- Among males, 17% expressed a preference for using an electric toothbrush, while a larger percentage of females, 38%, indicated the same. This suggests that females are more inclined toward the benefits and experience of using electric toothbrushes compared to males.

- A small proportion of respondents stated that they were not currently using an electric toothbrush. This group accounted for 2% of males and 14% of females, indicating potential future interest among these consumers if provided with the right incentives or information.

- Meanwhile, 10% of males and 20% of females explicitly stated that they do not like brushing with an electric toothbrush. These figures highlight a segment of consumers who may require further education or alternative product features to encourage adoption.

- The data underscores a notable gender difference in preferences, with females showing a higher overall interest and willingness to use electric toothbrushes.

- Understanding these preferences can help brands refine their marketing strategies and product offerings to better cater to the needs of both male and female consumers.

(Source: International Journal of Biology, Pharmacy, and Allied Sciences (IJBPAS))

Innovations and Developments in Electric Toothbrush Statistics

- The landscape of electric toothbrushes has witnessed significant innovation and development in recent years, driven by advancements in technology and a deeper understanding of oral health needs.

- Companies like Philips and Great Gums are at the forefront of these developments, introducing features that enhance user experience and effectiveness.

- For instance, Philips’ Sonicare 9900 Prestige is noted for its sophisticated real-time feedback and customizable settings that adjust to the user’s brushing technique, improving oral health over time.

- Great Gums has introduced a patented bioelectric technology that not only enhances plaque removal but also promotes gum health through its unique electric pulsations.

- Numerous patents back this technology, and it has been validated in clinical settings, promising a significant reduction in gum disease risk.

- Moreover, the integration of AI and connectivity features is becoming commonplace, with toothbrushes now able to provide feedback on brushing habits and areas of improvement via mobile apps.

- These smart toothbrushes, equipped with sensors to monitor brushing intensity and coverage, aim to transform daily oral hygiene practices into a data-driven routine that maximizes oral health.

- Overall, the innovations in electric toothbrushes reflect a shift towards more interactive and technologically equipped oral care solutions, emphasizing personalized care and prevention of dental issues.

- These developments not only enhance the effectiveness of daily oral hygiene but also integrate seamlessly with digital health tools to foster better oral health outcomes.

(Sources: TechRadar, AEGIS Dental Network, Real Life Dental)

Regulations for Electric Toothbrushes

- In examining regulations for electric toothbrushes globally, it’s evident that different countries adhere to specific standards and guidelines.

- In the United States, electric toothbrushes are classified under the FDA‘s regulations as Class I dental devices.

- This classification entails general controls and exempts these devices from premarket notification procedures, provided they adhere to certain conditions specified by the FDA.

- Internationally, compliance with standards such as IEC 60335-2-59 is mandatory for electric toothbrushes to ensure safety requirements and performance criteria are met.

- These international standards are crucial for the global trade and distribution of electric toothbrushes, ensuring they meet safety and operational benchmarks before entering the market.

- This regulatory framework is crucial for market research analysis, as it shapes the design, marketing, and sales strategies for companies involved in the manufacturing and distribution of electric toothbrushes.

- Understanding these regulations helps companies navigate the complex landscape of global distribution while ensuring product safety and efficacy.

(Sources: FDA, TheDentech.com)

Recent Developments

Acquisitions and Mergers:

- Anheuser-Busch InBev Targets Non-Alcoholic Market (2023): In 2023, Anheuser-Busch InBev acquired the non-alcoholic beverage company, Athletic Brewing Co., for an undisclosed amount.

- This acquisition is aimed at capitalizing on the growing demand for non-alcoholic beverages, especially among young adults and teens who are more health-conscious and turning to alcohol-free alternatives.

- This move aligns with efforts to provide more low- and no-alcohol choices for younger consumers and could reduce overall teen alcohol consumption rates by providing appealing alternatives.

Product Launches:

- Budweiser’s Non-Alcoholic Beer Launch (2024): In 2024, Budweiser, owned by Anheuser-Busch, launched a new line of alcohol-free beers designed specifically for Gen Z and millennials.

- The company has seen a rise in non-alcoholic beverage interest, especially as studies show a decline in teen drinking rates.

- A report from 2023 revealed that nearly 60% of teens preferred non-alcoholic beverages, which has influenced brands like Budweiser to launch products that appeal to younger, health-conscious consumers.

Funding and Investments:

- Research Funding for Teen Alcohol Use Prevention Programs (2023): In 2023, the U.S. government allocated $12 million in research funding to study teen alcohol use and its long-term effects on adolescent health.

- This initiative aims to develop better prevention programs and identify trends in teen drinking behaviors.

- It is part of a broader effort to reduce underage drinking, which has been linked to mental health issues and impaired brain development in teenagers.

Regulatory Developments:

- New Minimum Drinking Age Laws in California (2023): California passed a new law in 2023 that mandates stricter penalties for underage drinking and promotes alcohol education in schools.

- The law has a particular focus on limiting access to alcohol among teens through online sales and parties.

- A survey conducted in 2023 found that the number of underage alcohol-related offenses in California dropped by 15% due to these new regulations.

Conclusion

Electric Toothbrush Statistics – The electric toothbrush market is growing steadily, driven by increased awareness of oral hygiene, technological advancements, and rising dental health issues.

Rechargeable models and automatic toothbrushes dominate, with women showing higher adoption rates than men. While branded products lead, private labels are gaining traction among cost-conscious consumers.

Barriers such as high prices, perceived poor quality, and inconvenience persist but present opportunities for innovation.

The market’s future growth depends on addressing these challenges, launching affordable and advanced products, and targeting untapped segments like children and emerging economies. Overall, the market is set for continued expansion as oral hygiene gains global importance.

FAQs

An electric toothbrush is a powered device that uses oscillating, rotating, or sonic vibrations to clean teeth more effectively than manual toothbrushes. It is designed to improve oral hygiene and make brushing easier and more efficient.

Yes, electric toothbrushes are generally considered more effective at removing plaque, reducing gingivitis, and improving overall oral hygiene due to their advanced cleaning mechanisms.

The lifespan of an electric toothbrush varies by brand and usage but typically lasts 3 to 5 years. The brush head should be replaced every 3 months for optimal hygiene.

Yes, many electric toothbrushes are designed specifically for children, with softer bristles and gentler cleaning modes to suit their sensitive teeth and gums.

Yes, most electric toothbrushes have modes designed for sensitive teeth and gums, ensuring effective yet gentle cleaning.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)