Table of Contents

- Introduction

- Editor’s Choice

- Yacht Market Overview

- Luxury Yacht and Private Jet Market Overview

- The Largest Sailing Yacht Worldwide Statistics

- Largest Motor Yachts Worldwide

- Yacht Size Statistics

- Yacht Statistics – By Country

- Yacht Export Statistics

- Yacht Import Statistics

- Yacht Sales Statistics

- Demographics of Yacht Owners Statistics

- Yacht Captain Demographics

- Employment Statistics By Yacht Captain

- Participation in Yacht Recreational Activities

- Yacht Regulations

- Recent Developments

- Conclusion

- FAQs

Introduction

Yacht Statistics: Yachts are sophisticated recreational vessels used for leisure cruising, racing, and social events, encompassing sailing yachts, motor yachts, catamarans, and superyachts.

The yacht market is driven by increasing disposable incomes, a growing interest in adventure tourism, and technological advancements. Although it faces challenges such as high maintenance costs and environmental regulations.

North America leads in market size, followed by Europe and the emerging Asia-Pacific region. Key trends include a focus on sustainability, customization, digitalization, and a rising preference for yacht charters over ownership.

The industry is poised for growth as it adapts to changing consumer preferences and environmental standards.

Editor’s Choice

- The global yacht market revenue reached $10.3 billion in 2023.

- The global yacht market demonstrates a varied distribution in market share based on the length of the yachts. Yachts that are between 20 to 50 meters in length dominate the market. Holding a substantial 60% of the market share.

- The global luxury yacht market revenue is expected to reach $14.58 billion by 2030.

- As of January 2020, the list of the largest sailing yachts worldwide is headlined by some remarkably long vessels. Each is a testament to the grandeur and capabilities of modern yacht design. The “Sailing Yacht A” leads the group with an impressive length of 142.8 meters. Making it the largest sailing yacht globally at that time.

- In 2024, the landscape of the largest motor yachts worldwide is characterized by impressive lengths that define modern maritime luxury. Leading the pack is the Azzam, stretching an expansive 181 meters, making it the longest motor yacht in the world.

- According to a 2017 study by the International University of Monaco and the Rossinavi shipyard. The typical yacht owner used to be between 45 and 55 years old.

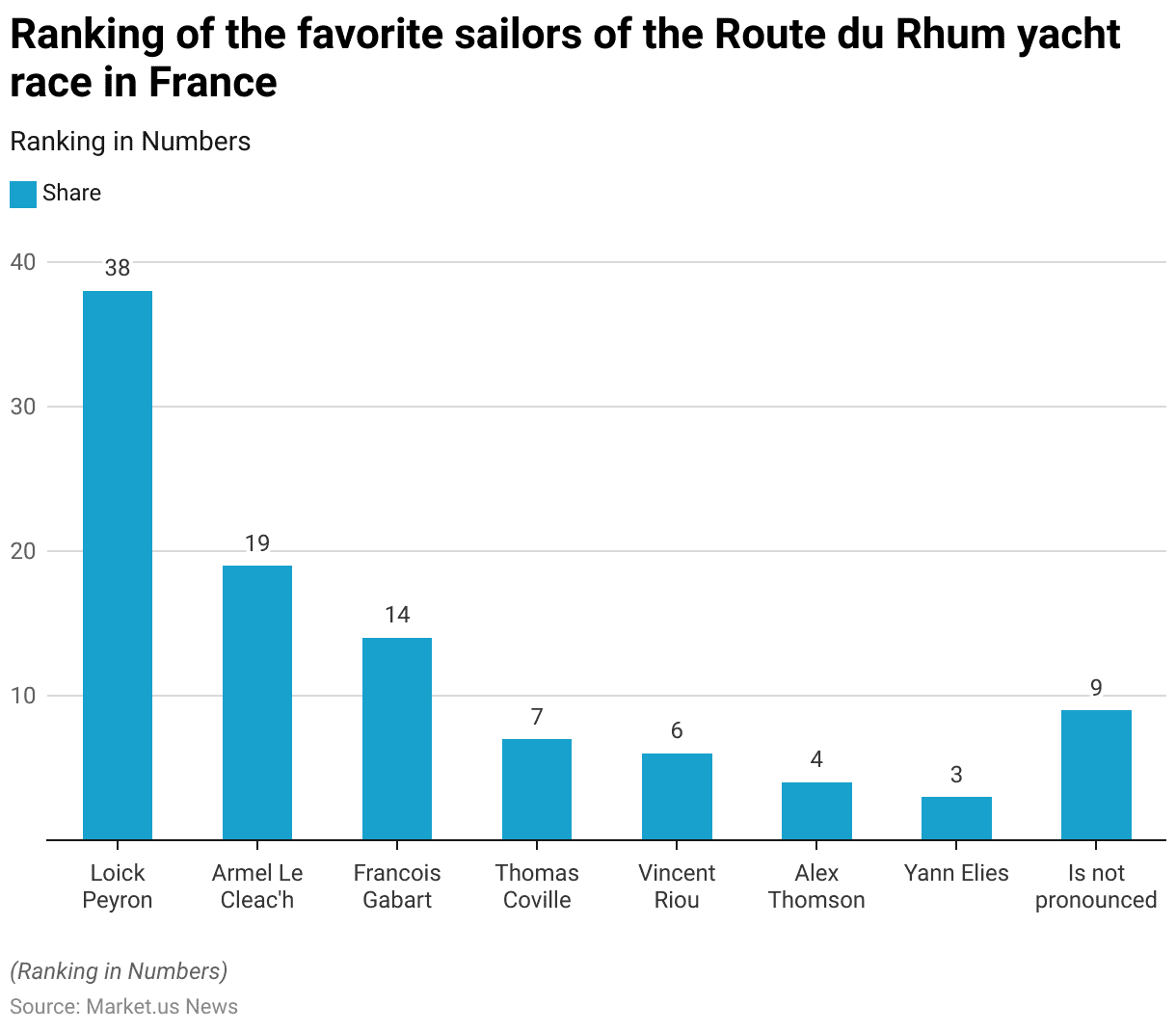

- In the 2018 Route du Rhum yacht race in France, a survey on fans’ favorite racers revealed Loick Peyron as the leading choice, with a substantial 38% of respondents favoring him.

- Hydrogen-powered yacht market size is expected to be worth around USD billion by 2032.

Yacht Market Overview

Global Yacht Market Size Statistics

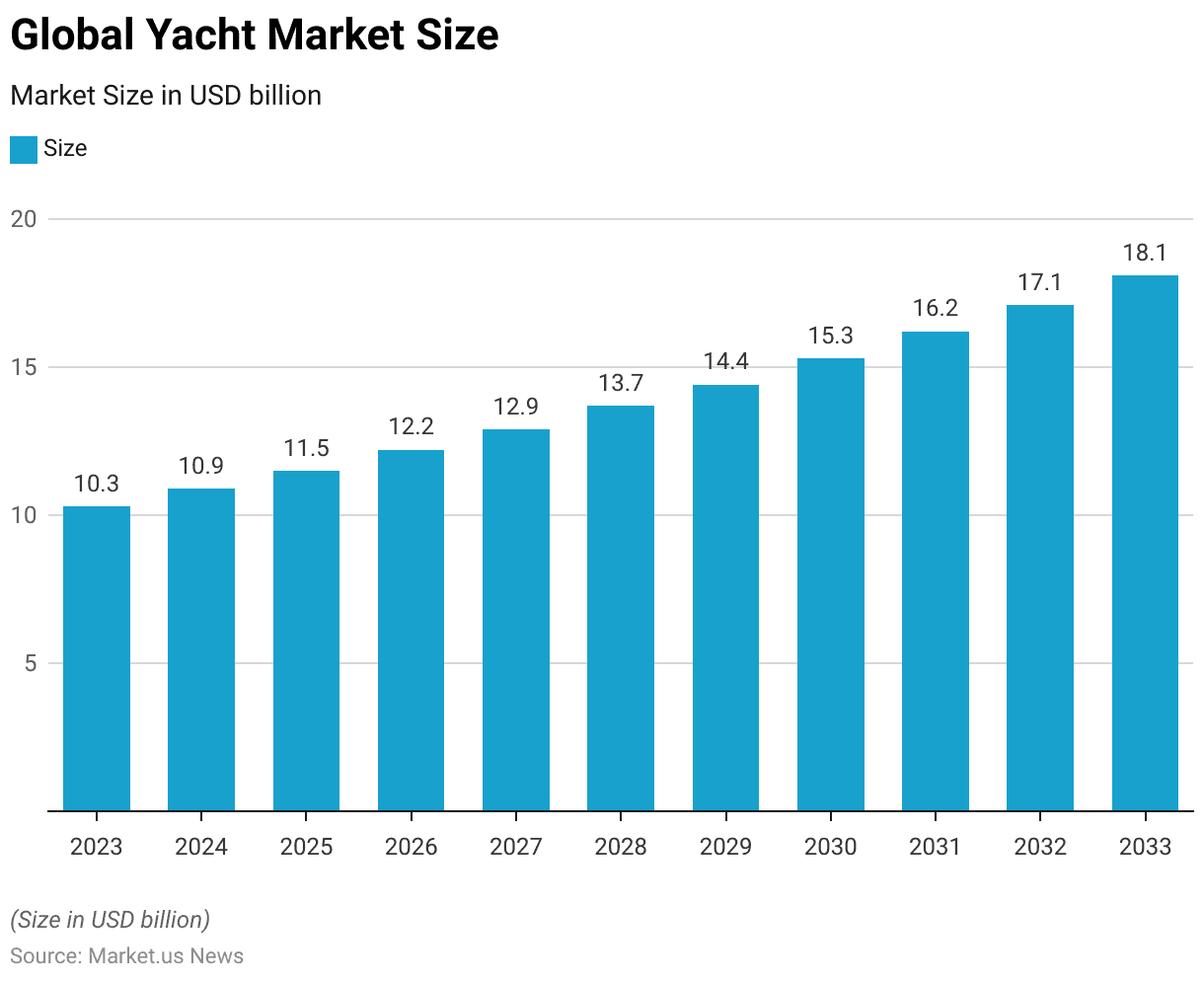

- The global yacht market is projected to exhibit a consistent growth trajectory from 2023 through 2033 at a CAGR of 5.8%.

- In 2023, the market size was valued at approximately $10.3 billion.

- A gradual increase is anticipated in the following years, with the market reaching $10.9 billion in 2024 and further expanding to $11.5 billion by 2025.

- This upward trend is expected to continue, with market valuations forecasted at $12.2 billion in 2026, $12.9 billion in 2027, and $13.7 billion by 2028.

- By the end of the decade in 2029, the market is likely to attain a size of $14.4 billion. Escalating to $15.3 billion in 2030.

- The growth momentum is projected to sustain, with the market estimated to increase to $16.2 billion in 2031, $17.1 billion in 2032, and reaching $18.1 billion by 2033.

- This consistent expansion reflects a robust outlook for the yacht industry over the next decade.

(Source: market.us)

Global Yacht Market Size – By Type Statistics

- The global yacht market is projected to grow from $10.3 billion in 2023 to $18.1 billion by 2033, reflecting a consistent expansion across various yacht types.

- In 2023, the market distribution included super yachts at $3.63 billion, sport yachts at $2.93 billion, flybridge yachts at $1.55 billion, long-range yachts at $1.13 billion, and other types at $1.07 billion. The growth trends continue with super yachts and sport yachts leading the expansion.

- By 2024, the market size will increase to $10.9 billion, with super yachts growing to $3.84 billion and sport yachts to $3.10 billion.

- Further, this upward trend persists through the decade, with significant growth in all categories. By 2030, the market size will reach $15.3 billion. Driven by super yachts at $5.39 billion and sport yachts at $4.35 billion.

- The other yacht types also see growth, with flybridge yachts reaching $2.30 billion. Long-range yachts are at $1.68 billion, and other types climbing to $1.59 billion.

- By 2033, the market further expands, with super yachts peaking at $6.37 billion, sport yachts at $5.14 billion, flybridge yachts at $2.72 billion, long-range yachts at $1.99 billion, and other yacht types at $1.88 billion.

- The data indicates robust growth across all yacht segments, highlighting a vibrant and evolving yacht industry.

(Source: market.us)

Yacht Market Share – By Length Statistics

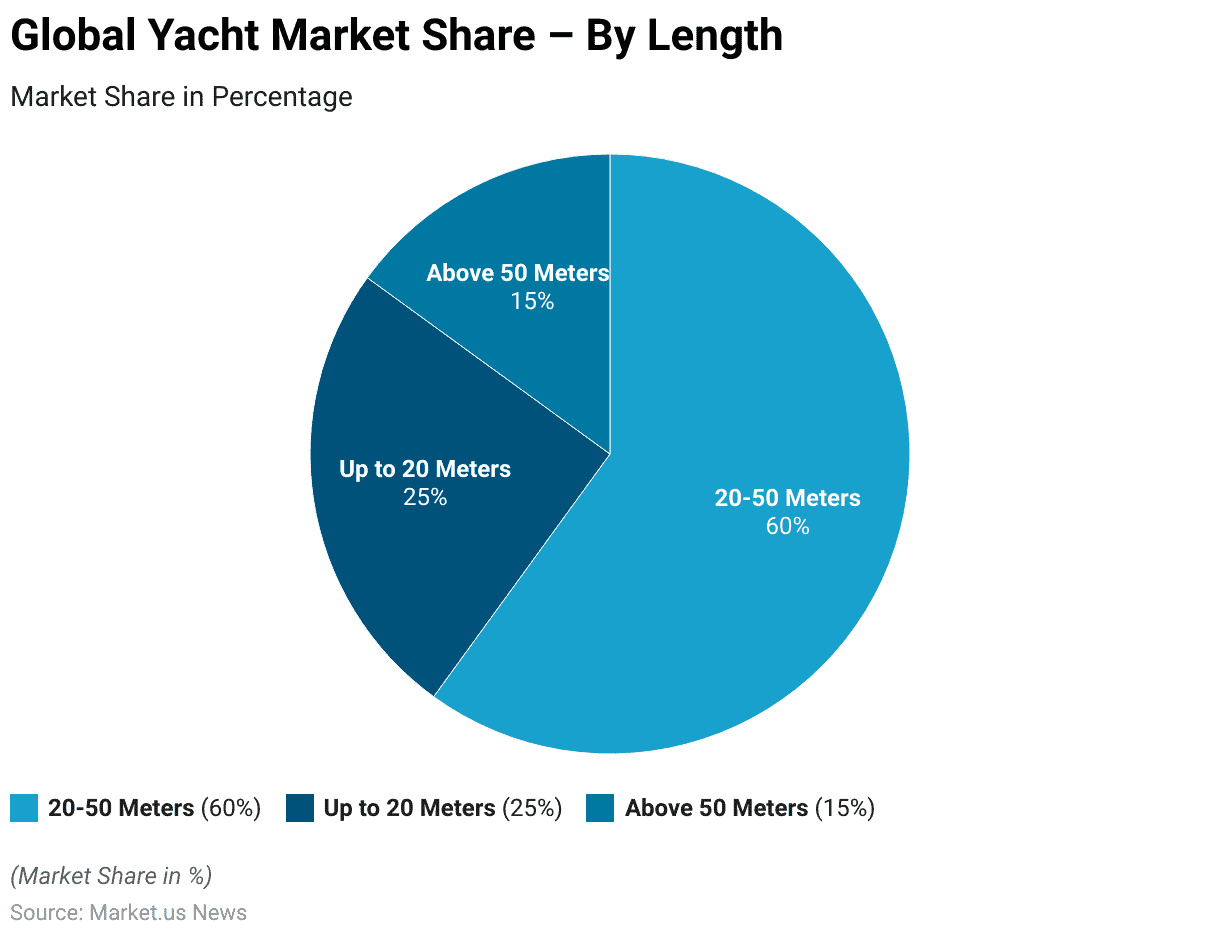

- The global yacht market demonstrates a varied distribution in market share based on the length of the yachts.

- Yachts that are between 20 to 50 meters in length dominate the market. Holding a substantial 60% of the market share.

- Smaller yachts, measuring up to 20 meters, represent 25% of the market.

- Meanwhile, larger yachts that exceed 50 meters in length account for 15% of the market.

- This segmentation underscores a clear preference for mid-sized yachts within the industry while also indicating significant niches in both smaller and larger yacht categories.

(Source: market.us)

Luxury Yacht and Private Jet Market Overview

Global Luxury Yacht Market Size Statistics

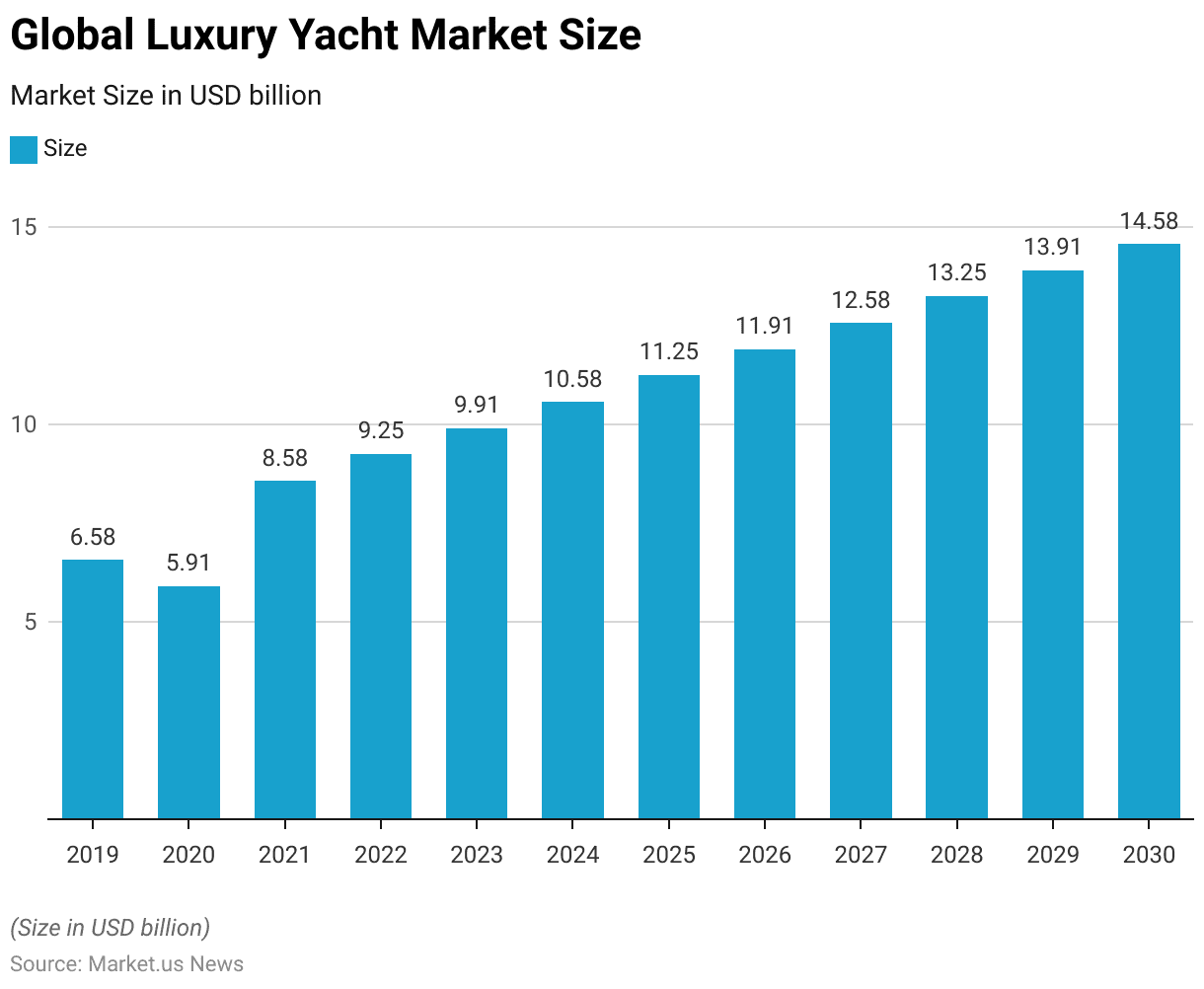

- The global luxury yacht market has experienced fluctuations and growth from 2019 through the forecast period up to 2030.

- Starting with a market size of $6.58 billion in 2019, there was a decline to $5.91 billion in 2020, likely influenced by economic factors.

- The market rebounded significantly in 2021, reaching $8.58 billion, and continued its upward trajectory in the following years.

- By 2022, the market size increased to $9.25 billion, followed by $9.91 billion in 2023.

- The growth trend is projected to persist, with the market size estimated to rise to $10.58 billion in 2024, then $11.25 billion in 2025, and $11.91 billion in 2026.

- The market is expected to further expand to $12.58 billion in 2027, $13.25 billion in 2028, $13.91 billion in 2029, and ultimately reach $14.58 billion by 2030.

- This steady increase highlights the ongoing demand and robust growth potential within the global luxury yacht sector.

(Source: Statista)

Value of the Luxury Yacht and Private Jet Market Worldwide Statistics

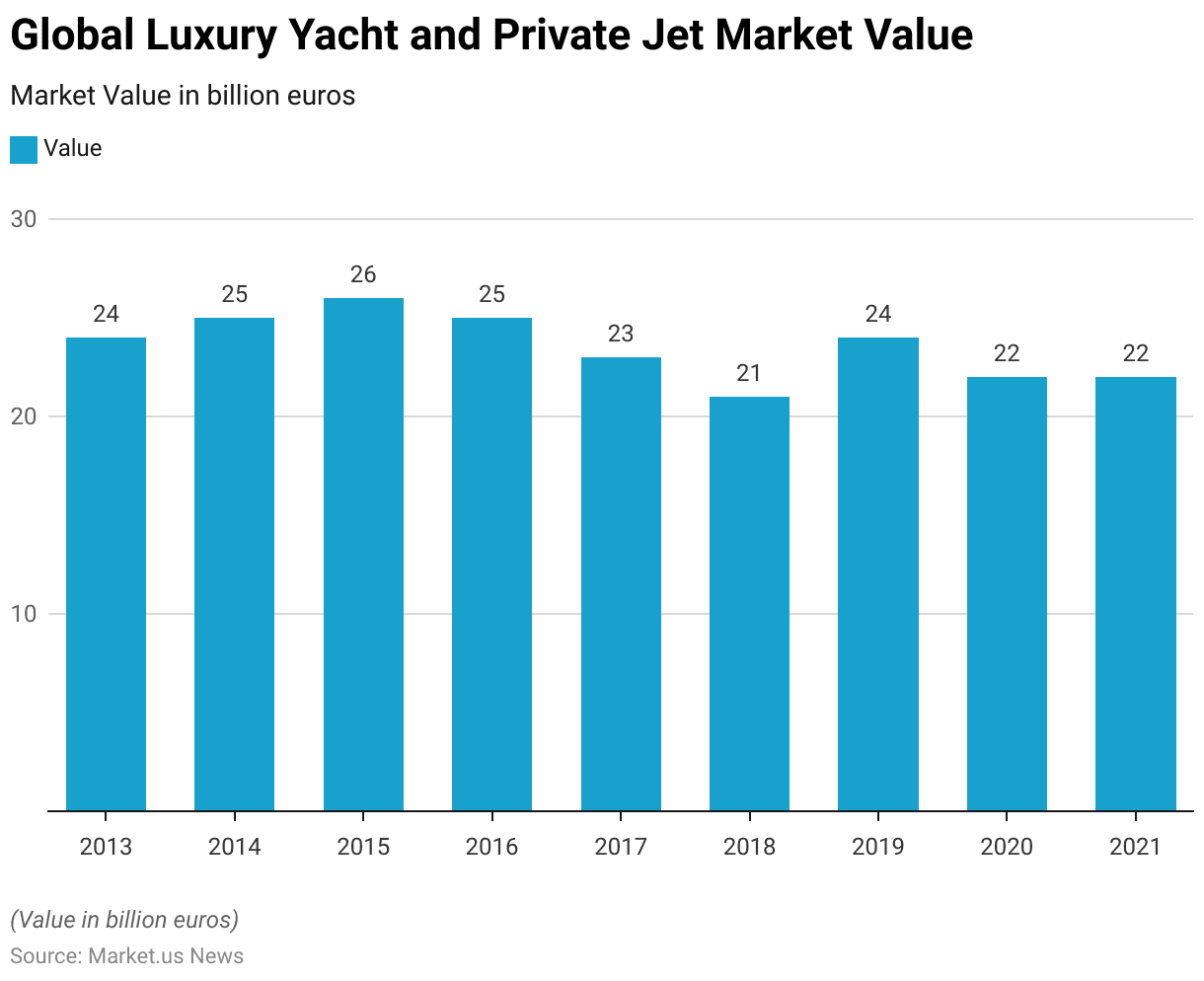

- The global market value of luxury yachts and private jets has seen a varied performance from 2013 to 2021.

- In 2013, the market was valued at 24 billion euros, and it showed a slight increase to 25 billion euros in 2014. Then to 26 billion euros in 2015, indicating a period of steady growth.

- However, the market experienced a slight decline in 2016, dropping back to 25 billion euros, and continued to decrease to 23 billion euros in 2017 and 21 billion euros in 2018.

- The market value saw a recovery in 2019, rising to 24 billion euros. But it slightly dipped again to 22 billion euros in 2020 and remained steady at 22 billion euros in 2021.

- This fluctuation in market value reflects various economic and market-specific factors impacting the luxury asset sector during this period.

(Source: Statista)

Value of The Luxury Yacht and Private Jet Market Worldwide – By Segment Statistics

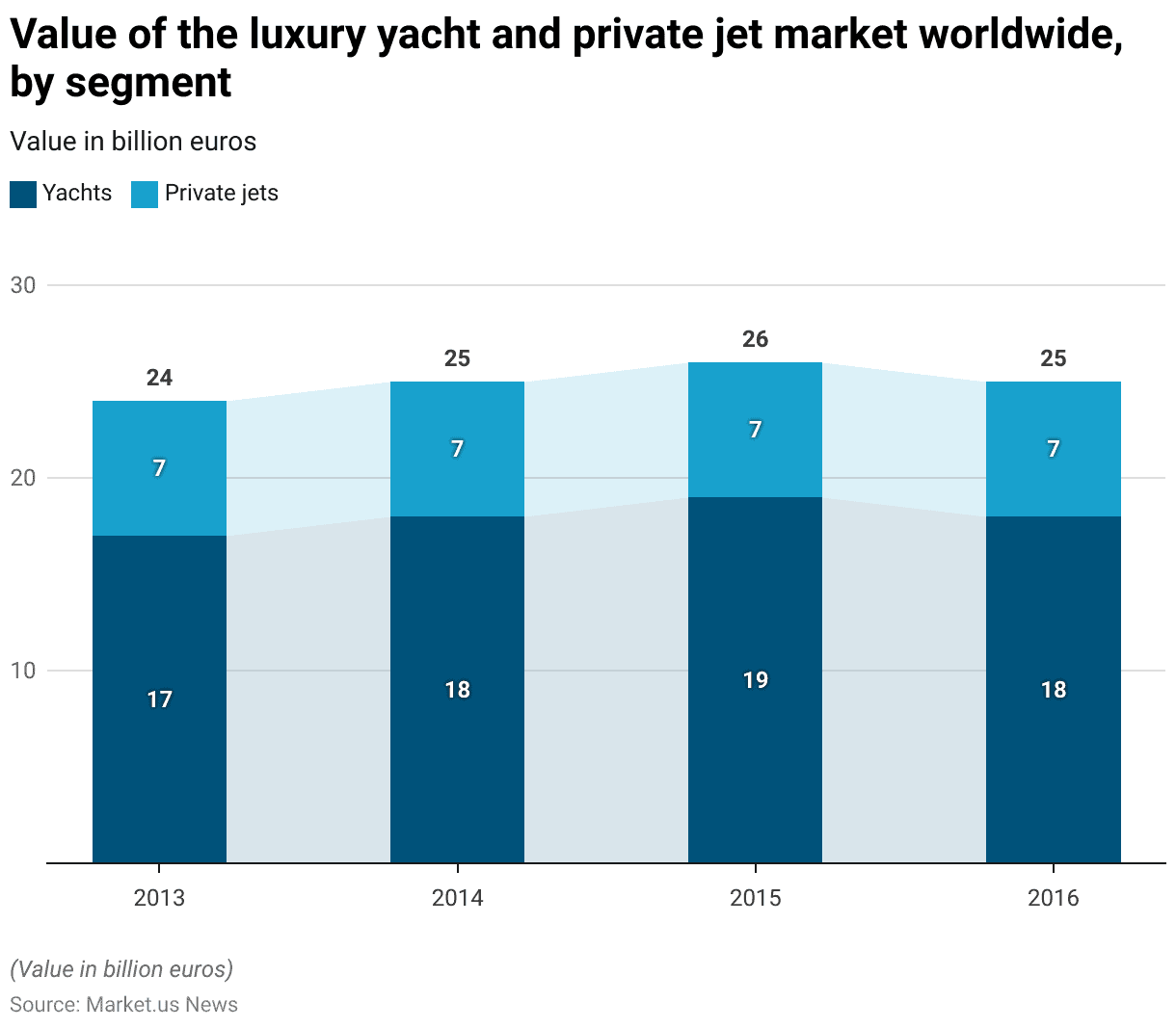

- From 2013 to 2016, the luxury yacht and private jet market experienced varied trends across its segments, valued in billions of euros.

- In the yacht sector, the market value increased from 17 billion euros in 2013 to 18 billion euros in 2014, followed by a further rise to 19 billion euros in 2015.

- However, there was a slight decrease in 2016, bringing the value down to 18 billion euros.

- Conversely, the private jet segment remained stable throughout the same period. Consistently holding a market value of 7 billion euros each year from 2013 to 2016.

- This stability in the private jet market contrasts with the slight fluctuations observed in the yacht market during these years.

(Source: Statista)

The Largest Sailing Yacht Worldwide Statistics

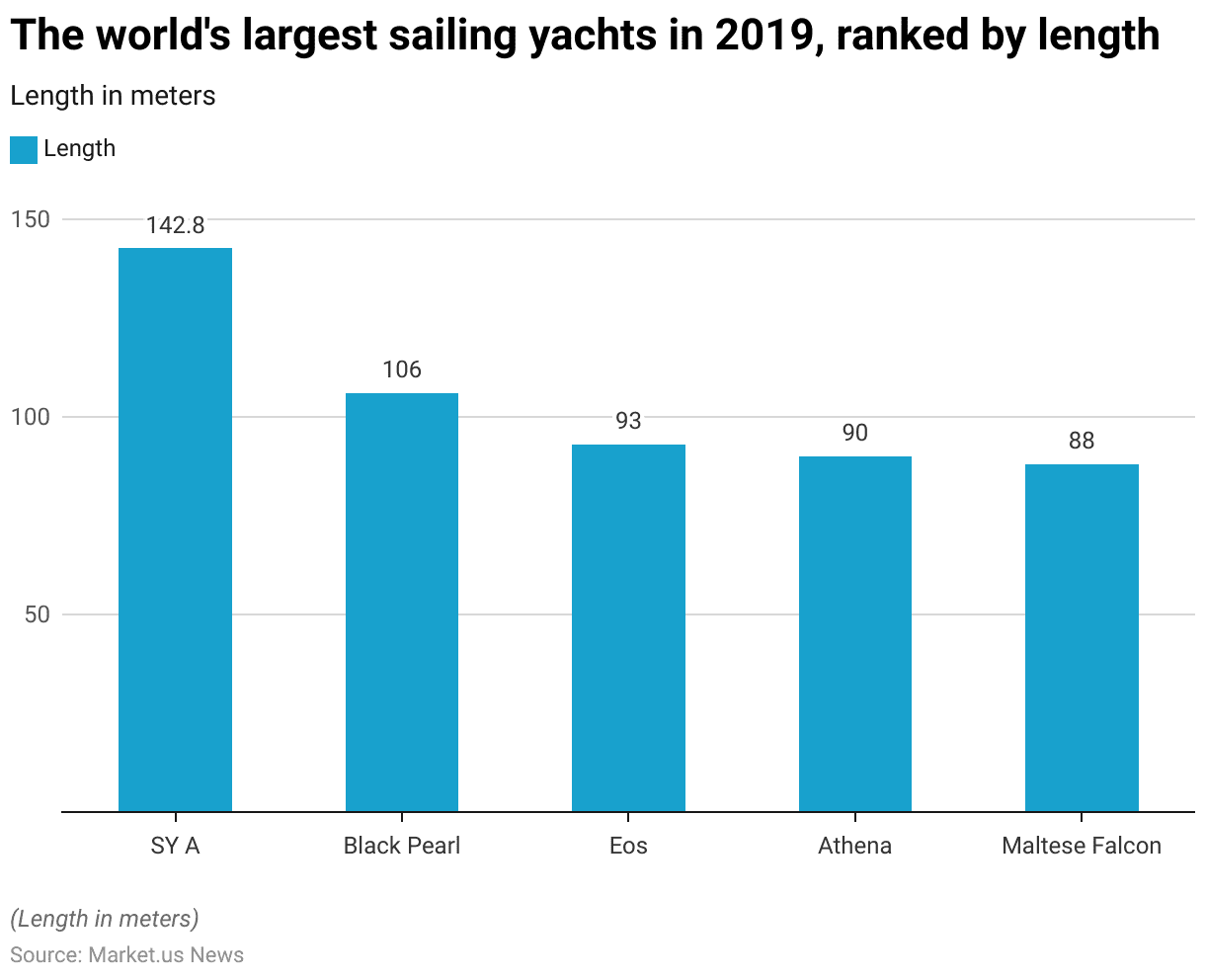

2019

- As of 2019, the world’s largest sailing yachts are distinguished by their impressive lengths.

- The SY A tops the list as the longest, measuring 142.8 meters.

- It is followed by the Black Pearl, which spans 106 meters.

- The Eos, another significant vessel, measures 93 meters in length.

- Close behind is the Athena, which is 90 meters in length.

- The Maltese Falcon, also among the largest, measures 88 meters.

- These yachts represent the pinnacle of luxury sailing, combining size with advanced engineering and exquisite design.

(Source: Statista)

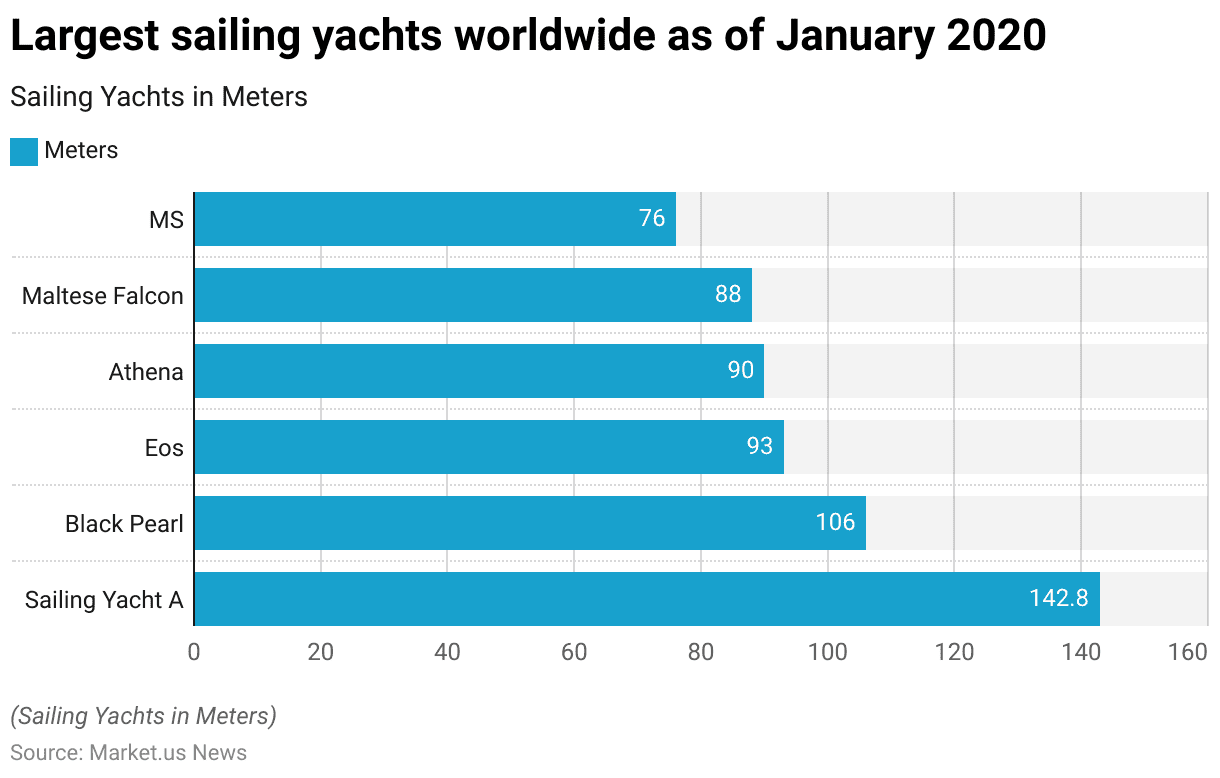

2020

- As of January 2020, the list of the largest sailing yachts worldwide is headlined by some remarkably long vessels. Each is a testament to the grandeur and capabilities of modern yacht design.

- The “Sailing Yacht A” leads the group with an impressive length of 142.8 meters. Making it the largest sailing yacht globally at that time.

- It is followed by the “Black Pearl,” which measures 106 meters.

- The “Eos” is next, with a length of 93 meters, while the “Athena” and “Maltese Falcon” are close behind at 90 meters and 88 meters, respectively.

- The “MS” rounds out the list with a length of 76 meters.

- These yachts represent the pinnacle of luxury sailing with their expansive sizes and sophisticated engineering.

(Source: Statista)

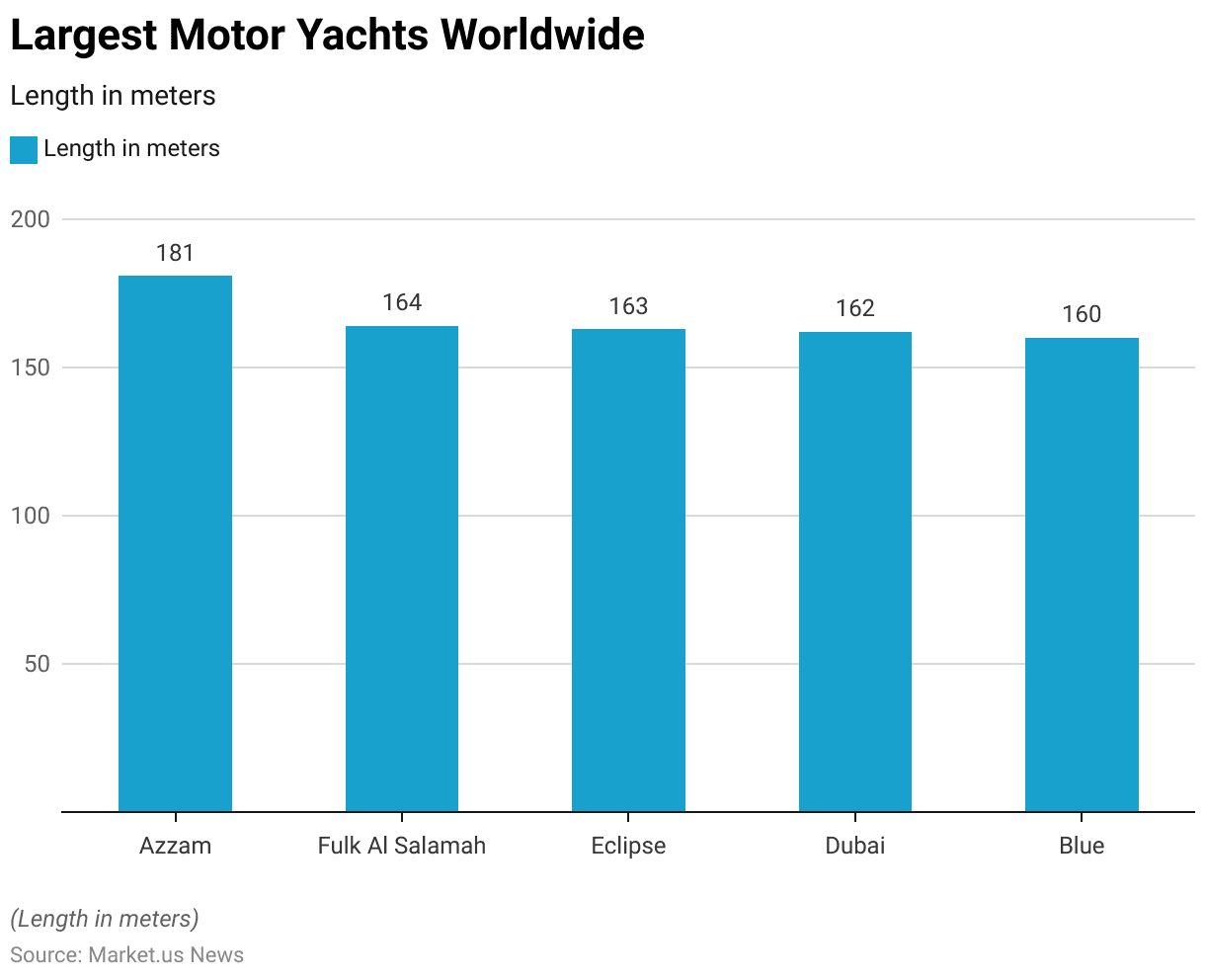

Largest Motor Yachts Worldwide

- In 2024, the landscape of the largest motor yachts worldwide is characterized by impressive lengths that define modern maritime luxury.

- Leading the pack is the Azzam, stretching an expansive 181 meters, making it the longest motor yacht in the world.

- Following closely is the Fulk Al Salamah at 164 meters and the Eclipse, which measures 163 meters.

- The yacht Dubai comes in next at 162 meters, closely trailed by the Blue at 160 meters.

- These yachts not only reflect significant advancements in yacht design and technology but also represent the epitome of luxury in the yachting world.

(Source: Statista)

Yacht Size Statistics

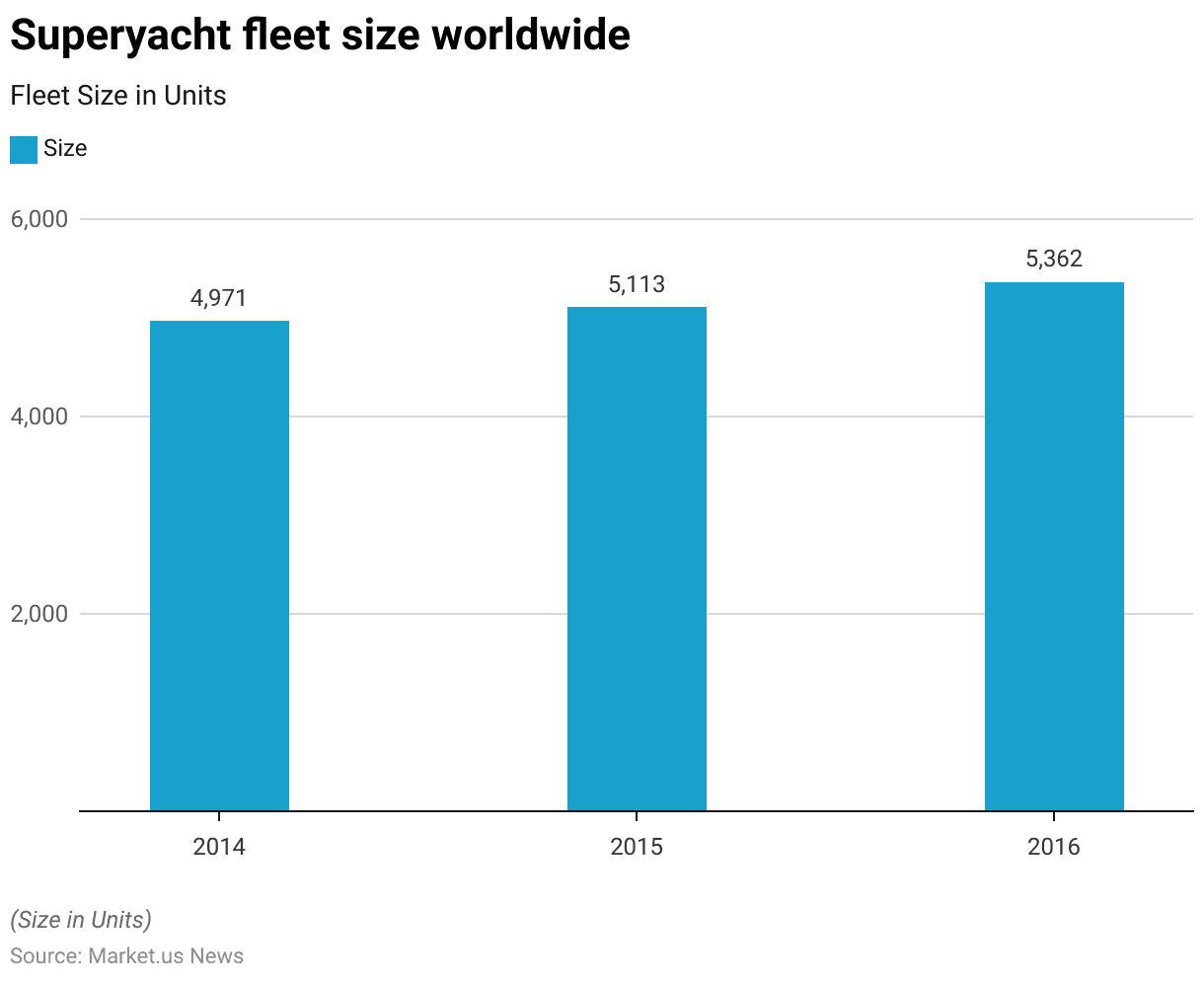

Superyacht Fleet Size Worldwide

- Between 2014 and 2016, the worldwide superyacht fleet experienced steady growth.

- In 2014, the global superyacht fleet comprised 4,971 units.

- By 2015, this number had modestly increased to 5,113 units, indicating ongoing interest and investment in luxury yachting.

- The upward trend continued into 2016, with the fleet size expanding further to 5,362 units.

- This consistent growth over the three years reflects a robust and expanding market for superyachts. Driven by increasing demand for high-end, luxury maritime experiences.

(Source: Statista)

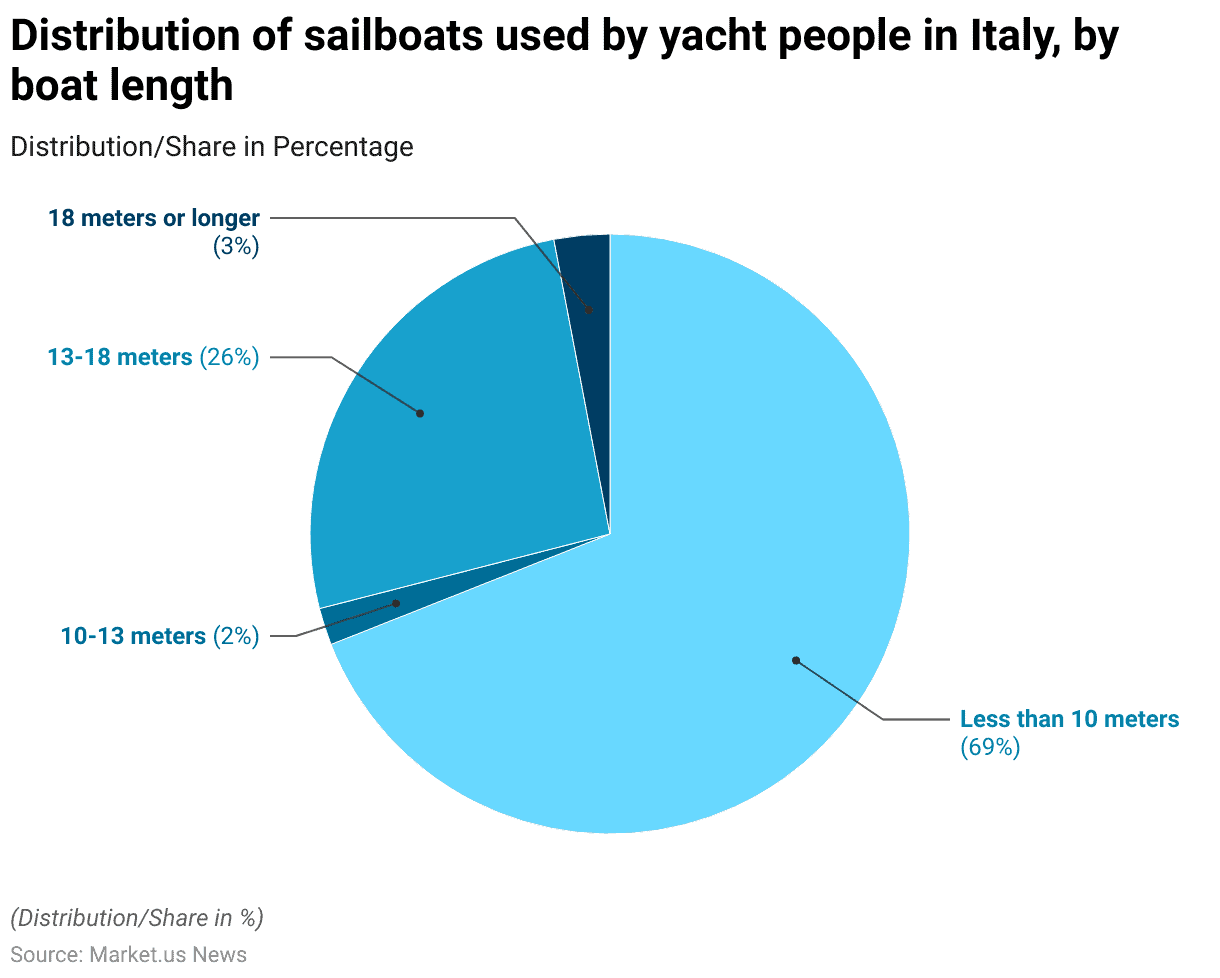

Sailboats Used by Yacht People – By Boat Length Statistics

- In 2018, the distribution of sailboats used by yacht enthusiasts in Italy showed a clear preference for smaller vessel sizes.

- The majority, or 69%, of respondents reported using sailboats that were less than 10 meters in length.

- This indicates a significant inclination towards more compact and potentially more manageable boats within the recreational sailing community.

- In contrast, only a small fraction of the boaters, 2%, used sailboats ranging from 10 to 13 meters.

- Sailboats with a length between 13 and 18 meters were used by 26% of the respondents. Suggesting that a quarter of the market favors moderately larger vessels.

- Additionally, boats that were 18 meters or longer were the least preferred, with only 3% of yacht enthusiasts opting for these larger sizes.

- This distribution highlights the varied preferences in boat sizes among sailing fans in Italy.

(Source: Statista)

Yacht Statistics – By Country

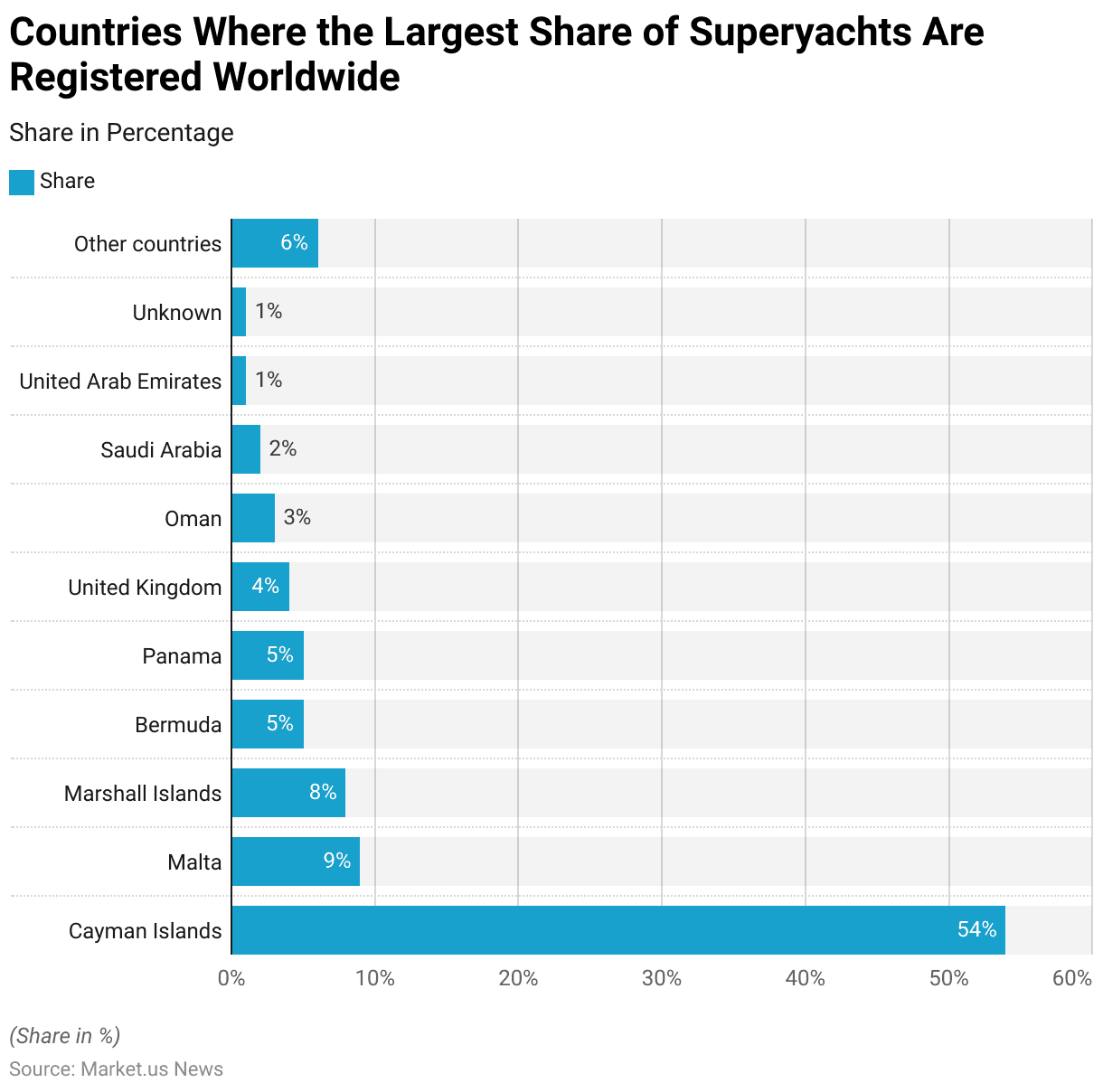

Countries Where the Largest Share of Superyachts Are Registered Worldwide

- As of May 2022, the Cayman Islands emerges as the leading jurisdiction for superyacht registrations. Holding a significant 54% of the global share.

- Malta follows with 9% of superyacht registrations, while the Marshall Islands accounts for 8%.

- Bermuda and Panama each host 5% of the world’s registered superyachts, reflecting their favorable regulatory environments.

- The United Kingdom has 4% of these vessels registered under its flag.

- Meanwhile, Oman and Saudi Arabia have smaller shares, with 3% and 2% respectively.

- The United Arab Emirates accounts for 1% of the registrations, with an additional 1% classified under ‘Unknown’.

- Other countries collectively account for 6% of superyacht registrations, showcasing a diverse global distribution of yacht registrations.

(Source: Statista)

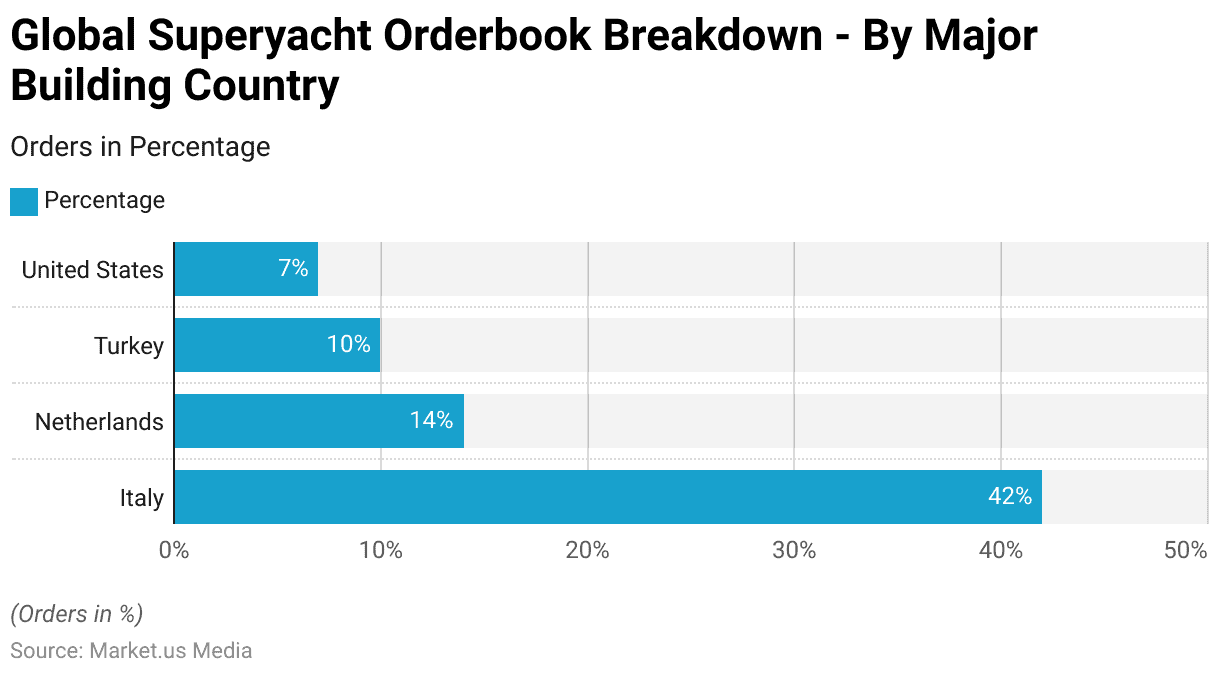

Global Superyacht Orderbook Breakdown – By Major Building Country

- In 2016, the global superyacht orderbook demonstrated a clear concentration of activity among several key building countries.

- Italy led the way with a dominant 42% of the total orders. Underscoring its prestigious position in the superyacht manufacturing industry.

- The Netherlands also held a significant share, accounting for 14% of the orders. Reflecting its well-established reputation for quality yacht building.

- Turkey contributed a notable 10% to the global order book, highlighting its emerging presence in the luxury yacht market.

- Meanwhile, the United States was responsible for 7% of the orders, indicating a substantial. Though smaller, role in the global market for superyachts.

- These figures illustrate the distribution of superyacht-building activity across leading maritime nations.

(Source: Statista)

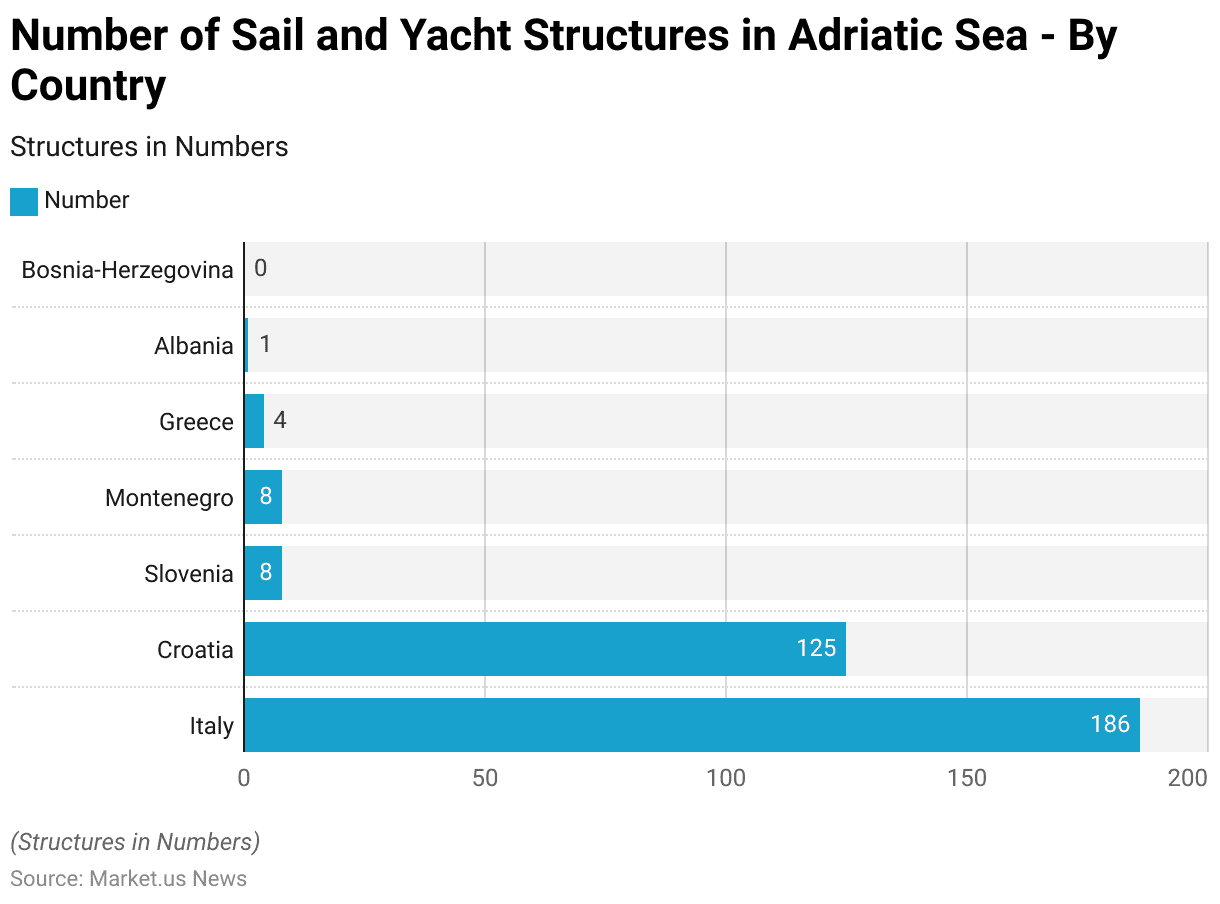

Number of Sail and Yacht Structures in the Adriatic Sea – By Country Statistics

- In 2018, the distribution of sail and yacht structures across ports in the Adriatic Sea varied significantly by country.

- Italy led the count with a total of 186 structures, underscoring its prominent role in the regional maritime sector.

- Croatia followed with 125 structures, reflecting its established yachting industry and attractive coastal offerings.

- Both Slovenia and Montenegro each hosted eight structures, indicating more modest but still significant maritime activities in these countries.

- Greece, known for its extensive coastlines and islands, had four structures.

- Albania had a minimal presence with just one structure. In contrast, Bosnia-Herzegovina did not have any sail or yacht structures in its ports. Highlighting limited development in this sector within the country.

(Source: Statista)

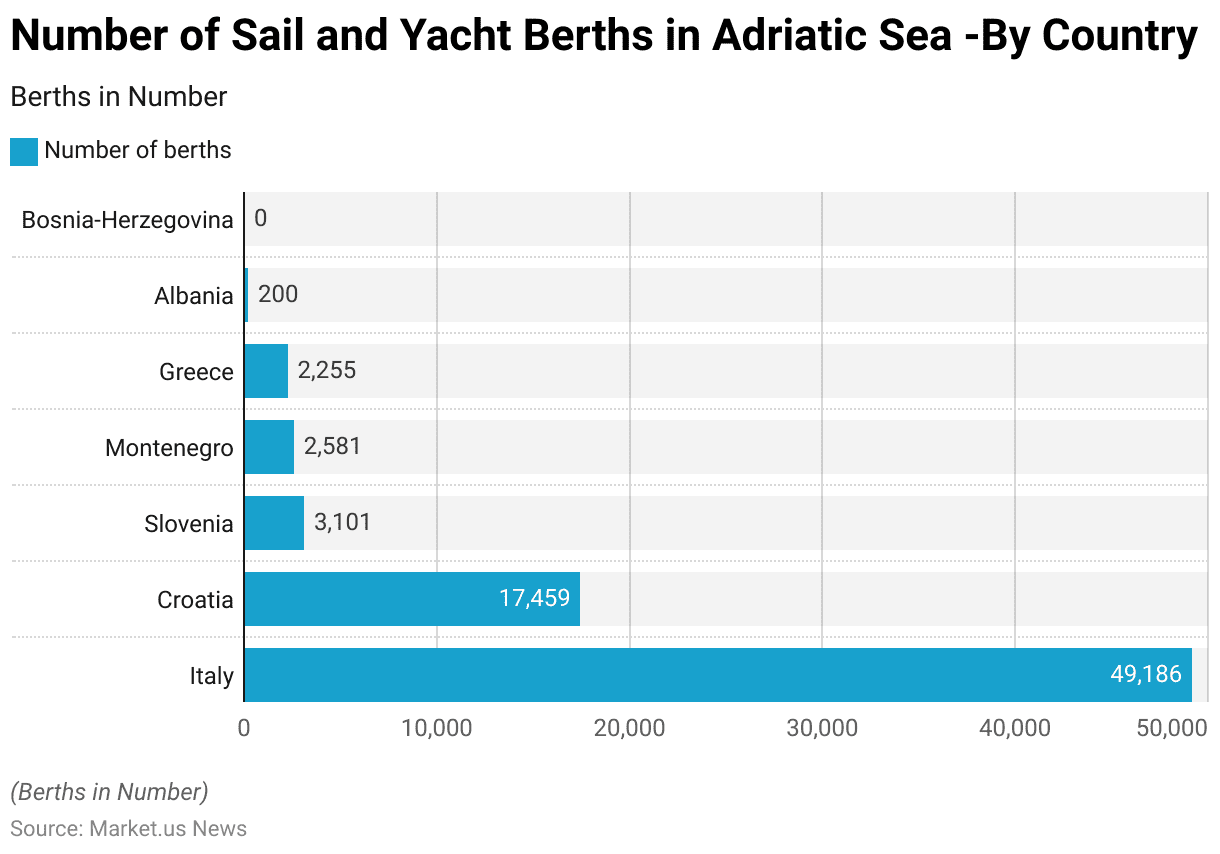

Number of Sail and Yacht Berths in Adriatic Sea -By Country Statistics

- In 2018, the number of sail and yacht berths available in Adriatic Sea ports exhibited substantial variation across different countries.

- Italy dominated the region with an impressive total of 49,186 berths, highlighting its significant maritime infrastructure.

- Croatia also featured prominently, providing 17,459 berths, indicative of its strong nautical tourism sector.

- Further, Slovenia and Montenegro offered a more moderate number of berths, with 3,101 and 2,581, respectively, supporting their growing roles in the Adriatic maritime landscape.

- Greece, despite its extensive coastline and numerous islands, had 2,255 berths.

- Albania had a relatively small number, with only 200 berths, while Bosnia-Herzegovina had no sail or yacht berths. Underscoring its minimal engagement in the yachting sector within the Adriatic region.

(Source: Statista)

Yacht Export Statistics

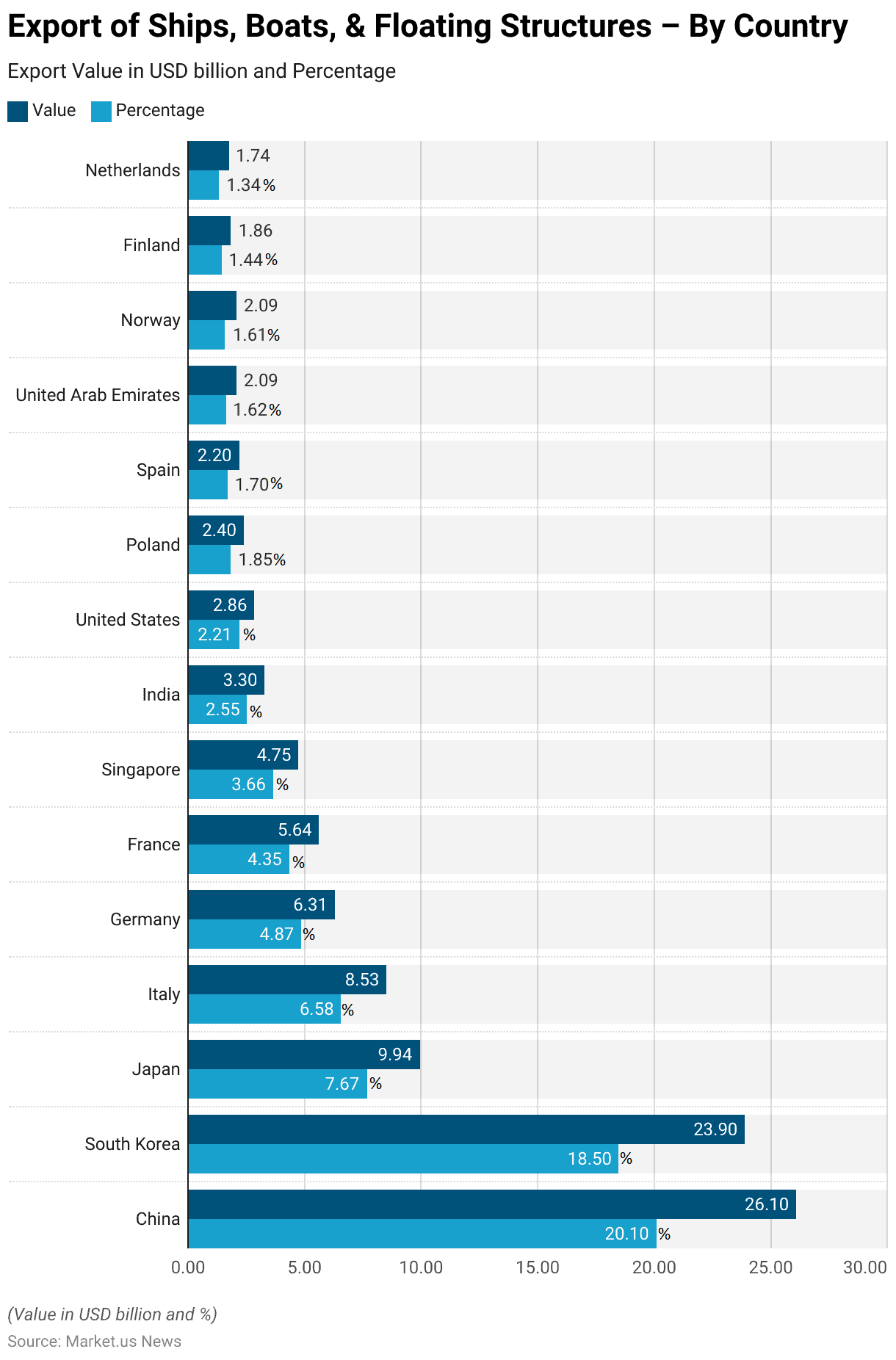

Export of Ships, Boats, & Floating Structures – By Country

- In 2022, the global export market for ships, boats, and floating structures was dominated by China and South Korea.

- China led the market with an export value of $26.1 billion, accounting for 20.1% of the global share, followed closely by South Korea with $23.9 billion, representing 18.5% of the market.

- Japan also played a significant role, contributing $9.94 billion to exports, which corresponds to 7.67% of the market.

- Italy and Germany were other notable exporters, with Italy exporting $8.53 billion worth of maritime equipment (6.58% of the market) and Germany $6.31 billion (4.87%).

- France, Singapore, and India were also key players, exporting $5.64 billion, $4.75 billion, and $3.3 billion, respectively.

- Lesser yet substantial contributions came from the United States, Poland, Spain, the United Arab Emirates, Norway, Finland, and the Netherlands, each contributing between 1.34% and 2.21% to the global export figures in this sector.

- These statistics illustrate a diverse and competitive landscape in the maritime manufacturing industry.

(Source: The Observatory of Economic Complexity)

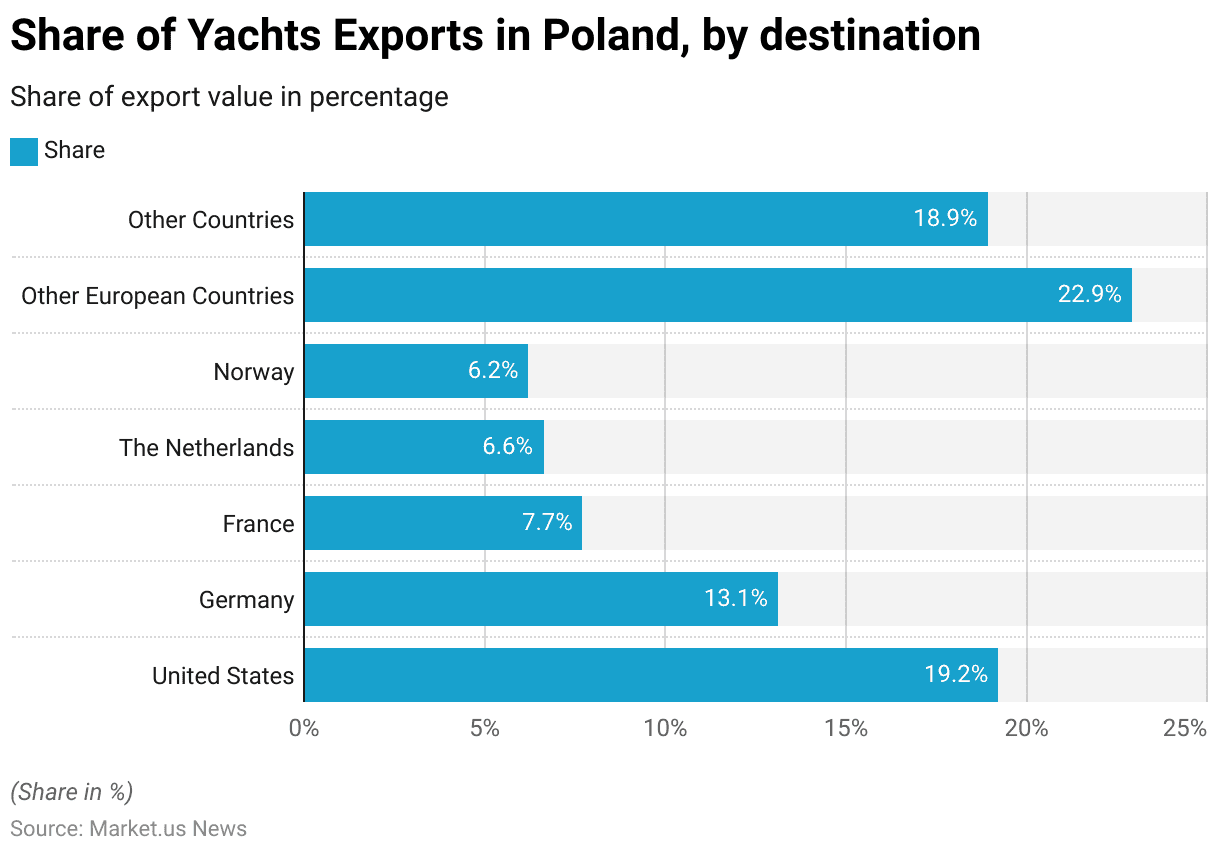

Yacht Exports in Poland – By Destination Statistics

- In 2022, Poland’s yacht export market exhibited a diverse geographical distribution.

- The United States was the primary destination, receiving 19.20% of Poland’s yacht exports.

- Germany followed as another significant market, accounting for 13.10% of the exports.

- France and the Netherlands were also notable importers of Polish yachts, with shares of 7.70% and 6.60%, respectively.

- Norway received 6.20% of the exports, highlighting Poland’s reach into various European markets.

- Additionally, other European countries collectively accounted for a substantial 22.90% of Poland’s yacht exports.

- Markets outside of Europe, grouped under ‘Other Countries,’ also played a significant role, absorbing 18.90% of the exports.

- This distribution underscores Poland’s extensive involvement in the global yacht market and its diverse range of export destinations.

(Source: Statista)

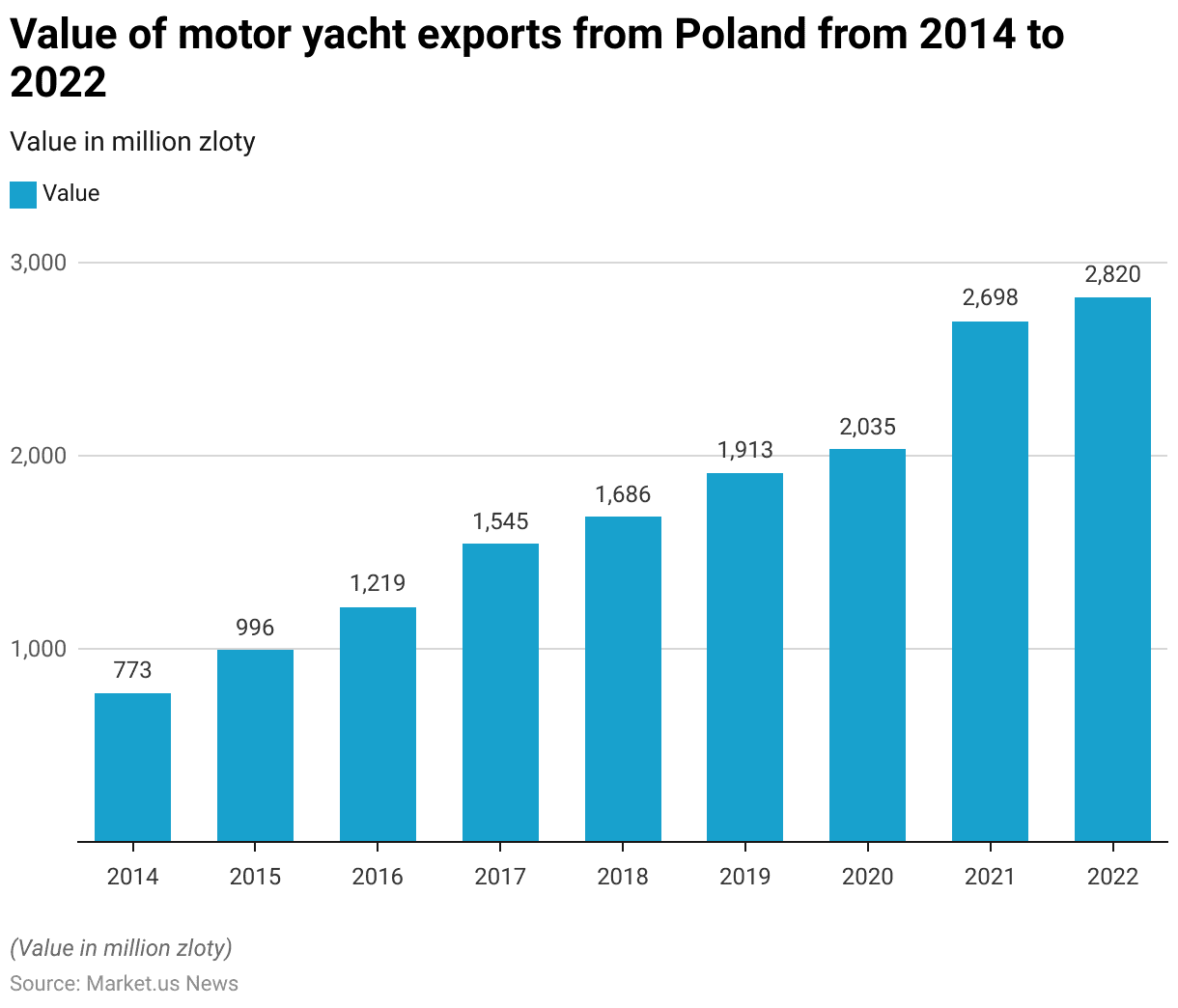

Motor Yacht Export Value from Poland Statistics

- From 2014 to 2022, Poland experienced consistent growth in the export value of motor yachts, measured in millions of zloty.

- Starting in 2014, the export value was 773 million zloty. The subsequent years saw a steady increase: in 2015, the value rose to 996 million zloty, followed by a further increase to 1,219 million zloty in 2016.

- The growth continued, with the export value reaching 1,545 million zloty in 2017 and 1,686 million zloty in 2018.

- By 2019, the export value had climbed to 1,913 million zloty, showing a robust expansion of the sector.

- The upward trajectory persisted into the next few years, with the export value reaching 2,035 million zloty in 2020.

- The year 2021 saw a significant jump to 2,698 million zloty, and by 2022, the export value peaked at 2,820 million zloty.

- This consistent increase over the years underscores Poland’s growing prominence in the global motor yacht industry and its successful expansion in yacht manufacturing and exportation.

(Source: Statista)

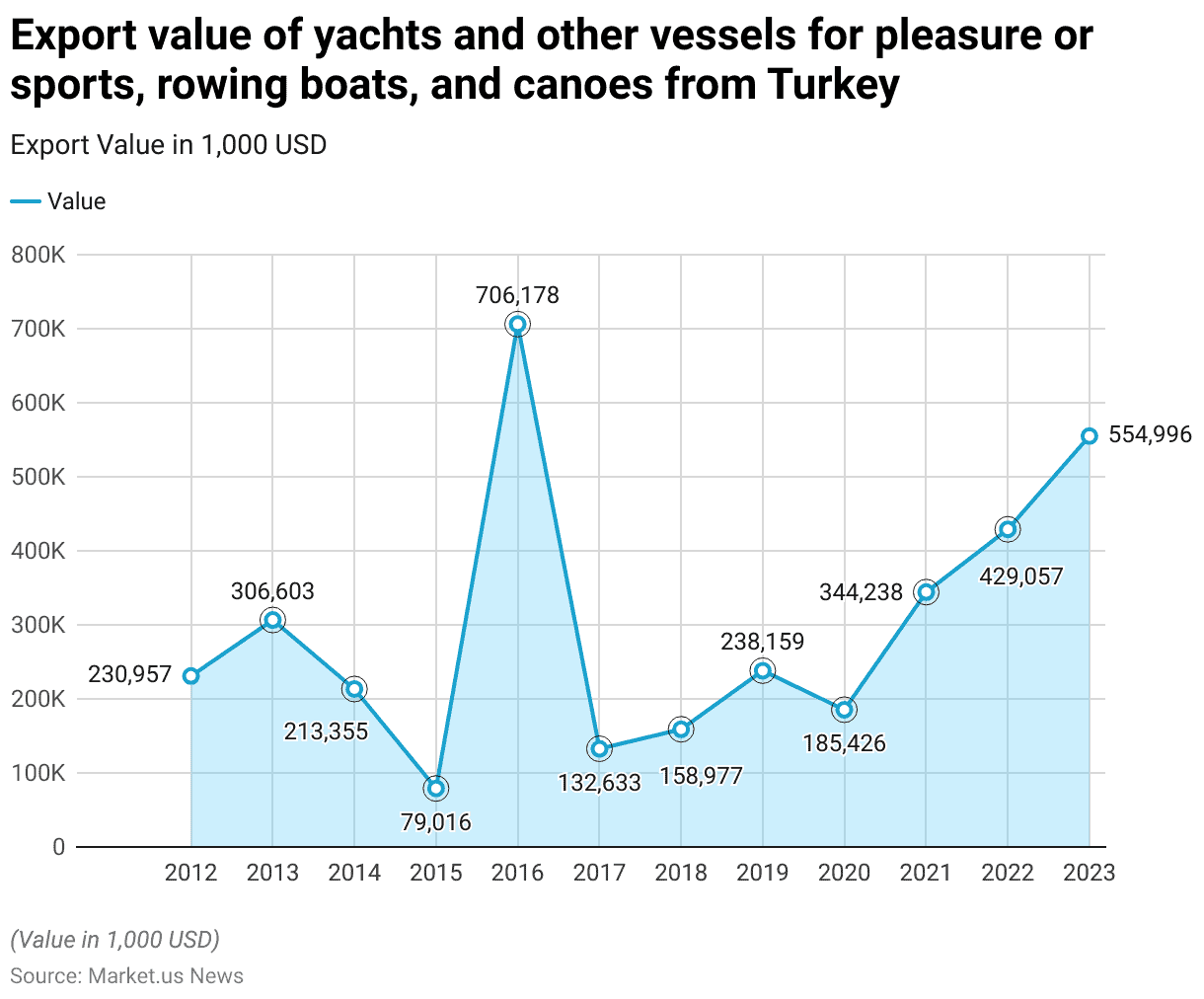

Export Value of Yacht, Rowing Boats, and Canoes from Turkey Statistics

- Between 2012 and 2023, Turkey’s export value of yachts and other vessels for pleasure or sports, including rowing boats and canoes, exhibited significant fluctuations.

- In 2012, the export value stood at approximately $230,957 thousand.

- The value increased to $306,603 thousand in 2013 but dropped to $213,355 thousand in 2014.

- A substantial decrease occurred in 2015, with exports plummeting to just $79,016 thousand.

- However, a dramatic rise in 2016 saw export values soar to $706,178 thousand.

- This peak was followed by a decline, with 2017 and 2018 witnessing values of $132,633 thousand and $158,977 thousand, respectively.

- A moderate recovery was seen in 2019, with exports valued at $238,159 thousand, but this figure fell to $185,426 thousand in 2020, likely impacted by global economic conditions.

- The trend reversed in 2021 as exports rebounded strongly to $344,238 thousand and continued to rise to $429,057 thousand in 2022.

- By 2023, the export value had reached its zenith at $554,996 thousand, indicating a robust recovery and growth trajectory in the latter part of the analyzed period.

- This data underscores the volatile yet ultimately upward trend in Turkey’s yacht export market over the analyzed years.

(Source: Statista)

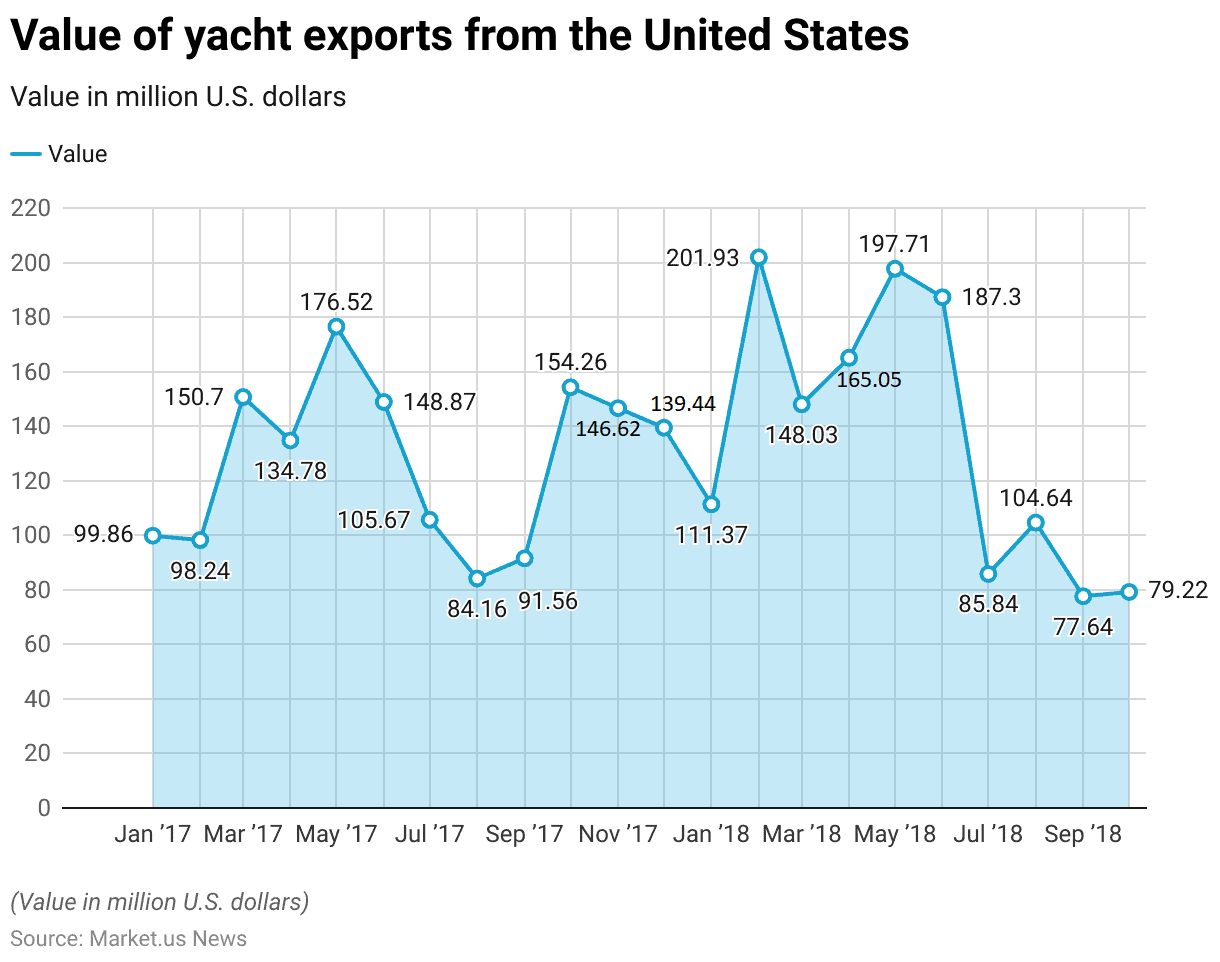

U.S. Yacht Exports Statistics

- Between January 2017 and October 2018, the United States saw fluctuating values in yacht exports, with amounts expressed in million U.S. dollars.

- In January 2017, exports were valued at $99.86 million, slightly decreasing in February to $98.24 million.

- A significant increase occurred in March, reaching $150.7 million, followed by April and May with $134.78 million and $176.52 million, respectively.

- The mid-year months from June to October 2017 showed mixed figures, starting at $148.87 million in June, dipping to $105.67 million in July, further decreasing to $84.16 million in August, then rebounding to $91.56 million in September and peaking at $154.26 million in October.

- The value continued to fluctuate towards the year-end and into 2018, with notable peaks in February 2018 at $201.93 million and May at $197.71 million.

- However, the latter part of 2018 saw a decline, with July at $85.84 million, August at $104.64 million, September at $77.64 million, and October at $79.22 million.

- This period highlights the variable dynamics within the U.S. yacht export market, marked by periods of significant highs and lows.

(Source: Statista)

Yacht Import Statistics

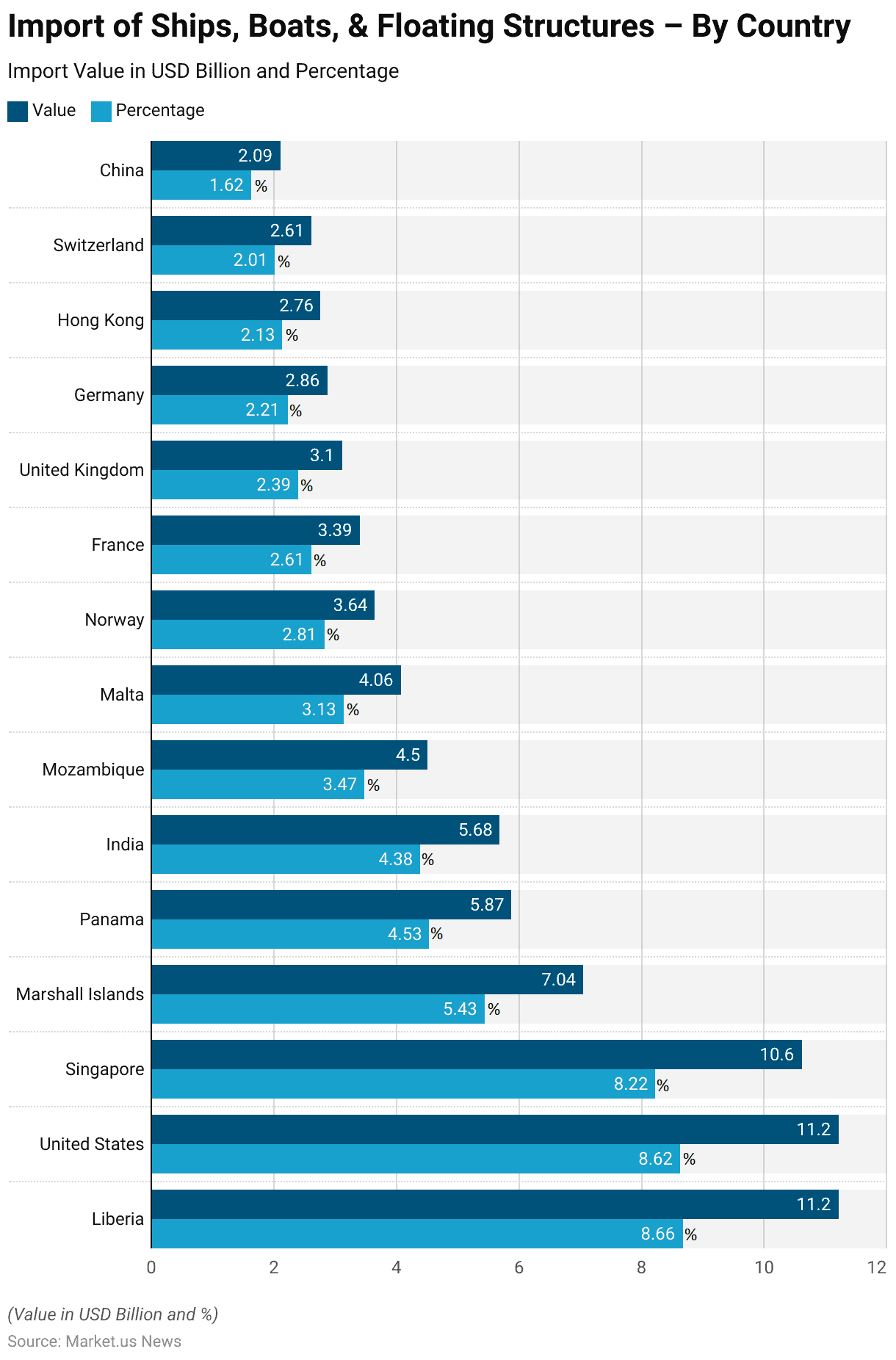

Import of Ships, Boats, & Floating Structures – By Country

- In 2022, the global market for importing ships, boats, and floating structures was led by Liberia and the United States, each accounting for significant portions of the import market.

- Liberia imported $11.2 billion worth of these goods, representing 8.66% of the market, closely followed by the United States, with a nearly equivalent value but slightly lower market share of 8.62%.

- Singapore also showed a strong presence with $10.6 billion in imports, capturing 8.22% of the market.

- The Marshall Islands and Panama were other notable importers, with values of $7.04 billion and $5.87 billion, respectively, corresponding to market shares of 5.43% and 4.53%.

- Further contributions came from India, importing $5.68 billion (4.38% of the market), and Mozambique with $4.5 billion (3.47%).

- Smaller yet significant imports were recorded by Malta ($4.06 billion), Norway ($3.64 billion), and France ($3.39 billion), each constituting around 2% to 3% of the market.

- The United Kingdom, Germany, Hong Kong, Switzerland, and China also participated in the market, with imports ranging from $2.09 billion to $3.1 billion, reflecting lesser but still essential involvement in the global market for maritime structures.

- This distribution highlights a diverse and dynamic international landscape in the maritime import sector.

(Source: The Observatory of Economic Complexity)

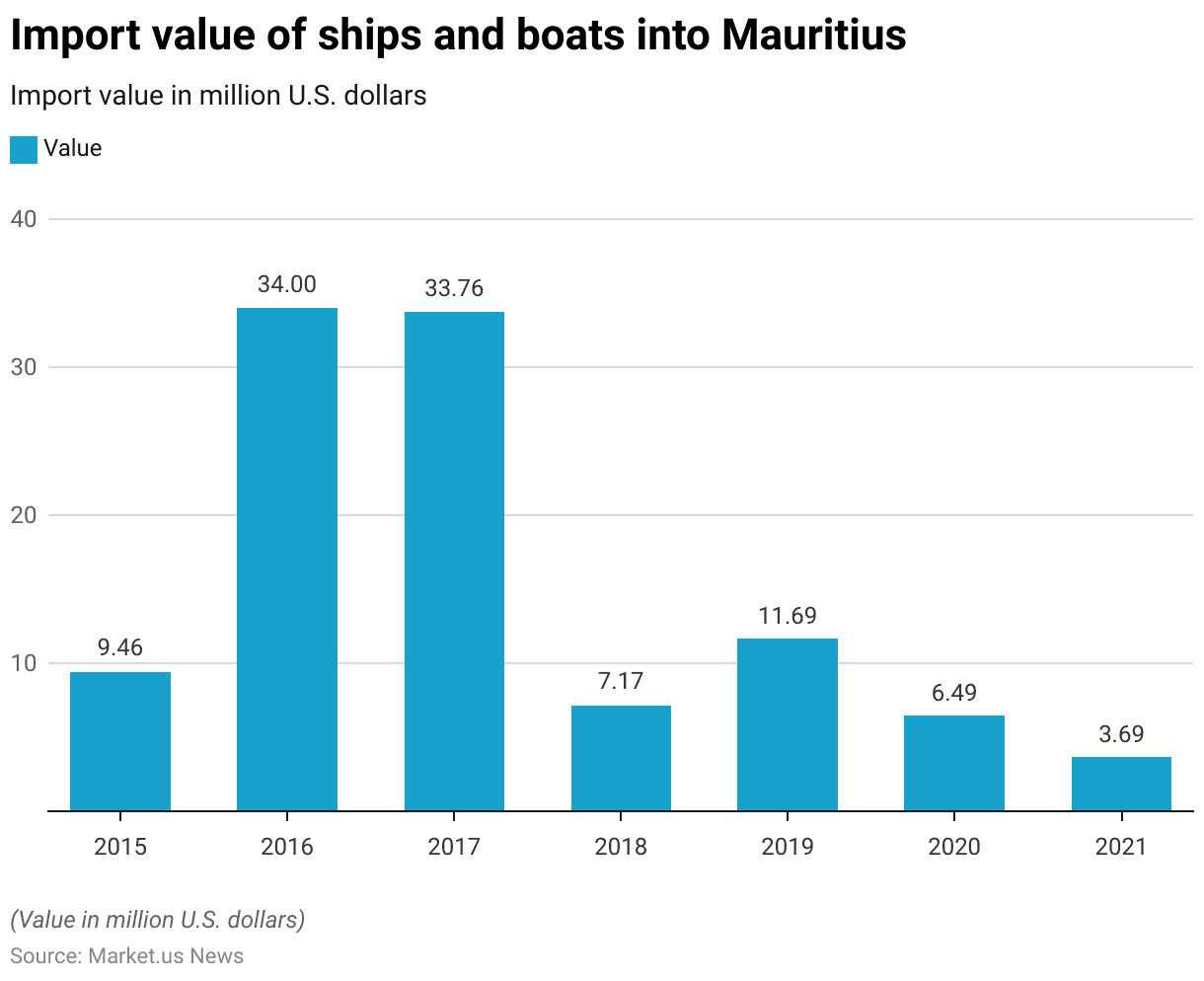

Ships and Boats Import Value into Mauritius

- From 2015 to 2021, Mauritius experienced significant fluctuations in the import value of ships and boats, measured in million U.S. dollars.

- In 2015, the import value stood at $9.46 million, followed by a substantial increase in 2016, when it reached $34 million.

- The trend continued closely in 2017, with imports slightly declining to $33.76 million.

- However, a sharp drop occurred in 2018, with the import value plummeting to $7.17 million.

- There was a modest recovery in 2019, as the imports rose to $11.69 million.

- The following years saw a downward trend, with 2020 imports at $6.49 million and further declining to $3.69 million in 2021.

- This seven-year span illustrates the volatile nature of Mauritius’s import market for ships and boats, reflecting varying economic conditions and possibly changing domestic demands.

(Source: Statista)

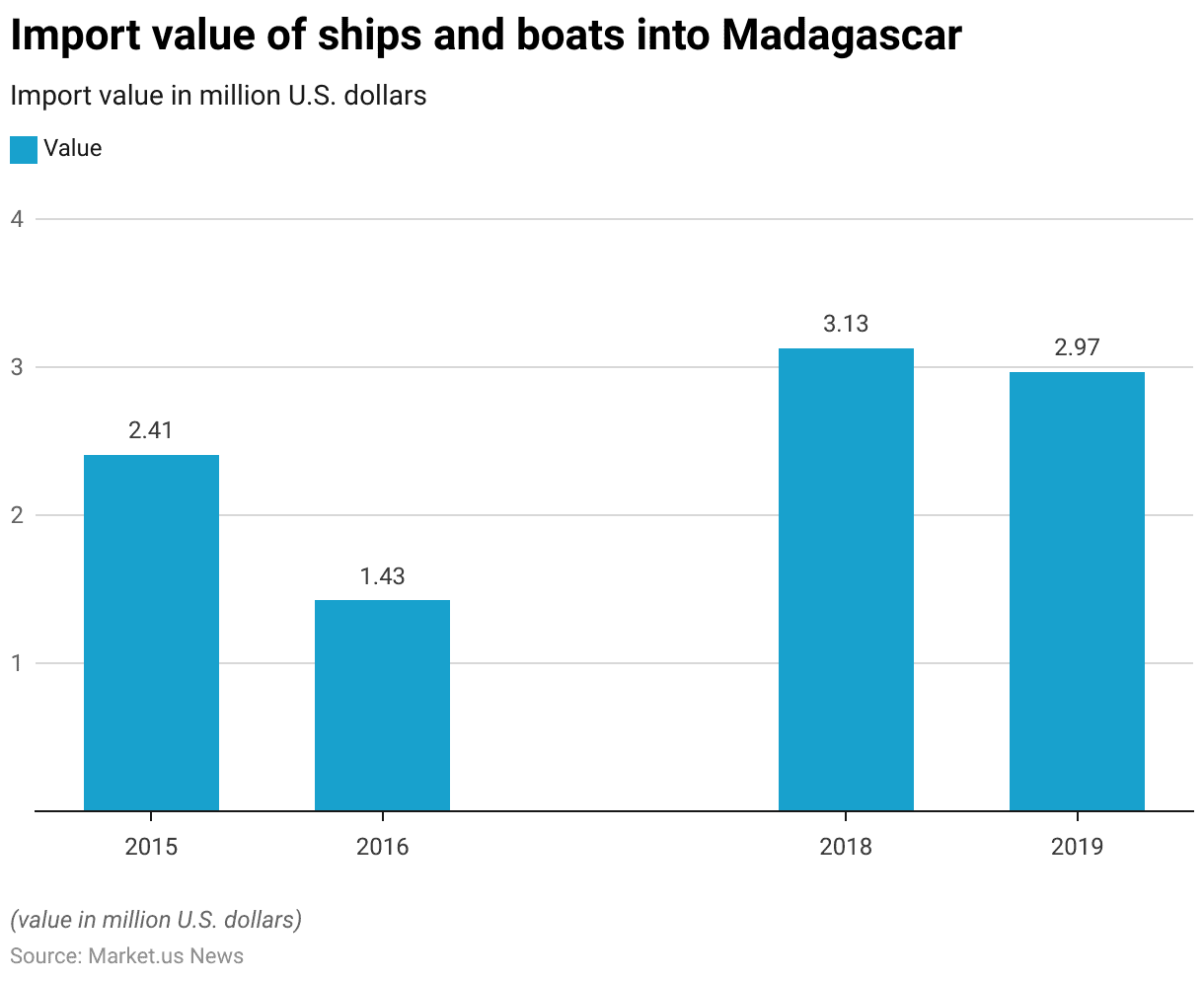

Import Value of Ships and Boats into Madagascar

- From 2015 to 2019, Madagascar’s imports of ships and boats displayed a pattern of fluctuation in terms of value, expressed in millions of U.S. dollars.

- In 2015, the import value started at $2.41 million. It then decreased significantly in 2016 to $1.43 million, suggesting a temporary decline in maritime acquisitions.

- There appears to be a data gap for 2017, but by 2018, there was a notable increase, with the import value rising to $3.13 million.

- This trend slightly declined in 2019, with the import value adjusting to $2.97 million.

- This five-year trend highlights the variable demand for maritime vessels in Madagascar, reflecting changes in economic conditions or shifts in maritime transport needs within the country.

(Source: Statista)

Yacht Sales Statistics

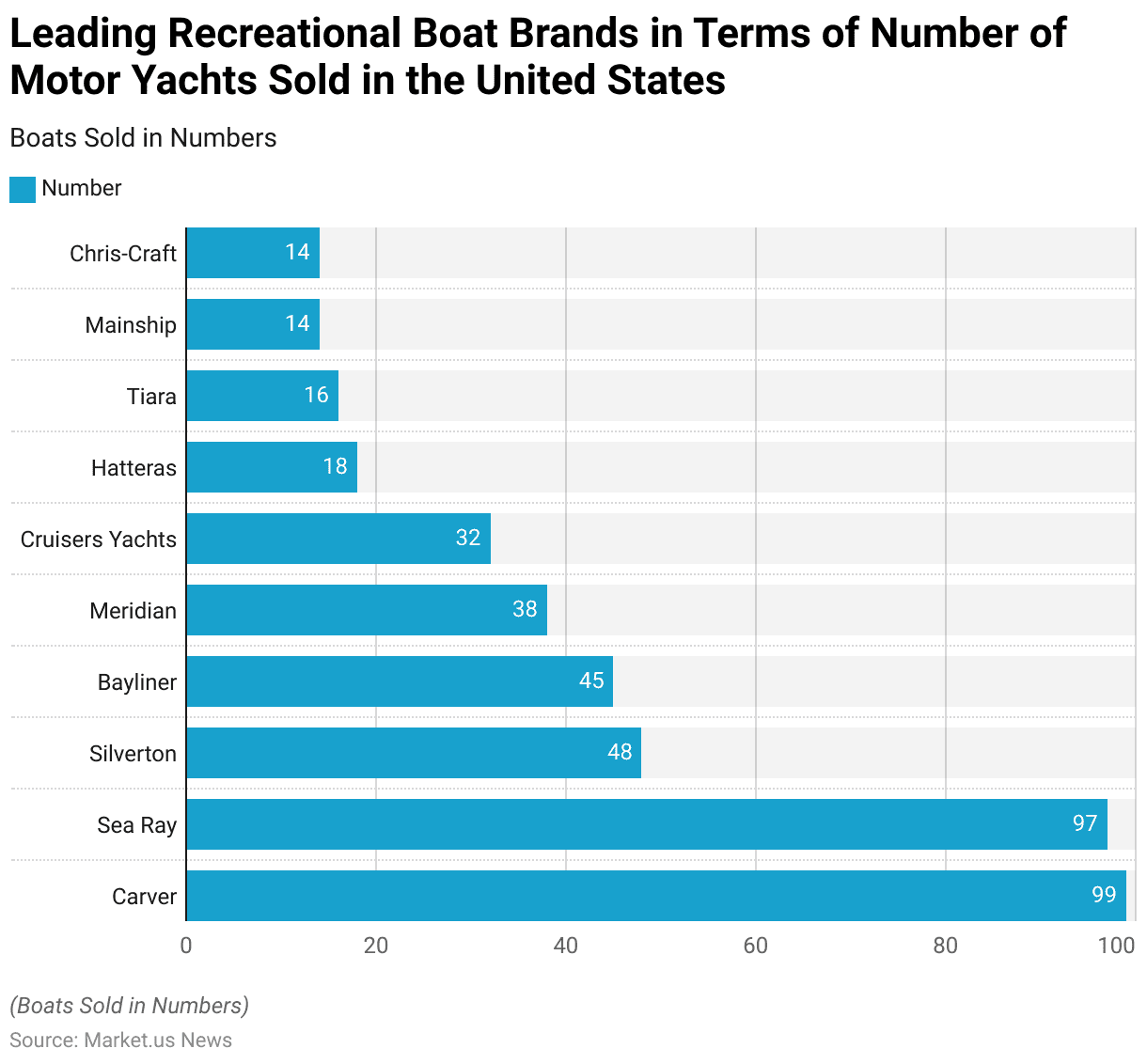

Leading Recreational Boat Brands in Terms of Number of Motor Yachts Sold in the United States

- In the second quarter of 2017, several recreational boat brands stood out in the U.S. market for their motor yacht sales.

- Carver led the pack with the highest number of boats sold, totaling 99 units.

- Closely following was Sea Ray, with 97 boats sold, demonstrating its strong presence in the market.

- Silverton and Bayliner also had significant sales figures, with 48 and 45 boats sold, respectively. Indicating their popularity among boating enthusiasts.

- Meridian managed to sell 38 boats, while Cruisers Yachts sold 32, showing a moderate but steady demand for their yachts.

- The sales numbers dipped further for some of the more premium or specialized brands: Hatteras sold 18 boats, Tiara 16 boats, and both Mainship and Chris-Craft sold 14 boats each.

- This varied performance across brands highlights different consumer preferences and market positions within the recreational boating industry in the United States during that period.

(Source: Statista)

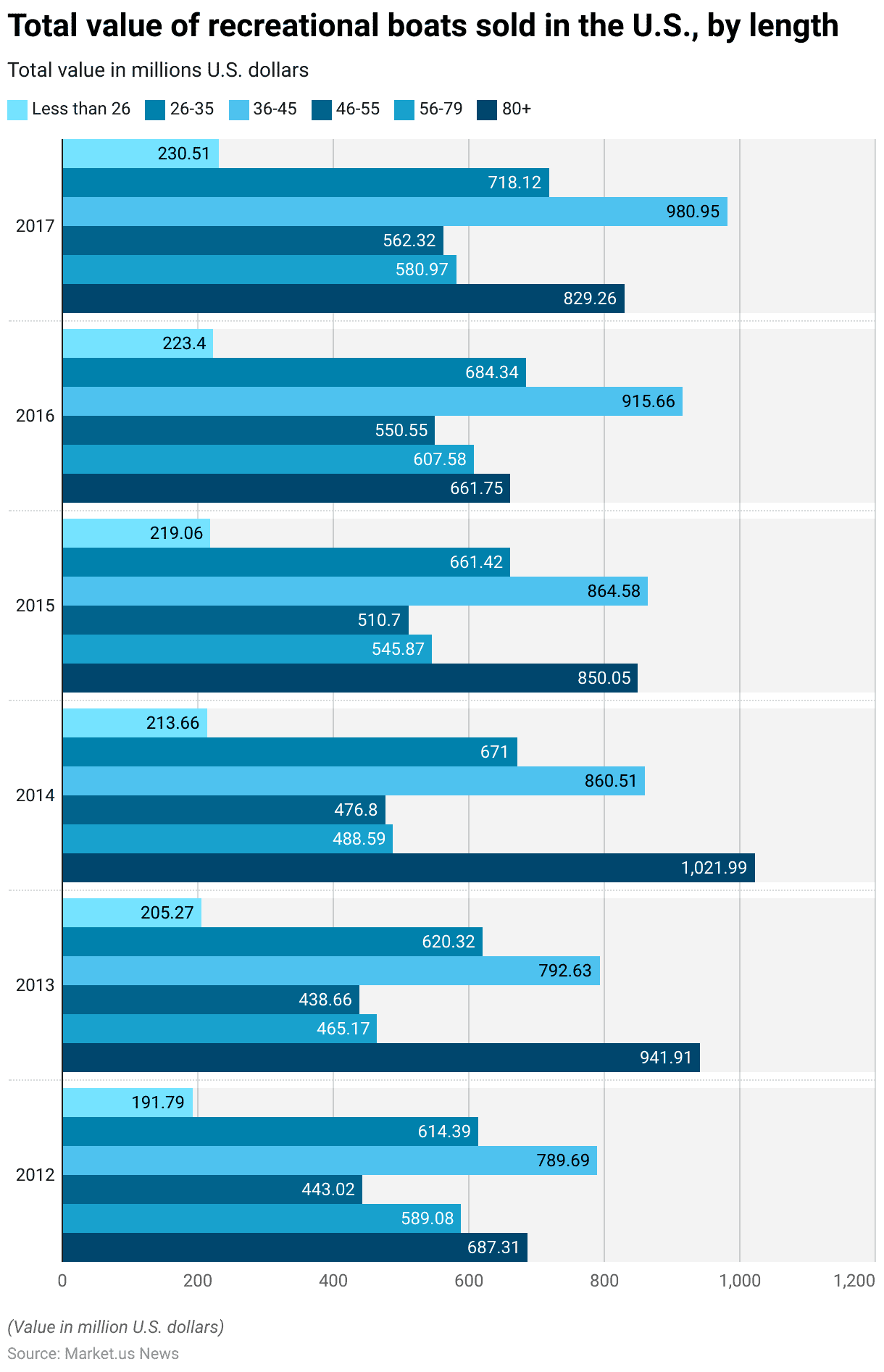

Sales Value of Recreational Boats in the U.S. – By Length

- From 2012 to 2017, the total value of recreational boats sold in the U.S. varied significantly across different boat lengths.

- Boats less than 26 feet in length saw steady growth in sales. Starting from $191.79 million in 2012 and increasing each year to reach $230.51 million by 2017.

- The 26-35 feet category also showed growth over the six years, beginning at $614.39 million in 2012 and rising to $718.12 million in 2017, indicating a strong demand for this size range.

- For boats measuring 36-45 feet, there was substantial growth. Starting at $789.69 million in 2012 and peaking at $980.95 million in 2017.

- The 46-55 feet category experienced moderate increases, beginning at $443.02 million in 2012 and growing to $562.32 million in 2017, with a notable jump in sales between 2014 and 2016.

- The 56-79-foot boats, however, saw a dip in sales from $589.08 million in 2012 to $580.97 million in 2017, despite peaking at $607.58 million in 2016.

- The largest boats, those over 80 feet, exhibited the most fluctuation. Sales surged from $687.31 million in 2012 to a high of $1021.99 million in 2014, then dropped significantly to $661.75 million in 2016 before rebounding to $829.26 million in 2017.

- This data underscores the dynamic nature of the boat market in the U.S. Reflecting varying consumer preferences and economic conditions impacting boat sales across different length categories.

(Source: Statista)

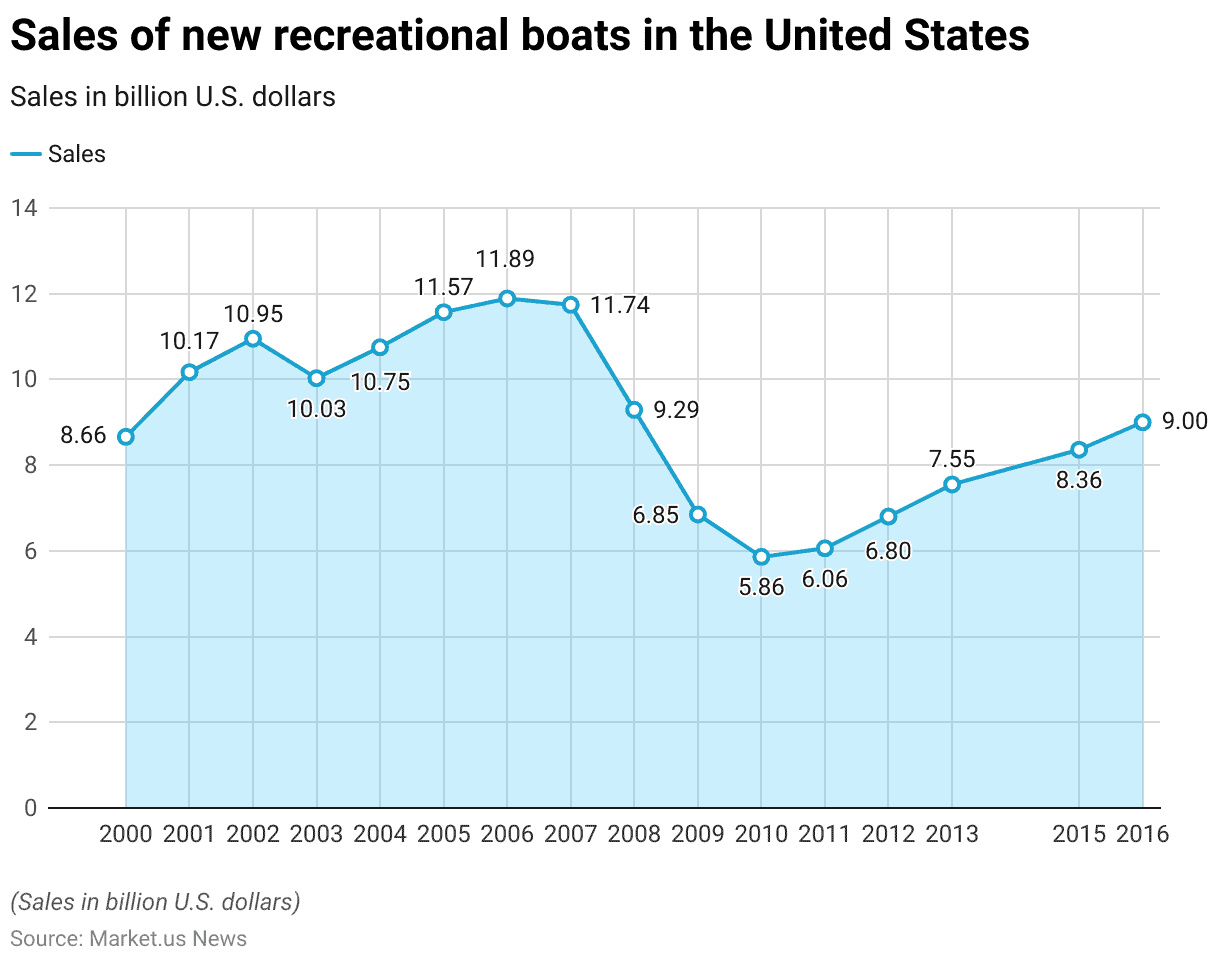

Sales of New Recreational Boats in the United States

- From 2000 to 2016, sales of new recreational boats in the United States experienced both growth and decline, reflecting varying economic conditions.

- Starting in 2000, sales were at $8.66 billion and increased over the next few years, peaking at $10.95 billion in 2002.

- Following this peak, sales fluctuated slightly but remained robust through 2007, with figures generally staying above $10 billion and reaching $11.89 billion in 2006, the highest in this period.

- However, the economic downturn had a pronounced impact starting in 2008, when sales dropped to $9.29 billion and continued to decline sharply, reaching a low of $5.86 billion in 2010.

- The recovery was gradual but steady from this point, with sales climbing back to $6.8 billion by 2012 and continuing to rise to $9 billion by 2016.

- This upward trend in the latter years suggests a rebound in consumer confidence and spending power, leading to increased boat sales.

- This period captures the volatile nature of boat sales in response to broader economic shifts, with significant recoveries following the sharp declines of the late 2000s.

(Source: Statista)

Demographics of Yacht Owners Statistics

By Age

- Over the past 20 years, the average age of superyacht owners has dropped by about 10 years, with a current trend showing that younger people are increasingly buying these luxury vessels.

- According to a 2017 study by the International University of Monaco and the Rossinavi shipyard, the typical yacht owner used to be between 45 and 55 years old.

- This age range is expected to shift to between 35 and 45 over the next two decades. A key factor in this shift is that 20% of the world’s wealthiest 100 billionaires who are under 50 are entering the yacht market, bringing down the average age of buyers.

- The trend of younger buyers is predicted to accelerate, with Millennials poised to become the main demographic purchasing superyachts in the next 10 years.

- This younger generation’s growing interest in yachting is supported by research from Italian yacht manufacturer Rossinavi and the University of Monaco, which anticipates a further reduction of 10 to 15 years in the average age of superyacht buyers over the coming decade.

- Furthermore, data from Boat International indicates that while the average age of yacht owners is decreasing, the average age of the yachts being sold has increased this year to 13 years.

- This suggests that while younger individuals are buying more yachts, they are also purchasing older vessels.

(Sources: Forbes, Superyacht News, Atlantic Pacific Marine Ltd, Robb Report)

By Gender

- While the boating industry is making strides toward gender equality, historically, more men have bought boats than women.

- However, recent trends indicate that this gap is closing. The popularity of sailing and boating is expected to continue growing, becoming a favorite hobby for a diverse range of people.

- Recent data from Boat Trader highlights a significant increase in women’s participation in the boat-buying process. In September 2020, there was a notable 75% rise in the number of women shopping for boats compared to the previous year, showing a substantial increase in their interest. This trend continued into early 2021, with a 23% increase in the number of women browsing Boat Trader in January and February compared to the same months in the previous year.

- Particularly impressive is the surge in interest among millennial women aged 25 to 34 who visited Boat Trader. Since last May, there has been a dramatic 76% increase in visits from women in this age group.

- This shows that younger women are becoming significantly more involved in exploring and purchasing boats, contributing to the dynamic growth in the boating industry.

(Source: Wavetech Powersports)

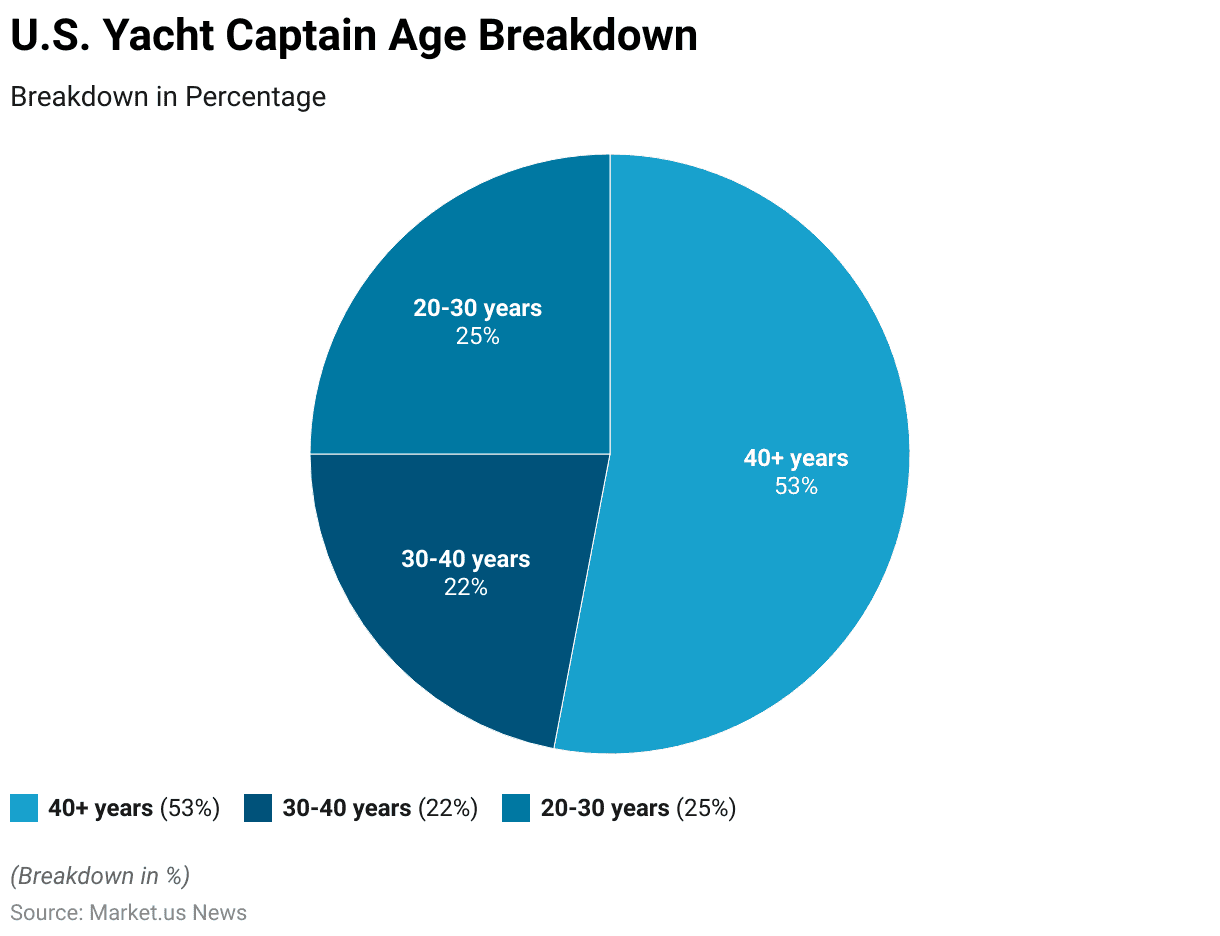

Yacht Captain Demographics

Age

- In the U.S., the age breakdown of yacht captains shows a distribution with a significant number of more experienced captains.

- Those aged 40 years and older make up the majority, comprising 53% of yacht captains.

- This indicates that over half of the captains have likely accrued substantial maritime experience and expertise.

- Captains aged between 30 and 40 years represent 22% of the total, suggesting that a smaller yet significant portion of the workforce is in their mid-career phase.

- Meanwhile, younger captains, aged between 20 to 30 years, make up 25% of the total.

- This relatively high percentage of younger captains could be reflective of a growing interest among younger individuals in pursuing a career in yachting, possibly driven by the lifestyle appeal and opportunities within the industry.

(Source: Zippia)

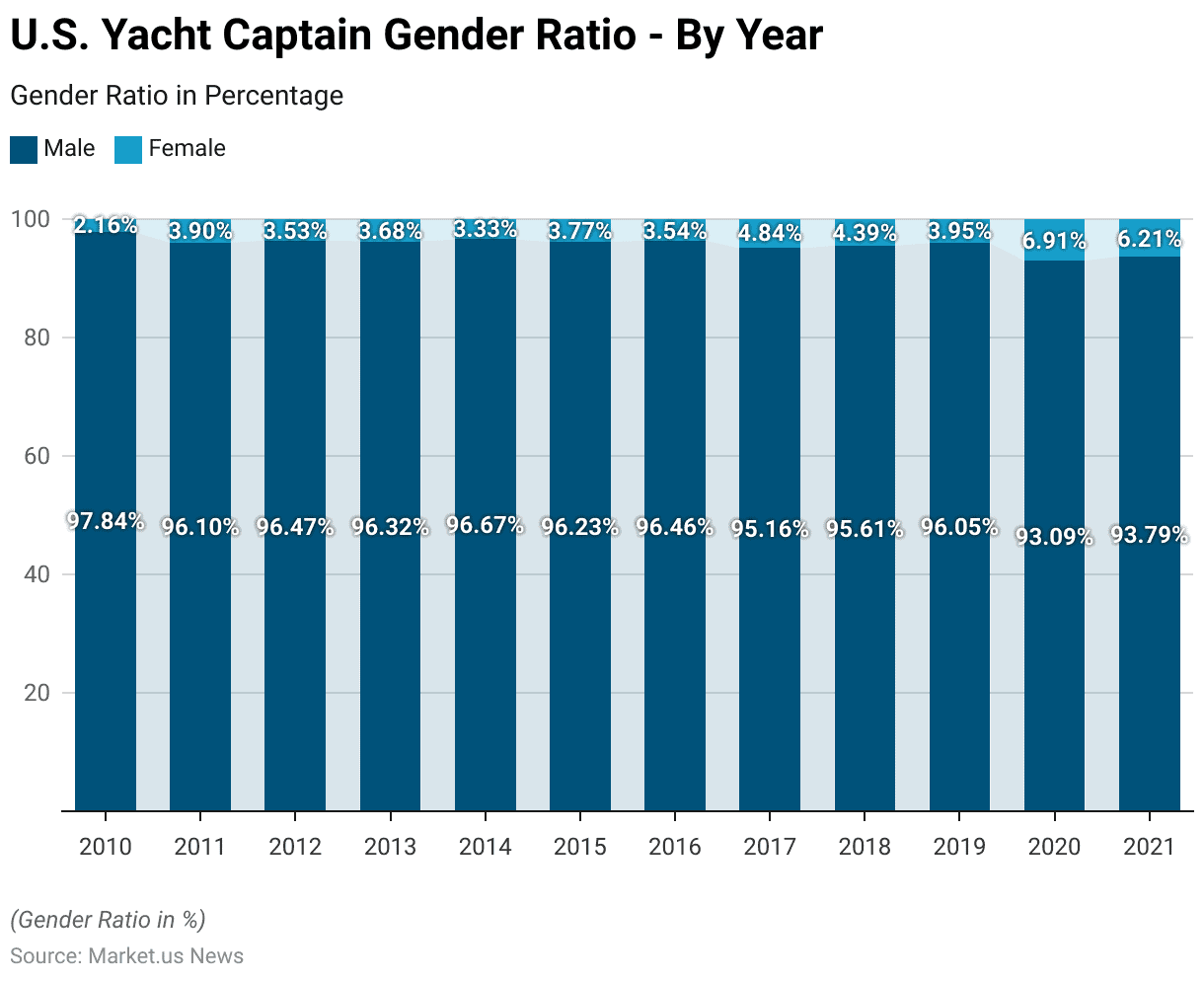

Gender

- Over the past decade, there has been a noticeable change in the gender ratio among yacht captains in the U.S., reflecting a slow but steady increase in female representation.

- In 2010, male yacht captains overwhelmingly dominated the field, comprising 97.84% of the total, while females made up only 2.16%.

- Over the years, the percentage of male captains has gradually decreased, falling to 93.79% by 2021.

- Correspondingly, the proportion of female captains has risen from the initial low percentage in 2010 to 6.21% in 2021.

- The most significant year-to-year changes include 2011 when the percentage of female captains increased to 3.90%, and notably in 2020, when it reached 6.91%.

- This trend indicates a growing inclusion of women in this traditionally male-dominated role, highlighting broader shifts towards gender diversity in maritime professions.

(Source: Zippia)

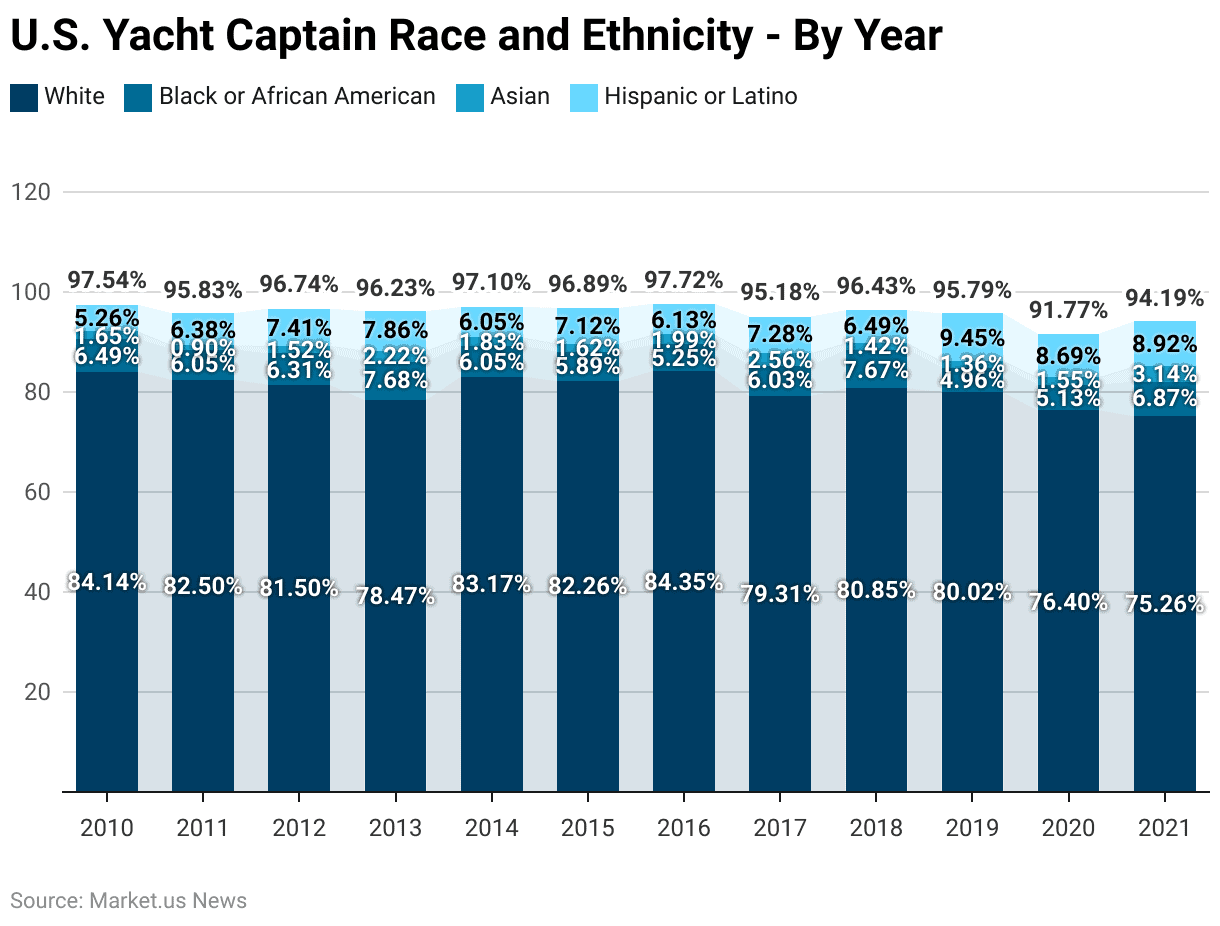

Race/Ethnicity

- Over the years from 2010 to 2021, the racial and ethnic composition of yacht captains in the U.S. has shown some notable shifts.

- In 2010, the majority of yacht captains were White, making up 84.14% of the total. This percentage gradually declined to 75.26% by 2021.

- The percentage of Black or African American captains has varied slightly each year, starting at 6.49% in 2010, dipping in some years, and increasing to 6.87% by 2021.

- Asian representation among yacht captains also saw changes, beginning at 1.65% in 2010 and more than doubling to 3.14% by 2021.

- The Hispanic or Latino captain demographic has shown a gradual increase over the years, starting from 5.26% in 2010 and rising significantly to 8.92% in 2021.

- The data from these years highlights a slow but steady diversification within the profession, reflecting broader trends of increasing racial and ethnic inclusivity across various sectors.

- Notably, the year 2019 saw a significant increase in Hispanic or Latino captains, peaking at 9.45%, illustrating a pivotal year for diversity in this field.

(Source: Zippia)

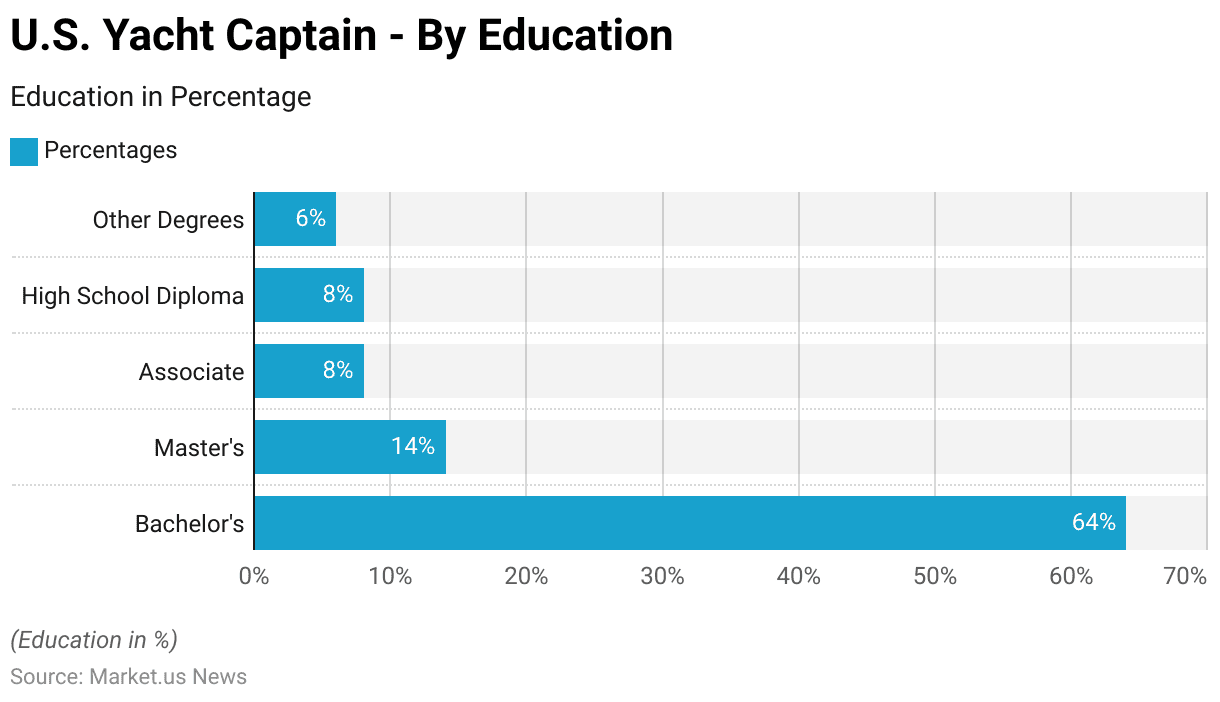

Education

- In the U.S., the educational background of yacht captains shows a significant emphasis on higher education.

- The majority, 64%, hold a Bachelor’s degree, indicating that a substantial portion of captains have completed undergraduate studies.

- Additionally, 14% of yacht captains have achieved a Master’s degree, further showcasing the high level of education prevalent among these professionals.

- Those with an Associate degree and those who have only a high school diploma each make up 8% of the total, suggesting that while higher education is common, there are still pathways into this career for those with less formal education.

- Another 6% hold other types of degrees, which may include specialized or vocational qualifications relevant to maritime operations.

- This distribution highlights the varied educational paths that lead to a career as a yacht captain, with a strong leaning towards advanced education.

(Source: Zippia)

Employment Statistics By Yacht Captain

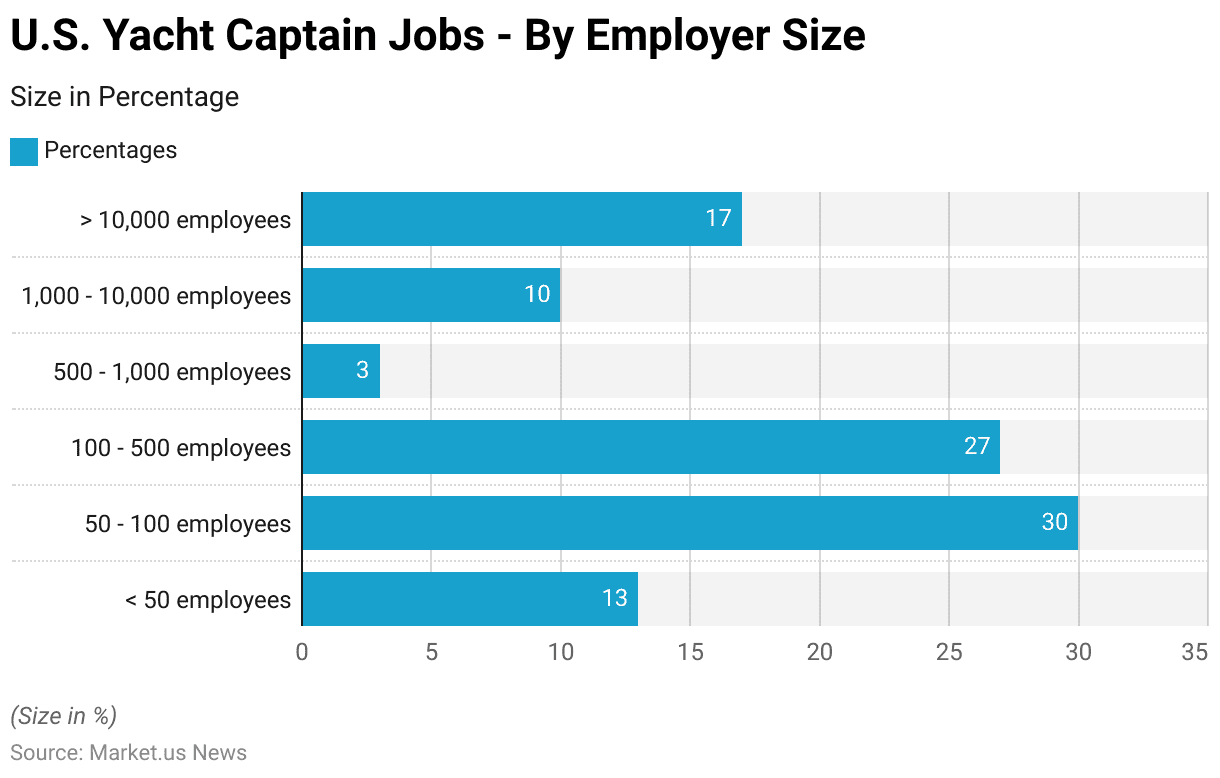

Yacht Captain Jobs – By Employer Size Statistics

- In the U.S., yacht captains are employed across a diverse range of company sizes.

- A significant portion of these captains, 30%, work for companies with between 50 and 100 employees, indicating that mid-sized companies are major employers in this sector.

- Similarly, companies with 100 to 500 employees also represent a large segment, employing 27% of yacht captains, showcasing the strong presence of substantial maritime businesses.

- Interestingly, larger companies with more than 10,000 employees account for 17% of yacht captain jobs, highlighting that major corporations also play a significant role in the industry.

- Smaller companies with fewer than 50 employees employ 13% of yacht captains, suggesting that there are opportunities in more intimate business settings.

- Very large companies with 1,000 to 10,000 employees host 10% of yacht captains, while those with 500 to 1,000 employees make up a smaller share at 3%.

- This breakdown indicates a broad spectrum of employment opportunities for yacht captains, from small enterprises to large multinational corporations.

(Source: Zippia)

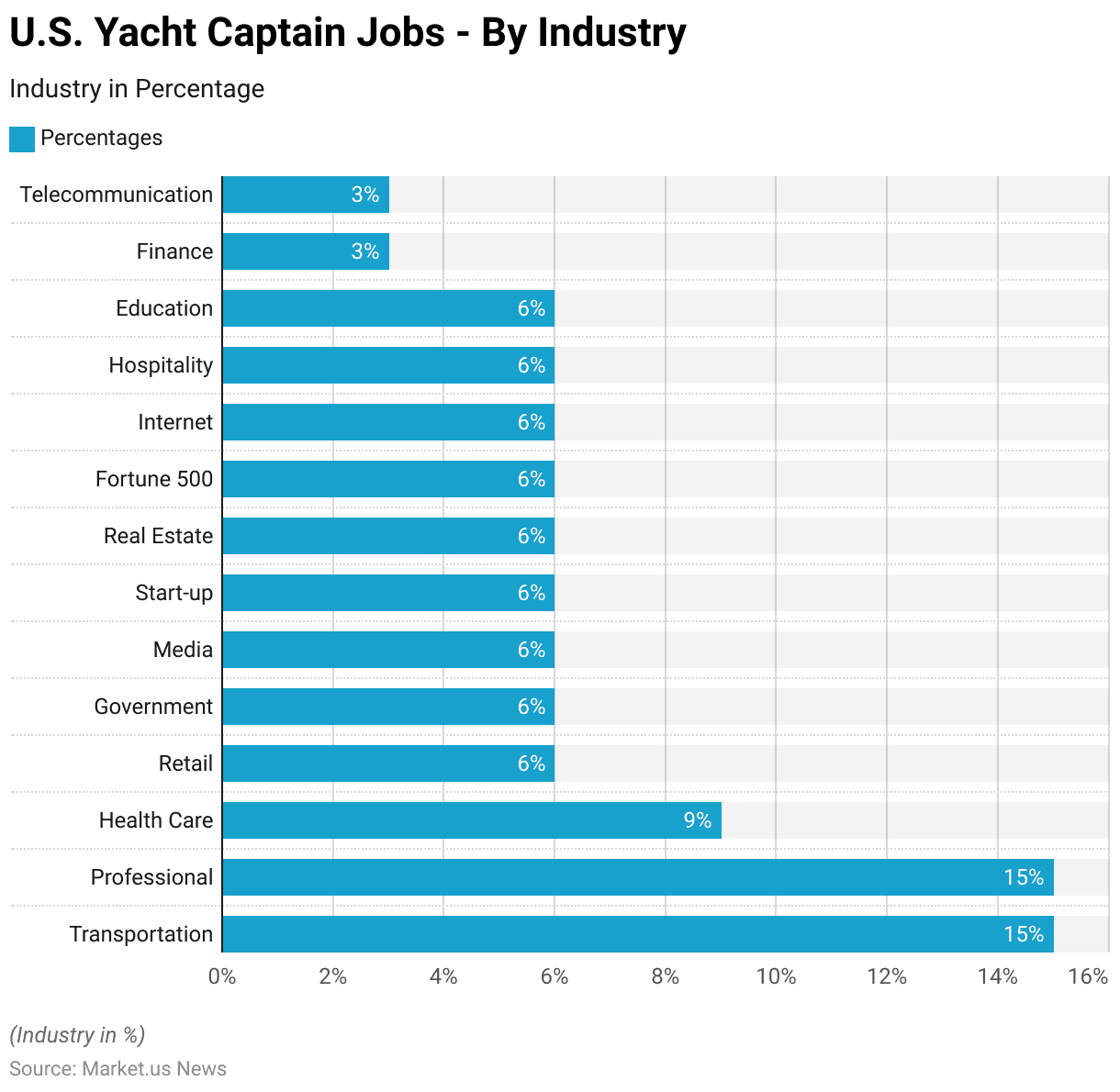

Industry – Yacht Captain Jobs Statistics

- In the U.S., yacht captains find employment across a diverse array of industries.

- The transportation and professional services industries are the leading employers, each accounting for 15% of yacht captain jobs.

- This indicates a strong demand for yacht captains within sectors that require extensive logistical and expert skills.

- The healthcare industry also plays a significant role, employing 9% of yacht captains, which might indicate that health institutions or private services own or operate yachts for various purposes.

- Other sectors such as retail, government, media, startups, real estate, Fortune 500 companies, the internet sector, hospitality, and education each employ 6% of yacht captains.

- These figures suggest that yachts are utilized in a variety of contexts, from corporate and leisure to educational and governmental uses.

- The finance and telecommunications industries account for the smallest share, each with 3%, showing less involvement with yachts compared to other sectors.

- This distribution highlights how yacht captains are integrated into numerous facets of the economic landscape, reflecting the versatile applications of yachts across different fields.

(Source: Zippia)

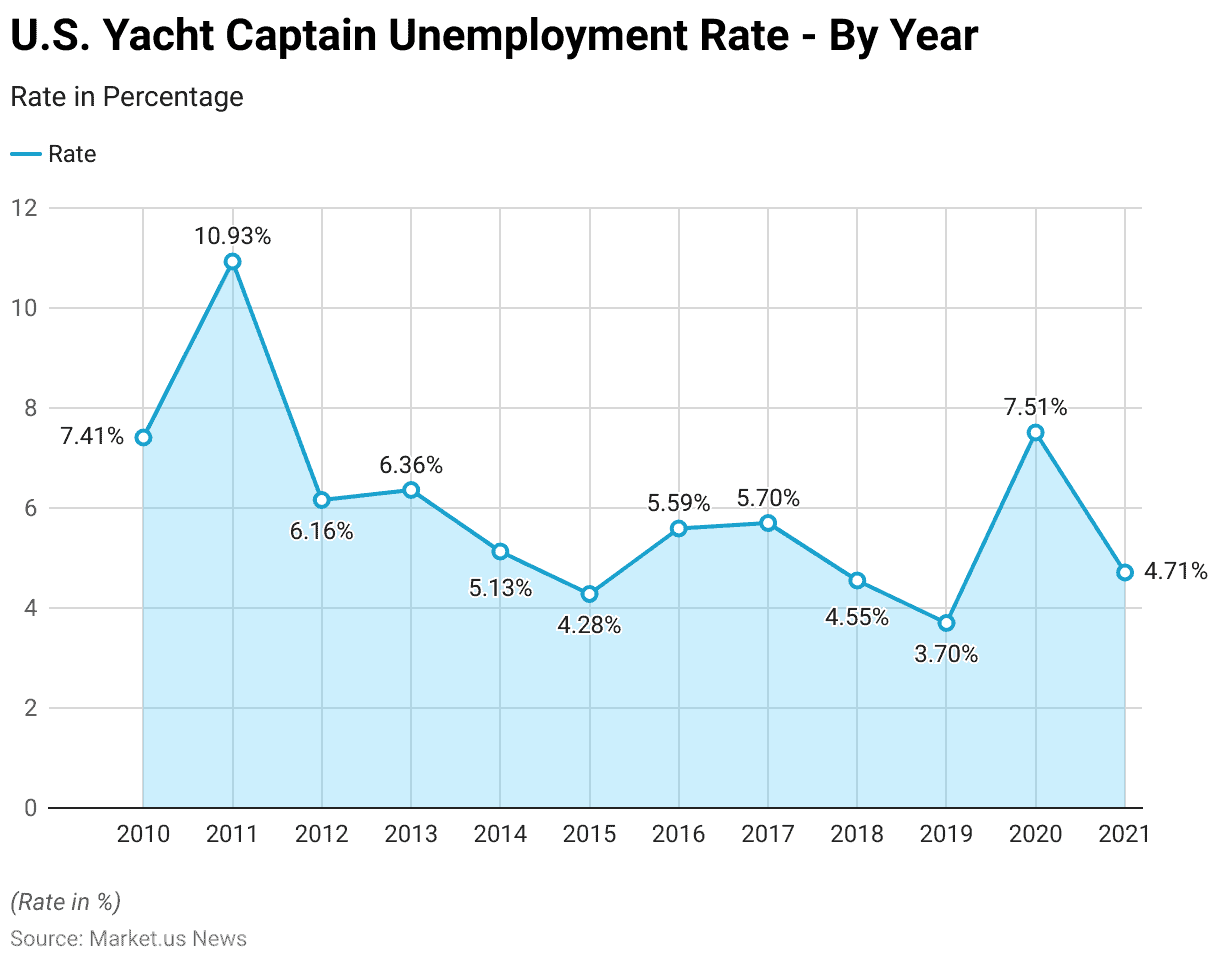

Yacht Captain Unemployment Rate Statistics

- Over the past decade, the unemployment rate among U.S. yacht captains has shown significant fluctuations.

- In 2010, the rate stood at 7.41%, which increased to a peak of 10.93% in 2011, indicating a challenging period for yacht captains in finding employment.

- The rate then gradually improved, dropping to 6.16% in 2012 and maintaining a slight decrease to 6.36% in 2013.

- By 2014, the unemployment rate had fallen to 5.13%, and it continued to improve in 2015, reaching a low of 4.28%.

- However, there was a slight uptick in the following years, with rates of 5.59% in 2016 and 5.70% in 2017.

- The unemployment rate dipped again to 4.55% in 2018 and further decreased to 3.70% in 2019, marking the lowest rate within this period.

- The rate experienced a sharp increase in 2020, likely influenced by economic impacts related to global events, climbing to 7.51%.

- The situation appeared to stabilize somewhat in 2021, with the unemployment rate reducing to 4.71%.

- This trend indicates varying economic conditions that have influenced the job market for yacht captains over the years.

(Source: Zippia)

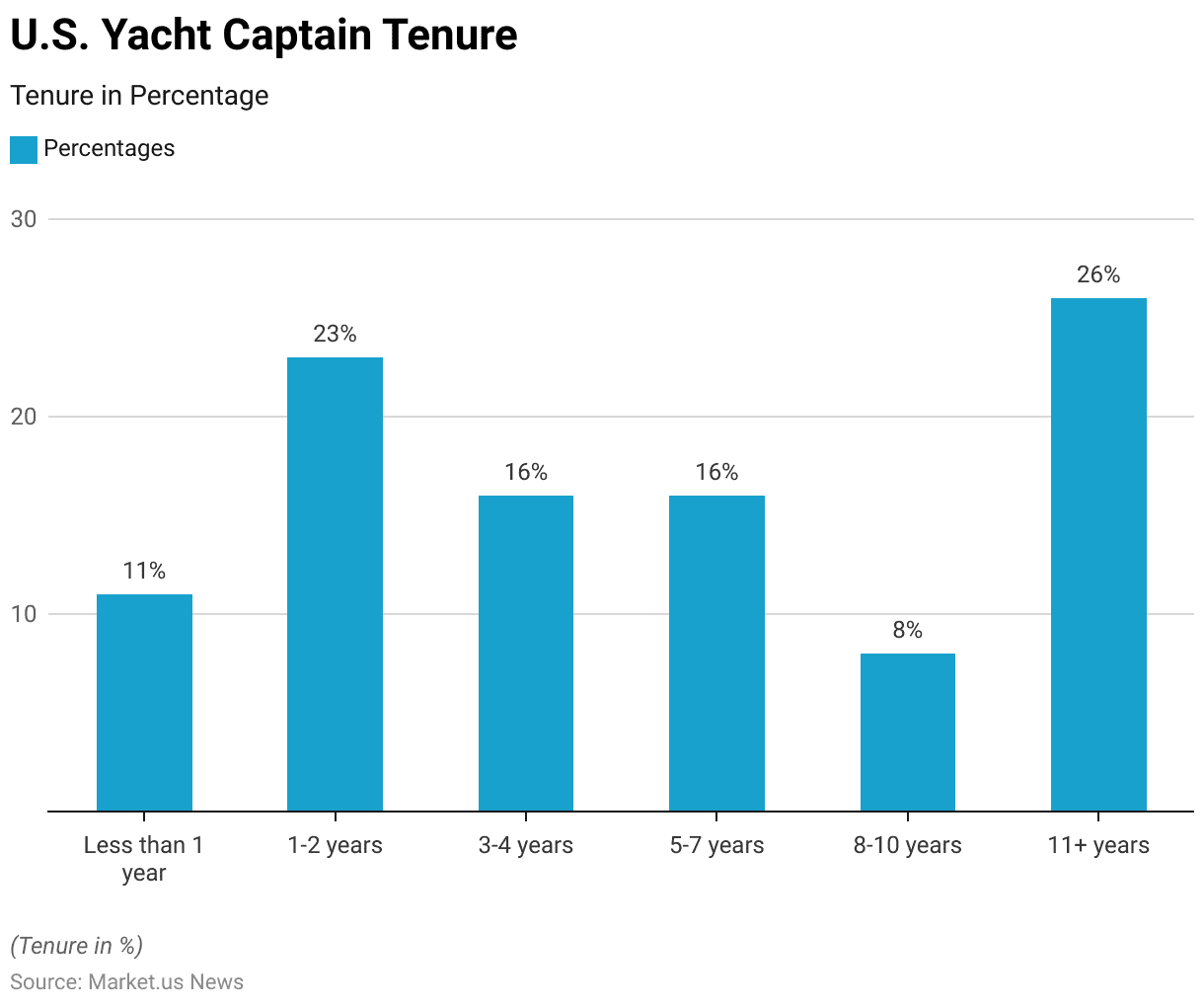

Yacht Captain Tenure Statistics

- In the U.S., the tenure of yacht captains varies widely, reflecting a broad range of experience levels within the profession.

- The data indicates that 11% of yacht captains have been in their role for less than one year, suggesting a notable influx of new entrants into the field.

- Captains who have held their positions for 1-2 years constitute the largest group at 23%, indicating that many find the early years of yachting compelling enough to stay on.

- Those with 3-4 years and 5-7 years of experience each make up 16% of the total, showing a steady retention as captains gain more experience.

- However, the percentage drops to 8% for those with 8-10 years in the role, possibly reflecting a point where some captains choose to transition to other career paths or retirements.

- Remarkably, the most experienced group, those with over 11 years of experience, accounts for 26% of all yacht captains.

- This suggests a significant core of highly experienced professionals who have dedicated a considerable part of their careers to the maritime industry. Underscoring their commitment and possibly indicating a high level of satisfaction or unique opportunities within this field.

(Source: Zippia)

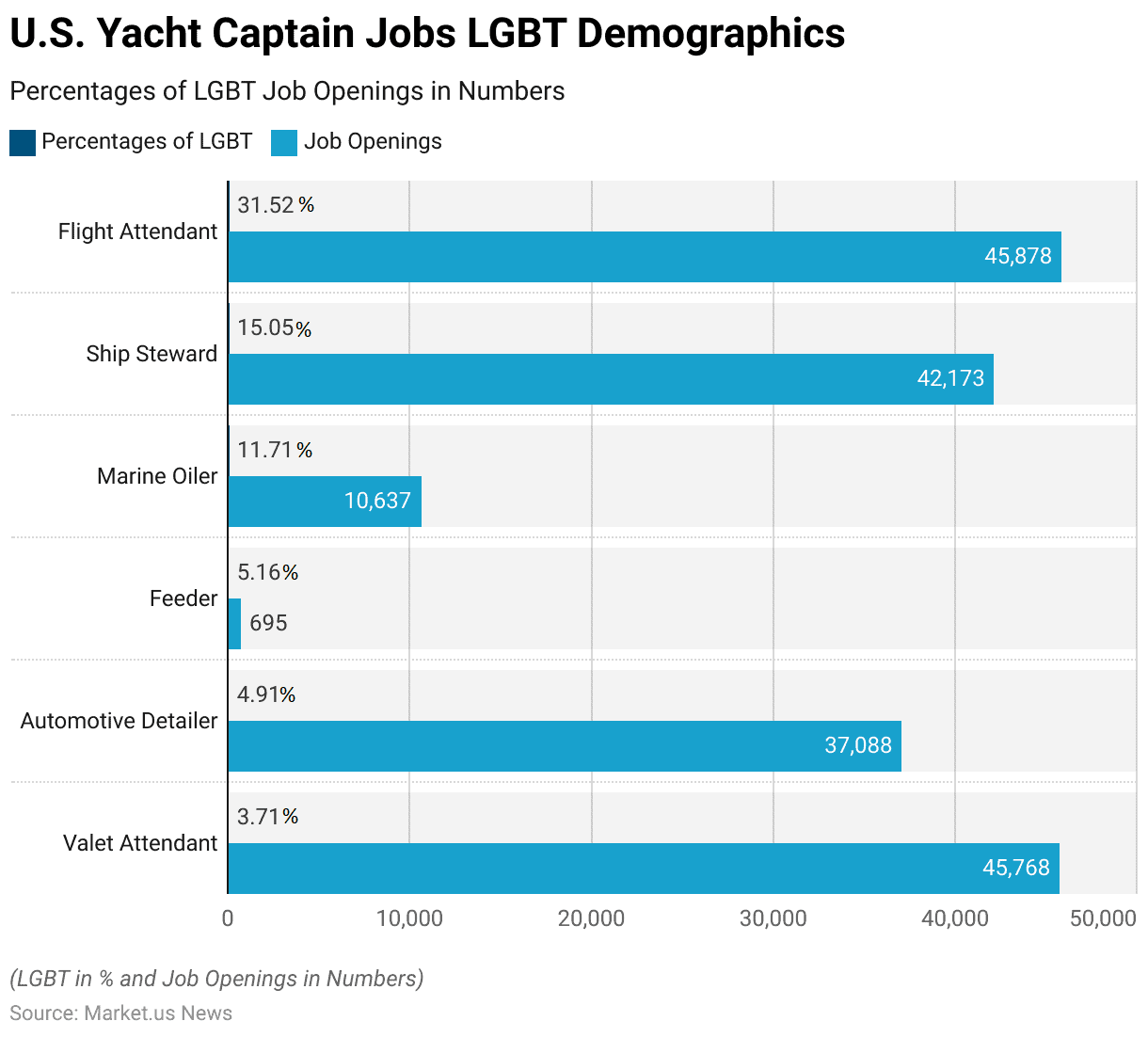

Demographics of Yacht Captain Jobs LGBT Statistics

- In the U.S., the representation of LGBT individuals varies significantly across different professions related to the yacht and maritime industry, as well as other service roles. Each is accompanied by a distinct number of job openings.

- Among these professions, flight attendants show the highest percentage of LGBT representation at 31.52%, with 45,878 job openings available, highlighting a notable presence of LGBT individuals in this field.

- Ship stewards also have a significant LGBT demographic, comprising 15.05% with 42,173 job openings.

- Marine oilers have an 11.71% LGBT representation, corresponding to 10,637 job vacancies.

- Lesser percentages are seen in other related roles, such as feeders, who have 5.16% LGBT representation with 695 job openings, automotive detailers with 4.91% and 37,088 jobs, and valet attendants with 3.71% with 45,768 available positions.

- This data reflects the diversity within the workforce of these professions and the varying degrees of LGBT inclusion across different sectors.

(Source: Zippia)

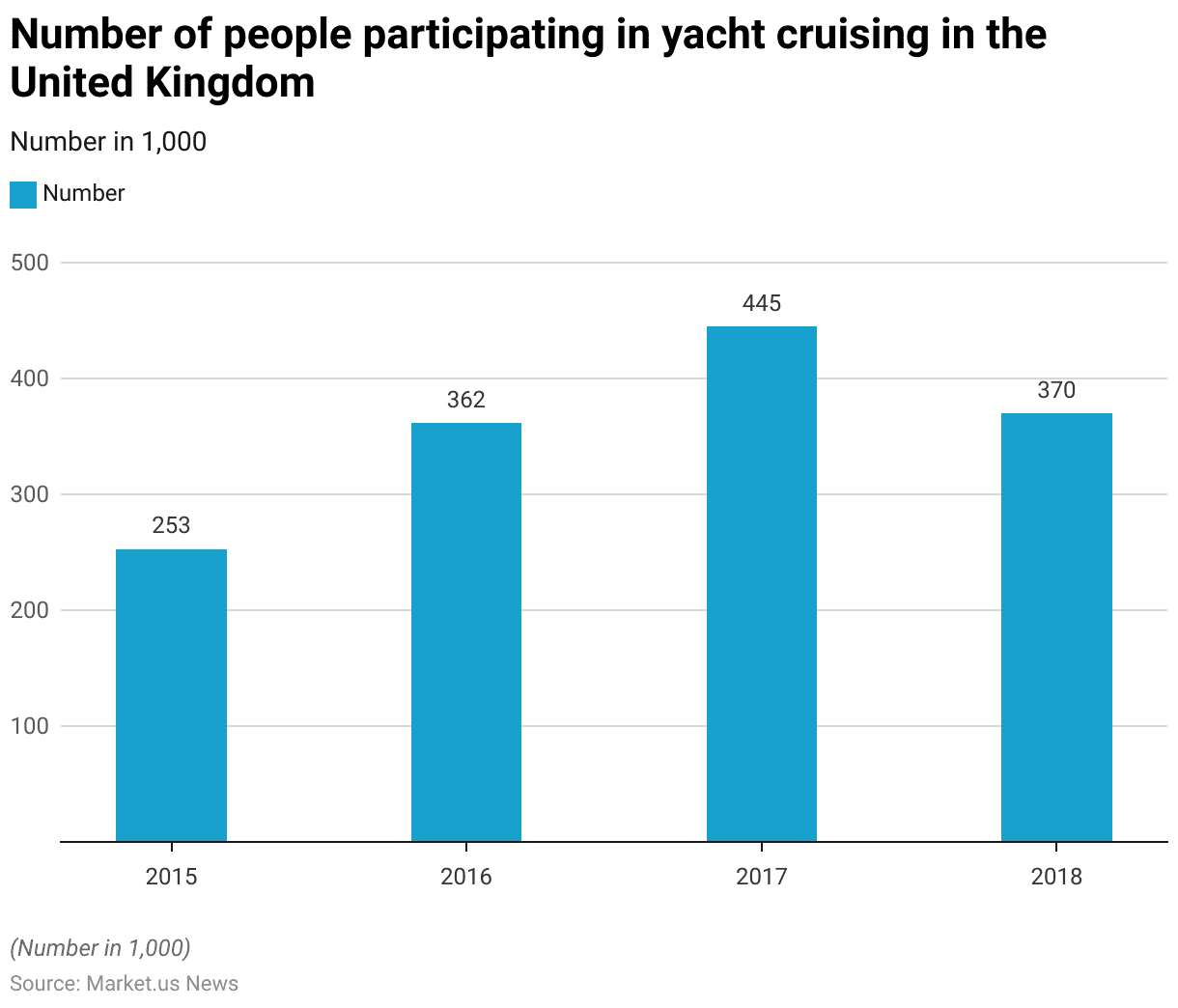

Participation in Yacht Recreational Activities

People Participating in Yacht Cruising in the United Kingdom Statistics

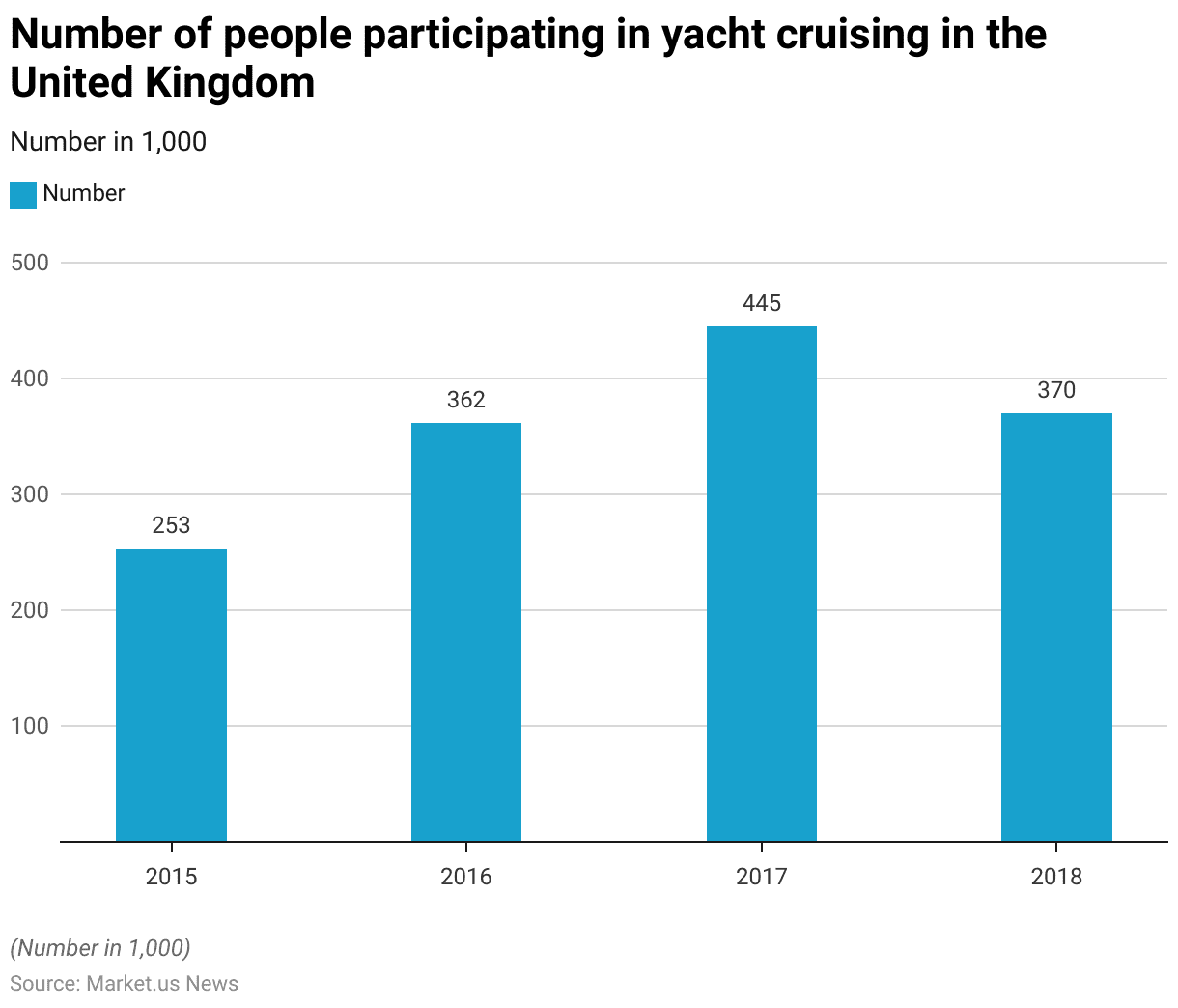

- From 2015 to 2018, the number of people participating in yacht cruising in the United Kingdom saw significant fluctuations.

- In 2015, approximately 253,000 individuals took part in yacht cruising activities.

- The following year, 2016, saw a substantial increase, with participation rising to 362,000.

- This upward trend continued into 2017, which recorded the highest participation over these years at 445,000 individuals.

- However, in 2018, there was a noticeable decrease in the number of participants, which dropped to 370,000.

- This data indicates a growing interest in yacht cruising in the mid-years, followed by a slight decline by the end of the period.

(Source: Statista)

Sailing Participation in the U.S.

- The number of sailing participants in the United States experienced several fluctuations from 2010 to 2023.

- In 2010, there were 4.11 million participants, but the number slightly declined to 3.8 million by 2011.

- This downward trend continued minimally over the next few years, stabilizing around 3.92 million in 2013 and 2014.

- However, a resurgence occurred in 2015 and 2016, with participant numbers rebounding to approximately 4.1 million each year.

- After 2016, there was a gradual decline; by 2017, the number decreased to 3.97 million and further to 3.75 million in 2018.

- The trend continued downward through 2020, which saw the number drop to 3.49 million, likely influenced by global events impacting outdoor activities.

- The lowest point came in 2021, with 3.46 million participants.

- However, a slight recovery was evident in 2022 with 3.63 million participants, and a more significant recovery back to 4.1 million participants was forecasted for 2023, indicating a return to earlier levels of engagement in sailing.

- This fluctuation over the years suggests variability in interest and participation, potentially influenced by economic factors, societal trends, and external events.

(Source: Statista)

Region-wise Sailing Participants in The United States

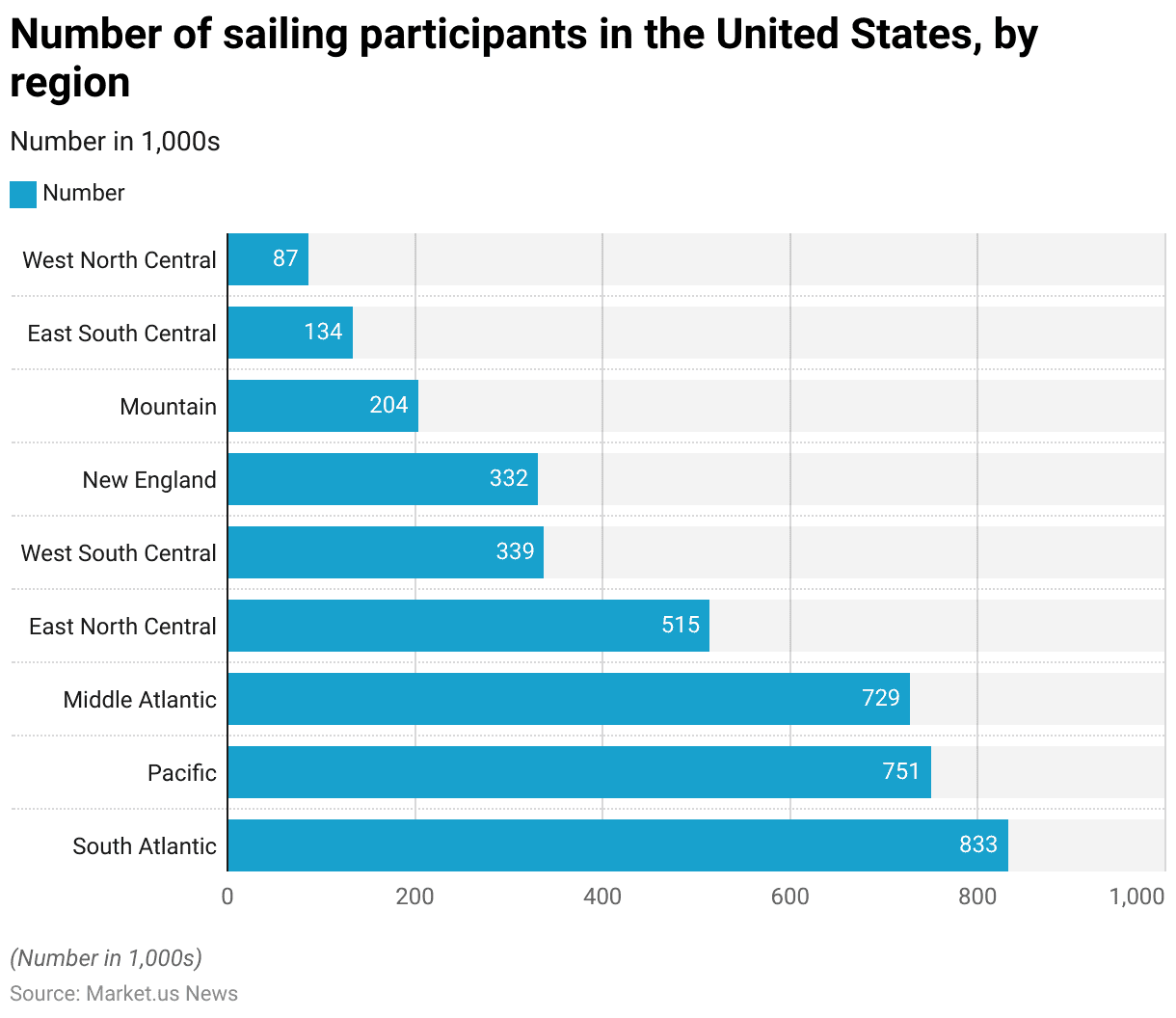

- In 2014, the distribution of sailing participants across different regions in the United States showcased varied levels of engagement.

- The South Atlantic region had the highest number of participants, with approximately 833,000 individuals taking part in sailing activities.

- This was closely followed by the Pacific region, which had 751,000 participants.

- The Middle Atlantic region also saw a significant number of sailors, with 729,000 individuals.

- Other regions had lower participation rates. The East North Central region reported 515,000 sailing participants, while the West South Central region had 339,000.

- New England recorded 332,000 participants.

- The numbers further dropped in the Mountain region with 204,000 participants.

- The East South Central region had notably fewer sailors, with just 134,000 participants, and the West North Central region had the least, with only 87,000 participants.

- This overview illustrates a notable disparity in sailing participation across the U.S., with coastal areas generally showing higher engagement than inland regions.

(Source: Statista)

Sailing Club Membership in England

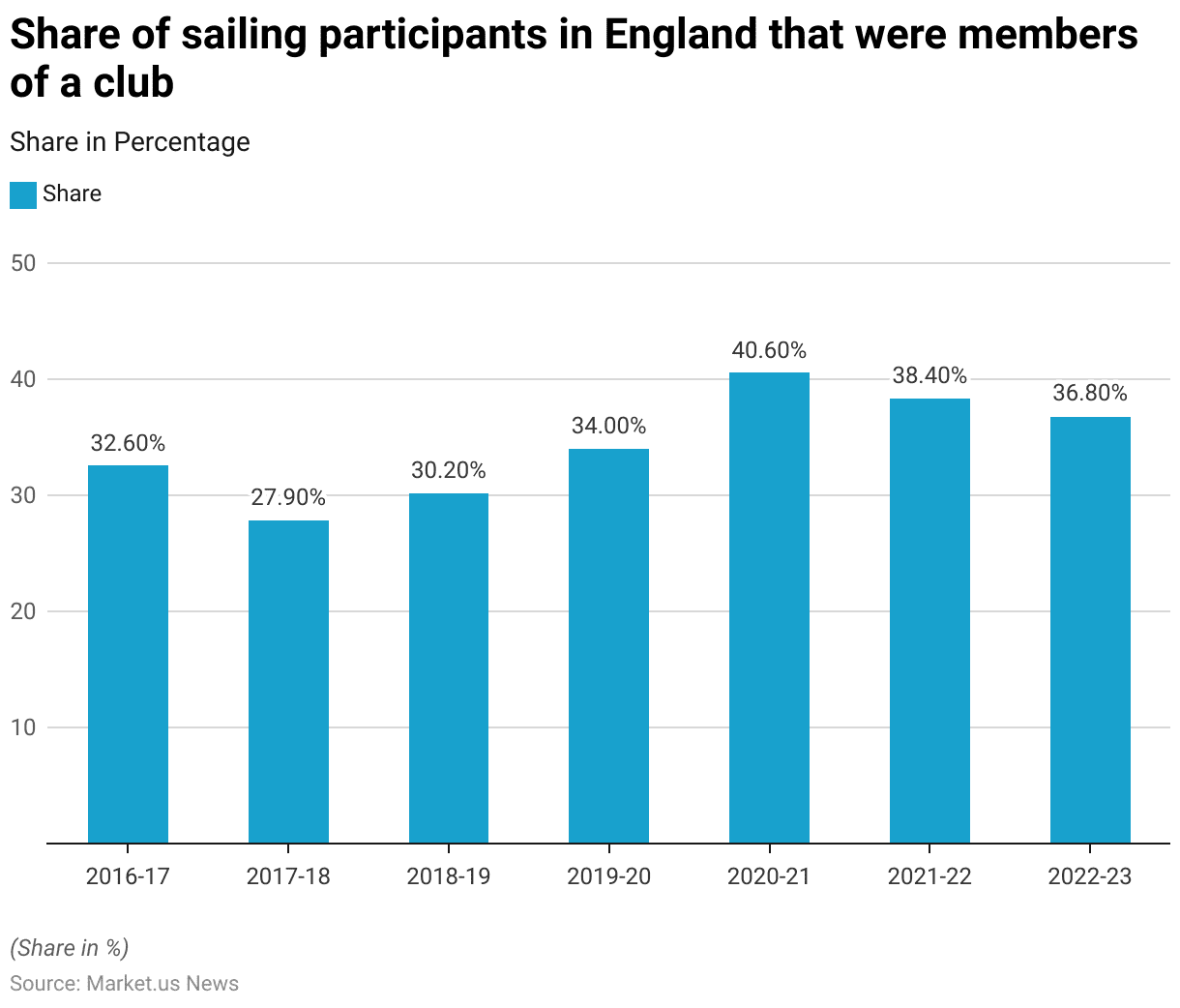

- From the 2016-17 season to the 2022-23 season, the percentage of sailing participants in England who were members of a club showed significant variation.

- In the 2016-17 season, 32.60% of participants were club members.

- This figure dipped to 27.90% in the 2017-18 season, marking the lowest membership rate over these years.

- The membership rate then increased slightly to 30.20% in the 2018-19 season.

- The subsequent season, 2019-20, saw an increase of 34.00% in club membership.

- A notable spike occurred in the 2020-21 season, when club membership surged to 40.60%, possibly influenced by a resurgence in local outdoor activities and community engagement following global events.

- However, there was a decrease to 38.40% in the 2021-22 season and a further decline to 36.80% in the 2022-23 season.

- These fluctuations indicate varying levels of engagement with sailing clubs, reflecting changes in societal behavior, economic factors, and perhaps the effects of external events on recreational activities.

(Source: Statista)

Favorite Yacht Racers Statistics

- In the 2018 Route du Rhum yacht race in France, a survey on fans’ favorite racers revealed Loick Peyron as the leading choice, with a substantial 38% of respondents favoring him.

- Armel Le Cleac’h followed as the second favorite, garnering 19% of the preferences, while Francois Gabart was chosen by 14% of the respondents, placing him third.

- Other racers like Thomas Coville and Vincent Riou received lower shares of support, with 7% and 6%, respectively.

- Alex Thomson and Yann Elies had even smaller percentages, at 4% and 3%.

- Additionally, 9% of those surveyed chose not to pronounce a favorite.

- This distribution underscores Loick Peyron’s significant popularity among fans compared to his peers in this prestigious solo transatlantic race.

(Source: Statista)

Yacht Regulations

- Yacht regulations differ significantly worldwide, governed by a combination of national and international maritime laws and local authorities.

- Key areas of compliance include flag state regulations, customs and import duties, environmental regulations, and safety standards.

- Each yacht’s flag state dictates specific laws impacting everything from crew requirements to safety protocols.

- For instance, under the Maritime Labour Convention (MLC) and the Large Yacht Code (LY3), privately used yachts between 24 meters and 500 gross tons must adhere to safety and pollution standards, though requirements intensify once a vessel transitions to charter operations, necessitating stricter adherence to regulations like the International Safety Management Code (ISM).

- Additionally, regulations cover the management of emissions and pollution as stipulated by international conventions like MARPOL ANNEX VI, which mandates specific certificates and records to minimize marine pollution.

- The complexity of these regulations underscores the importance of continuous education and consultation with maritime law professionals to ensure compliance and smooth sailing across international waters.

(Sources: Yacht Sales and Services, Manta Maritime, Windward Yachts)

Recent Developments

Acquisitions and Mergers:

- Ferretti Group acquires Wally Yachts: In 2023, Ferretti Group, a leading luxury yacht manufacturer, acquired Wally Yachts, known for its innovative and modern yacht designs, for $120 million. This acquisition strengthens Ferretti’s position in the luxury yacht market by adding Wally’s cutting-edge technology and design to its portfolio.

- Sanlorenzo acquires Bluegame: In early 2023, Sanlorenzo, a major player in the yacht industry, acquired Bluegame, a yacht builder specializing in smaller, eco-friendly vessels. The deal, valued at $90 million, is aimed at expanding Sanlorenzo’s range of yachts. Especially in the growing sustainable yacht segment.

New Product Launches:

- Azimut Yachts launches Magellano 30 Metri: In late 2023, Azimut Yachts introduced the Magellano 30 Metri, a superyacht designed for long-range cruising. This new model features a hybrid propulsion system, allowing it to reduce fuel consumption by 25%, aligning with the growing demand for more eco-friendly yachting solutions.

- Sunseeker unveils Superhawk 55: In early 2024, Sunseeker launched the Superhawk 55, a high-performance sports yacht designed for speed and luxury. The yacht boasts cutting-edge navigation technology and advanced materials, aimed at attracting customers seeking both performance and elegance.

Funding:

- Silent Yachts secures $50 million in funding for electric yachts: In 2023, Silent Yachts, a pioneer in solar-electric catamarans, raised $50 million to expand its production capacity and develop new electric-powered yachts. This funding will accelerate the company’s efforts in promoting sustainability in the yachting industry.

- Eco Yachts raises $30 million to develop sustainable yachts: In early 2024, Eco Yachts, a company focusing on sustainable yacht manufacturing, secured $30 million to further develop its carbon-neutral yacht models. The funding will help scale production and expand the company’s presence in the global market.

Technological Advancements:

- Hybrid and electric propulsion systems: By 2025, it is projected that 30% of new yachts will be equipped with hybrid or fully electric propulsion systems. Reducing emissions and fuel consumption. This trend is driven by the increasing demand for environmentally friendly yachting solutions.

- Smart yacht technology: The integration of smart boat technology in yachts is on the rise. By 2026, 40% of luxury yachts are expected to feature smart systems that allow owners to control navigation, entertainment, and energy management remotely through mobile apps.

Conclusion

Yacht Statistics – The yacht industry encompasses a dynamic range of activities from recreational boating to competitive racing.

Reflecting significant growth and shifts influenced by economic trends, advancing technology, and evolving consumer preferences.

Notably, the sector is seeing a younger demographic emerge, particularly Millennials, poised to dominate the market.

Moreover, events like the Route du Rhum highlight the enduring appeal of yacht racing, with racers such as Loick Peyron attracting substantial followings due to their prowess and appeal.

Overall, the yacht industry continues to be a forerunner of economic health and cultural shifts, representing a unique intersection of adventure, technology, and luxury.

FAQs

A yacht is a medium to large boat used for private cruising, racing, or as a luxury or recreational vessel. They are often equipped with substantial amenities and are built for comfort and speed.

Yachts can be broadly categorized into sailing yachts, motor yachts, luxury yachts, and super yachts, each differing in size, style, and purpose. Sails power sailing yachts, while motor yachts rely on engines.

The cost of a yacht varies widely based on size, type, brand, age, and features. Prices can range from a few hundred thousand dollars for smaller, older models to hundreds of millions of dollars for large luxury or super yachts.

Some of the most prestigious yacht manufacturers include Azimut, Westport, Sunseeker, Benetti, and Feadship, which are known for their quality, luxury, and advanced technology.

Legal requirements can include registration, insurance, safety equipment compliance, and sometimes the completion of a boating safety course, depending on the size of the yacht and the region of operation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)