Table of Contents

- Introduction

- Editor’s Choice

- Hair Dryer Market Statistics

- Hair Dryer Price Statistics

- Export and Import Statistics of Electric Hair Dryer

- Share of Women Using Hair Dryers Worldwide

- Hair Dryer Sales Trends Statistics

- Hand-held Hair Dryer Manufacturers

- Hair Dryer Brand Preferences

- Price Expectations for a Hair Dryer Among Consumers

- Innovation in Hair Dryers

- Regulations for Hair Dryers

- Recent Developments

- Conclusion

- FAQs

Introduction

Hair Dryer Statistics: A hair dryer, or blow dryer, is an electrical device used to dry and style hair by blowing hot air. It consists of a heating element (usually made of metal or ceramic), a fan that blows air over the heated element, and a motor that powers the fan.

The device also features air intake and exhaust vents to regulate airflow. Control buttons allow users to adjust the temperature and airflow speed, with many models offering a cool shot button to set the style.

Hair dryers come in various types, from basic models with simple settings to advanced versions offering multiple heat and speed options.

Editor’s Choice

- The global hair dryer market revenue is projected to reach USD 10.24 billion in 2029.

- The competitive landscape of the global hair dryer market in 2022 was led by Remington, which held the largest market share at 14%.

- The global hair dryer market in 2024 demonstrates significant regional revenue contributions, led by China, with the highest revenue at USD 1,912 million.

- In 2022, the global electric hair dryer export market was led by China, which dominated with an export value of USD 1.34 billion, accounting for 53.40% of the total market share.

- In 2022, the United States led the global electric hair dryer import market with a total import value of USD 413 million, representing 16.40% of the global share.

- In recent advancements in hair dryer technology, Dyson has emerged as a key innovator with its launch of the Dyson Supersonic Nural™ and Supersonic r™ models, which showcase significant enhancements aimed at optimizing user experience and hair health.

- In India, the import and manufacturing of hair dryers are regulated under several standards, including the E-Waste Management Rules, 2022, which require an Extended Producer Responsibility (EPR) certificate to ensure proper e-waste disposal.

Hair Dryer Market Statistics

Global Hair Dryer Market Revenue Statistics

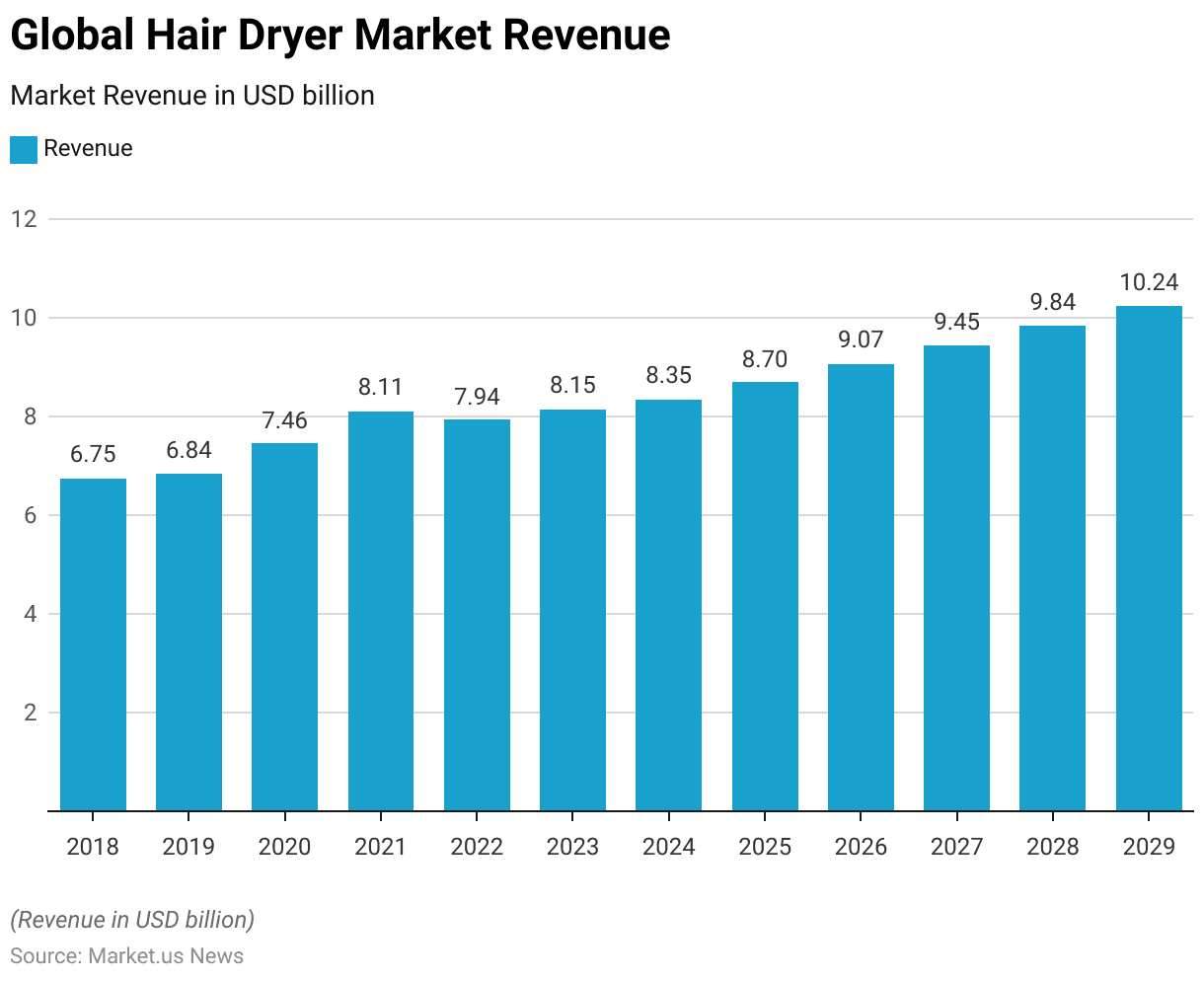

- The global hair dryer market has demonstrated consistent growth over the years, with significant revenue milestones achieved from 2018 to 2029 at a CAGR of 4.17%.

- In 2018, the market revenue stood at USD 6.75 billion, followed by a slight increase in 2019 to USD 6.84 billion.

- The market experienced steady growth in 2020, reaching USD 7.46 billion, and continued to expand in 2021, with revenues climbing to USD 8.11 billion.

- Despite a slight decline in 2022 to USD 7.94 billion, the market quickly rebounded in 2023, achieving USD 8.15 billion.

- Projections for the following years indicate robust growth, with the market expected to generate USD 8.35 billion in 2024 and USD 8.70 billion in 2025.

- By 2026, the revenue is projected to reach USD 9.07 billion, maintaining upward momentum in 2027 at USD 9.45 billion.

- The growth trajectory is expected to continue, with revenues climbing to USD 9.84 billion in 2028 and further reaching USD 10.24 billion in 2029.

- This consistent expansion reflects the rising demand for hair dryers, driven by technological advancements and increasing consumer preferences for premium hair care products.

(Source: Statista)

Hair Dryer Market Revenue Change Statistics

- The global hair dryer market has experienced varied percentage changes in revenue from 2019 to 2029, reflecting both periods of growth and decline.

- In 2019, the market showed modest growth with a revenue change of 1.4%.

- This growth accelerated significantly in 2020 with a notable 9.1% increase, followed by a slightly lower but still substantial growth of 8.7% in 2021.

- However, the market faced a downturn in 2022, experiencing a negative revenue change of -2.1%.

- The market rebounded in 2023 with a revenue increase of 2.7% and maintained steady growth in 2024 at 2.5%.

- Stronger growth rates were observed in subsequent years, with a 4.2% increase in 2025 and an even higher 4.3% in 2026.

- The growth stabilized in 2027 with a 4.2% increase, followed by slightly lower but consistent growth of 4.1% in both 2028 and 2029.

- These fluctuations in revenue change highlight the evolving dynamics of the hair dryer market, influenced by factors such as consumer preferences, technological advancements, and global economic conditions.

(Source: Statista)

Global Hair Dryers Market Volume Statistics

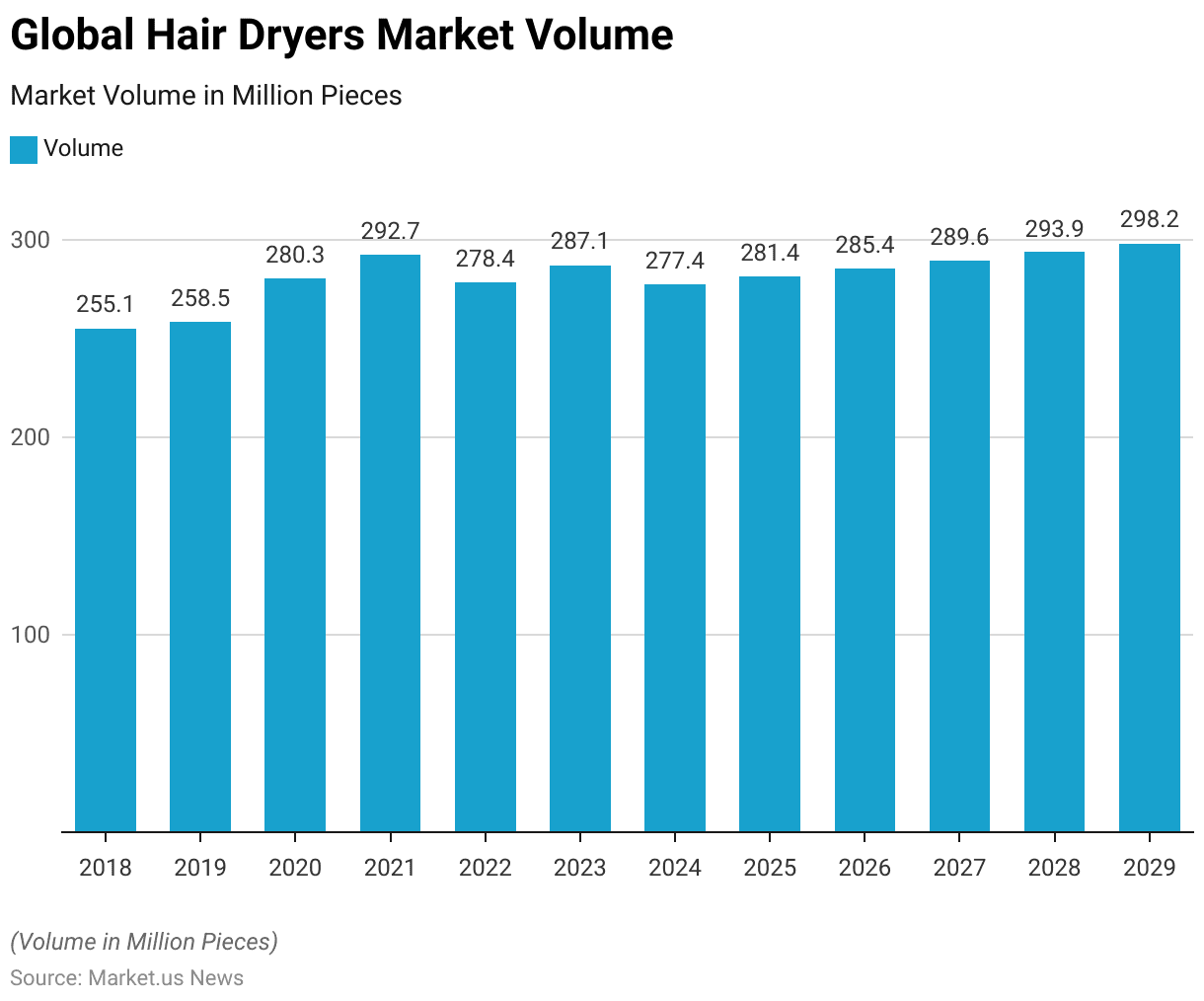

- The global hair dryer market volume has shown fluctuations over the years, with significant growth followed by periods of decline and recovery.

- In 2018, the market volume was 255.1 million pieces, increasing to 258.5 million pieces in 2019.

- The market witnessed robust growth in 2020, reaching 280.3 million pieces, and further expanded to 292.7 million pieces in 2021.

- However, in 2022, the market volume declined to 278.4 million pieces, reflecting a slight downturn.

- Recovery was observed in 2023, with the volume increasing to 287.1 million pieces, though it is projected to decline again to 277.4 million pieces in 2024.

- Gradual growth is expected from 2025 onwards, with volumes reaching 281.4 million pieces in 2025, 285.4 million pieces in 2026, and 289.6 million pieces in 2027.

- By 2028, the market volume is projected to rise to 293.9 million pieces, culminating in 298.2 million pieces in 2029.

- These trends indicate a dynamic market influenced by changing consumer preferences, technological advancements, and economic factors impacting the global demand for hair dryers.

(Source: Statista)

Average Revenue per Household

- The average revenue per household in the global hair dryer market has shown a gradual increase from 2018 to 2029.

- In 2018, the average revenue per household was USD 3.55, which slightly decreased to USD 3.54 in 2019.

- However, it rebounded in 2020, reaching USD 3.83, and continued to grow steadily to USD 4.12 in 2021.

- A slight decline was observed in 2022, where the average revenue dropped to USD 4.00, but it picked up again in 2023, reaching USD 4.08.

- The upward trend is projected to continue in the coming years, with the average revenue per household expected to reach USD 4.14 in 2024 and USD 4.28 in 2025.

- Further growth is anticipated, with values climbing to USD 4.43 in 2026, USD 4.58 in 2027, and USD 4.74 in 2028.

- By 2029, the average revenue per household is projected to reach USD 4.90.

- This consistent growth reflects increasing consumer spending on hair dryers, driven by the rising demand for high-quality personal care products and innovative features.

(Source: Statista)

Global Hair Dryer Market Share – By Sales Channel Statistics

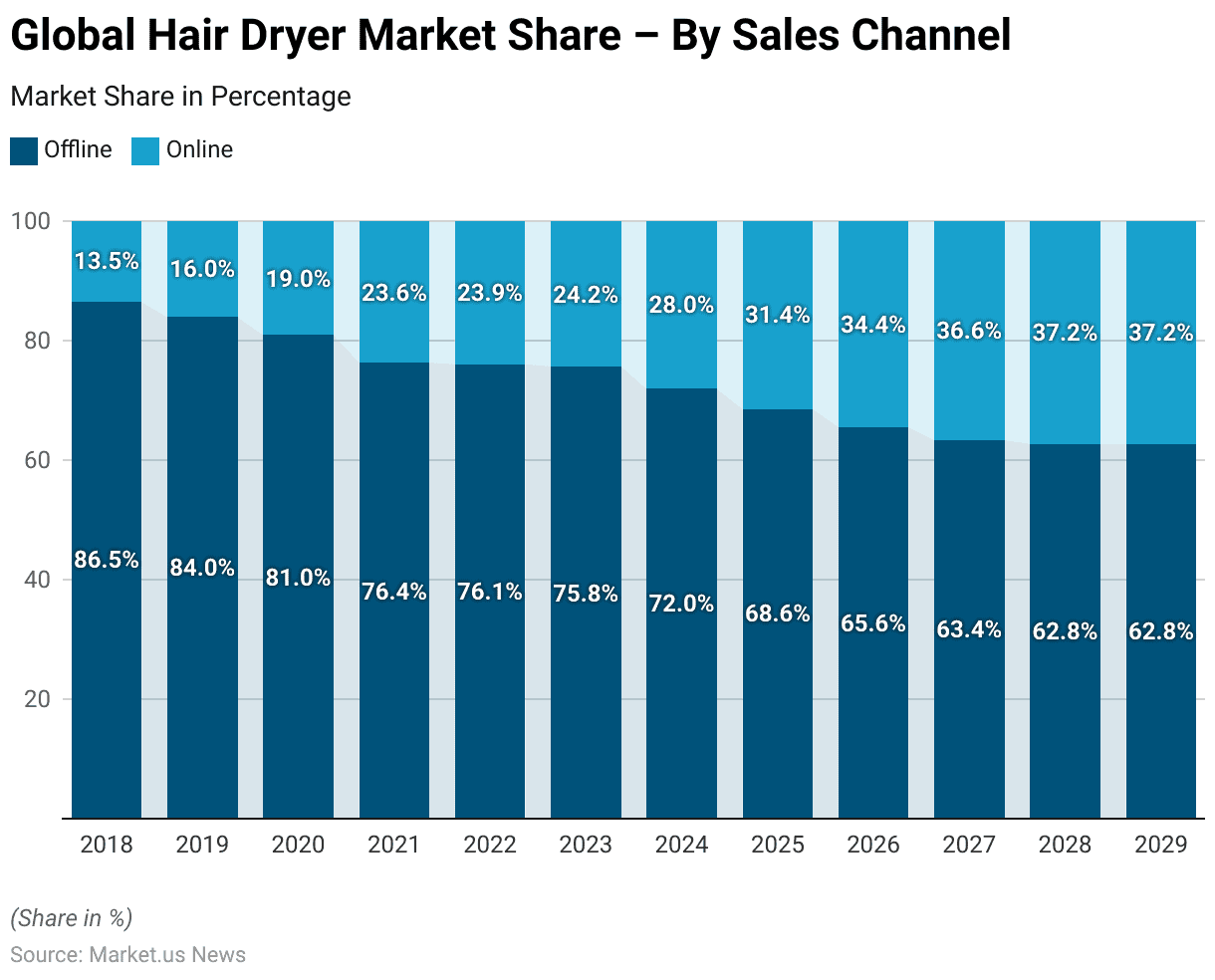

- The global hair dryer market has witnessed a significant shift in sales channels from offline to online over the years, as reflected in the market share distribution from 2018 to 2029.

- In 2018, offline sales dominated the market with 86.5% of the total share, while online sales contributed only 13.5%.

- This trend began to change steadily, with offline sales decreasing to 84.0% in 2019 and 81.0% in 2020, while online sales increased to 16.0% and 19.0%, respectively.

- By 2021, offline sales dropped further to 76.4%, and online sales climbed to 23.6%.

- The trend persisted in 2022, with offline channels accounting for 76.1% and online channels growing to 23.9%.

- In 2023, offline sales reduced slightly to 75.8%, while online sales reached 24.2%.

- The shift became more pronounced in subsequent years, with offline sales projected to fall to 72.0% in 2024 and 68.6% in 2025, as online sales increased to 28.0% and 31.4%, respectively.

- The trend is expected to continue, with offline sales declining to 65.6% in 2026 and 63.4% in 2027, while online sales grow to 34.4% and 36.6%.

- By 2028 and 2029, offline sales are projected to stabilize at 62.8%, while online sales will account for 37.2% of the market share.

- This shift reflects the growing consumer preference for online shopping due to convenience, a wider range of options, and competitive pricing in the hair dryer market.

(Source: Statista)

Competitive Landscape of Global Hair Dryer Market Statistics

- The competitive landscape of the global hair dryer market in 2022 was led by Remington, which held the largest market share at 14%.

- AGARO followed with an 8% market share, while Dyson and Babyliss each accounted for 7% of the market.

- Braun held a 6% share, and Hot Tools captured 5%.

- Several other companies, including MONDIAL, Taiffl, Taurus, and Vivo, each contributed 2% to the market.

- Collectively, smaller and less prominent brands made up the remaining 45% of the market, highlighting the fragmented nature of the industry.

- This distribution reflects a competitive market where both well-established brands and numerous smaller players coexist.

(Source: Statista)

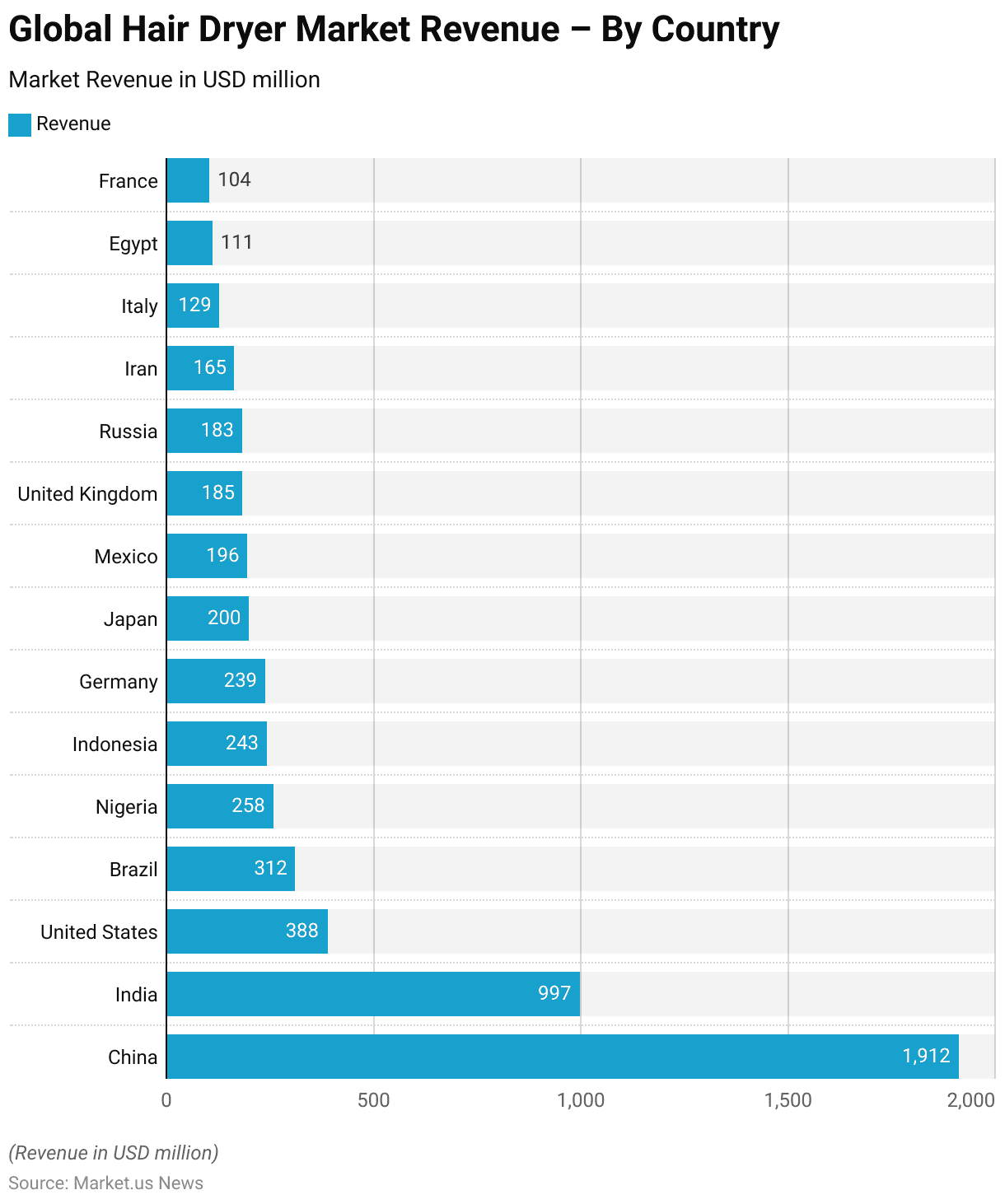

Global Hair Dryer Market Revenue – By Country Statistics

- The global hair dryer market in 2024 demonstrates significant regional revenue contributions, led by China, with the highest revenue at USD 1,912 million.

- India follows as the second-largest market, generating USD 997 million.

- The United States ranks third with USD 388 million, while Brazil contributes USD 312 million.

- Nigeria and Indonesia report revenues of USD 258 million and USD 243 million, respectively.

- Germany stands at USD 239 million, closely followed by Japan at USD 200 million and Mexico at USD 196 million.

- The United Kingdom and Russia generate similar revenues of USD 185 million and USD 183 million, respectively.

- Iran accounts for USD 165 million, while Italy contributes USD 129 million.

- Egypt and France round out the list with revenues of USD 111 million and USD 104 million, respectively.

- These figures highlight the strong presence of the hair dryer market across both developed and emerging economies, with China and India dominating the global landscape.

(Source: Statista)

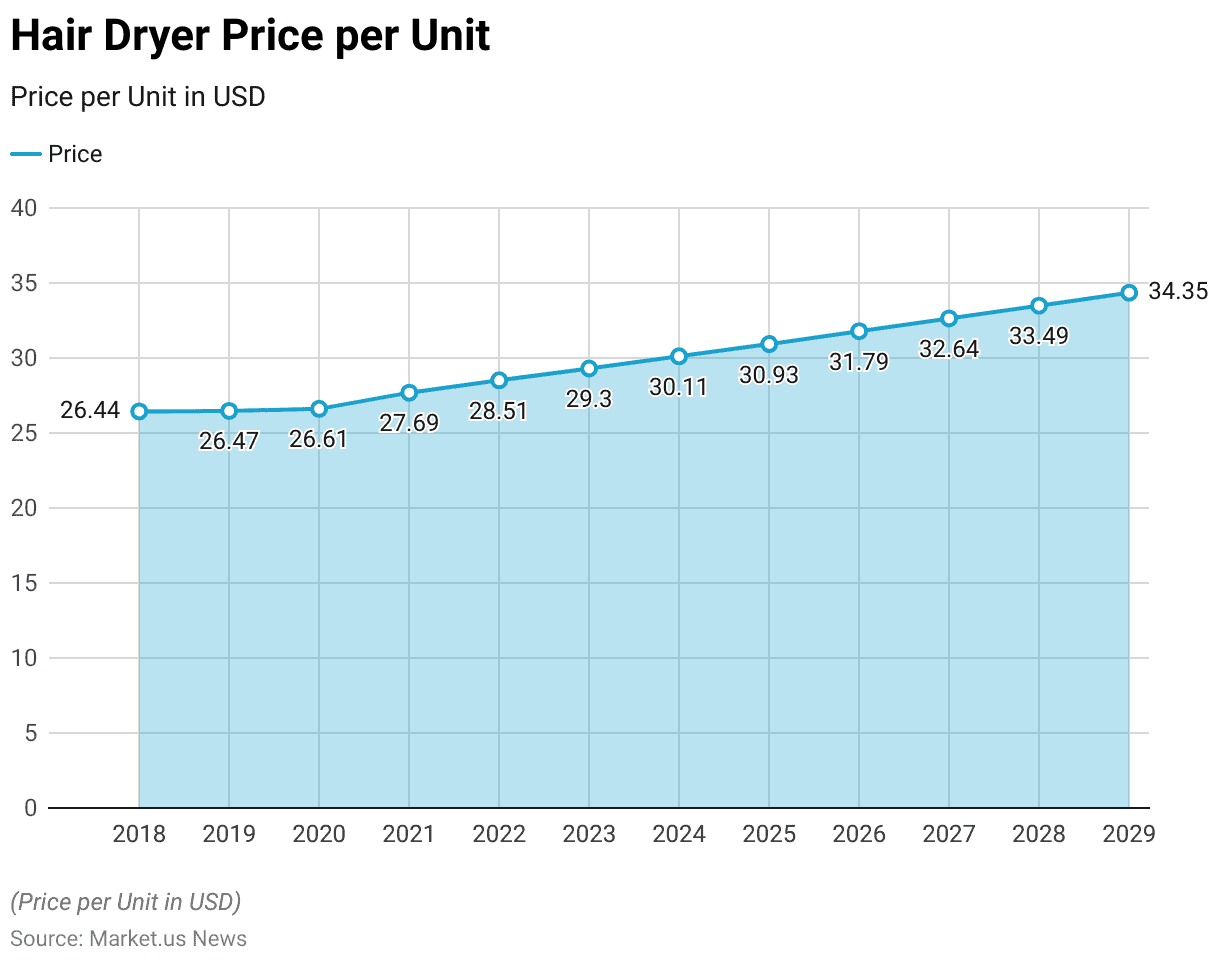

Hair Dryer Price Statistics

- The average price per unit of hair dryers has shown a steady increase from 2018 to 2029, reflecting consistent growth in value over time.

- In 2018, the price per unit stood at USD 26.44, which slightly increased to USD 26.47 in 2019 and USD 26.61 in 2020.

- A notable rise was observed in 2021, where the price reached USD 27.69, followed by further growth to USD 28.51 in 2022 and USD 29.3 in 2023.

- The upward trend is projected to continue in the coming years, with the price per unit expected to reach USD 30.11 in 2024, USD 30.93 in 2025, and USD 31.79 in 2026.

- By 2027, the price is anticipated to climb to USD 32.64, followed by USD 33.49 in 2028.

- By the end of 2029, the price per unit is projected to reach USD 34.35.

- This gradual increase highlights the rising value perception of hair dryers, driven by advancements in technology, premium features, and consumer willingness to invest in high-quality personal care appliances.

(Source: Statista)

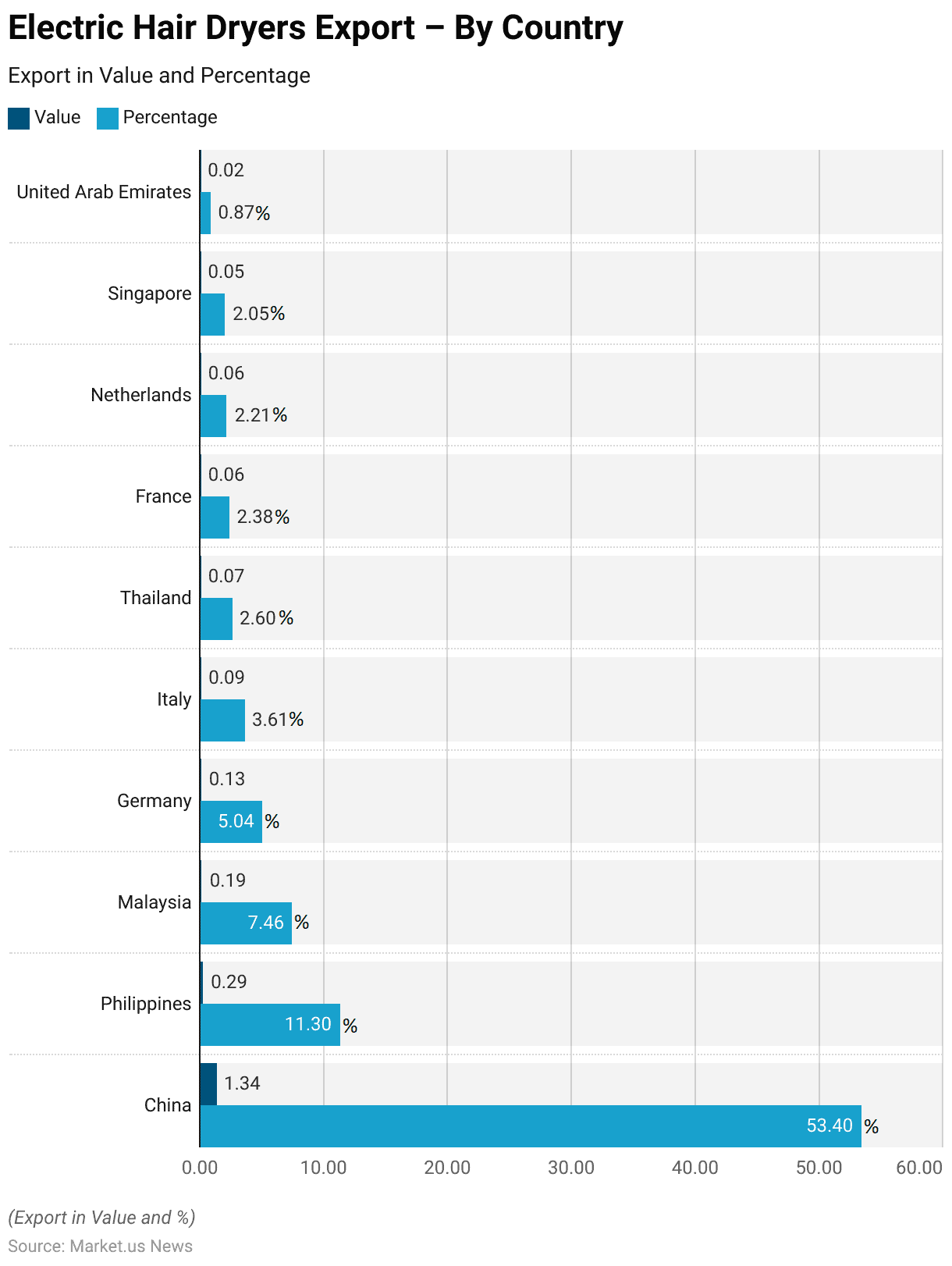

Export and Import Statistics of Electric Hair Dryer

Electric Hair Dryers Export – By Country

- In 2022, the global electric hair dryer export market was led by China, which dominated with an export value of USD 1.34 billion, accounting for 53.40% of the total market share.

- The Philippines ranked second with exports worth USD 0.285 billion, contributing 11.30% to the global share.

- Malaysia followed with an export value of USD 0.188 billion, representing 7.46%.

- Germany and Italy were significant contributors as well, with exports of USD 0.127 billion (5.04%) and USD 0.0908 billion (3.61%), respectively.

- Thailand exported electric hair dryers worth USD 0.0654 billion, holding a 2.60% market share, while France accounted for 2.38% with an export value of USD 0.0598 billion.

- The Netherlands contributed USD 0.0556 billion (2.21%), followed by Singapore with USD 0.0516 billion (2.05%).

- The United Arab Emirates rounded out the list with an export value of USD 0.0219 billion, accounting for 0.87% of the market.

- These figures highlight China’s dominance in the market, with a significant gap between it and other exporting countries, reflecting its position as the global leader in electric hair dryer manufacturing and exports.

(Source: OEC World)

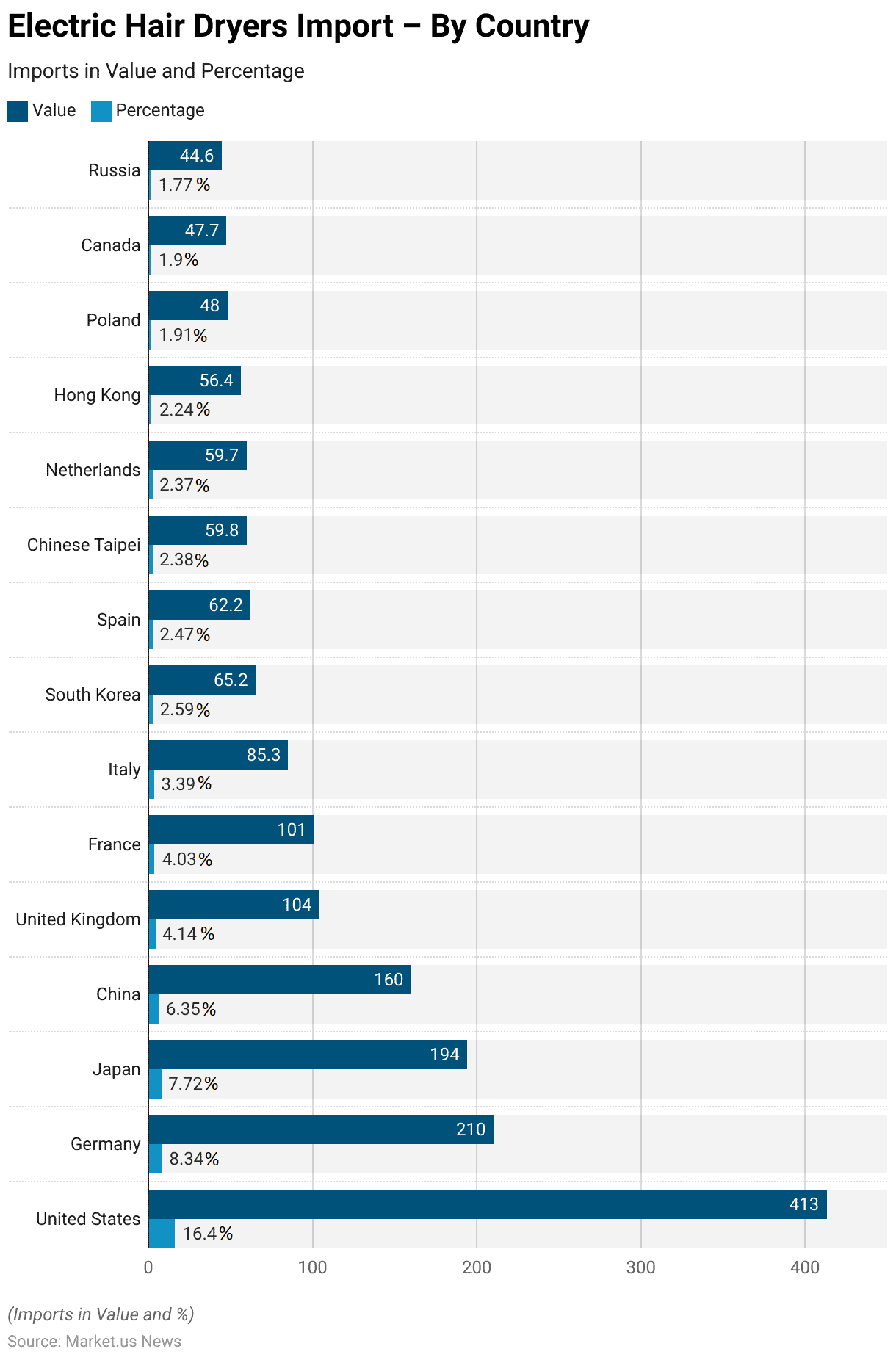

Electric Hair Dryers Import – By Country

- In 2022, the United States led the global electric hair dryer import market with a total import value of USD 413 million, representing 16.40% of the global share.

- Germany followed as the second-largest importer, accounting for USD 210 million (8.34%), while Japan ranked third with USD 194 million (7.72%).

- China also held a significant share, importing USD 160 million worth of electric hair dryers, contributing 6.35% to the global market.

- The United Kingdom imported USD 104 million (4.14%), closely followed by France at USD 101 million (4.03%).

- Italy recorded imports worth USD 85.3 million (3.39%), while South Korea and Spain contributed USD 65.2 million (2.59%) and USD 62.2 million (2.47%), respectively.

- Chinese Taipei and the Netherlands each accounted for around 2.4% of the market, with imports of USD 59.8 million and USD 59.7 million, respectively.

- Other notable importers include Hong Kong with USD 56.4 million (2.24%), Poland with USD 48 million (1.91%), Canada at USD 47.7 million (1.90%), and Russia with imports worth USD 44.6 million (1.77%).

- These figures highlight the United States’ leading position in the import market, with Europe and Asia also playing significant roles in driving the global demand for electric hair dryers.

(Source: OEC World)

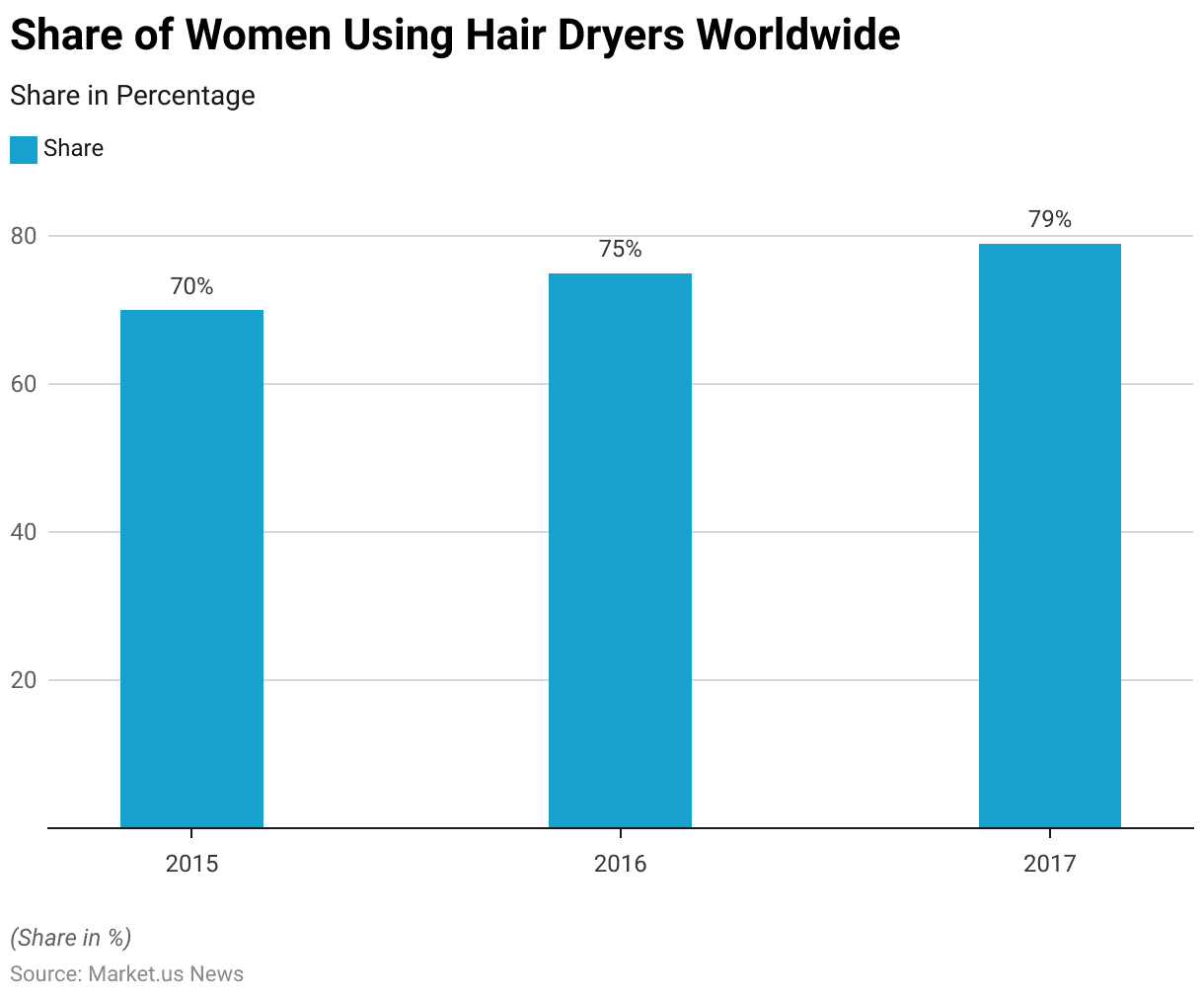

- The share of women using hair dryers worldwide showed a steady increase from 2015 to 2017, reflecting a growing preference for this personal care appliance.

- In 2015, 70% of respondents reported using hair dryers.

- This figure rose to 75% in 2016, indicating a 5% increase in adoption.

- By 2017, the percentage further climbed to 79%, showcasing a continuous upward trend.

- This growth highlights the increasing importance of hair dryers in women’s grooming routines globally during this period.

(Source: Statista)

Hair Dryer Sales Trends Statistics

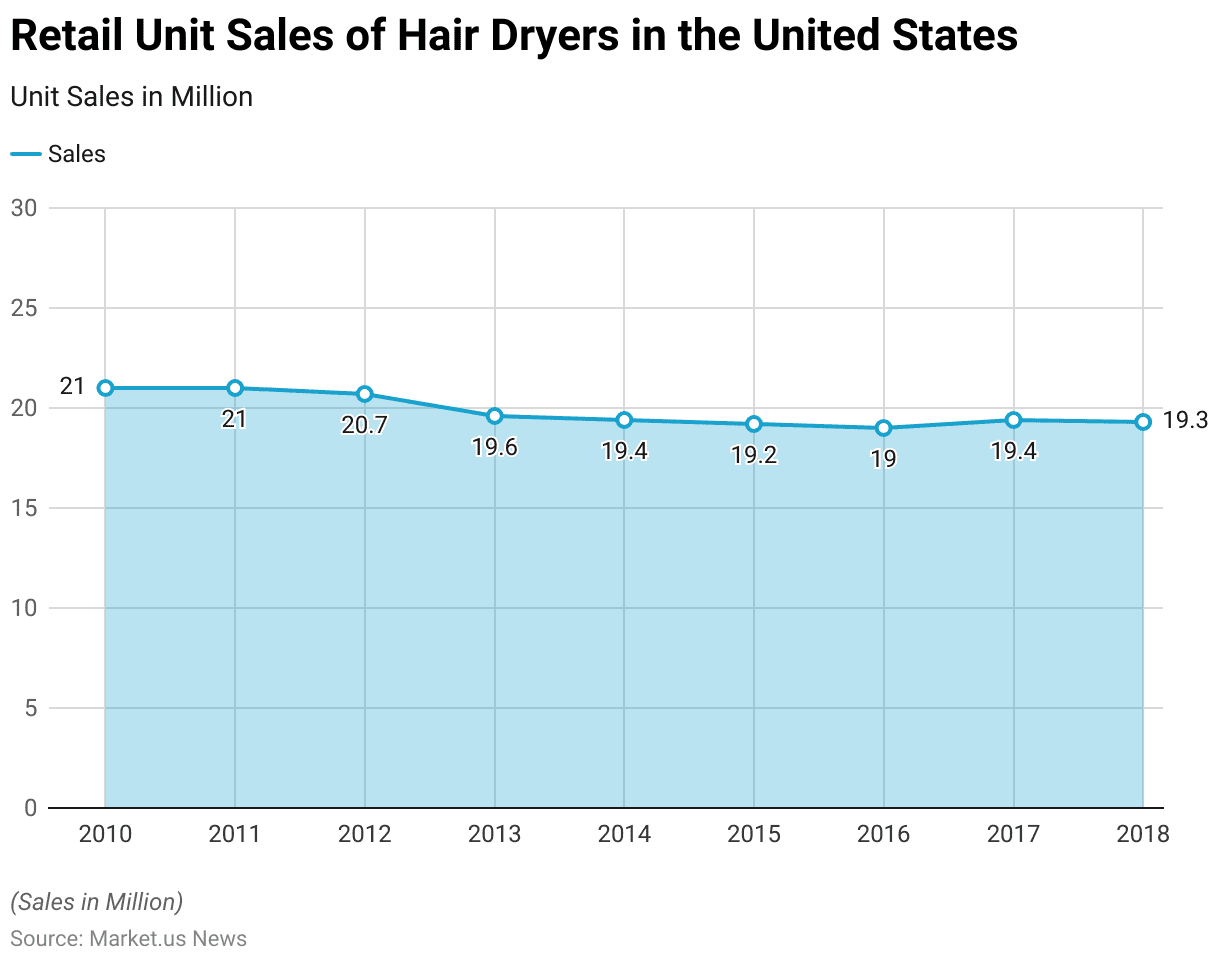

- The retail unit sales of hair dryers in the United States experienced a gradual decline from 2010 to 2018, with fluctuations in certain years.

- In 2010 and 2011, unit sales stood at 21 million, marking the highest level during this period.

- By 2012, sales had slightly decreased to 20.7 million units.

- The decline continued in subsequent years, with 19.6 million units sold in 2013 and 19.4 million in 2014.

- In 2015, unit sales dropped further to 19.2 million, and by 2016, they reached their lowest point at 19 million.

- A slight recovery was observed in 2017, with sales increasing to 19.4 million units, but this was followed by a marginal decline in 2018, with sales recorded at 19.3 million units.

- These trends highlight a decreasing demand for hair dryers in the U.S. retail market over the period, with some minor rebounds.

(Source: Statista)

Hand-held Hair Dryer Manufacturers

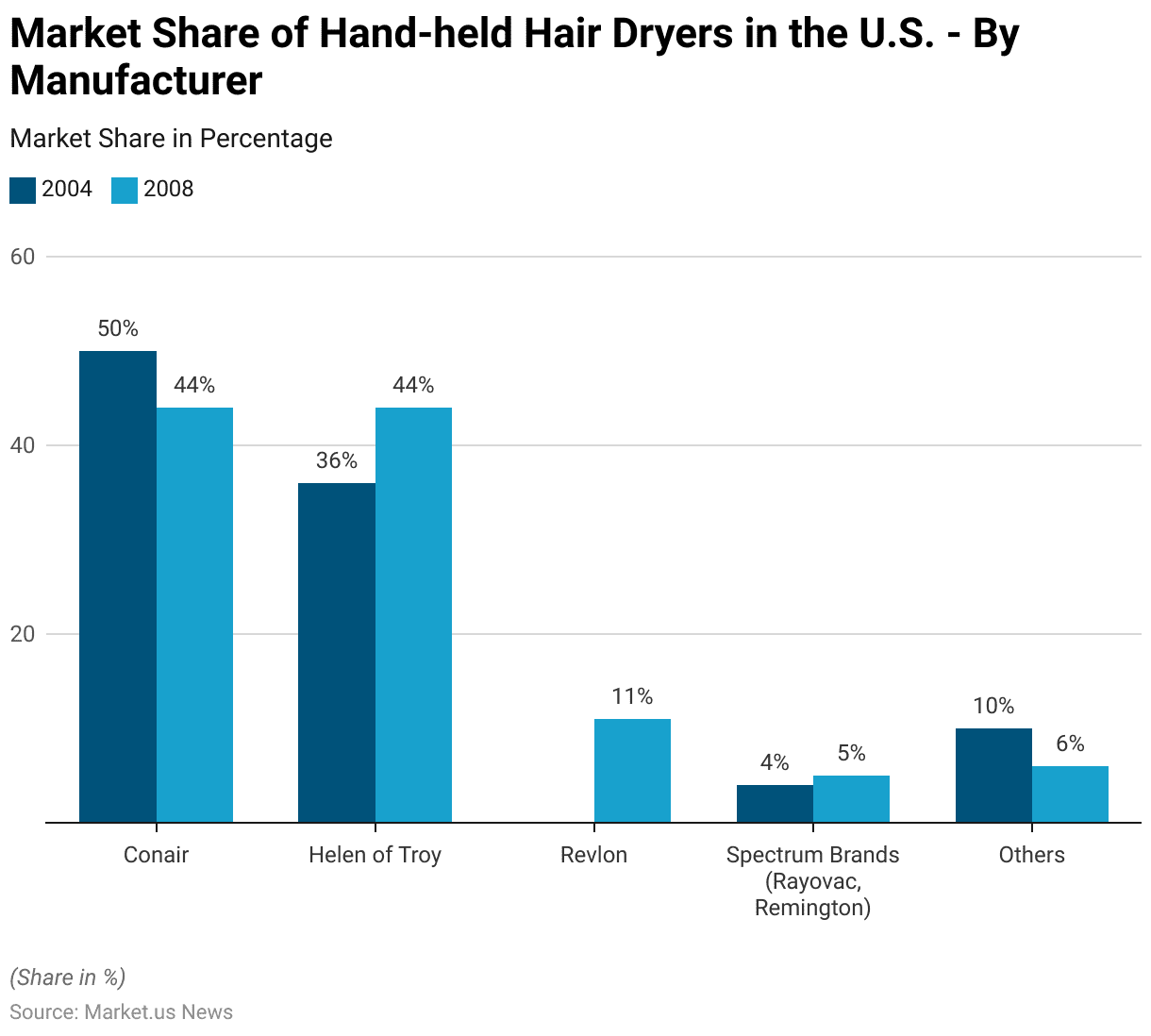

- The U.S. market share of hand-held hair dryers by manufacturer experienced notable shifts between 2004 and 2008.

- In 2004, Conair dominated the market with a 50% share, followed by Helen of Troy at 36%.

- Spectrum Brands (Rayovac, Remington) held a modest 4%, while other manufacturers collectively accounted for 10%.

- By 2008, the market saw significant changes.

- Conair’s market share declined to 44%, tying with Helen of Troy, which also grew to capture 44% of the market.

- Revlon emerged as a notable player with an 11% share.

- Spectrum Brands saw a slight increase, rising to 5%, while the share of other manufacturers dropped to 6%.

- These trends reflect a more competitive landscape, with Helen of Troy gaining ground and other players slightly increasing or consolidating their positions.

(Source: Statista)

Hair Dryer Brand Preferences

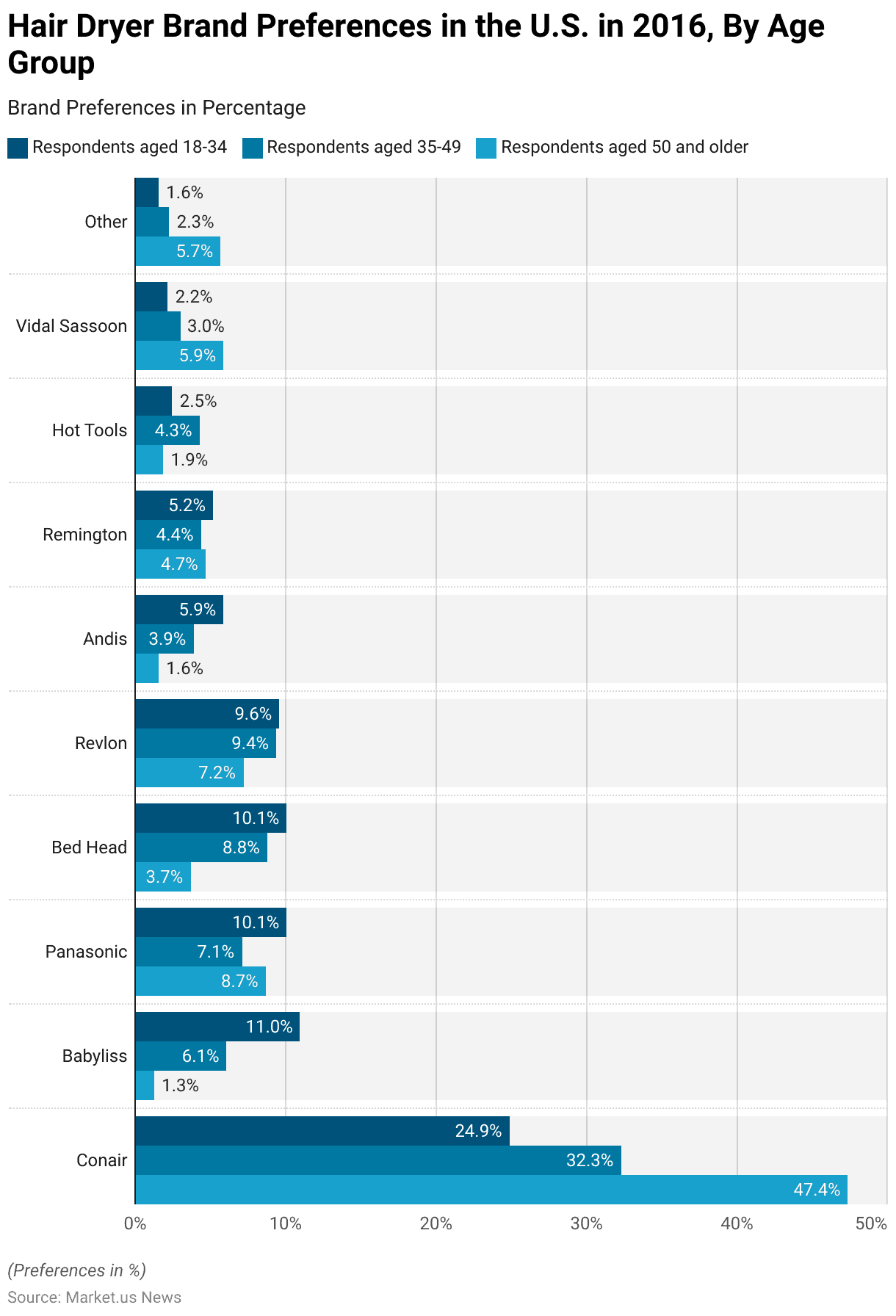

- In 2016, brand preferences for hair dryers in the United States varied significantly across different age groups.

- Among respondents aged 18-34, Conair was the most preferred brand, capturing 24.9% of the market, followed by Babyliss at 11%, and Panasonic and Bed Head both at 10.1%.

- Revlon held 9.6%, while Andis had 5.9%.

- Remington and Hot Tools were less popular, with 5.2% and 2.5%, respectively, while Vidal Sassoon and “Other” brands captured 2.2% and 1.6%.

- For respondents aged 35-49, Conair maintained its leading position with a higher preference of 32.3%.

- Bed Head ranked second at 8.8%, followed closely by Revlon (9.4%) and Panasonic (7.1%).

- Babyliss dropped to 6.1%, and Andis accounted for 3.9%.

- Remington and Hot Tools held 4.4% and 4.3%, respectively, while Vidal Sassoon and “Other” brands increased slightly to 3% and 2.3%.

- Among respondents aged 50 and older, Conair’s dominance was even more pronounced, with 47.4% preference.

- Panasonic followed at 8.7%, and Revlon ranked third with 7.2%.

- Vidal Sassoon and “Other” brands gained traction in this group, with 5.9% and 5.7%, respectively.

- Bed Head, Babyliss, and Andis saw reduced preferences, capturing 3.7%, 1.3%, and 1.6%, respectively.

- Remington held steady at 4.7%, while Hot Tools accounted for 1.9%.

- These preferences highlight Conair’s strong appeal across all age groups and the varying popularity of other brands based on consumer age.

(Source: Statista)

Price Expectations for a Hair Dryer Among Consumers

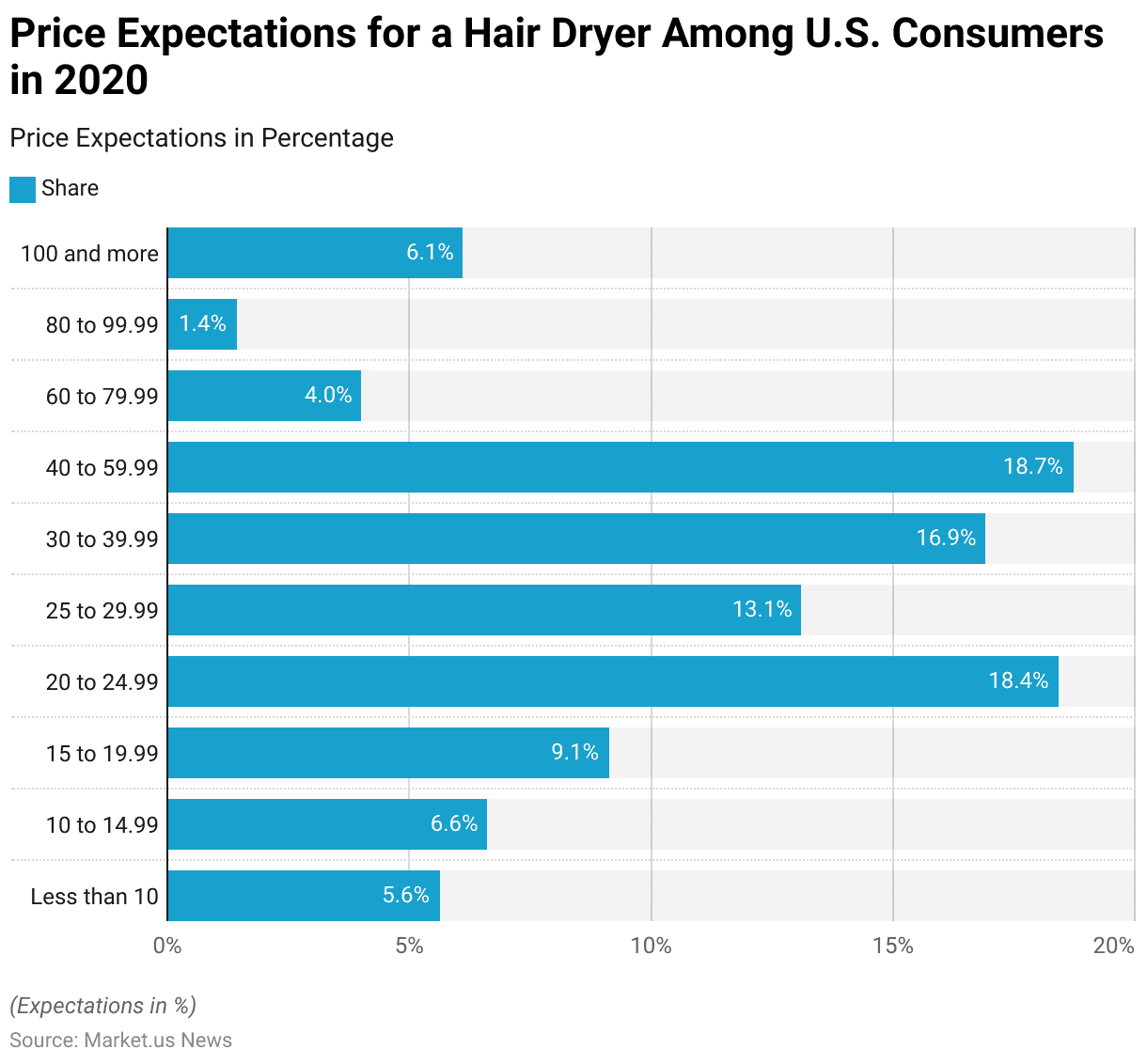

- In 2020, U.S. consumers displayed varied price expectations for purchasing a hair dryer, with preferences spanning a wide range of price categories.

- The largest share of respondents (18.7%) indicated a willingness to pay between USD 40 and 59.99, followed closely by 18.4% opting for the USD 20 to 24.99 range.

- The USD 30 to 39.99 range was also popular, with 16.9% of respondents selecting it, while 13.1% favored the USD 25 to 29.99 price point.

- Lower price categories saw smaller shares, with 9.1% expecting to pay between USD 15 and 19.99, 6.6% choosing USD 10 to 14.99, and 5.6% considering less than USD 10.

- Higher price categories were less preferred, with only 4% selecting the USD 60 to 79.99 range, 1.4% opting for USD 80 to 99.99, and 6.1% willing to pay USD 100 or more.

- These data indicate a strong preference for mid-range pricing among consumers, while both budget and premium options captured smaller but notable shares.

(Source: Statista)

Innovation in Hair Dryers

- In recent advancements in hair dryer technology, Dyson has emerged as a key innovator with its launch of the Dyson Supersonic Nural™ and Supersonic r™ models, which showcase significant enhancements aimed at optimizing user experience and hair health.

- The Supersonic Nural™ is distinguished by its intelligent sensor technology, including a Time of Flight sensor that automatically adjusts heat to minimize damage and enhance hair shine, making it a standout for consumer use.

- This model also incorporates various user-friendly features like Scalp Protect mode, which regulates temperature based on proximity to the scalp to prevent overheating.

- For professional stylists, the Supersonic r™ model offers a compact and lighter design that delivers fast, precise styling without heat damage.

- This hair dryer is 30% smaller and 20% lighter than previous versions, facilitating ease of use during long styling sessions. It’s equipped with revolutionary heater and motor technologies, ensuring a smoother and shinier finish.

- Notably, it uses Radio Frequency Identification (RFID) sensors in its attachments, which communicate with the dryer to optimize airflow and temperature automatically.

- These innovations by Dyson not only push the boundaries of personal care appliance technology but also cater to both consumer and professional needs, ensuring superior performance and healthier hair outcomes.

(Sources: Dyson, TechRadar)

Regulations for Hair Dryers

- Regulations for hair dryers vary significantly by country, focusing on ensuring consumer safety and environmental protection.

- In the United States, the Consumer Product Safety Commission (CPSC) has mandated that all hand-supported hair dryers must include an integral immersion protection device to prevent electrocution risks when the device contacts water.

- This regulation is enforced under federal safety rules, which also allow the CPSC to halt shipments of non-compliant products and conduct recalls.

- In India, the import and manufacturing of hair dryers are regulated under several standards, including the E-Waste Management Rules, 2022, which require an Extended Producer Responsibility (EPR) certificate to ensure proper e-waste disposal.

- Additionally, the Bureau of Indian Standards mandates compliance with Indian safety standards through the Foreign Manufacturer Certification Scheme, while the Legal Metrology Packaged Commodity Rules, 2011, enforce clear labeling of the products.

- Vietnam has its own set of requirements, including electrical safety and EMC compatibility tests as per the national standards QCVN 4:2009/BKHCN and TCVN 7492-1:2010, respectively.

- Imported hair dryers must undergo these tests and receive a CR EMC and Safety Type Approval before entering the market.

- Such meticulous regulation across various countries ensures that the hair dryers available in the market adhere to the highest safety standards, protecting consumers from potential hazards and contributing to global efforts in sustainable electronic waste management.

(Source: U.S. Consumer Product Safety Commission, Trusted Compliance & Import Services, NKGABC Blog)

Recent Developments

Acquisitions and Mergers:

- Procter & Gamble Acquires NuMe (2023): In August 2023, Procter & Gamble acquired NuMe, a premium hair care and styling tools company, for $250 million. This acquisition aims to expand P&G’s product portfolio in the high-end hair dryer segment and boost its presence in the global market.

- Dyson Acquires Smart Styling Technology Firm (2024): In early 2024, Dyson announced the acquisition of a smart styling technology startup for $120 million. The move strengthens Dyson’s innovation pipeline for intelligent hair dryers equipped with temperature control and hair health monitoring features.

Product Launches:

- Dyson Introduces Airwrap 2.0 (2024): In March 2024, Dyson launched Airwrap 2.0, a multifunctional hair styling tool with enhanced drying technology. The product, priced at $599, features upgraded temperature control and faster drying times, catering to professional stylists and premium users.

- Philips Releases Eco-Friendly Hair Dryer (2023): In November 2023, Philips unveiled an energy-efficient hair dryer using 30% less energy compared to conventional models. Retailing at $120, the dryer targets eco-conscious consumers and aligns with Philips’ sustainability goals.

Funding and Investments:

- Shark Beauty Secures $50 Million in Funding (2023): Shark Beauty, known for its innovative hair care devices, raised $50 million in Series B funding in July 2023. The funds will be used to develop next-generation hair dryers with AI features and to expand its distribution channels globally.

- GHD Receives $30 Million for Smart Hair Tools (2023): GHD (Good Hair Day) received $30 million in investment in December 2023 to enhance its product offerings, including hair dryers integrated with real-time heat sensing technology to minimize hair damage.

Technological Advancements:

- AI and Temperature Regulation Features: By 2024, 15% of hair dryers in the market are expected to feature AI-based temperature control, reducing hair damage and enhancing styling precision. Companies like Dyson and Philips are pioneering these advancements.

- Sustainable Designs on the Rise: Sustainability is a key focus, with 20% of new models launched in 2023 incorporating recyclable materials and energy-efficient designs.

Conclusion

Hair Dryer Statistics – The global hair dryer market has shown steady growth, driven by technological advancements, changing lifestyles, and increasing demand for personal grooming products.

While dominated by major brands like Conair and Helen of Troy, the market remains competitive, with rising online sales and demand for premium products.

Key markets such as China and India lead in revenue, while the U.S. drives imports. Consumers favor mid-range pricing, though premium options are gaining traction.

With increasing disposable incomes, advanced technologies, and e-commerce expansion, the market is poised for further growth, reinforcing the hair dryer’s significance in personal care.

FAQs

The growth of the hair dryer market is driven by rising disposable incomes, increasing consumer demand for personal grooming products, technological advancements, and the growing popularity of premium and professional-grade hair dryers.

China and India lead the market in revenue, while the United States plays a significant role in imports. Emerging economies are also contributing to the market’s growth due to increasing urbanization and lifestyle changes.

The market is witnessing a shift toward online sales channels due to convenience, wider product availability, and competitive pricing, while offline retail still holds a significant share.

Consumers prefer mid-range products priced between USD 20 and 60, though premium options exceeding USD 100 are gaining traction among a niche audience.

Major brands like Conair, Helen of Troy, Dyson, and Revlon dominate the market, offering various products tailored to different consumer needs.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)