Table of Contents

Introduction

According to Sweetener Statistics, Sweeteners are substances used to add sweetness to food and beverages. They come in various types, including natural sweeteners like stevia and honey, artificial sweeteners such as aspartame and sucralose, and sugar alcohols like xylitol and sorbitol.

These sweeteners are widely used in different products like soft drinks, baked goods, medications, and personal care items.

While natural sweeteners are derived from plants, artificial sweeteners are chemically produced, and sugar alcohols offer reduced calorie options.

Regulations govern their use and labeling to ensure consumer safety and awareness. Understanding sweeteners is crucial for product formulation and compliance with industry standards.

Editor’s Choice

- The global sweetener market revenue reached 174.0 billion USD in 2023.

- Sucrose dominated the market in 2022 with revenues of USD 56.67 billion. Followed by natural sweeteners at USD 45.72 billion and artificial sweeteners at USD 24.15 billion.

- As of the latest data available, solid sweeteners dominate the market with a substantial market share of 70%.

- China, boasting a substantial revenue of USD 125.1 billion, underscores its prominent position in the sweetener industry.

- Advantame stands out as the sweetest among the listed sweeteners, being approximately 20,000 times sweeter than sugar.

- In the United States, the usage of various sugar substitutes among consumers varies. Splenda is the most commonly used, cited by 51.4 million consumers.

- On a scale of 1 to 10, indicating the likelihood of consumption of foods and beverages containing various sweeteners, respondents ranked honey highest with a score of 7.1.

Sweetener Market Overview

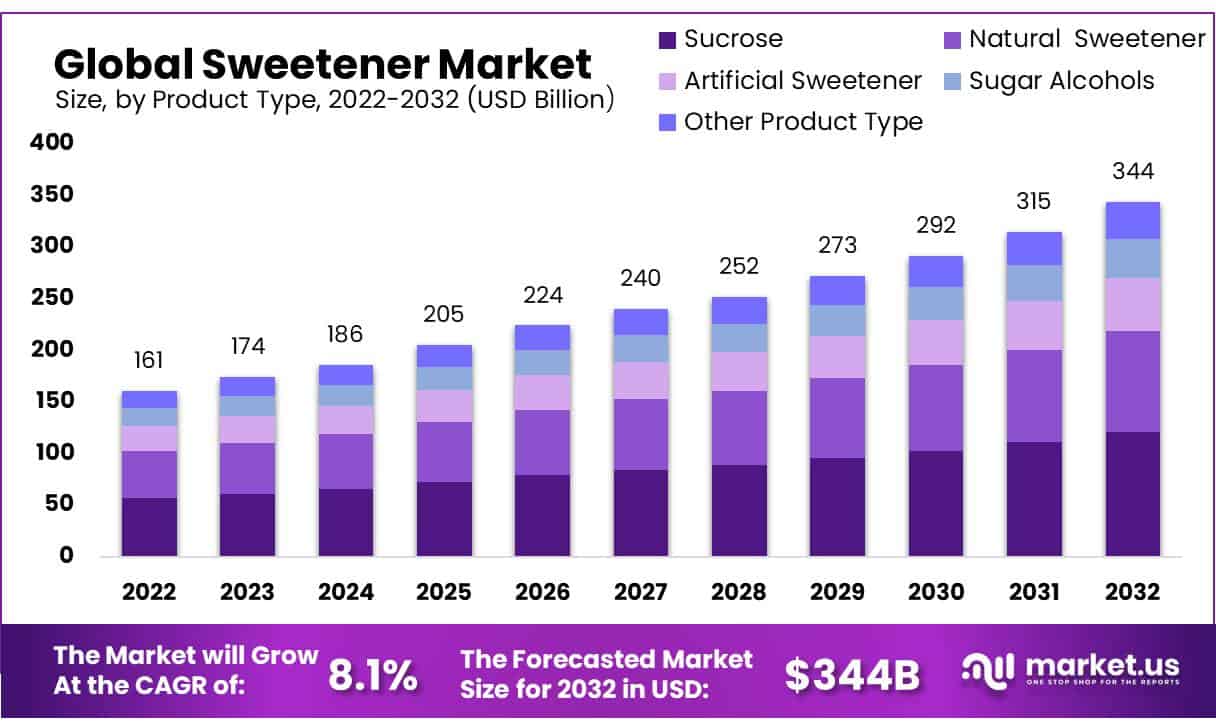

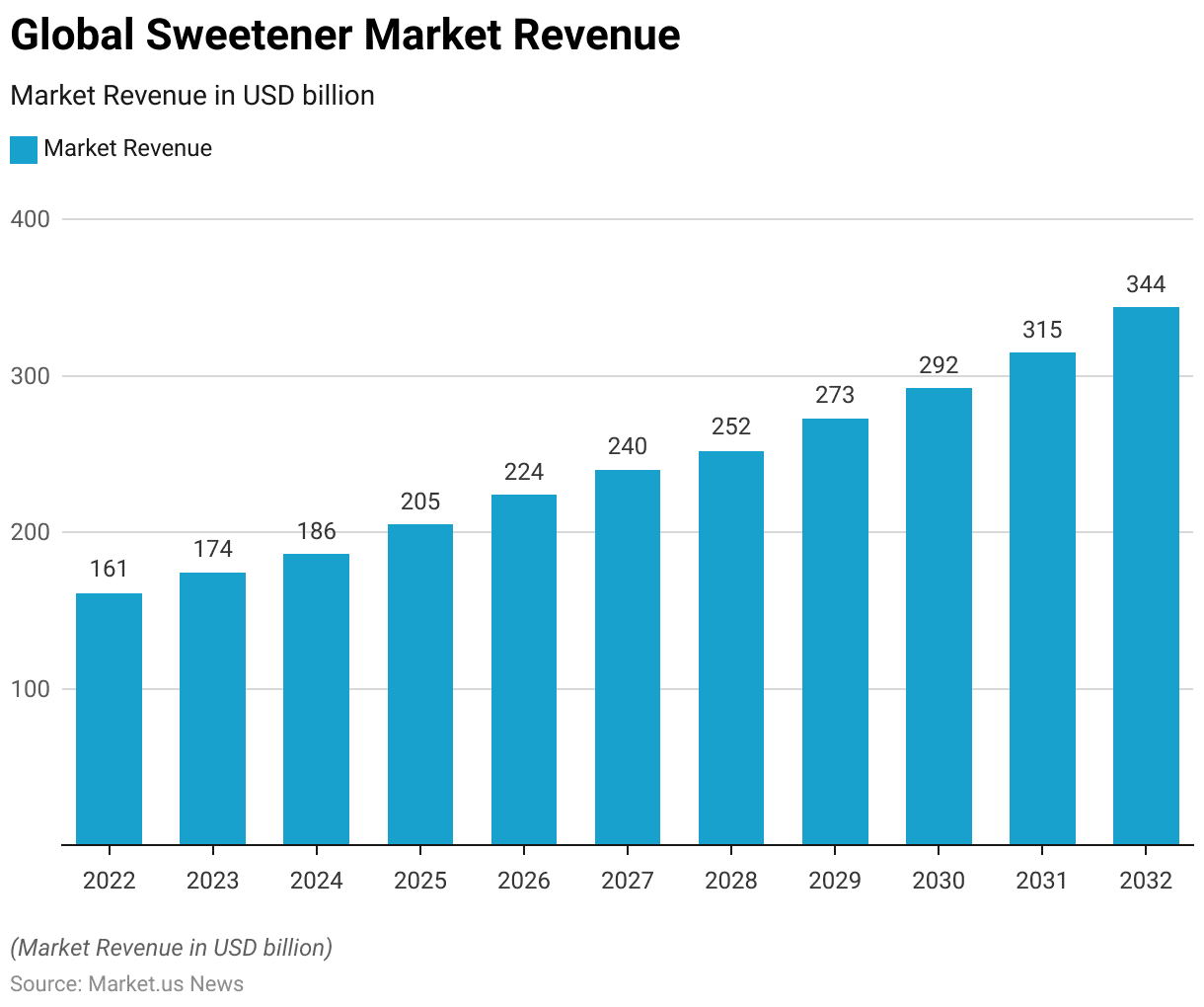

Global Sweetener Market Size

- The global sweetener market has demonstrated steady revenue growth over the past decade at a CAGR of 8.13%, with a clear upward trajectory projected for the foreseeable future.

- Starting at 161.0 billion USD in 2022, the market saw incremental increases, reaching 174.0 billion USD in 2023 and further climbing to 186.0 billion USD in 2024.

- By 2030, the market is forecasted to reach 292.0 billion USD, followed by significant growth to 315.0 billion USD in 2031 and 344.0 billion USD in 2032.

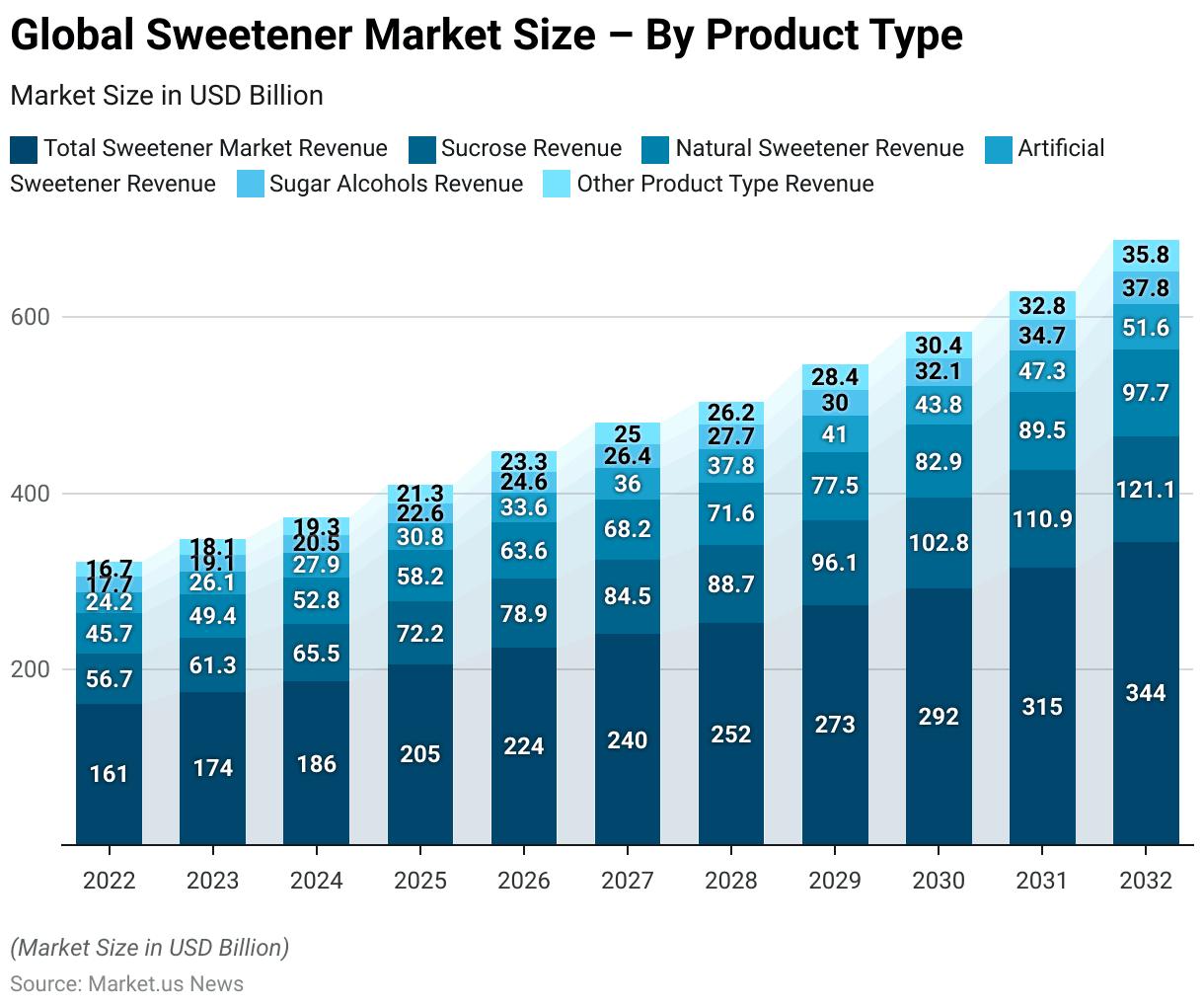

Global Sweetener Market Size – By Product Type

- The global sweetener market demonstrates a consistent upward trajectory, with substantial growth projected over the next decade.

- Sucrose dominated the market with revenues of USD 56.67 billion, followed by natural sweeteners at USD 45.72 billion and artificial sweeteners at USD 24.15 billion.

- Additionally, sugar alcohols accounted for USD 17.71 billion, while other product types contributed USD 16.74 billion. By 2032. The market is forecasted to reach USD 344.0 billion, indicating a robust expansion.

- Sucrose is anticipated to maintain its leading position, with revenues expected to reach USD 121.09 billion. Followed by natural sweeteners at USD 97.70 billion and artificial sweeteners at USD 51.60 billion.

- Sugar alcohols and other product types are also poised for significant growth, with revenues projected to reach USD 37.84 billion and USD 35.78 billion, respectively.

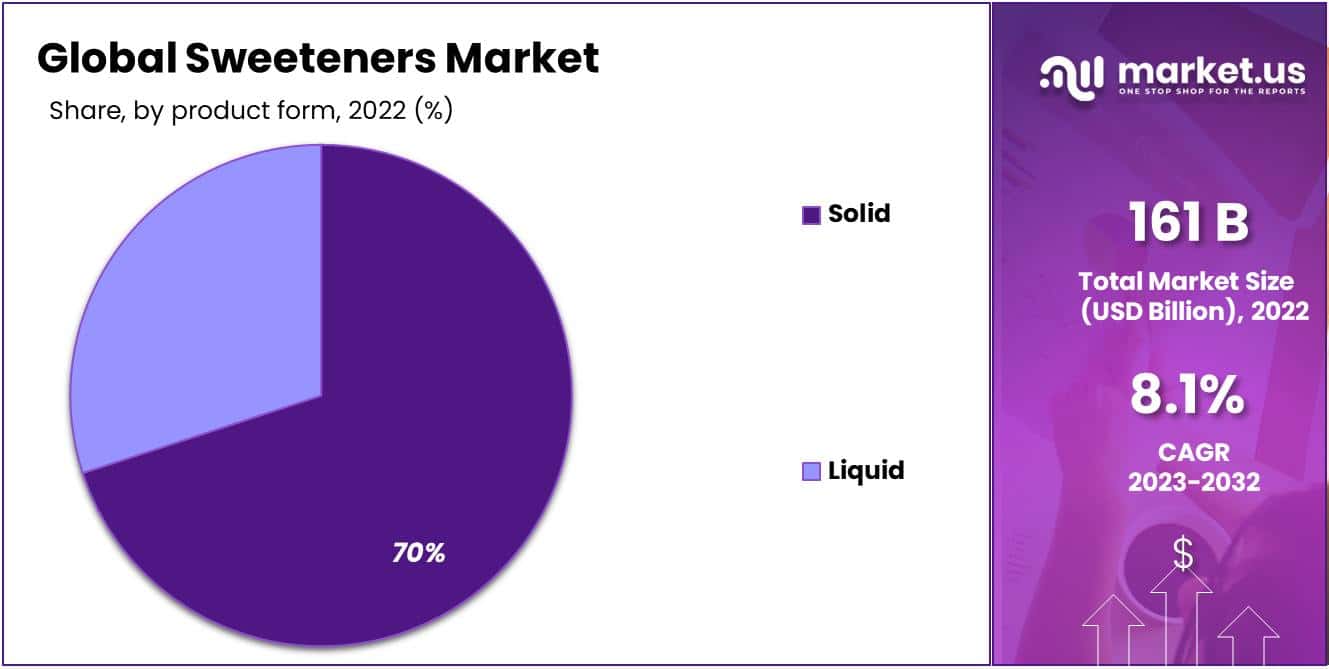

Sweetener Market Share – By Product Form

- In the sweetener market, product form plays a crucial role in shaping consumer choices and industry trends.

- As of the latest data available, solid sweeteners dominate the market with a substantial market share of 70%.

- In contrast, liquid sweeteners hold a smaller but significant share of 30%.

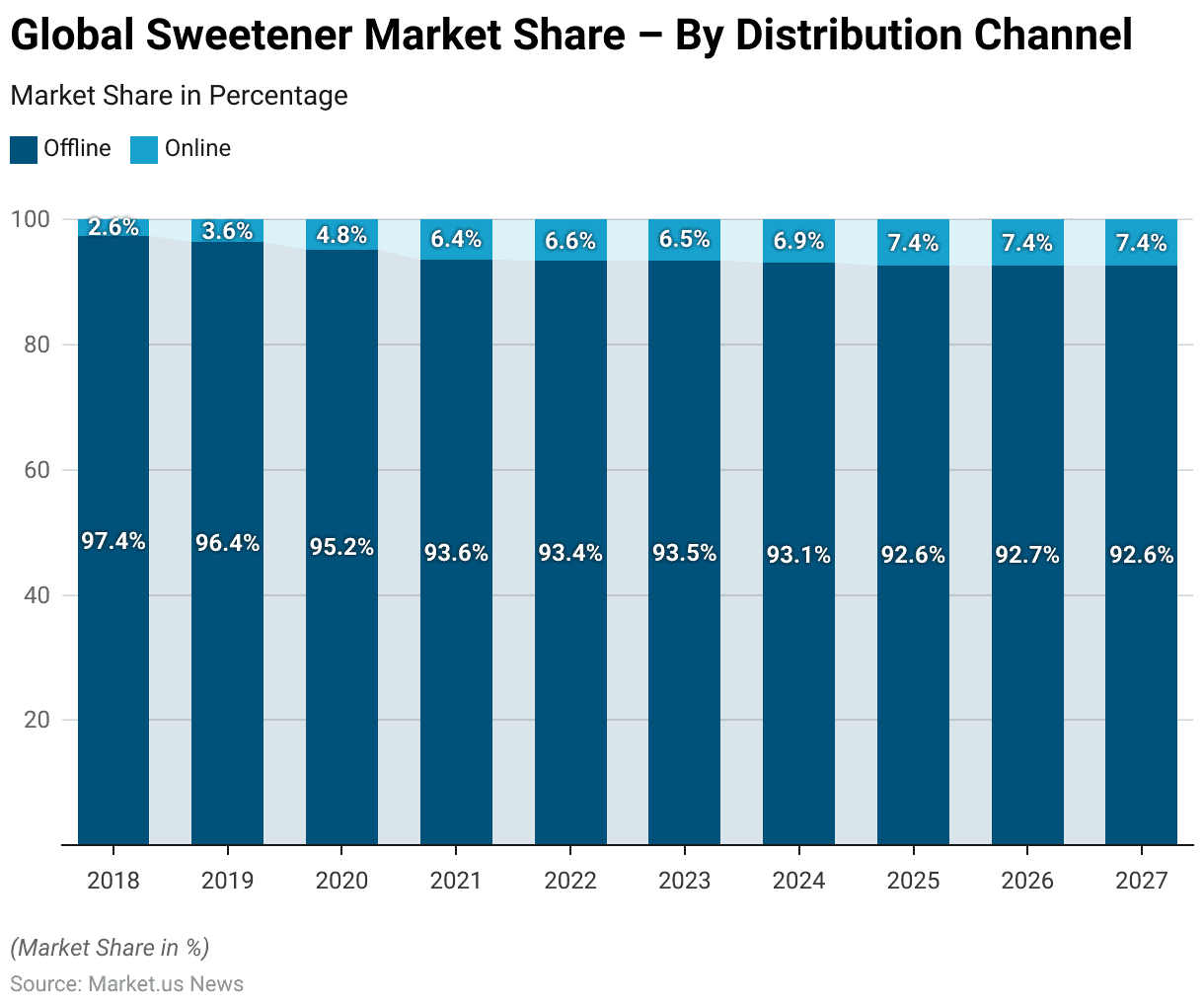

Global Sweetener Market Share – By Distribution Channel

- The distribution channels for the global sweetener market have shown a consistent trend over the past decade, with a gradual shift towards online platforms.

- In 2018, offline channels dominated with a share of 97.4%, while online channels accounted for a mere 2.6%.

- However, the online segment has steadily gained traction, reaching 6.9% by 2024. Conversely, offline channels have experienced a decline, albeit marginal, dropping to 93.1% in the same year.

- Looking ahead, projections indicate a continued but slow decline in offline sales. With a corresponding rise in online market share, potentially reaching 7.4% by 2027.

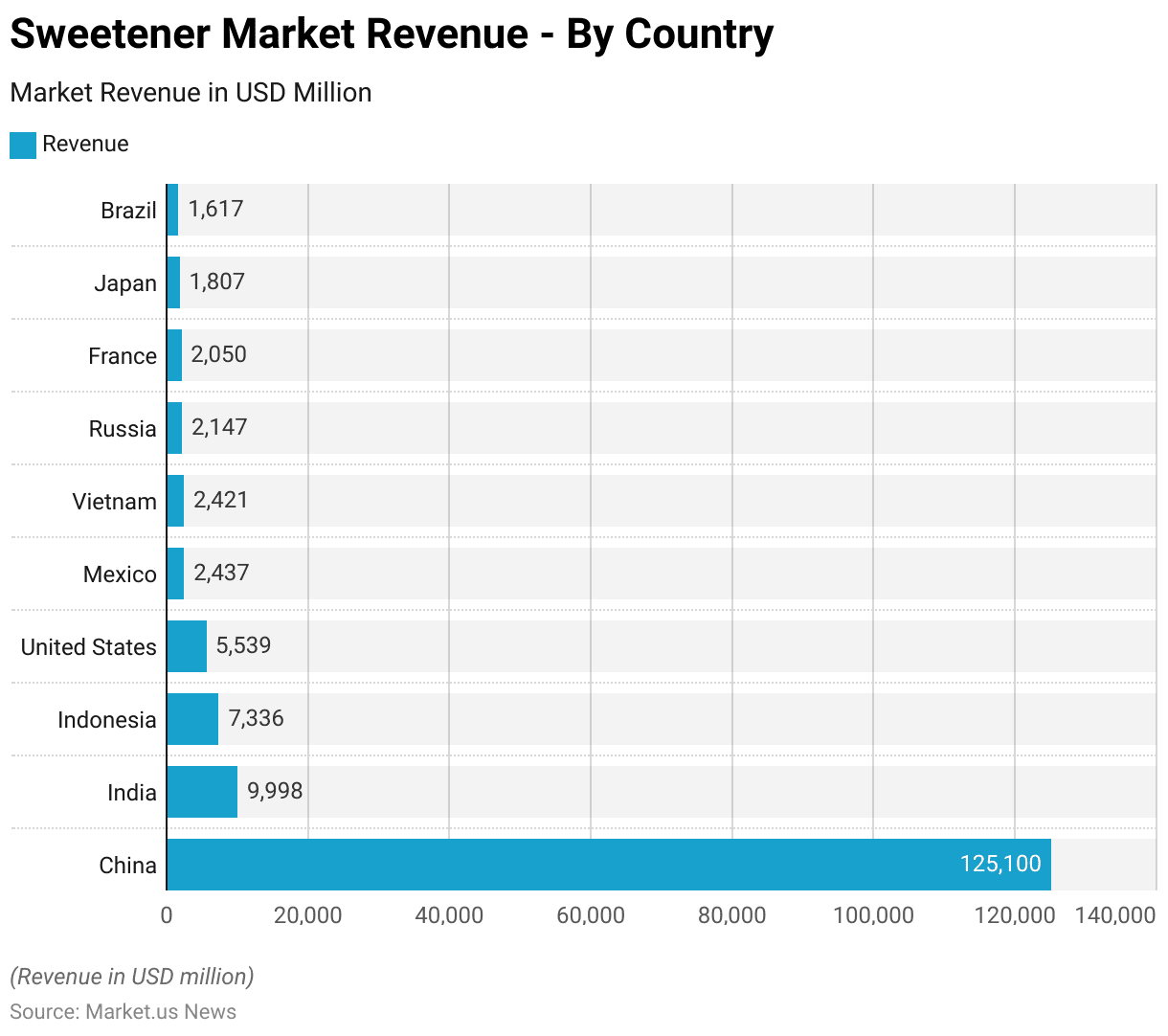

Regional Analysis of the Global Sweetener Market

- The global sweetener market demonstrates varying revenue distributions across key countries.

- Leading the pack is China, boasting a substantial revenue of USD 125.1 billion, underscoring its prominent position in the industry.

- Following closely behind is India, with a noteworthy revenue of USD 9.998 billion, showcasing its significant contribution to the market.

- Indonesia emerges as another formidable player, with a revenue of USD 7.336 billion, reflecting its growing presence in the sweetener sector.

- The United States, with a revenue of USD 5.539 billion, maintains a solid foothold in the market, indicative of its enduring demand for sweetening agents.

- Mexico and Vietnam follow suit, each contributing USD 2.437 billion and USD 2.421 billion, respectively, to the overall revenue pool.

Sweetness Intensity of Sweeteners

- Sweeteners vary in their sweetness intensity compared to table sugar, measured in times sweeter.

- Advantame stands out as the sweetest among the listed sweeteners, being approximately 20,000 times sweeter than sugar.

- Neotame follows with a range of 7,000 to 13,000 times sweeter, while thaumatin falls between 2,000 to 3,000 times sweeter.

- Saccharin ranges from 200 to 700 times sweeter, while sucralose is approximately 600 times sweeter.

- Steviol glycosides exhibit a sweetness intensity of 200 to 400 times sweeter. While Luo Han Gou ranges from 100 to 250 times sweeter.

- Aspartame and acesulfame potassium (Ace-K) both share a sweetness intensity of 200 times sweeter than sugar.

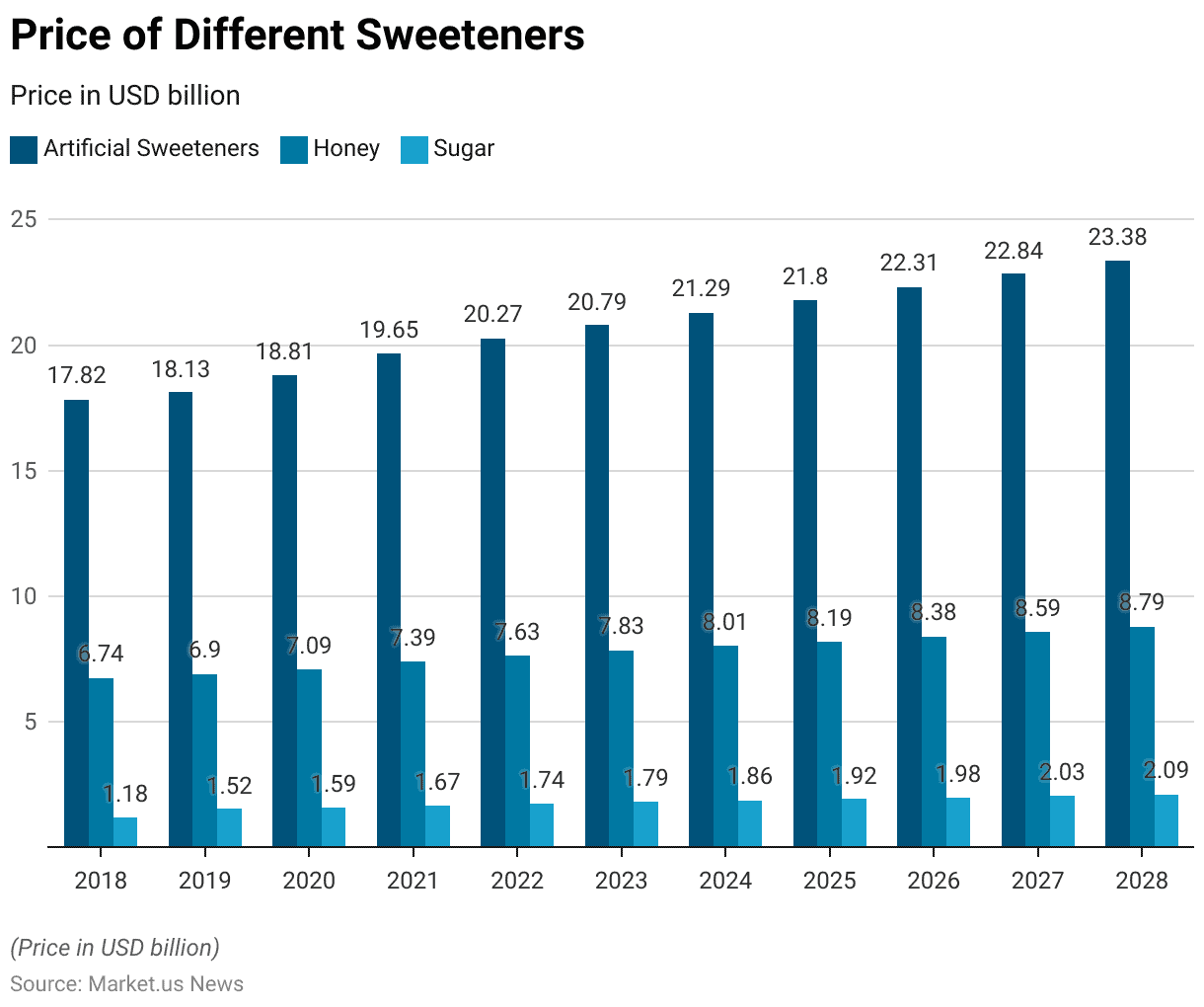

Price of Sweeteners

- The price per unit of sweeteners, measured in USD, demonstrates varying trends across different types over the years.

- Artificial sweeteners exhibited a steady increase from 17.82 USD in 2018 to 22.84 USD in 2027, reflecting a consistent upward trajectory.

- Similarly, honey saw a gradual rise in price from 6.74 USD in 2018 to 8.59 USD in 2027.

- In contrast, sugar displayed a comparatively stable pattern, with minimal fluctuations, starting at 1.18 USD in 2018 and reaching 2.03 USD in 2027.

Well-known Low-Calorie Sweeteners

- Low-calorie sweeteners, also known as artificial sweeteners, offer a sugar-free alternative for individuals seeking to reduce calorie intake or manage blood sugar levels.

- Common brand names include Equal®, NutraSweet®, and Sugar Twin® for aspartame, Sunett® and Sweet One® for Acesulfame-K, and Sweet’N Low®, Sweet Twin®, and Necta Sweet® for saccharin.

- These sweeteners are significantly sweeter than sugar, with aspartame, Acesulfame-K, and saccharin being approximately 200 times sweeter, sucralose 600 times sweeter, and neotame 7,000 to 13,000 times sweeter.

- Advantame, with no specific brand names, is the sweetest, being approximately 20,000 times sweeter than sugar.

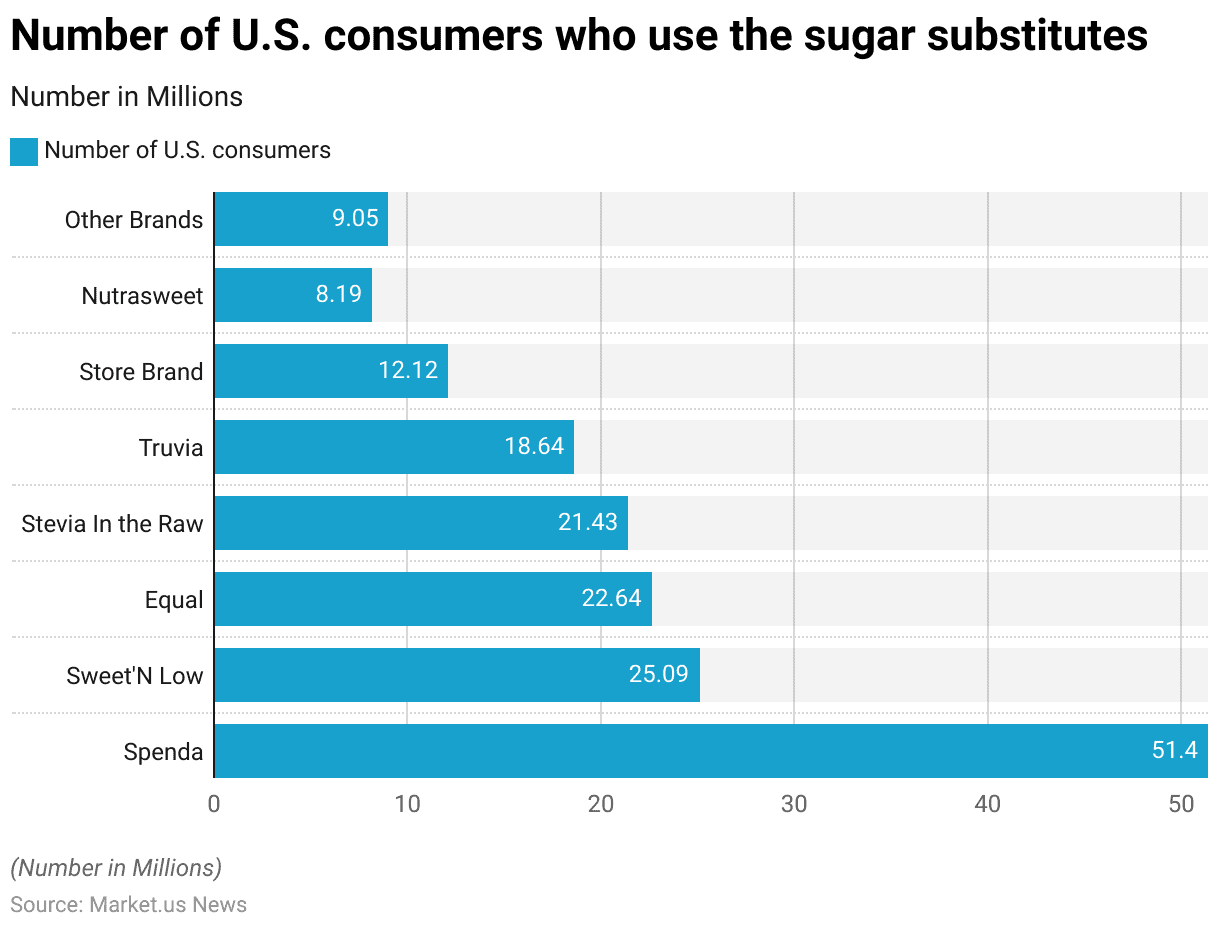

Popular Sugar Substitutes

- In the United States, the usage of various sugar substitutes among consumers varies, with Splenda being the most commonly used, cited by 51.4 million consumers.

- Following closely behind is Sweet’N Low, preferred by 25.09 million consumers, and Equal, favored by 22.64 million consumers.

- Stevia In the Raw and Truvia are also popular choices, with 21.43 million and 18.64 million consumers, respectively.

- Store brands represent a significant portion of the market, with 12.12 million consumers opting for these alternatives.

- 8.19 million consumers utilize Nutrasweet, while other brands collectively account for 9.05 million consumers.

Consumer Preferences

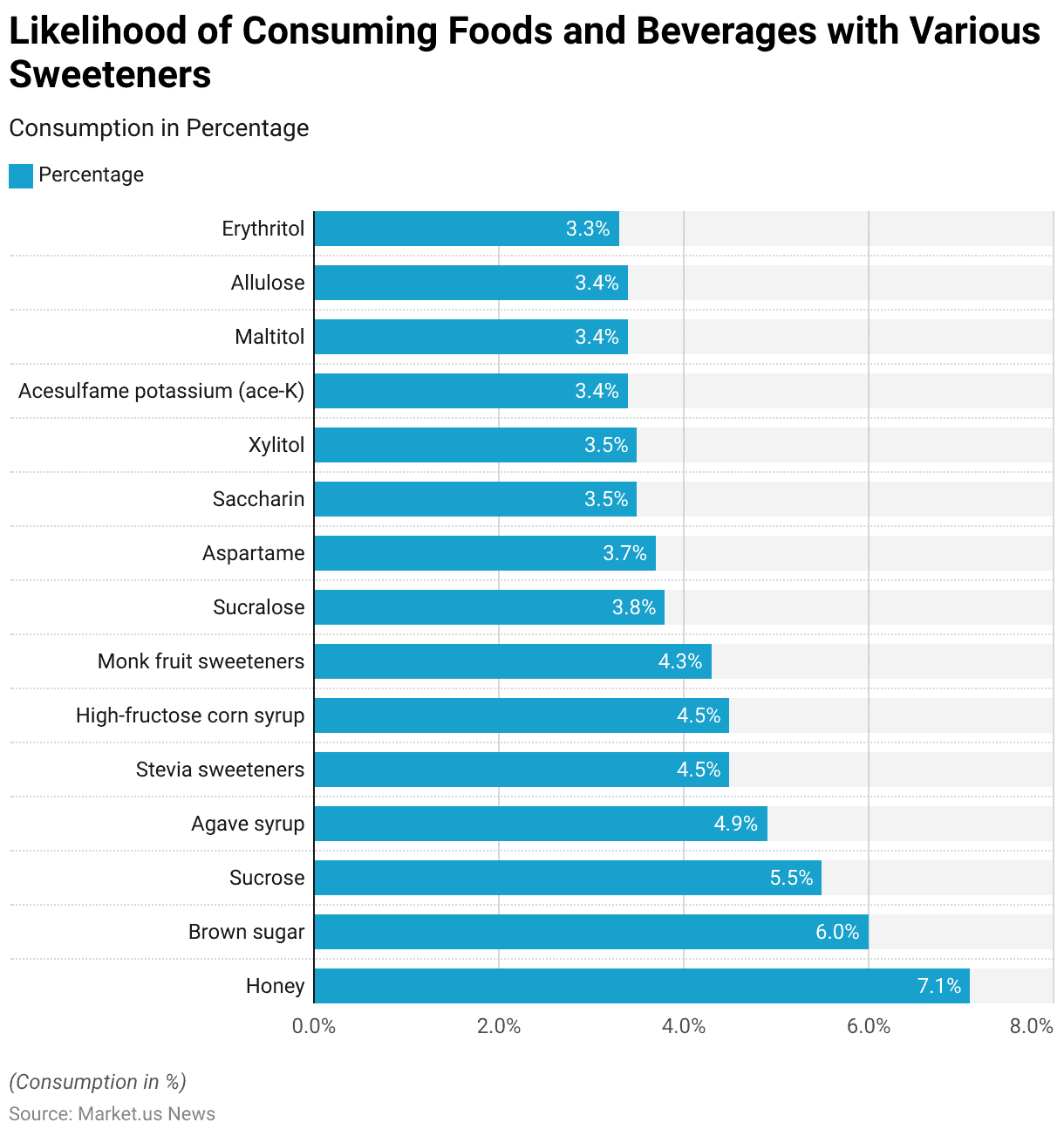

Likelihood of Consuming Foods and Beverages with Various Sweeteners

- On a scale of 1 to 10, indicating the likelihood of consumption of foods and beverages containing various sweeteners, respondents ranked honey highest with a score of 7.1, followed by brown sugar at 6 and sucrose at 5.5.

- Agave syrup received a rating of 4.9, while stevia sweeteners and high-fructose corn syrup both scored 4.5. Monk fruit sweeteners were slightly lower at 4.3.

- Artificial sweeteners such as sucralose, aspartame, and saccharin garnered scores of 3.8, 3.7, and 3.5, respectively, indicating a lower likelihood of consumption compared to natural sweeteners.

- Xylitol, acesulfame potassium (ace-K), maltitol, and allulose all received ratings of 3.4, while erythritol was slightly lower at 3.3.

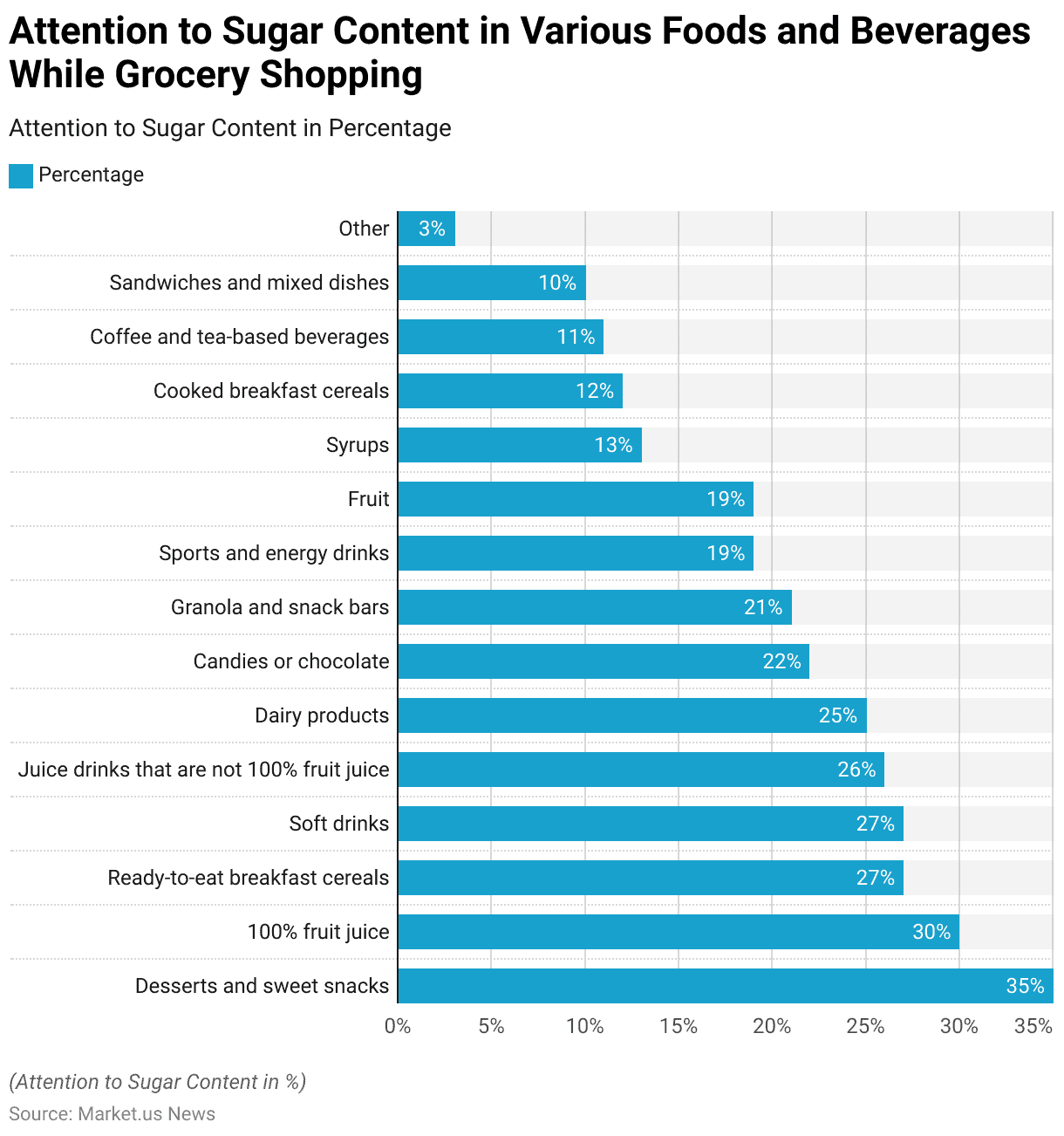

Attention to Sugar Content in Various Foods and Beverages While Grocery Shopping

- When grocery shopping, consumers pay the most attention to the sugar content in certain types of foods and beverages.

- Among these, desserts and sweet snacks are the top priority for 35% of shoppers, followed closely by 100% fruit juice at 30%.

- Ready-to-eat breakfast cereals and soft drinks tie for the next spot, with 27% of shoppers focusing on their sugar content.

- Additionally, juice drinks that are not 100% fruit juice and dairy products are also significant considerations, with 26% and 25% of shoppers, respectively, paying attention to their sugar content.

- Candies or chocolate, granola and snack bars, sports and energy drinks, and fruits are also areas of concern for a considerable portion of shoppers, ranging from 19% to 22%.

Trust in Information Sources about Health Effects of Sugar and Low-Calorie Sweeteners

- Trust in various sources that provide information about the health effects of consuming sugar and low-calorie sweeteners varies among different demographics.

- Health-focused websites are generally trusted by 18% of respondents, while registered dietitians featured in the media are considered trustworthy by 13%.

- Fitness professionals also hold credibility for 13% of respondents, similar to friends and family.

- Meanwhile, the website or social media accounts of a food or beverage brand are trusted by 8% of respondents, and bloggers or social media influencers without medical or nutrition degrees are trusted by 6%.

- When considering respondents who are parents or caregivers of children under 18 years old, trust in registered dietitians in the media increases to 20%, and fitness professionals to 25%.

- Conversely, trust in health-focused websites decreases slightly to 16%, and trust in friends and family decreases to 11%.

Regulatory Aspects of Sweeteners

- The FDA has regulated aspartame as a food additive since 1974, initially approving it for use as a tabletop sweetener, in chewing gum, and in certain food bases such as cold breakfast cereals.

- Over time, the FDA expanded its approval to include additional uses, with the most recent approval in 1996 allowing aspartame to be used as a general-purpose sweetener.

- The FDA allows the use of sugar alcohols as sugar substitutes, which vary in sweetness from 25% to 100% compared to sugar.

- The FDA bans the use of cyclamates and their salts in the United States. Additionally, whole-leaf and crude extracts of stevia are under an Import Alert by the FDA.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)