Table of Contents

- Introduction

- Editor’s Choice

- Nail Polish Market Statistics

- Women’s Reasons for Using Nail Polish Statistics

- Most Used Nail Polish Brands Among Female Consumers Statistics

- Nail Polish Purchase Locations According to Women Statistics

- Age Dynamics of Nail Polish Users Statistics

- Nail Polish Usage Statistics

- Awareness of Nail Polish Brands Among Women Statistics

- Nail Polish Sales Value Statistics

- Women’s Nail Polish Expenditure Statistics

- Spending on Nail Salon Services

- Gender Dynamics of Nail Session Expenses

- Opinions of Male Consumers

- Trends in Nail Art

- Formulation of Nail Lacquers

- Nail Polish Formulation Performance Metrics

- Regulations for Nail Polishes

- Conclusion

- FAQs

Introduction

Nail Polish Statistics: Nail polish is a cosmetic product used to color and protect nails, typically composed of pigments, solvents, film-forming agents, plasticizers, and thickeners.

It comes in various finishes, including cream, glossy, matte, metallic, glitter, and gel, each offering different aesthetic effects.

The application process generally involves using a base coat, followed by one or more layers of color, and finishing with a top coat for durability and shine.

Nail polishes have evolved with innovations like vegan, cruelty-free, and “free-from” formulations, as well as longer-lasting, chip-resistant options.

Removal is typically done with acetone-based removers, though gel polishes require specialized techniques.

Editor’s Choice

- By 2033, the global nail polish market size is projected to reach USD 25.8 billion.

- As of May 2017, women in the United States cited a variety of reasons for using nail polish, with the most common being to enhance their appearance, as 55% of respondents indicated they used it to “look better.”

- In 2017, the most popular nail polish brands among female consumers in the United Kingdom were led by Rimmel, which captured 43% of the market share.

- As of May 2017, women in the United States showed a clear preference for purchasing nail polish from drugstores, with 47% of respondents indicating this as their preferred location.

- In 2017, brand awareness of nail polish products among women in the United Kingdom was highest for Rimmel, with 74% of respondents recognizing the brand.

- As of May 2017, 36% of women in the United States reported spending $25 or less annually on nail polish products.

- In Europe, the regulation of cosmetics, including nail polishes, falls under the EU Cosmetics Regulation (EC No 1223/2009), which mandates that products must be safe for use, with specific restrictions on harmful chemicals such as formaldehyde and toluene.

Nail Polish Market Statistics

Global Nail Polish Market Size Statistics

- The global Nail Polish market is projected to experience steady growth over the next decade at a CAGR of 8.8%.

- In 2023, the market size was estimated at USD 11.1 billion, with a year-over-year increase of approximately USD 1 billion.

- By 2024, the market is expected to reach USD 12.1 billion, followed by further growth to USD 13.1 billion in 2025.

- The market continues its upward trajectory, with projections estimating it will reach USD 14.3 billion in 2026 and USD 15.6 billion in 2027.

- By 2028, the market is forecasted to grow to USD 16.9 billion, and this expansion will continue, reaching USD 18.4 billion in 2029 and USD 20.0 billion by 2030.

- The growth is anticipated to accelerate slightly, with the market size expected to hit USD 21.8 billion in 2031 and, ultimately, USD 23.7 billion by 2032.

- By 2033, the global Nail Polish market is projected to reach USD 25.8 billion, reflecting a consistent and robust growth trajectory throughout the period.

(Source: market.us)

Global Nail Polish Market Size – By Product Type Statistics

2023-2027

- The global Nail Polish market, segmented by product type, demonstrates consistent growth across all categories from 2023 to 2027.

- In 2023, the total market size was USD 11.1 billion, with liquid nail polish accounting for USD 5.99 billion, gel formulations contributing USD 4.33 billion, and other products making up USD 0.78 billion.

- The market is expected to grow steadily, with the total market size reaching USD 12.1 billion in 2024, driven by an increase in liquid nail polish to USD 6.53 billion, gel nail polish to USD 4.72 billion, and other products to USD 0.85 billion.

- By 2025, the overall market is projected to reach USD 13.1 billion, with liquid nail polish growing to USD 7.07 billion, gel nail polish to USD 5.11 billion, and other products to USD 0.92 billion.

- Growth continues through 2026, when the market is forecasted at USD 14.3 billion, with liquid nail polish rising to USD 7.72 billion, gel nail polish to USD 5.58 billion, and other products to USD 1.00 billion.

- In 2027, the market will expand to USD 15.6 billion, with liquid nail polish accounting for USD 8.42 billion, gel nail polish USD 6.08 billion, and other products USD 1.09 billion.

2028-2033

- By 2028, the market size is expected to reach USD 16.9 billion, with liquid nail polish growing to USD 9.13 billion, gel nail polish to USD 6.59 billion, and other products to USD 1.18 billion.

- In 2029, the market is projected to grow further to USD 18.4 billion, with liquid nail polish at USD 9.94 billion, gel nail polish at USD 7.18 billion, and other products at USD 1.29 billion.

- By 2030, the market is forecasted to reach USD 20.0 billion, with liquid nail polish at USD 10.80 billion, gel nail polish at USD 7.80 billion, and other products at USD 1.40 billion.

- In 2031, the market will expand to USD 21.8 billion, driven by liquid nail polish at USD 11.77 billion, gel nail polish at USD 8.50 billion, and other products at USD 1.53 billion.

- The market is expected to reach USD 23.7 billion in 2032, with liquid nail polish at USD 12.80 billion, gel nail polish at USD 9.24 billion, and other products at USD 1.66 billion.

- Finally, in 2033, the global market is projected to reach USD 25.8 billion, with liquid nail polish at USD 13.93 billion, gel nail polish at USD 10.06 billion, and other products at USD 1.81 billion, reflecting strong growth across all product categories.

(Source: market.us)

Global Nail Polish Market Share – By Distribution Channel Statistics

- In 2022, the global nail polish market was distributed across various channels, with specialty stores commanding the largest share at 38%.

- Supermarkets and hypermarkets followed closely, holding a 29% share of the market.

- Independent stores accounted for 23% of the market, while e-commerce represented a smaller yet significant 10% share.

- This distribution highlights the dominant role of specialty stores in the nail polish market while also indicating the growing presence of supermarkets, hypermarkets, and online platforms as important sales channels.

(Source: market.us)

Women’s Reasons for Using Nail Polish Statistics

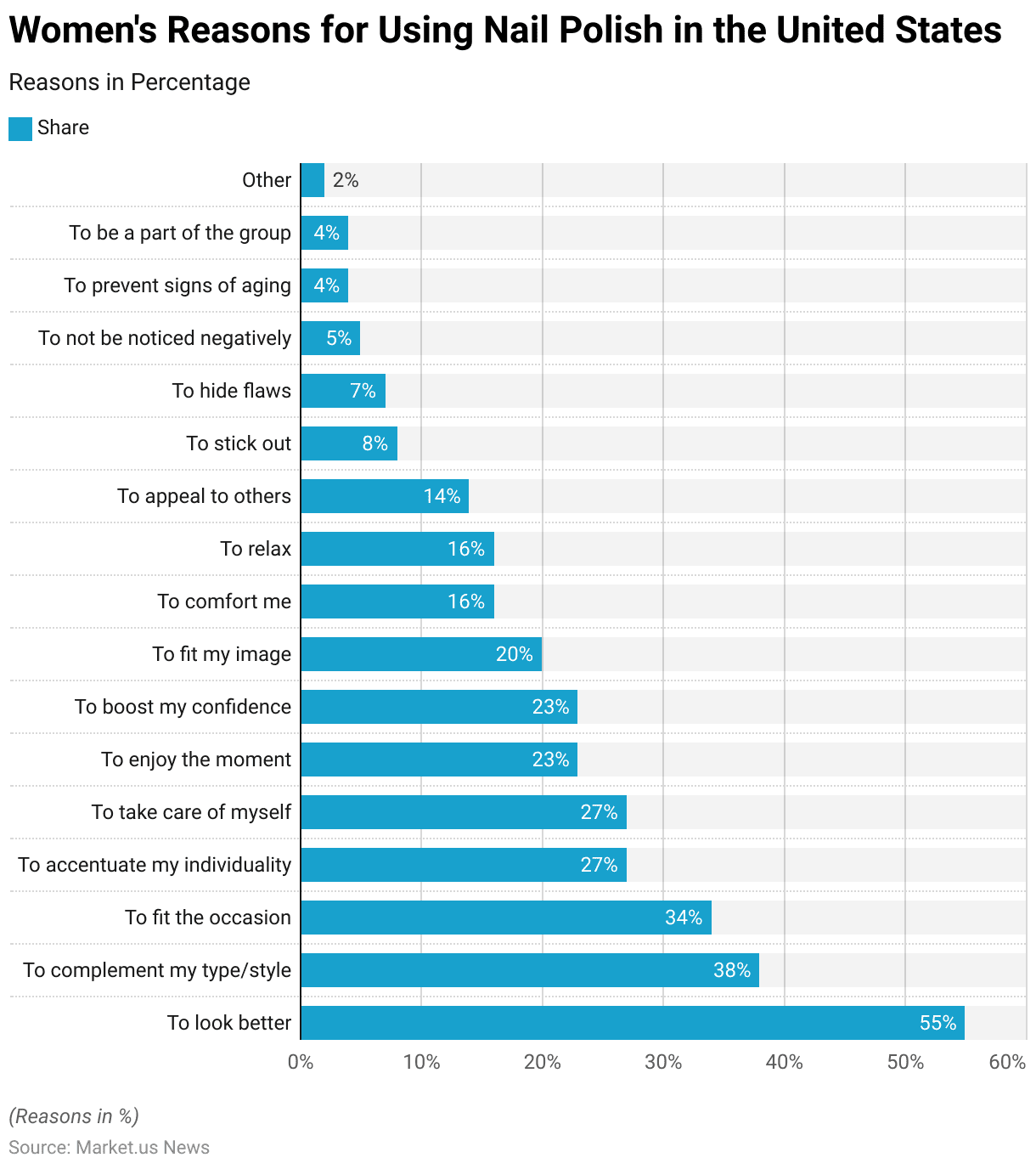

- As of May 2017, women in the United States cited a variety of reasons for using nail polish, with the most common being to enhance their appearance, as 55% of respondents indicated they used it to “look better.”

- Additionally, 38% of women reported using nail polish to complement their style, while 34% did so to fit a specific occasion.

- Nail polish was also seen as a means to express individuality, with 27% of respondents mentioning this as a reason, alongside the same percentage who used it as part of self-care.

- For 23%, using nail polish was a way to enjoy the moment and boost confidence.

- Other motivations included fitting their image (20%), seeking comfort (16%), and relaxation (16%).

- A smaller proportion of women used nail polish to appeal to others (14%), stand out (8%), hide flaws (7%), avoid negative attention (5%), or prevent signs of aging (4%).

- Lastly, 4% of respondents cited nail polish use as a way to feel part of a group, while 2% reported other reasons.

(Source: Statista)

Most Used Nail Polish Brands Among Female Consumers Statistics

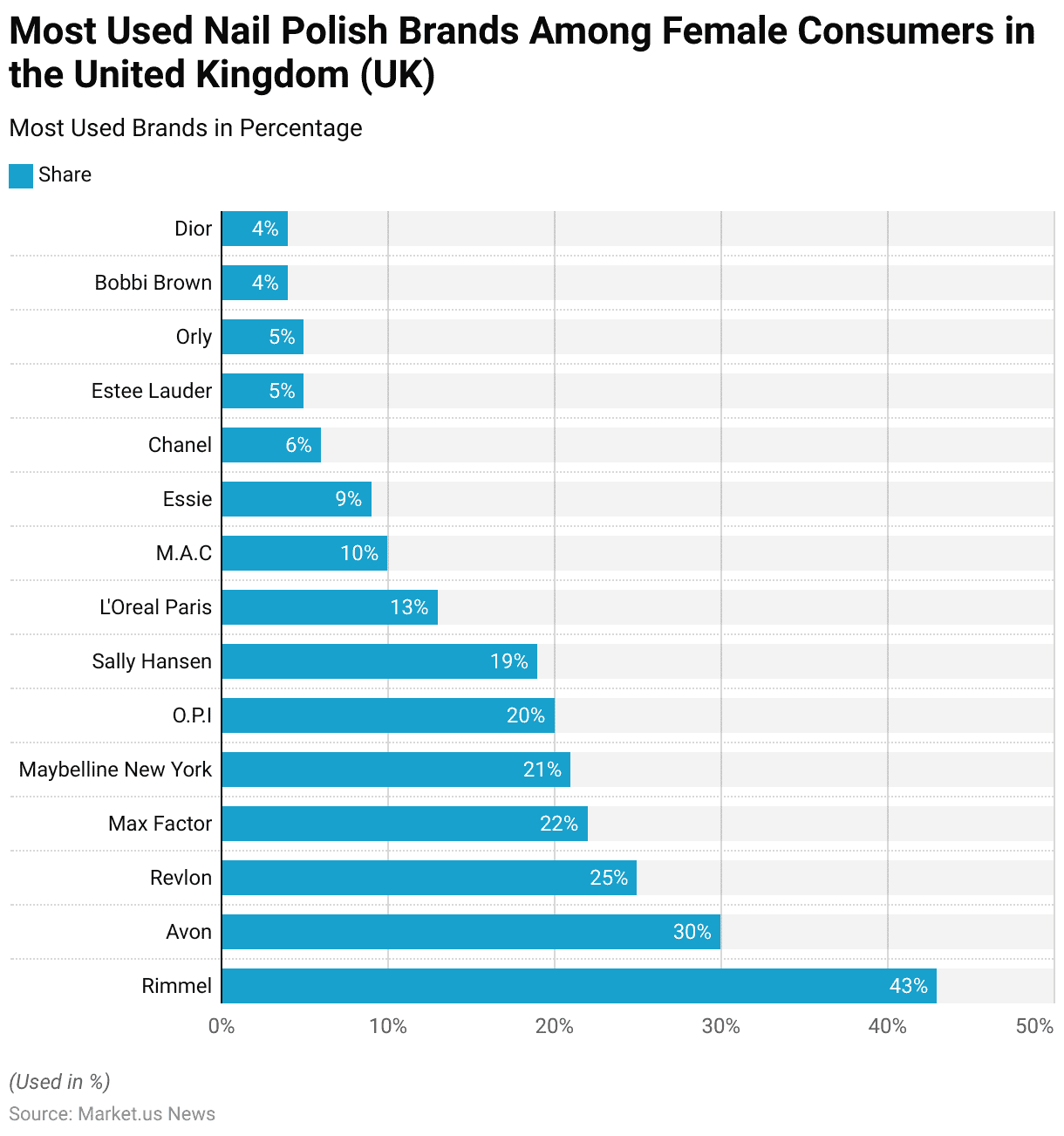

- In 2017, the most popular nail polish brands among female consumers in the United Kingdom were led by Rimmel, which captured 43% of the market share.

- Avon followed with 30%, while Revlon secured 25%.

- Max Factor and Maybelline New York held shares of 22% and 21%, respectively. O.P.I. was used by 20% of respondents, with Sally Hansen at 19%.

- L’Oréal Paris accounted for 13% of the market, while M.A.C. had a share of 10%.

- Other notable brands included Essie (9%), Chanel (6%), Estee Lauder (5%), and Orly (5%), with Bobbi Brown and Dior each holding 4%.

- This distribution highlights Rimmel’s dominant position in the UK market, with several other established brands maintaining strong consumer bases.

(Source: Statista)

Nail Polish Purchase Locations According to Women Statistics

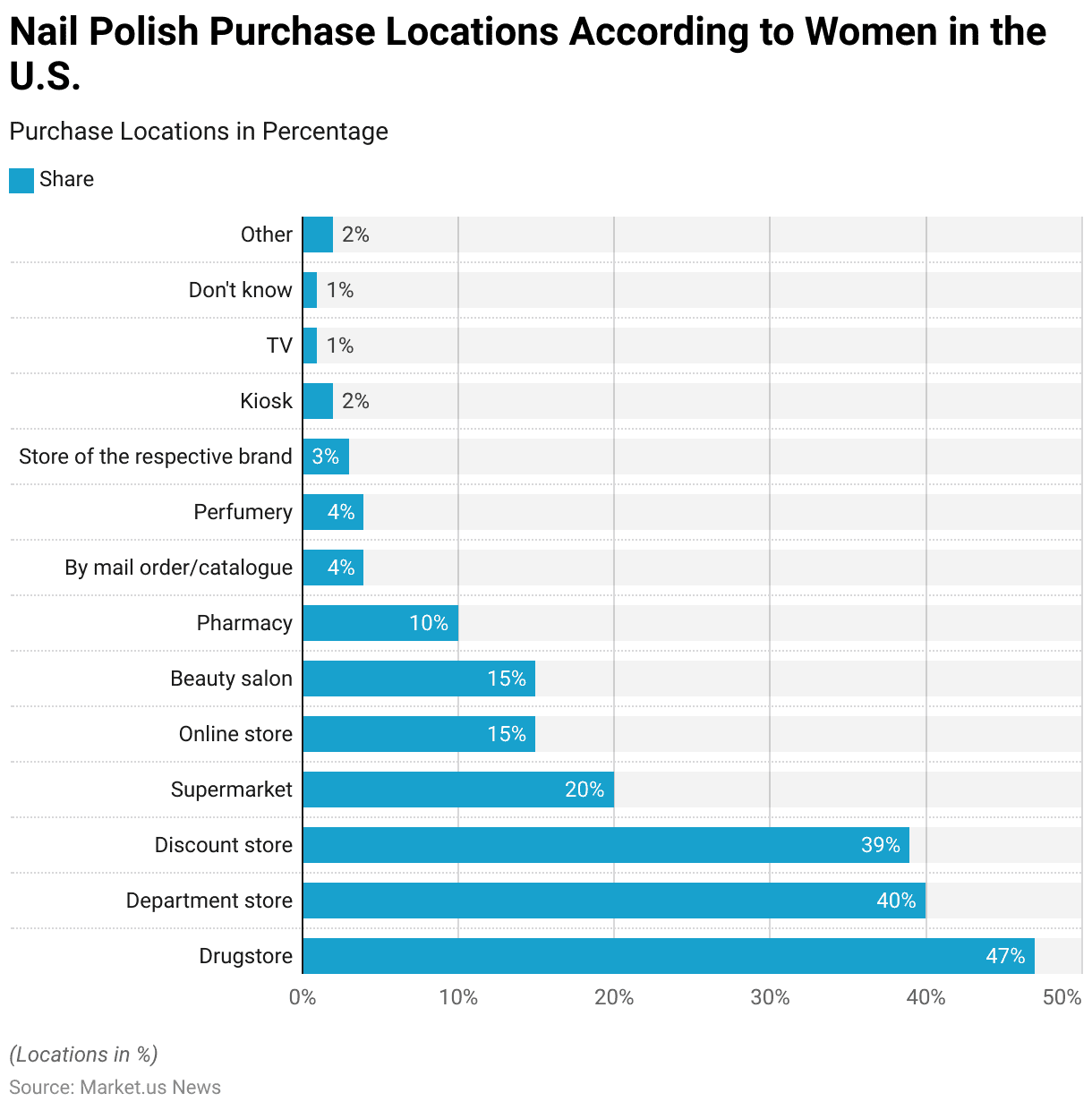

- As of May 2017, women in the United States showed a clear preference for purchasing nail polish from drugstores, with 47% of respondents indicating this as their preferred location.

- Department stores were also a popular choice, with 40% of women purchasing nail polish there, followed closely by discount stores at 39%.

- Supermarkets accounted for 20% of nail polish purchases, while online stores and beauty salons each attracted 15% of respondents.

- Pharmacies were less commonly used, with 10% of women buying nail polish there.

- Other less frequent purchase locations included mail order or catalog (4%), perfumeries (4%), and brand-specific stores (3%).

- Kiosks, TV, and those uncertain of their purchase location each represented a very small share of respondents, at 2%, 1%, and 1%, respectively.

- Additionally, 2% of respondents selected “other” as their preferred purchase channel.

- This data highlights the dominant role of traditional brick-and-mortar retail locations, such as drugstores and department stores, in the nail polish market, with online and beauty salon sales representing a smaller share.

(Source: Statista)

Age Dynamics of Nail Polish Users Statistics

Frequency of Nail Polish Use Among Women – By Age Statistics

- In 2017, the frequency of nail polish use among women in the United Kingdom varied across age groups.

- Among women aged 18-29 years, 14% reported using nail polish every day, while 12% of women aged 30-59 years and 8% of those aged 60 years and older used it daily.

- Nail polish use several times a week was more common among younger women, with 12% of those aged 18-29 and 8% of those aged 30-59 using it multiple times a week, compared to 6% of women aged 60 and older.

- Once-a-week use was more frequent among younger women (20%) compared to 14% in the 30-59 age group and 11% in the 60 and older group.

- For less frequent use, 18% of women aged 18-29 used nail polish 2-3 times a month, compared to 15% of those aged 30-59 and 13% of those aged 60 and older.

- Monthly use was reported by 12% of women aged 18-29, 10% of women aged 30-59, and 9% of women aged 60 and older.

- A higher proportion of older women used nail polish less frequently, with 24% of women aged 30-59 and 27% of women aged 60 and older reporting they used it less often.

- Additionally, 10% of women aged 18-29, 17% of those aged 30-59, and 27% of women aged 60 and older never used nail polish.

- This data reflects a clear trend of younger women using nail polish more frequently than older age groups.

(Source: Statista)

Nail Polish Brands Used Most Frequently by Women – By Age Group Statistics

- As of May 2017, the most frequently used nail polish brands in the United States varied by age group.

- Among women aged 18-29, O.P.I. was the most popular brand, used by 44%, followed by Sally Hansen at 39%, and Wet N Wild at 29%.

- Essie was used by 26% of women in this age group, while N.Y.C. New York Color and Sinful Color were favored by 23% and 22%, respectively.

- For women aged 30-59, O.P.I. remained the leading brand at 48%, with Sally Hansen closely following at 46%.

- Revlon had a notable presence at 31%, while Wet N Wild and Essie were used by 34% and 22% of respondents, respectively.

- In the 60 years and older group, O.P.I., and Sally Hansen were still the top brands, used by 38% and 44% of women, respectively.

- Revlon gained significant popularity in this age group, with 35% of respondents selecting it.

- Other brands, such as Wet N Wild (22%), Avon (16%), and L’Oréal Paris (7%), had lower shares among older women.

- Additionally, luxury brands like Chanel, Dior, and Yves Saint Laurent saw minimal use across all age groups.

- The data highlights a trend of more established brands like O.P.I., Sally Hansen, and Revlon being more commonly used, with preferences varying somewhat by age group.

(Source: Statista)

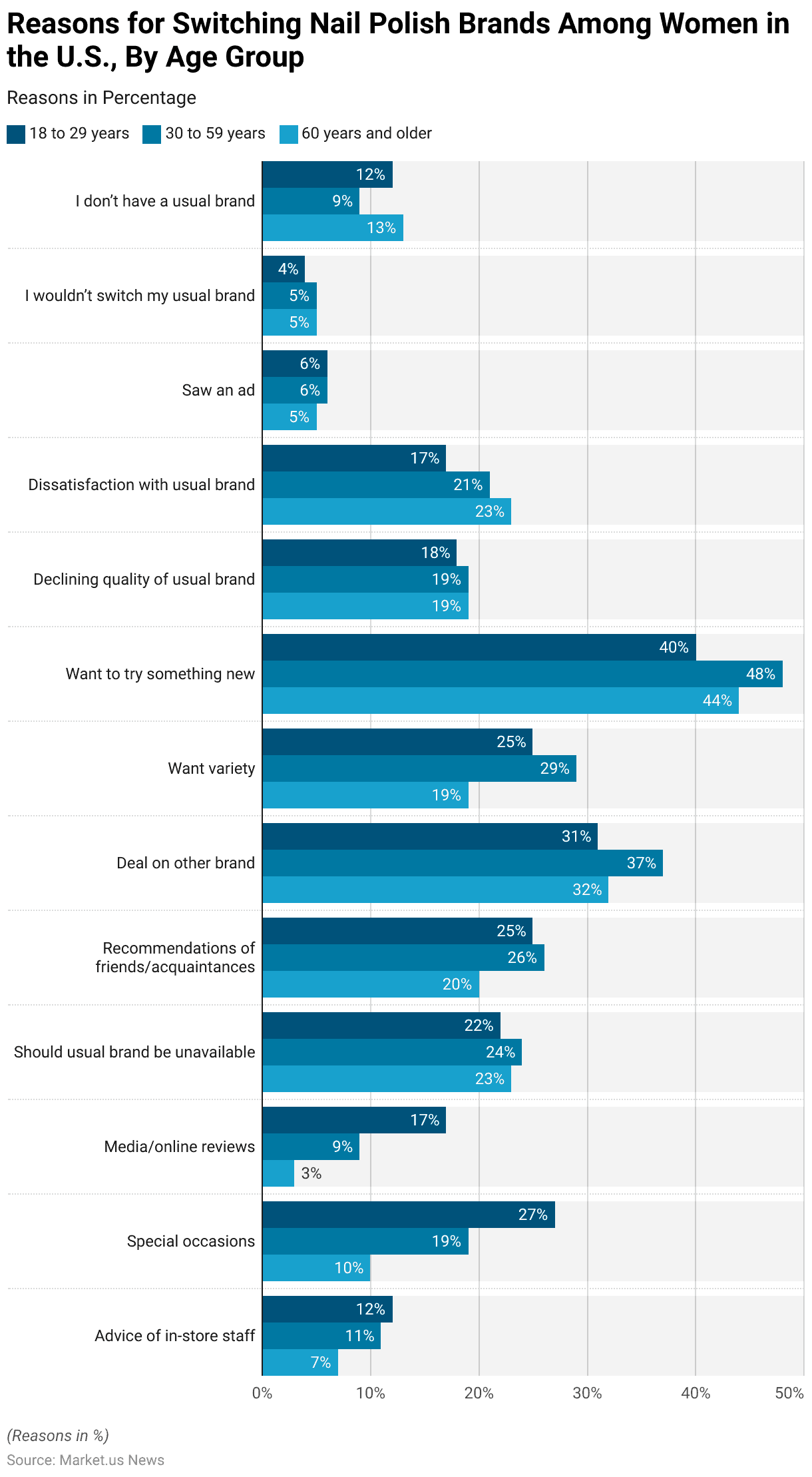

Reasons for Switching Nail Polish Brands Among Women – By Age Group Statistics

- As of May 2017, the reasons for switching nail polish brands varied by age group among women in the United States.

- Among women aged 18-29, the most common reason for switching brands was the desire to try something new, with 40% reporting this as a factor.

- A deal on another brand was also a key motivator for 31%, while 27% switched brands for special occasions.

- Recommendations from friends and acquaintances influenced 25% of women, and 22% switched when their usual brand was unavailable.

- Media and online reviews prompted 17% of women in this age group to try a new brand.

- For women aged 30-59, trying something new was again the most common reason (48%), followed by the desire for variety (29%) and deals on other brands (37%).

- A substantial 26% switched brands based on recommendations from friends, and 24% did so when their usual brand was unavailable. Special occasions influenced 19%, while media and online reviews drove 9% of this age group to change brands.

- Among women aged 60 and older, trying something new (44%) and getting advice from friends (20%) were also significant factors, along with deals (32%) and the unavailability of their usual brand (23%).

- However, dissatisfaction with the usual brand (23%) was a notable reason for this older group, as was declining quality (19%).

- Overall, across all age groups, deals on other brands, the desire to try something new, and recommendations from friends and acquaintances were the primary motivators for switching nail polish brands.

- A relatively small percentage of respondents (4-5%) indicated they would not switch their usual brand, and 12% of younger women and 13% of older women reported not having a usual brand at all.

(Source: Statista)

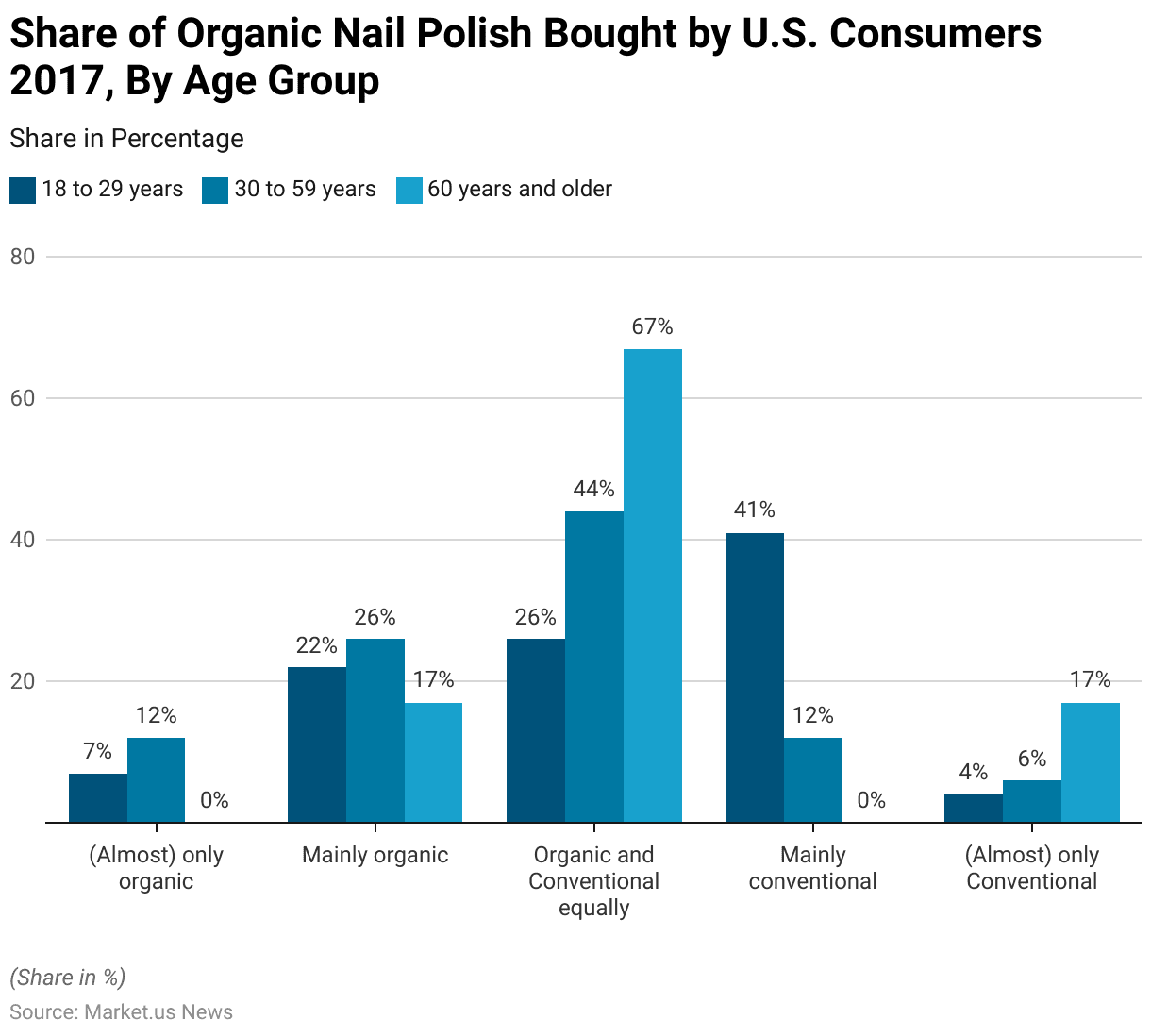

Organic Nail Polish Bought by Consumers – Age Group Statistics

- As of May 2017, the purchase of organic nail polish in the United States varied significantly by age group.

- Among consumers aged 18 to 29, 7% reported buying almost exclusively organic products, while 22% mainly purchased organic, and 26% used both organic and conventional products equally.

- A significant 41% of this age group favored mainly conventional nail polish, with only 4% opting for nearly all conventional products.

- In the 30 to 59 age group, 12% reported using almost exclusively organic nail polish, and 26% favored mainly organic products.

- However, a larger portion, 44%, used both organic and conventional products equally.

- Only 12% of consumers in this age group primarily used conventional nail polish, and 6% used almost exclusively conventional products.

- Among those aged 60 and older, there was a pronounced preference for conventional nail polish, with 67% using both types equally and 17% using almost exclusively conventional products.

- Only 17% of women in this age group purchased mainly organic nail polish, and none reported using nearly all organic products.

- This data reveals a trend of younger consumers being more inclined toward organic options, while older consumers predominantly used conventional products.

(Source: Statista)

Nail Polish Usage Statistics

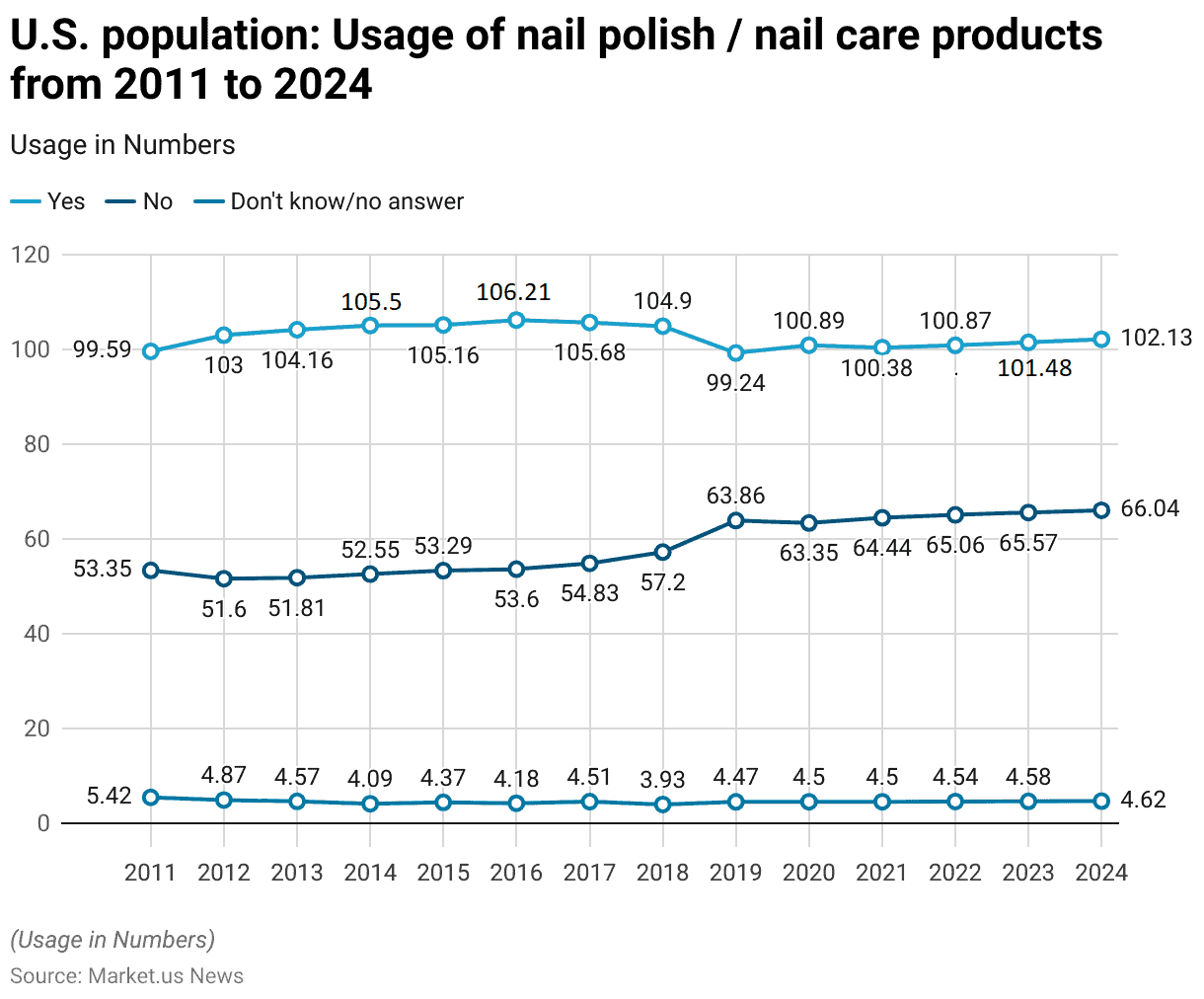

Usage of Nail Polish and Nail Care Products in the U.S. Statistics

- From 2011 to 2024, the U.S. population’s usage of nail polish and nail care products showed a gradual increase in the number of consumers who used these products, alongside a steady decline in the number of non-users.

- In 2011, 99.59 million consumers reported using nail care products, with 53.35 million not using them and 5.42 million providing no answer or not knowing.

- By 2012, the number of users rose to 103 million, while non-users decreased to 51.6 million.

- This upward trend continued in the following years, with the number of users increasing to 104.16 million in 2013 and 105.05 million in 2014.

- From 2015 to 2016, the consumer base remained stable, with users around 105 million, while the number of non-users remained above 53 million.

- In 2017, 105.68 million individuals used nail care products, but by 2019, the number of non-users had grown to 63.86 million, with only 99.24 million users.

- The trend reversed in 2020, with the number of users rising to 100.89 million and non-users slightly decreasing to 63.35 million.

- This pattern continued in the following years, with minor fluctuations in the number of users, reaching 102.13 million in 2024, while non-users increased gradually to 66.04 million.

- Over the 13 years, the proportion of users gradually grew, while the number of non-users consistently rose as well, though at a slower pace.

(Source: Statista)

Frequency of Nail Polish Use Among Women Statistics

- From 2018 to 2021, the frequency of nail polish usage among women in Germany varied across different categories.

- In 2018, 0.45 million women used nail polish several times a day, but this number significantly increased in 2019 to 2.42 million before decreasing again to 1.82 million in 2021.

- Daily usage was reported by 1.79 million women in 2018, rising to 3.59 million in 2019, but slightly decreased in the following years, reaching 3.01 million by 2021.

- Several times a week, nail polish was used by 5 million women in 2018, which decreased to 3.88 million in 2019 but later increased again to 4.22 million in 2021.

- About 3 to 4 times a month, 6.75 million women used nail polish in 2018, with a slight decline in 2021, reaching 5.7 million.

- The number of women who used nail polish less than once a month also dropped from 6.43 million in 2018 to 3.58 million in 2021.

- Usage on special occasions remained high, with 6.82 million women using nail polish only for special occasions in 2018, increasing to 7.75 million in 2020 and remaining stable at 7.71 million in 2021.

- The number of women who reported never using nail polish increased steadily, from 7.94 million in 2018 to 9.59 million in 2021.

- The percentage of women who provided no answer decreased from 0.57 million in 2018 to 0.13 million in 2021.

- This data illustrates a general decline in frequent usage and a steady rise in the number of women who seldom or never use nail polish in Germany.

(Source: Statista)

Usage Frequency of Nail Polish and Nail Care Products Statistics

- In 2020, the frequency of nail polish and nail care product usage among U.S. consumers varied widely.

- A total of 5.13 million consumers reported using these products 10 times or more in the last 30 days, while 4.15 million used them 7-9 times.

- A larger group of 10.58 million consumers used nail polish or nail care products 5-6 times in the same period.

- The most common usage frequency was once, with 38.37 million consumers applying nail products just one time.

- Additionally, 21.84 million consumers used nail polish or nail care products between 2-4 times, and 18 million consumers reported not using these products at all in the last 30 days.

- This data highlights that while some consumers are highly engaged with nail care, a significant portion uses products infrequently or not at all.

(Source: Statista)

Nail Varnish/Gel and Nail Care Usage Frequency

- In 2023, the number of female users of “Nail Varnish/Gel and Nail Care” products in Great Britain (GB) was categorized by usage frequency.

- The largest group, comprising light users, numbered approximately 8,013.72 thousand.

- Medium users, who use these products more regularly, totaled around 2,921.88 thousand, while heavy users, who are the most frequent consumers, accounted for 2,143.49 thousand.

- This distribution illustrates a significant base of light users, with a smaller but still substantial segment engaging with nail products at medium to heavy frequencies.

(Source: Statista)

Nail Varnish & Nail Care Usage – By Type

- From 2015 to 2020, the number of people using various nail varnish and nail care products in Great Britain fluctuated across product types.

- Nail varnish usage declined from 14,264 thousand in 2015 to 10,601 thousand in 2020, reflecting a steady decrease over the years.

- Nail top coat users followed a similar trend, decreasing from 7,218 thousand in 2015 to 6,819 thousand in 2020.

- The number of people using nail-based products declined more sharply, from 4,773 thousand in 2015 to 3,682 thousand in 2020.

- Nail care products also saw a reduction, with usage dropping from 4,089 thousand in 2015 to 2,822 thousand in 2020.

- Nail gel usage, however, showed an upward trajectory, increasing from 3,247 thousand in 2017 to 3,826 thousand in 2020.

- Similarly, the use of semi-permanent varnish grew slightly from 915 thousand in 2017 to 958 thousand in 2020, though it remained a smaller segment compared to other types.

- Overall, while traditional nail varnish and care products experienced a decline, nail gels and semi-permanent varnishes demonstrated moderate growth during this period.

(Source: Statista)

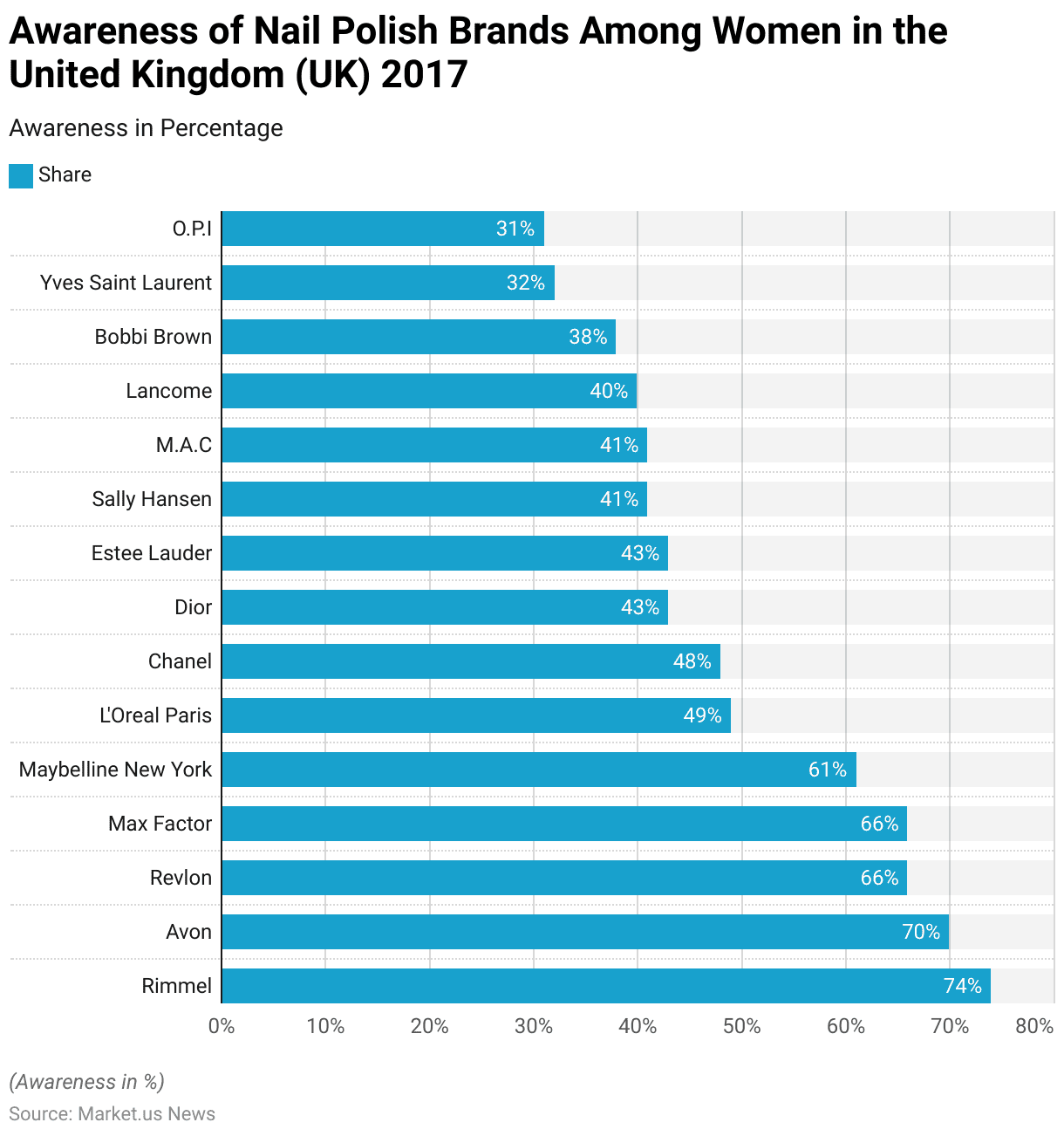

Awareness of Nail Polish Brands Among Women Statistics

- In 2017, brand awareness of nail polish products among women in the United Kingdom was highest for Rimmel, with 74% of respondents recognizing the brand.

- Avon followed closely at 70%, and Revlon and Max Factor both had awareness levels of 66%.

- Maybelline New York was known by 61% of women, while L’Oréal Paris had 49% awareness.

- Premium brands like Chanel and Dior were recognized by 48% and 43% of respondents, respectively.

- Estee Lauder also had a 43% recognition rate, with Sally Hansen and M.A.C. each known by 41% of women.

- Other high-end brands, such as Lancôme and Bobbi Brown, were recognized by 40% and 38% of respondents.

- Yves Saint Laurent had a recognition rate of 32%, while O.P.I. was known by 31% of women.

- This data highlights the strong brand recognition for both mass-market and luxury nail polish brands, with Rimmel and Avon leading the pack in consumer awareness.

(Source: Statista)

Nail Polish Sales Value Statistics

Japan

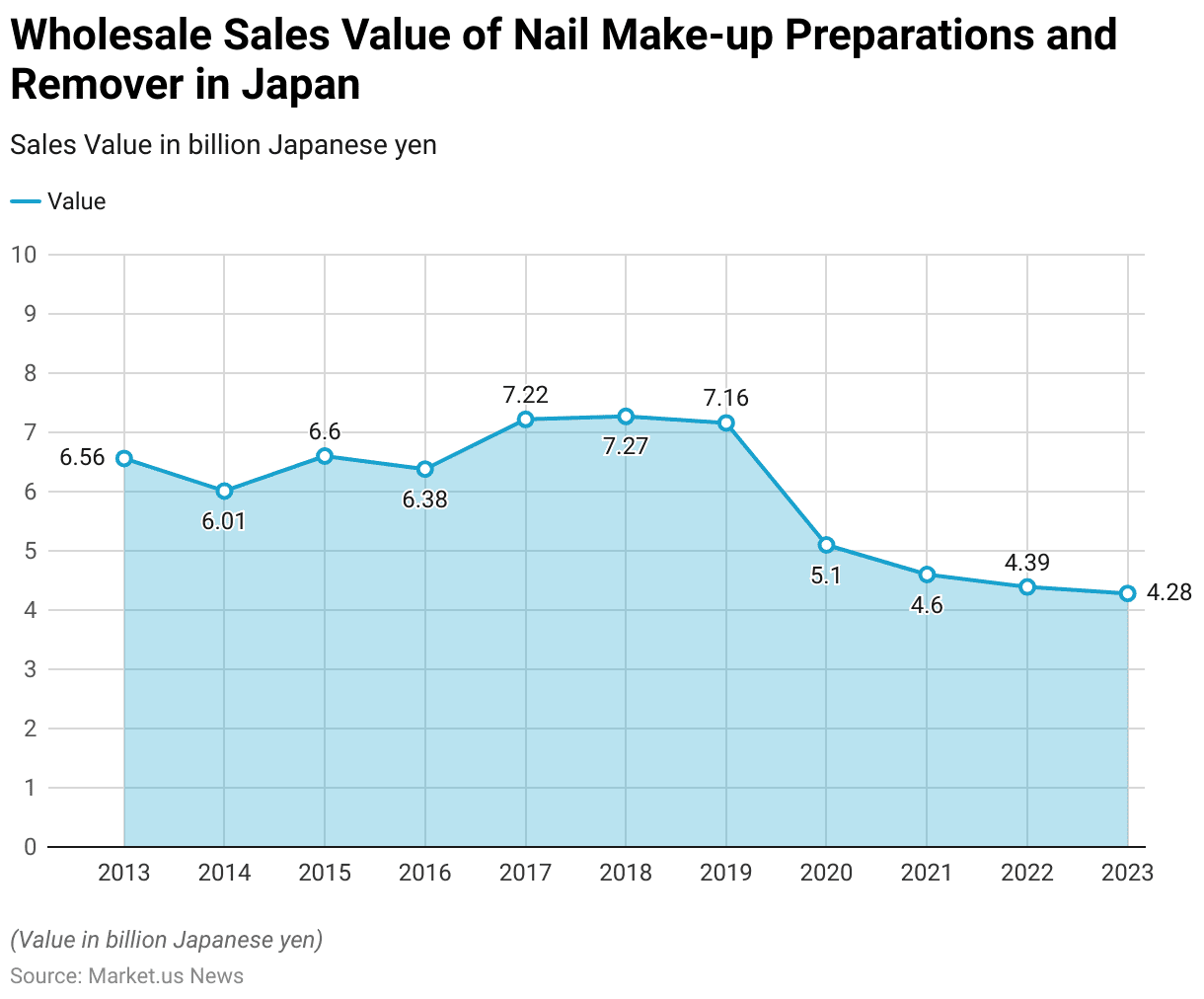

- From 2013 to 2023, the wholesale sales value of nail makeup preparations and removers in Japan showed fluctuations.

- In 2013, the sales value was 6.56 billion Japanese yen, which slightly decreased to 6.01 billion yen in 2014.

- The market saw a modest recovery in 2015, reaching 6.6 billion yen, followed by a slight dip to 6.38 billion yen in 2016.

- A more significant increase occurred in 2017, with sales rising to 7.22 billion yen, and continued to grow in 2018, reaching 7.27 billion yen.

- However, from 2019 onwards, the market began to contract, with sales falling to 7.16 billion yen in 2019, then dropping significantly in 2020 to 5.1 billion yen, likely influenced by the COVID-19 pandemic.

- Sales continued to decline over the next few years, reaching 4.6 billion yen in 2021 and further decreasing to 4.39 billion yen in 2022.

- By 2023, the sales value had declined to 4.28 billion yen, reflecting a downward trend in the market for nail makeup preparations and removers in Japan over the past decade.

(Source: Statista)

United States

- In 2019, the nail cosmetics market in the United States saw significant sales across various product segments.

- Nail polish led the market with 136.49 million units sold, followed by nail accessories and implements, which totaled 94.74 million units.

- Artificial nails and accessories accounted for 57.79 million units, while nail polish removers had sales of 49.14 million units.

- Nail treatment products saw 26.06 million units sold, and nail polish accessories represented a smaller portion of the market, with only 0.21 million units sold.

- This data underscores the dominant role of nail polish in the U.S. market, with other product categories such as accessories, artificial nails, and removers also contributing significantly to overall sales.

(Source: Statista)

Women’s Nail Polish Expenditure Statistics

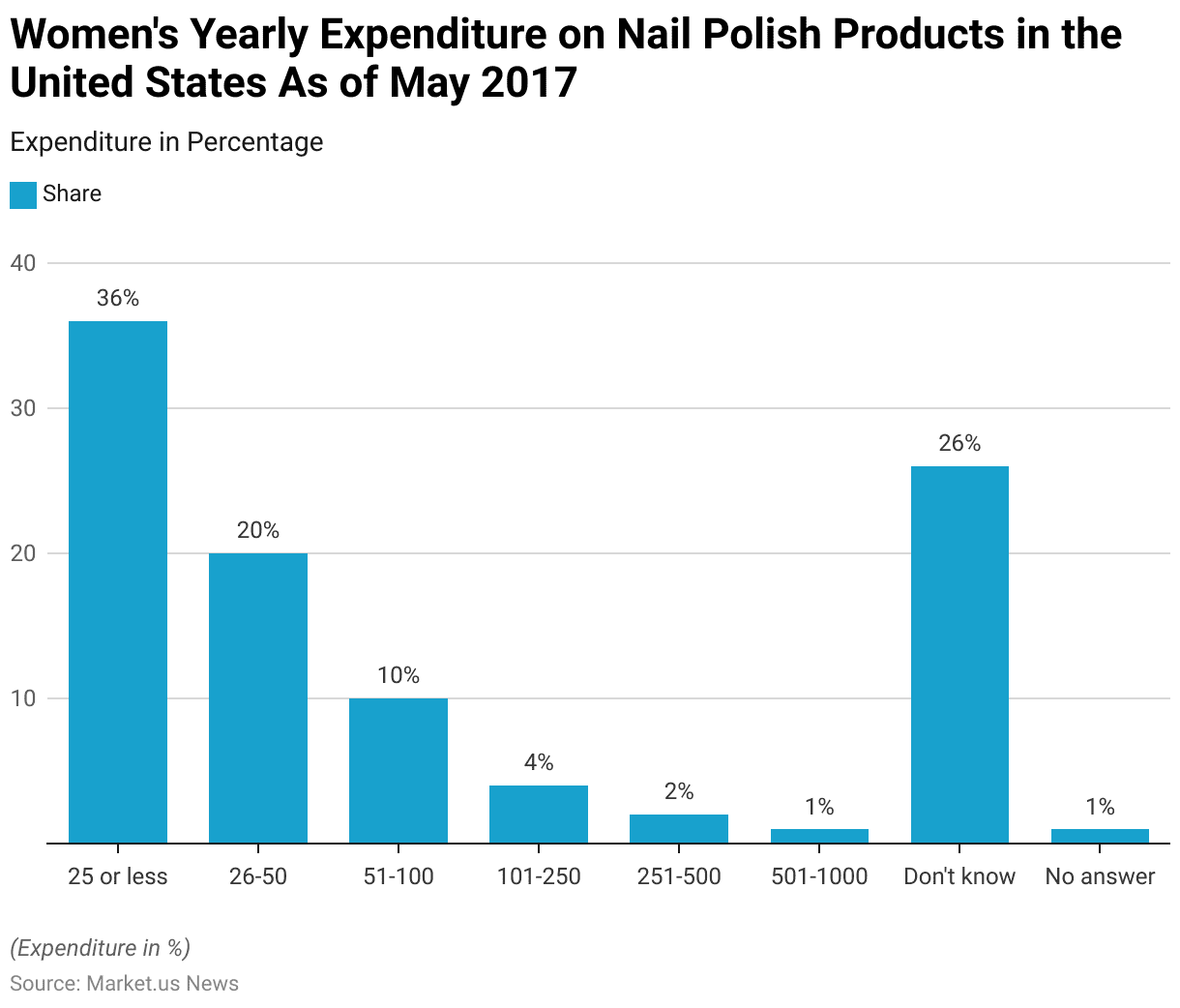

- As of May 2017, women in the United States reported varying levels of yearly expenditure on nail polish products.

- A significant 36% of respondents spent $25 or less annually on nail polish, while 20% spent between $26 and $50.

- A smaller portion, 10%, reported annual expenditures of $51 to $100, and just 4% spent between $101 and $250.

- Only 2% of women spent $251 to $500, and 1% spent between $501 and $1,000.

- Additionally, 26% of respondents indicated they did not know how much they spent, and 1% chose not to provide an answer.

- This data reflects a general trend of modest spending on nail polish products, with a significant portion of consumers uncertain about their exact expenditure.

(Source: Statista)

Spending on Nail Salon Services

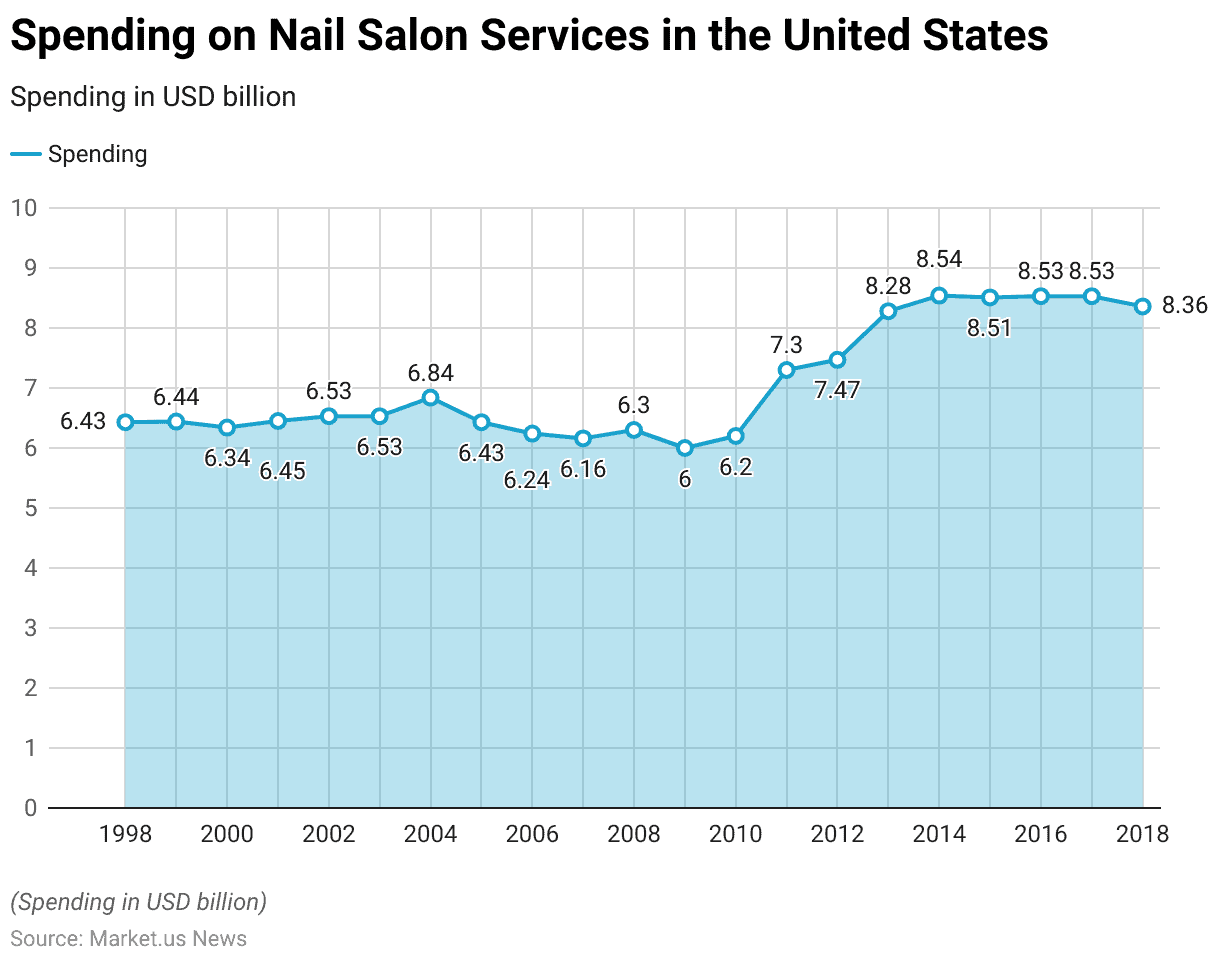

- From 1998 to 2018, spending on nail salon services in the United States showed some fluctuations, with a general upward trend over the two decades.

- In 1998, spending was $6.43 billion, and it remained relatively stable in the following years, with slight increases and decreases, such as reaching $6.44 billion in 1999 and dipping to $6.34 billion in 2000.

- By 2002, spending increased to $6.53 billion, holding steady through 2003.

- The figure rose again in 2004 to $6.84 billion before declining to $6.43 billion in 2005.

- From 2006 to 2009, spending remained between $6.16 billion and $6.30 billion, with a slight dip in 2009 to $6.00 billion.

- Starting in 2010, spending began to rise more consistently, reaching $7.30 billion in 2011 and $7.47 billion in 2012.

- The upward trend continued through the next few years, peaking at $8.28 billion in 2013 and remaining relatively stable between $8.51 billion and $8.53 billion from 2015 to 2017.

- In 2018, spending slightly decreased to $8.36 billion.

- This data illustrates the overall growth in consumer spending on nail salon services over the 20 years, reflecting the increasing popularity and demand for professional nail care.

(Source: Statista)

Gender Dynamics of Nail Session Expenses

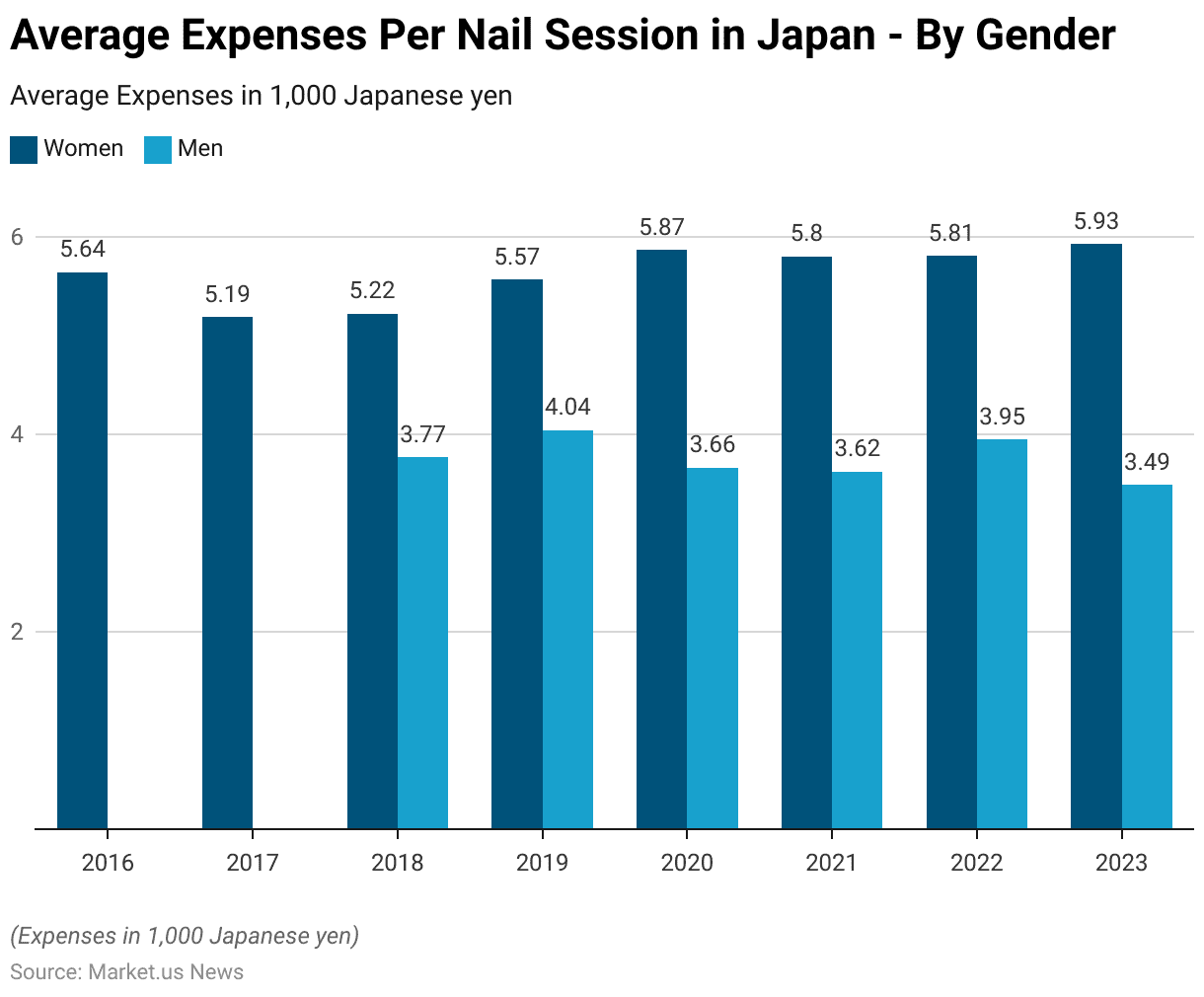

- From 2016 to 2023, the average expenses per nail session in Japan varied by gender.

- For women, the average expenditure started at ¥5.64 thousand in 2016 and gradually decreased to ¥5.19 thousand in 2017 before rising again in 2018 to ¥5.22 thousand.

- In 2019, expenses increased to ¥5.57 thousand, and this upward trend continued, reaching ¥5.87 thousand in 2020.

- The average expense for women remained relatively stable in the following years, with slight fluctuations: ¥5.80 thousand in 2021, ¥5.81 thousand in 2022, and finally ¥5.93 thousand in 2023.

- For men, the average spending was notably lower, with ¥3.77 thousand in 2018 and a gradual increase to ¥4.04 thousand in 2019.

- However, expenses for men fluctuated between ¥3.49 thousand and ¥3.95 thousand from 2020 to 2023, with ¥3.66 thousand in 2020, ¥3.62 thousand in 2021, ¥3.95 thousand in 2022, and ¥3.49 thousand in 2023.

- This data highlights a consistently higher expenditure for women compared to men, with both groups showing relatively stable or minor fluctuations in spending over the years.

(Source: Statista)

Opinions of Male Consumers

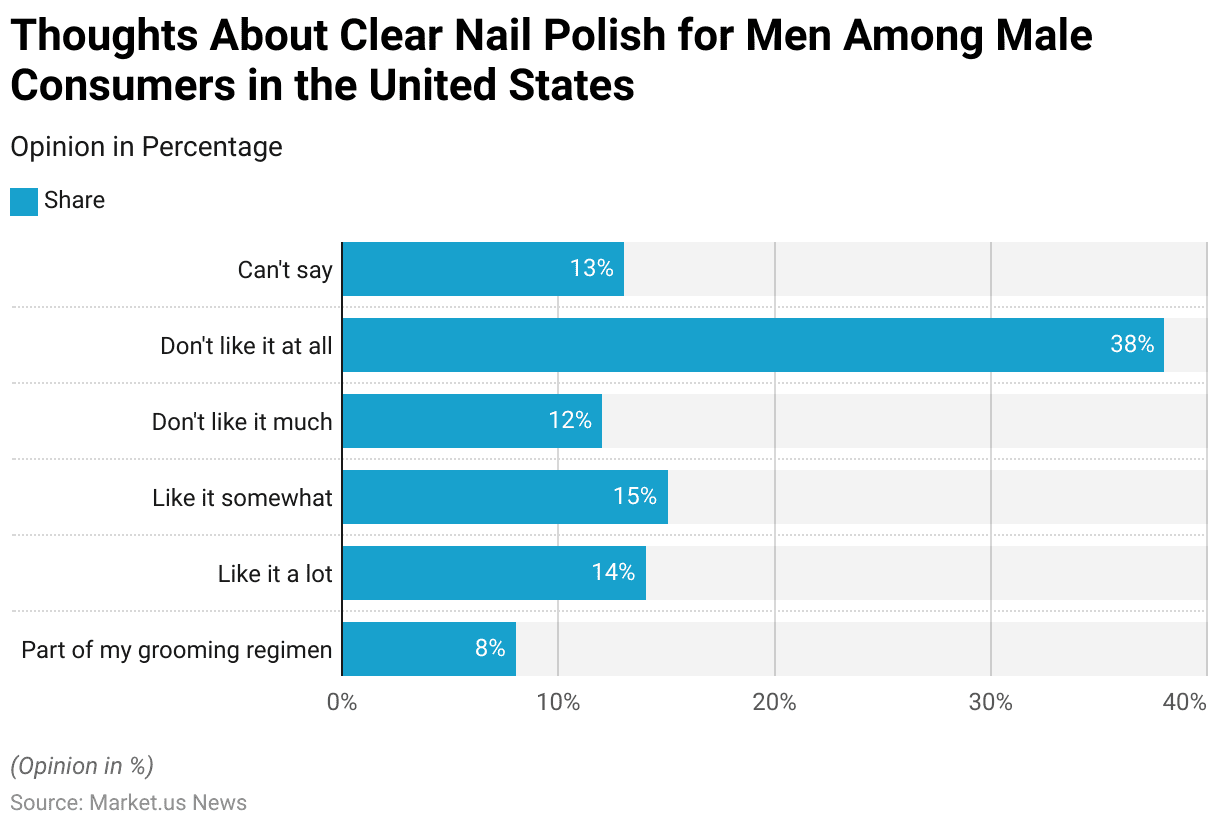

Thoughts About Clear Nail Polish for Men Among Male Consumers

- As of June 2017, male consumers in the United States had varied opinions about clear nail polish.

- A small portion, 8%, considered it a part of their grooming regimen, while 14% liked it a lot.

- Additionally, 15% liked it somewhat, indicating some level of interest in the product.

- However, a larger share, 12%, did not like it much, and 38% expressed a strong dislike, stating they did not like it at all.

- Lastly, 13% of respondents were unsure or could not provide an opinion.

- This distribution reveals a more significant inclination toward disinterest or aversion to clear nail polish among U.S. men.

(Source: Statista)

Thoughts About Clear Nail Polish for Men Among Male Consumers – By Age Group

- As of June 2017, male consumers in the United States expressed varying opinions about clear nail polish, with notable differences across age groups.

- Among men aged 18 to 29, 8% considered it part of their grooming regimen, and 26% liked it a lot.

- Additionally, 19% liked it somewhat, while 12% did not like it much, and 24% disliked it entirely.

- Only 12% of this age group were unsure. In the 30 to 59 age group, 9% viewed clear nail polish as part of their grooming regimen, with 14% liking it a lot.

- A slightly larger share, 17%, liked it somewhat, but 11% did not like it much, and 37% did not like it at all.

- The remaining 11% of men in this group were unsure. Among those aged 60 and older, only 2% considered clear nail polish part of their grooming routine, with just 3% liking it a lot.

- However, 8% liked it somewhat, 15% did not like it much, and a significant 53% disliked it altogether.

- The remaining 19% in this age group were uncertain. Overall, younger men showed more positive attitudes toward clear nail polish, while older men were more likely to express disinterest or dislike.

(Source: Statista)

Trends in Nail Art

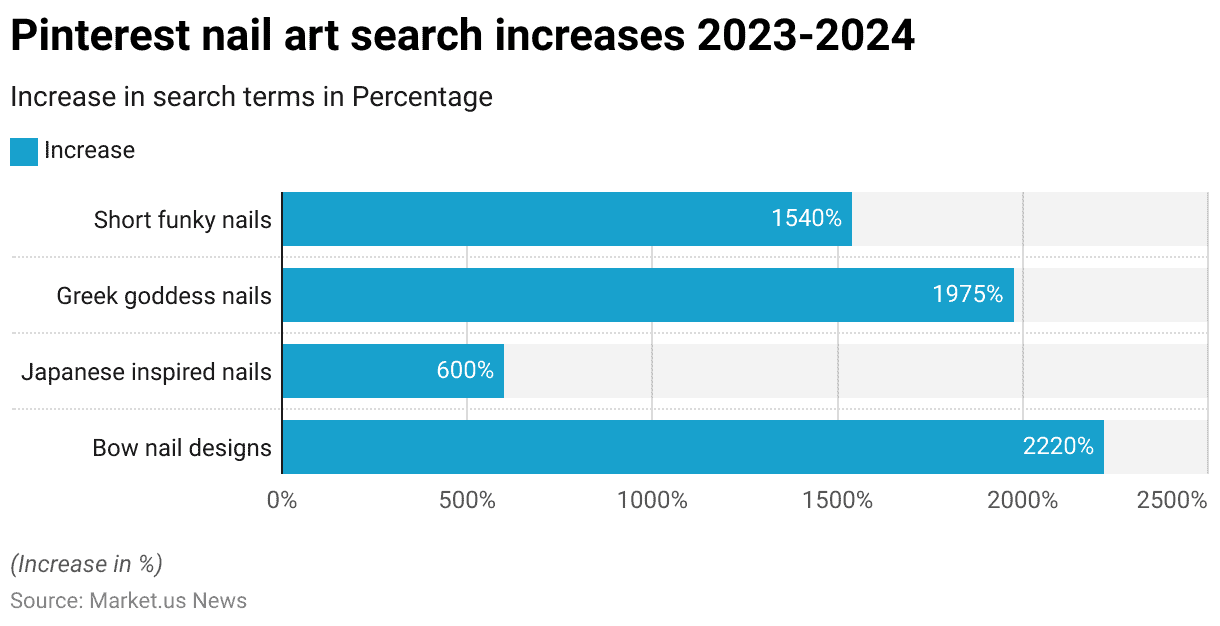

- Between June 2023 and June 2024, there was a significant increase in searches for various nail art trends on Pinterest.

- Bow nail designs saw an extraordinary rise, with search terms increasing by 2,220%.

- Japanese-inspired nails also gained considerable attention, experiencing a 600% surge in searches.

- Greek goddess nails followed closely, with searches rising by 1,975%, while short funky nails saw a 1,540% increase in search interest.

- These dramatic increases highlight a growing interest in unique and creative nail art styles, with consumers seeking bold and distinctive designs.

(Source: Statista)

Formulation of Nail Lacquers

- The formulation for a pearlescent nail lacquer consists of several ingredients in specific percentages to achieve the desired performance and appearance.

- The base of the formula is primarily composed of 14.90% nitrocellulose, which provides film-forming properties, and 34.04% butyl acetate, a solvent that helps the lacquer spread smoothly.

- Toluene, at 30.00%, acts as a solvent and helps in achieving the desired consistency.

- The resin, toluene sulphonamide formaldehyde resin, makes up 7.10% and contributes to the lacquer’s durability and adhesion.

- Dibutyl phthalate, at 4.80%, functions as a plasticizer to improve flexibility, while camphor (2.40%) aids in the lacquer’s drying process.

- Stearyl konium hectorite, at 1.20%, serves as a thickening agent, ensuring proper viscosity.

- To protect the polish from UV damage and improve stability, 0.20% benzophenone-1 is included.

- Pearlescent effects are achieved with color additives, including 0.08% D&C Red No. 7 Calcium Lake, 0.05% D&C Red No. 34 Calcium Lake, and 0.08% FD&C Yellow No. 5 Aluminum Lake.

- Bismuth oxychloride, at 5.00%, provides the signature pearlescent shimmer, while iron oxides (0.15%) contribute to the color and opacity of the lacquer.

- These ingredients collectively give the nail lacquer its characteristic finish, texture, and durability.

(Source: SRM University)

Nail Polish Formulation Performance Metrics

- Several key properties characterize the performance metrics for nail polish formulation.

- The formulation is required to form a film at room temperature, ensuring smooth application and durability.

- It should exhibit a gloss level greater than 60 GUs, reflecting a shiny, polished finish.

- Adhesion is also critical, with a minimum rating of over 4, to ensure the polish stays in place on the nail surface.

- The Persoz hardness, depending on the coat, should fall within the range of 50 to 70, indicating the level of scratch resistance.

- Viscosity is measured between 400 and 750 cP, with the exact value depending on the shade, using a Brookfield viscometer with spindle SC34.

- The pH of the polish should be maintained between 4 and 8 for stability and skin compatibility.

- Film tackiness should be slight to none, ensuring the polish is smooth and not sticky after application.

- Finally, the lastingness of the nail polish should exceed 3 days, indicating good wear resistance and durability over time.

(Source: Department of Chemistry, University of California, Berkeley)

Regulations for Nail Polishes

- Regulations for nail polishes are governed by stringent laws and policies designed to ensure consumer safety and product quality across different countries.

- In the U.S., the Food and Drug Administration (FDA) oversees the safety of cosmetics, including nail polishes, under the Federal Food, Drug, and Cosmetic Act. However, it does not approve products before they are sold. The FDA monitors ingredient safety and can take action if a product is found to be hazardous.

- In Europe, the regulation of cosmetics, including nail polishes, falls under the EU Cosmetics Regulation (EC No 1223/2009), which mandates that products must be safe for use, with specific restrictions on harmful chemicals such as formaldehyde and toluene.

- The European Chemicals Agency (ECHA) also monitors hazardous substances, ensuring compliance with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals).

- In Canada, Health Canada’s Cosmetic Regulations govern the sale and distribution of nail polishes, with a list of restricted ingredients and guidelines for product safety.

- In Japan, the Pharmaceutical and Medical Device Agency (PMDA) oversees cosmetic product regulation, with strict requirements for ingredients and labeling.

- Globally, there is a trend toward banning or limiting the use of harmful chemicals, particularly the “toxic trio“—formaldehyde, dibutyl phthalate (DBP), and toluene.

- As consumer demand for safer and environmentally friendly products rises, regulatory bodies continue to refine policies to address these concerns, fostering industry growth while prioritizing public health and safety.

(Sources: U.S. Food and Drug Administration, European Union, ECHA, Health Canada, Pharmaceutical and Medical Device Agency (PMDA))

Conclusion

Nail Polish Statistics – The nail polish market has experienced steady growth, driven by rising consumer demand for high-quality, durable products and increasing interest in organic and eco-friendly options.

Consumers are also exploring more personalized nail care experiences, with a growing preference for premium and innovative products.

E-commerce and specialty retail channels have expanded access to a wide range of nail lacquers, gel products, and treatments.

As trends in self-care and grooming continue to evolve, the industry is expected to maintain its upward trajectory, fueled by both innovation and changing consumer behaviors across global markets.

FAQs

Most modern nail polishes are considered safe for use. However, certain ingredients such as formaldehyde, toluene, and dibutyl phthalate (DBP) have been linked to health concerns, leading many manufacturers to produce “3-free,” “5-free,” or “7-free” formulations that exclude these chemicals. These are regarded as safer alternatives, particularly for individuals with sensitivities or concerns about toxicity.

Yes, nail polish is safe to use on toenails. The application process is largely the same as for fingernails. However, toenails tend to grow more slowly, so polish may last longer on toenails compared to fingernails. It is important to ensure proper hygiene and clean nail tools to avoid fungal infections, which are more common in toenails due to closed footwear.

“3-free,” “5-free,” or “7-free” nail polishes are formulations that exclude specific harmful chemicals. The term “3-free” means the polish is free from toluene, formaldehyde, and dibutyl phthalate (DBP). “5-free” and “7-free” versions exclude additional chemicals such as camphor and xylene. These formulations are generally considered safer for use, especially for individuals with allergies or sensitivities.

Yes, there is an increasing range of eco-friendly, cruelty-free, and vegan nail polish brands. These formulations are typically made without animal-derived ingredients (such as carmine or shellac) and are often free from toxic chemicals. Many eco-friendly polishes also use sustainable packaging and are produced by companies that prioritize ethical sourcing and environmental impact.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)