Table of Contents

Introduction

The Global Sports headphones Market is projected to reach a value of approximately USD 20.9 billion by 2034, up from USD 5.6 billion in 2024. This growth represents a compound annual growth rate (CAGR) of 14.1% during the forecast period from 2025 to 2034.

Sports headphones refer to a specialized category of audio devices designed to be worn during physical activities, such as running, cycling, or gym workouts. These headphones are engineered to be durable, sweat-resistant, and often equipped with features such as wireless connectivity, noise isolation, and secure fits to stay in place during intense movements. The sports headphones market refers to the global industry that encompasses the production, distribution, and sale of these devices, catering to fitness enthusiasts, athletes, and casual users alike.

This market is driven by increasing consumer demand for fitness-focused audio solutions, as sports headphones offer a practical and comfortable way to listen to music, podcasts, or take calls while exercising. Growth in this market is fueled by the rising health consciousness among consumers, the expanding popularity of fitness-related activities, and the growing penetration of wireless technology in everyday consumer products. Additionally, advancements in technology, such as longer battery life, improved sound quality, and enhanced sweatproof features, contribute significantly to the market’s expansion.

The increasing integration of fitness tracking features and health-related functionalities, such as heart rate monitoring, further drives the demand for sports headphones. As more individuals prioritize health and wellness, there is a growing opportunity for market players to innovate with new, more versatile products that cater to a wide range of athletic activities. Additionally, the rising trend of athleisure and fitness lifestyle brands collaborating with audio device manufacturers presents substantial opportunities for growth within the sports headphones market.

Key Takeaways

- The global sports headphones market is expected to reach USD 20.9 billion by 2034, with a robust growth rate of 14.1% CAGR from 2025 to 2034.

- In-ear headphones are the leading segment in 2024, attributed to their compact design, portability, and comfort for active users.

- Smart headphones dominate the market in 2024, driven by advanced functionalities such as fitness tracking, heart rate monitoring, and mobile app integration.

- True wireless headphones are the preferred choice in 2024, offering convenience, portability, and features like noise cancellation and sweat resistance.

- Online retail holds a dominant position in the market in 2024, benefiting from the convenience, competitive pricing, and extensive selection available to consumers.

- North America leads the global sports headphones market with a 35.2% share, valued at USD 1.9 billion in 2024, fueled by increasing fitness demand and technological advancements.

Request A Sample Copy Of This Report at https://market.us/report/sports-headphones-market/request-sample/

Impact of US Tariffs on Sports Headphones Market

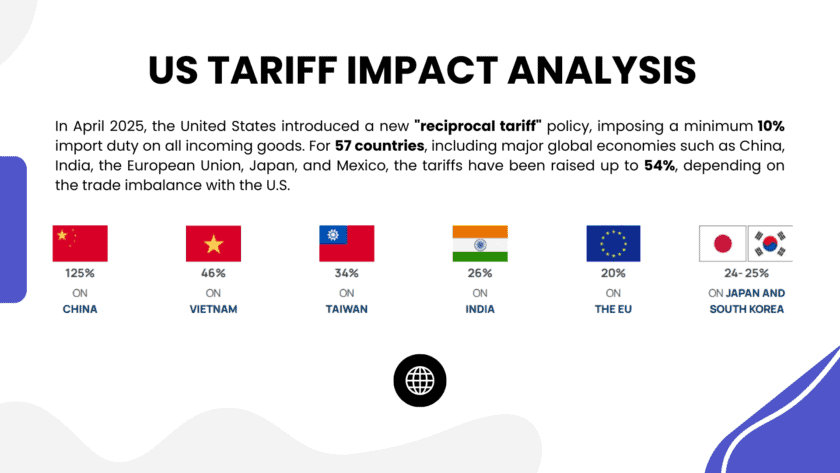

The recent implementation of U.S. tariffs has significantly impacted the sports headphones market, particularly affecting pricing, supply chains, and consumer purchasing behavior.

Tariff Structure and Affected Products

Headphones and earphones, including sports models, fall under Harmonized Tariff Schedule (HTS) code 8518.30. This category encompasses devices such as the Bose Sport Earbuds, Jabra Elite Active 75t, and Sony WF-SP800N. The U.S. has imposed a 10% baseline tariff on all imports, with additional duties of up to 145% on goods from specific countries, notably China .

Impact on Pricing and Consumer Behavior

The increased tariffs have led to higher import costs, which are often passed on to consumers, resulting in price hikes for sports headphones. For instance, higher-end models like the iPhone Pro Max and MacBook Pro have experienced price increases ranging from $50 to $150 . Similarly, sports headphones have become more expensive, prompting consumers to expedite purchases to avoid further price increases .

Supply Chain Disruptions

The tariffs have disrupted global supply chains, leading to reduced imports and potential shortages. U.S. imports from China have declined by 36%, and businesses are reporting depleted inventories and halted new orders .

Strategic Responses by Brands

In response to these challenges, some brands are reevaluating their U.S. distribution strategies. Companies are considering investments in U.S.-based third-party logistics centers or bonded warehouses to mitigate tariff costs and maintain customer satisfaction .

Market Outlook

The sports headphones market faces continued uncertainty due to the evolving tariff landscape. While some companies are adapting their strategies, the long-term effects on pricing and supply chains remain to be fully seen.

Emerging Trends

- Integration of Smart Features: Sports headphones are increasingly incorporating smart functionalities such as voice assistants and connectivity with fitness applications, enhancing user experience during workouts.

- Advancements in Audio Technology: Technological innovations like 3D surround sound and active head tracking are being integrated into sports headphones, providing users with immersive audio experiences.

- Rise of Bone Conduction Technology: Bone conduction headphones are gaining popularity among athletes, allowing them to remain aware of their surroundings while enjoying music during physical activities.

- Sustainability Initiatives: Manufacturers are focusing on eco-friendly materials and sustainable production processes to appeal to environmentally conscious consumers.

- Enhanced Durability and Sweat Resistance: The demand for sports headphones with increased durability and sweat resistance is growing, catering to the needs of fitness enthusiasts engaged in intense workouts.

Top Use Cases

- Running and Jogging: Sports headphones provide runners with high-quality audio and secure fit, enhancing their workout experience.

- Cycling: Cyclists use sports headphones to enjoy music or podcasts while maintaining awareness of their surroundings for safety.

- Gym Workouts: Fitness enthusiasts utilize sports headphones to stay motivated with music during strength training and cardio sessions.

- Outdoor Activities: Individuals engaged in hiking or trekking use sports headphones to enjoy audio content while exploring nature.

- Virtual Fitness Classes: With the rise of online fitness programs, sports headphones are used to deliver clear audio for virtual workouts.

Major Challenges

- High Cost of Premium Models: Advanced sports headphones with features like noise cancellation and bone conduction technology are often priced higher, limiting accessibility for some consumers.

- Battery Life Limitations: Some sports headphones have shorter battery life, which can be a drawback during extended workouts or outdoor activities.

- Device Compatibility Issues: Incompatibility with certain devices and operating systems can hinder the widespread adoption of sports headphones.

- Market Saturation: The increasing number of brands and products in the market can make it challenging for consumers to choose the right sports headphones.

- Counterfeit Products: The prevalence of counterfeit sports headphones can affect consumer trust and brand reputation.

Top Opportunities

- Expansion into Emerging Markets: The growing interest in fitness and sports activities in emerging markets presents opportunities for sports headphone manufacturers to expand their presence.

- Integration with Virtual Workouts: As virtual fitness classes gain popularity, there is an increasing demand for high-quality audio solutions, creating opportunities for sports headphone manufacturers.

- Adoption of AI and Voice Assistance: Incorporating AI technology and voice assistants into sports headphones opens up opportunities for smarter, hands-free interactions, enhancing the user experience during workouts.

- Development of Eco-Friendly Products: The shift towards sustainability provides opportunities for manufacturers to develop eco-friendly sports headphones, appealing to environmentally conscious consumers.

- Customization and Personalization: Offering customizable features and personalized fit options can attract consumers seeking tailored audio solutions for their fitness needs.

Key Player Analysis

In 2024, the global sports headphones market is characterized by the presence of several key players, each contributing to the competitive dynamics through innovation, brand strength, and technological advancements. Samsung continues to capitalize on its established consumer electronics ecosystem, integrating advanced features such as noise cancellation and long-lasting battery life into its sports headphones, thereby enhancing user experience. Bang & Olufsen stands out with its premium offerings, targeting high-end consumers who seek both sound quality and aesthetics.

Sony maintains its leadership position through cutting-edge noise-canceling technology and personalized sound settings, making it a preferred choice for fitness enthusiasts. Sennheiser is focusing on superior sound fidelity and ergonomics, while Apple leverages its seamless integration with other Apple devices, driving significant market share. Audio-Technica, Bragi, and JLab cater to the mid-range segment, offering balance between quality and affordability. Emerging brands like Boat and Cowin are expanding their presence through competitive pricing and robust marketing strategies.

Purchase The Full Report Now at https://market.us/purchase-report/?report_id=140318

Top Key Players in the Market

- Samsung

- Bang & Olufsen

- Sony

- Sennheiser

- Apple

- Audio-Technica

- Bragi

- Jays

- JLab

- Motorola Mobility (Lenovo)

- Philips

- Pioneer

- Boat

- Cowin

Regional Analysis

North America Leading Region in Sports Headphones Market with 35.2% Share

In 2024, North America emerged as the dominant region in the global sports headphones market, accounting for 35.2% of the market share, valued at USD 1.9 billion. This leadership is attributed to the region’s robust fitness culture, high disposable income, and advanced technological infrastructure. The United States, in particular, has a significant influence on this dominance. The country’s extensive network of fitness centers, coupled with a growing emphasis on health and wellness, has driven the demand for sports headphones. Additionally, the prevalence of smart devices and the increasing adoption of wireless audio solutions have further bolstered market growth.

However, recent trade policies, notably the “Liberation Day” tariffs introduced in April 2025, have introduced new challenges. These tariffs impose a 10% baseline duty on all imports, with higher rates on specific goods from countries like China. Such measures are expected to impact the pricing and availability of sports headphones in the U.S. market, potentially affecting consumer purchasing behavior and market dynamics .

Despite these challenges, North America’s position remains strong due to its innovation-driven market and consumer preference for high-quality audio products. The region’s ability to adapt to changing economic conditions and its continued investment in fitness-related technologies are likely to sustain its leading market share in the foreseeable future.

Recent Developments

- In January 2024, Sony India introduced its latest wireless sports headphones, the Sony Float Run WI-OE610. These headphones are tailored for runners, featuring a unique design that positions the speaker close to the ear without actually touching the ear canal. This innovative design ensures that the ear remains unobstructed while still providing high-quality sound. The focus on comfort and stability makes them ideal for those who want to enjoy music without compromising their performance or safety during outdoor activities.

- In January 2024, OneOdio, a well-known audio equipment brand, showcased its latest innovation, OpenRock X, at CES 2024. The company, celebrated for its audio expertise, highlighted its commitment to enhancing the user experience with open-ear audio solutions. OpenRock, OneOdio’s sub-brand, debuted a range of products, including the OpenRock S, OpenRock Pro, and the soon-to-be-released OpenRock X, further establishing its position as a leader in professional audio technology. This new series promises to elevate audio experiences for music enthusiasts and athletes alike.

- On January 12, 2024, 1MORE, a global leader in headphone technology, marked a major achievement by winning the CES 2024 TWICE Picks Award for its innovative open-fit model. This recognition affirms 1MORE’s role as a trailblazer in the headphone industry. At CES 2024, the company showcased its successful 2023 models while also unveiling new open-fit and HiFi series headphones set for release in 2024. This award solidifies 1MORE’s ongoing commitment to groundbreaking audio innovation and quality.

Conclusion

The sports headphones market is experiencing significant growth, driven by increasing consumer demand for fitness-focused audio solutions. Technological advancements, such as the integration of smart features, improved battery life, and enhanced durability, are contributing to the market’s expansion. The rising popularity of wireless and true wireless headphones, coupled with advancements in audio technology, is further fueling this growth. Additionally, the increasing awareness of health and fitness among consumers is driving the demand for specialized audio devices that cater to active lifestyles. As the market continues to evolve, manufacturers are focusing on innovation and sustainability to meet the changing preferences of consumers. The future outlook for the sports headphones market remains positive, with opportunities for expansion in emerging markets and the integration of advanced technologies to enhance user experience.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)