Table of Contents

Introduction

The Global Micro Motor Market is projected to reach approximately USD 81.5 billion by 2033, rising from a valuation of USD 43.4 billion in 2023. This growth reflects a compound annual growth rate (CAGR) of 6.5% over the forecast period from 2024 to 2033.

Micro motors are miniature electric motors characterized by compact size, high precision, and efficient performance, widely utilized in applications where space and weight constraints are critical, such as in medical devices, automotive systems, industrial automation, robotics, and consumer electronics. The micro motor market refers to the global industry engaged in the design, production, and distribution of these motors across various sectors, with product variants including brushed and brushless micro motors.

The growth of the micro motor market can be attributed to the rising trend of miniaturization in electronic components and mechanical systems, which has significantly increased demand for compact power sources in medical imaging equipment, hearing aids, dental tools, drones, and automotive actuators. Moreover, the proliferation of electric vehicles (EVs), smart devices, and automation technologies has created sustained demand for high-performance micro motors offering precise motion control and energy efficiency.

In particular, advancements in micro-electromechanical systems (MEMS) and increasing investment in robotics and industrial automation have enhanced adoption rates globally. Favorable government initiatives supporting healthcare modernization and smart manufacturing are further accelerating market expansion. Additionally, the expanding aging population and increasing prevalence of chronic diseases are fostering demand for micro motor-integrated healthcare equipment.

While Asia-Pacific leads in production due to strong manufacturing infrastructure, North America and Europe remain key innovation hubs, offering new growth opportunities. The continued evolution of high-efficiency motor technologies, including brushless DC and coreless motors, presents significant opportunities for market players to capitalize on emerging applications requiring precision engineering, thus reinforcing a positive outlook for the global micro motor market.

Key Takeaways

- The global Micro Motor Market was valued at USD 43.4 billion in 2023 and is anticipated to reach USD 81.5 billion by 2033, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

- In 2023, DC micro motors accounted for the largest market share of 62.3% in the type segment, primarily supported by their widespread adoption in automotive systems and consumer electronic devices.

- Brushed motor technology led the market in 2023 with a 52.1% share, attributed to its cost-effectiveness and ease of manufacturing, making it a preferred choice for various end-use industries.

- Micro motors operating at less than 10V held a 32.3% share in 2023, driven by their growing use in compact and low-power electronic devices.

- The automotive segment emerged as the leading application area in 2023, capturing 26.8% of the market share due to increasing demand for efficient, high-performance components in modern vehicles.

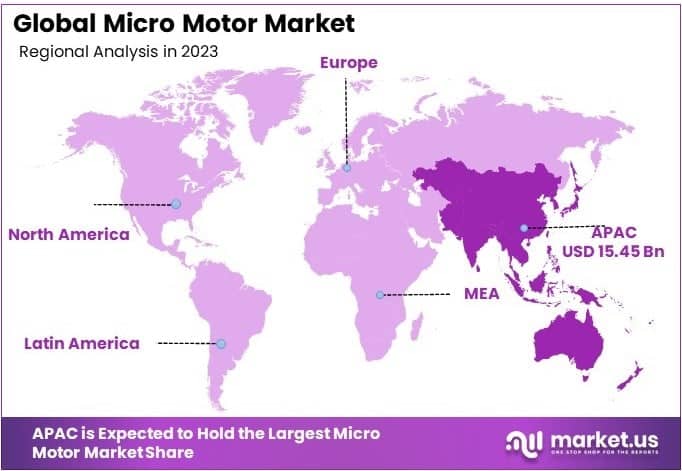

- Asia-Pacific dominated the global market in 2023 with a 35.6% share, supported by rapid industrialization, increasing electronics production, and the strong presence of major micro motor manufacturers in the region.

Delve into Sector-Wise Impact Assessments of US Trade Tariffs https://market.us/report/micro-motor-market/request-sample/

Impact of U.S. Tariffs on the Micro Motor Industry

The imposition of U.S. tariffs on micro motors and related components has led to significant economic ramifications across the industry.

📊 Economic Impact on Micro Motor Industry

- Increased Production Costs: Tariffs on imported components such as engines, fuel cells, and control systems have elevated production costs for micro combined heat and power (mCHP) systems. This has prompted manufacturers to reassess their supply chains and consider domestic sourcing or alternative suppliers to mitigate cost pressures.

- Supply Chain Disruptions: The tariffs have disrupted established supply chains, particularly those reliant on imports from countries subject to the new duties. Manufacturers are facing challenges in sourcing essential components, leading to potential delays in production and delivery schedules.

- Price Adjustments: To offset increased costs, manufacturers may pass on expenses to consumers, resulting in higher prices for end products. This could impact demand, especially in price-sensitive markets, and may necessitate strategic pricing decisions

Emerging Trends

- Miniaturization in Medical Devices: Advancements in micro motor technology have enabled the development of smaller medical devices, such as biopsy tools that reduce incision sizes by up to 80% and decrease procedure times by approximately 75%.

- Electrostatic Motor Innovation: New electrostatic motors, utilizing alternating positive and negative charges, offer up to 80% greater efficiency compared to traditional motors and reduce reliance on rare-earth elements.

- Integration in Compact Electric Vehicles: Micro motors are being incorporated into compact electric vehicles, such as the Microlino, which features a 17-bhp electric motor and offers a battery range of up to 142 miles.

- Adoption in Industrial Automation: The increasing trend of automation in industrial processes is driving the demand for micro motors, which are essential in devices like CNC systems and robotic welding machines.

- Use in Consumer Electronics: The proliferation of consumer electronics, including smartphones and wearable devices, is boosting the demand for micro motors that provide precise movement and vibration functionalities.

Top Use Cases

- Automotive Components: Micro motors are integral in various automotive applications, including power windows, seat adjustments, and anti-lock braking systems.

- Medical Equipment: They are used in medical devices such as insulin pumps, portable ultrasounds, and surgical tools, facilitating minimally invasive procedures.

- Industrial Machinery: Micro motors drive components in industrial machinery, including conveyors and robotic arms, enhancing precision and efficiency.

- Consumer Appliances: In household appliances like coffee makers and air purifiers, micro motors enable compact and efficient operation.

- Aerospace Applications: They are employed in aerospace systems, such as aircraft actuation systems and unmanned aerial vehicles, where high precision and reliability are crucial.

Major Challenges

- High Capital Investment: Developing and producing micro motors require significant financial resources, which can be a barrier to entry for new manufacturers.

- Dependence on Raw Materials: The industry relies heavily on specific raw materials like magnets and copper, making it vulnerable to supply chain disruptions and price fluctuations.

- Technological Complexity: As devices become more miniaturized, achieving high performance without compromising durability becomes increasingly challenging.

- Regulatory Compliance: Meeting stringent environmental and safety regulations requires additional investment in cleaner technologies and processes.

- Overheating Issues: The compact size of micro motors often leads to overheating, posing challenges in maintaining operational stability.

Top Opportunities

- Advancements in Medical Equipment: The growing demand for advanced medical devices presents opportunities for micro motor applications in surgical robots and diagnostic tools.

- Rise in Electric Vehicles (EVs): The shift towards electric and autonomous vehicles increases the need for efficient micro motors in various vehicle functions.

- Integration with IoT Devices: The incorporation of micro motors in Internet of Things (IoT) devices offers enhanced functionality and opens new market segments.

- Growth in Aerospace Industry: The expanding aerospace sector requires micro motors for applications demanding high precision and reliability.

- Development of Brushless DC Motors: The increasing adoption of brushless motors, known for low maintenance and high efficiency, creates growth opportunities in various industries

Key Player Analysis

In the global Micro Motor Market, key players like Nidec Corporation, Johnson Electric Holdings Limited, and Mitsuba Corporation dominate through their diverse product portfolios and technological advancements. Nidec Corporation, a leading manufacturer, excels in offering highly efficient micro motors for various applications, including automotive and industrial sectors. Johnson Electric Holdings, known for its precision and reliability, emphasizes innovation in micro motor technologies, securing a strong market position. Mitsuba Corporation’s robust focus on electric vehicle solutions further enhances its competitive edge in the rapidly evolving market.

Buehler Motor Inc. and Constar Micromotor have carved a niche by specializing in high-performance and custom micro motors, meeting the specific needs of industries such as healthcare and consumer electronics. Mabuchi Motor Co Ltd and Maxon Motor AG provide a broad range of micro motors designed for applications requiring high torque and compact sizes, contributing significantly to market growth. ABB Group and Siemens AG leverage their global reach and industrial expertise, expanding micro motor applications across energy-efficient systems and automation, reinforcing their leadership in the market.

Top Key Players in the Market

- Nidec Corporation

- Johnson Electric Holdings Limited

- Mitsuba Corporation

- Buehler Motor Inc.

- Constar Micromotor

- Mabuchi Motor Co Ltd

- Maxon Motor AG

- Arc Systems Inc

- ABB Group

- Siemens AG

Purchase The Full Report Now at https://market.us/purchase-report/?report_id=131792

Regional Analysis

Asia-Pacific Leads the Global Micro Motor Market with 35.6% Share in 2024, Driven by Strong Demand and Manufacturing Growth

In 2024, Asia-Pacific emerged as the leading region in the global micro motor market, accounting for 35.6% of the total market share, with an estimated market value of USD 15.45 billion. This dominance is primarily attributed to the region’s robust manufacturing base, high-volume electronics production, and expanding automotive and industrial automation sectors. Countries such as China, Japan, South Korea, and India have been central to this growth, supported by government incentives, infrastructure development, and foreign direct investment in precision engineering industries. China, in particular, has maintained its position as a global manufacturing hub for miniature motors used in consumer electronics, automotive components, and medical devices.

The region’s market expansion is further bolstered by rising demand for compact, high-efficiency motors in electric vehicles, robotics, and industrial automation applications. The ongoing trend toward miniaturization in end-user sectors has further propelled the adoption of micro motors across various industries. Additionally, increased research and development activities, as well as investments in motor technology innovations across Asia-Pacific, have positioned the region as a key innovator and supplier in the global value chain. The cost-competitive production landscape, coupled with the availability of skilled labor and supportive government policies, has further enhanced Asia-Pacific’s regional advantage.

However, the imposition of U.S. tariffs on imports from China has introduced notable challenges for regional exporters. These tariffs have affected supply chains and increased operational costs for manufacturers that rely on the U.S. as a key export market for micro motor components. In response, several firms have begun shifting production bases to Southeast Asian countries such as Vietnam and Thailand to mitigate tariff-related risks while maintaining proximity to regional supply networks. Despite such challenges, Asia-Pacific is expected to maintain its leadership due to its strategic advantages in production capacity, technological integration, and demand-side momentum.

Recent Developments

- In June 2024, Sony Corporation reached an agreement to sell its consumer electronics division to a private equity firm, with the transaction expected to conclude by the end of 2025. This move is aimed at streamlining Sony’s operations, allowing it to focus more on its core sectors like gaming and entertainment.

- In May 2024, Siemens AG announced the completion of the sale of its industrial automation solutions business to Schneider Electric. The deal, valued at approximately €1.2 billion, is a strategic shift for Siemens, which plans to reinvest the funds into its digitalization and sustainability efforts.

- In 2023, Bosch and Continental collaborated to create an advanced automotive sensor system that improves vehicle safety by enhancing the precision of real-time hazard detection. This cutting-edge technology is now being integrated into multiple new car models, marking a significant advancement in autonomous driving.

Conclusion

The global micro motor market is witnessing robust growth, driven by increasing demand for compact and energy-efficient motors across industries like automotive, healthcare, and industrial automation. Innovations in miniaturization and technologies such as brushless DC motors are enhancing motor performance. The rise of electric vehicles and the shift towards portable medical devices are key growth drivers. Asia-Pacific remains the dominant region due to its strong manufacturing base and automation advancements. Despite challenges like supply chain dependencies and regulatory hurdles, the market is set for continued expansion, offering significant opportunities for innovation and investment.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)