Table of Contents

Introduction

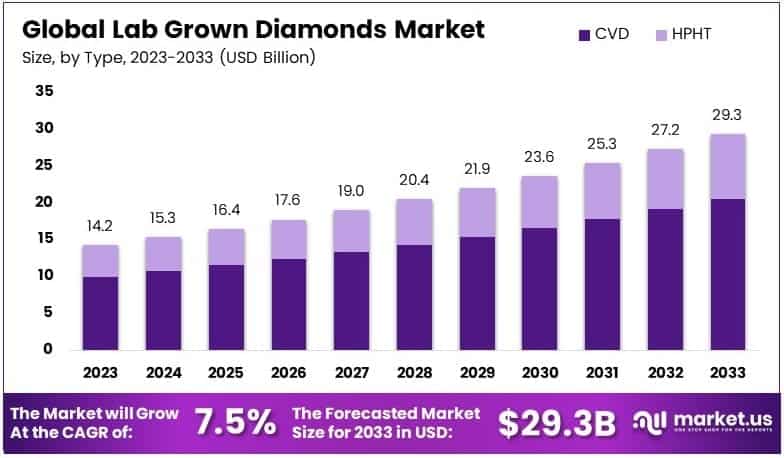

The Global lab-grown diamonds market is projected to reach approximately USD 29.3 billion by 2033, rising from a valuation of USD 14.2 billion in 2023. This growth is anticipated to occur at a compound annual growth rate (CAGR) of 7.5% during the forecast period from 2024 to 2033.

Lab-grown diamonds, also known as synthetic or cultured diamonds, are man-made gemstones produced through advanced technological processes such as High Pressure High Temperature (HPHT) or Chemical Vapor Deposition (CVD) that replicate the natural formation of diamonds. These diamonds possess the same physical, chemical, and optical properties as mined diamonds but are created in controlled laboratory environments, making them a sustainable and ethical alternative.

The lab-grown diamonds market refers to the global industry engaged in the production, distribution, and sale of these synthetic gemstones across various applications, primarily in jewelry, industrial tools, and electronics. In recent years, the market has experienced notable expansion, driven by increasing environmental awareness, shifting consumer preferences toward sustainable luxury, and advancements in diamond synthesis technologies that have significantly improved product quality and reduced production costs.

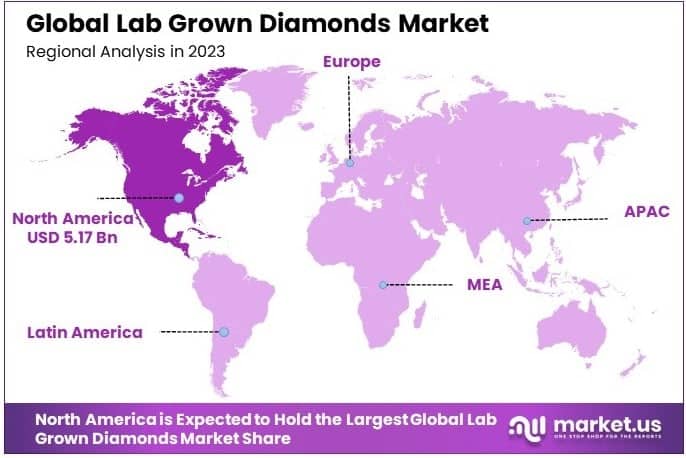

Moreover, the affordability of lab-grown diamonds typically 30% to 40% less expensive than their mined counterparts—is contributing to their rising adoption among millennials and Gen Z consumers. The demand is also bolstered by the growing presence of lab-grown diamonds in mainstream retail channels and high-end fashion brands, further legitimizing the product in the luxury goods segment. An additional growth opportunity lies in their potential use in semiconductors and thermal conductors, where synthetic diamonds offer superior hardness and heat dissipation properties. With increasing regulatory scrutiny on ethical sourcing and a broader industry push toward sustainability, lab-grown diamonds are positioned as a viable solution to the environmental and ethical concerns surrounding traditional diamond mining. Consequently, the market is expected to witness sustained growth over the forecast period, with Asia-Pacific and North America emerging as key regions of opportunity.

Key Takeaways

- The global lab grown diamonds market was valued at USD 14.2 billion in 2023 and is projected to reach USD 29.3 billion by 2033, expanding at a compound annual growth rate (CAGR) of 7.5% during the forecast period.

- In 2023, CVD (Chemical Vapor Deposition) lab-grown diamonds emerged as the dominant type segment, primarily due to their cost-effectiveness and high optical and structural quality, making them suitable for both industrial and jewelry applications.

- The Machine and Cutting Tools segment accounted for the largest application share at 27.8% in 2023, driven by the extensive use of lab-grown diamonds in precision cutting, drilling, and abrasive industrial tools.

- Colored lab-grown diamonds experienced significant traction in 2023, reflecting growing demand for aesthetic diversity and customization in high-end and fashion jewelry design.

- North America led the global market in 2023 with a 36.4% revenue share, valued at approximately USD 5.17 billion, supported by technological advancements, increasing consumer awareness, and robust adoption in both industrial and luxury segments.

Gain Forecast-Based Insights into Future Tariff Impacts at https://market.us/report/lab-grown-diamonds-market/request-sample/

Lab Grown Diamonds Statistics

- Over 133 million carats of mined diamonds entered the market in 2024.

- Consumers aged 21-40 are more likely to consider lab-grown diamonds than older groups.

- About ⅔ of shoppers aged 21-40 are open to lab-grown diamonds for engagement rings.

- Lab-grown diamonds are typically 30-40% cheaper than natural diamonds.

- 60% of lab-grown diamond sales by value at specialty jewelers are for bridal purposes.

- Generic lab-grown diamonds are priced 75-85% lower than similar quality natural diamonds.

- Lab-grown diamonds were once priced 10-15% less than comparable natural diamonds.

- Lab-grown diamonds retain significant value despite being 20-40% less expensive than mined diamonds.

- The lab-grown diamond market is expected to grow by 22% annually in the coming years.

Emerging Trends

- Rapid Price Decline: Since 2020, lab-grown diamond prices have decreased by approximately 74%, attributed to advancements in production technologies and increased manufacturing efficiencies.

- Environmental Advantages: Producing one carat of lab-grown diamond disrupts only 0.0065 m² of land and generates about 0.5 kg of mineral waste, compared to 9 m² of land disruption and 2,600 kg of waste for mined diamonds.

- Technological Advancements: The development of High Pressure-High Temperature (HPHT) and Chemical Vapor Deposition (CVD) methods has enhanced the quality and scalability of lab-grown diamonds, reducing production costs and meeting growing demand.

- Consumer Shift Towards Sustainability: Younger consumers, particularly millennials and Gen Z, are increasingly favoring lab-grown diamonds due to their ethical sourcing and lower environmental impact.

- Expansion Beyond Jewelry: Lab-grown diamonds are finding applications in electronics, optics, and cutting tools, leveraging their superior hardness and thermal conductivity.

Top Use Cases

- Jewelry: Lab-grown diamonds are extensively used in rings, necklaces, and bracelets, offering consumers affordable and ethically sourced alternatives to mined diamonds.

- Electronics: Due to their excellent thermal conductivity, lab-grown diamonds are utilized in high-performance electronic components, including semiconductors and heat spreaders.

- Industrial Cutting and Grinding Tools: Their exceptional hardness makes lab-grown diamonds ideal for manufacturing cutting, grinding, and drilling tools, enhancing efficiency and durability.

- Medical Equipment: Lab-grown diamonds are employed in surgical scalpels, dental drills, and eye surgery tools, offering precision and biocompatibility.

- Quantum Computing: The unique properties of lab-grown diamonds, such as nitrogen-vacancy centers, are instrumental in developing quantum sensors and qubit processors.

Major Challenges

- Consumer Perception: A segment of consumers perceives natural diamonds as more valuable and authentic, posing a challenge to the widespread acceptance of lab-grown alternatives.

- Lack of Standardized Certification: The absence of universally accepted certification and regulatory frameworks for lab-grown diamonds complicates market entry and consumer trust.

- Price Volatility: As production scales up, the rapid decrease in prices may impact profitability and market stability.

- Competition from Mined Diamonds: Traditional diamond mining companies, with established market share and brand recognition, present significant competition to lab-grown diamond producers.

- High Initial Capital Investment: Establishing and scaling production facilities for lab-grown diamonds require substantial upfront investment, potentially hindering market entry

Top Opportunities

- Sustainable Consumer Trends: The increasing demand for environmentally friendly and ethically sourced products presents a significant opportunity for lab-grown diamonds.

- Technological Innovations: Advancements in diamond-growing technologies can enhance the quality, size, and diversity of lab-grown diamonds, expanding their applications.

- Customization and Personalization: The controlled production process allows for customizable and personalized lab-grown diamonds, catering to consumer preferences for unique jewelry.

- Expansion into Industrial Applications: The superior properties of lab-grown diamonds open avenues in electronics, optics, and cutting tools, diversifying market opportunities.

- E-commerce Growth: The rise of online retail platforms facilitates broader consumer access to lab-grown diamonds, enhancing market reach.

Key Player Analysis

In 2024, the competitive landscape of the global lab-grown diamonds market is characterized by strategic innovation, vertical integration, and increasing retail penetration. De Beers Group, through its Lightbox Jewelry brand, continues to influence market pricing and perception by positioning lab-grown diamonds as fashion accessories rather than luxury goods. ALTR Created Diamonds and Diamond Foundry are emphasizing sustainability and origin transparency, appealing to ethically driven consumers and reinforcing premium positioning.

Gemesis and New Diamond Technology are advancing high-pressure, high-temperature (HPHT) and chemical vapor deposition (CVD) techniques to enhance quality and scalability. Swarovski leverages brand equity to promote synthetic diamonds in fashion-forward segments, while Chatham Created Gems & Diamonds maintains a stronghold in color-rich, lab-created stones. Charles & Colvard focuses on affordability and e-commerce-driven distribution, targeting value-conscious buyers. Pure Grown Diamonds is scaling operations to meet growing demand, and Stuller, Inc. serves as a key B2B distributor, ensuring wide accessibility across independent jewelers.

Purchase The Full Report Now at https://market.us/purchase-report/?report_id=131751

Top Key Players in the Market

- De Beers Group

- ALTR Created Diamonds

- Diamond Foundry

- Gemesis

- New Diamond Technology

- Swarovski

- Chatham Created Gems & Diamonds

- Charles & Colvard

- Pure Grown Diamonds

- Stuller, Inc.

Regional Analysis

North America Leads Lab-Grown Diamonds Market with Largest Market Share of 36.4%

North America has emerged as the dominant region in the global lab-grown diamonds market, accounting for 36.4% of the total market share in 2024, with a market valuation of USD 5.17 billion. This leadership is primarily driven by the United States, which alone contributed approximately USD 7.1 billion to the regional market in 2024.

The region’s growth is propelled by increasing consumer preference for sustainable and ethically sourced diamonds, particularly among millennials and Gen Z demographics. Lab-grown diamonds have gained significant traction in the engagement ring segment, reflecting a broader shift towards environmentally conscious purchasing decisions.

However, the market faces challenges due to recent U.S. trade policies. The imposition of a 10% import tariff on diamonds has disrupted global trade dynamics, affecting major suppliers like India, which processes over 80% of the world’s diamonds. These tariffs have led to decreased demand and financial strain within the industry, with reports of significant job losses and reduced exports from key processing hubs such as Surat.

Industry leaders, including De Beers, have criticized these tariffs, highlighting their potential to harm U.S. consumers and the domestic jewelry sector without offering tangible benefits to American employment. This growth underscores the region’s resilience and the increasing consumer inclination towards sustainable luxury products.

Recent Developments

- In 2024, Pandora introduced its lab-grown diamond collection in Denmark, marking the brand’s first launch of these diamonds in the European Union. After successful rollouts in the US, UK, and Australia, Pandora also opened its first flagship store in Copenhagen to strengthen its presence in its home market.

- In 2024, Tracr confirmed that from 2025, all De Beers-sourced diamonds over 0.5 carats (polished) will display a single country of origin. This move aligns with new G7 import rules and follows De Beers’ earlier step to provide origin data for rough diamonds above 1.25 carats on the Tracr digital platform.

- In 2023, Blackstone completed the acquisition of the International Gemological Institute from Fosun’s Shanghai Yuyuan and co-founder Roland Lorie. This acquisition expands Blackstone’s portfolio in the global certification and diamond services space.

- In 2023, Cullen Jewellery launched its first coloured lab-grown diamond line titled ‘Love in Colour,’ offering stones in pink, yellow, and blue shades. This new collection showcases the brand’s focus on combining luxury with sustainability.

- In 2024, Aukera Grown Diamond Jewellery introduced India’s first lab-grown polki collection, named the ‘Queen’s Reserve Polki Collection.’ The launch coincided with the opening of the brand’s new boutique in Bengaluru, with actress Priyanka Upendra attending the event

Conclusion

The lab-grown diamonds market is experiencing robust growth, driven by increasing consumer demand for sustainable and ethically sourced alternatives to mined diamonds. Advancements in production technologies, such as High Pressure High Temperature (HPHT) and Chemical Vapor Deposition (CVD), have enhanced the quality and affordability of lab-grown diamonds, making them more accessible to a broader consumer base. This shift is particularly evident among millennials and Gen Z consumers, who prioritize environmental responsibility and transparency in their purchasing decisions. The market’s expansion is further supported by the integration of lab-grown diamonds into various applications beyond jewelry, including electronics and industrial tools, due to their superior hardness and thermal conductivity. As the industry continues to evolve, with increased adoption in emerging markets and the development of standardized certification processes, lab-grown diamonds are poised to play a significant role in the future of the global diamond industry.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)