Table of Contents

Overview

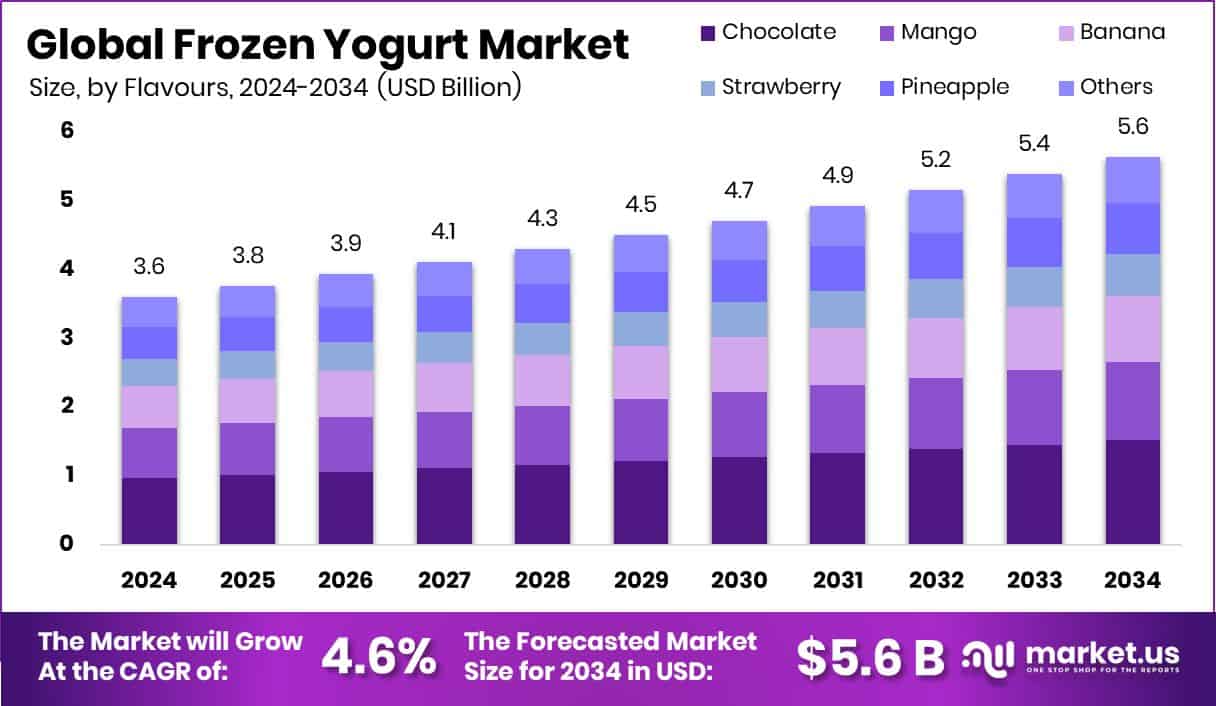

New York, NY – May 06, 2025 – The global Frozen Yogurt Market is growing fast, with demand rising as more people look for healthier dessert options. In 2024, the market was valued at USD 3.6 billion, and it is expected to reach USD 5.6 billion by 2034, growing at a steady rate of 4.6% per year.

Chocolate commands a 27.3% share in the Frozen Yogurt Market’s flavor segment in 2024, leading due to its widespread appeal across all age groups, especially children and young adults. Low-fat frozen yogurt (0.5%–2% fat) holds a 67.3% market share in 2024, reflecting consumer demand for healthier dessert options that maintain flavor and texture. Dairy-based frozen yogurt dominates with a 78.3% share, driven by its creamy texture and traditional consumer preference. Offline sales channels account for 74.3% of frozen yogurt sales.

US Tariff Impact on Market

The Trump tariff tit-for-tat morphed, and dairy became front and center. President Trump said late last week, Canada has been ripping us off for years on lumber and on dairy products, and he cited Canada’s 250% tariff on U.S. dairy exports, warning that the U.S. would match those tariffs. Canada’s supply management program has long been a bone of contention for the U.S. dairy industry, and it remains a “sacred cow among Canadian dairy farmers.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/global-frozen-yogurt-market/request-sample/

It is accurate that Canada imposes a tariff of approximately 250% on U.S. exports of certain dairy products into Canada, and even more with Canada’s 25% retaliatory tariffs in place. However, that tariff would only apply if we were able to reach and exceed the quota on U.S. dairy exports agreed to under the U.S.-Mexico-Canada Agreement.

Key Takeaways

- The Global Frozen Yogurt Market is expected to be worth around USD 5.6 billion by 2034, up from USD 3.6 billion in 2024, and grow at a CAGR of 4.6% from 2025 to 2034.

- The chocolate flavor dominates the Frozen Yogurt Market with a share of 27.3%.

- Low-fat options, ranging from 0.5% to 2% fat, represent 67.3% of the market.

- Dairy-based frozen yogurt products hold a substantial market share of 78.3%.

- Offline sales channels lead in distribution, accounting for 74.3% of frozen yogurt sales.

- The Asia-Pacific frozen yogurt market reached a value of USD 1.5 billion.

Analyst Viewpoint

Investment opportunities are ripe, as Health-conscious consumers are craving low-fat, probiotic-rich desserts. The Asia-Pacific region, holding a commanding position, is a hotspot due to rising incomes and urbanization in countries like China and Japan. Consumer insights reveal a strong pull toward customization of consumers love self-serve models where they can mix flavors like tart mango or chocolate with unique toppings.

Innovations like plant-based options and sustainable packaging are also drawing younger crowds, especially millennials and Gen Z, who prioritize health and eco-friendliness. Investing in tech, like AI-driven kiosks or loyalty apps, can boost engagement and streamline operations, making it a smart move for forward-thinking brands. However, risks loom large.

The regulatory environment adds another layer of complexity, strict food safety and labeling rules vary by region, and non-compliance can lead to costly fines or recalls. Economic uncertainty, like inflation squeezing disposable incomes, could also curb impulse buys, which account for a chunk of sales. Investors need to weigh these hurdles carefully, but the market’s growth potential and consumer love for frozen yogurt make it a tempting bet if you play your cards right.

Report Scope

| Market Value (2024) | USD 3.6 Billion |

| Forecast Revenue (2034) | USD 5.6 Billion |

| CAGR (2025-2034) | 4.6% |

| Segments Covered | By Flavours (Chocolate, Mango, Banana, Strawberry, Pineapple, Others), By Fat Contents (Low fat (0.5% -2%), No fat (Less Than 0.5%)), By Product Type (Dairy-Based, Non-Dairy Based), By Sales Channel (Offline Sales Channel (Hypermarkets/Supermarkets, Departmental Stores, Convenience Store, Others), Online Sales Channel (Company Website, E-commerce Platform, Others)) |

| Competitive Landscape | Danone, Pinkberry, Honey Hill Farms, Scott Brothers Dairy, Red Mango Inc., Yogurtland Inc., Gujarat Cooperative Milk Marketing Federation, Nestle S.A., General Mills, Nancy’s Yogurt, Mixmi, Wallaby Organic, Glenisk, Weeel, Snog |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=145486

Key Market Segments

By Flavors Analysis

- Chocolate commands a 27.3% share in the Frozen Yogurt Market’s flavor segment in 2024, leading due to its widespread appeal across all age groups, especially children and young adults. Its versatility as a standalone flavor or paired with toppings like chocolate chips or brownies solidifies its market dominance. Frozen yogurt chains and retailers prioritize chocolate in their offerings, driven by its consistently high sales.

By Fat Content Analysis

- Low-fat frozen yogurt (0.5%–2% fat) holds a 67.3% market share in 2024, reflecting consumer demand for healthier dessert options that maintain flavor and texture. Popular among health-conscious individuals, including those on calorie-controlled or cholesterol-managed diets, low-fat variants dominate urban markets where wellness trends shape buying behavior.

By Product Type Analysis

- Dairy-based frozen yogurt dominates with a 78.3% share in 2024, driven by its creamy texture and traditional consumer preference. Available widely in supermarkets, dessert shops, and quick-service restaurants, dairy-based products are seen as a healthier alternative to ice cream. Innovations like Greek-style, probiotic-rich, and low-lactose options bolster the segment’s growth, appealing to consumers seeking functional benefits like better digestion.

By Sales Channel Analysis

- Offline sales channels account for 74.3% of frozen yogurt sales in 2024, driven by the strong presence of frozen yogurt parlors, supermarkets, convenience stores, and hypermarkets. Self-serve shops and quick-service restaurants enhance the segment’s appeal through experiential value and impulse purchases, particularly in urban and high-traffic areas.

Regional Analysis

- The Asia-Pacific region led the Frozen Yogurt Market in 2024, capturing a 43.3% global share with a market value of USD 1.5 billion. This dominance was fueled by rising health awareness, urbanization, and increasing disposable incomes in countries like China, Japan, and South Korea. The region’s expanding middle class and preference for healthier dessert options significantly drove demand.

- North America trailed closely, bolstered by established frozen yogurt brands and robust retail infrastructure. Strong consumer demand for low-fat and high-protein products was evident, particularly in the U.S. and Canada. Europe experienced consistent growth, driven by health-conscious consumers and the growing availability of plant-based frozen yogurt in markets like Germany, France, and the UK.

- Latin America saw moderate growth, with urban younger consumers increasingly recognizing frozen yogurt’s benefits. The Middle East & Africa region showed gradual market expansion, propelled by retail growth and the influence of Western dietary trends in urban areas.

Top Use Cases

- Health-Conscious Dessert Option: Frozen yogurt is popular as a healthier alternative to ice cream, offering low-fat and probiotic-rich choices. Consumers, especially young adults, prefer it for its lower calorie content and digestive benefits, driving demand in urban areas where wellness trends dominate.

- Self-Serve Model Adoption: The self-serve frozen yogurt model lets customers customize flavors and toppings, boosting engagement. This trend, prevalent in over two-thirds of stores, appeals to consumers seeking control over portions and dietary preferences, increasing sales in high-traffic retail locations.

- Flavor Innovation and Variety: Unique flavors like tart, mango, and exotic combinations attract adventurous consumers. Seasonal and limited-edition options, such as white peach tart, keep menus fresh, encouraging repeat purchases and appealing to diverse tastes in competitive markets.

- Plant-Based and Non-Dairy Growth: Non-dairy frozen yogurt, made from almond, coconut, or oat milk, caters to vegans and lactose-intolerant consumers. This segment is growing as health and sustainability concerns rise, expanding market reach in regions like North America and Europe.

- Probiotic and Functional Benefits: Frozen yogurt’s probiotic content promotes gut health, appealing to health-focused buyers. Brands emphasize functional ingredients like vitamins and organic additives, positioning it as a guilt-free snack for fitness enthusiasts and families.

Recent Developments

- Danone has expanded its plant-based yogurt offerings, including frozen yogurt alternatives under brands like Alpro and So Delicious. The company focuses on dairy-free, probiotic-rich options to cater to health-conscious and vegan consumers. Innovations include low-sugar and high-protein frozen yogurt varieties. Danone is also investing in sustainable packaging to reduce environmental impact.

- Pinkberry continues to dominate the premium frozen yogurt segment with new seasonal flavors and limited-edition collaborations. Recently, they introduced vegan and keto-friendly options to attract health-focused customers. The brand is expanding its digital presence with mobile ordering and loyalty programs. Pinkberry also partners with fitness influencers to promote its low-calorie offerings.

- Honey Hill Farms specializes in organic frozen yogurt, recently launching a probiotic-enriched line for gut health. The company emphasizes farm-frozen ingredients and has expanded distribution to major grocery chains. New flavors like turmeric, ginger, and blueberry acai target functional food trends. They also introduced mini-cups for portion-controlled snacking.

- Scott Brothers Dairy has introduced high-protein frozen yogurt aimed at athletes and fitness enthusiasts. Their recent Greek frozen yogurt line offers double the protein of traditional options. The company is also testing sugar-free varieties sweetened with monk fruit and stevia. Expansion into convenience stores has boosted accessibility.

- Red Mango continues innovating with real fruit-infused frozen yogurt and plant-based alternatives. Their recent Superfood Swirl combines yogurt with chia seeds and antioxidants. The brand has enhanced its mobile app for faster ordering and personalized promotions. Red Mango is also testing CBD-infused frozen yogurt in select markets.

Conclusion

The Frozen Yogurt Market is set for steady growth. Consumers are driving demand for healthier, lower-calorie desserts, pushing brands to innovate with plant-based, probiotic-rich, and high-protein options. Key players like Danone, Pinkberry, and Red Mango are expanding flavors, improving digital ordering, and exploring trends like CBD-infused and keto-friendly yogurts. The market’s future looks bright, with opportunities in vegan alternatives, functional ingredients, and emerging markets. As health-conscious eating grows, frozen yogurt will remain a popular choice, blending taste and wellness in the dessert industry.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)