Table of Contents

Introduction

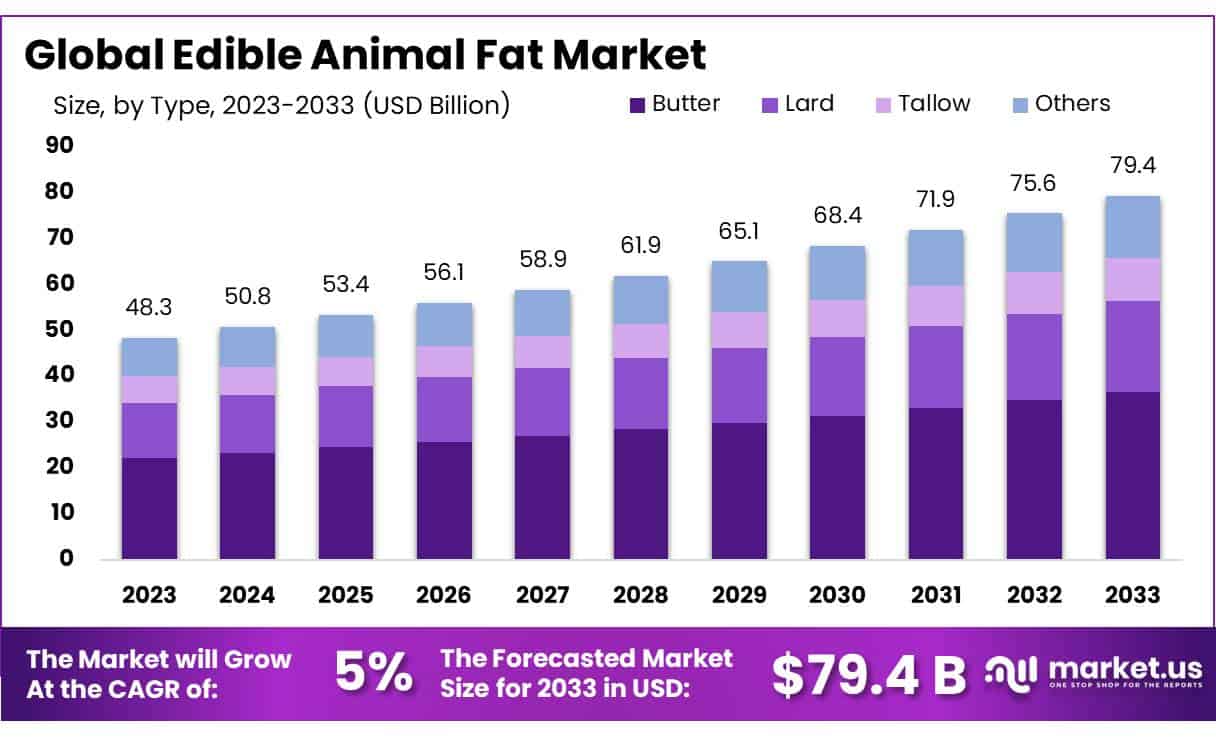

New York, NY – February 12, 2025 – The Edible Animal Fat Market is experiencing robust growth, with expectations to expand significantly from USD 48.3 billion in 2023 to around USD 79.4 billion by 2033, charting a steady CAGR of 5.0% over the next decade.

This growth is driven by increasing demand from various industries, including food processing and cosmetics, where animal fats are valued for their unique properties and flavor enhancement. The market’s popularity stems from the renewed interest in traditional and natural ingredients among health-conscious consumers, especially in emerging economies where culinary practices heavily rely on animal fats.

Opportunities are abundant as innovations in food technology and sustainable fat processing are opening new applications and markets, potentially increasing the reach and versatility of animal fats. Moreover, market expansion is further supported by the global rise in meat consumption and processing, which ensures a steady supply of these fats. As the market adapts to changing consumer preferences and regulatory landscapes, the future looks promising for the edible animal fat sector, pointing towards a trajectory of continued growth and expansion.

Key Takeaways

- The Edible Animal Fat Market is expected to be worth around USD 79.4 billion by 2033, up from USD 48.3 billion in 2023, and grow at a CAGR of 5.0%.

- Butter held a dominant market position, capturing more than a 46.1% share of the edible animal fat market.

- Solid edible animal fats held a dominant market position, capturing more than a 62.2% share.

- Cattle held a dominant market position in the edible animal fat market, capturing more than a 52.2% share.

- Food held a dominant market position in the edible animal fat market, capturing more than 82.1% share.

- Europe leads the global market, holding a dominant share of 36.9%, with a valuation of USD 17.8 billion.

Report Scope

| Market Value (2024) | USD 48.3 Billion |

| Forecast Revenue (2034) | USD 79.4 Billion |

| CAGR (2025-2034) | 5.0% |

| Segments Covered | By Type (Butter, Lard, Tallow, Others), By Form (Liquid, Solid, Semi-Solid), By Source (Cattle, Pig, Others), By Application (Non-Food, Food) |

| Competitive Landscape | Archer-Daniels-Midland Company, Boyer Valley Company, LLC. (The Lauridsen Group), Bunge Limited, Cargill, Incorporated, Coast Packing Company, COLYER FEHR GROUP, Darling Ingredients, Fats & tallow blends, Hubberts Industries, Leo Group Ltd., PIERMEN B.V, Sanimax, SARIA A S GmbH and Co. KG, Sonac (Darling Ingredients Inc.), Ten Kate Vetten B.V., York Foods, Bunge Limited |

Emerging Trends

- Increased Demand for Traditional Flavors: There’s a growing consumer preference for traditional and artisanal food products, which is boosting the demand for animal fats in culinary applications. These fats are cherished for enhancing flavors and textures in cooking and baking, particularly in regions with rich culinary histories like Asia and Europe.

- Innovations in Fat Processing: Technological advancements in fat extraction and processing are enabling the production of higher-quality animal fats that meet stringent food safety standards. This is particularly important in the food industry where the purity and safety of ingredients are paramount.

- Sustainability and Ethical Sourcing: The market is witnessing a shift towards more sustainable and ethically sourced animal fats. Companies are increasingly focusing on transparency in their sourcing methods and striving to improve animal welfare standards in response to consumer demands for more ethically produced products.

- Expansion in Non-Food Applications: Edible animal fats are finding new applications beyond the food industry, such as in bio-diesel production and the oleochemical industry. This diversification is helping to stabilize market demand and open up new revenue streams for producers.

- Health and Nutrition Focus: While traditionally viewed as less healthy, there’s a shift towards reformulating animal fats for better health profiles, such as reducing saturated fat content and avoiding trans fats. This aligns with the global trend towards healthier dietary fats and could improve consumer perception of animal fat products.

Use Cases

- Culinary Applications: Animal fats like lard and tallow are cherished for their unique flavors and textures in cooking and baking. They’re particularly useful for high-temperature cooking methods like frying due to their high smoke points.

- Bio-diesel Production: Animal fats are being increasingly used as a bio-diesel component. This renewable energy use is gaining traction due to its lower environmental impact compared to fossil fuels.

- Cosmetic and Pharmaceutical Products: The stability and textural properties of animal fats make them valuable in cosmetics for creams and ointments. They are also utilized in pharmaceuticals to create capsules and other medicinal formats.

- Feed and Agricultural Uses: In agriculture, animal fats are added to feed to improve energy content and palatability for livestock. They’re also used in producing organic fertilizers.

- Traditional and Locally Sourced Foods: With a growing trend towards sustainable and locally sourced food products, animal fats are being utilized by communities to support local agriculture and reduce food miles.

Major Challenges

- Health Concerns: Despite a shift in perception, the association of animal fats with cardiovascular diseases and other health issues remains a significant challenge. These concerns can influence consumer choices and dietary guidelines, which may limit market growth.

- Competition from Plant-Based Alternatives: The rise of veganism and plant-based diets presents a substantial competitive threat. As more consumers opt for plant-based alternatives, the demand for animal-derived fats could see a decline.

- Regulatory and Compliance Hurdles: Navigating the complex regulatory landscapes that govern food products can be challenging. Compliance with health and safety standards is crucial but often burdensome.

- Supply Chain Disruptions: Global events such as geopolitical tensions and economic instability can disrupt supply chains, affecting the availability and cost of animal fats.

- Consumer Preferences and Trends: Keeping pace with changing consumer preferences and dietary trends is crucial. As consumers increasingly seek natural and minimally processed foods, the industry must adapt to maintain relevance.

Market Growth Opportunities

- Biodiesel Production: As global efforts to reduce carbon emissions continue, the use of animal fats in biodiesel production presents a significant opportunity. Technological advancements in biodiesel processes are making it more efficient and cost-effective to utilize animal fats as a renewable energy source.

- Demand for Natural and Minimally Processed Foods: There is a rising consumer demand for natural ingredients, which benefits the edible animal fat market. Animal fats are increasingly valued for their flavor and cooking properties, especially in culinary traditions that prioritize natural and traditional cooking methods.

- Expanding Food Industry Applications: The food industry’s ongoing preference for high-quality, flavor-enhancing ingredients supports the continued use of animal fats in various applications, including baking, frying, and flavoring. This is particularly relevant as consumer preferences shift towards sensory attributes like taste and mouthfeel.

- Nutritional and Health Benefits: There’s growing awareness of the health benefits associated with certain types of animal fats, which are rich in vitamins and essential fatty acids. This can drive demand in sectors like health foods, where consumers are looking for wholesome and effective dietary choices.

Recent Developments

1. Archer-Daniels-Midland Company (ADM)

- Recent Developments:

- Innovation: ADM has been investing in sustainable and alternative protein sources, including plant-based fats and oils, which indirectly impact the edible animal fat sector by providing alternatives. In 2023, ADM expanded its production capabilities for plant-based oils and fats to meet the growing demand for sustainable food ingredients.

- Partnerships: ADM partnered with several food tech companies to develop innovative fat solutions for plant-based meat alternatives. This includes collaborations to improve the texture and flavor of plant-based products, which could reduce reliance on traditional animal fats.

- Government Data: According to the USDA, ADM’s investments in sustainable oils align with U.S. government initiatives to reduce greenhouse gas emissions in the agriculture sector.

- Contribution to the Edible Animal Fat Sector:

- ADM’s focus on plant-based fats and oils is shifting the industry toward sustainable alternatives, potentially reducing the demand for traditional edible animal fats.

2. Boyer Valley Company, LLC. (The Lauridsen Group)

- Recent Developments:

- Innovation: Boyer Valley has been working on improving the quality and shelf life of edible animal fats through advanced rendering technologies. In 2023, they introduced a new filtration system that enhances the purity of animal fats used in food production.

- Investments: The company invested in expanding its rendering facilities to increase production capacity for edible animal fats, catering to the growing demand in the food industry.

- Government Data: The FDA has recognized Boyer Valley’s efforts in improving food safety standards for animal-derived products.

- Contribution to the Edible Animal Fat Sector:

- Boyer Valley’s advancements in rendering technology and quality control are helping to maintain the relevance of edible animal fats in the food industry.

3. Bunge Limited

- Recent Developments:

- Acquisitions: In 2022, Bunge acquired a majority stake in a European edible oils and fats company, expanding its portfolio in the animal fat and plant-based fat sectors.

- Partnerships: Bunge partnered with a leading food manufacturer in 2023 to develop hybrid fat solutions that combine animal and plant-based fats, aiming to improve sustainability without compromising on taste.

- Government Data: The European Food Safety Authority (EFSA) has highlighted Bunge’s efforts in meeting EU sustainability standards for edible fats.

- Contribution to the Edible Animal Fat Sector:

- Bunge’s hybrid fat solutions are bridging the gap between traditional animal fats and plant-based alternatives, ensuring continued use of animal fats in a more sustainable manner.

4. Cargill, Incorporated

- Recent Developments:

- Innovation: Cargill has been developing new animal fat-based ingredients for the food industry, focusing on improving the nutritional profile and functionality of edible animal fats. In 2023, they launched a new line of low-saturated-fat animal fats for use in baked goods and processed foods.

- Investments: Cargill invested in upgrading its rendering facilities to produce higher-quality edible animal fats, with a focus on sustainability and reducing environmental impact.

- Government Data: The U.S. Department of Agriculture (USDA) has acknowledged Cargill’s efforts in reducing waste and improving efficiency in animal fat production.

- Contribution to the Edible Animal Fat Sector:

- Cargill’s innovations are helping to modernize the edible animal fat industry, making it more sustainable and nutritionally beneficial.

5. Coast Packing Company

- Recent Developments:

- Innovation: Coast Packing has been focusing on producing non-hydrogenated edible animal fats, catering to the demand for cleaner-label ingredients. In 2023, they introduced a new line of non-GMO animal fats for use in organic food products.

- Partnerships: The company partnered with several food manufacturers to supply high-quality animal fats for use in plant-based meat alternatives, ensuring better flavor and texture.

- Government Data: The FDA has recognized Coast Packing’s efforts in meeting clean-label and non-GMO standards for food ingredients.

- Contribution to the Edible Animal Fat Sector:

- Coast Packing’s focus on non-hydrogenated and non-GMO animal fats is helping to align the industry with consumer demand for healthier and more natural food products.

Conclusion

The Edible Animal Fat Market is positioned for dynamic growth, driven by a blend of traditional culinary applications and modern industrial uses. As consumers increasingly value natural and minimally processed ingredients, animal fats are enjoying renewed interest in their authentic flavors and cooking benefits. Additionally, the market is buoyed by the expanding role of animal fats in biodiesel production, aligning with global sustainability efforts. Despite facing challenges from health concerns and the rise of plant-based alternatives, the versatility and ongoing technological enhancements in fat processing and extraction are opening new avenues for growth. As the industry continues to innovate and adapt to changing consumer preferences and environmental standards, the future of the edible animal fat market looks promising, offering diverse opportunities for market players.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)