Table of Contents

Introduction

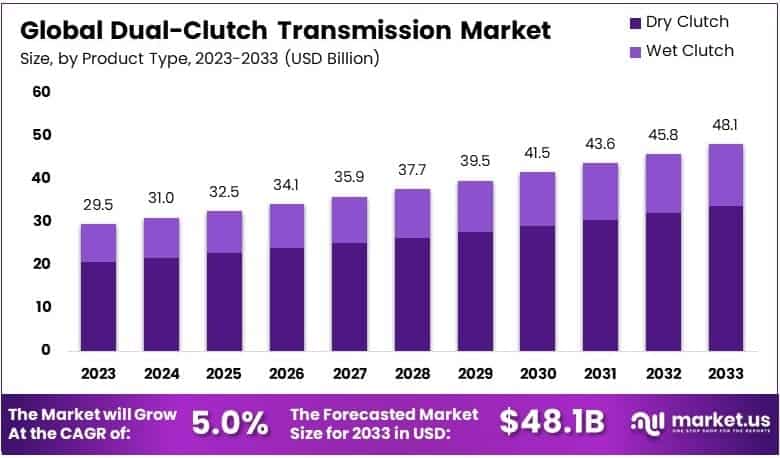

New York, NY – March 20 , 2025 – The Global Dual-Clutch Transmission (DCT) market is projected to reach approximately USD 48.1 billion by 2033, up from USD 29.5 billion in 2023, reflecting a CAGR of 5.0% over the forecast period 2024–2033.

The Dual-Clutch Transmission (DCT) market is experiencing steady growth, driven by the increasing demand for high-performance and fuel-efficient vehicles. A Dual-Clutch Transmission is an advanced automatic transmission system that uses two separate clutches for odd and even gear sets, ensuring seamless gear shifts, reduced power loss, and enhanced driving dynamics. The DCT market is expanding as automotive manufacturers integrate this technology into passenger cars, sports cars, and even commercial vehicles to improve fuel economy and driving comfort.

Key growth factors include rising consumer preference for smooth and fast gear shifts, stringent emission regulations promoting fuel-efficient technologies, and advancements in electric and hybrid vehicles incorporating DCT systems. Additionally, the demand for high-performance and luxury vehicles, particularly in regions like North America, Europe, and China, is fueling market expansion. The increasing production of electric vehicles (EVs) with hybrid DCTs presents opportunities for further innovation and adoption. However, cost concerns and complex manufacturing processes remain challenges for widespread implementation.

The growing demand for lightweight and energy-efficient drivetrains, particularly in electric and hybrid powertrains, provides a significant opportunity for market players to enhance transmission efficiency and reduce CO₂ emissions. Additionally, continuous opportunities exist in the aftermarket sector, where demand for DCT replacements and performance upgrades is rising. As automotive electrification accelerates, manufacturers investing in research and development for next-generation DCTs with optimized efficiency and durability will gain a competitive edge. Overall, the DCT market is poised for sustained growth, driven by technological advancements, regulatory support, and shifting consumer preferences.

Key Takeaways

- Dual-Clutch Transmission Market was valued at USD 29.5 billion in 2023 and is projected to reach USD 48.1 billion by 2033, growing at a CAGR of 5.0%.

- Dry Clutch dominated in 2023, recognized for its efficiency in passenger vehicles.

- Passenger Vehicles led the market, reflecting high consumer adoption.

- The Automated Gearshift system emerged as the leading type, emphasizing the industry’s focus on driver convenience.

- Asia-Pacific accounted for a significant market share in 2023, driven by the region’s expanding automotive industry.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 29.5 Billion |

| Forecast Revenue (2033) | USD 48.1 Billion |

| CAGR (2024-2033) | 5.0% |

| Segments Covered | By Product Type (Dry Clutch, Wet Clutch), By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Motorsport Cars), By Gearshift (Manual, Automated), By Gearbox Type (Single Plate Clutch, Multi Plate Clutch) |

| Competitive Landscape | ZF Friedrichshafen AG, Getrag (Magna International), BorgWarner Inc., Aisin Seiki Co., Ltd., Honda Motor Co., Ltd., Hyundai Motor Company, Volkswagen Group, Ford Motor Company, General Motors, Daimler AG (Mercedes-Benz), FCA US LLC (Stellantis), Schaeffler Group, Jatco Ltd., Mitsubishi Motors, Porsche AG |

Explore Our Sample Report to Gain a Deeper Understanding of the Latest Market Trends https://market.us/report/dual-clutch-transmission-market/request-sample/

Emerging Trends

- Integration with Hybrid and Electric Vehicles: The increasing adoption of hybrid and electric vehicles has led to the integration of DCTs to enhance efficiency and performance. This trend aligns with the global shift towards sustainable transportation.

- Advancements in Transmission Technology: Continuous innovations in DCT technology, such as improved shift speeds and enhanced durability, are contributing to better vehicle performance and fuel efficiency.

- Adoption in High-Performance Vehicles: DCTs are increasingly favored in sports and luxury vehicles due to their ability to provide rapid gear shifts and a smoother driving experience.

- Focus on Fuel Efficiency: Manufacturers are adopting DCTs to meet stringent fuel efficiency regulations and consumer demand for vehicles with better mileage.

- Regional Market Expansion: The Asia-Pacific region, particularly countries like India and China, is experiencing significant growth in DCT adoption, driven by rising vehicle sales and manufacturing activities.

Top Use Cases

- Passenger Vehicles: DCTs are widely used in passenger cars to enhance driving comfort and fuel efficiency.

- Sports Cars: The rapid gear-shifting capability of DCTs makes them ideal for high-performance sports cars, offering improved acceleration and driving dynamics.

- Luxury Vehicles: Luxury car manufacturers utilize DCTs to provide smooth and responsive driving experiences, aligning with premium vehicle standards.

- Hybrid Vehicles: In hybrid models, DCTs contribute to better fuel economy and seamless power delivery between electric and combustion engines.

- Commercial Vehicles: Some light commercial vehicles adopt DCTs to improve fuel efficiency and reduce operational costs.

Major Challenges

- High Manufacturing Costs: The complexity of DCT systems leads to higher production costs, which can affect their adoption in cost-sensitive markets.

- Maintenance Complexity: DCTs require specialized maintenance, which can be a barrier for widespread adoption, especially in regions lacking technical expertise.

- Competition from Other Transmission Technologies: Alternative transmission systems, such as continuously variable transmissions (CVTs), pose competition to DCTs due to their simpler design and lower costs.

- Consumer Perception: Some consumers may be hesitant to adopt DCT-equipped vehicles due to concerns about reliability and driving experience.

- Technological Integration: Integrating DCTs with emerging vehicle technologies, such as autonomous driving systems, presents engineering challenges.

Top Opportunities

- Expansion in Emerging Markets: Growing automotive markets in Asia-Pacific and other developing regions present significant opportunities for DCT adoption.

- Aftermarket Services: Providing maintenance and upgrade services for DCTs can open new revenue streams for automotive service providers.

- Technological Collaborations: Partnerships between transmission manufacturers and automotive companies can lead to innovations and cost reductions in DCT technology.

- Integration with Autonomous Vehicles: Developing DCTs compatible with autonomous driving systems can position manufacturers at the forefront of automotive technology.

- Enhanced Consumer Education: Educating consumers about the benefits of DCTs can drive acceptance and demand, particularly in markets unfamiliar with the technology.

Key Player Analysis

The Global Dual-Clutch Transmission (DCT) Market in 2024 is driven by key players leveraging technological advancements to enhance transmission efficiency, fuel economy, and driving performance. ZF Friedrichshafen AG and Getrag (Magna International) continue to lead with advanced DCT solutions, integrating hybrid compatibility and lightweight materials.

BorgWarner Inc. and Aisin Seiki Co., Ltd. focus on refining mechatronic control systems to improve shift precision. Honda Motor Co., Ltd., Hyundai Motor Company, and Volkswagen Group dominate the passenger car segment, adopting DCTs in performance-oriented and mainstream models. Ford Motor Company and General Motors emphasize dual-clutch technology for high-performance vehicles, while Daimler AG (Mercedes-Benz) and Porsche AG lead luxury and sports car applications.

FCA US LLC (Stellantis), Schaeffler Group, Jatco Ltd., and Mitsubishi Motors contribute through innovative transmission components and expanding DCT adoption in diverse vehicle segments. Overall, the competitive landscape is marked by innovation, electrification integration, and evolving regulatory compliance strategies.

Top Key Players

- ZF Friedrichshafen AG

- Getrag (Magna International)

- BorgWarner Inc.

- Aisin Seiki Co., Ltd.

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Volkswagen Group

- Ford Motor Company

- General Motors

- Daimler AG (Mercedes-Benz)

- FCA US LLC (Stellantis)

- Schaeffler Group

- Jatco Ltd.

- Mitsubishi Motors

- Porsche AG

Recent Developments

- In 2025, Stellantis will begin producing 300,000 electrified dual-clutch transmissions (eDCTs) annually at its Termoli plant in Italy. The initiative, set to start in 2026, aims to expand Stellantis’ hybrid vehicle portfolio while addressing uncertainties regarding the site’s potential conversion into an EV battery facility under the ACC joint venture.

- In January 29, 2025, American Axle & Manufacturing (AAM) (NYSE: AXL) has reached an agreement with the board of Dowlais Group plc (LON: DWL) on a proposed acquisition. The deal, valued at approximately $1.44 billion in cash and AAM shares, will see AAM acquire the entire issued and to-be-issued ordinary share capital of Dowlais.

Conclusion

The global dual-clutch transmission (DCT) market is projected to experience significant growth, driven by increasing demand for fuel-efficient and high-performance vehicles. The integration of DCTs in hybrid and electric vehicles, along with advancements in transmission technology, is expected to further propel market expansion. However, challenges such as high manufacturing costs and maintenance complexities may hinder widespread adoption. Nonetheless, opportunities in emerging markets and the aftermarket sector present avenues for growth. Overall, the DCT market is poised for sustained growth, supported by technological advancements and shifting consumer preferences.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)