Table of Contents

Introduction

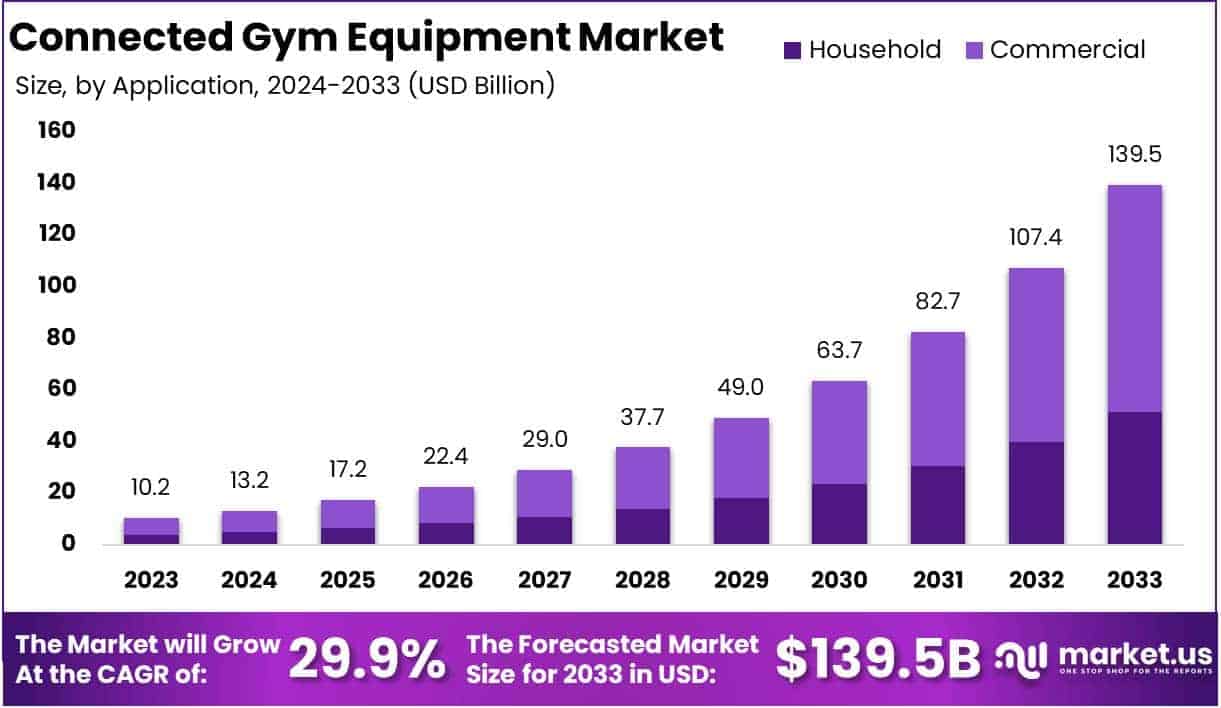

The Global Connected Gym Equipment Market is projected to reach approximately USD 139.5 billion by 2033, up from USD 10.2 billion in 2023, reflecting a compound annual growth rate (CAGR) of 29.9% during the forecast period from 2024 to 2033.

The connected gym equipment market refers to fitness devices integrated with digital technology, enabling real-time tracking, personalized workouts, and remote interaction with trainers or other users. These devices, such as smart treadmills, stationary bikes, and resistance machines, are connected to the internet via apps or wearable devices, offering a more engaging and data-driven fitness experience. The market has seen strong growth due to the increasing adoption of health-conscious lifestyles and advancements in IoT (Internet of Things) technology.

Rising consumer demand for home fitness solutions, as well as the growing focus on personalized and convenient workout experiences, are key drivers. Technological innovations, such as AI and machine learning for adaptive training programs, further fuel market expansion. Additionally, the growth of corporate wellness programs and the increasing popularity of virtual fitness classes present significant opportunities for market players. This dynamic landscape offers vast potential for new products and services that cater to both individual users and businesses.

Key Takeaways

- The Global Connected Gym Equipment Market is expected to experience significant growth, increasing from USD 10.2 Billion in 2023 to an estimated USD 139.5 Billion by 2033, with a remarkable CAGR of 29.9% from 2024 to 2033.

- Cardio Equipment led the market in 2023, capturing 45% of the market share, driven by strong demand for personalized and interactive workout experiences.

- Strength Training and Functional Training Equipment are gaining traction, reflecting growing consumer interest in holistic and data-driven fitness solutions.

- The Commercial segment held a dominant 63% of the market in 2023, fueled by the widespread adoption of connected devices in gyms and corporate wellness programs.

- Online sales dominated the market with a 55% share in 2023, benefiting from the rising influence of e-commerce and digital marketing strategies.

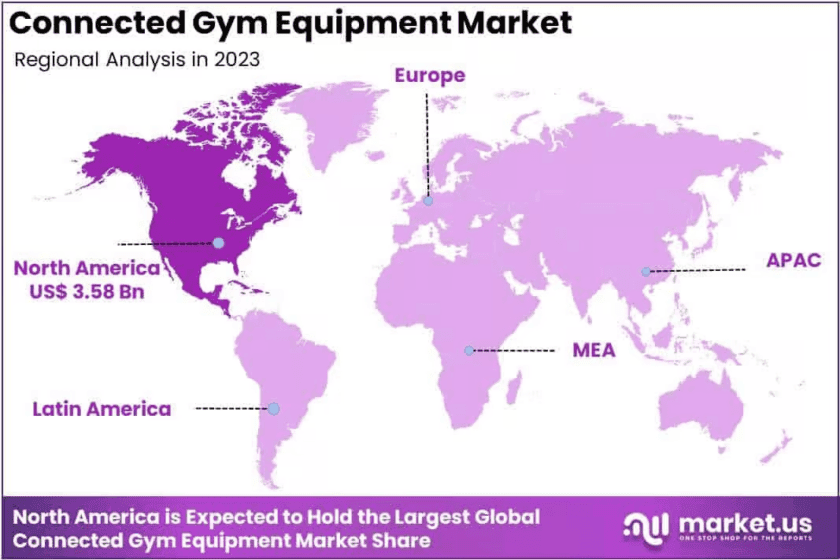

- North America led the regional market with 35.1% of the share in 2023, supported by high levels of technological adoption and a robust fitness culture.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 10.2 Billion |

| Forecast Revenue (2033) | USD 139.5 Billion |

| CAGR (2024-2033) | 29.9% |

| Segments Covered | By Product (Cardio Equipment, Strength Training Equipment, Functional Training Equipment, Others), By Application (Household, Commercial), By Distribution Channel (Online, Offline) |

| Competitive Landscape | Brunswick Corporation, Core Health & Fitness LLC, Draper Inc., EGYM, Johnson Health Tech Co. Ltd., Les Mills International Ltd., Nautilus Inc., Paradigm Health & Wellness, Precor Incorporated, Technogym S.p.A, TRUE Fitness Technology Inc., Other Key Players |

Connected Gym Equipment Statistics

Fitness Equipment Market Overview (2023-2024)

- The global fitness equipment industry is valued at $14.3 billion.

- It grows at a rate of 3.7% annually, slower than the overall fitness and gym sectors.

- The market is expected to reach $14.8 billion by 2025.

- The home fitness segment dominates, making up 84% of the market.

- Functional training equipment is expanding rapidly, with a 47% annual growth.

- Connected gym equipment is the second-fastest growing segment, increasing at 32% per year.

- Consumer products represent 84% of the overall fitness equipment market.

- The commercial fitness equipment market was valued at $2.2 billion in 2023.

- Commercial products make up 16% of the total fitness equipment market.

Yoga Market Growth and Trends

- The number of global yoga practitioners is expected to hit 350 million by 2030.

- Currently, there are approximately 300 million people practicing yoga worldwide.

- Women make up 72% of yoga practitioners, while men account for 28%.

- The largest demographic of yoga practitioners is women aged 30-49.

- More than 84% of U.S. yoga practitioners are under 50 years old.

- Yoga participation in the U.S. is significant among 18-24-year-olds, who make up 16.9% of total practitioners.

- 80.7% of yoga practitioners are female, 51.9% have a college education, and 46.9% are non-smokers.

- Many U.S. yoga practitioners are well-educated with an annual household income over $75,000.

Yoga Participation in the U.S.

- 44% of Americans who practice yoga attend classes 2-3 times a week.

- Most yoga practitioners prefer morning sessions (34%) over evening sessions (18%).

- U.S. yoga participants spend an average of $90 per month on their practice.

- On average, yoga practitioners in the U.S. are willing to pay $40 for a one-time special yoga experience.

- 6% of yogis are willing to spend more than $100 for a memorable yoga experience.

- 37% of U.S. yoga practitioners have been practicing for more than five years.

- 70% of yoga practitioners in the U.S. incorporate yoga as part of their overall wellness routine, which includes mindfulness and meditation.

Yoga Teachers and Studios in the U.S.

- There are approximately 100,000 active yoga teachers in the United States.

- The average salary for a yoga instructor in the U.S. is $45,000 per year.

- 72% of yoga teachers offer both in-person and online classes.

- A typical U.S. yoga studio serves around 200-300 regular students.

Gym Membership Trends and Challenges

- 70.97% of gym members in the U.S. still don’t use their memberships regularly.

- 34.94% of gym members in the U.S. don’t plan on returning, even after vaccination.

- 29.8% of gym members have canceled their memberships since the pandemic, with another 25.76% putting their accounts on hold.

- 24.24% of U.S. gym members are waiting until they, their friends, and family are fully vaccinated before returning.

Fitness Trends in the UK

- In the UK, 32.08% of people go to the gym primarily to lose weight.

Emerging Trends

- Integration with Wearable Devices: Connected gym equipment is increasingly integrating with wearable devices like fitness trackers and smartwatches. This allows users to synchronize their workouts with data on heart rate, calories burned, and performance metrics, offering a more comprehensive view of their fitness journey. Over 60% of fitness enthusiasts are using wearables alongside connected equipment to track their progress seamlessly.

- AI-Powered Personalization: Artificial intelligence is being used to offer personalized workout recommendations based on an individual’s fitness goals, performance, and preferences. This trend is growing rapidly as AI can adapt exercises and adjust intensity levels in real-time. It is estimated that around 45% of gym users now prefer AI-assisted workout plans for more tailored experiences.

- Social Connectivity and Virtual Competitions: Many connected gym equipment platforms are incorporating social features, enabling users to challenge friends, share progress, or join virtual competitions. This gamification of fitness has led to a rise in community-driven workouts, with nearly 40% of users now engaging in online fitness groups or challenges as a part of their routine.

- Subscription-Based Fitness Services: The rise of subscription-based fitness platforms linked to connected gym equipment is another major trend. These platforms provide users with a variety of classes, including yoga, pilates, and strength training, all accessible from home. Over 50% of connected gym equipment users are subscribed to at least one online fitness service.

- Health Data Analytics for Injury Prevention: With the increase in smart gym equipment, there is a growing focus on analyzing performance data to prevent injuries. By tracking form, posture, and muscle fatigue, connected devices can provide real-time feedback to users. This data-driven approach is projected to grow as more gym-goers prioritize injury prevention alongside fitness goals.

Top Use Cases

- Home Fitness and Virtual Workouts: Connected gym equipment enables users to turn their homes into personalized fitness studios. With the rise in at-home fitness, connected devices are offering a variety of on-demand virtual workout classes, which users can participate in anytime. The market for home fitness solutions has grown by more than 30% in the past two years.

- Smart Tracking and Progress Monitoring: Connected gym machines track key metrics like distance, calories burned, heart rate, and repetitions in real time. This data is automatically logged and updated in users’ profiles, allowing them to monitor long-term progress. According to user surveys, about 55% of gym-goers use smart tracking to monitor their fitness progress more efficiently.

- Customization of Workout Programs: Based on the real-time data collected during workouts, connected equipment can adjust the workout intensity, reps, or load automatically. This offers an experience tailored to individual performance levels, preventing overtraining or undertraining. Customization features are available in over 65% of connected fitness equipment on the market.

- Corporate Wellness Programs: Companies are increasingly adopting connected gym equipment to boost employee health and wellness. This trend is seen in workplace fitness programs that offer smart gym equipment for on-site or remote employees, contributing to better overall health and reduced healthcare costs. More than 40% of large enterprises now offer fitness programs that integrate connected gym equipment.

- Virtual Coaching and Real-Time Feedback: Many connected gym devices now offer virtual coaching, with real-time feedback based on users’ performance. This feature helps users adjust their form and technique, improving their results and minimizing the risk of injury. Approximately 30% of users of connected gym equipment report that virtual coaching improves their workout outcomes.

Major Challenges

- High Initial Costs: The advanced technology in connected gym equipment often comes with a higher price tag. This cost barrier is one of the most significant challenges for consumers looking to adopt these technologies. Many pieces of connected equipment can cost up to 3-4 times more than traditional gym machines.

- Data Privacy and Security: Connected gym equipment collects personal data, such as fitness levels, health metrics, and workout habits. Ensuring the security and privacy of this sensitive information is a major challenge. Over 25% of consumers express concerns about how their data is being handled by fitness device companies.

- Integration Issues with Other Devices: Despite the proliferation of connected gym equipment, interoperability between different brands and platforms remains a challenge. Many users face difficulties syncing devices like wearables, fitness trackers, and apps with gym equipment. Around 20% of users report issues with syncing their devices seamlessly.

- Technical Maintenance and Support: With the complexity of connected gym equipment, regular maintenance and technical support are required to ensure they continue functioning properly. A lack of responsive customer support can lead to dissatisfaction, especially as equipment is often out of order for extended periods. An estimated 15% of users face technical issues requiring repairs within the first year of use.

- Limited Access to High-Speed Internet: Many connected gym machines rely on internet access to offer cloud-based features, such as live workouts and virtual coaching. In regions with limited or poor internet connectivity, users may experience disruptions in service or a reduced user experience. This issue is particularly evident in rural or remote areas, where up to 18% of potential customers are unable to fully use connected gym equipment due to poor internet.

Top Opportunities

- Expansion into Emerging Markets: As fitness awareness increases globally, especially in emerging economies, there is a significant opportunity for connected gym equipment companies to expand into these regions. These markets are experiencing rapid urbanization and increasing disposable incomes, leading to a higher demand for advanced fitness solutions.

- Partnerships with Fitness Influencers: The rise of fitness influencers on social media presents an opportunity for connected gym equipment brands to collaborate with popular trainers and content creators. Such partnerships can drive product visibility and influence purchase decisions, especially among younger consumers who rely on social media for fitness inspiration.

- Integration with Health Monitoring Systems: As more people seek to monitor their overall health, there is an opportunity for connected gym equipment to integrate with broader health monitoring systems, such as telemedicine services or insurance programs. This could allow for a more holistic approach to health and fitness, with connected gym equipment being part of a larger wellness ecosystem.

- Sustainability and Eco-Friendly Design: With growing environmental concerns, there is a market opportunity for connected gym equipment manufacturers to focus on sustainable and eco-friendly designs. Offering energy-efficient machines or those made from recyclable materials could resonate with environmentally-conscious consumers, particularly in urban areas.

- Development of Hybrid Fitness Models: As hybrid fitness solutions (combining in-person and virtual experiences) become more popular, there is an opportunity to develop connected gym equipment that bridges the gap between gyms and home fitness. Users would be able to access in-person gym services and virtual workouts on the same platform, creating a seamless fitness experience for those who prefer flexible workout options.

Key Player Analysis

- Brunswick Corporation: Brunswick Corporation is a prominent player in the connected gym equipment market, offering a range of fitness products under the Life Fitness brand. The company is well-known for its innovative solutions, including treadmills, exercise bikes, and strength training equipment integrated with digital fitness platforms. Brunswick’s Life Fitness division is a market leader, with strong growth in both consumer and commercial sectors.

- Core Health & Fitness LLC: Core Health & Fitness LLC is a key player, offering well-known fitness brands like Star Trac, Schwinn, and StairMaster. The company specializes in connected fitness solutions, with advanced workout machines that sync with fitness apps to track progress. Their products are used in commercial gyms and by fitness enthusiasts globally.

- EGYM: EGYM focuses on high-tech strength training equipment and fitness solutions. The company’s products offer smart features like automatic load adjustments and real-time performance tracking, designed to optimize workout efficiency. EGYM’s offerings are widely adopted in fitness centers and by personal trainers globally.

- Johnson Health Tech Co. Ltd.: Johnson Health Tech is a global leader in fitness equipment manufacturing, with a strong presence in both the consumer and commercial markets. Its brands, including Horizon Fitness and Matrix, are renowned for their connected workout equipment, offering advanced tracking and digital connectivity features.

- Technogym S.p.A: Technogym is an Italian company recognized for its high-end fitness equipment, which includes connected solutions such as smart treadmills, bikes, and wellness apps. Technogym’s products are widely used in both gyms and by consumers at home. The company’s commitment to wellness technology has driven significant growth, solidifying its position as a leader in the connected fitness market.

Regional Analysis

The North American region is poised to retain its position as the dominant player in the connected gym equipment market, capturing approximately 35.1% of the global market share in 2023, with a total market value of USD 3.58 billion. This commanding share is driven by the increasing adoption of fitness technology, the high penetration of internet-connected devices, and a well-established fitness culture. The growing preference for at-home fitness solutions, coupled with the region’s advanced technological infrastructure, has spurred substantial demand for connected gym equipment.

In particular, the U.S. holds the largest market share in North America, owing to the presence of major manufacturers and innovators in the fitness technology space, as well as a large, health-conscious population willing to invest in high-quality fitness solutions. The growth of subscription-based fitness services, which complement connected gym equipment, is further bolstering the market’s expansion in this region. Furthermore, the increasing awareness of health and wellness, particularly post-pandemic, has contributed significantly to the surge in demand for innovative and interactive home fitness experiences.

Recent Developments

- In 2025, Beyond Power introduced the VOLTRA I, a compact rack-attached cable system designed to offer up to 200lbs of resistance. This innovative equipment combines eccentric and concentric adjustments in a sleek box that’s roughly the size of a shoe. I had the opportunity to test a pre-release version in July 2023, followed by the production model in January 2024. After rigorous testing over the past year, the VOLTRA I has shown great promise as a game-changer in home fitness.

- In April 1, 2024, EGYM, a global leader in fitness technology and corporate wellness, expanded its presence by acquiring Hussle, a key player in the UK corporate fitness market. This acquisition strengthens EGYM Wellpass, the company’s corporate fitness network, which now provides access to over 1,500 gyms, pools, and spas across the UK through a discounted pass, covering 96% of the country’s postal regions.

- In February 2024, Orangetheory Fitness and Self Esteem Brands announced a merger to create one of the largest fitness and wellness companies globally. The deal, valued at $3.5 billion in systemwide sales, unites a diverse portfolio that includes Orangetheory Fitness, Anytime Fitness, The Bar Method, and several other wellness brands, with around 7,000 franchise locations worldwide.

- Also in February 2024, EGYM partnered with Virtuagym to enhance their fitness offerings. This collaboration integrates Virtuagym’s member management software with EGYM’s ecosystem, creating a seamless experience for fitness clubs and users alike.

- In early 2024, EGYM and Life Fitness deepened their partnership to enhance the cardio experience. Their upcoming “Smart Cardio” integration combines EGYM’s software with Life Fitness’ advanced machines, allowing users to track performance and receive personalized workout recommendations based on real-time data.

Conclusion

The connected gym equipment market is set for remarkable growth, driven by technological advancements, the increasing demand for personalized fitness experiences, and a rising focus on health and wellness. As more consumers seek interactive, data-driven workout solutions, the integration of features like AI personalization, virtual coaching, and seamless connectivity with wearable devices is reshaping the fitness landscape. With growing opportunities in emerging markets and the expanding trend of home fitness, the market presents a dynamic space for innovation and investment. The evolution of connected gym equipment is not just transforming individual workout routines but also shaping the future of fitness as an integrated, technology-driven industry.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)