Table of Contents

Introduction

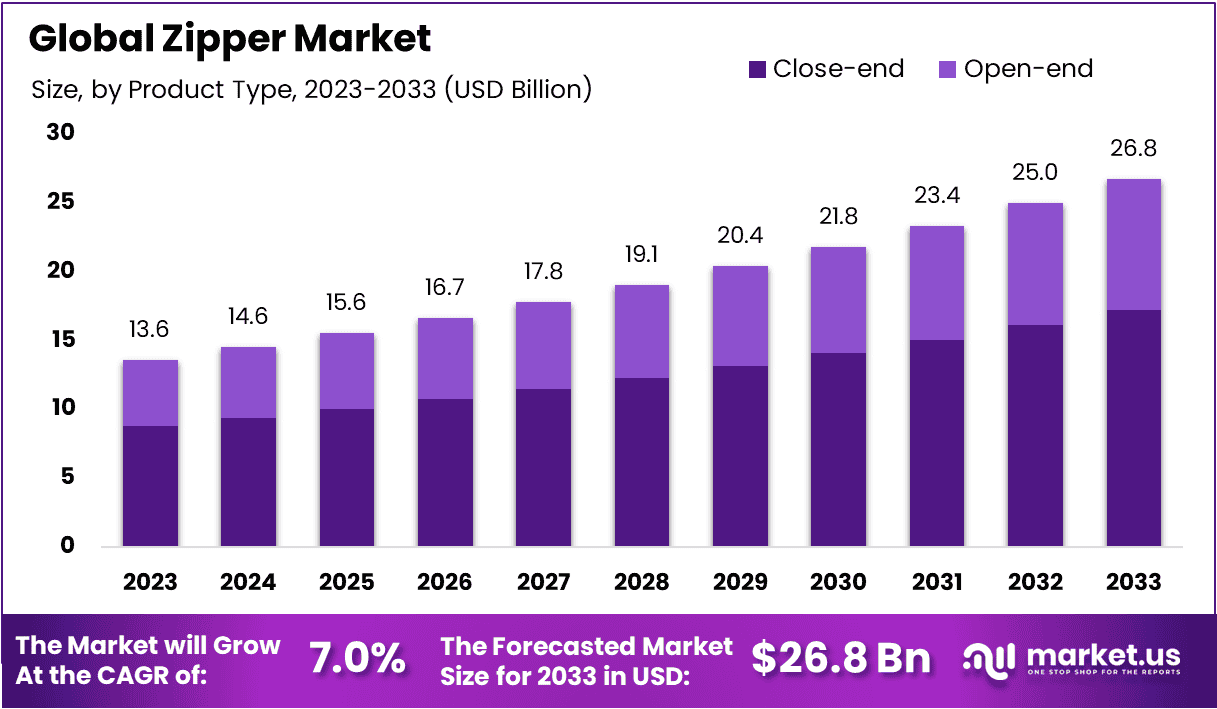

The Global Zipper Market is projected to reach a valuation of approximately USD 26.8 billion by 2033, up from an estimated USD 13.6 billion in 2023. This growth reflects a compound annual growth rate (CAGR) of 7.0% over the forecast period spanning 2024 to 2033.

A zipper is a widely utilized fastening device, designed to seamlessly join two pieces of material while providing easy functionality for opening and closing. Comprised of interlocking teeth or coils and a sliding mechanism, zippers are made from a variety of materials, including metal, plastic, and nylon, depending on their intended application. As a versatile component, zippers are integral to numerous industries, including fashion, luggage, automotive, and outdoor gear, offering both aesthetic appeal and functional utility.

The zipper market refers to the global industry that encompasses the design, manufacturing, and distribution of zippers for various applications. This market spans across key sectors such as apparel, accessories, footwear, and industrial products, with companies innovating to meet evolving consumer preferences and industrial requirements. It also includes high-performance zippers for specialized applications such as waterproof or fire-resistant garments. The market is characterized by a balance of standardized, cost-effective offerings and premium, customized solutions to cater to a diverse range of end-user needs.

The zipper market’s growth is propelled by several key factors. The expanding global apparel industry, driven by rising disposable incomes and fast fashion trends, remains a primary driver. Additionally, increasing demand for travel goods, outdoor equipment, and automotive interiors has created a steady need for durable and functional zippers. Advancements in materials technology, such as lightweight and eco-friendly options, have also fueled innovation in the market. Furthermore, the growing focus on premium quality and performance-enhancing products in sectors like sportswear and outdoor gear continues to enhance market growth.

The demand for zippers is heavily influenced by their ubiquitous application across a wide range of consumer and industrial products. The apparel industry accounts for a significant share of the demand, especially due to the growing popularity of casual wear, denim, and outerwear. Similarly, the luggage and travel accessories segment is witnessing robust demand owing to rising travel and tourism activities worldwide. Additionally, increasing consumer awareness about sustainable products is shifting demand toward eco-friendly zippers, reflecting a broader trend of responsible consumption in the global market.

The zipper market offers numerous growth opportunities driven by innovation and market expansion. Emerging markets in Asia-Pacific, Africa, and Latin America present significant potential for growth due to rapid urbanization, increased disposable incomes, and rising demand for fashion and lifestyle products.

Moreover, the advent of smart textiles and functional garments creates a new avenue for high-tech zippers designed for wearable technology and advanced applications. The sustainability movement also provides opportunities for manufacturers to develop biodegradable or recycled zippers, appealing to environmentally conscious consumers. Partnerships with apparel and accessory brands for co-branded, high-performance zipper solutions further open doors for value-added collaborations, enhancing market competitiveness.

Key Takeaways

- The global zipper market is set to grow from USD 13.6 billion in 2023 to USD 26.8 billion by 2033, at a 7.0% CAGR (2024–2033).

- Close-end zippers dominate with 64.5% share due to their versatile applications.

- Metal zippers lead with 68.5% share, driven by their durability and appeal in premium fashion and outdoor gear.

- Garments hold the largest share (35.6%) owing to consistent demand in apparel and fashion.

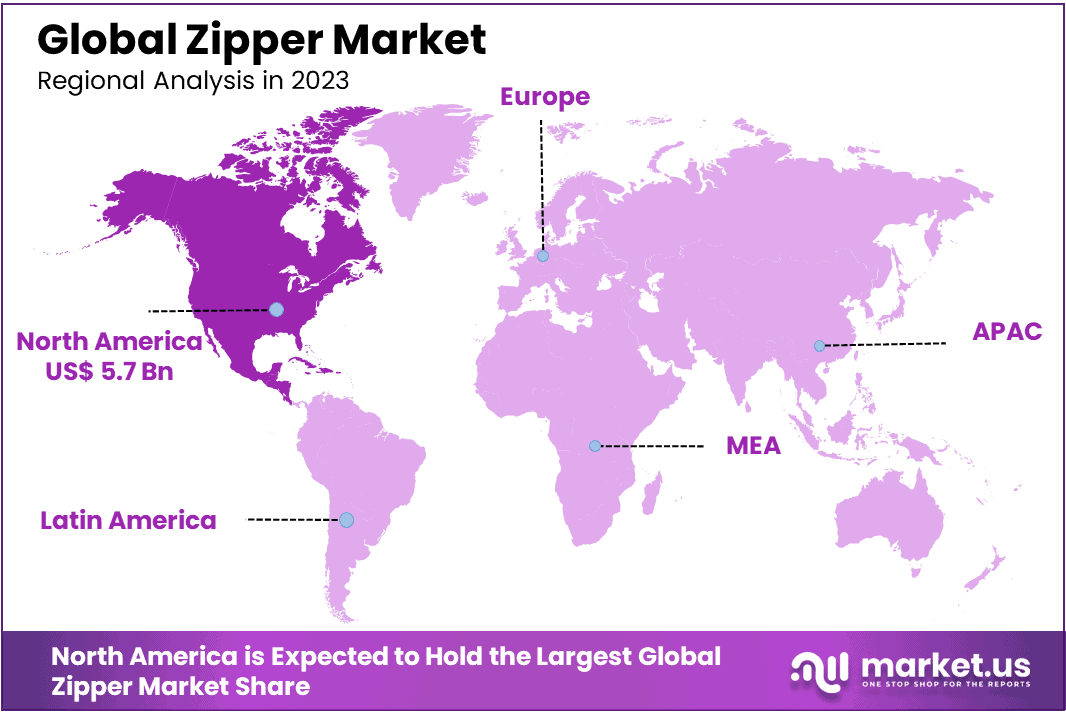

- North America Largest market with b share, driven by strong apparel and luggage industries.

- Europe Accounts for 28.7% share, supported by luxury fashion growth and focus on sustainability.

Zipper Statistics

- YKK controls 46% of the global zipper market.

- Americans use 4.5 billion zippers each year, averaging 14 per person annually.

- YKK produces enough zippers yearly to circle the globe 50 times.

- The Macon, Georgia facility manufactures 65,000 miles of zippers annually.

- YKK operates factories in 71 countries and offers zippers in 9,500 colors.

- The company’s black zippers come in 20 different shades.

- Producing a YKK zipper involves 15 to 50 steps, including copper melting.

- YKK manufactures over 1.5 billion zippers annually with 39,000 employees.

- Recycled plastic zippers save 60% of energy compared to virgin plastic.

- Vietnam imports the most zippers, totaling 1.6 million shipments.

- In February 2024, the U.S. imported 11 zipper shipments from Germany.

- High-quality metal zippers last through 10,000 opening and closing cycles.

- The typical jacket zipper measures between 20 and 25 inches.

Emerging Trends

- Sustainability-Driven Innovation: With rising consumer demand for eco-friendly products, the zipper industry is increasingly adopting sustainable materials like recycled polyester, organic cotton, and biodegradable plastics. This shift aligns with global efforts to reduce environmental footprints. For example, some zipper manufacturers are now incorporating recycled metals and reducing waste in production processes.

- Technological Advancements in Zipper Design: The integration of advanced technologies like laser cutting and precision molding is allowing for the production of high-performance zippers. Waterproof and fire-resistant zippers, often used in outdoor apparel and industrial applications, are growing in popularity. These innovations are meeting specialized consumer needs across diverse sectors.

- Customization and Personalization: Brands are prioritizing customized zipper solutions to enhance product aesthetics and functionality. Options such as customized pullers, varied colors, and logo embossing on zippers are becoming prevalent, particularly in the fashion industry. This trend is enabling greater brand differentiation in a competitive market.

- Growth of Invisible and Seamless Zippers: Invisible and seamless zippers are becoming more common, especially in high-end fashion and home furnishings. These zippers offer improved aesthetics and functionality by blending into the fabric, catering to consumers who prioritize sleek and minimalistic designs.

- Rising Adoption in Smart Clothing and Wearable Tech: Zippers are playing a pivotal role in wearable technology, with innovations such as conductive zippers that connect electronic devices within garments. These advancements are particularly relevant in sportswear, medical wearables, and military gear, contributing to the growing overlap between textiles and technology.

Top Use Cases

- Apparel Industry: Over 70% of zippers produced globally are used in clothing, ranging from jeans and jackets to dresses and skirts. The durability and convenience of zippers make them a staple in garment design, and the growing demand for ready-to-wear fashion continues to drive this application.

- Luggage and Bags: Zippers are critical in the luggage and accessories sector, with millions of bags, backpacks, and suitcases manufactured every year. Water-resistant and heavy-duty zippers are especially popular for ensuring secure and functional storage solutions for consumers on the move.

- Outdoor Gear and Sporting Goods: The outdoor and sportswear markets heavily rely on zippers for products like tents, sleeping bags, and performance apparel. For example, zippers with weatherproof sealing are essential for extreme-weather camping gear, with this sector witnessing a steady rise in demand as outdoor activities gain popularity globally.

- Automotive Interiors: Zippers are widely used in automotive interiors, such as for seat covers, cushions, and compartments. With over 75 million vehicles manufactured globally each year, the automotive sector represents a significant and stable demand for specialized zipper designs.

- Medical and Safety Applications: In the healthcare sector, zippers are used in hospital gowns, mattress covers, and even body bags. Additionally, safety applications such as firefighter uniforms and hazmat suits require flame-retardant and durable zippers, highlighting their critical role in protective gear manufacturing.

Major Challenges

- Price Sensitivity Among Manufacturers: The zipper industry is highly competitive, with manufacturers often struggling to maintain profit margins due to pressure to keep prices low. Zippers account for a small fraction of the total production cost of clothing and accessories, but any increase in cost can deter bulk buyers, particularly in price-sensitive markets.

- Environmental Concerns Over Plastic Zippers: Many zippers, particularly coil zippers, are made from plastic. With over 300 million tons of plastic waste generated annually worldwide, regulatory and consumer scrutiny on plastic-based zippers is intensifying. Companies must invest in biodegradable alternatives to meet sustainability expectations.

- Quality and Performance Issues: Substandard zippers can lead to product failures, damaging brand reputation. Approximately 20-30% of garment defects are attributed to zipper malfunctions, such as jamming or breaking, which can result in returns or recalls for manufacturers.

- Global Supply Chain Disruptions: The zipper market, like many other industries, faces challenges related to global supply chain disruptions, including delays in raw material sourcing and increased logistics costs. For instance, metal shortages and transportation bottlenecks during the COVID-19 pandemic significantly impacted production timelines.

- Counterfeit Products and Intellectual Property Concerns: Counterfeit zippers, which often lack quality and durability, have flooded certain markets. This not only erodes revenue for genuine manufacturers but also raises concerns about product safety and consumer satisfaction, especially in critical applications such as medical or automotive sectors.

Top Opportunities

- Expansion in Emerging Economies: Countries in Asia, Africa, and Latin America represent untapped markets for zipper manufacturers. With rising disposable incomes and growing middle-class populations, the demand for apparel, luggage, and other zipper-dependent products is expected to increase substantially in these regions.

- R&D in Smart Zipper Technologies: There is significant potential in developing smart zippers with integrated functionalities, such as temperature control or health monitoring. These innovations cater to rapidly growing segments like wearable technology and medical textiles, which are projected to grow at double-digit rates in the coming decade.

- Adoption of Circular Economy Models: The zipper industry has opportunities to embrace circular economy principles by producing fully recyclable zippers and establishing take-back programs. This approach aligns with increasing consumer preference for sustainable and eco-friendly products, creating a competitive edge for early adopters.

- Growth in the E-Commerce Sector: The rise of e-commerce has boosted global demand for zippered packaging solutions, particularly in the food and consumer goods industries. Reclosable zippers on plastic bags, for instance, provide added convenience for consumers and are gaining traction in online retail packaging.

- Advancements in Lightweight and Durable Materials: There is increasing demand for lightweight, high-strength zippers for aerospace, automotive, and outdoor gear applications. Innovations in materials, such as carbon fiber and advanced composites, could open up new markets while addressing consumer preferences for lighter, more durable solutions.

Key Player Analysis

- YKK Group: YKK Group is the largest player in the zipper market, holding a significant share due to its unmatched production capacity and global presence. The company produces approximately 10 billion zippers annually and operates in over 70 countries, with manufacturing facilities strategically located to meet global demand. YKK’s focus on quality, innovation, and sustainability has made it a preferred supplier for major fashion brands worldwide. For example, its “Natulon” zippers, made from recycled materials, reflect the company’s commitment to eco-friendly solutions.

- SBS Zipper: Fujian SBS Zipper Science & Technology Co., Ltd., commonly known as SBS Zipper, is a leading Chinese zipper manufacturer that has rapidly gained market prominence, producing over 4 billion zippers annually. The company specializes in providing cost-effective yet high-quality zippers, making it a strong competitor in the mid-range and budget segments. SBS serves both domestic and international markets, with a growing presence in North America and Europe. SBS Zipper’s focus on product variety, including metal, plastic, and invisible zippers, has solidified its market position.

- Ideal Fastener Corporation: Ideal Fastener Corporation is one of the largest privately-owned zipper manufacturers globally, producing over 500 million zippers annually. Headquartered in the United States, Ideal serves clients across the apparel, luggage, and automotive industries, with a notable emphasis on customization. The company supplies zippers to renowned brands such as Victoria’s Secret and Calvin Klein, showcasing its premium product quality. Its production capabilities and tailored solutions give it a competitive edge in niche markets.

- Coats Group plc: Coats Group plc, a UK-based company, is a leading supplier of industrial threads and zippers. It produces approximately 800 million zippers annually and has a strong global footprint, operating in over 50 countries. Coats is known for its innovation in durable and high-performance zippers for industries such as sportswear, outdoor gear, and technical applications. Its recent investments in digital technology and sustainability initiatives, such as using recycled polyester in zipper production, underline its forward-thinking approach.

- Riri Group: Riri Group, based in Switzerland, is a premium zipper manufacturer specializing in luxury and high-end applications. With an annual production of around 60 million zippers, Riri caters to global luxury brands like Gucci, Prada, and Louis Vuitton. The company is known for its precision engineering, elegant designs, and exclusive finishes, which align with the needs of the high-fashion industry. Its focus on innovation and quality control ensures it remains a trusted partner for luxury clients worldwide.

Future Outlook of the Zipper Industry

The zipper industry is poised for innovation-driven growth, fueled by increasing demand across apparel, luggage, automotive, and industrial applications. Recent advancements in sustainable materials, such as biodegradable zippers and recycled polyester, are addressing environmental concerns and aligning with growing consumer preference for eco-friendly products. Major players in the industry are securing strategic investments to innovate and scale operations. For instance, YKK Corporation, a market leader, announced investments in automated manufacturing to enhance production efficiency .

Additionally, funding in smart textiles is driving the integration of zippers with wearable technologies, with notable deals such as Velcro Companies acquiring market assets to diversify fastener solutions. The zipper market benefits from global urbanization trends, which fuel the demand for travel goods and fashion accessories, while collaboration between fashion brands and manufacturers creates opportunities for co-branded innovations. With sustainability and technology at the forefront, the zipper industry is set for sustained transformation.

North America Zipper Market

North America Leads Zipper Market with Largest Market Share at 42.3%

In 2023, North America emerged as the dominant region in the global zipper market, holding a substantial market share of 42.3% and generating revenues of USD 5.7 billion. The region’s dominance can be attributed to a well-established apparel and textile industry, along with rising demand for high-quality, durable fasteners across various sectors such as fashion, automotive, and outdoor gear.

The United States, in particular, plays a pivotal role, driven by its robust consumer base, advanced manufacturing capabilities, and the adoption of innovative zipper technologies. Additionally, the presence of leading global zipper manufacturers in the region strengthens its position as a market leader. With a growing focus on sustainability and product innovation, North America is expected to maintain its competitive edge in the coming years.

Recent Developments

- In 2024, Prada Group reported a 16% year-over-year increase in sales, reaching €1.187 billion in the first quarter. The growth was largely driven by the exceptional performance of Miu Miu, which achieved an 89% sales increase compared to the previous year. This success reflects Prada’s strategic focus on retail excellence, product innovation, and strong customer engagement. Asia-Pacific showed steady growth of 16%, with Japan leading at 46% due to robust domestic and tourist spending. Europe grew 18%, the Middle East rose 15%, and the Americas improved by 5%.

- In 2024, the automation and robotics sector in the U.S. experienced a shift in funding patterns, with investors prioritizing later-stage companies over early-stage ventures. This cautious approach highlights the impact of broader economic uncertainties and a focus on risk mitigation. The trend underscores a realignment of investment strategies as companies seek stability and growth in a challenging financial environment.

- In 2023, Kuraray Co., Ltd., headquartered in Tokyo, participated in the Materials Show in Boston and Portland to showcase its sustainable materials for apparel and sporting goods. The company highlighted innovations such as marine-biodegradable cellulose acetate fiber and MAGIC TAPE™ made from recycled materials. The exhibits reflected Kuraray’s commitment to driving a sustainable future through environmentally conscious products.

- In 2024, Zip secured $190 million in a Series D funding round, raising its valuation to $2.2 billion. Led by BOND, the round also included participation from new investors like DST Global and Adams Street, along with existing backers Y Combinator and CRV. This funding positions Zip for further expansion and innovation in its market.

Conclusion

The global zipper market is poised for steady growth, driven by diverse applications across industries such as apparel, luggage, automotive, and outdoor gear. Innovations in design, sustainability efforts, and advancements in materials are shaping the industry’s trajectory, catering to evolving consumer demands for high-performance, eco-friendly, and customizable solutions. While challenges such as price sensitivity and environmental concerns persist, opportunities in emerging markets, smart technologies, and lightweight materials present significant growth potential. As manufacturers focus on quality, efficiency, and sustainability, the zipper industry is set to remain an integral component of global manufacturing and product development in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)