Table of Contents

Introduction

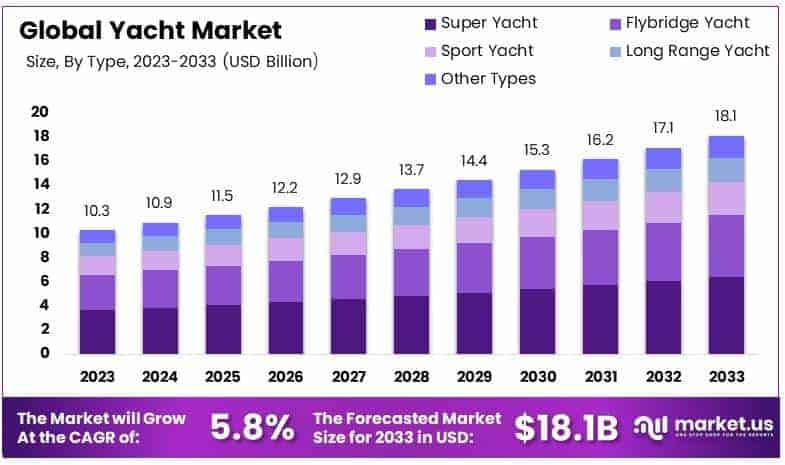

The Global Yacht Market is projected to reach a valuation of USD 18.1 billion by 2033, up from USD 10.3 billion in 2023, reflecting a compound annual growth rate (CAGR) of 5.8% during the forecast period of 2024 to 2033.

A yacht is a luxury watercraft designed for recreational activities, often associated with wealth and prestige. Typically ranging from 30 feet to over 300 feet, yachts can be motorized or sail-powered, offering various levels of luxury and customization. These vessels are equipped with high-end amenities such as lounges, cabins, entertainment systems, and even swimming pools, catering to leisure, sport, or long-distance cruising. The term “yacht” has become synonymous with opulence and exclusivity, making it a prominent symbol of personal luxury and lifestyle.

The yacht market encompasses the global industry for the design, manufacturing, sales, chartering, and maintenance of yachts. It includes diverse segments such as superyachts (over 80 feet), motor yachts, sailing yachts, and expedition yachts, serving private owners, charter companies, and leisure travelers. The market is driven by affluent individuals, tourism growth, and rising disposable incomes in emerging economies. Manufacturers and service providers operate in a competitive environment, focusing on innovation, sustainability, and tailored customer experiences. The market also benefits from adjacent industries, such as marine electronics, luxury goods, and the broader travel and leisure sector.

The yacht market’s growth is fueled by several factors, including increasing disposable incomes among ultra-high-net-worth individuals (UHNWIs), rising interest in leisure and luxury travel, and technological advancements in yacht design and materials. The demand for environmentally sustainable yachts has also gained traction, with manufacturers introducing hybrid engines, solar panels, and eco-friendly interiors. Moreover, the growing popularity of experiential travel, where consumers prioritize unique and memorable experiences, drives the demand for luxury charters and ownership. Economic recovery in post-pandemic scenarios has further accelerated the purchase and chartering of yachts globally.

The demand for yachts is concentrated among UHNWIs and affluent individuals who seek exclusive leisure experiences. Regions such as North America, Europe, and the Asia-Pacific dominate the market, with significant contributions from the Middle East due to a growing population of wealthy consumers. Charter services are also becoming a preferred option for individuals seeking short-term luxury experiences without the long-term commitment of ownership. Additionally, demand is rising for mid-sized yachts, as they offer a balance of luxury and affordability, catering to a broader audience.

The yacht market presents numerous opportunities for growth and innovation. Emerging markets, particularly in Asia and Latin America, offer untapped potential due to increasing wealth and shifting consumer aspirations. Sustainability remains a key area, with rising demand for green technologies, such as electric propulsion systems and energy-efficient designs. Customization and personalization services also represent a lucrative avenue, as affluent buyers seek unique vessels that reflect their tastes and lifestyles. Furthermore, the digitalization of the yacht industry, from smart navigation systems to AI-powered maintenance, is set to transform the customer experience and enhance operational efficiency.

Key Takeaways

- The yacht market was valued at USD 10.3 billion in 2023 and is projected to grow to USD 18.1 billion by 2033, registering a CAGR of 5.8% over the forecast period.

- Super yachts accounted for 30.5% of the type segment in 2023, reflecting their strong demand among high-net-worth individuals and their status as a symbol of luxury.

- Yachts in the 20-50 meter length category dominated the market in 2023, capturing 56% share due to their ideal size for private leisure and charter purposes.

- Motor yachts led the propulsion segment with a commanding 84% share in 2023, favored for their speed and availability in a wide range of sizes to suit different needs.

- Europe emerged as the leading regional market in 2023, holding 33.6% of the global share, driven by its iconic destinations such as Greece and Italy, coupled with a strong tourism sector.

Yacht Statistics

- Superyacht sales declined by 17% in 2023, with vessels over 200 feet experiencing a 40% drop.

- Yachts measuring 20–50 meters dominated the market, accounting for 60% of the share, while smaller yachts up to 20 meters represented 25%, and those over 50 meters made up 15%.

- Croatia led global yacht charter bookings in 2022 with 38%, followed by Greece at 29%.

- Alimos Marina in Athens housed 8% of the global yacht charter fleet, making it the busiest marina.

- Monohull sailboats represented 65% of global charters, while catamarans accounted for 25%.

- Bavaria was the leading yacht brand globally, making up 19% of the fleet, with Lagoon 42 being the most popular model at 4% and Bavaria Cruiser 46 closely following at 3.45%.

- 58% of sailing vessels worldwide were under 5 years old by 2022, reflecting high demand for newer models.

- The term “Yacht Charter” saw an average of 27,000 global monthly searches, with Croatia leading online interest, recording 23,500 searches per month for sailing-related terms.

- New yacht sales up to July 2024 were down 31% compared to the same period in 2023, while used yacht sales fell by 9%.

- Yacht sales in the 40–50 meter range increased, with 30 units sold by mid-2024 compared to 27 in 2023. Sales of yachts between 50–60 meters dropped by 33%, declining from 12 to 8 units.

- Environmental regulations influenced the design of 60% of new yachts launched in 2023.

Emerging Trends

- Adoption of Sustainable Technologies : Environmental concerns are prompting yacht manufacturers to integrate eco-friendly technologies. Innovations such as hydrogen fuel cells and hybrid propulsion systems are becoming more prevalent. For instance, Feadship’s Project 821, launched in May 2024, is the world’s first hydrogen-powered superyacht, utilizing hydrogen fuel cells to reduce carbon emissions. Similarly, Sanlorenzo’s Almax employs a green methanol reformer fuel cell system to generate hydrogen, powering the yacht’s systems with zero carbon dioxide emissions.

- Growth of the Sharing Economy in Yachting : The sharing economy is influencing the yachting sector, with platforms like Click&Boat and Boatsetter facilitating peer-to-peer boat rentals. Click&Boat, for example, offers over 35,000 boats globally, connecting owners with renters seeking cost-effective boating experiences. This model increases accessibility and appeals to a broader audience, including younger demographics interested in yachting without the financial commitment of ownership.

- Integration of Advanced Technologies: Yacht designs are increasingly incorporating advanced technologies to enhance performance and user experience. The use of hydrofoil technology, which lifts the vessel above water at high speeds, reduces drag and improves fuel efficiency. Additionally, the implementation of artificial intelligence (AI) and Internet of Things (IoT) systems enables predictive maintenance and smart navigation, optimizing operational efficiency.

- Expansion into Emerging Markets: The yachting industry is experiencing growth in emerging markets, particularly in Asia and the Middle East. Countries in these regions are investing in marina infrastructure to attract yacht tourism. For example, Indonesia is developing new facilities to cater to luxury yachts, aiming to become a prominent yachting destination. This expansion opens new avenues for yacht manufacturers and service providers to tap into previously underexplored markets.

- Emphasis on Customization and Unique Experiences: There is a growing demand for highly customized yachts that offer unique experiences. Clients are seeking personalized designs and features that reflect their preferences and lifestyles. Innovations like the Migaloo M5, a 500-foot submersible superyacht equipped with luxury amenities such as a spa and helipad, exemplify this trend. This vessel can submerge completely, offering an unparalleled yachting experience

Top Use Cases

- Private Leisure and Recreation: Yachts are primarily used for private leisure, offering a platform for cruising, fishing, and water sports. These vessels serve as floating retreats, enabling personalized experiences for owners and their guests. The rise in recreational boating registrations highlights the popularity of yachts in personal lifestyle choices.

- Charter Services: The demand for yacht charters is rising, driven by travelers seeking short-term access to luxury vessels without the financial burden of ownership. Chartering provides tailored experiences, catering to diverse preferences, from adventure seekers to high-end relaxation enthusiasts.

- Corporate Events and Incentives: Yachts are increasingly used for hosting corporate events, such as strategy meetings, team-building retreats, and client entertainment. The exclusivity and privacy of a yacht make it an ideal choice for businesses looking to impress or connect with stakeholders in a unique setting.

- Research and Exploration: Expedition yachts equipped with advanced navigation and research tools are used for oceanographic studies, underwater archaeology, and biodiversity exploration. These vessels often operate in extreme environments, such as polar regions, supporting both scientific missions and eco-tourism initiatives.

- Luxury Hospitality and Tourism: The yachting industry is merging with luxury tourism, with hotel brands launching their own yachts to provide high-end, all-inclusive experiences at sea. These ventures cater to affluent travelers, combining five-star amenities with the allure of nautical adventure.

Major Challenges

- Rising Operational Costs: Operating a yacht has become increasingly expensive due to higher fuel prices, maintenance expenses, and crew salaries. For instance, the average annual operating cost of a 60-meter superyacht is approximately $3.1 million, accounting for about 10-15% of the yacht’s value. These escalating costs can deter potential buyers and strain existing owners.

- Environmental Regulations and Sustainability Concerns: The industry is under pressure to reduce its environmental footprint. Superyachts contribute significantly to greenhouse gas emissions, with the top 300 superyachts emitting nearly 285,000 tons of CO₂ annually, surpassing the total emissions of some small countries. Compliance with stricter environmental regulations necessitates investment in greener technologies, which can be costly and complex to implement.

- Limited Marina Infrastructure: The growing number of large yachts has led to a shortage of suitable berths. In popular destinations like the South of France, securing a berth for a 100-meter yacht can cost millions of euros, and waiting lists are common. This scarcity hampers the industry’s ability to accommodate the increasing fleet of superyachts.

- Impact of Geopolitical Events: Geopolitical tensions and sanctions have affected yacht sales and ownership. For example, sanctions on Russian oligarchs led to a 17% decline in superyacht sales in 2023, with only 203 new superyachts sold compared to 245 in 2022. Such events create market volatility and uncertainty.

- Skilled Labor Shortages: The industry faces a shortage of skilled labor, including experienced crew members and specialized craftsmen. This gap affects the quality of service and the timely delivery of new yachts. Efforts to address this issue include training programs and initiatives to attract talent to the maritime sector.

Top Opportunities

- Expansion into Emerging Markets: The Asia-Pacific region, particularly countries like China and India, is experiencing a rise in high-net-worth individuals. This demographic shift presents a significant opportunity for yacht manufacturers and service providers to tap into new customer bases. Developing localized marketing strategies and establishing regional partnerships can facilitate market entry and growth.

- Development of Eco-Friendly Yachts: With increasing environmental awareness, there is a growing demand for sustainable yachting options. Investing in the development of yachts powered by alternative energy sources, such as electric or hybrid propulsion systems, can attract environmentally conscious consumers and comply with stricter environmental regulations.

- Enhancement of Yacht Charter Services: The sharing economy has influenced consumer behavior, leading to a preference for experiences over ownership. Expanding yacht charter services, including fractional ownership models, can make yachting more accessible to a broader audience. Offering flexible charter packages and personalized experiences can cater to diverse customer preferences.

- Integration of Advanced Technologies: Incorporating advanced technologies like artificial intelligence, Internet of Things (IoT), and automation can enhance the safety, efficiency, and user experience of yachts. For example, implementing smart navigation systems and predictive maintenance can reduce operational costs and improve customer satisfaction.

- Expansion of Yacht Tourism Infrastructure: Investing in the development of marinas and related infrastructure in underutilized coastal areas can boost yacht tourism. Enhancing facilities and services in these regions can attract yacht owners and charterers, stimulating local economies and creating new business opportunities within the industry.

Key Player Analysis

- Alexander Marine International Co., Ltd.: Alexander Marine, the parent company of Ocean Alexander Yachts, is a Taiwanese yacht manufacturer renowned for its luxury motor yachts. In 2023, the company reported annual revenue of TWD 6.33 billion, reflecting a 13.85% growth from the previous year. This growth underscores Alexander Marine’s expanding presence in the global yacht market.

- Princess Yachts Limited: Based in Plymouth, England, Princess Yachts is a leading builder of luxury motor yachts. In 2022, the company reported revenue of £315.2 million. Despite facing operational challenges, Princess Yachts maintains a solid order book, indicating sustained demand for its products.

- Viking Yacht Company : Viking Yacht Company, headquartered in New Jersey, USA, specializes in high-performance sportfishing and cruising yachts. The company is recognized for its innovation and quality craftsmanship, contributing to its strong market position. Specific financial data for Viking Yacht Company is not publicly disclosed.

- Heesen Yachts Sales B.V.: Heesen Yachts, located in the Netherlands, is renowned for its custom-built superyachts. The company has delivered over 170 yachts since its inception, with a total length exceeding 5,100 meters. Heesen’s commitment to innovation and quality has solidified its reputation in the luxury yacht sector.

- Ferretti S.p.A: Ferretti Group, an Italian masses several prestigious yacht brands, including Ferretti Yachts, Riva, and Pershing. In 2022, the group reported consolidated revenues of €1.03 billion, marking a 15% increase from the previous year. This growth reflects the group’s strong market presence and diversified portfolio.

Recent Developments

- In 2023, Ferretti Group acquired a 70,000-square-meter production site in San Vitale, Ravenna, for an initial investment of €40 million. The project includes an additional €40 million investment over three years to expand production and establish an R&D center, increasing capacity by 20%. The acquisition was funded by equity raised through the company’s Hong Kong stock exchange listing.

- In 2024, Fincantieri and Crystal finalized an order for a high-end cruise ship under a prior agreement announced in June. The deal, valued as significant, is subject to financing and other terms, showcasing the continued collaboration between the two companies.

- In 2024, Volvo Penta and Azimut earned an MRH Innovation & Sustainability Award for developing a hybrid-electric propulsion system for the Azimut Seadeck 7 yacht. This pilot project combines Volvo Penta’s IPS propulsion with hybrid power, advancing marine electrification.

- In March 2024, Sanlorenzo S.p.A. completed the acquisition of 95% of Simpson Marine Limited for $10 million, with a potential $7 million earn-out based on 2023 performance. Simpson Marine reported pro-forma EBITDA of $6.5 million and net income of $4.5 million in 2023. Final figures will be confirmed after financial audits by April 2024.

Conclusion

The global yacht market is poised for significant growth, driven by increasing disposable incomes among high-net-worth individuals and a rising interest in luxury leisure activities. Advancements in sustainable technologies, such as hybrid propulsion systems and eco-friendly materials, are reshaping the industry to meet environmental standards and consumer preferences. The expansion into emerging markets, particularly in Asia and the Middle East, presents new opportunities for manufacturers and service providers. However, challenges such as rising operational costs, stringent environmental regulations, and limited marina infrastructure may impact market dynamics. To capitalize on growth prospects, stakeholders should focus on innovation, sustainability, and enhancing customer experiences to navigate the evolving landscape of the yacht industry.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)