Table of Contents

Introduction

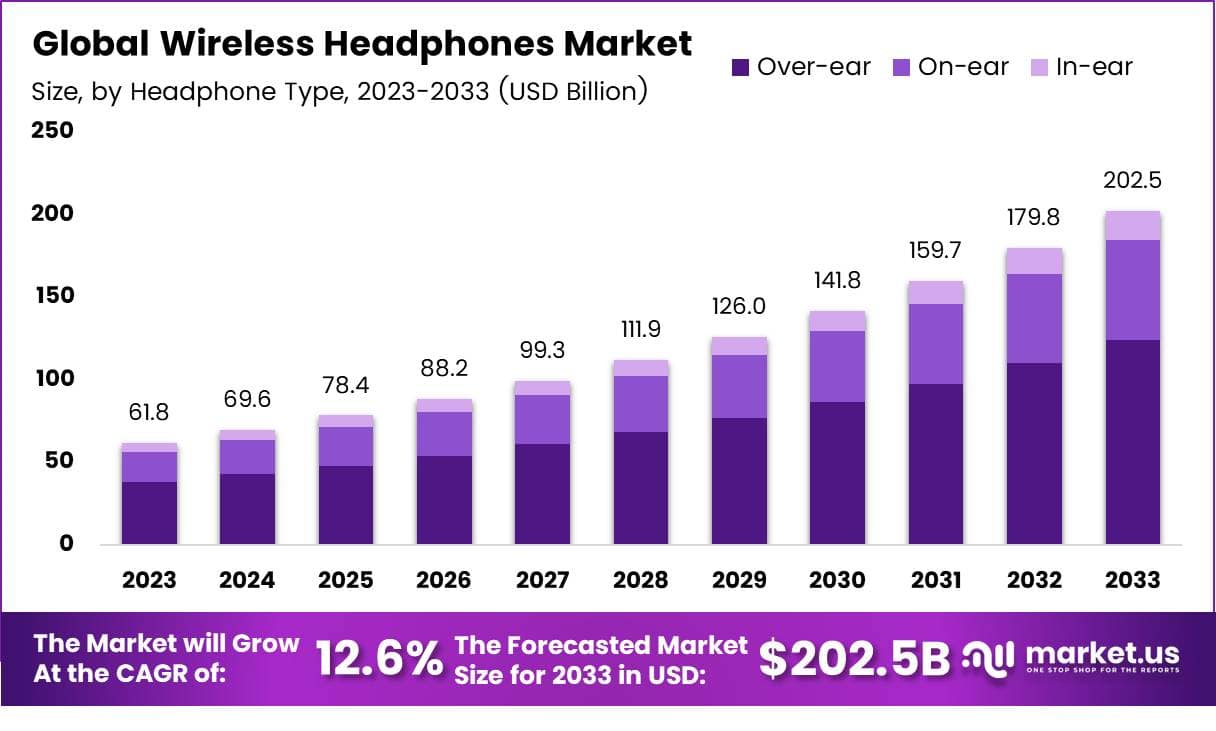

The Global Wireless Headphones Market is projected to reach approximately USD 202.5 billion by 2033, increasing from an estimated USD 61.8 billion in 2023. This growth is anticipated to occur at a compound annual growth rate (CAGR) of 12.6% during the forecast period from 2024 to 2033.

Wireless headphones are audio devices that transmit sound signals via wireless technologies such as Bluetooth, radio frequency (RF), or infrared (IR), eliminating the need for physical cables. These headphones offer mobility, convenience, and compatibility with a wide range of electronic devices including smartphones, tablets, smart TVs, gaming consoles, and laptops. The wireless headphones market refers to the global industry that encompasses the design, development, production, and sale of these products, catering to various consumer segments such as fitness enthusiasts, gamers, audiophiles, and business professionals.

The market has witnessed substantial expansion in recent years, driven by the growing penetration of smartphones, rapid adoption of smart wearable technologies, increasing preference for untethered audio experiences, and technological advancements in Bluetooth connectivity, active noise cancellation, and voice assistant integration. Demand has been further fueled by consumer lifestyle shifts towards convenience and portability, alongside the rising trend of remote work and online education that has amplified the need for high-quality audio accessories. Moreover, the popularity of streaming services, mobile gaming, and podcast consumption is contributing to sustained market growth.

Opportunities lie in the integration of AI-driven features, low-latency audio transmission, and enhanced battery performance, which are expected to attract technologically inclined consumers. Emerging markets in Asia-Pacific and Latin America present lucrative prospects due to growing urbanization, increasing disposable incomes, and expanding smartphone user bases. Additionally, product diversification across price segments and collaborations between audio brands and tech giants are anticipated to foster innovation and widen consumer reach, thereby accelerating market growth over the forecast period.

Key Takeaways

- The global wireless headphones market is expected to reach USD 202.5 billion by 2033, expanding at a CAGR of 12.6% from 2024 to 2033, indicating sustained growth driven by technological advancements and rising audio consumption.

- Over-ear headphones led the market in 2023, capturing a 47.9% share, primarily due to their superior sound quality, enhanced noise cancellation features, and comfort for extended use.

- Bluetooth connectivity emerged as the dominant mode in 2023, favored for its reliability, low energy consumption, and wide device compatibility, establishing it as the preferred standard for wireless audio transmission.

- The Music & Entertainment segment held the largest application share in 2023, underpinned by growing consumer expectations for high-quality, immersive audio experiences across streaming and gaming platforms.

- Online distribution channels remained the leading sales avenue in 2023, supported by the expansion of e-commerce platforms and consumer preference for convenience, product variety, and competitive pricing.

- The Asia-Pacific region accounted for approximately 40% of the global market in 2024, with a market valuation of USD 24.7 billion, driven by a large tech-savvy population, increasing disposable income, and widespread mobile device penetration.

Tariffs and Trade Policy Uncertainty Could Imapct on, Request A Sample Copy Of This Report at https://market.us/report/wireless-headphones-market/request-sample/

Wireless Headphones Statistics

Audio Quality as the Top Requirement

75% of respondents prioritize audio quality when choosing new headphones. This feature stands out as the most important consideration for users.

Common Headphone Usage

- 87% of people in the U.S. use headphones for listening to music.

- 49% use headphones for watching movies or TV shows.

- 36% use them for listening to the radio.

- 28% wear headphones to listen to audiobooks.

- 25% use them for phone calls.

- 9% use headphones for working with sound.

Average Headphone Usage Per Week

Young adults aged 19–29 years are the top users of headphones, averaging 7.8 hours of use per week.

Daily Headphone Usage

Survey participants on average wear headphones for at least 2 hours per day. Among them:

- 80% use headphones between 30 minutes and 2 hours per day.

- 20% use headphones for 3 or more hours per day.

Reasons for Wearing Headphones

- 47% of users wear headphones to avoid their environment.

- 42% use headphones to signal they want to be left alone.

- 20% wear them to avoid distraction at work.

- 20% view headphones as a fashion accessory.

- 23% of respondents said they never use headphones.

Emerging Trends

- Auracast Technology Adoption: The introduction of Auracast, a new Bluetooth technology, enables multiple users to connect their wireless headphones to a single device, enhancing shared listening experiences in public venues like gyms and airports.

- Bone Conduction Headphones: Bone conduction technology is gaining traction, especially among athletes and outdoor enthusiasts, as it allows users to hear ambient sounds while listening to audio, enhancing safety during activities like running and cycling.

- Integration with Smart Home Ecosystems: Wireless headphones are increasingly being designed to integrate seamlessly with smart home devices and IoT ecosystems, allowing for hands-free control and enhanced user experiences.

- Biometric Sensor Integration: Manufacturers are incorporating biometric sensors, such as heart rate monitors, into wireless headphones, catering to the growing demand for health and fitness tracking features.

- Expansion in Emerging Markets: Emerging markets, particularly in Asia-Pacific, are witnessing rapid growth in wireless headphone adoption, driven by increasing disposable incomes and a growing tech-savvy population.

Top Use Cases

- Fitness and Sports: Wireless headphones with features like sweat resistance and secure fit are widely used during workouts and outdoor activities, providing users with freedom of movement and durability.

- Gaming: Low-latency audio transmission and noise-canceling microphones in wireless headphones enhance gaming experiences by providing immersive sound and clear communication.

- Virtual Meetings: The rise of remote work has increased the demand for wireless headphones with high-quality microphones and noise cancellation, facilitating effective virtual communication.

- Travel and Commuting: Features like active noise cancellation and long battery life make wireless headphones ideal for travelers and commuters seeking uninterrupted audio experiences.

- Augmented Reality (AR) Applications: Bone conduction headphones are being explored for AR applications, allowing users to receive audio cues without blocking environmental sounds, enhancing situational awareness.

Major Challenges

- Connectivity Limitations: Standard wireless headphones often have a limited range of approximately 33 feet, which can restrict user mobility and affect the listening experience.

- Battery Life Constraints: Despite advancements, battery life remains a concern, especially for users requiring extended usage without frequent recharging.

- Price Sensitivity: Intense competition and a wide range of available options make consumers highly price-sensitive, challenging manufacturers to balance cost and quality.

- Health Concerns: Prolonged use of wireless headphones at high volumes can lead to hearing damage, and concerns about electromagnetic field exposure persist among certain user groups.

- Market Saturation: The influx of numerous brands and models has led to market saturation, making it difficult for new entrants to establish a foothold without significant differentiation.

Top Opportunities

- Integration with Smart Home Devices: Developing wireless headphones that seamlessly connect with smart home systems presents an opportunity to enhance user convenience and control.

- Professional and Specialized Applications: Expanding into sectors like aviation, virtual reality, and professional audio production can open new markets for wireless headphone manufacturers.

- Biometric Monitoring Features: Incorporating health monitoring capabilities, such as heart rate and calorie tracking, can attract health-conscious consumers seeking multifunctional devices.

- Emerging Wireless Technologies: Adopting new wireless technologies like Bluetooth LE Audio and Wi-Fi 6 can improve audio quality, reduce latency, and enhance power efficiency.

- Customization and Personalization: Offering customizable features and personalized designs can cater to individual preferences, providing a competitive edge in a crowded market.

Key Player Analysis

The competitive landscape of the global wireless headphones market in 2024 is characterized by the presence of both consumer electronics giants and niche audio specialists. Apple Inc. continues to lead through its AirPods line, integrating seamless ecosystem compatibility and technological innovation. Sony Corporation and Bose Corporation maintain strong market positions with their advanced noise-cancellation features and premium sound profiles, catering to both audiophiles and general consumers.

Sennheiser electronic GmbH & Co. and Bang & Olufsen remain influential in the high-end segment, offering superior audio fidelity and sophisticated design. Skullcandy, JLab Audio, and Wicked Audio Inc. appeal to younger demographics with affordable, style-forward products. Jabra excels in combining audio quality with productivity features, particularly in enterprise and fitness segments.

AfterShokz distinguishes itself through bone-conduction technology, targeting safety-conscious users. V-MODA LLC and Master & Dynamic leverage premium materials and craftsmanship, reinforcing their brand appeal. Harman International Industries Inc. strengthens its position through diversified offerings under JBL and other sub-brands.

Purchase The Full Report Now at https://market.us/purchase-report/?report_id=135631

Top Key Players in the Market

- Skullcandy

- Wicked Audio Inc.

- Master & Dynamic.

- Jabra

- JLab Audio

- Harman International Industries Inc.

- Sony Corporation

- Sennheiser electronic GmbH & Co

- Apple Inc.

- Bose Corporation

- AfterShokz

- V-MODA LLC

- Bang & Olufsen

Regional Analysis

Asia-Pacific Leads the Wireless Headphones Market with Largest Market Share of 40% in 2024

The Asia-Pacific region emerged as the leading contributor to the global wireless headphones market, accounting for the largest market share of approximately 40% in 2024. The region’s wireless headphones market was valued at USD 24.7 billion, making it the most significant revenue generator in the global landscape. This dominance is primarily driven by rapid urbanization, rising disposable incomes, and the expanding middle-class population across key countries such as China, India, Japan, and South Korea.

Increased smartphone penetration, coupled with a growing preference for wireless and Bluetooth-enabled audio devices, has accelerated market growth. Furthermore, the proliferation of music streaming platforms, online gaming, and content consumption on digital platforms has spurred the demand for high-quality, wire-free audio products among consumers.

China continues to play a pivotal role as a major manufacturing and consumption hub, supported by local giants and global brands investing heavily in product development and retail expansion. India’s youthful demographic and the increasing affordability of wireless headphones through e-commerce platforms have also significantly contributed to regional growth.

In addition, government initiatives supporting digital transformation and 5G rollout across several Asia-Pacific economies have enhanced consumer access to wireless devices, further strengthening market expansion. The strong presence of both premium and budget-friendly product segments enables a wider consumer base, thereby maintaining Asia-Pacific’s leadership position in the wireless headphones market.

Recent Developments

- In 2024, Apple introduced its latest AirPods 4 lineup with a fresh design and enhanced features. Two versions were revealed—AirPods 4 and AirPods 4 with Active Noise Cancellation (ANC). Both models come with an open-ear fit designed for better comfort and audio experience. The AirPods Max series also received new color options such as midnight, starlight, blue, purple, and orange. Apple upgraded the charging system to USB-C, making it more convenient for users.

- In 2024, the U.S. FDA gave approval for the first software-based over-the-counter hearing aid feature. This technology is designed to work with select versions of Apple’s AirPods Pro. Once set up, it allows users to amplify sound, providing support for those with hearing challenges. The feature is meant for adults aged 18 and above with perceived hearing loss.

- In 2024, JBL launched the Tour Pro 3, following the earlier success of the Tour Pro 2. The new wireless earbuds include a larger display on the smart charging case with new controls. The earbuds feature a dual driver setup for rich sound quality and support the LDAC codec. Additional improvements include JBL Spatial 360 audio with head tracking and adaptive ANC for a more immersive and personalized audio experience.

Conclusion

The global wireless headphones market is poised for sustained growth, driven by continuous technological advancements and evolving consumer preferences. Innovations such as AI integration, biometric monitoring, and enhanced connectivity features are transforming wireless headphones into multifunctional devices that cater to diverse user needs. The increasing adoption of smart devices, coupled with the rising demand for high-quality audio experiences, is further propelling market expansion. Additionally, the proliferation of e-commerce platforms and the growing popularity of online shopping are making wireless headphones more accessible to a broader consumer base. As manufacturers continue to innovate and diversify their product offerings, the wireless headphones market is expected to maintain its upward trajectory in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)