Table of Contents

Overview

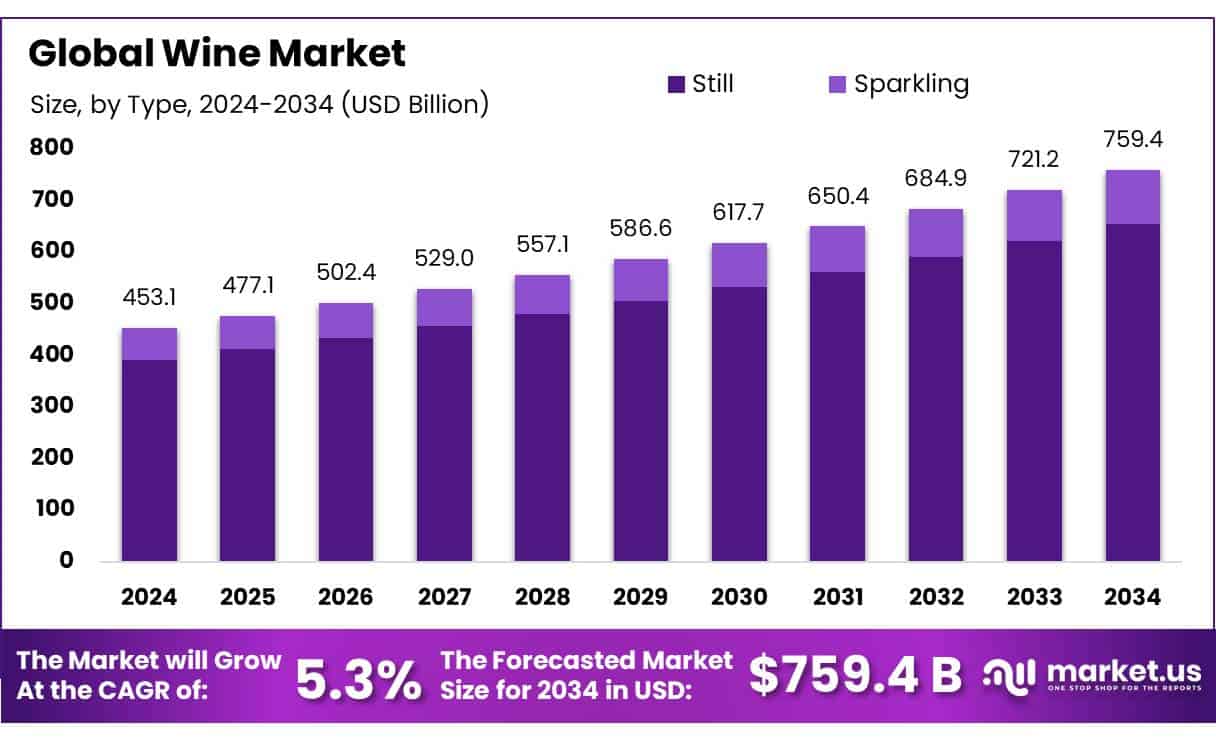

New York, NY – May 08, 2025 – The global Wine Market is experiencing steady growth, driven by increasing consumer demand and evolving preferences. In 2024, the market was valued at USD 453.1 billion and is projected to reach USD 759.4 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.3% from 2025 to 2034.

In 2024, still wine commanded an 86.3% market share, underscoring its enduring popularity. white wine captured a 52.2% market share, favored for its light, refreshing character and ability to pair with diverse cuisines, including seafood and poultry. Cabernet Sauvignon secured an 18.4% market share, celebrated for its bold flavors and aging potential. Off-trade channels, including supermarkets and specialty stores, accounted for 68.5% of wine sales. Women held a 54.3% share of the wine market, reflecting their significant influence.

US Tariff Impact on Market

The U.S. is the fourth-largest wine-producing nation in the world, but still doesn’t produce enough to slake the thirst of American wine lovers. Instead, every year, the U.S. imports around 37% of the wine it consumes, about 5 times more than it exports. This analysis was conducted by Rafael del Rey, an international wine economist and founder of Del Rey Analysts of Wine Markets.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/global-wine-market/request-sample/

Headquartered in the EU and with more than 30 years of experience analyzing the global wine trade, he has recently published a report on the impact of the potential 200% tariffs the Trump administration has threatened on E.U. wine exports, as well as strategies businesses can adopt. Given that 72.3% of the imported wine to the U.S. comes from EU countries, the potential 200% tariff increase would make it nearly impossible for distributors and consumers to continue purchasing them at the new prices, states del Rey in an online interview.

Key Takeaways

- Wine Market size is expected to be worth around USD 759.4 Bn by 2034, from USD 453.1 Bn in 2024, growing at a CAGR of 5.3%.

- Still wine held a dominant market position, capturing more than an 86.3% share.

- White wine maintained its strong market presence, capturing more than a 52.2% share.

- Cabernet Sauvignon held a dominant market position, capturing more than an 18.4% share.

- Off-trade distribution channels firmly held the reins of the wine market, accounting for more than 68.5% of the total market share.

- Bottles continued to be the preferred packaging type in the wine market, securing a dominant 93.7% share.

- 36-45 years age group held a dominant position in the wine market, capturing more than a 34.5% share.

- Female end-users held a dominant market position in the wine industry, capturing more than a 54.3% share.

- European wine market continued to assert its dominance, capturing a substantial 43.3% of the global market share, valued at approximately USD 196.1 billion.

Analyst Viewpoint

The global Wine Market is rising demand for premium and organic wines. Investment opportunities shine in sustainable wineries, particularly those producing organic and biodynamic wines. Industry professionals anticipate growth in high-end segments like Piedmont and Champagne. Emerging markets like China offer exciting prospects for international brands.

Investors should focus on wineries embracing climate-resilient practices and digital sales channels to mitigate these challenges. Consumer insights reveal a shift toward health-conscious and experiential drinking. Younger consumers, especially Millennials and Gen Z, are driving demand for low-alcohol and non-alcoholic wines, with non-alcoholic wine sales.

They crave authenticity, favoring brands with sustainable stories and unique varietals from regions like Oregon or Argentina. Technology is transforming the industry, and AI-driven vineyard management and AR-enhanced labels are boosting efficiency and engagement. Yet, the regulatory environment remains tricky. Stricter labeling laws and health warnings in markets like the US and EU demand quick compliance, especially for smaller wineries.

Report Scope

| Market Value (2024) | USD 453.1 Billion |

| Forecast Revenue (2034) | USD 759.4 Billion |

| CAGR (2025-2034) | 5.3% |

| Segments Covered | By Type (Still, Sparkling), By Color (White, Red, Rose Wine), By Grape Variety (Cabernet Sauvignon, Merlot, Airen, Tempranillo, Chardonnay, Syrah, Grenache, Sauvignon Blanc, Trebbiano Toscana, Others), By Distribution Channel (On-trade, Off -trade), By Packaging Type (Bottles, Cans), By Age Group (18-25 Years, 26-35 Years, 36-45 Years, Above 46 Years), By End-User (Male, Female) |

| Competitive Landscape | E. & J. Gallo Winery, Constellation Brands Inc., The Wine Group LLC, Pernod Ricard, Lagfin SCA, Treasury Wine Estates Limited, Bronco Wine Company, Foley Family Wines, Bacardi Limited, Symington Family Estates, Madeira Wine Company SA, Bronco Wine Co., Casella Family Brand, Constellation Brands, Inc., Henkell Freixenet |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=145409

Key Market Segments

By Type

- In 2024, still wine commanded an 86.3% market share, underscoring its enduring popularity. Its versatility, diverse flavor profiles, and suitability for both casual and formal occasions solidify its position as the preferred choice among consumers, reinforcing its leadership in the wine market across varied demographics.

By Color

- In 2024, white wine captured a 52.2% market share, favored for its light, refreshing character and ability to pair with diverse cuisines, including seafood and poultry. Its widespread appeal in social and dining settings cements its status as a consumer favorite.

By Grape Variety

- In 2024, Cabernet Sauvignon secured an 18.4% market share, celebrated for its bold flavors and aging potential. Its adaptability and complex profile make it a top choice among wine enthusiasts for both everyday enjoyment and special occasions.

By Distribution Channel

- In 2024, off-trade channels, including supermarkets and specialty stores, accounted for 68.5% of wine sales. Offering a broad selection and competitive pricing, these outlets cater to consumers’ preference for convenience and variety, a trend likely to persist into 2025.

By Packaging Type

- In 2024, bottled wine held a 93.7% market share, reflecting its role as the preferred packaging for quality and aging. Its traditional appeal and association with premium wine experiences continue to make bottles the industry standard.

By Age Group

- In 2024, the 36-45 age group accounted for 34.5% of the wine market, fueled by refined palates and greater purchasing power. Their preference for premium, complex wines highlights their influence on market trends.

By End-User

- In 2024, women held a 54.3% share of the wine market, reflecting their significant influence. Their diverse preferences and growing engagement drive demand for varied, high-quality wines, shaping industry offerings and marketing strategies.

Regional Analysis

- The European wine market solidified its global leadership, commanding a 43.3% share valued at approximately USD 196.1 billion. This dominance is rooted in the region’s rich wine heritage and its reputation for crafting world-class wines. Key producers like France, Italy, and Spain drive the majority of Europe’s wine production, shaping global trends and standards.

- Europe’s market strength stems from advanced winemaking techniques, vast vineyard coverage, and diverse geography, enabling a broad spectrum of wine styles and flavors. Ideal climates and fertile soils further enhance the region’s ability to produce internationally acclaimed wines.

- Strong regulatory systems, including Protected Designation of Origin (PDO) and Protected Geographical Indication (PGI), ensure quality and authenticity, boosting consumer trust and the global appeal of European wines. Consumer preferences in Europe are shifting toward premium and sustainable wines, fueled by rising disposable incomes and a focus on provenance and eco-friendly practices.

Top Use Cases

- Premiumization Trend: Consumers are increasingly choosing high-quality, premium wines, valuing craftsmanship and unique flavors. This shift is driven by younger drinkers in emerging markets seeking sophisticated experiences, boosting demand for super-premium and organic wines, which offer higher profit margins for producers.

- Sustainable Wine Demand: Eco-conscious consumers prefer organic and biodynamic wines, reflecting a focus on health and environmental concerns. Wineries adopting sustainable practices, like compostable packaging, attract these buyers, enhancing brand loyalty and market share in a competitive landscape.

- E-Commerce Growth: Online wine sales are surging, driven by convenience and personalized subscriptions. Digital platforms allow wineries to reach consumers directly, offering tailored recommendations based on preferences, which increases customer engagement and boosts off-trade sales.

- Wine Tourism Surge: Vineyard visits and tastings are gaining popularity, offering immersive experiences. Consumers, especially millennials, seek to learn about winemaking, driving tourism revenue for wineries and strengthening brand loyalty through memorable, hands-on interactions.

- Social Media Marketing: Wineries leverage platforms like Instagram to showcase wines and engage younger audiences. Influencer campaigns and virtual winery tours boost brand visibility, driving sales by connecting with tech-savvy consumers who value authentic storytelling.

Recent Developments

1. E. & J. Gallo Winery

- Gallo Winery continues expanding its premium wine portfolio, acquiring brands like Rombauer Vineyards in 2023. They focus on sustainability, reducing water usage in their vineyards. Their new direct-to-consumer platform enhances customer engagement. Gallo also introduced low-alcohol wines to cater to health-conscious drinkers.

2. Constellation Brands Inc.

- Constellation Brands invested in premiumization, launching luxury wines like The Prisoner Unshackled. They expanded their Mexican wine portfolio, leveraging the growing demand for premium imports. Their sustainability efforts include carbon-neutral winemaking. Constellation also partnered with e-commerce platforms to boost online sales.

3. The Wine Group LLC

- The Wine Group launched sustainable packaging, including lightweight bottles, to reduce environmental impact. They expanded their Franzia boxed wine line with organic options. The company also acquired new vineyards in California to strengthen its supply chains. Their focus remains on affordable, high-volume wines.

4. Pernod Ricard

- Pernod Ricard expanded its wine segment with premium brands like Campo Viejo and Jacob’s Creek. They introduced non-alcoholic wine alternatives to tap into the sober-curious trend. The company is also committed to regenerative agriculture for sustainable grape farming.

5. Lagfin SCA (Owner of Moët Hennessy)

- Lagfin’s Moët Hennessy launched Dom Pérignon’s latest vintage, emphasizing luxury positioning. They invested in climate-resilient vineyards to combat climate change. The company also expanded in China, capitalizing on the rising demand for prestige wines.

Conclusion

The global Wine Market is set for strong growth. Rising demand for premium, organic, and low-alcohol wines, along with expanding markets in Asia-Pacific, will drive this growth. Companies are innovating with sustainable packaging, e-commerce strategies, and new product lines to meet changing consumer tastes. Europe remains dominant, but North America and emerging economies like China and India offer major expansion opportunities.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)