Table of Contents

Introduction

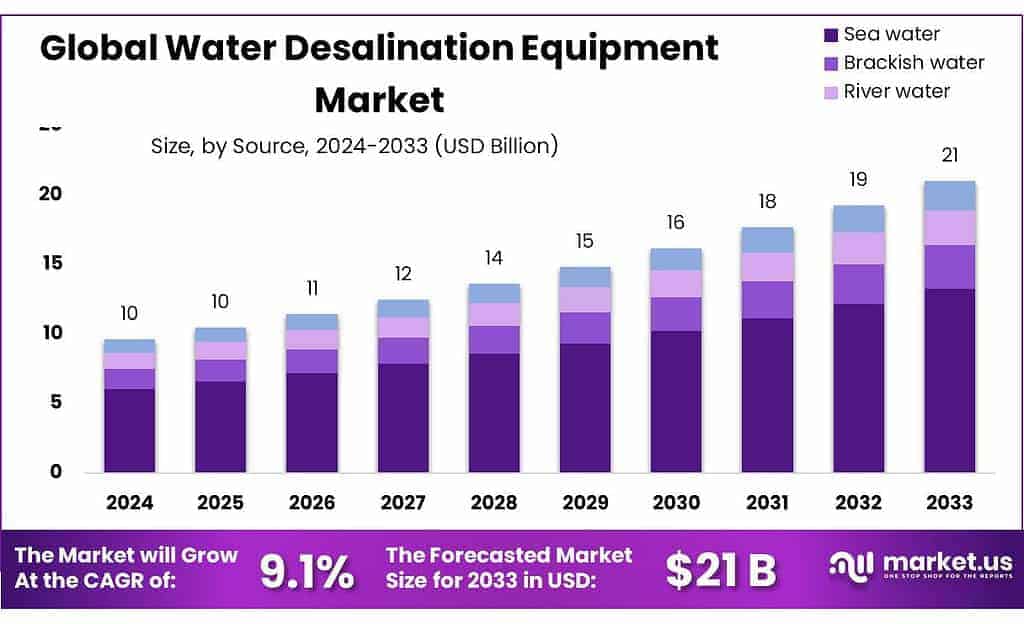

The global water desalination equipment market, valued at USD 10 billion in 2023, is poised for substantial growth, projecting an ascent to around USD 21 billion by 2033. This surge reflects a compound annual growth rate (CAGR) of 9.1% over the decade.

Driving this robust expansion are escalating freshwater scarcity issues and the escalating demands of an ever-growing global population, particularly in urban and industrial sectors.

Reverse osmosis (RO) technology, renowned for its cost-effectiveness and minimal chemical use, dominates the market due to its ability to treat various types of water, including seawater, which forms the largest source segment.

The municipal sector is expected to remain the primary consumer of water desalination equipment, tasked with supplying potable water to expanding urban populations. Challenges, however, persist, including high energy consumption and the environmental impact of brine disposal, which could restrain market growth.

Recent advancements have addressed these challenges, including developing more energy-efficient desalination processes and implementing renewable energy sources to power operations, thereby reducing the carbon footprint associated with traditional desalination methods.

The market is highly competitive, with key players like Tory Industries, Suez Group, and DuPont leading the charge. These companies continually innovate in technological and operational facets to enhance efficiency and sustainability.

Regionally, the Middle East and Africa continue to lead the global demand, driven by acute water shortages and governmental initiatives to expand desalination capacity. Asia Pacific is anticipated to experience the fastest growth due to increasing industrialization and urbanization, especially in countries like China and India, which face significant water scarcity challenges.

Abengoa inaugurated the world’s largest reverse osmosis desalination plant that is partially powered by solar energy. Located in Saudi Arabia, the Jubail 3A has a capacity of 600,000 cubic meters per day and began its commercial operations in 2023. This project aligns with Saudi Arabia’s vision to integrate renewable energy in water desalination projects.

Acciona ramped up its largest desalination plant, Al Khobar 2 in Saudi Arabia, to full production. This plant is now capable of producing 630,000 cubic meters of potable water daily, serving approximately 3 million people.

Key Takeaways

- Desalination Equipment Market size is expected to be worth around USD 21 billion by 2033, from USD 10 billion in 2023, growing at a CAGR of 9.1%.

- Sea Water held a dominant market position in the Water Desalination Equipment market, capturing more than a 63.2% share.

- Membranes held a dominant market position in the Water Desalination Equipment market, capturing more than a 47.4% share.

- Reverse Osmosis (RO) held a dominant market position in the Water Desalination Equipment market, capturing more than a 62.3% share.

- The municipal sector held a dominant market position in the Water Desalination Equipment market, capturing more than a 71.2% share.

- Asia Pacific (APAC) region is the market leader, commanding a 46% share with a valuation of USD 4.4 billion.

Water Desalination Equipment Statistics

Desalination Grants and Global Water Challenges

- The California Department of Water Resources (DWR) has awarded over $82 million in grants for desalination projects funded by Proposition 1. Recent funding includes $5 million for three projects in Mendocino, Fresno, and Los Angeles counties aimed at diversifying local water supplies. Additionally, DWR contributed $16 million to the National Alliance for Water Innovation (NAWI) to advance desalination research

- The U.S. Department of Energy (DOE) has awarded $9 million to 12 projects aimed at enhancing the energy efficiency of desalination and water reuse technologies through the National Alliance for Water Innovation

- Located in Torrance, this project involves constructing a conveyance pipeline to connect an existing well to the Goldsworthy Desalter system. It aims to reduce reliance on imported water and increase desalinated water production by approximately 1,120 acre-feet per year, enough to serve about 2,200 households. This project is part of a broader initiative supported by a $5 million grant from Proposition.

- According to the World Health Organization (WHO), approximately 2 billion people around the world don’t have access to clean and safe water. Contaminated water is responsible for the transmission of diseases such as diarrhea, cholera, dysentery, typhoid, and polio, with an estimated 485,000 deaths from diarrhea alone each year.

- There have been over 8,600 desalination plants installed worldwide, with approximately 20 percent of them in the U.S., the largest number of any country in the world.

Global Desalination Capacity and Industry Leaders

- Distillation processes produce about 3.4 billion gpd globally, which is about 50 percent of the worldwide desalination capacity. MSF plants provide about 84 percent of that capacity.

- In spite of the fact that water covers about 71 percent of the Earth’s surface area, however, it is a challenge to meet all humans, animals, and plants’ demands for freshwater. Freshwater is about 2.5% of total water quantity, most of it is as glaciers, ice caps, and groundwater, and only 0.008% represents the accessible surface freshwater.

- With very numerous membrane desalination references – ranging from modular equipment to large turnkey projects producing up to 392,000 m³ of drinking water per day – Veolia Water Technologies is the world’s undisputed industry leader

- Dow, in cooperation with the U.S. Department of the Interior, built a 1 million gallons per day (mgd) long tube vertical distillation (LTV) plant at $1.2 million, that produced water for the City of Freeport and for Dow operations.

- Thermal and membrane capacity on a worldwide basis was about 7 billion gallons per day (bgd) in early 2000, with about 50% in thermal processes and 50% in membrane technologies.

Emerging Trends

- Renewable Energy Integration: Advances in renewable energy technologies are increasingly being integrated with desalination processes. This trend focuses on reducing the carbon footprint of desalination plants and includes the use of solar, wind, and wave energy to power operations, making the process more sustainable and cost-effective.

- Membrane Technology Innovations: Innovations in membrane technology are enhancing the efficiency of desalination equipment. New developments like forward osmosis, membrane distillation, and nanofiltration are improving the energy efficiency and effectiveness of removing salts and other impurities from water.

- Smart Desalination Operations: The use of advanced sensors and IoT (Internet of Things) technologies is becoming more prevalent. These technologies enhance monitoring and control systems within desalination plants, leading to optimized operations and reduced maintenance costs.

- Modular and Mobile Desalination Systems: There’s a growing trend towards modular and mobile desalination units that can be easily deployed and scaled according to demand. These systems are particularly useful in remote or emergency areas where traditional infrastructure is not feasible.

- Zero Liquid Discharge (ZLD) Systems: ZLD systems are gaining traction as they aim to eliminate wastewater discharge by recycling and reusing all extracted water. This approach is particularly valuable in regions with strict environmental regulations and limited water resources.

Use Cases

- Community Water Supply: Desalination plants are crucial in coastal areas where freshwater resources are scarce. These plants utilize technologies like reverse osmosis to transform seawater into drinkable water, supporting entire communities with reliable access to fresh water.

- Agricultural Irrigation: In regions with limited rainfall and freshwater resources, desalination equipment is used to produce water suitable for irrigation. This allows for the cultivation of crops in arid zones where agriculture would otherwise not be feasible.

- Industrial Applications: Industries often require large quantities of purified water. Desalination provides a consistent water supply for various industrial processes, including those needing high-purity water, such as in pharmaceuticals and electronics manufacturing.

- Hospitality and Resorts: In tourist destinations, particularly on islands or coastal areas without sufficient freshwater sources, desalination systems are installed to meet the water demands of hotels and resorts. These systems ensure a continuous supply of fresh water for guests and operations.

- Emergency Water Supply: Portable desalination units are crucial in emergency and disaster relief efforts, providing drinking water in situations where traditional water infrastructure is compromised or unavailable. These systems can be rapidly deployed to support affected populations.

Major Challenges

- High Energy Consumption: Desalination, particularly through reverse osmosis (RO), requires substantial energy primarily due to the high pressure needed for the process. This makes it an energy-intensive operation, contributing significantly to the operational costs.

- Brine Disposal: The disposal of brine, which is the concentrated saltwater byproduct of desalination, poses environmental challenges. It can negatively affect marine ecosystems due to its high salinity and the presence of other chemicals.

- Membrane Fouling: Over time, the membranes used in RO systems can become clogged with salts, biological materials, and other sediments, which reduces their efficiency and increases maintenance needs. Cleaning these membranes is necessary but temporarily halts production, adding to costs.

- Financial Costs: The upfront capital for constructing desalination plants is high, and the ongoing operational expenses, mainly driven by energy use and membrane maintenance, add to the financial burden. This makes desalination a costly option compared to other water supply sources.

- Environmental Impact: Besides brine disposal, the intake systems used for collecting seawater can harm marine life by pulling in and trapping organisms. This has led to calls for more environmentally friendly intake systems, which can be more expensive and complex to install.

Market Growth Opportunities

- Expansion in Arid Regions: The Middle East & Africa, known for their acute water shortages, have been leaders in adopting desalination technologies. This region continues to be a major growth opportunity due to its climatic conditions and the lack of freshwater sources. Investments in large-scale seawater reverse osmosis desalination plants are prevalent, with substantial government backing.

- Urbanization and Industrial Demand: Rapid urbanization and industrial growth, particularly in Asia Pacific countries like China and India, are significantly driving the demand for desalination equipment. These regions face challenges like saltwater intrusion in aquifers and extensive water extraction, making them prime candidates for desalination technologies to meet both municipal and industrial water needs.

- Technological Advancements: Innovations in desalination technologies, such as improvements in membrane technologies and energy-efficient processes, offer considerable potential for market growth. These advancements help reduce the operational costs associated with desalination processes, making the technology more accessible and feasible across various regions.

- Integration with Renewable Energy: Pairing desalination plants with renewable energy sources is an emerging trend that not only addresses the high energy demands of desalination but also reduces the environmental impact. This integration is especially crucial in regions with abundant sunlight and coastal access where solar-powered desalination can be effectively implemented.

- Portable and Modular Desalination Systems: There is a growing demand for portable and modular desalination units that can be deployed quickly and efficiently in response to emergency situations or used in remote locations. These systems are increasingly popular in disaster relief efforts and for small-scale industrial applications.

Key Players Analysis

- Abengoa is a key player in the water desalination sector, specializing in advanced technologies for water treatment. The company has been involved in various desalination projects globally.

- Acciona S.A. specializes in water desalination projects, using energy-efficient solutions. The company’s desalination plants aim to provide sustainable and environmentally friendly freshwater production.

- Advanced Watertek specializes in delivering high-quality water treatment and desalination solutions. They offer advanced systems for both seawater and brackish water desalination.

- Aquatech International LLC provides innovative water treatment solutions, focusing on desalination, wastewater reuse, and zero liquid discharge systems. Their expertise spans across various industries globally.

- Biwater provides sustainable water treatment and desalination solutions globally. They design and deliver water desalination plants for both municipal and industrial sectors, focusing on innovation and efficiency.

- Doosan Heavy Industries & Construction is a leader in water desalination, providing advanced desalination plants and systems globally. They offer cutting-edge solutions for seawater desalination to address water scarcity.

- Ferrovial specializes in water desalination projects, delivering sustainable solutions for efficient water production. They focus on enhancing global water supply through innovative desalination technologies.

- Genesis Water Technologies offers innovative water desalination solutions, focusing on efficient and sustainable seawater treatment systems. They provide customizable solutions for municipal and industrial clients globally.

- Guangzhou KangYang Seawater Desalination Equipment Co., Ltd. (KYSEARO) specializes in seawater desalination systems, providing advanced solutions for freshwater production in regions facing water scarcity. They offer turnkey desalination equipment.

- IDE Technologies is a leading provider of desalination solutions, focusing on large-scale seawater desalination plants. They deliver sustainable, efficient systems to address global water shortages.

- Koch Separation Solutions provides advanced filtration and separation technologies for desalination, offering solutions to improve water treatment efficiency in seawater desalination processes.

- SUEZ SA offers comprehensive water desalination solutions, focusing on advanced technologies to improve water quality and efficiency in seawater desalination projects. They work globally to tackle water scarcity.

- Veolia Environnement SA provides cutting-edge water desalination technologies, specializing in sustainable solutions for drinking water and wastewater treatment. Their focus is on minimizing environmental impact and enhancing water resource management.

- Webuild SpA focuses on large-scale infrastructure projects, including water desalination plants. They deliver sustainable solutions to improve water availability in regions with water scarcity.

- Xylem Inc. provides innovative water solutions, including advanced desalination technologies. They specialize in water treatment systems that improve water quality and efficiency, helping address global water challenges.

Conclusion

The water desalination equipment market is poised for growth, driven by technological advancements, increasing demand in arid regions, and the integration with renewable energy sources. As urbanization and industrialization escalate, particularly in the Asia Pacific, the need for efficient and sustainable water solutions like desalination is becoming more critical. These trends indicate a robust future for the desalination industry, offering significant opportunities for development and innovation

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)