Table of Contents

Overview

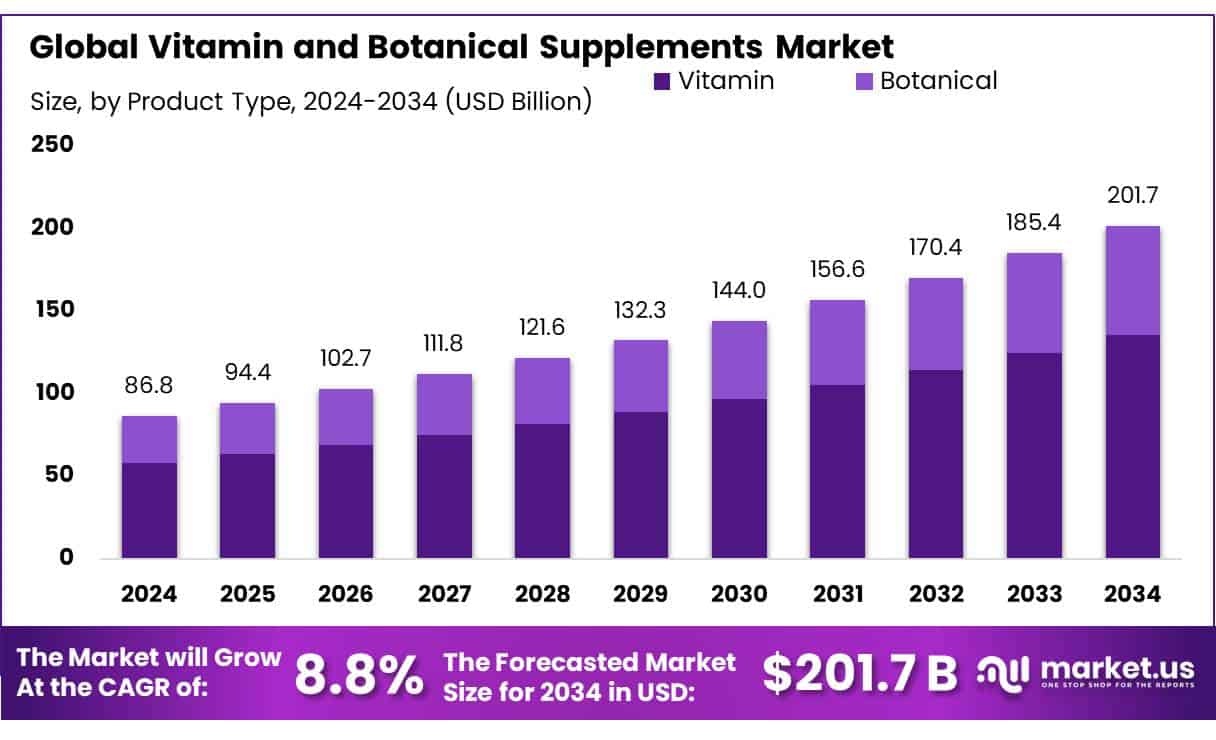

New York, NY – May 16, 2025 – The global Vitamin and Botanical Supplements Market is growing fast, driven by increasing demand for natural health products. In 2024, the market was valued at USD 86.8 billion and is expected to reach USD 201.7 billion by 2034, growing at a strong 8.8% CAGR.

Vitamins led the global vitamin and botanical supplements market in 2024, commanding a 67.1% share. Their dominance stems from widespread consumer trust and daily use for immunity, bone health, and overall wellness. Tablets led a 32.7% market share in 2024, valued for their convenience, long shelf life, and precise dosage.

Supermarkets and hypermarkets captured a 37.4% share in 2024, driven by their convenience and trusted shopping experience. General health applications dominated with a 35.8% share in 2024, fueled by growing demand for daily wellness support. Adults accounted for a 53.2% market share in 2024, driven by their focus on preventive healthcare, immunity, and nutritional balance.

US Tariff Impact on Market

On April 2, 2025, the Trump administration announced new tariffs, prompting dietary supplement industry stakeholders to evaluate their potential impacts. The tariffs, which include 34% on China, 32% on Taiwan, 27% on India, 26% on South Korea, and 20% on the EU, among others, target key regions supplying dietary supplement ingredients and finished products. While the full scope of the effects remains unclear in the short term, they are expected to be significant.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/vitamin-and-botanical-supplements-market/request-sample/

Loren Israelsen, President of the United Natural Products Alliance, noted that effective tariff rates for many dietary ingredients range from 55% to nearly 70%. He emphasized the immediate and substantial impact, as primary suppliers like China, India, and Japan, alongside secondary suppliers such as Malaysia, Indonesia, and South Africa, face significant tariff increases.

Key Takeaways

- Vitamin and Botanical Supplements Market size is expected to be worth around USD 201.7 billion by 2034, from USD 86.8 billion in 2024, growing at a CAGR of 8.8%.

- Vitamin held a dominant market position, capturing more than a 67.1% share of the global vitamin and botanical supplements market.

- Tablets held a dominant market position, capturing more than a 32.7% share of the global vitamin and botanical supplements market.

- Supermarkets and Hypermarkets held a dominant market position, capturing more than a 37.4% share in the global vitamin and botanical supplements market.

- General Health held a dominant market position, capturing more than a 35.8% share.

- Adults held a dominant market position, capturing more than a 53.2% share in the vitamin and botanical supplements market.

Report Scope

| Market Value (2024) | USD 86.8 Billion |

| Forecast Revenue (2034) | USD 201.7 Billion |

| CAGR (2025-2034) | 8.8% |

| Segments Covered | By Product Type (Vitamin, Botanical), By Formulation (Tablets, Capsules, Soft Gels, Powders, Gummies, Liquids, Others), By Distribution Channel (Supermarkets/ Hypermarkets, Pharmacies, Specialty Stores, Online Platforms, Others), By Application (General Health, Energy and Weight Management, Bone and Joint Health, Gastrointestinal Health, Immunity, Cardiac Health, Diabetes, Anti-cancer, Others), By End-user ( Adults, Geriatric, Pregnant Women, Children, Infants) |

| Competitive Landscape | Nestlé S.A., Amway Corporation, Abbott Laboratories, ADM, NOW Foods, Nutraceutical International Corporation, Jarrow Formulas, Inc., Glanbia plc, Herbalife International of America, Inc., Blackmores, Sanofi S.A., BASF SE, Lonza, Dabur India Ltd, Nu Skin Enterprises, Inc., Other Key Players |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=147347

Key Market Segments

By Product Type

- Vitamins led the global vitamin and botanical supplements market in 2024, commanding a 67.1% share. Their dominance stems from widespread consumer trust and daily use for immunity, bone health, and overall wellness. Essential vitamins like C, D, and B12, particularly in multivitamin formats, remain popular across age groups. Post-pandemic awareness of nutritional deficiencies has further boosted demand for routine supplementation.

By Formulation

- Tablets held a leading 32.7% market share in 2024, valued for their convenience, long shelf life, and precise dosage. Their affordability, ease of storage, and portability make them ideal for daily use. Manufacturers prefer tablets for efficient production and the ability to combine multiple nutrients in one dose.

By Distribution Channel

- Supermarkets and hypermarkets captured a 37.4% share in 2024, driven by their convenience and trusted shopping experience. These outlets offer a wide product range, enabling consumers to browse, compare prices, and read labels in-store. Strategic placement near health aisles or checkouts encourages impulse buys, while expanded wellness sections and competitive private-label supplements enhance their appeal.

By Application

- General health applications dominated with a 35.8% share in 2024, fueled by the growing demand for daily wellness support. Versatile products like multivitamins and herbal blends, targeting vitality, digestion, and immunity, appeal to a broad audience, from young adults to seniors.

By End-User

- Adults accounted for a 53.2% market share in 2024, driven by their focus on preventive healthcare, immunity, and nutritional balance. Working professionals, parents, and older adults use supplements for stress relief, heart health, digestion, and bone support to address dietary gaps and boost energy.

Regional Analysis

- North America led the global market in 2024, holding a 46.9% share valued at approximately USD 40.7 billion. This is driven by heightened health awareness, an aging population, and widespread adoption of preventive healthcare. Canada significantly contributes to regional growth, with rising health consciousness and diverse supplement offerings. Key players like Abbott, Amway, Glanbia, Bayer, and NOW Foods drive innovation and expand product lines to meet evolving consumer needs.

Top Use Cases

- Immunity Support: Vitamins like C, D, and botanical extracts like elderberry and echinacea are popular for boosting immune health. Consumers take these daily or during flu seasons to prevent illness, driven by heightened health awareness post-pandemic, especially among adults and seniors seeking natural preventive solutions.

- General Wellness: Multivitamins and herbal blends support overall health, energy, and vitality. Used daily by adults across age groups, these supplements fill nutritional gaps, appealing to those prioritizing preventive care and balanced lifestyles, with a focus on maintaining long-term well-being.

- Weight Management: Vitamin B, D, and botanicals like green tea extract aid metabolism and fat burning. Popular among working professionals and fitness enthusiasts, these supplements support weight control efforts, addressing rising obesity concerns and complementing active lifestyles.

- Stress and Mental Health: Botanical supplements like ashwagandha and valerian, alongside B vitamins, help reduce stress and improve mood. Adults, especially millennials and busy professionals, use them to manage anxiety and enhance mental clarity, driven by growing mental health awareness.

- Digestive Health: Probiotics, prebiotics, and botanicals like ginger promote gut health. Consumers, particularly adults and seniors, use these to improve digestion and reduce bloating, with demand rising due to increased focus on gut-brain health connections and natural remedies.

Recent Developments

1. Nestlé S.A.

- Nestlé has expanded its health science division with new plant-based and personalized nutrition supplements. The company launched “Garden of Life” probiotics and vitamins, focusing on clean-label, organic ingredients. Nestlé also invested in microbiome research to develop gut-health supplements. Their recent innovations include vitamin-packed functional beverages.

2. Amway Corporation

- Amway introduced Nutrilite Vitamin D with Zinc to support immune health. They also enhanced their botanical supplements, sourcing ingredients from sustainable farms. Amway’s “Nutrilite Double X” multivitamin now includes phytonutrient-rich plant blends. The company emphasizes traceability in its supply chain.

3. Abbott Laboratories

- Abbott launched “Ensure Plant-Based Protein” with vitamins and botanicals for vegans. Their “Similac Probiotic Tri-Blend” for infant nutrition includes immune-boosting botanicals. Abbott is also researching adaptogenic herbs like ashwagandha for stress-relief supplements.

4. ADM (Archer Daniels Midland)

- ADM expanded its Health & Wellness portfolio with new botanical extracts, including turmeric and elderberry. They partnered with biotech firms to develop clinically backed supplements. ADM’s “Onavita” plant-based protein now includes added vitamins.

5. NOW Foods

- NOW Foods launched “Adaptogens + Mushrooms” supplements featuring reishi and lion’s mane. They also introduced “Ultra Omega-3” with added vitamin D3. NOW emphasizes non-GMO, third-party tested ingredients and expanded its organic herbal supplement line.

Conclusion

The Vitamin and Botanical Supplements Market is booming, driven by consumer demand for preventive health, immunity, and wellness solutions. Vitamins lead due to widespread trust, while botanicals gain traction for natural benefits. North America dominates, supported by health consciousness and innovation. With applications like stress relief and healthy aging, the market appeals to all ages and is poised for continued growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)