Table of Contents

Introduction

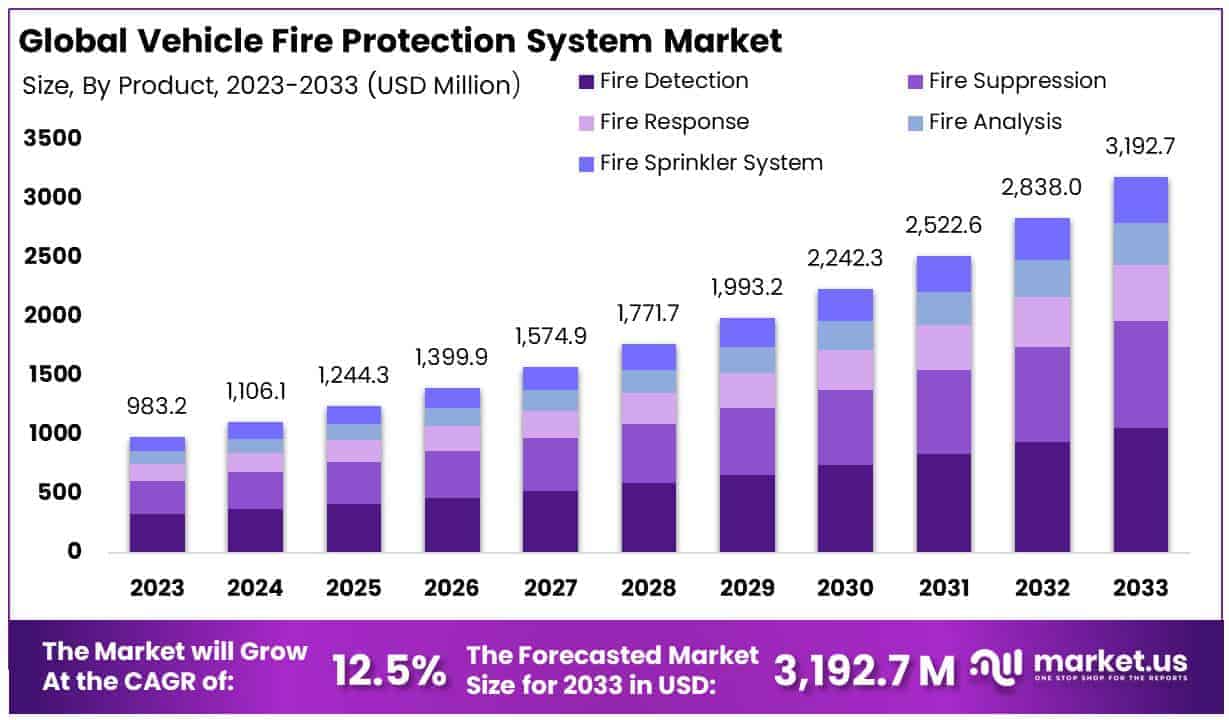

The Global Vehicle Fire Protection System Market is expected to grow from USD 983.2 million in 2023 to approximately USD 3,192.7 million by 2033, with a compound annual growth rate (CAGR) of 12.50% during the forecast period from 2024 to 2033.

The Vehicle Fire Protection System (VFPS) refers to a specialized safety mechanism designed to prevent, detect, and suppress fires in vehicles, particularly in sectors such as transportation, military, and heavy machinery. These systems typically include fire detection sensors, fire extinguishing agents, and suppression mechanisms, all aimed at reducing the risk of fire-related accidents and ensuring the safety of passengers and cargo.

The Vehicle Fire Protection System market involves the manufacturing, development, and deployment of these fire safety technologies across various vehicle types, including passenger cars, commercial trucks, buses, and specialized vehicles used in industries like mining and defense. Growth in the market is driven by rising safety standards, increasing demand for advanced vehicle safety features, and the growing awareness of fire hazards in both passenger and commercial vehicles.

Moreover, the increasing adoption of electric vehicles (EVs) has spurred the need for advanced fire protection solutions due to the unique fire risks posed by lithium-ion batteries. The demand for VFPS is expected to rise as regulatory bodies worldwide enforce stricter fire safety norms and vehicle manufacturers incorporate more sophisticated systems to comply with these requirements.

The market presents significant opportunities, particularly in the electric vehicle segment and in emerging markets where vehicle production and sales are expanding rapidly. Additionally, there is a growing trend of retrofitting older vehicles with advanced fire protection systems, offering further market expansion potential. These factors collectively position the Vehicle Fire Protection System market for steady growth, driven by both technological advancements and an increasing focus on vehicle safety.

Key Takeaways

- The Global Vehicle Fire Protection System Market is projected to experience significant growth, reaching USD 3,192.7 million by 2033, up from USD 983.2 million in 2023, reflecting a robust CAGR of 12.50% from 2024 to 2033.

- Fire Detection systems dominate the market, holding a 43.9% share due to their critical role in the early identification of fire risks.

- Managed Services lead the segment with a 34.3% market share, providing essential support for the management and maintenance of fire protection systems.

- Buses account for the largest share of the market at 55%, driven by the need for enhanced safety measures due to their higher passenger capacity and stringent regulatory requirements.

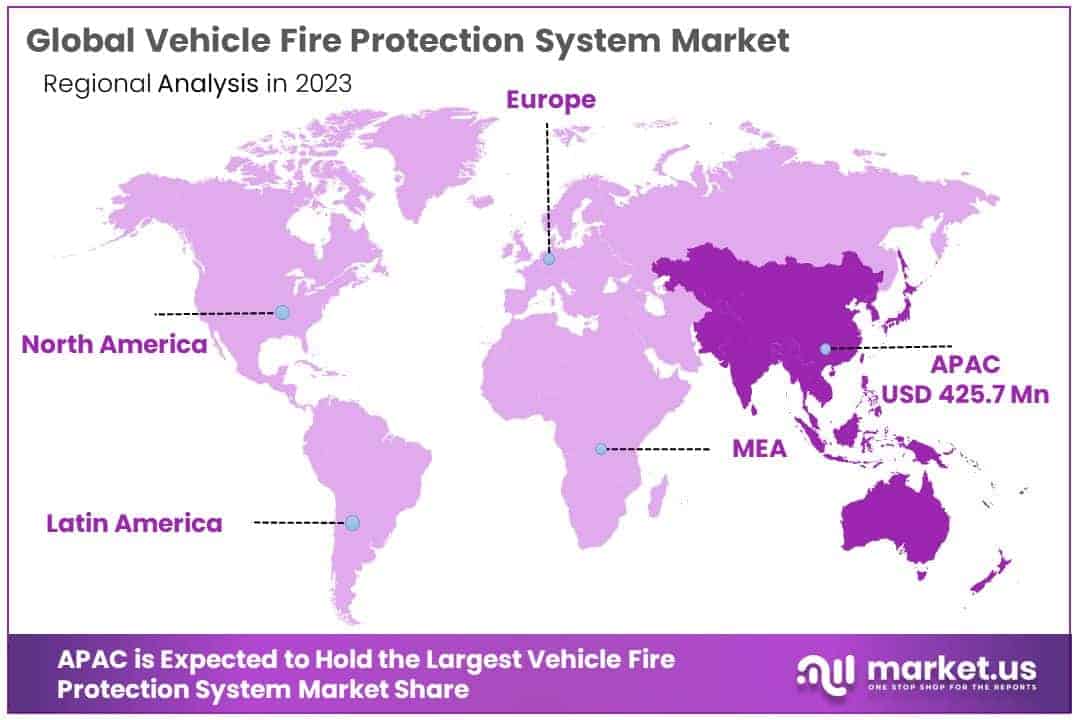

- The Asia-Pacific (APAC) region commands a substantial 42.2% market share, supported by growing demand for advanced vehicle safety features in emerging economies.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 983.2 Million |

| Forecast Revenue (2033) | USD 3,192.7 Million |

| CAGR (2024-2033) | 12.50% |

| Segments Covered | By Product Types (Fire Detection, Fire Suppression, Fire Response, Fire Analysis, Fire Sprinkler System), By Service (Managed Service, Installation and Design Service, Maintenance Service, Others), By End-Use (Buses, Industrial Machinery) |

| Competitive Landscape | Johnson Controls International plc, United Technologies Corporation, Dafo Brand Ab, McWane Inc., Halma plc, Fogmaker International AB, Rotarex S.A, Koorsen Fire & Security Inc |

Emerging Trends

- Integration with Advanced Safety Technologies: Vehicle fire protection systems are increasingly being integrated with advanced safety technologies such as collision detection, real-time monitoring, and smart sensors. These technologies allow for quicker detection and faster response times in the event of a fire, thus enhancing overall vehicle safety.

- Electric Vehicle (EV) Growth: As the electric vehicle market expands, there is a rising demand for fire protection systems specifically designed for electric vehicles. EVs pose unique fire risks due to their battery systems, which are being addressed with specialized fire suppression technologies.

- Adoption of Automated Fire Suppression Systems: Automated fire suppression systems are becoming more popular in vehicles. These systems activate automatically when a fire is detected, reducing the need for manual intervention and potentially limiting the spread of the fire.

- Growing Interest in Lightweight Materials: Lightweight and fire-resistant materials are being increasingly used in the design and manufacturing of fire protection systems. This helps improve vehicle fuel efficiency without compromising the performance of fire protection.

- Regulatory Support for Safety Standards: Stricter government regulations and safety standards are pushing for the integration of fire protection systems in both commercial and passenger vehicles. This regulatory push is expected to increase demand in the market, especially in regions with higher vehicle production rates.

Top Use Cases

- Passenger Vehicles: Fire protection systems are primarily used in passenger cars to protect occupants from the risk of fire due to accidents or electrical failures. These systems help prevent fire outbreaks from spreading and offer an additional layer of safety for passengers.

- Commercial Vehicles: Trucks, buses, and other commercial vehicles require fire protection systems to mitigate fire hazards that arise from engine overheating, fuel leaks, or electrical failures, ensuring the safety of drivers and cargo.

- Electric Vehicles (EVs): Given the increasing adoption of electric vehicles, fire protection systems tailored for EVs are becoming a crucial aspect of safety. Lithium-ion battery fires in EVs are a significant concern, driving demand for specialized fire suppression technologies.

- Specialty Vehicles (e.g., Military, Emergency): Military vehicles, emergency response vehicles, and other specialized vehicles often operate in high-risk environments. Fire protection systems in these vehicles are vital for ensuring operational readiness and crew safety.

- Automated and Autonomous Vehicles: As autonomous vehicle technology continues to develop, fire protection systems are being integrated to ensure that these vehicles are adequately protected in the event of a fire, with automated systems able to activate quickly and mitigate risks.

Major Challenges

- Cost of Advanced Systems: High-tech fire protection systems can be expensive to develop and implement, especially for electric and commercial vehicles. This could potentially slow the adoption of such systems, particularly in price-sensitive markets.

- Technological Complexity: The complexity of integrating fire protection systems with other vehicle safety and sensor technologies presents challenges. Compatibility with existing vehicle architectures and ensuring reliability across various vehicle types can be difficult.

- Limited Awareness Among Consumers: There is a general lack of awareness among consumers about the importance of fire protection systems in vehicles. This leads to lower adoption rates and could affect market growth unless education campaigns are launched.

- Regulatory Variability: Different regions have varying regulatory requirements for fire protection systems in vehicles. This makes it challenging for manufacturers to standardize designs and systems across different markets.

- Battery Fire Risks in EVs: As electric vehicles become more common, the risk of fires related to lithium-ion batteries remains a challenge. Existing fire protection solutions are still evolving to effectively address these risks, which may limit consumer confidence in EV safety.

Top Opportunities

- Development of EV-Specific Fire Protection Systems: The rise of electric vehicles presents an opportunity for developing fire protection systems specifically designed for lithium-ion battery fires. Innovating in this area could address a significant gap in the market.

- Technological Innovation in Fire Suppression Systems: There is significant opportunity for innovation in fire suppression technology, particularly with the development of more effective and environmentally friendly fire retardants and suppression agents. This innovation could drive adoption in both commercial and passenger vehicles.

- Regulatory Compliance for Global Markets: With increasing safety regulations globally, vehicle manufacturers have a unique opportunity to enhance their product offerings by integrating advanced fire protection systems that comply with evolving regulatory standards.

- Automated Vehicle Safety Systems: As autonomous and connected vehicles become more prevalent, there will be opportunities to incorporate automated fire suppression systems that work seamlessly with the vehicle’s broader safety architecture.

- Aftermarket Fire Protection Solutions: There is potential for companies to tap into the growing market for aftermarket fire protection systems, offering vehicle owners and fleet operators the ability to retrofit their vehicles with fire suppression technologies.

Key Player Analysis

The global Vehicle Fire Protection System market in 2024 is characterized by the strong presence of key players such as Johnson Controls International plc, United Technologies Corporation, and Dafo Brand Ab. These companies are pivotal in driving the market through technological advancements and robust product offerings. Johnson Controls International, a leader in fire protection solutions, leverages its extensive global footprint and R&D capabilities to offer integrated systems. United Technologies Corporation, with its innovative approach, focuses on enhancing the safety and efficiency of fire suppression systems, catering to both commercial and defense sectors.

Dafo Brand Ab stands out with its specialized fire suppression systems designed for heavy-duty vehicles, such as buses and trucks. Companies like McWane Inc., Halma plc, and Rotarex S.A. are also significant contributors, focusing on system reliability and product innovation. Meanwhile, Koorsen Fire & Security Inc. strengthens its market presence through localized service offerings, bolstering client relationships across regions. These players collectively contribute to the growing demand for enhanced fire protection solutions within the vehicle sector.

Top Market Key Players

- Johnson Controls International plc

- United Technologies Corporation

- Dafo Brand Ab

- McWane Inc.

- Halma plc

- Fogmaker International AB

- Rotarex S.A

- Koorsen Fire & Security Inc

Regional Analysis

Asia Pacific Leading Region in Vehicle Fire Protection System Market with 42.2% Market Share in 2024

The Asia Pacific region is poised to dominate the global Vehicle Fire Protection System market, accounting for a substantial share of 42.2% in 2024. With a market value of USD 425.7 million, this region remains the largest and fastest-growing market for vehicle fire protection systems, driven by a combination of factors such as rapid industrialization, increasing automotive production, and stringent safety regulations.

The growing adoption of advanced fire safety systems in the automotive sector, coupled with a surge in vehicle production and consumer awareness, significantly contributes to the market’s expansion.

China, India, and Japan are key players in this regional growth, with these countries having established themselves as major automotive manufacturing hubs. China, in particular, continues to lead the market with robust demand for both passenger and commercial vehicles, necessitating advanced fire protection systems to meet safety standards. Additionally, the expanding electric vehicle (EV) market in the region is further boosting demand, as fire protection measures become even more critical with the integration of high-voltage battery systems.

The increasing regulatory focus on automotive safety standards, including fire protection measures, also plays a significant role in propelling market growth in Asia Pacific. The region’s dominance is expected to continue, with further advancements in fire protection technology and an ongoing commitment to enhancing vehicle safety standards. As a result, Asia Pacific is set to maintain its leading position in the global vehicle fire protection system market through the forecast period.

Recent Developments

- In April 9, 2024, AFEX Fire Suppression Systems, a leader in designing fire protection solutions for heavy-duty mobile machinery, announced that its innovative liquid agent system, featuring the new SAFE-X agent, has earned FM Approval’s FM 5970, 2022 edition certification. This certification is dedicated to assessing the performance of fire protection systems used in heavy-duty mobile equipment.

- On November 19, 2024, Emerson (NYSE: EMR) revealed a strategic investment through its corporate venture capital branch, Emerson Ventures, in EECOMOBILITY. This startup specializes in advanced battery testing and monitoring software for electric vehicles, energy storage, and industrial sectors. EECOMOBILITY’s AI-driven software and rapid battery testing systems are designed to detect potential defects that could lead to performance issues or fire risks, strengthening the automotive industry’s safety measures.

- In 2024, Siemens Smart Infrastructure announced its acquisition of Danfoss Fire Safety, a subsidiary of the Denmark-based Danfoss Group. This acquisition will expand Siemens’ sustainable offerings and accelerate its transition toward delivering advanced fire suppression technologies, contributing to a more secure and eco-friendly portfolio.

Conclusion

The Vehicle Fire Protection System market is witnessing substantial growth, driven by increasing safety standards, the rise in vehicle production, and the growing demand for advanced fire suppression solutions across various vehicle types. The market is expected to expand further as electric vehicles gain traction, highlighting the need for specialized fire protection technologies tailored to address the unique risks associated with lithium-ion batteries. As regulatory bodies enforce stricter safety regulations and consumers become more aware of fire risks, the adoption of fire protection systems is anticipated to grow, presenting significant opportunities for technological advancements and regional expansion. The increasing integration of fire protection systems with other vehicle safety technologies and the rising trend of retrofitting older vehicles will further support the market’s growth, positioning it for continued success in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)