Table of Contents

Overview

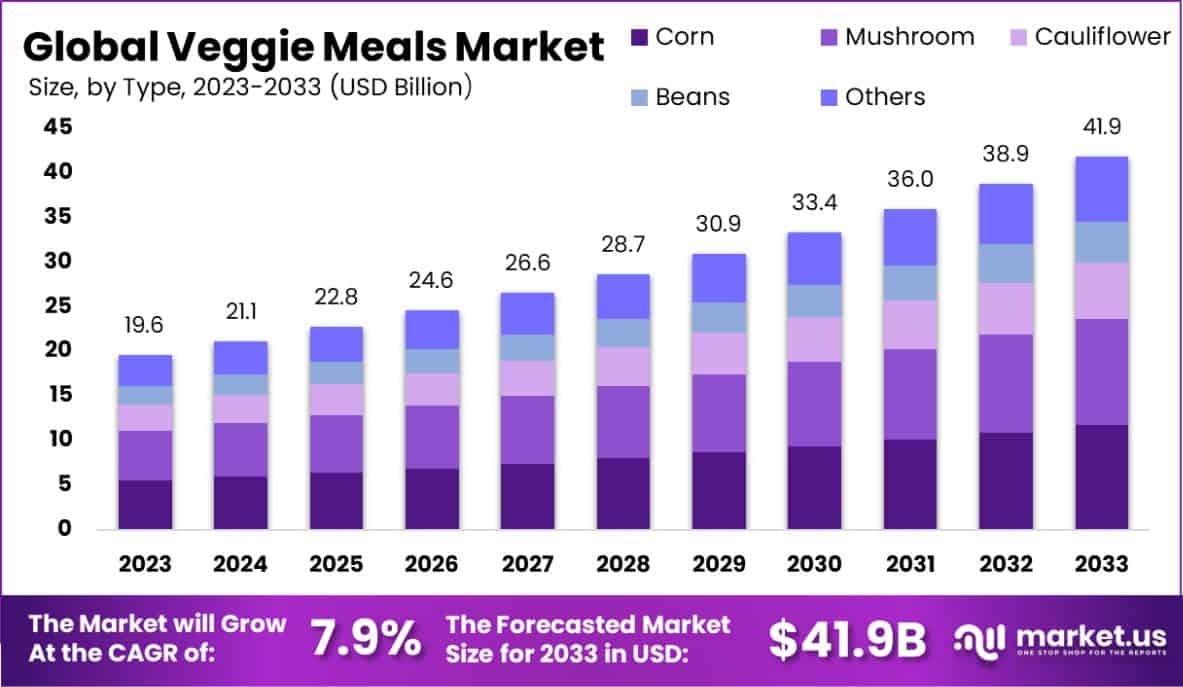

New York, NY – February 19, 2025 – The Global Veggie Meals Market is experiencing significant growth, projected to expand from USD 19.6 billion in 2023 to USD 41.9 billion by 2033, with a CAGR of 7.9%. This surge is driven by increasing consumer preferences for healthier and more sustainable food choices, reflecting a major shift towards plant-based diets.

The market offers a wide array of plant-based meal solutions, including ready-to-eat and frozen meals, catering to a diverse demographic opting for alternatives to traditional meat-based products. The Asia-Pacific region dominates the market, with a 42.7% share, backed by urbanization and lifestyle changes in countries like China and India.

Industry players are focusing on innovations to mimic conventional meal flavors and textures using plant-based ingredients while rising health consciousness and environmental concerns further propel this market. Additionally, trends such as the demand for clean-label, organic, non-GMO, and gluten-free products are significant growth factors, appealing to a health-aware audience seeking nutritional benefits alongside convenience.

Key Takeaways

- The Global Veggie Meals Market is expected to be worth around USD 41.9 Billion by 2033, up from USD 19.6 Billion in 2023, and grow at a CAGR of 7.9% from 2024 to 2033.

- Corn dominates with a 27.4% market share, reflecting its versatility and affordability.

- Ready-to-eat meals lead with 54.5%, driven by convenience and busy consumer lifestyles.

- Non-organic options comprise 75.3% of the market, appealing to cost-conscious consumers globally.

- Asian cuisine holds a 37.2% share, benefiting from bold flavors and cultural adaptability.

- Refrigerated veggie meals account for 65.2%, highlighting the demand for fresh and premium-quality offerings.

- Vegetarians represent 47.2% of the market, underscoring significant adoption beyond fully vegan demographics.

- Supermarkets and hypermarkets dominate with 53.4%, preferred for accessibility and diverse product assortments.

- The Asia-Pacific Veggie Meals Market holds 42.7%, valued at USD 8.4 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/veggie-meals-market/free-sample/

Experts Review

Government incentives supporting sustainable eating practices bolster the veggie meals market. Technological innovations, such as advanced plant-based food processing, are creating investment opportunities despite risks like high costs of premium products and limited rural accessibility. Consumer awareness is heightened by the increasing understanding of diet-related health and environmental impacts.

Technological impacts include improvements in meal preservation, and extending shelf life without sacrificing quality. The regulatory environment favors this growth, with policies promoting plant-based diets and sustainable practices. Nonetheless, challenges remain, such as addressing taste perceptions and pricing barriers. Expansion into emerging markets, leveraging online sales channels, and continuous product innovation are crucial strategies to harness growth opportunities while overcoming these challenges.

➤ Directly Purchase a copy of the report – https://market.us/purchase-report/?report_id=137211

Key Market Segments

By Type: Corn Leads with Versatility

- In 2023, corn emerged as the dominant player in the By Type segment of the Veggie Meals Market, capturing a 27.4% share. Its versatility in various cuisines and the rising demand for plant-based food products have solidified its leading position.

By Meal Type: Ready-to-Eat Meals Dominate

- In 2023, ready-to-eat meals dominated the By Meal Type segment of the Veggie Meals Market, holding a 54.5% share. This segment’s strong performance is fueled by consumer preferences for convenience and time-saving solutions in their daily lives.

By Ingredient Type: Non-organic ingredients Prevail

- In 2023, non-organic ingredients held a dominant position in the By Ingredient Type segment of the Veggie Meals Market, capturing a 75.3% share. Their cost-effectiveness and widespread accessibility have made them the preferred choice for a larger consumer base.

Regional Analysis

Asia-Pacific Leads the Veggie Meals Market

- In 2023, the Veggie Meals Market showcased distinct regional trends, with the Asia-Pacific region emerging as the dominant player, accounting for 42.7% of the market share and valued at USD 8.4 billion. This leadership is attributed to the region’s vast population, increasing health awareness, and the growing adoption of plant-based diets, particularly in countries like China, India, and Japan. Rapid urbanization and rising disposable incomes further bolster market growth in this region.

- North America secured the second-largest market share, driven by a strong vegan and flexitarian population. The popularity of plant-based protein alternatives and continuous innovation in ready-to-eat veggie meals are key growth drivers in the U.S. and Canada.

- Europe also made a significant contribution to the market, supported by stringent regulations promoting sustainable eating practices and the rising demand for organic and clean-label products. High consumer awareness and the presence of established market players catering to health-conscious consumers further strengthen the region’s position.

- Latin America and the Middle East & Africa represent emerging markets with substantial growth potential. Improving infrastructure and increasing awareness of plant-based diets are key factors driving market expansion in these regions. The global growth of retail and e-commerce channels has also facilitated market penetration across all regions.

Top Use Cases

- Health-Conscious Consumers: Veggie meals cater to people looking to improve their health. These meals offer high nutritional value, with essential vitamins and minerals from vegetables, promoting better digestion, skin health, and weight management. Health-conscious consumers prefer veggie meals to support a plant-based lifestyle and reduce their intake of animal-based products.

- Environmental Impact Reduction: Veggie meals are often chosen by individuals aiming to reduce their environmental footprint. As plant-based foods typically require fewer natural resources, like water and land, compared to animal farming, these meals help lower carbon emissions. This choice aligns with sustainability goals and appeals to eco-conscious consumers.

- Vegans and Vegetarians: Vegans and vegetarians rely on veggie meals as part of their daily diet. Since these meals do not contain any animal products, they align perfectly with plant-based eating habits. Whether for health, ethical reasons, or personal preference, this use case represents a growing segment of the population seeking veggie-based alternatives.

- Meal Kit Subscribers: With the rise of meal kit delivery services, veggie meals are popular choices for consumers. These services provide pre-portioned ingredients and easy recipes, saving time and effort. Veggie meals are often highlighted in such kits as they meet the needs of busy individuals who want convenient yet nutritious meal options at home.

- Weight Management: Veggie meals are an excellent option for people trying to manage their weight. These meals tend to be low in calories but high in fiber, which helps with satiety. They support a balanced diet that includes lots of vegetables, aiding in digestion and helping individuals maintain a healthy weight without feeling deprived.

Recent Developments

1. Amy’s Kitchen

- Recent Developments:

- Product Innovation: Launched a new line of frozen vegan bowls in 2023, featuring globally inspired flavors like Thai Green Curry and Mexican Fiesta, catering to the increasing demand for diverse plant-based options.

- Partnerships: Partnered with Thrive Market in 2022 to offer exclusive discounts on Amy’s products, making plant-based meals more accessible to online shoppers.

- Contribution to the Veggie Meals Sector:

- Amy’s Kitchen continues to expand its portfolio of organic, plant-based meals, making them more accessible and sustainable. Their focus on eco-friendly production methods supports the broader shift toward sustainable food systems.

2. Beyond Meat

- Recent Developments:

- Innovation: In 2023, Beyond Meat launched Beyond IV, its fourth-generation plant-based beef product, with improved taste, texture, and nutritional profile (lower saturated fat and sodium).

- Partnerships: Partnered with McDonald’s in 2022 to expand the McPlant burger to all U.S. locations, significantly increasing the availability of plant-based fast food options.

- Government Collaboration: Collaborated with the U.S. Department of Agriculture (USDA) in 2023 to promote plant-based proteins as part of the National School Lunch Program, aiming to introduce healthier, sustainable options in schools.

- Contribution to the Veggie Meals Sector:

- Beyond Meat’s innovations and partnerships have mainstreamed plant-based proteins, making them a staple in fast food and institutional dining.

3. Field Roast

- Recent Developments:

- Product Expansion: In 2022, Field Roast introduced a new line of plant-based sausages and burgers, including a spicy Mexican Chipotle flavor, targeting the growing demand for bold, ethnic-inspired plant-based options.

- Sustainability Initiatives: In 2023, the company committed to sourcing 100% of its ingredients from sustainable farms by 2025, aligning with the USDA’s Sustainable Agriculture Goals.

- Contribution to the Veggie Meals Sector:

- Field Roast’s focus on artisanal, flavorful plant-based products has elevated the perception of veggie meals as gourmet options.

4. Gardein

- Recent Developments:

- Innovation: In 2023, Gardein launched a new line of plant-based seafood alternatives, including fishless fillets and crabless cakes, addressing the growing demand for sustainable seafood options.

- Partnerships: Partnered with Kroger in 2022 to offer exclusive meal kits featuring Gardein products, making plant-based cooking more convenient for consumers.

- Government Recognition: Gardein’s products were featured in the 2023 USDA Dietary Guidelines as a recommended source of plant-based protein.

- Contribution to the Veggie Meals Sector:

- Gardein’s expansion into plant-based seafood and meal kits has diversified the veggie meals market, offering more options for consumers seeking sustainable alternatives.

5. Veggies Made Great

- Recent Developments:

- Product Innovation: In 2023, Veggies Made Great introduced a new line of keto-friendly veggie muffins and frittatas, catering to the growing demand for low-carb, plant-based options.

- Retail Expansion: Expanded its retail presence in 2022 by partnering with Walmart and Target, making its products more accessible to mainstream consumers.

- Health Advocacy: Collaborated with the American Heart Association in 2023 to promote plant-based eating as part of a heart-healthy diet.

- Contribution to the Veggie Meals Sector:

- Veggies Made Great has made plant-based eating more convenient and accessible, particularly for health-conscious consumers.

Conclusion

Veggie Meals have become a popular choice for a wide range of consumers, driven by factors such as health benefits, environmental concerns, and dietary preferences. As more people adopt plant-based diets or seek healthier, sustainable alternatives, the demand for veggie meals continues to grow. With their nutritional advantages, convenience, and ability to cater to various dietary needs, veggie meals are positioned to remain a key segment in the food industry. As awareness about the positive impact of plant-based eating spreads, this market is likely to expand even further, offering a variety of innovative and delicious meal options for consumers.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)