Table of Contents

Introduction

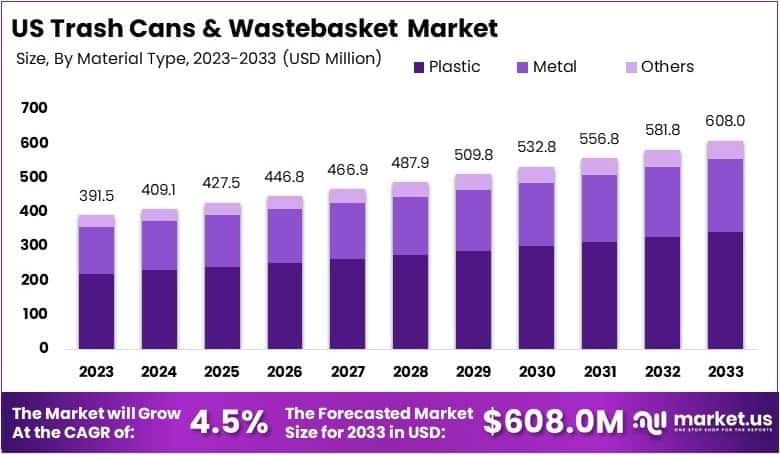

The US market for trash cans and wastebaskets Market is projected to reach approximately USD 608.0 million by 2033, up from USD 391.5 million in 2023, reflecting a compound annual growth rate (CAGR) of 4.5% throughout the forecast period from 2024 to 2033.

The U.S. trash cans and wastebasket market refers to the production, distribution, and consumption of waste disposal containers used in residential, commercial, and industrial settings. These products include a wide range of containers, such as household trash cans, recycling bins, wastebaskets, and specialized containers for offices, outdoor areas, and institutional use. The market also encompasses various types of materials, including plastic, metal, and biodegradable options, with design innovations focusing on convenience, sustainability, and hygiene.

The growth of the U.S. trash cans and wastebasket market is primarily driven by increasing urbanization, rising environmental awareness, and the growing demand for sustainable waste management solutions. The demand for trash cans and wastebaskets has also been influenced by consumer preferences for durable and aesthetically pleasing designs, as well as the expansion of recycling initiatives and waste diversion programs. The need for more efficient waste disposal systems, coupled with environmental sustainability goals, further enhances the market’s potential.

Opportunities within the market are vast, with the growing trend towards eco-friendly and recyclable materials opening avenues for innovation. The adoption of smart waste solutions, including sensor-based waste management systems, presents a significant opportunity for growth. Additionally, the increasing emphasis on waste segregation and recycling regulations in commercial and residential settings is expected to propel demand for specialized waste containers. Overall, the U.S. trash cans and wastebasket market is poised for steady growth as both consumer and regulatory preferences evolve towards sustainability and efficiency in waste management.

Key Takeaways

- The US trash cans and wastebasket market was valued at USD 391.5 million in 2023 and is projected to reach USD 608.0 million by 2033, growing at a compound annual growth rate (CAGR) of 4.5%.

- In 2023, plastic material accounted for the largest market share at 56.2%, driven by its affordability and lightweight properties.

- The standalone modality led the market in 2023 with a share of 71.2%, reflecting its widespread use in both residential and public spaces.

- Medium capacity trash cans were the most popular in 2023, comprising 47.2% of the market, primarily due to their suitability for residential waste disposal.

- The residential end-use segment accounted for the largest share of 34.5% in 2023, driven by increasing household waste management needs.

- The U.S. held a significant market share of 89.4% in 2023, supported by high adoption rates and strong government recycling initiatives.

US Trash Cans and Wastebasket Statistics

Waste Generation in the U.S.

- The average U.S. resident creates over 4.9 pounds of trash per day.

- Annually, this totals up to 56 tons of waste per person.

- Despite comprising only 4% of the global population, the U.S. generates nearly 12% of the world’s total waste.

- Every day, the U.S. produces enough waste to fill 63,000 garbage trucks.

- If these trucks were lined up, they would stretch approximately 119,450 miles, reaching half the distance to the moon.

Waste from Specific Groups

- The average college student produces 640 pounds of solid waste annually.

- This includes 500 disposable cups and 320 pounds of paper waste.

Long-Term Impact

- In a lifetime, an average American will generate 90,000 pounds of trash.

Hazardous and Industrial Waste

- Global hazardous waste generation is enough to fill the New Orleans Superdome more than 1,500 times annually.

- Nearly one-third of U.S. waste comes from product packaging.

Disposable Products and Their Environmental Cost

- An average child uses 8,000 to 10,000 disposable diapers before being potty-trained.

- This results in 18 billion disposable diapers discarded each year in the U.S.

- Every second, 570 diapers are thrown away.

- Diaper disposal costs the U.S. economy $350 million annually.

- These diapers will remain in landfills for up to 500 years.

Plastic Waste and Packaging

- U.S. consumers discard enough plastic cutlery (cups, forks, spoons, and knives) each year to circle the equator 300 times—7.47 million miles.

- The U.S. disposes of approximately 300 million tires annually.

- 1.6 billion pens and 2 billion razor blades are discarded annually in the U.S.

- Packaging accounts for about 65% of household trash.

Environmental Impact of Landfills

- Landfills are densely packed, leading to anaerobic (oxygen-free) degradation.

- This process generates methane gas, which is 25 times more potent than carbon dioxide as a greenhouse gas.

Other Types of Waste

- The U.S. discards 5.7 million tons of carpet each year.

- Although only 3.1% of the world’s children live in the U.S., Americans purchase and dispose of 40% of the world’s toys.

- Each day, Americans throw away approximately 43,000 tons of food.

- On average, each person discards 1,200 pounds of organic waste, which could be repurposed into compost.

Global Food Waste

- One-third of global food production, approximately 1.3 billion tons, is wasted every year.

- In Latin America, the food wasted could feed around 300 million people.

- In Europe, it could feed 200 million people.

- In Africa, it could also feed 300 million people.

- Saving just one-fourth of this wasted food could feed approximately 870 million people globally.

Ocean Pollution

- Over 14 billion pounds of garbage are dumped into the world’s oceans annually, much of it plastic.

E-Waste

- Each year, over 53.6 million tons of electronic waste (cell phones, computers, TVs) is generated globally.

Recycling Potential

- The U.S. recycling rate stands at about 32%. Increasing it to 75% would be equivalent to removing 50 million cars from U.S. roads.

Textiles and Clothing Waste

- Every year, over 14 million tons of recyclable clothing, shoes, and textiles end up in landfills.

- Just five recycled plastic bottles can provide enough fiberfill to stuff a ski jacket.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 391.5 Million |

| Forecast Revenue (2033) | USD 608.0 Million |

| CAGR (2024-2033) | 4.5% |

| Segments Covered | By Material Type (Metal, Plastic, Others), By Modality (Wheeled, Standalone), By Capacity (Small, Medium, Large), By End-User (Residential, Public Facilities, Commercial Offices, Industrial Facilities, Others), By Distribution Channel (Home Improvement Stores, Supermarkets/Hypermarkets, Online Retail, Others) |

| Competitive Landscape | Newell Brands Inc., Toter LLC, Continental Commercial Products, Carlisle FoodService Products, Suncast Corporation, Safco Products Company, United Solutions Inc., Abco Safety, Wabash Valley Manufacturing Inc., Otto Environmental Systems North America, Inc |

Emerging Trends

- Integration of Smart Technologies: The market is witnessing a shift towards smart waste management solutions, including sensor-equipped bins that monitor waste levels and optimize collection schedules.

- Sustainability Initiatives: There is a growing emphasis on eco-friendly materials and designs, driven by consumer demand for products that support recycling and waste reduction efforts.

- Urbanization Impact: The increasing urban population is influencing the demand for compact and efficient waste disposal solutions suitable for limited spaces in residential and commercial settings.

- Government Regulations: Municipalities are implementing stricter waste management policies, including mandatory use of covered bins to reduce litter and improve sanitation.

- Consumer Preferences: There is a noticeable trend towards multifunctional and aesthetically pleasing waste containers that blend seamlessly with modern interior designs.

Top Use Cases

- Residential Waste Management: Households utilize trash cans and wastebaskets for daily waste disposal, with medium-sized bins being particularly popular due to their balance between capacity and manageability.

- Commercial Offices: Businesses require durable and aesthetically pleasing waste containers to maintain cleanliness and meet regulatory standards.

- Public Facilities: Parks, streets, and public spaces use trash cans to manage waste generated by visitors, with standalone models being prevalent due to their simplicity and versatility.

- Industrial Facilities: Factories and warehouses employ specialized waste containers to handle specific types of waste, ensuring safety and compliance with environmental regulations.

- Retail Environments: Supermarkets and shopping malls use wastebaskets to maintain cleanliness and provide convenient waste disposal options for customers.

Major Challenges

- Waste Contamination: Improper disposal practices lead to contamination, hindering recycling efforts and increasing waste management costs.

- Space Constraints: Urban areas often face limited space for waste containers, necessitating compact and efficient designs.

- Aesthetic Integration: Balancing functionality with visual appeal is challenging, especially in public spaces where design is a consideration.

- Regulatory Compliance: Adhering to varying local regulations regarding waste disposal and container specifications can be complex for manufacturers and consumers alike.

- Consumer Education: Ensuring proper waste sorting and disposal practices among the public remains an ongoing challenge.

Top Opportunities

- Smart Waste Solutions: Developing and integrating smart technologies into waste containers presents opportunities for innovation and efficiency improvements.

- Eco-Friendly Materials: Utilizing sustainable materials in product design can attract environmentally conscious consumers and comply with increasing regulatory demands.

- Urban Waste Management: Addressing the unique challenges of waste disposal in densely populated urban areas through innovative product designs and services.

- Public-Private Partnerships: Collaborations between government entities and private companies can lead to improved waste management infrastructure and services.

- Consumer Education Programs: Implementing educational initiatives to promote proper waste disposal and recycling practices can enhance the effectiveness of waste management systems.

Key Player Analysis

In 2024, the U.S. trash cans and wastebasket market remains highly competitive, with key players contributing significantly to the market’s growth. Newell Brands Inc. continues to dominate, leveraging its diverse product offerings and strong distribution channels to maintain a robust market presence. Toter LLC, known for its innovation in automated waste solutions, is poised for expansion with its sustainable products. Continental Commercial Products and Carlisle FoodService Products are capitalizing on the rising demand for durable, high-quality waste management solutions, particularly within commercial and industrial segments.

Suncast Corporation and Safco Products Company are strong players, benefiting from their established reputation for producing durable, cost-effective waste solutions, appealing to both residential and commercial consumers. United Solutions Inc. and Abco Safety contribute by focusing on functional, user-friendly designs for home and office environments. Wabash Valley Manufacturing Inc. and Otto Environmental Systems North America continue to lead in the development of technologically advanced, eco-friendly waste management solutions, enhancing their market positioning.

Top Market Key Players

- Newell Brands Inc.

- Toter LLC

- Continental Commercial Products

- Carlisle FoodService Products

- Suncast Corporation

- Safco Products Company

- United Solutions Inc.

- Abco Safety

- Wabash Valley Manufacturing Inc.

- Otto Environmental Systems North America, Inc.

Recent Developments

- In 2025, Waste Connections, Inc. (TSX/NYSE: WCN) reported a successful conclusion to 2024, achieving strong financial growth with double-digit increases in both revenue and adjusted EBITDA. The company’s operational advancements were highlighted by improvements in employee engagement, retention, and the integration of private company acquisitions, totaling approximately $750 million in annualized revenues.

- In February 2024, Interstate Waste Services, Inc. (IWS) announced its agreement to acquire Oak Ridge Waste & Recycling, a prominent waste collection and recycling provider in Southwestern Connecticut and Suburban New York. This acquisition further strengthens IWS’s service coverage in the tri-state area, with the transaction expected to close by the end of the first quarter of 2024.

- In 2025, Ninestars Group introduced the Nova Series, a pioneering line of intelligent deodorizing trash cans. These innovative trash cans feature photoelectric purification technology, marking a new milestone in waste management solutions. Ninestars’ commitment to innovation continues with this launch, following their previous success as the inventor of the first intelligent induction trash cans.

- In January 2025, GFL Environmental Inc. (NYSE: GFL) (TSX: GFL) entered a definitive agreement with Apollo and BC Partners for the sale of its Environmental Services business. The transaction, valued at $8.0 billion, allows GFL to retain a $1.7 billion equity stake in the business and secure approximately $6.2 billion in net cash proceeds, after taxes and retained equity.

- In June 2024, the U.S. Department of Agriculture (USDA), Environmental Protection Agency (EPA), Food and Drug Administration (FDA), and the White House unveiled the National Strategy for Reducing Food Loss and Waste. This initiative, part of a broader government strategy to address climate change, promote environmental justice, and enhance food security, emphasizes the importance of recycling organics and fostering a circular economy.

Conclusion

The U.S. trash cans and wastebasket market is experiencing steady growth, driven by increasing urbanization, heightened environmental awareness, and a growing demand for sustainable waste management solutions. Advancements in smart waste technologies and the adoption of eco-friendly materials are further propelling market expansion. The residential sector remains the largest end-user, reflecting the essential role of waste management in daily life. As consumer preferences evolve towards durability, functionality, and environmental responsibility, the market is expected to continue its upward trajectory, offering opportunities for innovation and growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)