Table of Contents

Overview

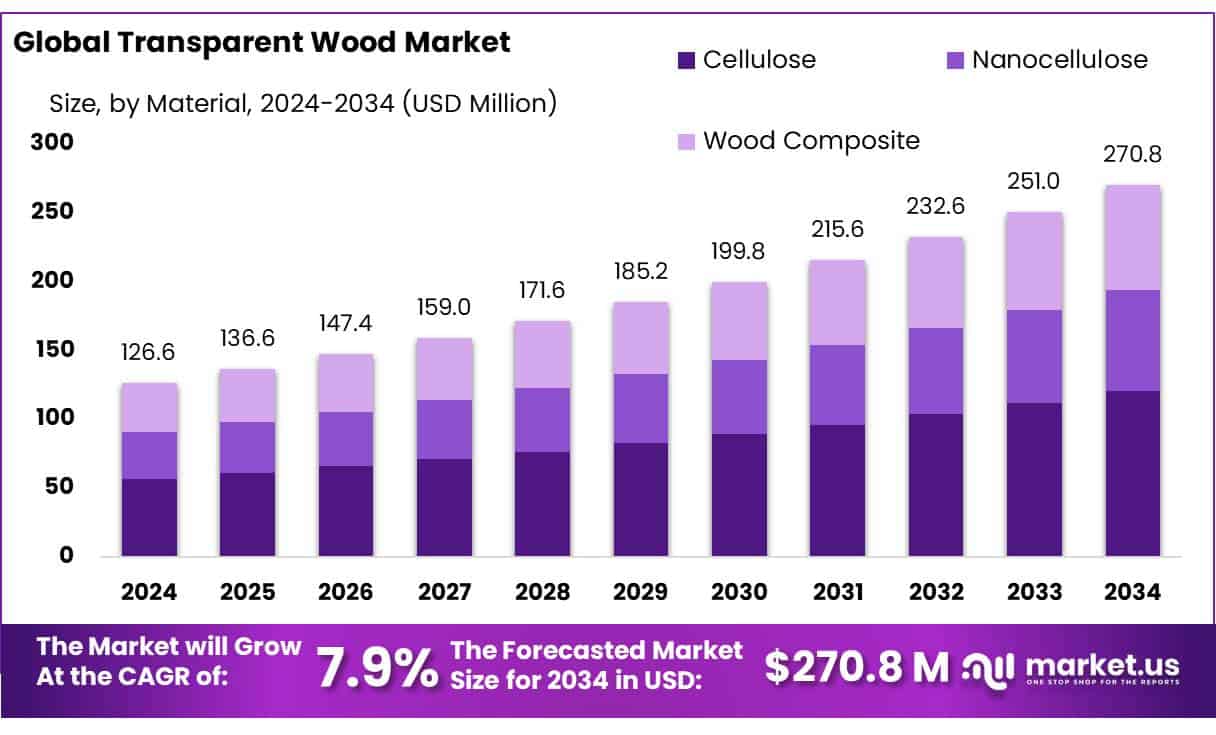

New York, NY – May 08, 2025 – The global Transparent Wood Market is gaining popularity as a sustainable and innovative material, with demand expected to rise significantly in the coming years. By 2034, the market is projected to reach USD 270.8 million, up from USD 126.6 million in 2024, growing at a strong 7.9% CAGR during 2025-2034.

In 2024, Cellulose led the Transparent Wood Market, securing a 44.6% share. Sheets dominated the Transparent Wood Market in 2024 with a 48.4% share, valued for their versatility and ease of use in applications like windows, walls, and interior design. The building and construction sector held a 39.9% share of the Transparent Wood Market, driven by demand for sustainable, energy-efficient materials.

US Tariff Impact on Transparent Wood Market

The investigations signal that tariffs on wood product imports could be on the horizon, as President Trump launched similar probes into steel and aluminum before announcing tariffs would be imposed on March 12. A report is due within 270 days of the order. Tariffs on lumber, timber, and derivative products would have a particularly significant impact on softwood lumber imports from Canada.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/transparent-wood-market/request-sample/

The U.S. and Canada have a long-standing dispute over softwood lumber imports, primarily due to allegations of unfair subsidies in Canada’s lumber industry. Canadian softwood imports are already subject to 6.74% in countervailing duties in addition to anti-dumping duties, which the Department of Commerce proposed to raise from 7.66% to 20.07% on March 3, bringing the total of potential levies to nearly 27%. A potential tariff on lumber, timber, and derivative products would also stack on top of the paused 25% tariffs on imports from Canada, which are set to resume on April 2.

Key Takeaways

- Transparent Wood Market size is expected to be worth around USD 270.8 Million by 2034, from USD 126.6 Million in 2024, growing at a CAGR of 7.9%.

- Cellulose held a dominant market position in the Transparent Wood Market, capturing more than a 44.6% share.

- Sheets held a dominant market position in the Transparent Wood Market, capturing more than a 48.4% share.

- High Transparency held a dominant market position in the Transparent Wood Market, capturing more than a 55.1% share.

- Building and Construction held a dominant market position in the Transparent Wood Market, capturing more than a 39.9% share.

- North America emerged as the dominant region in the transparent wood market, capturing a substantial 49.1% share, valued at approximately USD 62.1 million.

Report Scope

| Market Value (2024) | USD 126.6 Million |

| Forecast Revenue (2034) | USD 270.8 Million |

| CAGR (2025-2034) | 7.9% |

| Segments Covered | By Material (Cellulose, Nanocellulose, Wood Composite), By Form (Sheets, Panels, Films), By Transparency ( High Transparency, Medium Transparency, Low Transparency), By Application (Building and Construction, Automotive and Transportation, Electronics, Consumer Goods, Others) |

| Competitive Landscape | Gurit Holding AG, Oak Ridge National Laboratory (USA), Sappi Lanaken Mill (Sappi Group), Stora Enso, Sumitomo Forestry Co., Ltd., UFP Technologies, University of Maryland (USA), Woodoo |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=147766

Key Market Segments

By Material

- In 2024, cellulose led the Transparent Wood Market, securing a 44.6% share. Its natural, sustainable, and robust properties make it a top choice, especially in architecture and construction. With rising demand for eco-friendly, energy-efficient materials, cellulose is poised for further growth, driven by the push for renewable resources and lower carbon emissions. High transparency led the Transparent Wood Market in 2024, capturing a 55.1% share. Prized for glass-like clarity with added strength and insulation, it’s ideal for windows, skylights, and architectural designs.

By Form

- Sheets dominated the Transparent Wood Market in 2024 with a 48.4% share, valued for their versatility and ease of use in applications like windows, walls, and interior design. Offering durability, superior insulation, and easy installation, sheets are ideal for large-scale projects. As sustainable construction grows, sheets are expected to see increased demand due to their functional and aesthetic qualities.

By Transparency

- High transparency led the Transparent Wood Market in 2024, capturing a 55.1% share. Prized for glass-like clarity with added strength and insulation, it’s ideal for windows, skylights, and architectural designs. As energy-efficient and visually appealing solutions gain traction, high-transparency transparent wood is set to grow, fueled by sustainable construction trends.

By Application

- In 2024, the building and construction sector held a 39.9% share of the Transparent Wood Market, driven by demand for sustainable, energy-efficient materials. Transparent wood’s blend of aesthetics, natural light, and thermal insulation makes it popular for windows, walls, and facades in green building projects. Ongoing material innovations will likely boost its adoption in this sector moving forward.

Regional Analysis

- North America led the transparent wood market in 2024, holding a 49.1% share valued at approximately USD 62.1 million. This dominance is fueled by a strong construction sector, rising demand for sustainable materials, and government policies promoting eco-friendly building practices.

- The United States and Canada are key adopters, driven by their focus on green building standards and energy-efficient construction. Programs like the U.S. Green Building Council’s LEED certification encourage sustainable material use, boosting transparent wood in construction projects. Likewise, Canada’s carbon emission reduction goals have spurred investments in eco-friendly materials, increasing transparent wood.

- Advancements in manufacturing technologies have also improved production efficiency and affordability, broadening transparent wood’s applications in windows, facades, and interior design. These innovations have lowered costs and enhanced viability, further solidifying its popularity in North America.

Top Use Cases

- Energy-Efficient Windows: Transparent wood is used for windows, allowing natural light while providing better insulation than glass. It reduces heating and cooling costs, making buildings more energy-efficient. Its strength and shatter-resistant nature make it ideal for durable, eco-friendly window designs in homes and commercial spaces.

- Sustainable Facades: Transparent wood panels are applied in building facades to let in sunlight while maintaining privacy. Their high haze scatters light, creating soft illumination. This sustainable material enhances aesthetic appeal and supports green architecture by reducing reliance on artificial lighting and improving thermal performance.

- Interior Design Partitions: In interior design, transparent wood is used for partitions, blending natural wood textures with glass-like clarity. It creates open, light-filled spaces without sacrificing privacy. Its versatility suits modern and rustic styles, offering a sustainable alternative to traditional materials for stylish, eco-conscious interiors.

- Smart Skylights: Transparent wood is ideal for skylights, distributing sunlight evenly to reduce glare and energy use. Its thermal insulation keeps indoor temperatures stable, enhancing comfort. The material’s durability and aesthetic appeal make it a popular choice for sustainable, visually striking skylight designs in residential and commercial buildings.

- Photovoltaic Applications: Transparent wood is used in solar cells and electrochromic devices, leveraging its high haze to improve light absorption. It supports energy-efficient smart windows that adjust transparency to save energy. This application promotes sustainable construction by integrating renewable energy solutions into building designs.

Recent Developments

1. Gurit Holding AG

- Gurit, known for advanced composite materials, has been exploring transparent wood applications in lightweight construction and the automotive sectors. Their focus is on enhancing durability and optical clarity for commercial use. While not yet mass-producing transparent wood, Gurit’s expertise in composites positions them as a potential leader in scaling up production.

2. Oak Ridge National Laboratory (USA)

- ORNL has made breakthroughs in transparent wood by developing a lignin-removal process that improves clarity and strength. Their research focuses on energy-efficient building materials, including smart windows that regulate light and heat. ORNL’s innovations could lower costs and increase adoption in sustainable construction.

3. Sappi Lanaken Mill (Sappi Group)

- Sappi, a global leader in wood-based products, has invested in transparent wood research for packaging and architectural uses. Their approach involves refining cellulose to create optically clear wood films with high environmental benefits. Sappi aims to commercialize these materials for luxury packaging and interior design.

4. Stora Enso

- Stora Enso, a pioneer in biomaterials, has developed transparent wood for sustainable construction and electronics. Their latest innovations include wood-based transparent films for solar panels and touchscreens, emphasizing recyclability. The company is scaling production to meet demand for eco-friendly alternatives to glass and plastic.

Conclusion

The Transparent Wood Market is set for strong growth. Energy-efficient materials in construction, automotive, and electronics. Companies like Stora Enso, Sappi, and Oak Ridge National Laboratory are leading innovation, making transparent wood stronger, clearer, and more cost-effective. Key drivers include eco-friendly building trends, smart windows, and renewable packaging solutions. As technology improves and production scales up, transparent wood could replace glass and plastic in many applications, offering a greener future with huge market potential.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)