Table of Contents

Introduction

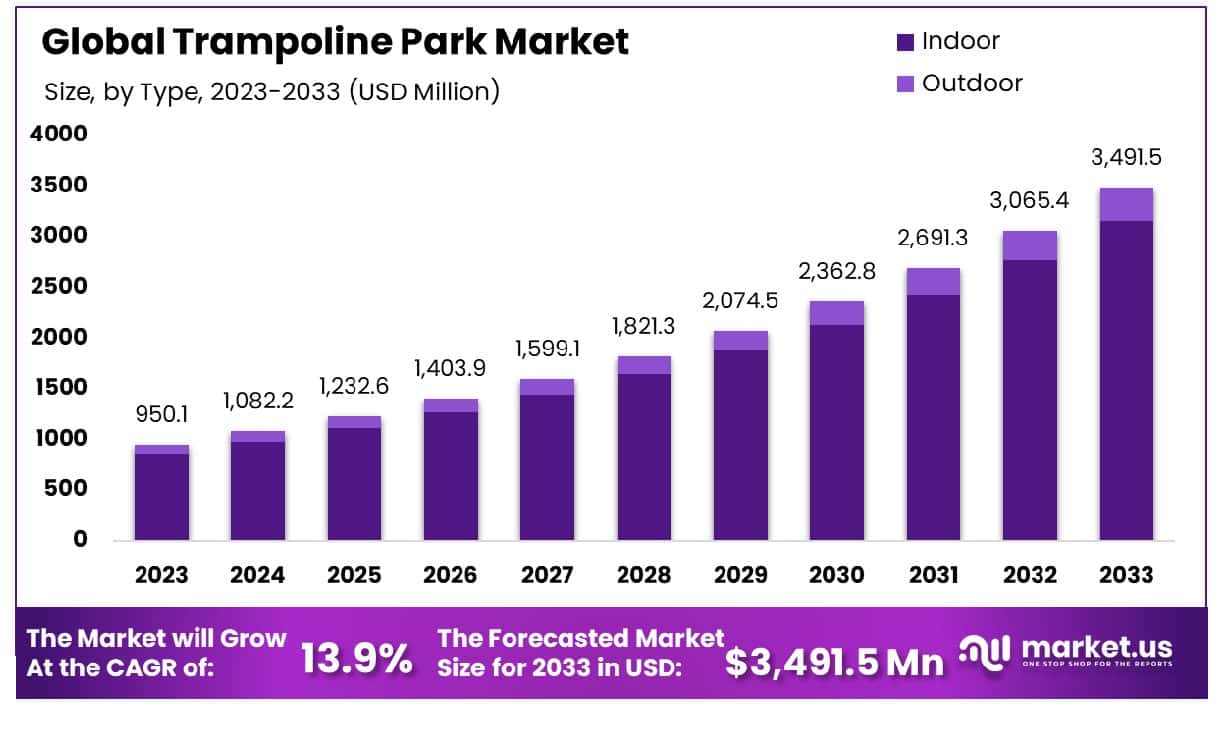

The Global Trampoline Park market is projected to grow from USD 950.1 million in 2023 to approximately USD 3,491.5 million by 2033, reflecting a compound annual growth rate (CAGR) of 13.9% during the forecast period of 2024 to 2033.

The trampoline park market encompasses businesses that provide recreational spaces equipped with trampolines for entertainment, fitness, and sports activities. These parks feature a variety of attractions such as dodgeball courts, foam pits, ninja warrior courses, and interactive jumping zones. They cater to a diverse audience, from children and families to fitness enthusiasts and corporate groups seeking team-building activities. The market includes operators who either develop standalone parks or integrate trampoline areas within larger entertainment facilities.

The trampoline park market is witnessing robust growth due to several key factors. A growing emphasis on active entertainment and fitness activities is driving demand, as consumers increasingly prioritize health and wellness. Technological integration, such as virtual and augmented reality, has enhanced the trampoline park experience, attracting more visitors. Additionally, the rise of franchising models has enabled rapid expansion, particularly in developed markets like North America and Europe, where trampoline parks have become a mainstream attraction.

The trampoline parks is expanding as more consumers seek engaging and family-friendly recreational options. The market appeals to a broad demographic, including children, teenagers, young adults, and fitness-conscious individuals. Furthermore, trampoline parks are increasingly utilized for group events, such as birthday parties, corporate gatherings, and fitness classes. This trend supports a stable and recurring revenue model, with parks reporting that special events and fitness sessions contribute up to 40% of their revenue streams.

Significant opportunities exist within the trampoline park market, especially in emerging regions like Asia-Pacific and the Middle East. Rising disposable incomes and urbanization in these regions create a favorable environment for new park developments. Additionally, diversifying offerings—such as integrating climbing walls, parkour areas, and digital experiences—can differentiate parks from competitors and capture a larger audience. The adoption of sustainable and eco-friendly practices is also gaining traction, as parks appeal to environmentally conscious consumers, further expanding their market base

Key Takeaways

- The global trampoline park market is projected to reach USD 3,491.5 million by 2033, up from USD 950.1 million in 2023, with a CAGR of 13.9% from 2024 to 2033.

- North America holds a 42.5% share of the trampoline park market, indicating its significant dominance in the industry.

- Adult consumers make up 60.6% of the market share, highlighting a focused engagement in this demographic segment.

- The indoor segment accounts for 90.4% of the market, reflecting a strong consumer preference for indoor trampoline parks.

Trampoline Park Statistics

- Over 1,500 trampoline parks operate worldwide, indicating the industry’s rapid growth and popularity across regions.

- 6-10 Age Group: This group makes up 35% of all jumpers, showing that elementary-aged children are the primary audience for trampoline parks.

- 11-15 Age Group: The second-largest group, comprising 26%, highlights how pre-teens and early teens are also major participants.

- Toddlers (1-5): This age group represents 13%, which shows that parks cater to even the youngest visitors with toddler-specific areas.

- Adults (21-40): 15% of jumpers fall in this adult age range, indicating growing appeal for fitness and adult-focused events.

- Youth Dominance: 77% of all participants are aged 17 or younger, confirming that trampoline parks are largely family and youth-oriented.

- Parenting Reward: 60% of parents with Generation Alpha children report constant satisfaction from parenting, aligning with their preference for engaging family activities like trampoline parks.

- Influence on Spending: Kids under 12 and teens drive $130-$670 billion in parental spending annually, underscoring the economic impact of youth preferences.

- U.S. Locations: Approximately 800 trampoline parks were operational in the United States in 2023, showing its dominance in this sector.

- Park Size: The average park size is between 25,000 and 40,000 square feet, indicating a need for large spaces to accommodate various activities.

- Daily Visitors: Parks typically see 300-500 visitors daily, reflecting consistent foot traffic.

- Weekend Crowds: Popular parks can have up to 1,000 visitors per day on weekends, their busiest period.

- Stay Duration: The average visitor spends around 2 hours, indicating enough time for multiple activities.

- Visitor Age Range: The most common age range for visitors is 6-17, confirming a focus on children and teens.

- Under 14 Demographic: 60% of visitors are under 14, emphasizing the focus on younger children.

- Admission Cost: A one-hour jump session usually costs $15-$25, making it an affordable entertainment option.

- Annual Memberships: Parks offer memberships between $200-$400, encouraging repeat visits and customer loyalty.

- Birthday Parties: 30% of revenue comes from hosting birthday parties, a popular attraction for families.

- Weekly Parties: Parks host about 15-20 birthday parties each week, showing the high demand for event bookings.

- Corporate Events: Around 10% of bookings are for team-building or corporate events, targeting a broader audience.

- Off-Season: The slowest period is September through November, as schools resume and outdoor activities compete.

- Staff Size: Parks typically employ 20-30 staff members to manage operations and ensure safety.

- Opening Cost: It costs between $1.2-$2.5 million to open a park, reflecting the investment needed for equipment and facilities.

- Breakeven Point: New parks typically reach breakeven in 18-24 months, depending on their success and location.

- Energy Costs: 8-10% of operating expenses go to energy, highlighting the need for efficient management.

- Insurance Costs: These range from $50,000-$100,000 per year, reflecting the risk and safety measures involved.

- Sky Zone’s Scale: The largest chain, Sky Zone, had over 200 locations as of 2023, showcasing its global reach.

- Revenue Generation: A typical park generates between $1.5-$3 million in annual revenue, reflecting strong profitability potential.

- Profit Margins: Parks generally maintain profit margins of 20-30% after expenses.

- Additional Attractions: 70% of parks offer features like ninja courses or foam pits, enhancing visitor appeal.

- Trampoline Count: Parks usually have 60-100 individual trampolines, ensuring varied jumping options.

- Fitness Classes: About 50% of parks offer fitness or trampoline-based workouts, attracting health-focused customers.

- Trampoline Dodgeball: Offered at 80% of parks, it remains a popular and competitive activity.

- Marketing Spend: Parks allocate 5-7% of their revenue to marketing efforts to attract new customers.

- Social Media: 60% of marketing is through social platforms, leveraging their audience engagement capabilities.

- Repeat Customers: Around 40% of visitors return, demonstrating customer satisfaction and loyalty.

- Acquisition Cost: It costs parks an average of $20-$30 to acquire each new customer.

- Food Sales: Food and beverages account for 25% of park revenue, indicating their importance as an additional income stream.

- Average Food Spend: Visitors typically spend $5-$8 on food and drinks during their visit.

- Adult Sessions: 15% of parks host adult-only jump events, catering to older audiences.

- Main Jump Surface Injuries: 60% of injuries occur on the main trampoline area, highlighting the need for safety protocols.

- Trampoline Replacement: Parks replace trampoline beds every 3-5 years to maintain safety and performance.

- Spring Lifespan: Springs in commercial parks last about 2 years before needing replacement.

- VR and AR: 30% of parks offer virtual reality or augmented reality attractions, adding modern experiences.

- Busiest Time: Saturday afternoons are the busiest, with 20% of weekly visits occurring then.

- Group Visits: 40% of guests come in groups of 4 or more, indicating a preference for group outings.

- Visitor Growth: Trampoline parks experience a 5-7% increase in visitor numbers annually.

- 13,256 injuries were reported at trampoline parks over 8,387,178 jumper hours.

- 11% of these injuries were considered significant.

- The overall injury rate was 1.14 per 1,000 jumper hours.

- High-performance jumping had the highest injury rate at 2.11 per 1,000 jumper hours.

- Injuries in inflatable bag or foam pit jumping occurred at 1.91 per 1,000 jumper hours.

- Significant injuries happened at a rate of 0.11 per 1,000 jumper hours.

- High-performance jumps saw the highest rate of significant injuries at 0.29 per 1,000 jumper hours.

- Parkour jumping had significant injuries at 0.22 per 1,000 jumper hours.

- The overall injury rate decreased by 0.72% per month during the study period.

Interesting Facts

- Invented by George Nissen: The trampoline was invented by George Nissen in 1936 as a tool for acrobatic training and entertainment.

- Spanish Origin: The word “trampoline” comes from the Spanish word trampolín, which means diving board.

- Olympic Sport: Trampolining became an official Olympic sport in the year 2000, showcasing athletes performing high-flying routines.

- First Design: The original trampoline was made with a metal frame and stretched canvas to create bounce.

- Astronaut Training: NASA used trampolines in astronaut training to simulate the sensation of weightlessness.

- Health Benefits: Jumping on a trampoline can help improve cardiovascular fitness, coordination, and balance.

- Bone Density: Trampolining can also increase bone density, making it beneficial for bone health.

- Largest Trampoline: The world’s largest trampoline is over 100 feet long and is located in Wales.

- Polypropylene Fabric: The trampoline bed is often made of woven polypropylene, a material known for its elasticity and durability.

- Inuit Influence: The trampoline was inspired by Inuit people, who used walrus skins as a form of bouncing game.

- Therapeutic Uses: Rebound therapy, using trampolines, helps individuals with developmental disabilities improve motor skills.

- Spring Tension: The height of a bounce depends on the trampoline’s spring tension and the elasticity of the fabric.

- Competitive Moves: Advanced trampolining involves complex moves like the “full-full” (two twists, two somersaults).

- Foam Pits: Many trampoline parks have foam pits, allowing jumpers to practice tricks safely.

- Lymphatic Boost: Bouncing on a trampoline can boost lymphatic flow, aiding in detoxification.

- Proprioception Improvement: Trampolining enhances body awareness, improving balance and spatial orientation.

- Glow Nights: Some parks offer “glow” sessions with black lights and neon colors for a unique jumping experience.

- Safety Nets: Modern trampolines often come with safety nets to reduce the risk of injuries during use.

- Family Activity: Trampolining is a popular family-friendly activity, promoting active play and bonding.

- Indoor and Outdoor Types: Trampolines are available in both indoor and outdoor varieties, each designed to maximize bounce and safety for different environments

- Peak Months: The busiest time for parks is in June, July, and August, likely due to school vacations.

Safety Tips

- Consult a Doctor: Ask your child’s pediatrician if it’s safe for them to use a trampoline, especially if they have medical conditions.

- Ground-Level Setup: Place the trampoline on even, soft ground like grass, not on concrete unless safety mats are used.

- Install Safety Features: Add protective pads over the frame, springs, and install a safety net around the trampoline.

- Regular Inspections: Check for tears, loose springs, or broken parts before each use, and fix any damage immediately.

- Limit Jumpers: Allow only one person on the trampoline at a time to avoid collisions and injuries.

- No Flips: Prohibit somersaults and flips as these can lead to neck or spine injuries.

- Wear Proper Clothing: Wear athletic clothes and remove shoes, socks, and jewelry to prevent slipping or getting caught.

- Supervise Children: Always have an adult supervise trampoline use, especially when children are jumping.

- Safe Entry and Exit: Teach children to stop jumping and safely slide off instead of jumping off the trampoline.

- Secure the Trampoline: Remove ladders after use to prevent unsupervised access by young children.

Emerging Trends

- Integration of Advanced Safety Protocols: Safety remains a critical priority for trampoline parks, and technological advancements are enhancing how operators manage it. Parks are increasingly adopting real-time monitoring systems and digital waivers, allowing for efficient injury prevention and streamlined check-ins. This focus on safety not only reduces liability but also builds customer trust, encouraging repeat visits and loyalty.

- Health and Wellness-Oriented Offerings: The trampoline park industry is aligning with the broader health and wellness trend, transforming these venues into fitness hubs. Many parks are now offering trampoline-based exercise classes, such as cardio workouts and strength training sessions, appealing to fitness enthusiasts who seek innovative ways to stay active. This trend expands the target market beyond recreational users to include those interested in regular fitness activities.

- Expansion of Membership Programs: To drive customer loyalty and generate consistent revenue streams, trampoline parks are increasingly offering membership programs. These programs often include perks like unlimited access, discounts, and exclusive events, incentivizing guests to visit frequently. By fostering a sense of community, these memberships turn occasional visitors into committed members, boosting customer lifetime value and enhancing overall profitability.

- Themed and Immersive Experiences: To stand out in a competitive market, trampoline parks are innovating with themed events and immersive experiences. These range from glow-in-the-dark nights to holiday-themed attractions, designed to create unique and memorable experiences for visitors. Such offerings not only attract new customers but also encourage repeat visits, as guests return for fresh experiences, enhancing word-of-mouth marketing.

- Increased Use of Technology for Guest Engagement: Technology is revolutionizing the trampoline park experience, with mobile apps, virtual queuing systems, and personalized marketing becoming standard. These tools streamline operations, reduce wait times, and enhance the overall guest experience by providing conveniences like mobile ticketing and real-time updates. Parks leveraging such technology are better positioned to meet evolving customer expectations, thereby boosting both attendance and guest satisfaction.

Use Cases

- Fitness and Wellness Programs: Trampoline parks are increasingly being used as fitness centers, offering dedicated classes like trampoline aerobics and high-intensity interval training (HIIT). These classes capitalize on the low-impact, high-calorie-burning nature of trampolining, which can burn up to 1,000 calories per hour. Parks are targeting a health-conscious audience seeking unique and effective ways to stay fit, and this use case is driving a significant portion of their revenue growth

- Corporate and Team-Building Events: With the versatility of trampoline parks, many operators are catering to businesses looking for unconventional team-building venues. Packages often include obstacle courses and group challenges that promote teamwork and camaraderie. This segment has shown robust growth, as companies increasingly prefer engaging, physical activities for team outings, particularly in regions like North America and Europe, where demand for these corporate experiences has surged.

- Birthday Parties and Special Events: Trampoline parks are popular venues for children’s birthday parties, with some parks reporting that event bookings account for nearly 40% of their total revenue. Operators offer comprehensive packages that include supervised activities, food, and exclusive use of certain park sections. By focusing on family-oriented services, trampoline parks are not only attracting younger demographics but also ensuring repeat visits as children return for different events.

- Skill Development and Sports Training: Many parks have introduced high-performance areas designed for aspiring athletes and gymnasts. These sections often feature advanced trampolines, foam pits, and ninja warrior-style courses, which allow for skill practice in a controlled environment. This use case is gaining traction, especially following the rise in popularity of trampoline sports, which are now part of the Olympic Games. Parks catering to this niche are seeing a steady influx of serious jumpers and athletes looking to refine their skills.

- Immersive and Themed Entertainment Experiences: To enhance customer engagement, trampoline parks are creating themed events, such as glow-in-the-dark jump nights or holiday-themed experiences. These immersive events are designed to attract a broad audience, including young adults and families, and have proven effective in increasing foot traffic during off-peak hours. For example, parks implementing these experiences have reported a 25-30% increase in attendance during special events, demonstrating their potential as revenue drivers

Major Challenges

- High Operational and Maintenance Costs: The trampoline park industry faces substantial operational expenses, including rent, utilities, insurance, and staffing. Initial setup costs for a medium-sized park can range from $1 million to $3 million, and ongoing maintenance of safety features significantly adds to these expenses. To remain profitable, park operators must carefully manage cash flow and invest in efficient solutions. However, the financial burden of these costs can deter new entrants and limit market expansion.

- Safety and Liability Concerns: Trampoline parks are inherently risky environments, with injury incidents reported frequently. In England, for example, over 1,181 ambulance call-outs were recorded in a single year, equating to more than three incidents daily. To address this, parks must adhere to rigorous safety standards like the PAS 5000, which outlines strict operational and maintenance protocols. However, ensuring compliance and providing adequate insurance coverage elevates operational costs and liability risks, impacting profitability.

- Seasonal Demand Fluctuations: Visitor numbers at trampoline parks often vary with the seasons, leading to inconsistent revenue streams. During warmer months, outdoor activities tend to attract more people, reducing foot traffic to indoor parks. In contrast, colder seasons can drive attendance up but also create overcrowding issues. This cyclical pattern complicates financial planning, making it challenging for operators to maintain stable profitability year-round.

- Market Saturation and Intense Competition: The rapid growth of trampoline parks has led to market saturation, particularly in urban areas. This intense competition forces operators to differentiate themselves through innovative attractions and unique customer experiences. However, the investment required to continuously update offerings and stand out can be high, and price wars with competitors can compress profit margins further, threatening the sustainability of some parks.

- Regulatory Compliance Challenges: The industry is subject to various regulatory requirements aimed at ensuring safety, ranging from construction standards to daily operational protocols. Complying with these regulations requires significant investment in safety equipment, training, and routine inspections. Failure to meet these requirements can lead to penalties or even closures, making regulatory compliance a major concern for trampoline park operators

Top Opportunities

- Expansion into Emerging Markets: The Asia-Pacific region, particularly China, represents a significant growth opportunity for trampoline parks. As disposable incomes rise and urbanization continues, the demand for recreational activities is increasing. Establishing trampoline parks in these untapped areas could capture new audiences and build brand presence early on.

- Integration of Health and Fitness Programs: The trend toward health and wellness presents an opportunity for trampoline parks to position themselves as fitness hubs. By offering trampoline-based exercise classes, such as HIIT sessions and aerobics, parks can tap into the fitness industry, attracting health-conscious consumers and generating steady revenue streams. With fitness classes contributing up to 20% of revenue in some successful parks, this diversification can significantly boost profitability and broaden the park’s target demographic.

- Development of Corporate and Group Event Packages: Corporate events and team-building activities offer a lucrative opportunity for trampoline parks. Customizing packages for corporate clients can create additional revenue sources, especially during weekdays or off-peak times when regular foot traffic may be lower. These tailored experiences not only appeal to businesses but also build long-term relationships, increasing client retention and park visibility in the local community. Some parks have reported a 25% increase in bookings by capitalizing on this segment.

- Implementation of Technology-Driven Attractions: Incorporating augmented reality (AR) and virtual reality (VR) into trampoline park attractions is becoming increasingly popular. These immersive experiences enhance customer engagement and differentiate parks from competitors. By investing in tech-based attractions, parks can attract tech-savvy young adults and teenagers, expanding their customer base. Parks that have implemented such technologies have seen up to a 30% increase in visitor numbers, demonstrating the effectiveness of these innovations.

- Franchise Model Expansion: Trampoline parks can leverage the franchise model to grow rapidly, especially in developed markets like North America and Europe. Franchising allows for quicker expansion with reduced financial risk, as local partners share the investment burden. This approach has been instrumental in scaling the presence of parks like Urban Air Adventure Park, which has expanded to hundreds of locations. Franchise models also help maintain consistent branding and service quality, boosting customer loyalty and brand recognition.

Key Player Analysis

- Fun Spot Manufacturing: As a leader in the trampoline park industry, Fun Spot Manufacturing offers comprehensive solutions, including design, installation, and maintenance. With over 40 years of experience, the company has expanded globally and supports clients through every stage, ensuring quality and safety. Now part of the ABEO Group, Fun Spot leverages its portfolio to provide a broad range of products, such as climbing walls and ninja courses, enhancing park appeal. Their equipment meets ASTM standards, providing longevity and a faster return on investment for park owners.

- Playcraft Limited: Playcraft Limited is a significant player in the European trampoline park market, focusing on customized designs that cater to both small and large-scale parks. Known for its innovative approach, Playcraft integrates modern safety features and interactive elements, like augmented reality (AR), to attract diverse audiences. With a strong presence in the UK, Playcraft has reported consistent growth, supported by its strategy of combining traditional trampolining with cutting-edge experiences.

- Best American Trampoline Parks: Based in the United States, Best American Trampoline Parks specializes in custom trampoline park solutions tailored for high traffic and safety compliance. They have developed over 300 parks, integrating features like dodgeball courts and foam pits, which contribute to a dynamic user experience. The company’s focus on compliance with safety regulations has strengthened its position, particularly in North America, where they serve a large market share.

- Airparx: Airparx, part of the UK’s Iplayco Group, is a versatile manufacturer that combines trampoline parks with other entertainment modules, such as climbing walls and interactive soft play areas. The company’s emphasis on modular designs allows parks to adapt and expand easily based on customer demand. Airparx has gained traction in both the European and Asia-Pacific markets, capitalizing on its expertise in providing family-friendly and fitness-oriented experiences.

- ELI Play: ELI Play, headquartered in the Netherlands, offers innovative trampoline and adventure park solutions throughout Europe and beyond. The company is known for integrating digital features, such as interactive walls and VR setups, to enhance user engagement. By focusing on expanding its technology offerings, ELI Play has positioned itself as a leader in providing modern, immersive park experiences

Recent Developments

- In 2024, Altitude Trampoline Park announced its continued growth with six development agreements leading to 13 new locations across the U.S. Since January 2024, they have opened parks in Spring Hill, Florida; Austell, Georgia; North Versailles, Pennsylvania; and Webster, Texas, and have eight more units under construction. Their future plans include expanding to North Carolina, South Carolina, and Tennessee, among other regions.

- In 2023, CircusTrix, a major player in the trampoline park industry, rebranded to Sky Zone, Inc. effective January 1. This rebranding unified their offerings under the Sky Zone name and now includes three brands: Sky Zone, Defy, and Rockin’ Jump, to streamline their identity and operations.

- In 2023, Altitude Trampoline Park also announced the addition of 20 new park locations to its development pipeline across multiple U.S. states, including New Jersey, Massachusetts, Texas, Florida, Pennsylvania, Arizona, Georgia, California, and Illinois. They currently have eight locations under construction as part of this growth initiative

- In 2023 – Indoor Active Brands, a company specializing in indoor entertainment concepts, launched The Pickle Pad on December 14. The Pickle Pad is an indoor pickleball center featuring a restaurant called Crave Social Eatery, offering chef-inspired meals. The facility includes over 20 gaming options, such as social and yard games for all ages. As part of NRD Capital’s portfolio, Indoor Active Brands also manages Altitude Trampoline Park and plans to use its experience in entertainment and restaurant franchising to support franchisees of both brands.

Conclusion

The trampoline park market is experiencing strong growth driven by increasing consumer interest in active entertainment and fitness-oriented activities. As more people seek engaging ways to stay fit and enjoy leisure time, trampoline parks are becoming popular destinations for families, fitness enthusiasts, and event planners. This growing appeal spans across age groups, indicating a broad market potential.

Moreover, the integration of new technologies, such as augmented and virtual reality, is enhancing the visitor experience, further boosting customer retention and attracting new demographics. While the market faces challenges like high operational costs and safety compliance, the opportunities for expansion particularly in emerging markets like Asia-Pacific and through franchise models remain promising. With strategic innovation and adaptability, trampoline parks are well-positioned for continued success and market expansion in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)