Table of Contents

Introduction

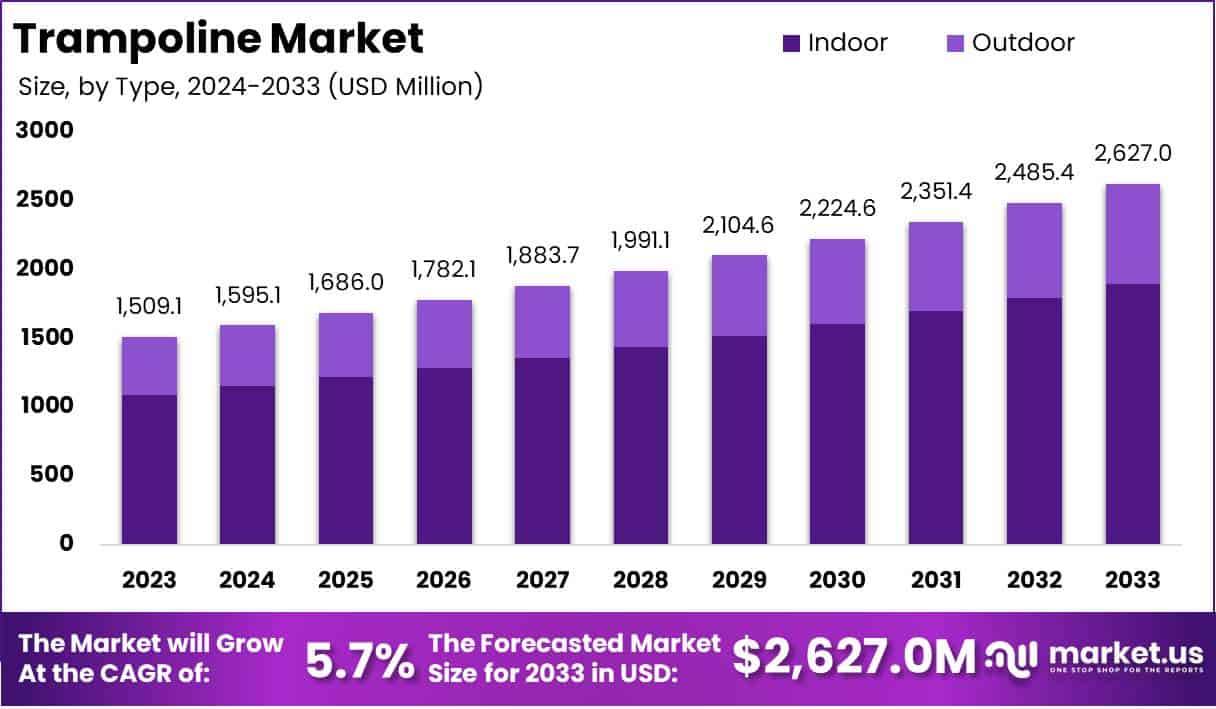

The Global Trampoline Market is projected to reach approximately USD 2,627.0 Million by 2033, up from an estimated USD 1,509.1 Million in 2023. This growth reflects a compound annual growth rate (CAGR) of 5.7% over the forecast period from 2024 to 2033.

A Trampoline is a piece of recreational and fitness equipment that consists of a taut, strong fabric stretched over a steel frame and supported by coiled springs. It is primarily used for jumping and bouncing, making it popular among children and fitness enthusiasts alike.

Trampolines are available in a variety of sizes and types, ranging from small indoor trampolines for personal use to large outdoor models designed for recreational or competitive purposes. Over time, trampolines have evolved from simple recreational tools to versatile products with applications in sports training, gymnastics, physical therapy, and even stress relief activities.

The trampoline market encompasses the global production, distribution, and sale of trampolines for various purposes, including recreation, fitness, and professional sports. It includes a wide range of products such as mini trampolines, round trampolines, rectangular trampolines, and specialty trampolines for professional use.

The market spans diverse customer segments, including residential users, schools, sports training facilities, and entertainment centers. The industry is influenced by consumer trends in outdoor recreation, home fitness, and health-conscious lifestyles, as well as innovations in trampoline safety and design.

The growth of the trampoline market is driven by several key factors. Firstly, rising awareness of the health benefits of physical activity has led to increased adoption of trampolines for fitness and exercise. Trampolining is recognized as a low-impact activity that improves cardiovascular health, enhances balance, and strengthens muscles.

Secondly, the surge in outdoor recreational activities among families and children has fueled demand for trampolines as an entertainment option. Additionally, technological advancements in trampoline design, such as safety enclosures, improved materials, and innovative shapes, have enhanced product appeal and boosted consumer confidence in their safety. Increasing disposable incomes and the growing trend of transforming backyards into recreational spaces are further supporting market expansion.

The demand for trampolines is influenced by diverse demographic and lifestyle factors. Families with young children represent a significant consumer segment, as trampolines are often perceived as an engaging and active form of play. The fitness industry has also emerged as a key driver of demand, with trampolines being integrated into workout routines for their cardio and strength-training benefits.

Seasonal trends play a role, with demand typically peaking during warmer months as consumers invest in outdoor recreational activities. Additionally, the rise of trampoline parks as entertainment venues has created a steady demand for large-scale, commercial-grade trampolines.

The trampoline market offers a range of growth opportunities across both developed and emerging markets. In developed regions, consumers are increasingly willing to invest in premium trampolines that incorporate advanced safety features and innovative designs. The rising popularity of fitness-focused trampolines presents a strong growth avenue, as consumers seek equipment that supports their health and wellness goals. In emerging markets, urbanization and a growing middle-class population are creating demand for affordable recreational products, including trampolines.

Key Takeaways

- The global trampoline market is projected to grow from USD 1,509.1 million in 2023 to USD 2,627.0 million by 2033, reflecting a CAGR of 5.7%.

- Outdoor trampolines dominated the market with a 72.2% share in 2023, driven by their popularity in backyard recreation and the incorporation of enhanced safety features.

- Large trampolines accounted for a 54.3% market share, supported by their suitability for group use and robust construction.

- Children’s trampolines held a 64.3% share, highlighting strong demand for recreational products targeted at younger age groups.

- Residential trampolines led with a 72.3% share, attributed to their affordability and preference for home-based usage.

- The Asia-Pacific region held the largest share of 37.2% in 2023, driven by increasing disposable incomes and ongoing urbanization.

Trampoline Statistics

World Records and Achievements

- The highest trampoline bounce ever recorded is 670 cm (22 ft, 1 in).

- The record for most consecutive somersaults is 3,333.

- The longest continuous trampoline bouncing lasted 53 days.

- The record for most backflips in one minute is 49.

- The most people to jump on a trampoline simultaneously is 376.

Trampoline Sports and Olympics

- Trampolining became an official Olympic sport in 2000 during the Sydney Games.

- Competitive trampoline events focus on acrobatics, precision, and height.

Trampoline Safety Innovations

- Springfree Trampolines have eliminated 90% of product-related injuries.

- Inground trampolines, although safer from falls, require significant installation costs exceeding $5,000.

Injury Statistics

- Over 100,000 trampoline-related injuries occur in the U.S. each year.

- 90% of injuries involve children aged 5-15.

- Lower extremities account for 36% of all injuries, followed by upper extremities (31.8%).

- Trampoline parks see 7,000-15,000 ER visits annually, with 34% of injuries happening in these parks.

- Injuries at trampoline parks are 1.7 times more likely to require hospital visits compared to backyard trampolines.

Common Causes of Injuries

- 75% of injuries occur when multiple people are jumping together.

- Falls account for 27%-39% of injuries, and 20% are caused by contact with springs or frames.

- Leg fractures make up 59% of trampoline park injuries.

Trampoline Parks vs. Backyard Trampolines

- Injuries at trampoline parks are more severe than those on backyard trampolines.

- Children are twice as likely to sustain musculoskeletal injuries at trampoline parks.

- 9% of trampoline park injuries require hospitalization, compared to 5.2% from backyard trampolines.

Age Groups and Jumping Trends

- The most frequent jumpers are aged 6-10, representing 35% of all participants.

- Children aged 11-15 make up 26% of all jumpers.

- Toddlers aged 1-5 represent 13% of all jumps.

- Adults aged 21-40 account for 15% of trampoline users, showing growing popularity among older age groups.

Fun Trampoline Facts

- NASA discovered that 10 minutes of jumping burns more calories than 30 minutes of running.

- The world’s largest trampoline park, Flip Out Trampoline Park in Glasgow, Scotland, spans 63,000 square feet.

- The largest trampoline measures 5,852 square meters.

Trampoline Space and Design

- Traditional spring trampolines lose around 2 feet of jumping surface due to springs, so a 14-ft trampoline provides only 12 feet of usable space.

Serious Safety Concerns

- 6 deaths have been reported at trampoline parks.

- Young children are 14 times more likely to sustain injuries than older children.

Emerging Trends

- Health and Fitness Applications: Trampolines are gaining popularity as fitness tools, with rebound exercises becoming a key workout trend. Activities like trampoline aerobics and low-impact cardio exercises help improve cardiovascular health and joint mobility. This trend is supported by research showing that a 10-minute trampoline workout burns similar calories to 30 minutes of running.

- Integration of Smart Technology: Smart trampolines equipped with sensors and tracking devices are emerging as a growing trend. These trampolines track metrics such as jump height, calorie burn, and workout time, enhancing user engagement. This aligns with the increasing demand for tech-integrated fitness solutions.

- Sustainable Materials in Manufacturing: As consumers become more environmentally conscious, trampoline manufacturers are exploring sustainable materials, such as recycled steel and eco-friendly fabrics, to reduce environmental impact. This shift reflects broader trends in the adoption of green manufacturing practices across industries.

- Growing Popularity in Urban Spaces: Compact, foldable trampolines designed for indoor use are becoming popular in urban areas where outdoor space is limited. These models appeal to families and fitness enthusiasts living in apartments or small homes, catering to a rising urban demographic.

- Focus on Safety Innovations: Safety is a critical concern, leading to innovations like enhanced safety nets, padded frames, and self-closing entry systems. These features address rising consumer demand for products that reduce injury risks, particularly for children. Safety-certified trampolines are becoming a top choice for families.

Top Use Cases

- Fitness and Rehabilitation: Trampolines are widely used in fitness routines for low-impact workouts, helping people improve balance, core strength, and endurance. They are also used in physical therapy to rehabilitate injured joints and muscles, benefiting an aging population and those recovering from injuries.

- Children’s Play and Development: Trampolines serve as entertainment tools for children, enhancing physical activity and coordination. Statistics show that about 70% of trampoline sales are for family use, underscoring their popularity in the home recreational market.

- Sports Training: Athletes in sports like gymnastics, diving, and freestyle skiing use trampolines to practice precision, flips, and jumps. This training is particularly critical for skill development, and professional-grade trampolines are a significant investment for sports academies.

- Entertainment Parks and Events: Trampoline parks have become a $2 billion industry globally, catering to group activities, birthday parties, and recreational events. These parks feature interconnected trampolines, obstacle courses, and foam pits, offering a diversified experience for participants of all ages.

- Stress Relief and Mental Well-Being: Trampolining is increasingly recognized as a stress-relief activity. Studies suggest that 15-20 minutes of jumping releases endorphins, improving mental health and reducing anxiety. This application resonates with consumers seeking holistic wellness solutions.

Major Challenges

- High Risk of Injuries: Despite safety advancements, trampolines are associated with injuries, particularly among children. Data shows that trampolines account for over 100,000 emergency room visits annually in the U.S. alone, raising concerns about safety standards and liability issues.

- Cost Concerns for Premium Models: High-quality trampolines with advanced features, such as smart tracking or robust safety systems, often come with a premium price tag. This limits their accessibility to budget-conscious consumers, impacting the broader adoption of these innovations.

- Space Requirements: Traditional outdoor trampolines require significant yard space, making them impractical for urban households or smaller homes. This spatial limitation restricts potential buyers, especially in densely populated cities.

- Regulatory Compliance and Product Standards: Trampoline manufacturers face challenges in meeting stringent safety and quality standards set by regulatory bodies. Non-compliance can lead to recalls, fines, or bans, creating operational and financial hurdles for manufacturers.

- Environmental Impact of Manufacturing: The production of trampolines, which often uses non-recyclable materials like PVC and synthetic fabrics, poses environmental challenges. As sustainability becomes a priority, manufacturers may face pressure to adopt eco-friendly alternatives, potentially raising production costs.

Top Opportunities

- Expansion in Fitness Markets: The rising focus on health and fitness creates significant growth opportunities for trampoline-based workout programs. Small-sized fitness trampolines for home gyms or boutique fitness studios are expected to drive sales, with the global fitness industry projected to exceed $100 billion in the coming years.

- Emergence of Trampoline Parks in Developing Regions: Developing economies are witnessing rapid growth in entertainment facilities. The establishment of trampoline parks in regions such as Asia-Pacific and the Middle East offers lucrative opportunities, driven by increasing disposable incomes and urbanization.

- Integration of Virtual Reality (VR) in Trampolining: The incorporation of VR technologies into trampoline systems can create immersive gaming and exercise experiences. This innovation appeals to tech-savvy millennials and Gen Z consumers, blending recreation with cutting-edge technology.

- Government Initiatives to Promote Physical Activity: Many governments are promoting physical activity as a way to combat obesity and lifestyle diseases. Subsidies or support for recreational products like trampolines may boost market growth, especially in schools and community centers.

- Customization and Modular Designs: Offering trampolines with customizable features, such as adjustable bounce levels or interchangeable safety nets, presents a strong growth opportunity. Modular designs that cater to specific user needs—whether for children, athletes, or fitness enthusiasts—can increase product appeal across diverse customer segments

Key Player Analysis

- Skywalker Holdings LLC: Skywalker Holdings LLC is one of the leading trampoline manufacturers globally, recognized for its safety-focused designs and extensive product portfolio. The company commands a significant share of the North American market, with approximately 20% market penetration in the U.S. residential segment. Skywalker’s patented no-gap enclosure system has been instrumental in building trust among parents, and the company sells over 500,000 trampolines annually. Its products are widely distributed through retail giants like Walmart, Target, and Amazon, ensuring strong visibility in the global market.

- Springfree Trampoline Inc.: Springfree Trampoline Inc. has revolutionized the market by introducing innovative designs that eliminate traditional trampoline springs, offering unparalleled safety. With an annual revenue exceeding $80 million, the company has captured a loyal customer base, especially in premium markets like North America, Europe, and Australia. Springfree’s commitment to durability and performance has made it a favorite among families and fitness enthusiasts. The company also leverages digital marketing and e-commerce platforms to expand its global footprint.

- Jumpflex: Jumpflex, based in New Zealand, specializes in high-quality outdoor trampolines, emphasizing durability and affordability. The company holds a growing market share in Australasia and is expanding rapidly into North America, reporting annual sales growth of 15% year-over-year since 2020. Jumpflex distinguishes itself with robust warranties and a focus on delivering value-for-money products, selling approximately 100,000 units globally per year. Its focus on e-commerce has enabled direct-to-consumer (DTC) sales, reducing reliance on traditional retail chains.

- Vuly Trampolines Pty Ltd.: Vuly Trampolines, an Australian-based company, is a key innovator in the trampoline industry, known for its cutting-edge features such as shade covers, interactive games, and robust designs. The company dominates the Australian market, with an estimated 60% share of premium trampoline sales . Vuly’s annual revenue is reported to be around $50 million, supported by aggressive R&D investments and strategic partnerships with retailers in Europe and North America. Vuly’s focus on safety and innovation continues to position it as a global leader.

- Plum Products Ltd.: Plum Products Ltd., headquartered in the UK, specializes in outdoor play equipment, including trampolines that cater to children and families. The company holds a strong position in the European market, with a 15% market share in the UK residential trampoline segment. Plum’s eco-friendly and stylish trampoline designs appeal to environmentally conscious consumers. The company sells approximately 350,000 units annually, with a steady revenue stream from both online and offline retail channels. Plum Products is also expanding its offerings into global markets, including Asia and North America.

Asia Pacific Trampoline Market

Asia Pacific Leads the Trampoline Market with the Largest Market Share of 37.2%

The Asia Pacific region has emerged as the leading market for trampolines, capturing a dominant 37.2% share of the global market in 2023, with a market valuation of USD 561.3 million. This significant market position is attributed to the region’s growing focus on outdoor recreational activities, coupled with rising disposable incomes and urbanization trends in key countries such as China, India, and Australia.

The increasing penetration of fitness-focused products, including trampolines, as part of health and wellness initiatives, has further propelled demand across both residential and commercial segments, particularly in urban centers. Additionally, the region’s young demographic and a surge in e-commerce platforms offering a wide variety of trampoline options have contributed to sustained market growth.

China stands out as a key growth driver within Asia Pacific, leveraging robust domestic manufacturing capabilities and export potential, while India and Southeast Asia present expanding opportunities due to the popularity of family-focused entertainment. These factors collectively solidify Asia Pacific’s leadership in the trampoline market.

Recent Developments

- In 2024, Sky Zone plans to significantly expand its footprint by launching 10 new parks in key markets. These parks will be established through franchise agreements in cities like Austin, Seattle, Henderson, and Atlanta, aiming to meet growing demand. The openings are scheduled for the first quarter of 2026, marking a strategic move to strengthen its presence in high-traffic urban areas.

- In 2024, Trampoline, an emerging B2B home décor brand, secured $5 million in seed funding led by Matrix Partners India and WaterBridge Ventures, with an additional $2 million in venture debt from Alteria Capital. This funding enables the company to enhance supply chain operations, develop innovative product lines, and build a strong team to accelerate its growth.

- In 2023, Vuly Play donated an Ultra Medium Trampoline valued at over $1,049, as part of its community sponsorship initiative. Known as Australia’s trusted outdoor play equipment brand, Vuly Play designs products suited for diverse weather conditions, ensuring safety and fun for families. The Ultra Medium Trampoline features advanced safety elements, making it a popular choice for outdoor recreation.

- In 2023, BOUNCE India opened a 40,000 sq. ft. adventure park, offering 100+ interconnected trampolines and exciting activities like X-Park, Big Bag, and Slam Dunk. As part of a global freestyle movement, the park promotes creativity, physical activity, and self-expression in a vibrant setting, catering to individuals of all ages looking for fun and fitness.

Conclusion

The Global trampoline market is poised for sustained growth, driven by rising awareness of health and fitness, increasing demand for recreational activities, and innovations in product design and safety features. The market’s expansion is supported by evolving consumer preferences, including the adoption of trampolines as fitness tools, stress-relief equipment, and entertainment solutions for families and children.

While challenges such as safety concerns and high costs of premium models persist, advancements in compact designs, smart technology integration, and sustainable manufacturing present significant opportunities for future development. As urbanization and disposable incomes continue to rise, especially in emerging markets, trampolines are set to become a key component of both home and commercial recreational spaces, solidifying their role in fostering active and healthy lifestyles.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)