Table of Contents

Introduction

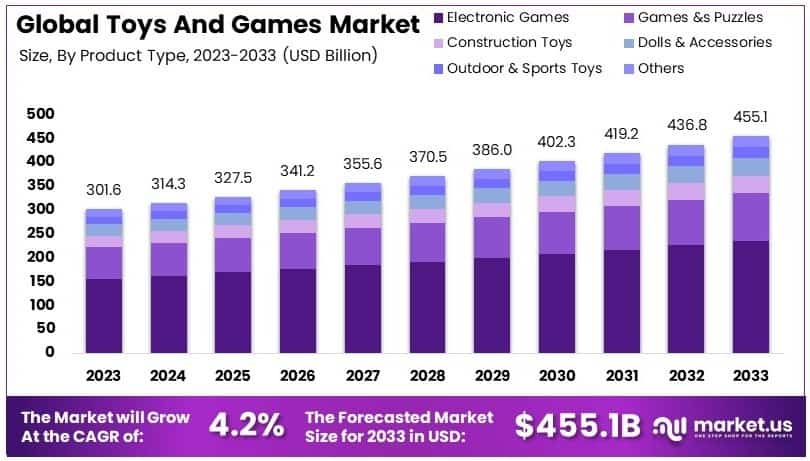

New York, NY – April 09, 2025 – The Global Toys And Games Market is projected to reach approximately USD 455.1 billion by 2033, increasing from USD 301.6 billion in 2023. This growth reflects a compound annual growth rate (CAGR) of 4.2% over the forecast period spanning from 2024 to 2033.

Toys and games refer to a broad category of products designed primarily for entertainment, learning, and development purposes among children and, increasingly, adults. These products include traditional toys, educational kits, board games, action figures, construction sets, video games, and digitally integrated gaming experiences. The toys and games market encompasses the production, distribution, and retailing of such items across various age groups and demographics.

It has evolved significantly, driven by a convergence of physical and digital experiences, and is now influenced by trends in consumer behavior, technology adoption, and cultural preferences. The growth of the global toys and games market is being propelled by several key factors. Increasing disposable incomes, rising awareness of educational play, and expanding middle-class populations in emerging economies are boosting demand. Moreover, the integration of advanced technologies such as augmented reality (AR), artificial intelligence (AI), and Internet of Things (IoT) in toys is reshaping consumer expectations, fostering interactive and immersive play.

The market is also experiencing robust demand due to the growing influence of licensed products based on movies, TV shows, and digital content, particularly from platforms such as YouTube and streaming services. Furthermore, the ongoing shift toward e-commerce and direct-to-consumer channels has improved accessibility and market penetration.

A significant opportunity lies in the rising demand for sustainable and eco-friendly toys as environmentally conscious parenting gains traction globally. Manufacturers that can align innovation with safety, learning value, and sustainability are expected to gain a competitive edge in this dynamic and highly segmented market. Overall, the toys and games market is poised for steady growth, supported by both traditional play and digital transformation.

Key Takeaways

- The global Toys and Games Market was valued at USD 301.6 billion in 2023 and is projected to reach USD 455.1 billion by 2033, expanding at a Compound Annual Growth Rate (CAGR) of 4.2% during the forecast period.

- Electronic Games emerged as the leading product type in 2023, capturing a 51.7% market share, primarily due to their interactive features and educational benefits, which appeal to both children and adults.

- The 15 Years and Above age segment accounted for the largest share at 42.5% in 2023, reflecting a growing trend of gaming among older age groups, supported by the increasing popularity of digital and console-based games.

- Plastic remained the dominant material used in toy manufacturing in 2023, owing to its cost-effectiveness and design versatility, enabling mass production and a wide variety of toy offerings.

- The Offline distribution channel held a leading position with a 53.2% share in 2023, indicating a sustained consumer preference for in-store purchases, driven by the ability to physically examine products before buying.

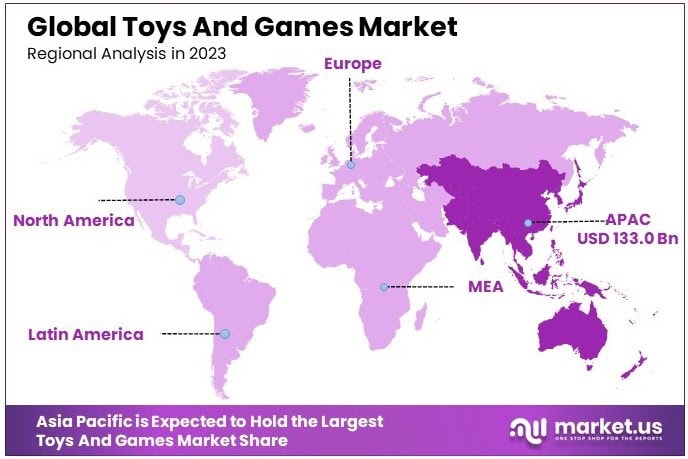

- The Asia-Pacific region led the global market in 2023 with a 44.1% share, equivalent to USD 133.00 billion, supported by a robust manufacturing infrastructure, growing population, and rising consumer spending on toys and games.

Request A Sample Copy Of This Report at https://market.us/report/toys-and-games-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 301.6 Billion |

| Forecast Revenue (2033) | USD 455.1 Billion |

| CAGR (2024-2033) | 4.2% |

| Segments Covered | By Product Type (Games and Puzzles, Electronic Games, Construction Toys, Dolls and Accessories, Outdoor and Sports Toys, Others), By Age Group (Below 8 Years, 9–15 Years, 15+ Years), By Material (Plastic, Wood, Fabric, Metal, Others), By Distribution Channel (Online Retailers, Offline Channels (Supermarkets and Hypermarkets, Specialty Stores, Traditional Stores, Others)) |

| Competitive Landscape | Hasbro, Inc., Mattel, Inc., LEGO Group, Spin Master Ltd., Bandai Namco Holdings Inc., Funko, Inc., MGA Entertainment, VTech Holdings Ltd., Fisher-Price (subsidiary of Mattel), Crayola LLC |

Emerging Trends

- Rise of Smart Toys: The integration of technology into toys is gaining momentum. Smart toys that combine physical play with interactive digital elements are becoming increasingly popular among tech-savvy children.

- Sustainable and Eco-friendly Products: Environmental concerns are driving demand for toys made from recycled or biodegradable materials. Manufacturers are responding by producing eco-friendly options such as wooden toys and games made from recycled paper.

- Experiential and Immersive Play: Toys offering experiences beyond physical products, such as augmented reality (AR) and virtual reality (VR) integrations, are on the rise. These toys provide immersive play experiences that blend the physical and digital worlds.

- Growth of eSports: The increasing popularity of competitive gaming has led to a surge in eSports-related toys and games. This trend reflects the broader acceptance and recognition of eSports as a mainstream form of entertainment.

- Personalization and Craftsmanship: There is a growing demand for personalized and handcrafted toys. Artisanal and bespoke toys offer unique qualities that mass-produced items cannot match, catering to consumers who value individuality and quality.

Top Use Cases

- Educational Development: Toys designed to enhance cognitive and motor skills are widely used by parents and educators to support children’s learning and development.

- Entertainment and Leisure: Traditional toys and games serve as primary sources of entertainment, providing recreational activities for children and adults alike.

- Therapeutic Applications: Certain toys are utilized in therapeutic settings to aid in the development of social and emotional skills, particularly among children with special needs.

- Collectibles and Memorabilia: Action figures, dolls, and other collectibles serve as both playthings and valuable items for enthusiasts and collectors.

- Physical Activity Promotion: Outdoor games and sports-related toys encourage physical exercise and promote active lifestyles among children.

Major Challenges

- Competition from Digital Alternatives: The proliferation of digital entertainment options, such as video games and mobile apps, presents significant competition to traditional toys and games.

- Quality and Safety Concerns: Ensuring the safety and quality of toys remains a critical challenge, with parents often concerned about hazardous materials and compliance with safety standards.

- Counterfeit Products: The prevalence of counterfeit and substandard toys affects consumer trust and impacts the revenue of legitimate manufacturers.

- Regulatory Compliance: Manufacturers must navigate stringent regulations regarding toy safety and environmental impact, which can increase operational costs and affect product launch timelines.

- Changing Consumer Preferences: Evolving tastes and preferences, influenced by technological advancements and cultural shifts, require continuous innovation and adaptation from toy manufacturers.

Top Opportunities

- Expansion in Emerging Markets: Rising disposable incomes in regions such as Asia-Pacific and Latin America present opportunities for market growth and increased sales.

- Development of Educational Toys: Creating toys that focus on STEM (Science, Technology, Engineering, and Mathematics) education can meet the growing demand for products that combine learning with play.

- Sustainable Product Lines: Investing in eco-friendly and sustainable toys can attract environmentally conscious consumers and provide a competitive edge in the market.

- Integration of Advanced Technologies: Incorporating technologies such as AR, VR, and artificial intelligence (AI) into toys can create innovative and engaging products that appeal to tech-savvy consumers.

- Adult and ‘Kidult’ Market Segment: Tapping into the adult demographic that collects or engages with toys and games for nostalgia or hobby purposes can open new revenue streams.

Key Player Analysis

In 2024, the global toys and games market remains significantly shaped by a group of dominant players, each leveraging strong brand equity, diverse product portfolios, and expansive global distribution networks. Hasbro, Inc. and Mattel, Inc. continue to lead through iconic brands such as Monopoly, Transformers, Barbie, and Hot Wheels, while maintaining innovation pipelines supported by licensing agreements with major entertainment franchises.

LEGO Group upholds a resilient position by blending traditional construction play with digital integration through app-based kits and themed sets. Spin Master Ltd. and MGA Entertainment have gained traction via character-driven offerings and media tie-ins, notably with PAW Patrol and L.O.L. Surprise. Bandai Namco Holdings Inc. reinforces its influence through cross-media synergy between toys and anime content. VTech Holdings Ltd. and Fisher-Price maintain leadership in educational and infant toys by integrating electronic learning tools. Funko, Inc. captures the collectible segment, and Crayola LLC sustains relevance in creative play, emphasizing arts-based engagement.

Purchase The Full Report Now at https://market.us/purchase-report/?report_id=134184

Top Key Players in the Market

- Hasbro, Inc.

- Mattel, Inc.

- LEGO Group

- Spin Master Ltd.

- Bandai Namco Holdings Inc.

- Funko, Inc.

- MGA Entertainment

- VTech Holdings Ltd.

- Fisher-Price (subsidiary of Mattel)

- Crayola LLC

Regional Analysis

Asia Pacific Dominates the Toys and Games Market with Largest Market Share of 44.1% in 2024

In 2024, Asia Pacific emerged as the leading region in the global toys and games market, accounting for the largest market share of 44.1%, which translates to a market valuation of USD 133.0 billion. This dominant position can be attributed to the presence of a large child population base, expanding middle-class income groups, and a rapidly growing e-commerce infrastructure that has significantly enhanced product accessibility across urban and semi-urban areas. Countries such as China, India, Japan, and South Korea have been instrumental in driving demand, fueled by increasing consumer spending on children’s entertainment, educational toys, and character-based merchandise.

Recent Developments

- In 2023, Sega Sammy announced a deal worth $776 million to acquire Rovio Entertainment, the Finnish company behind the popular Angry Birds game. The Japanese gaming firm aimed to expand its mobile gaming business through this acquisition. As part of the offer, Sega Sammy proposed to purchase each Rovio share at 9.25 euros, offering a premium over the market price. The deal was set to be finalized in May, marking a major move in the mobile gaming space.

- In 2025, Savvy Games Group, backed by Saudi Arabia’s Public Investment Fund, shared plans to expand its presence in the console and PC gaming sectors. The company is exploring new acquisitions after previously buying mobile game maker Scopely for $4.9 billion in 2023. Savvy had earlier committed $1 billion to Embracer Group, with a follow-up deal worth $2 billion falling through, leading to internal restructuring at Embracer. Future investments are expected to target major game development platforms.

- In 2024, Nintendo made headlines with the acquisition of Shiver Entertainment, a U.S.-based developer experienced in porting titles for the Switch console. Shiver had worked on well-known games like Hogwarts Legacy and Mortal Kombat 1. This strategic move marks Nintendo’s effort to strengthen its development resources and ensure high-quality ports for its gaming platform.

- In 2024, Ty Warner introduced a new toy concept called Beanie Bouncers, blending the classic plush toy design with a fun, bouncy feature. These toys were showcased at a special holiday event held at the Sphere in Las Vegas from December 16th to 22nd. The display turned into a festive experience for visitors, reflecting Warner’s continued innovation in the toy industry.

Conclusion

The global toys and games market is poised for steady growth, driven by technological advancements, evolving consumer preferences, and demographic shifts. Key trends include the integration of digital elements into traditional toys, the rise of eco-friendly products, and the expanding adult consumer segment. Companies that align their strategies to these trends are well-positioned to capitalize on emerging opportunities in this dynamic market landscape.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)