Table of Contents

Fitness Tracker Market Overview

Fitness tracker brands provide wearable devices that monitor physical activity, health metrics, and overall fitness levels, becoming increasingly popular due to the focus on health and wellness.

Key features include activity monitoring, heart rate tracking, sleep analysis, and caloric expenditure calculations, with advanced models offering GPS functionality.

Many devices sync with mobile apps for detailed insights, customizable goals, and social connectivity. The market has seen technological advancements. With improvements in sensor accuracy and battery life, alongside a growing emphasis on integration with health ecosystems.

When selecting a fitness tracker, consumers prioritize accuracy, battery longevity, and comfort, making these devices valuable tools for personal health management.

Market Drivers

The global fitness tracker market is driven by several key factors, including rising health awareness and the growing prevalence of lifestyle-related chronic diseases. Which motivates consumers to monitor their fitness.

Technological advancements in sensor accuracy and battery life enhance the functionality of these devices. The increasing adoption of smart wearables and integration with mobile apps attract a broader audience.

Social connectivity features encourage user engagement and motivation, and corporate wellness programs promote the use of fitness trackers in the workplace.

Additionally, a focus on preventive healthcare further solidifies the role of fitness trackers in personal health management.

Market Size

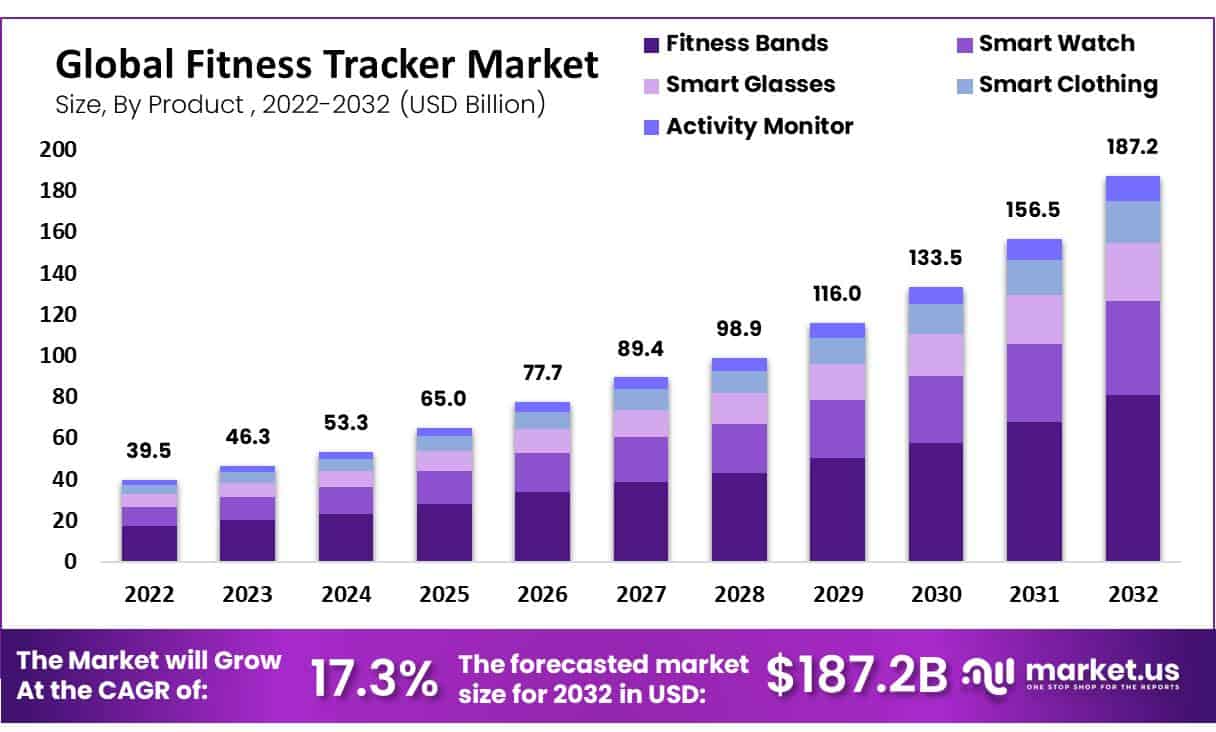

The global fitness tracker market is expected to grow from USD 39.5 billion in 2022 to around USD 187.20 billion by 2032, at a CAGR of 17.3%.

List of Major Companies

These are the top 10 companies operating in the Fitness Tracker Brands Market:

Xiaomi

Company Overview

| Establishment Year | 2010 |

| Headquarter | Beijing, China |

| Key Management | Lei Jun (CEO) |

| Revenue (US$ Bn) | $ 40.7 Billion (2023) |

| Headcount | ~ 32,543 (2022) |

| Website | https://www.mi.com/ |

About Xiaomi

Xiaomi Corporation has secured a strong position in the fitness tracker brands/market with its cost-effective and feature-rich Smart Band series.

The recent release of the Xiaomi Smart Band 9, featuring a 1.62-inch AMOLED display and up to 21 days of battery life, exemplifies this strategy. Launched in 2023, it is set to go global soon, continuing Xiaomi’s tradition of affordable wearables.

The company has also introduced proprietary technologies to enhance design and fit. Aiming to improve accuracy and aesthetics while competing against brands like Fitbit and Garmin. Extensive global unit shipments support Xiaomi’s dominance.

Geographical Presence

Xiaomi Corporation has established a significant global presence, emerging as a leading smartphone manufacturer primarily in China and India. Where it has captured substantial market shares through localized marketing and strong e-commerce partnerships.

The company has expanded rapidly in Southeast Asia and Western and Eastern Europe. It is beginning to penetrate Latin America and the Middle East, focusing on affordable products and strategic collaborations with local telecom operators.

While its presence in North America remains limited, primarily through online sales, Xiaomi’s adaptability and innovative offerings have facilitated its rapid growth across diverse markets. Solidifying its position as a major player in the consumer electronics sector.

Recent Developments

- In September 2024, Xiaomi unveiled a smart TV range in China called Redmi A Pro.

- In August 2024, Xiaomi introduced the Android 15 Beta 3 update in China.

Company Overview

| Establishment Year | 1998 |

| Headquarter | Mountain View, California, US. |

| Key Management | Sundar Pichai (CEO) |

| Revenue (US$ Bn) | $ 305.6 B (2023) |

| Headcount | ~ 182,502 (2023) |

| Website | https://about.google/ |

About Google

Google’s entry into the fitness tracker brands/market was significantly bolstered by its $2.1 billion acquisition of Fitbit in 2021 following regulatory challenges.

This acquisition expanded Google’s wearable technology portfolio and integrated Fitbit products. Like the Versa and Charge series, into its ecosystem, including Wear OS.

Fitbit recently added features such as blood glucose tracking via Fitbit Premium to enhance personalized fitness recommendations.

While concerns about data privacy have arisen, Google has pledged to keep Fitbit user data separate from its advertising business. This positions Google as a key competitor in the wearables market alongside Apple and Samsung.

Geographical Presence

Google LLC, headquartered in Mountain View, California, has a significant global presence with key operational locations across North America (e.g., New York City and Austin), Europe (Dublin and London), Asia-Pacific (Singapore and Tokyo), Latin America (São Paulo), and the Middle East and Africa (Dubai).

The company commands over 90% of the global search engine market and is expanding its cloud services, particularly in Asia-Pacific and North America.

Google’s strategy includes developing localized products. Forming partnerships to enhance service offerings, and complying with regional regulations. Which collectively reinforces its leadership in search, advertising, and cloud computing.

Recent Developments

- In August 2024, Google established a new data center in Uruguay.

- In August 2024, Google agreed to purchase electricity and renewable energy credits from Energix Renewables’ solar projects.

Apple

Company Overview

| Establishment Year | 1976 |

| Headquarter | Cupertino, California, U.S. |

| Key Management | Tim Cook (CEO) |

| Revenue (US$ Bn) | $ 383.2 Billion (2023) |

| Headcount | ~ 161,000 (2023) |

| Website | http://www.apple.com/ |

About Apple

Apple remains a leader in the fitness tracker brands/market, driven by its Apple Watch series, which has seen consistent product innovation.

In 2023, Apple introduced the Apple Watch Series 9 and Apple Watch Ultra 2. Both feature enhanced health monitoring capabilities, such as blood oxygen measurement, ECG, and sleep tracking. These watches also offer a new double-tap gesture and improvements in the environmental sustainability of the devices.

The Apple Watch’s tight integration with the iPhone and the broader Apple ecosystem enhances its appeal by providing a seamless user experience.

Furthermore, Apple continues to focus on advancing fitness and health tracking, including its ongoing developments in glucose monitoring technology.

These innovations, coupled with partnerships like those with healthcare institutions, strengthen Apple’s position in the wearable and health technology sector.

Geographical Presence

Apple Inc. has a significant global presence, with operations strategically distributed across North America, Europe, Asia-Pacific, Latin America, and the Middle East. In the United States, its headquarters in Cupertino drives substantial revenue through numerous retail locations.

Western Europe, particularly the UK, Germany, and France, represents major markets, while Apple is expanding its reach in Eastern Europe. Asia-Pacific is highlighted by a strong presence in China, alongside growing markets in Japan, South Korea, and India.

In Latin America, Brazil and Mexico are key, and the UAE serves as a hub for the Middle East, complemented by a growing footprint in South Africa. This strategic geographic distribution supports Apple’s ongoing revenue growth and responsiveness to diverse market demands.

Recent Development

- In September 2024, Apple introduced the new AirPods 4 and Apple Watch Series 10.

- In September 2024, Apple introduced AirPods Pro 2, featuring the first all-in-one hearing health experience.

Samsung

Company Overview

| Establishment Year | 1969 |

| Headquarter | Suwon, South Korea |

| Key Management | Jong-Hee Han (CEO) |

| Revenue (US$ Bn) | $ 198.2 Billion (2023) |

| Headcount | ~ 270,372 (2023) |

| Website | https://www.samsung.com/ |

About Samsung

Samsung Electronics continues to play an important role in the fitness tracker brands/market, particularly with the recent development of the Galaxy Fit 3.

Expected to launch in 2024, the Galaxy Fit 3 will include features like an AMOLED display, improved battery life, and enhanced health sensors, including heart rate and SpO2 monitoring.

This comes after a period of focus on smartwatches like the Galaxy Watch series, as Samsung has been enhancing its wearable offerings with tighter integration into the Android ecosystem. However, the Galaxy Fit 3 is aimed at providing a more affordable fitness tracking option.

Competing with devices from Xiaomi and Fitbit. Additionally, Samsung has been expanding its wearable portfolio by exploring future products like the Galaxy Ring. Potentially shifting its focus from traditional fitness bands to more innovative health-tracking wearables.

Geographical Presence

Samsung Electronics maintains a comprehensive geographical presence, with operations strategically located across key regions. In South Korea, the headquarters drive R&D and manufacturing. While China and India serve as vital hubs for production and innovation.

In North America, the U.S. hosts significant manufacturing plants, particularly in Texas and California, alongside operations in Canada. Europe features strong sales and R&D capabilities in Germany and the UK.

In Latin America, Brazil and Mexico enhance local production and market penetration. Additionally, the UAE and South Africa serve as critical bases for expanding operations in the Middle East and Africa.

This extensive network positions Samsung to respond effectively to global market trends and consumer demands.

Recent Development

- In September 2024, Samsung introduced the Music Frame WICKED Edition, a customizable wireless speaker.

- In September 2024, Samsung introduced the Bespoke AI Heat Pump Combo in New Zealand.

Nike

Company Overview

| Establishment Year | 1964 |

| Headquarter | Beaverton, Oregon, United States |

| Key Management | John Donahoe (CEO) |

| Revenue (US$ Bn) | $ 51.3 B (2024) |

| Headcount | ~ 79,400 (2024) |

| Website | https://www.nike.com/ |

About Nike

Nike has been leveraging its strong presence in the sportswear industry to explore the fitness technology market, particularly through collaborations and partnerships.

Although brands like Nike no longer directly produce fitness trackers, it continues to have a significant role in the fitness space with its popular Nike Training Club app and smart clothing initiatives.

Nike previously collaborated with Apple to integrate its fitness features into Apple Watch editions designed specifically for running and workouts.

The company has also expanded its digital ecosystem, focusing on wellness and sports engagement, including the launch of new sports-focused footwear like the Nike Kiger and ReactX Wildhorse 10 for runners.

Nike’s continued emphasis on digital fitness and sports engagement tools reflects its ongoing strategy to adapt to the evolving fitness tech market.

Geographical Presence

Nike, Inc. has a diverse geographical presence across four key regions: North America, Europe, the Middle East and Africa (EMEA), Greater China, and Asia-Pacific and Latin America (APLA).

North America accounts for about 40% of the company’s revenue, with major retail hubs in cities like New York and Los Angeles.

In EMEA, the growing demand for athleisure is driven by a youthful demographic, while Greater China presents significant growth potential due to rising disposable incomes and a fitness culture.

The APLA segment includes emerging markets such as Japan and Brazil, where health awareness is increasing.

Nike’s strategy emphasizes direct-to-consumer sales, localized marketing, and digital investment, positioning the company to maintain its competitive edge globally.

Recent Developments

- In August 2024, Nike opened a new store in Indore, Madhya Pradesh, India.

- In August 2024, Nike opened a new retail outlet in Quebec, Canada.

Huawei

Company Overview

| Establishment Year | 1987 |

| Headquarter | Shenzhen, China |

| Key Management | Ren Zhengfei (CEO) |

| Revenue (US$ Bn) | $ 99.6 Billion (2023) |

| Headcount | ~ 207,272 (2023) |

| Website | https://www.huawei.com/ |

About Huawei

Huawei has significantly expanded its presence in the fitness tracker brands/sector, continuously developing innovative wearables that integrate advanced health monitoring technologies.

The company’s TruSeen and TruSport systems, featured in devices like the Huawei Watch GT 4, offer detailed insights into heart rate, SpO2, sleep, and fitness tracking.

In 2023, Huawei further pushed the boundaries with the launch of the Watch Ultimate, a rugged smartwatch designed for extreme sports enthusiasts, featuring satellite communication and long battery life.

Additionally, Huawei is investing heavily in health-related research, including collaborations with European universities to advance ECG technology and cardiovascular disease management using AI-powered wearables.

These efforts reflect Huawei’s commitment to making fitness trackers smarter and more precise, positioning it as a major player in the global wearables market.

Geographical Presence

Huawei Technologies Co., Ltd. operates in over 170 countries, with a significant presence in Asia-Pacific, Europe, the Middle East, Africa, and the Americas.

In China, it dominates telecommunications and consumer electronics, while in Southeast Asia, it fosters digital transformation. Europe remains a critical market despite regulatory challenges, particularly in Western nations like Germany and France.

The Middle East sees Huawei supporting 5G rollout and smart city projects, while Africa benefits from its investments in network infrastructure.

In the Americas, the company navigates regulatory hurdles in the U.S. but explores opportunities in Canada and Latin America. Overall, Huawei’s strategic geographical focus and commitment to innovation position it well to capitalize on global digital transformation trends.

Recent Developments

- In September 2024, Huawei unveiled a tri-foldable phone, Mate XT.

- In August 2024, Huawei sold a 10% stake in Shenzhen Yinwang Intelligent Technology to Seres Group for $1.6 billion.

Adidas

Company Overview

| Establishment Year | 1924 |

| Headquarter | Herzogenaurach, Bavaria, Germany |

| Key Management | Bjørn Gulden (CEO) |

| Revenue (US$ Bn) | $ 23.2 Billion (2022) |

| Headcount | ~ 58,564 (2022) |

| Website | https://www.adidas.com/ |

About Adidas

Adidas has been actively working to enhance its presence in the fitness and training sector through strategic partnerships and product innovations.

In 2023, Adidas collaborated with Les Mills to launch a new training offering targeting next-generation fitness enthusiasts.

This collaboration, which includes virtual and in-person experiences, emphasizes strength training and provides tailored products like the Dropset 2 shoes and the FW23 Strength Collection, designed for optimal performance.

Adidas also continues to explore digital fitness solutions, integrating workout programs with rewards through its adiClub membership program and offering users discounts on the Les Mills+ Training App.

This marks a continued effort by Adidas to combine fitness apparel with digital engagement to meet the evolving needs of athletes and fitness fans.

Geographical Presence

Adidas AG maintains a robust geographical presence across several key regions. In North America, the brand benefits from strong consumer loyalty and a wide retail network, including flagship stores and a prominent online presence.

Europe remains a core market, bolstered by localized marketing strategies. The Asia-Pacific region, particularly China and India, offers significant growth potential, with an emphasis on digital engagement with younger consumers.

In Latin America, Adidas leverages partnerships to capture emerging demand for sports and lifestyle apparel, while in the Middle East and Africa, it focuses on urban centers and community initiatives.

This strategic, multi-channel approach enables Adidas to adapt to local preferences and sustain its competitive edge in the global sportswear market.

Recent Developments

- In September 2024, Adidas entered into a sponsorship partnership with Hexagon Cup.

- In August 2024, Adidas signed a memorandum of understanding with INDEFOL SOLAR to integrate 600 GWh of renewable energy annually.

Sony

Company Overview

| Establishment Year | 1946 |

| Headquarter | Tokyo, Japan |

| Key Management | Kenichiro Yoshida (CEO) |

| Revenue (US$ Bn) | $ 90.1 Billion (2023) |

| Headcount | ~ 113,000 (2023) |

| Website | https://sony.com/ |

About Sony

Sony Corporation has been exploring various avenues in the fitness tracker brands/sector, primarily focusing on wearable technology and health monitoring.

Although Sony has not launched a dedicated fitness tracker recently, it continues to expand its wearable tech capabilities through collaborations and acquisitions in the broader tech industry.

A notable development is Sony’s investment in advanced sensor technologies, such as through its acquisition of Altair Semiconductor, which supports its wearable devices like smartwatches.

Sony has also integrated health and activity tracking features into its wearables through partnerships with companies like Garmin and its subsidiary, Misfit.

The company is actively investing in AI and sensor advancements that could enhance its position in the fitness and health monitoring market.

Geographical Presence

Sony Corporation is a multinational conglomerate with a strong global presence across several regions. In North America, its PlayStation brand and Sony Pictures Entertainment are particularly influential.

In Europe, the company maintains a robust presence in consumer electronics and entertainment, with significant operations in the UK, Germany, and France.

Asia, particularly Japan, is critical for both manufacturing and sales, while the company is expanding in Latin America, especially in Brazil and Mexico.

Additionally, Sony is enhancing its footprint in the Middle East and Africa, focusing on consumer electronics and adapting its offerings to meet local market needs.

Overall, Sony leverages its diverse portfolio to address regional dynamics and consumer trends effectively.

Recent Development

- In September 2024, Sony partnered with TVN LIVE PRODUCTION to add a U8 truck to its outside broadcast fleet.

- In September 2024, Sony Electronics launched V2.0 for its SRG-A40 and SRG-A12 pan-tilt-zoom (PTZ) cameras.

Garmin

Company Overview

| Establishment Year | 1989 |

| Headquarter | Schaffhausen, Switzerland |

| Key Management | Cliff Pemble (CEO) |

| Revenue (US$ Bn) | $ 5.2 Billion (2023) |

| Headcount | ~ 20,000 (2024) |

| Website | http://www.garmin.com/ |

About Garmin

Garmin continues to be a dominant player in the fitness tracker brands/sector, particularly with its focus on high-performance smartwatches and GPS-enabled devices.

In 2023, Garmin launched the Forerunner 265 and Forerunner 965 series, featuring vibrant AMOLED displays and advanced fitness tracking capabilities.

These devices are designed to help athletes optimize their training routines with features such as recovery time suggestions and performance tracking.

Additionally, Garmin has made strategic acquisitions, including JL Audio, in August 2023, further strengthening its product portfolio in the connected devices and automotive infotainment space.

Garmin’s emphasis on innovation and expanding its presence in fitness technology ensures its strong position in the global market.

Geographical Presence

Garmin Ltd. is a global leader in GPS technology, with a significant geographical presence across multiple regions.

Its headquarters in Olathe, Kansas, serves North America, where strong demand for automotive and fitness products drives revenue.

In Europe, Garmin maintains regional offices in countries like Germany and the UK, capitalizing on the growing interest in outdoor and navigation solutions.

The Asia-Pacific market, particularly in Japan and China, is a focal point for expansion, driven by the increasing adoption of fitness wearables.

Latin America, notably Brazil and Mexico, presents emerging opportunities, while Garmin’s presence in the Middle East and Africa targets niche markets such as marine and aviation.

This strategic global footprint enhances Garmin’s market share and brand recognition across diverse sectors.

Recent Developments

- In September 2024, Garmin launched the Garmin Dash Cam X series of high-quality dash cameras.

- In September 2024, Garmin launched the ECG App for smartwatches in Malaysia.

Withings

Company Overview

| Establishment Year | 2008 |

| Headquarter | Issy-les-Moulineaux, France |

| Key Management | Mathieu Letombe (CEO) |

| Revenue (US$ Bn) | $ 64.4 Million (2023) |

| Headcount | ~ 368 (2023) |

| Website | https://www.withings.com/ |

About Withings

Withings has been actively expanding its presence in the fitness tracker brands and connected health sector through strategic acquisitions and product innovations.

In 2022, Withings acquired 8fit, a popular fitness app with over 40 million downloads, to strengthen its portfolio by combining personalized workout plans with its health tracking devices.

Additionally, Withings acquired Impeto Medical, further enhancing its expertise in medical devices. The company focuses on providing a holistic approach to health tracking with its smartwatches, scales, and health monitors, which track various health metrics like ECG, blood pressure, and sleep quality.

Recently, Withings has also been investing in its B2B division, securing $60 million in funding to develop advanced health tracking solutions for healthcare professionals, with plans to expand operations in the U.S. and France.

Geographical Presence

Withings, a leader in health technology, has established a strong geographical presence primarily in North America and Europe.

In the United States, it leverages robust retail and e-commerce channels, while France serves as a key domestic market.

Significant growth is also seen in Germany, the UK, and Scandinavia, driven by rising consumer adoption of health devices.

In the Asia-Pacific region, Withings is expanding in Japan and Australia, with potential growth in China despite challenges.

The company is gradually exploring opportunities in emerging markets in Latin America and Africa, adapting its strategies to meet regional health trends and consumer needs.

Recent Developments

- In February 2022, Withings acquired 8fit, a health and wellness app with over 40 million downloads. Available in six languages, 8fit provides users with workouts, personalized meal plans, and self-care guidance.

- In June 2020, Withings secured $60 million in funding to develop further noninvasive health devices that enhance personalized engagement between patients and physicians.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)