Table of Contents

Introduction

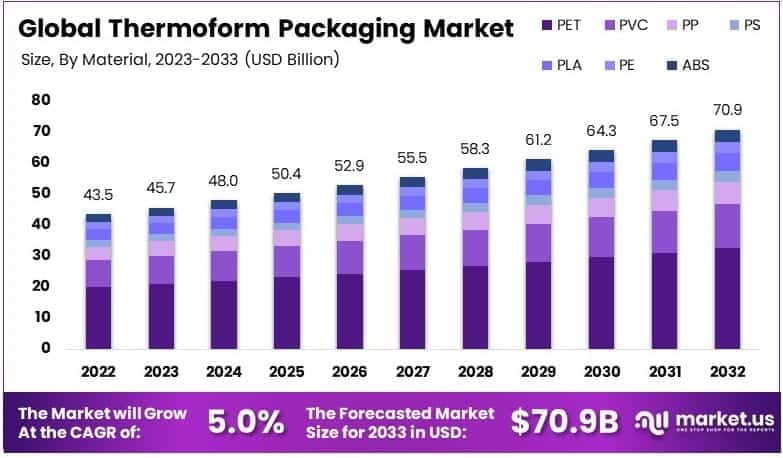

The Global Thermoform Packaging Market is projected to reach approximately USD 70.9 billion by 2033, up from an estimated USD 43.5 billion in 2023. This growth reflects a compound annual growth rate (CAGR) of 5.0% over the forecast period from 2024 to 2033.

Thermoform packaging refers to a manufacturing process wherein a plastic sheet is heated to a pliable forming temperature, molded into a specific shape in a mold, and trimmed to create a usable product, such as trays, clamshells, and blisters. This technique is widely adopted across food, pharmaceuticals, electronics, and consumer goods industries due to its cost-efficiency, lightweight nature, and versatility in protecting and displaying products. The thermoform packaging market, therefore, comprises the production, distribution, and sale of such packaging solutions, and it continues to witness notable growth driven by the expanding demand for sustainable, lightweight, and cost-effective packaging materials.

Growth of this market is primarily attributed to the rising consumption of packaged and convenience foods, heightened awareness regarding product safety, and the increasing adoption of recyclable and biodegradable materials. Additionally, regulatory pressures to reduce environmental impact and the growing preference for transparent packaging that enhances shelf appeal have further bolstered demand. The market is also being stimulated by advancements in thermoforming machinery and materials, enabling high-speed production and precision shaping, which enhance product consistency and reduce waste.

Rising demand from the healthcare and pharmaceutical industries, particularly for sterile and tamper-evident blister packs, is creating new opportunities for specialized thermoform packaging solutions. Furthermore, the shift towards e-commerce and direct-to-consumer retailing is opening avenues for durable yet lightweight protective packaging formats, accelerating the adoption of thermoformed products. Emerging economies, with their expanding middle-class population and increasing consumer spending on packaged goods, present significant growth potential, positioning thermoform packaging as a critical component in the evolving global packaging landscape.

Key Takeaways

- The global Thermoform Packaging Market was valued at USD 43.5 billion in 2023 and is projected to reachb by 2033, expanding at a CAGR of 5.0% during the forecast period.

- Polyethylene Terephthalate (PET) dominated the material segment in 2023, accounting for 46.1% of the market share, primarily due to its high recyclability, durability, and strength.

- Containers led the type segment with a 28.3% share in 2023, driven by strong demand from the food packaging sector owing to their functionality and convenience.

- The Food & Beverages segment emerged as the leading application category, capturing 50.7% share in 2023, supported by the increasing consumption of ready-to-eat and packaged food products globally.

- North America held a significant market share of 29.7% in 2023, valued at approximately USD 12.92 billion, fueled by the region’s adoption of advanced packaging technologies and sustainability-focused initiatives.

Review Historical Trends and Current Impacts of US Tariff Regulations https://market.us/report/thermoform-packaging-market/

Impact of U.S. Tariffs on the Thermoform Packaging Market

The U.S. tariff policy, particularly the imposition of a 10% across-the-board tariff and a 145% tariff on Chinese imports, has significantly impacted the thermoform packaging sector. This policy shift has disrupted supply chains, increased production costs, and altered competitive dynamics within the industry.

Impact on Thermoform Packaging Market

Increased Production Costs and Supply Chain Disruptions: The imposition of tariffs has led to heightened costs for raw materials and finished goods, particularly those sourced from China and Vietnam. For instance, the U.S. Department of Commerce initiated antidumping and countervailing duty investigations on thermoformed molded fiber products from China and Vietnam, citing significant price undercutting and government subsidies. Preliminary determinations indicated substantial dumping margins, with estimates of 477.97% for China and 231.73% to 260.56% for Vietnam.

These tariffs have disrupted the movement of essential machines, products, and materials, affecting American manufacturers across various sectors, including packaging.

Shifts in Global Supply Chains: In response to the tariffs, U.S. companies are reevaluating their supply chains. Some suppliers are scaling back or ceasing sales to the U.S. due to rising costs and policy uncertainty . Additionally, neighboring countries like South Korea, Thailand, and Vietnam are intensifying efforts to combat tariff evasion by Chinese exporters using deceptive labeling practices, which could further complicate sourcing strategies .

Economic Implications: The tariffs are projected to increase costs for U.S. households. Estimates suggest an average tax increase of more than $1,200 per household in 2025, with a reduction in after-tax incomes by approximately 1.2% on average . This economic strain could lead to decreased consumer spending, affecting demand for packaged goods and, consequently, the thermoform packaging market.

Emerging Trends

- Shift Towards Sustainable Materials: There is an increasing preference for biodegradable and compostable materials in thermoform packaging, driven by environmental concerns and consumer demand for eco-friendly solutions.

- Integration of Advanced Manufacturing Technologies: The adoption of digital printing and automation in thermoform packaging processes is enhancing efficiency and enabling greater customization to meet diverse consumer needs.

- Growth in On-the-Go and Convenience Packaging: The rising demand for easy-to-open, resealable, and portion-controlled packaging formats is influencing the design and production of thermoform packaging solutions.

- Increased Use in Electronics and Electricals: Thermoform packaging is gaining traction in the electronics sector for products like mobiles, batteries, and accessories, owing to its protective qualities and design flexibility.

- Expansion in the Pharmaceutical Sector: The pharmaceutical industry’s growth is contributing to increased demand for thermoform packaging, particularly for unit dose packaging solutions like blisters.

Top Use Cases

- Food and Beverage Industry: Thermoform packaging is extensively used for ready-to-eat meals, processed foods, and beverages, offering enhanced shelf life and protection.

- Pharmaceutical Packaging: The sector utilizes thermoform blisters for unit dose packaging, ensuring product integrity and compliance with regulatory standards.

- Electronics Packaging: Thermoform solutions like clamshells and trays are employed to protect electronic items such as headphones and mobile accessories during transportation and display.

- Personal Care and Cosmetics: The industry leverages thermoform packaging for products requiring aesthetic appeal and protection, such as skincare and cosmetic items.

- Medical Device Packaging: Thermoform packaging is used for medical devices, providing sterile and secure packaging solutions that comply with healthcare standards.

Major Challenges

- Environmental Concerns and Recycling Limitations: The use of non-renewable plastics in thermoform packaging raises environmental issues, and the lack of proper recycling infrastructure exacerbates the problem.

- High Initial Tooling Costs: The significant investment required for molds and tooling in thermoform packaging can be a barrier for small and medium-sized enterprises.

- Inconsistency in Product Quality: Variations in wall thickness and uniformity in thermoformed products can affect the quality and performance of the packaging.

- Competition from Alternative Packaging Solutions: The availability of other packaging methods, such as injection molding, which may offer cost advantages, poses a competitive challenge.

- Regulatory Pressures: Stringent government regulations on plastic usage are compelling manufacturers to seek alternative materials and adapt their processes accordingly.

Top Opportunities

- Development of Eco-Friendly Packaging Solutions: Investments in research and development are leading to the creation of sustainable and biodegradable thermoform packaging options.

- Advancements in Thermoforming Technology: Technological innovations are enabling more efficient production processes, reducing costs, and improving the quality of thermoform packaging.

- Expansion in Emerging Markets: Growing economies, particularly in the Asia-Pacific region, present significant opportunities for the thermoform packaging market due to increasing demand.

- Customization and Design Flexibility: The ability to create customized packaging solutions is attracting various industries to adopt thermoform packaging for their specific needs.

- Growth in E-commerce: The rise of online shopping is driving demand for protective and tamper-evident packaging solutions, positioning thermoform packaging as a suitable option.

Key Player Analysis

In 2024, the global thermoform packaging market is witnessing significant contributions from key players, each leveraging their unique strengths to drive innovation and sustainability. Amcor plc has enhanced its thermoforming manufacturing capacity in North America, aiming to cater to the growing healthcare ecosystem and providing more flexible options for companies seeking development collaborations . Berry Global Group, Inc. announced plans to expand its food service packaging manufacturing capabilities in North America, aligning with its long-term strategic growth commitments .

Sealed Air Corporation continues to focus on its core brands, such as Cryovac and Bubble Wrap, to maintain its position in the packaging industry . Sonoco Products Company remains a significant player, contributing to the market’s growth through its diverse packaging solutions . Huhtamaki Oyj has introduced groundbreaking mono-material technology, aiming to ensure that all of its packaging is 100% recyclable, compostable, or reusable by 2030 . WestRock Company continues to provide innovative packaging solutions, supporting the market’s expansion . Pactiv Evergreen Inc. maintains its strong presence in North America, supplying packaging products to various foodservice outlets .

Dart Container Corporation, known for being the world’s largest manufacturer of foam cups and containers, continues to play a vital role in the market . Molded Fiber Glass Companies contribute to the market by offering molded fiber packaging solutions . Placon Corporation has introduced the Crystal Seal Cravings line, made from recycled PET material, as a tamper-evident packaging solution, boosting sales and driving the growth of the thermoformed packaging market . Collectively, these companies are shaping the thermoform packaging landscape through strategic investments, technological advancements, and a commitment to sustainability.

Purchase The Full Report Now at https://market.us/purchase-report/?report_id=131750

Top Key Players in the Market

- Amcor plc

- Berry Global Group, Inc.

- Sealed Air Corporation

- Sonoco Products Company

- Huhtamaki Oyj

- WestRock Company

- Pactiv Evergreen Inc.

- Dart Container Corporation

- Molded Fiber Glass Companies

- Placon Corporation

Regional Analysis

North America Leads Thermoform Packaging Market with Largest Market Share of 29.7%

North America emerged as the leading region in the global thermoform packaging market in 2024, commanding a dominant market share of 29.7%, which translated to a market valuation of USD 12.92 billion. This leadership is primarily attributed to the region’s robust presence of advanced manufacturing infrastructure, widespread use of packaged consumer goods, and strong demand from key end-use industries such as food, pharmaceuticals, and electronics.

The presence of a mature retail sector and high per capita consumption of packaged products has further contributed to the region’s sustained dominance. The U.S., being the major contributor within the region, continues to influence growth dynamics due to its expansive consumer base and technological advancements in thermoforming techniques.

Moreover, stringent regulations concerning product safety and packaging integrity have compelled manufacturers to adopt high-quality, durable, and recyclable thermoform packaging solutions. However, the region also experienced implications from U.S. tariff policies, especially in relation to imported plastic resins and machinery, which have slightly affected production costs and supply chain stability.

The U.S. tariffs on materials sourced from countries like China have led to increased raw material prices, which, in turn, have impacted the pricing strategies of domestic thermoform packaging manufacturers. Despite this, innovation in sustainable packaging solutions and a shift toward biodegradable thermoform materials are expected to cushion the impact and sustain regional market growth. The strategic emphasis on automation, eco-friendly materials, and regulatory compliance continues to reinforce North America’s leading position in the global thermoform packaging landscape.

Recent Developments

- In 2024, Plastic Ingenuity launched a new educational initiative, introducing a free online course focused on Thermoform Circularity. This course is part of their ongoing “Good Information” series and aims to educate packaging professionals about sustainable practices in thermoformed packaging and its role in enhancing sustainability efforts.

- In September 2024, Sonoco Products Company began evaluating potential strategic options for its Thermoformed & Flexible Packaging (TFP) business. This move is part of Sonoco’s broader strategy to simplify its portfolio and improve operational efficiency, with an emphasis on increasing value for shareholders.

- In 2024, Amcor unveiled plans to expand its thermoforming capabilities in North America, particularly for the healthcare market. The expansion reflects Amcor’s commitment to meeting growing demand for sustainable and reliable packaging solutions within the healthcare sector.

- In September 3, 2024, Placon made a significant announcement with the introduction of EcoStar® 50S, a new sustainable packaging solution made from post-consumer recycled plastic. This innovative material aligns with the latest industry requirements and is now compliant across all 50 U.S. states.

- In September 10, 2024, Dart Container Corporation and PulPac entered into a strategic partnership. This collaboration will leverage Dart’s expertise in foodservice packaging and PulPac’s dry molded fiber technology to develop new, environmentally friendly packaging solutions for the foodservice industry.

Conclusion

The global thermoform packaging market is growing steadily due to rising demand from food, pharmaceutical, and electronics sectors, along with the expansion of e-commerce. Technological advancements, especially in automation and sustainable materials, are enhancing efficiency and supporting the shift toward eco-friendly solutions. While challenges like raw material costs and recycling limitations remain, ongoing innovation and increasing use in emerging markets are expected to drive continued growth in the coming years.