Table of Contents

Introduction

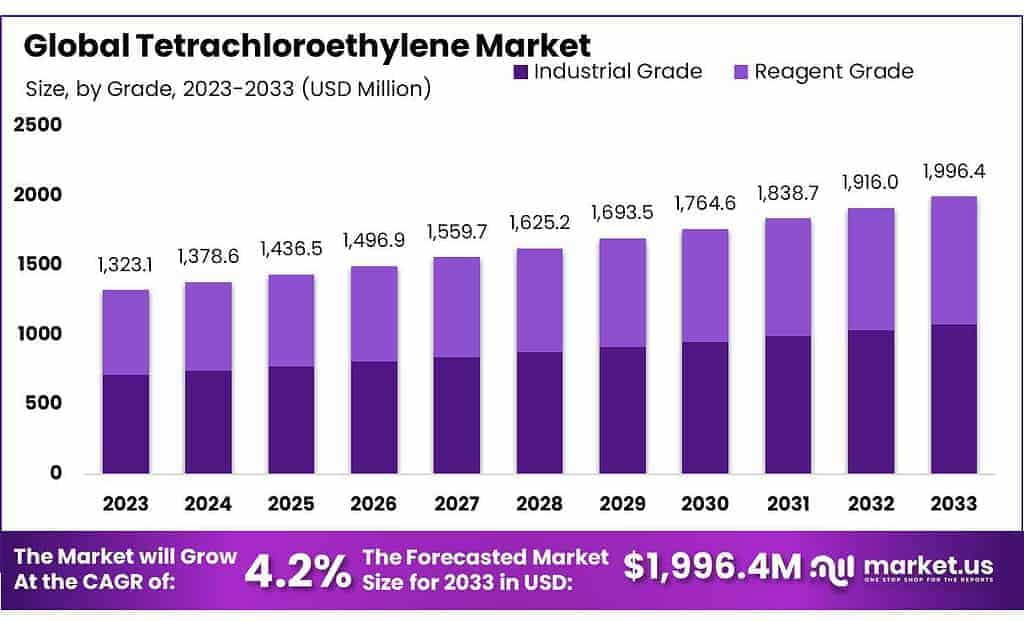

New York, NY – January 17, 2025 – The Global Tetrachloroethylene Market is poised for steady growth, with a projected market size of USD 1996.4 million by 2033, up from USD 1323.01 million in 2023. This growth represents a compound annual growth rate (CAGR) of 4.2% during the forecast period from 2024 to 2033.

Tetrachloroethylene, commonly known as perchloroethylene, is primarily used in dry cleaning, degreasing metals, and the production of adhesives and coatings. The market demand for this chemical is driven by its increasing application across various industries, including automotive, textiles, and chemicals. Growth factors such as the rising demand for dry cleaning services, expansion of industrial activities, and the adoption of tetrachloroethylene in manufacturing processes are fueling the market’s expansion.

Additionally, the growing focus on environmental sustainability and the development of alternatives to traditional solvents is likely to create opportunities for market players. The market’s popularity is also supported by the widespread use of tetrachloroethylene in solvent-based formulations and its role in supporting a range of industrial processes. As industries continue to advance and new applications emerge, the tetrachloroethylene market is expected to expand further, offering lucrative opportunities for both established and emerging players.

Key Takeaways

- The global Tetrachloroethylene Market is projected to reach USD 1996.4 million by 2033, growing from USD 1323.01 million in 2023 at a CAGR of 4.2%.

- Asia Pacific held 44.3% of the Tetrachloroethylene Market, valued at USD 588.7 million.

- Dry cleaning applications captured over 36.4% of the tetrachloroethylene market share in 2023, making it the leading segment.

- Industrial-grade tetrachloroethylene accounted for more than 54.3% of the market in 2023, mainly used in dry cleaning and metal degreasing.

- The Ethylene Oxychlorination process held a dominant market share of over 37.6% in 2023, favored for its cost-effectiveness.

- Indirect sales channels dominated the market with a 64.3% share in 2023, driven by extensive logistical support and local market expertise.

Emerging Trends

- Shift Towards Eco-Friendly Alternatives: Increasing environmental concerns are driving demand for more sustainable alternatives to tetrachloroethylene. Industries are actively researching green solvents and low-toxicity substitutes, which is creating pressure on traditional chemicals like tetrachloroethylene to adapt to eco-friendly standards.

- Regulatory Pressure on Usage: Growing regulations around hazardous chemicals are influencing the use of tetrachloroethylene in various applications. This is particularly true in the dry cleaning and automotive sectors, where stricter environmental and health standards are encouraging the adoption of safer, non-toxic alternatives.

- Growth in Emerging Economies: Tetrachloroethylene’s use in industrial applications is rising in emerging economies, particularly in Asia-Pacific and Latin America. The expanding manufacturing sector and increasing demand for textiles and automotive products in these regions are contributing to market growth.

- Technological Advancements in Manufacturing: New manufacturing technologies are enhancing the efficiency of tetrachloroethylene production processes. Innovations in chemical engineering are helping reduce energy consumption, improve yield, and minimize environmental impact, allowing for more sustainable production methods.

- Rising Demand in Automotive Industry: The automotive industry’s demand for tetrachloroethylene is increasing due to its application in metal degreasing and cleaning. As the industry focuses on cleaner production methods, tetrachloroethylene continues to play a vital role in maintaining parts and machinery, while contributing to high-efficiency manufacturing.

Use Cases

- Dry Cleaning: Tetrachloroethylene is widely used in the dry cleaning industry as a solvent for removing stains from delicate fabrics. Its ability to dissolve oils and grease without damaging clothes makes it an ideal choice for cleaning high-end garments and textiles.

- Degreasing in Automotive & Manufacturing: In the automotive and manufacturing sectors, tetrachloroethylene is used for degreasing metal parts. Its strong solvent properties help remove oils, greases, and contaminants from machinery components, ensuring smooth operations and preventing wear and tear in industrial processes.

- Chemical Intermediate: Tetrachloroethylene is used as an intermediate in the production of various chemicals, including fluoropolymers and refrigerants. Its role in chemical synthesis supports the production of materials used in a wide range of industries such as electronics and construction.

- Adhesive & Coating Production: The chemical is utilized in the formulation of adhesives, sealants, and coatings. Tetrachloroethylene helps in dissolving resins and other compounds, making it an effective solvent for products used in the automotive, construction, and packaging industries.

- Aerospace Industry: Tetrachloroethylene is used in aerospace applications for cleaning and degreasing aircraft components. It effectively removes oils, dust, and residues from critical parts, ensuring high levels of cleanliness and performance in aerospace equipment.

Major Challenges

- Environmental and Health Concerns: Tetrachloroethylene is associated with potential health risks, including respiratory problems and skin irritation. Prolonged exposure has been linked to liver and kidney damage, making its use a challenge in industries where worker safety and environmental sustainability are key concerns.

- Regulatory Restrictions: Governments worldwide are imposing stringent regulations on the use of tetrachloroethylene due to its hazardous nature. These restrictions are forcing companies to seek safer alternatives or invest in costly safety measures to comply with evolving environmental laws, creating a barrier to market growth.

- Toxicity in Water and Soil: Tetrachloroethylene can contaminate water and soil if improperly disposed of, causing long-term environmental damage. Its persistence in the environment makes cleanup efforts expensive and complicated, posing challenges for industries that rely on this chemical in industrial and commercial applications.

- Rising Costs of Alternatives: While there is a push toward eco-friendly substitutes for tetrachloroethylene, many of these alternatives tend to be more expensive. This price gap can be a significant challenge for companies, especially smaller businesses, which are hesitant to switch to higher-cost solvents without guaranteed performance benefits.

- Supply Chain and Raw Material Constraints: The production of tetrachloroethylene relies on specific raw materials and chemical processes that can be disrupted by supply chain issues or price fluctuations. This can lead to supply shortages, increased costs, and challenges in maintaining consistent product availability.

Market Growth Opportunities

- Demand for Sustainable Alternatives: The growing interest in environmentally friendly and non-toxic solvents offers a significant market opportunity. Companies investing in the development of safer alternatives to tetrachloroethylene can capitalize on consumer and regulatory demand for greener solutions in industries like dry cleaning and manufacturing.

- Expansion in Emerging Markets: Rapid industrialization in emerging economies, particularly in Asia-Pacific and Latin America, presents growth opportunities for tetrachloroethylene. As these regions expand their automotive, textile, and chemical industries, the demand for industrial solvents like tetrachloroethylene is expected to rise, driving market expansion.

- Adoption in New Industrial Applications: Tetrachloroethylene’s versatile solvent properties make it suitable for use in a wide range of applications, including new sectors like aerospace and electronics. As these industries grow, new opportunities will arise for tetrachloroethylene to serve as an essential part of cleaning, degreasing, and manufacturing processes.

- Technological Advancements in Production: Advances in production technology that improve efficiency and reduce environmental impact offer growth opportunities for tetrachloroethylene manufacturers. Investing in greener, more efficient production methods can lower costs, enhance sustainability, and open up new market segments.

- Recycling and Reuse Initiatives: As sustainability becomes a key focus, the recycling and reuse of tetrachloroethylene is gaining traction. Industries focusing on circular economy practices can tap into the potential of reusing tetrachloroethylene, reducing waste and costs while appealing to eco-conscious consumers and businesses.

Recent Developments

- AGC, In December 2023, AGC announced plans to expand the production capacity of fluorinated solvents, including those used as alternatives to PCE, at its Chiba Plant in Japan. The expansion is scheduled to be completed in 2025 and aims to meet the growing demand for environmentally-friendly solvents.

- Westlake Chemical Corporation, In August 2023, Westlake announced the acquisition of Hexion’s epoxy business for $1.2 billion. While not directly related to PCE, this acquisition expands Westlake’s portfolio of specialty chemicals and may impact its overall chlorinated organics business.

- Dow has been focusing on developing alternatives to chlorinated solvents like PCE. In 2022, they introduced new DOWSIL silicone-based cleaning solvents as environmentally preferable options for industrial cleaning applications.

- EPA Regulatory Actions, The U.S. Environmental Protection Agency (EPA) has taken significant regulatory action on PCE: In December 2024, the EPA finalized a rule under the Toxic Substances Control Act (TSCA) to address unreasonable risks from PCE. The rule prohibits most industrial and commercial uses of PCE, bans consumer use, and implements a 10-year phaseout for PCE use in dry cleaning.

Conclusion

The Tetrachloroethylene Market is expected to experience steady growth, driven by its versatile applications across various industries like dry cleaning, automotive, and manufacturing. While challenges such as environmental concerns, health risks, and regulatory restrictions remain, there are significant opportunities for innovation and market expansion.

The rising demand for sustainable alternatives and the growing industrial needs in emerging markets offer avenues for continued development. Companies that can adapt to stricter regulations, invest in greener production methods, and explore new applications in sectors like aerospace and healthcare will be well-positioned to capture market share.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)