Table of Contents

Introduction

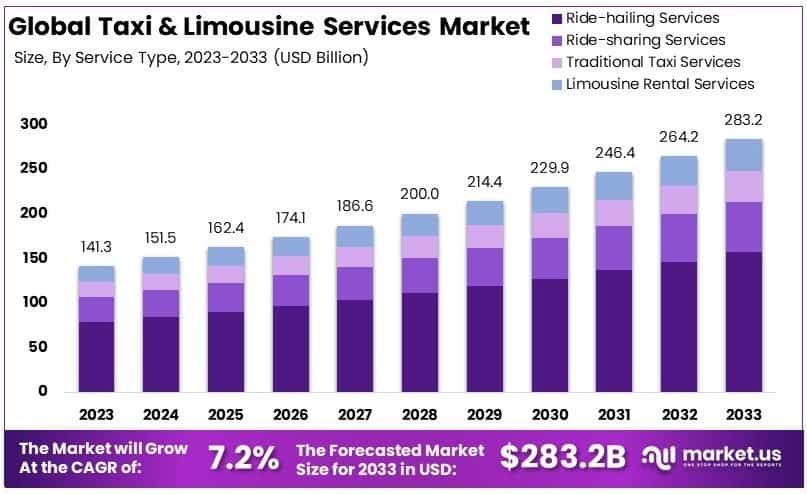

New York, NY – April 02, 2025 – The Global Taxi & Limousine Services Market is projected to reach approximately USD 283.2 billion by 2033, up from USD 141.3 billion in 2023, demonstrating a compound annual growth rate (CAGR) of 7.2% during the forecast period from 2024 to 2033.

The Taxi and Limousine Services Market encompasses a wide range of transportation services, which include traditional taxis, black car services, and limousines that offer pre-arranged and on-demand passenger transportation. This market is characterized by its provision of premium, scheduled, and luxury transport services in urban and suburban areas, catering to a diverse clientele seeking convenience, comfort, and exclusivity.

Growth factors within this market are primarily driven by the increasing urbanization and the rising disposable income among consumers, which enhances the demand for convenient and personalized transportation solutions. Additionally, the integration of technology in service delivery, such as mobile app-based booking systems and GPS tracking, has significantly improved user experience, leading to higher consumer adoption rates.

The demand for taxi and limousine services is further bolstered by the surge in tourism and corporate travel. As cities globally continue to attract business and leisure travelers, the need for reliable, efficient, and luxurious transportation options intensifies. This sector benefits from the perceived reliability and enhanced safety features offered by professional chauffeur services, distinguishing them from other forms of public transport.

Opportunities within the Taxi and Limousine Services Market are vast, especially with the ongoing advancements in technology. The adoption of electric and hybrid vehicles presents a substantial opportunity for market players to differentiate themselves by offering environmentally friendly transportation solutions.

Moreover, expanding into emerging markets, where there is a growing middle class and an increasing preference for luxury services, can provide new revenue streams for operators in this sector. This market is poised for further expansion as it continues to evolve with changing consumer preferences and technological innovations, making it a dynamic component of the urban mobility landscape.

Key Takeaways

- The Taxi & Limousine Services Market was valued at USD 141.3 billion in 2023. It is projected to reach USD 283.2 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 7.2%.

- In 2023, ride-hailing services accounted for 55.4% of the market share within service types, underpinned by their convenience and wide accessibility to consumers.

- Economy vehicles were the most preferred vehicle type in 2023, comprising 48.9% of the market. This preference highlights consumers’ inclination towards cost-effective transportation solutions.

- Online platforms emerged as the leading channel for booking taxi and limousine services in 2023, capturing 63.2% of the bookings. This trend underscores the growing shift towards digital and mobile app-based booking systems.

- Individual customers formed the largest customer segment, making up 57.3% of the market in 2023. This indicates a strong demand for personal transportation services over corporate or group services.

- The Asia Pacific region held a dominant position in the global market landscape, significantly influencing overall market growth due to its large consumer base and increasing urbanization.

Obtain A Sample Copy Of This Report at https://market.us/report/taxi-limousine-services-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 141.3 Billion |

| Forecast Revenue (2034) | USD 283.2 Billion |

| CAGR (2024-2034) | 7.2% |

| Segments Covered | By Service Type (Ride-hailing Services, Ride-sharing Services, Traditional Taxi Services, Limousine Rental Services), By Vehicle Type (Economy Vehicles, Luxury Vehicles, Electric Vehicles [EVs], Hybrid Vehicles), By Booking Channel (Online Platforms, Mobile Applications, Offline/Street Hailing, Call-based Bookings), By Customer Type (Individual Customers, Corporate Clients, Tourist and Leisure Travelers) |

| Competitive Landscape | Uber, Lyft, Didi Chuxing, Grab, Gett, Careem, Ola Cabs, Taxify (Bolt), Addison Lee, Luxor Limo, Blacklane, ExecuCar, SuperShuttle |

Emerging Trends

- Digital Integration: The adoption of technology in taxi and limousine services has simplified transportation. Mobile applications now offer features like live tracking, cashless transactions, and instant bookings, enhancing user convenience and safety.

- Eco-Friendly Solutions: There is a growing trend towards eco-friendly transportation solutions. Electric taxis are becoming more prevalent, driven by environmental concerns and the push for sustainable urban transport.

- Rise of Ride-Sharing: Shared transportation options are gaining traction as they offer cost-effective solutions for consumers. This shift is particularly noticeable in urban areas where ride-sharing options like UberPOOL are popular.

- Expansion in Emerging Markets: The taxi and limousine market in Asia-Pacific is expanding rapidly, fueled by the large population and increasing urbanization which drives the demand for efficient transportation solutions.

- Customer Personalization: Tailoring services to individual preferences is becoming a key focus. Operators are increasingly leveraging digital platforms to offer personalized travel experiences, catering to the specific needs and schedules of their customers.

Top Use Cases

- Daily Commuting: Taxis and limousines are extensively used for daily commutes, offering a reliable alternative to public transport, especially in densely populated cities.

- Corporate Travel: Business professionals often rely on limousine services for travel to meetings and corporate events, valuing the reliability and premium service.

- Tourism and Leisure: In tourist-heavy cities, taxis and limousines are crucial for visitors who need dependable transportation to explore attractions without the hassle of public transport.

- Luxury Events: Limousines remain a popular choice for special occasions such as weddings, proms, and other significant events, providing a touch of luxury and exclusivity.

- Integrated Transport Solutions: Taxis and limousines are integral to multimodal transport solutions, connecting with other forms of transport to facilitate seamless travel experiences for passengers.

Major Challenges

- Competition from Public Transport: Increasing investment in public transportation systems, especially in emerging economies, poses a significant challenge by providing cost-effective alternatives to taxis and limousines.

- Market Saturation: In many urban areas, the market is becoming saturated, making it challenging for new entrants and existing operators to maintain profitability.

- Regulatory Hurdles: Taxi and limousine operators often face stringent regulations which can impede operational flexibility and increase operational costs.

- Technological Disruption: The rapid pace of technological change requires continuous investment in new technologies to stay competitive, which can be a significant barrier for smaller operators.

- Changing Consumer Preferences: As consumer preferences shift towards more sustainable and shared transportation options, traditional taxi and limousine services must adapt to retain their market share.

Top Opportunities

- Technological Advancements: Investing in technology such as electric vehicle fleets, app-based platforms, and advanced booking systems presents significant growth opportunities.

- Expansion into Underpenetrated Markets: Suburban and rural areas offer new growth avenues for taxi and limousine services, where public transport options are often limited.

- Strategic Partnerships: Collaborations with hotels, airports, and corporate clients can provide steady revenue streams and increase market penetration.

- Diversification into Niche Markets: Catering to niche markets, such as luxury or environmentally conscious consumers, can help differentiate services and tap into lucrative segments.

- Global Market Expansion: The growing global demand for personal and convenient travel options presents opportunities for international expansion, especially in developing regions where the market is not yet saturated.

Key Player Analysis

Uber Technologies Inc. leads globally with its expansive network and diverse transport services. The company’s strategic expansions and user-friendly technological innovations enhance its competitive edge in various international markets. Lyft, Inc. remains a strong competitor in the U.S., emphasizing customer-centric values and sustainability. Its focus on community engagement and safety innovations maintains its strong market position. Didi Chuxing is the dominant force in China, leveraging local knowledge and technological advancements to extend its reach internationally. Its focus on competitive pricing and efficiency drives its success in new markets.

Grab Holdings Inc. excels in Southeast Asia by integrating transport with everyday services, making it indispensable to users. Its regional expansion and partnership strategies significantly strengthen its market presence. Gett, Inc. specializes in Europe’s corporate transport sector, partnering with local fleets to ensure reliability and scalability. Its focus on business clientele provides a stable revenue base. Careem Networks FZ-LLC, an Uber subsidiary, tailors its offerings to the Middle East, enhancing its regional influence with a broad service platform that includes ride-hailing and digital payments.

Ola Cabs dominates in India by catering to local preferences with a variety of transport options. Its initiatives toward sustainability and international expansion indicate robust growth potential. Taxify (Bolt) has made significant inroads in Europe and Africa by focusing on affordability and expanding its urban mobility services to include scooters and bikes, enhancing its appeal in populous areas. Addison Lee Group upholds its premium positioning in the UK with high-quality services and advanced technology, appealing mainly to corporate clients. Luxor Limo offers luxury transportation in New York City, attracting clients with its focus on comfort and style, catering to both corporate and leisure sectors.

Blacklane GmbH delivers premium, reliable transportation services globally, with a commitment to high quality and sustainability, attracting business travelers. ExecuCar focuses on premium sedan and SUV services in the U.S., known for its professionalism and customer satisfaction, particularly in business and airport transport. SuperShuttle International, Inc. provides economical airport shuttle services across the U.S., favored for its budget-friendly options and customer loyalty programs.

Top Companies in the Market

- Uber

- Lyft

- Didi Chuxing

- Grab

- Gett

- Careem

- Ola Cabs

- Taxify (Bolt)

- Addison Lee

- Luxor Limo

- Blacklane

- ExecuCar

- SuperShuttle

Purchase The Full Report Now at https://market.us/purchase-report/?report_id=136965

Recent Developments

- In 2025, Uber Technologies, Inc. (NYSE: UBER) announced on December 31 its highest-ever quarterly performance for the year ended 2024. Led by CEO Dara Khosrowshahi, Uber saw significant growth in MAPCs, trips, and Gross Bookings, driven by expansions into autonomous vehicles. The company is set to continue its momentum with a strong focus on long-term strategies.

- In 2025, Lyft (NASDAQ: LYFT), Inc., with a market value of $4.8 billion, reported a 31.4% increase in revenue over the past year, though it faces high volatility with a beta of 2.16. As the mobility sector evolves post-pandemic, Lyft navigates both opportunities and challenges, aiming for profitability and market share growth.

- In 2025, on February 20, Grab Holdings Limited (NASDAQ: GRAB) disclosed its strongest quarter in the unaudited financial results for 2024. CEO Anthony Tan highlighted a 20% year-over-year growth in On-Demand GMV. With increasing profitability and a growing user base, Grab is well-prepared for sustained growth and enhanced user engagement into 2025.

- In 2023, Dubai Taxi Company (DTC), a subsidiary of Dubai’s Roads and Transport Authority (RTA), introduced four new smart services on its DTC App. These developments are part of DTC’s commitment to advancing digital transformation, improving the safety and sustainability of its transportation services, and upholding Dubai’s leading status in the global transportation sector.

Conclusion

The Taxi and Limousine Services Market is set for significant growth over the next decade, driven by technological advancements, urbanization, and increasing consumer demand for convenience and luxury. As the market expands, the integration of eco-friendly vehicles and digital booking platforms will likely play a pivotal role in shaping its future. Moreover, the push towards personalization and the expansion into new geographic areas offer substantial opportunities for market players. However, challenges such as competition from public transport and regulatory hurdles will require strategic adaptations. The continued evolution of consumer preferences towards sustainable and efficient travel solutions suggests that companies that innovate and adapt to these changes will be well-positioned for success in the evolving landscape of global urban mobility.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)