Table of Contents

Introduction

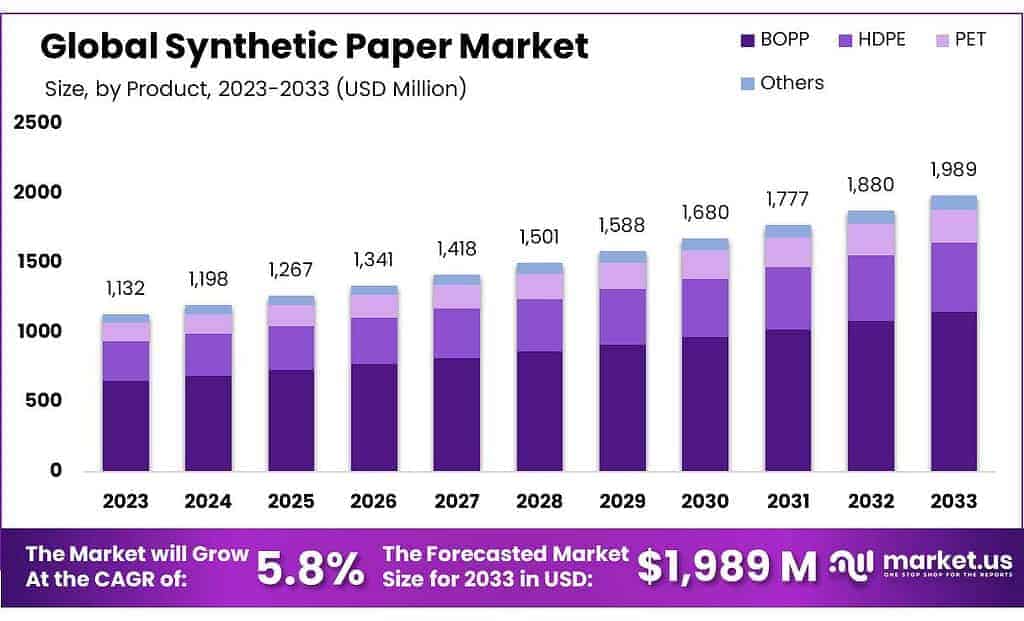

The global synthetic paper market is experiencing steady growth and is projected to reach a size of approximately USD 1,989 million by 2033, up from USD 1,132 million in 2023. This growth represents a compound annual growth rate (CAGR) of 5.8% during the forecast period from 2023 to 2033.

Synthetic paper, which is a plastic-based material often used in packaging, printing, and labeling, is gaining traction due to its durability, water resistance, and environmental advantages over traditional paper.

The increasing demand for sustainable alternatives to conventional paper products, along with the rising adoption of synthetic paper in industries such as packaging and labeling, are key drivers behind this market expansion.

Additionally, the growing preference for high-quality, weather-resistant materials for outdoor applications and the booming e-commerce sector, which demands robust packaging, further fuel the market’s growth. However, challenges such as the high production cost of synthetic paper and limited awareness in emerging markets may restrain growth to some extent.

Recent developments in the industry include advancements in manufacturing techniques and material innovation, which have led to more cost-effective production methods, contributing to market expansion. Furthermore, the integration of recycled materials into synthetic paper production is becoming more common as companies focus on improving sustainability and reducing their environmental footprint.

These factors are expected to create new opportunities, although balancing environmental concerns with production costs remains a key challenge for market players. Overall, the synthetic paper market is expected to continue its upward trajectory, driven by the demand for durable, eco-friendly alternatives in various end-user industries.

B&F Plastics introduced a new range of high-performance synthetic paper for the packaging sector in 2023, emphasizing its durability and water-resistant properties and enhancing its market presence.

Key Takeaways

- The Synthetic Paper market is projected to grow significantly, reaching around USD 1989 million by 2033 from USD 1132 million in 2023, at a CAGR of 5.8%.

- BOPP dominates the market, especially in packaging perishable products, and is expected to grow at a 5.6% CAGR. HDPE-based synthetic paper, ideal for packaging various items, is forecasted to be the fastest-growing category at 6.1%.

- Different thickness ranges cater to diverse needs. Papers below 200 microns suit applications requiring high print quality and durability. The 200 to 400 microns range finds use in outdoor signage, while papers above 400 microns are preferred for heavy-duty applications like book covers.

- Market share for non-labeling applications was 63%. Synthetic paper is a good material for packaging and other non-labeling purposes.

- Non-labeling applications account for a majority share due to synthetic paper’s suitability for packaging, driven by its durability, strength, and resistance to heat and moisture.

- The market was dominated by the Asia Pacific region, which accounted for 48.3% of global revenue in 2023. Due to the increasing demand in the packaging, pharmaceutical, and printing industries, the Asia Pacific market was worth US$ 478 million in 2021.

Synthetic Paper Statistics

UK Investments in Synthetic Paper Research

- The UK is a leader in engineering biology thanks in part to early, forward-thinking investment by the government over the last decade. This includes more than £100 million being invested through UK Research and Innovation’s Synthetic Biology for Growth program.

- A further £73 million is being invested into Engineering Biology Missions Hubs and Mission Awards that will build on our country’s reputation as a hub of innovation in the field.

- Synthetic biology, one of the most promising areas of modern science, is to receive a boost of over £60 million to help the UK become a world leader, the Minister for Universities and Science will announce today.

- The UK government has announced a significant £22 billion investment in carbon capture and storage projects, focusing on developing two carbon capture clusters in Merseyside and Teesside.

- A polymer £20 was issued in 2020 with a picture of J.M.W. Turner, and the £50 note was released in 2021, featuring Alan Turing. Although the polymer Bank of England notes are 15% smaller than the older, paper issue, they bear a similar design.

Economic Factors in Synthetic Paper Production

- This is a consequence of the extremely high production cost of £198.40/barrel inducing the complete absence of profitability. Furthermore, the operating expenditure is found to be the root cause of the consequential financial decline, totaling £1.46 million per annum.

- The two most detrimental expenditures for the production cost of the pyrolysis oils were the wages of the skilled operating labor and higher utility fees incurred by the extreme temperature conditions. In addition, an unrealistically optimistic sale price of £300/barrel was also applied to ascertain a positive economic incentive.

- India tops the list with 73,410 shipments, followed by China with 45,214, and Vietnam in third with 23,755 shipments. This strong position of India in the BOPP industry is driven by several key factors.

- In bulk polymerization, liquid propene acts as a solvent to prevent the precipitation of the polymer. The polymerization proceeds at 60 to 80 °C and 30–40 atm are applied to keep the propene in the liquid state.

- The bulk polymerization is limited to a maximum of 5% ethene as a comonomer due to the limited solubility of the polymer in the liquid propane.

Emerging Trends

- Sustainability and Eco-friendly Materials: There is a growing shift towards sustainable synthetic paper options, driven by environmental concerns. Manufacturers are increasingly using recycled plastics and biodegradable materials to create synthetic paper products that reduce the environmental impact compared to traditional plastic or paper packaging.

- Use in Digital Printing: The rise of digital printing technologies has boosted demand for synthetic paper, especially for applications like labels, posters, and high-quality packaging. Synthetic paper’s durability and resistance to water, tearing, and smudging make it ideal for digital printing applications that require vibrant, long-lasting colors.

- Growth in E-commerce Packaging: The rapid growth of e-commerce has created an increasing demand for durable, lightweight, and attractive packaging. Synthetic paper is becoming a popular choice for packaging materials due to its high resistance to moisture and wear, which helps ensure that products reach consumers in good condition.

- Technological Advancements in Manufacturing: New manufacturing techniques are improving the cost-effectiveness and quality of synthetic paper production. Advances in extrusion and coating technologies allow for the production of synthetic paper at lower costs while maintaining its durability and performance in various applications.

- Rising Adoption in Labeling Applications: Synthetic paper is increasingly being used in labeling, especially for food and beverage products, where durability and resistance to moisture are critical. The trend is supported by the growing demand for high-quality, long-lasting labels that can withstand exposure to various environmental conditions without degrading.

Use Cases

- Packaging: Synthetic paper is widely used in packaging, especially for products that require durable, moisture-resistant materials. It is commonly found in food packaging, as it is non-absorbent and can withstand exposure to moisture without losing its strength or appearance. This makes it ideal for snacks, frozen food packaging, and other products that need to be kept fresh.

- Labeling: Synthetic paper is increasingly used in product labeling, particularly for items that require long-lasting, high-quality labels. This includes applications in the beverage, pharmaceutical, and cosmetics industries. Labels made from synthetic paper are resistant to tearing, fading, and smudging, even in humid or outdoor environments.

- Outdoor Signage and Posters: Due to its resistance to weather conditions, synthetic paper is commonly used for outdoor signage, posters, and banners. Its ability to withstand rain, wind, and sunlight makes it suitable for advertising materials, road signs, and promotional banners that need to endure for extended periods outdoors.

- Printing and Publishing: Synthetic paper is used in high-end printing applications, such as brochures, catalogs, and promotional materials. Its superior durability, combined with vibrant color reproduction, makes it a popular choice for marketing materials that need to stand out and last longer than traditional paper products.

- Maps and Manuals: Synthetic paper is ideal for products like maps, instruction manuals, and warranties, where durability is key. These products are often exposed to rough handling, dirt, moisture, and wear, and synthetic paper offers the strength needed to maintain clarity and legibility throughout their lifespan.

Major Challenges

- High Production Costs: One of the biggest challenges for synthetic paper is its high production cost compared to traditional paper. The materials used, such as plastic resins, and the specialized manufacturing processes make it more expensive, which can limit adoption, especially in price-sensitive markets.

- Environmental Concerns: Despite being more durable and water resistant, synthetic paper is often made from non-biodegradable materials, which raises environmental concerns. As the world moves toward sustainability, finding ways to recycle synthetic paper or develop biodegradable alternatives remains a significant challenge.

- Limited Recycling Infrastructure: While synthetic paper is durable and long-lasting, it is difficult to recycle due to its plastic-based composition. Most recycling systems are not equipped to handle synthetic paper, leading to increased waste and contributing to the global plastic waste problem.

- Consumer Awareness: Many consumers and businesses are still unaware of the benefits and applications of synthetic paper. This lack of awareness can slow its adoption in various industries, particularly in emerging markets where traditional paper products are more commonly used.

- Regulatory Hurdles: With increasing environmental regulations and the push for sustainable materials, synthetic paper producers face challenges in complying with new laws. These regulations may include restrictions on plastic use, forcing manufacturers to find ways to meet sustainability targets while maintaining the performance qualities of synthetic paper.

Market Growth Opportunities

- Rising Demand for Eco-friendly Packaging: With growing consumer demand for sustainable products, synthetic paper presents an opportunity for companies to offer environmentally friendly packaging alternatives. Many brands are shifting towards eco-conscious materials for their packaging, and synthetic paper can meet this need due to its durability and potential for recycling.

- Expansion in the Labeling Industry: As industries like food, beverage, and pharmaceuticals continue to expand, the need for high-quality, durable labels grows. Synthetic paper is ideal for these applications due to its resistance to water, tearing, and fading. With the rise in global retail and e-commerce, the labeling market offers significant growth potential for synthetic paper.

- Technological Advancements in Production: New advancements in manufacturing technologies are improving the efficiency and cost-effectiveness of synthetic paper production. By reducing costs, synthetic paper becomes more accessible to a broader range of industries, especially in packaging, publishing, and outdoor advertising, thus opening new growth avenues.

- Growth in Outdoor Advertising: As outdoor advertising continues to grow globally, synthetic paper is increasingly being used for banners, posters, and signs. Its ability to withstand outdoor conditions such as moisture, wind, and UV light makes it a prime material for the expanding outdoor advertising industry.

- Government Regulations Supporting Sustainable Alternatives: With governments around the world introducing stricter regulations to reduce plastic waste, there is a growing opportunity for synthetic paper producers to offer alternatives to traditional plastics. By promoting the recyclability and durability of synthetic paper, manufacturers can align with these regulatory trends and tap into a market eager for sustainable solutions.

Key Players Analysis

- Formosa Plastics Group is a major player in the synthetic paper industry, known for its production of environmentally friendly synthetic paper products. The company leverages advanced technology to manufacture durable, water-resistant paper alternatives.

- SIHL Group is a leading manufacturer of synthetic paper, specializing in high-quality, durable, and eco-friendly materials for various applications. The company is committed to providing innovative solutions that meet the demands of modern industries.

- B&F Plastics, Inc. is a key player in the synthetic paper market, producing durable, water-resistant, and eco-friendly alternatives to traditional paper. Their products are widely used in packaging, labeling, and signage applications.

- Jindal Poly Films Ltd. is a prominent manufacturer of synthetic paper, offering high-quality, durable, and versatile products for various industrial uses. The company focuses on delivering innovative and sustainable solutions for packaging, labeling, and other applications.

- Cosmo Films Ltd. is a leading manufacturer of synthetic paper, known for its high-quality, durable, and eco-friendly products used in packaging, labeling, and promotional materials. The company focuses on sustainability and innovation in its product offerings.

- Granwell Products, Inc. specializes in producing synthetic paper solutions for a variety of industries, offering durable, water-resistant, and recyclable options for packaging, labels, and other applications. Their products are designed for high performance and environmental sustainability.

- Transcendia, Inc. manufactures synthetic paper products that are durable, tear-resistant, and waterproof, catering to industries such as packaging, labeling, and graphics. Their innovative solutions focus on high performance and sustainability.

- Valéron Strength Films specializes in producing high-strength synthetic papers that are known for their durability and resistance to tearing, making them ideal for demanding applications such as packaging, tags, and labels. Their products are eco-friendly and versatile.

- Toyobo Co., Ltd. is a key player in the synthetic paper industry, known for producing high-performance, eco-friendly, and durable synthetic papers. These products are used in a range of applications, including packaging, labeling, and promotional materials.

- TechNova offers a variety of synthetic paper solutions, focusing on durable, high-quality, and environmentally friendly products for industries like packaging, printing, and labeling. Their synthetic papers are known for their excellent printability and resilience.

Conclusion

The synthetic paper market is poised for steady growth, driven by increasing demand for sustainable, durable materials in packaging, labeling, and printing. With advancements in technology and growing eco-consciousness, synthetic paper offers significant opportunities, despite challenges related to production costs and environmental impact, positioning it as a versatile alternative to traditional paper.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)