Table of Contents

Introduction

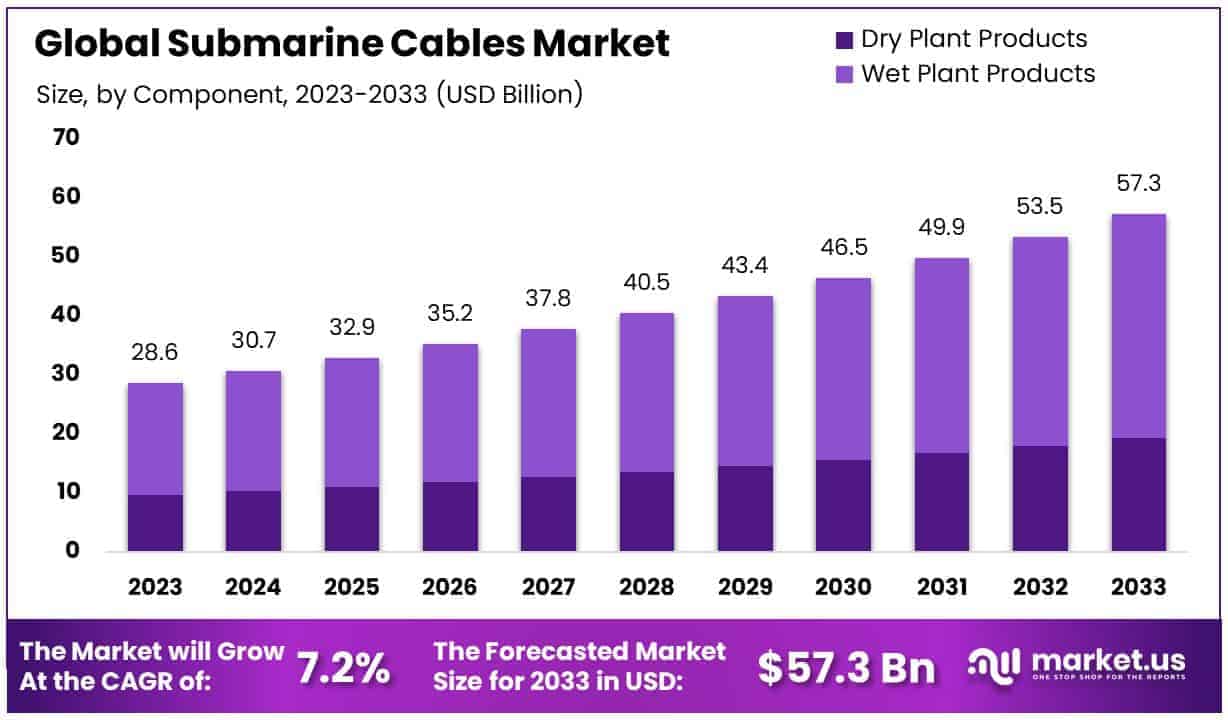

The Global Submarine Cables Market is projected to reach approximately USD 57.3 billion by 2033, up from USD 28.6 billion in 2023, expanding at a compound annual growth rate (CAGR) of 7.20% between 2024 and 2033.

Submarine cables are high-capacity cables laid on the ocean floor, designed to transmit telecommunications signals, including internet, data, and voice, between continents. These cables are crucial for global communication infrastructure, enabling intercontinental data exchange, cloud services, and broadband connectivity. The submarine cables market refers to the industry focused on the design, manufacturing, installation, and maintenance of these cables.

Growth in the market is primarily driven by the expanding demand for high-speed internet and data services, spurred by the increasing reliance on cloud computing, IoT, and digital transformation across sectors. Furthermore, the growing adoption of 5G technologies, which require enhanced data transmission capabilities, fuels demand for robust submarine cable networks. The market presents significant opportunities for growth, especially with the ongoing investment in new cable routes to support emerging markets, such as Asia-Pacific and Africa. Furthermore, advancements in cable technology and increasing demand for data centers contribute to the market’s expansion potential.

Fundamental Insights

- The Global Submarine Cables Market is expected to grow significantly, reaching USD 57.3 Billion by 2033, up from USD 28.6 Billion in 2023, at a CAGR of 7.20% from 2024 to 2033.

- Holding a substantial market share of 72.4%, dry plant products, including terrestrial components, play a key role in the management and operation of submarine cable systems.

- Power cables dominate the market with a 63.4% share, driven by the global shift towards renewable energy sources and the integration of offshore energy projects into the energy grid.

- High voltage cables hold a significant 64.1% share, enabling efficient transmission of electricity over long distances, especially for connecting offshore wind farms and facilitating international power exchanges.

- Offshore wind power generation the largest in the market, accounting for 45.6% of the market share, fueled by growing investments in offshore wind farms and the global transition towards sustainable energy.

- The installation and commissioning segment holds the largest share at 40.6%, reflecting the importance of deploying new submarine cable systems and integrating them into existing infrastructure.

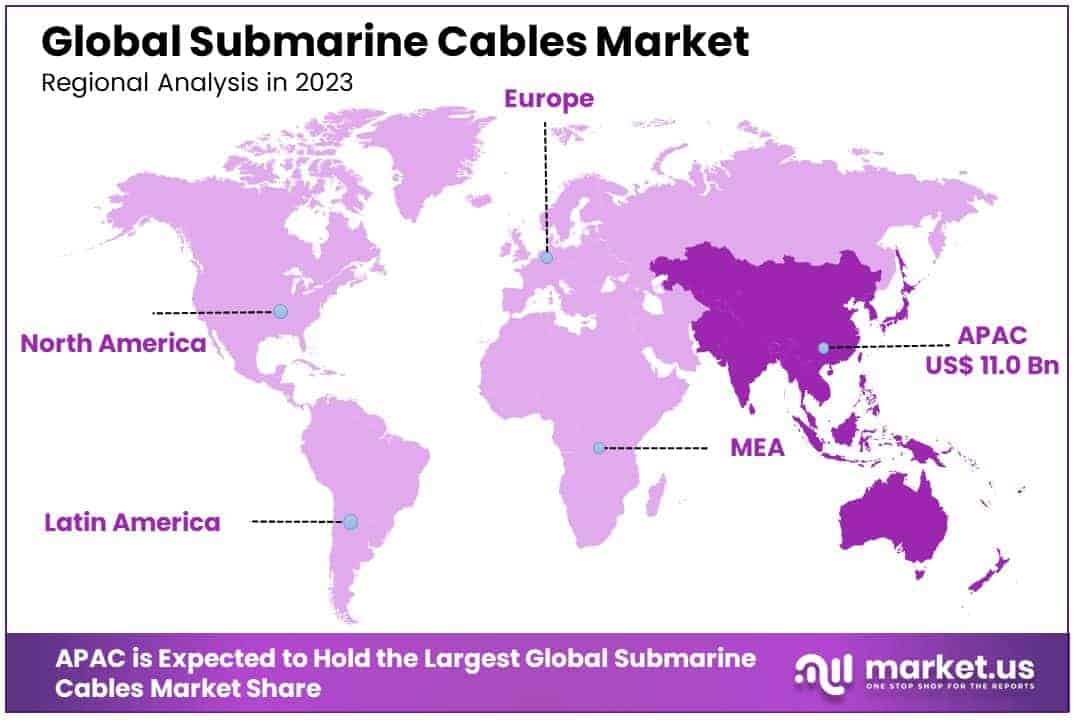

- Asia Pacific leads the market with a 38.5% share, driven by increasing investments in submarine cable projects to support the region’s growing connectivity needs.

Submarine Cables Statistics

- There are 430 active submarine cables that span all oceans except the Arctic Ocean.

- These cables typically have a diameter of 25 millimeters and weigh 1.4 tons per kilometer.

- The total length of submarine cables worldwide exceeds 1.3 million kilometers.

- Cable lengths vary widely, from the 131 km CeltixConnect cable between Ireland and the UK to the 20,000 km Asia America Gateway.

- The planned MAREA cable is expected to support 160 Tbps of capacity once completed.

- On average, over 100 cable faults are reported annually, with fishing activities responsible for 38% of them.

- Another 25% of faults are caused by anchorage issues, while only 6% are due to component failures.

- Submarine cables typically have a lifespan of 25 years from the time of manufacture.

- Of the 51 cable ships globally, 21 are assigned to private or club maintenance zones, and 26 are used for installation work.

- Four cable ships in the current fleet do not have a specific assigned purpose.

- The Atlantic Ocean hosts 41% of the global cable ship fleet, while 37% are stationed in the Pacific Ocean.

- Global submarine cable capacity is projected to grow by more than 140% by the end of 2022.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 28.6 Billion |

| Forecast Revenue (2033) | USD 57.3 Billion |

| CAGR (2024-2033) | 7.20% |

| Segments Covered | By Component (Dry Plant Products, Wet Plant Products), By Application (Power Cables, Communication Cables), By Voltage (Medium Voltage, High Voltage, Extra High Voltage), By End-User (Offshore Wind Power Generation, Inter Country & Island Connection, Offshore Oil & Gas), By Offerings (Installation & Commissioning, Upgrade, Maintenance) |

| Competitive Landscape | ALE International, ALE USA Inc., SubCom, LLC, NEC Corporation, Prysmian S.p.A, Nexans, Google LLC, Amazon.com, Inc., Microsoft, NKT A/S, ZTT |

Emerging Trends

- Increased Capacity and Higher Data Speeds: The demand for high-bandwidth, low-latency connections is driving the trend of upgrading submarine cables to support higher data speeds. New cables, like those being installed in the transatlantic region, are designed with greater capacity, enabling faster communication and more data transfer. This is particularly essential as global data traffic continues to rise by more than 25% annually.

- Advanced Cable Materials: The adoption of more durable and resilient materials is a growing trend in the submarine cable industry. New developments in fiber optic technology and coating materials are designed to improve the longevity and reliability of cables. The use of materials like UV-resistant polyethylene helps protect cables from harsh underwater conditions, significantly reducing maintenance costs.

- Diversification of Cable Networks: There is a shift toward diversifying the routes of submarine cables to ensure redundancy and resilience against natural disasters or geopolitical tensions. For example, new routes being laid between Asia and Europe avoid traditional chokepoints, providing additional security and network reliability. The industry is increasingly adopting mesh network architectures, ensuring continuous service even in case of cable disruptions.

- Environmental Monitoring and Sustainability: As the focus on sustainability grows, submarine cable projects are incorporating environmental considerations, including minimizing ecological impact. Operators are using advanced techniques for seabed surveys and route planning to reduce damage to marine ecosystems. The implementation of environmentally-friendly cable burial methods is also becoming a common practice.

- Integration with Emerging Technologies: Submarine cables are being increasingly integrated into emerging technologies such as 5G and the Internet of Things (IoT). This integration enables ultra-fast data transfer needed for 5G deployment, which is expected to grow globally. Submarine cables provide critical infrastructure for IoT by offering secure, high-speed communication channels for the billions of connected devices projected to be operational in the coming years.

Top Use Cases

- Global Internet Connectivity Submarine cables are the backbone of the global internet infrastructure, enabling high-speed communication between continents. As of 2023, over 380 submarine cables connect major internet hubs, facilitating more than 99% of international data traffic, a vital aspect of everyday online activities and business operations.

- International Data Centers Interconnection Submarine cables play a pivotal role in connecting international data centers, enabling data synchronization and cloud computing across regions. This interconnection facilitates faster data exchange, improving service delivery for applications like cloud storage, big data analytics, and e-commerce. The capacity of these cables allows data centers to scale and support the growing demand for cloud services.

- Cross-Border Financial Transactions Submarine cables are crucial for enabling secure and rapid financial transactions between countries. This use case is especially important for the banking and financial services sector, where low latency is essential for transactions such as high-frequency trading and international money transfers. These cables support the real-time flow of information, enabling financial markets to function smoothly.

- Marine Research and Communication Submarine cables support scientific research by providing communication channels for underwater sensors and research vessels. These cables are used to transmit data for marine studies, such as oceanographic research, seismic monitoring, and climate change analysis. They enable real-time transmission of data from deep-sea instruments, enhancing the global understanding of marine environments.

- Disaster Recovery and Redundancy In disaster recovery scenarios, submarine cables ensure the continuity of communication and data transfer when terrestrial networks fail. These cables provide a reliable backup infrastructure, enabling regions to remain connected and continue critical services. In cases of natural disasters or network interruptions, data routed through submarine cables offers significant redundancy to avoid service disruptions.

Major Challenges

- High Installation and Maintenance Costs The cost of laying submarine cables remains one of the most significant barriers to market expansion. Installation costs can exceed several hundred million dollars per route, depending on the distance and depth of the sea. Additionally, maintenance is an ongoing expense, with repairs required for damage caused by natural events or human activity, further driving up operational costs.

- Environmental and Ecological Risks The installation and operation of submarine cables can have an impact on marine ecosystems. Cable laying involves disturbing the seabed, which can affect local marine life and biodiversity. Furthermore, concerns about the long-term environmental effects of cables, such as the impact of electromagnetic fields on marine organisms, are becoming more prevalent.

- Vulnerability to Natural Disasters Submarine cables are susceptible to damage from natural disasters such as earthquakes, tsunamis, or undersea landslides. For example, the 2006 earthquake in Taiwan caused significant disruptions to several undersea cables, affecting global internet traffic. The vulnerability of submarine cables to such natural phenomena underscores the need for redundancy and improved protection mechanisms.

- Geopolitical Risks Political tensions between nations can threaten the security and operational continuity of submarine cables. In areas where international relations are strained, the construction or maintenance of submarine cables may be hindered due to regulatory issues or territorial disputes. This poses a risk to the global connectivity provided by submarine cables, especially in politically sensitive regions.

- Security and Cyber Threats Submarine cables are increasingly becoming targets for cyberattacks due to their critical role in global data transmission. The threat of tapping into or sabotaging submarine cables for espionage or terrorism is a growing concern. Given the sensitivity of the data they carry, ensuring the security of submarine cables is a significant challenge that requires advanced technology and international cooperation.

Top Opportunities

- Expansion of 5G Networks The roll-out of 5G networks across the globe presents a significant opportunity for submarine cable expansion. With 5G expected to increase mobile data consumption and demand for low-latency communications, submarine cables will be essential for providing the necessary bandwidth and connectivity. The growing reliance on data transfer for mobile and IoT services further accelerates the need for advanced cable infrastructure.

- Expansion in Emerging Markets The growing internet penetration in emerging markets, particularly in Africa, Asia, and South America, presents significant opportunities for the submarine cable market. These regions are increasingly relying on submarine cables to improve connectivity and access to global internet services. As internet users in these regions increase, the demand for reliable and fast internet infrastructure will drive further investments in submarine cables.

- Growing Cloud Computing and Data Center Demand The increasing adoption of cloud services and the proliferation of data centers offer substantial growth potential for submarine cable networks. Submarine cables facilitate data transfer between global data centers, providing the necessary infrastructure for the growing demand for cloud storage, computing, and processing. With data consumption on the rise, the need for robust intercontinental data links will continue to expand.

- Technological Innovation in Cable Design Advancements in cable design and technology, including the development of more efficient and cost-effective cables, present significant opportunities. The advent of low-latency cables and higher-capacity systems is expected to meet the demands of modern communication networks. The integration of improved fiber optics and more durable materials will continue to enhance cable performance and longevity, creating opportunities for new installations.

- Government Investments in Digital Infrastructure Governments worldwide are increasingly investing in digital infrastructure to boost connectivity and economic development. As part of these initiatives, many countries are enhancing their telecommunications infrastructure by laying new submarine cables or upgrading existing systems. These investments will create opportunities for growth in the submarine cable sector, especially in regions where digital connectivity is still being developed or upgraded.

Key Player Analysis

- ALE International: ALE International is a key player in the submarine cable industry, specializing in the design, deployment, and maintenance of high-performance subsea communication systems. The company provides advanced optical cable technology and offers installation services that meet the increasing demand for high-speed, long-distance communication. ALE International has been involved in several major international projects, contributing to the development of next-generation subsea cables. Their capabilities are backed by advanced engineering solutions and a strong presence in the global market.

- SubCom, LLC: SubCom, LLC is a prominent leader in subsea cable manufacturing and installation. The company offers a complete portfolio of services including system design, subsea cable production, and installation. It is known for its role in building some of the world’s most advanced and longest subsea cable networks. The company has been involved in several large-scale projects, enhancing global connectivity, and is known for its work in supporting both commercial and government telecommunications.

- NEC Corporation: NEC Corporation is a well-established Japanese technology company that has a significant stake in the submarine cable market. It is involved in manufacturing, laying, and maintaining submarine cables, with a strong focus on contributing to global digital infrastructure. NEC has delivered multiple high-capacity submarine cable systems worldwide. The company’s technological expertise in subsea communication solutions has cemented its role in connecting various parts of the world.

- Prysmian S.p.A: Prysmian S.p.A, an Italian company, is a global leader in the production of cables, including subsea cables. The company is known for its innovative submarine cable technologies and has been involved in numerous major offshore cable projects. The company’s advanced materials and production capabilities have placed it at the forefront of global submarine cable deployment, including high-voltage and fiber optic systems that support both telecommunications and energy sectors.

- Nexans: Nexans is a French multinational company that operates in the submarine cable market, focusing on the development of subsea cables for telecom and power transmission. The company’s subsea division has been involved in the manufacturing and installation of cables for both telecom and energy applications, including offshore wind farm connections and long-distance communications. The company’s continued investment in new technologies supports its growth in the global submarine cable market.

Regional Analysis

Asia Pacific: Submarine Cables Market with Largest Market Share (38.5%) in 2023

The Asia Pacific region dominates the global submarine cables market, holding a significant market share of 38.5% in 2023, valued at approximately USD 11.0 million. This dominance is largely driven by the region’s robust demand for high-speed data transmission, driven by the increasing adoption of internet services, cloud computing, and growing digital infrastructure. The growing volume of cross-border data traffic within the region, coupled with the expansion of the telecommunications sector, has spurred investments in submarine cable networks.

Countries such as China, Japan, South Korea, and India are key contributors to this market, with major international submarine cable projects underway to enhance global connectivity. Furthermore, the rise in internet penetration rates, especially in developing nations, and the increasing deployment of 5G networks, are expected to further boost the market growth in the region. The Asia Pacific market’s growth trajectory remains strong due to its high demand for reliable, high-capacity connectivity solutions that support the region’s economic and technological advancements.

Recent Developments

- In January 2025, Nokia, headquartered in Espoo, Finland, confirmed the completion of its transaction involving the sale of Alcatel Submarine Networks (ASN) to the French State, represented by Agence des participations de l’Etat. The agreement was finalized on December 31, 2024. Nokia will maintain a 20% ownership stake in ASN, alongside board representation, to facilitate a smooth transition, with plans for the French State to acquire the remaining share in the future.

- In 2024, Intelia New Zealand announced its intention to develop the Te Waipounamu submarine cable, which will connect Invercargill, New Zealand, to both Sydney and Melbourne, Australia. This cable, named after the Māori term for New Zealand’s South Island, aims to enhance the digital infrastructure linking the two countries.

- In October 2023, NEC Corporation revealed the completion of the Patara-2 submarine cable system, which now links multiple Indonesian islands. The project, owned by Telkom Indonesia, is expected to play a critical role in advancing Indonesia’s digital connectivity and modernization efforts.

- In 2023, Google Cloud introduced the South Pacific Connect project, which involves the deployment of two new subsea cables, Honomoana and Tabua, connecting Pacific nations to the United States and Australia. This initiative is a collaboration with various partners, including Fiji International Telecommunications and APTelecom, to bolster connectivity and resilience in the region.

- In 2023, Alcatel Submarine Networks, Elettra Tlc, Medusa, and Orange began the construction of the Medusa Submarine Cable System, which will enhance connectivity across the Mediterranean region, linking countries such as Morocco, Spain, and Egypt. The system’s Via Tunisia component, connecting France and Tunisia, is co-funded by the European Union’s Connecting Europe Facility.

Conclusion

The global submarine cables market is poised for significant growth, driven by the increasing demand for high-speed internet, cloud services, and data centers, along with the continued expansion of 5G networks. As digital transformation accelerates across industries and regions, the need for robust, reliable communication infrastructure will continue to rise. Submarine cables, being the backbone of international data exchange, will play a critical role in meeting these demands. Despite challenges such as high installation costs, environmental concerns, and vulnerabilities to natural disasters, the market is expected to benefit from technological advancements, including improved cable materials and designs, along with strategic investments in emerging markets. These factors collectively position the submarine cable industry for sustained growth and increased global connectivity in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)