Table of Contents

Introduction

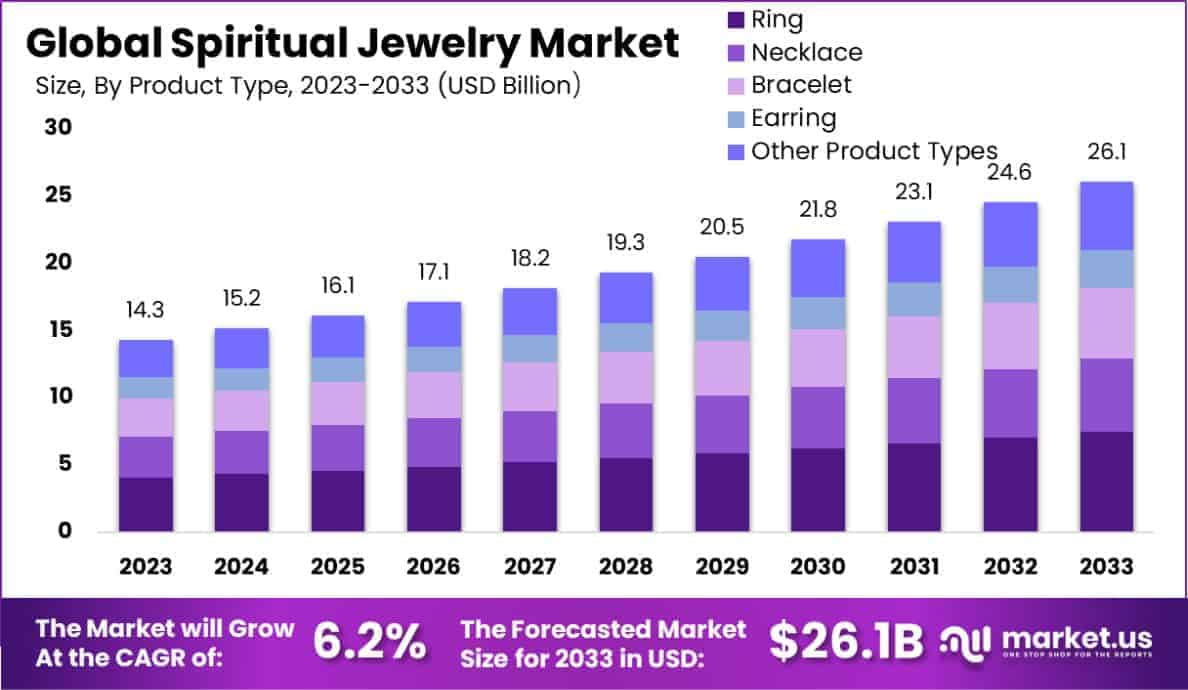

The Global Spiritual Jewelry Market is projected to reach a valuation of approximately USD 26.1 billion by 2033, up from an estimated USD 14.3 billion in 2023. The market is anticipated to grow at a compound annual growth rate (CAGR) of 6.2% during the forecast period from 2024 to 2033.

Spiritual jewelry refers to adornments that carry symbolic, cultural, or religious significance, often designed to evoke a sense of connection to higher powers, inner peace, or spiritual growth. These pieces frequently incorporate meaningful symbols, sacred gemstones, healing crystals, or motifs from various spiritual traditions, such as chakras, mandalas, or religious icons.

The purpose of spiritual jewelry extends beyond mere aesthetics, as it is often used as a medium for meditation, self-expression, energy balancing, or affirming personal beliefs. Increasingly, spiritual jewelry blends contemporary designs with ancient practices, making it both fashionable and deeply meaningful for wearers.

The spiritual jewelry market encompasses the production, distribution, and retail of jewelry items designed to cater to individuals seeking spiritual, emotional, or holistic well-being through wearable accessories. This market is influenced by a blend of cultural traditions, wellness trends, and the growing consumer desire for products that reflect personal values or beliefs.

Key product categories include bracelets, necklaces, pendants, rings, and earrings crafted with spiritual elements such as healing stones, mantras, or religious symbols. The market spans diverse demographics and is particularly driven by interest in wellness, mindfulness practices, and cultural appreciation, with both artisanal and mass-market brands capitalizing on this demand.

Several factors are driving the growth of the spiritual jewelry market. First, the global wellness movement has significantly elevated the importance of mindfulness and self-care, with consumers seeking products that align with these practices. Additionally, the rising popularity of alternative healing methods, such as crystal therapy and chakra balancing, has expanded the appeal of spiritual jewelry.

Social media and influencer marketing have further amplified demand, as platforms like Instagram and TikTok showcase these products as both stylish and meaningful. Moreover, increased disposable income and a shift toward personalized products have encouraged consumers to invest in spiritual jewelry that reflects their individuality and spiritual journey.

Demand for spiritual jewelry is experiencing robust growth as consumers increasingly prioritize holistic well-being, spirituality, and personal expression. Millennials and Gen Z, in particular, are driving this trend, as these demographics seek products that align with their values and resonate with their interest in mindfulness, sustainability, and authenticity.

The versatility of spiritual jewelry—serving as both a fashion statement and a tool for spiritual connection—has broadened its appeal across diverse consumer segments. Furthermore, the market is witnessing increased interest from global regions where spiritual traditions and wellness practices, such as yoga and meditation, are deeply rooted or gaining traction.

The spiritual jewelry market offers significant opportunities for growth and innovation. Brands can tap into rising consumer interest by blending traditional craftsmanship with modern designs to cater to both spirituality enthusiasts and fashion-forward individuals. The use of sustainably sourced materials and ethical production processes can further attract eco-conscious consumers.

Key Takeaways

- The Global Spiritual Jewelry Market is projected to reach USD 26.1 billion by 2033, up from USD 14.3 billion in 2023, growing at a compound annual growth rate (CAGR) of 6.2% during the forecast period of 2024 to 2033.

- In 2023, the Ring segment held a leading position in the market by product type within the Spiritual Jewelry Market.

- The Precious Metals segment dominated the material category in 2023, maintaining a significant share of the Spiritual Jewelry Market.

- In the gemstone segment, Quartz emerged as the leading category in 2023, holding a prominent position in the Spiritual Jewelry Market.

- The Women end-user segment accounted for a dominant share of 61.2% in 2023, positioning itself as the largest consumer group within the Spiritual Jewelry Market.

- By distribution channel, the Online segment led the market in 2023, reflecting its strong influence within the Spiritual Jewelry Market.

- The Asia Pacific region captured a 35.4% share of the market in 2023, generating USD 5.06 billion in revenue and establishing itself as the leading regional market for Spiritual Jewelry.

Spiritual Jewelry Statistics

- 44% of males and 56% of females have purchased jewelry at some point in their lives.

- White gold is the preferred choice for 35% of women surveyed.

- The U.S. accounts for 48% of global demand for polished diamonds.

- Online jewelry sales represent 5-10% of total jewelry sales globally.

- Only 11% of women who enjoy jewelry dislike wearing rings.

- Among ring wearers, 52% favor statement rings, while 37% prefer band rings.

- Women dominate the costume jewelry market, holding 58% of its share.

- Silver ranks as the second most popular material at 17%, followed by platinum at 15%.

- Rose gold accounts for 13% of preferences, while yellow gold lags at 11%.

- Mixed-material or undecided buyers make up 9% of the market.

- Five countries produce 80% of the world’s silver jewelry.

- In the UK, most jewelry manufacturers and retailers employ up to four staff members.

- The UK has at least 9,435 professionals working in the jewelry industry.

- Nearly 45% of consumers browse online but prefer making purchases in-store.

Emerging Trends

- Rising Popularity of Crystal-Based Jewelry: Spiritual jewelry featuring crystals like amethyst, rose quartz, and citrine is gaining significant traction due to their perceived healing properties. This trend aligns with the global surge in wellness-focused lifestyles, where individuals seek products that promote emotional balance, stress relief, and self-awareness. For instance, Google Trends reports a consistent rise in searches for “crystal healing” in the last five years, reflecting heightened consumer interest.

- Customization and Personalization: Consumers increasingly prefer spiritual jewelry that is customized to their needs, such as birthstone pendants, chakra-aligned bracelets, or mantra-inscribed necklaces. Personalized designs resonate with buyers as they feel more connected to the symbolism behind the jewelry. According to surveys, nearly 60% of consumers in the jewelry segment now favor products that have a personal or unique touch.

- Sustainability and Ethical Sourcing: Eco-conscious consumers are demanding spiritual jewelry made from sustainable materials and ethically sourced gemstones. This trend is encouraging brands to focus on using recycled metals and conflict-free stones. For example, the global shift toward sustainability has led 80% of millennials to prioritize products that reflect ethical values.

- Integration with Technology: Innovations such as NFC (Near Field Communication) tags are being integrated into spiritual jewelry. These tags allow users to scan their jewelry with a smartphone to access guided meditations, affirmations, or spiritual meanings. This fusion of spirituality and technology is appealing, especially to tech-savvy younger demographics.

- Cultural Appreciation and Global Influence: Spiritual jewelry designs inspired by diverse cultures and ancient traditions, such as Buddhist malas, Indian Rudraksha beads, and Celtic symbols, are gaining popularity worldwide. With globalization and increased access to cultural knowledge through digital platforms, spiritual motifs from different regions are being embraced across markets.

Top Use Cases

- Stress Relief and Emotional Healing: Many individuals use spiritual jewelry as a tool for stress management and emotional well-being. For example, amethyst necklaces are often worn to combat anxiety, while rose quartz bracelets are believed to promote love and self-acceptance. It is estimated that over 45% of buyers purchase such jewelry with the intent of emotional healing.

- Daily Meditation and Mindfulness Practices: Spiritual jewelry such as mala beads or chakra pendants is frequently used during meditation sessions to enhance focus and spiritual connection. More than 30% of mindfulness practitioners incorporate these products into their daily routines, making them a significant driver of sales in the segment.

- Protection from Negative Energy: Certain designs, like evil eye pendants or black tourmaline bracelets, are popular for their perceived ability to ward off negative energy or offer spiritual protection. The demand for these products has grown by over 25% in recent years, as people increasingly prioritize spiritual safeguards in uncertain times.

- Fashion with a Deeper Meaning: Beyond their spiritual purposes, many consumers view spiritual jewelry as a stylish accessory that conveys their beliefs or personal identity. For instance, chakra bracelets are worn not only for energy balance but also as trendy, colorful wristwear. Around 40% of buyers are motivated by this dual-purpose use of spiritual jewelry.

- Gifting with Intention: Spiritual jewelry is often purchased as a meaningful gift for loved ones, symbolizing good wishes such as protection, love, or healing. Over 35% of sales in the category occur during holidays, festivals, or special occasions when people look for thoughtful, symbolic gifts.

Major Challenges

- Market Saturation and Lack of Differentiation: With an increasing number of brands entering the spiritual jewelry market, the space is becoming crowded. This creates challenges for businesses to stand out, as products often look similar and use common materials like quartz or amethyst. Over 50% of new entrants struggle with differentiation.

- Skepticism Around Spiritual Claims: Many consumers remain skeptical about the metaphysical benefits of spiritual jewelry. The lack of scientific evidence supporting claims like “energy healing” can deter a significant portion of potential buyers. Studies show that nearly 25% of consumers hesitate to purchase due to doubts about efficacy.

- High Competition from Mass-Produced Items: Low-cost, mass-produced spiritual jewelry is flooding online platforms and retail markets, making it difficult for small or premium brands to compete. This has led to pricing pressure, with some businesses reporting a decline in profit margins by as much as 15%.

- Raw Material Sourcing Issues: The reliance on natural gemstones and materials poses challenges related to supply chain disruptions, price volatility, and ethical concerns. For example, the price of high-quality gemstones has risen by over 20% in the last two years due to limited availability and increased demand.

- Counterfeit Products and Quality Concerns: The proliferation of counterfeit spiritual jewelry, often made from synthetic or low-quality materials, erodes consumer trust. Counterfeit items account for approximately 10-15% of the spiritual jewelry market, damaging the reputation of legitimate brands.

Top Opportunities

- Expansion into Emerging Markets: Regions like Southeast Asia, Africa, and Latin America present significant growth opportunities for spiritual jewelry brands due to rising disposable incomes and increased interest in wellness products. For instance, the wellness market in Asia is expected to grow at double the global average rate, offering a promising landscape for spiritual jewelry.

- Collaborations with Influencers and Wellness Gurus: Partnering with influencers and thought leaders in the wellness industry can help brands build credibility and expand their reach. Over 70% of wellness-focused brands that collaborate with influencers report an increase in brand awareness and sales.

- Incorporation of Augmented Reality (AR) for Shopping: Using AR technology to allow customers to virtually try on spiritual jewelry can enhance the online shopping experience and drive e-commerce growth. Research indicates that 40% of consumers are more likely to buy jewelry after interacting with AR tools.

- Diversification of Product Offerings: Expanding beyond necklaces and bracelets to include items like spiritual rings, anklets, and wearable talismans can help brands tap into new customer segments. Adding affordable product lines could also attract younger audiences, who make up 35% of total buyers.

- Focus on Corporate Wellness Programs: Corporate wellness initiatives are increasingly incorporating spiritual tools for employee well-being. Spiritual jewelry can be marketed as part of wellness kits or incentives, targeting businesses that spend billions annually on employee engagement and wellness solutions.

Key Player Analysis

- Brother Wolf USA: Brother Wolf USA is a prominent player specializing in faith-based and spiritual jewelry, particularly saint medallions and talismans. The brand has built a strong reputation for its handcrafted designs, often incorporating sterling silver and gold. Its focus on customizability and artisanal quality positions it as a leader in the U.S. market.

- Chow Tai Fook Jewelry Company Limited: Headquartered in Hong Kong, While traditionally known for its fine jewelry, the company has expanded its portfolio to include spiritual and symbolic pieces, such as pendants inspired by feng shui and Chinese spiritual traditions. Its widespread retail presence and e-commerce capabilities make it a key player in Asia’s spiritual jewelry segment.

- Ka Gold Jewelry: Ka Gold Jewelry, based in Israel, focuses on handcrafted spiritual and sacred geometry-inspired designs. Ka Gold emphasizes materials such as gold, silver, and gemstones imbued with symbolic meanings, catering to a global audience seeking meaningful adornments rooted in ancient spiritual traditions.

- Richemont SA: Richemont, a Swiss luxury conglomerate, owns high-end jewelry brands like Cartier and Van Cleef & Arpels. While primarily associated with luxury, Richemont has introduced spiritual jewelry lines that include religious motifs and talismanic designs, blending craftsmanship with meaning.

- Pandora, a Danish brand, Known for its customizable charm bracelets, the brand has seen success in launching spiritual charms and pendants, such as angel wings, infinity symbols, and tree of life designs. Its mass appeal, coupled with a strong online and offline retail presence, has made Pandora a significant player in the affordable spiritual jewelry market.

Asia Pacific Spiritual Jewelry Market

Asia Pacific Leads the Spiritual Jewelry Market with the Largest Market Share of 35.4%

The Asia Pacific region dominated the global spiritual jewelry market in 2023, accounting for 35.4% of the total market share and generating revenue of approximately USD 5.06 billion. This region’s leadership is driven by its deep cultural connection to spirituality, healing practices, and the use of gemstones in traditional and modern lifestyles.

Countries such as India, China, and Japan contribute significantly to the demand for spiritual jewelry due to their historical use of sacred symbols, gemstones like jade and rudraksha, and growing wellness trends among younger demographics.

India, as a cultural hub for spirituality, plays a pivotal role in the market with its strong demand for malas, chakra jewelry, and gemstones associated with Vedic traditions. China’s increasing adoption of Feng Shui and talismanic accessories further propels growth. Moreover, the region’s rising disposable income levels and urbanization have led to higher consumer spending on personal wellness products, including spiritual jewelry.

The Asia Pacific market benefits from an expansive local manufacturing base, which supports cost-efficient production and global export. These factors collectively reinforce its dominance in the global spiritual jewelry industry, positioning it as the most lucrative market segment in the coming years.

Recent Developments

- In 2024, Aditya Birla Group launched its jewellery retail brand ‘Indriya’, stepping into the competitive jewellery market alongside Tanishq and Reliance Jewels. With a vision to become a top-three player within five years, the Rs 5,000 crore initiative aims to leverage the rising demand for branded jewellery in India. Launching during the festive season, the brand focuses on the booming wedding market and the growing preference for trusted names.

- In 2024, Karma and Luck, a Las Vegas-based brand celebrated for its fusion of luxury and spirituality, reopened its flagship store at the Grand Canal Shoppes. The grand reopening event, held in December 2023, featured a vibrant celebration of ancient traditions and modern aesthetics. The redesigned space combines natural elements with timeless design, creating a unique shopping experience for customers seeking spiritual and stylish products.

- In 2023, Richemont reported exceptional results for its Jewellery Maisons division, achieving 21% sales growth and a 35% operating margin for the year ending March 31, 2023. These results contributed to the Group’s record-breaking sales of €19,953 million and operating profit of €5,031 million, driven by growth across all regions and distribution channels.

- In 2024, Hatton Jewels partnered with Ishy Khan, a jewellery expert known for his appearances on the BBC’s Antiques Roadshow. The collaboration, titled ‘Ishy’s Expert Edit,’ offers exclusive insights into antique and vintage jewellery through social media and blog posts. This partnership brings a curated selection of timeless pieces to enthusiasts, blending expertise and storytelling to engage audiences.

Conclusion

The spiritual jewelry market continues to grow as consumers increasingly seek products that combine aesthetic appeal with deeper meaning and purpose. This trend is fueled by rising interest in mindfulness, holistic wellness, and personal expression, making spiritual jewelry a versatile accessory for both fashion and functionality.

While challenges such as market saturation and skepticism about metaphysical claims persist, the demand for meaningful, customizable, and ethically made products provides significant growth opportunities. By embracing innovative designs, sustainable practices, and technology integration, brands can cater to the evolving preferences of a diverse, global audience. The future of this market lies in blending cultural authenticity with modern consumer needs, ensuring that spiritual jewelry remains both relevant and impactful across generations and geographies.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)