Table of Contents

Introduction

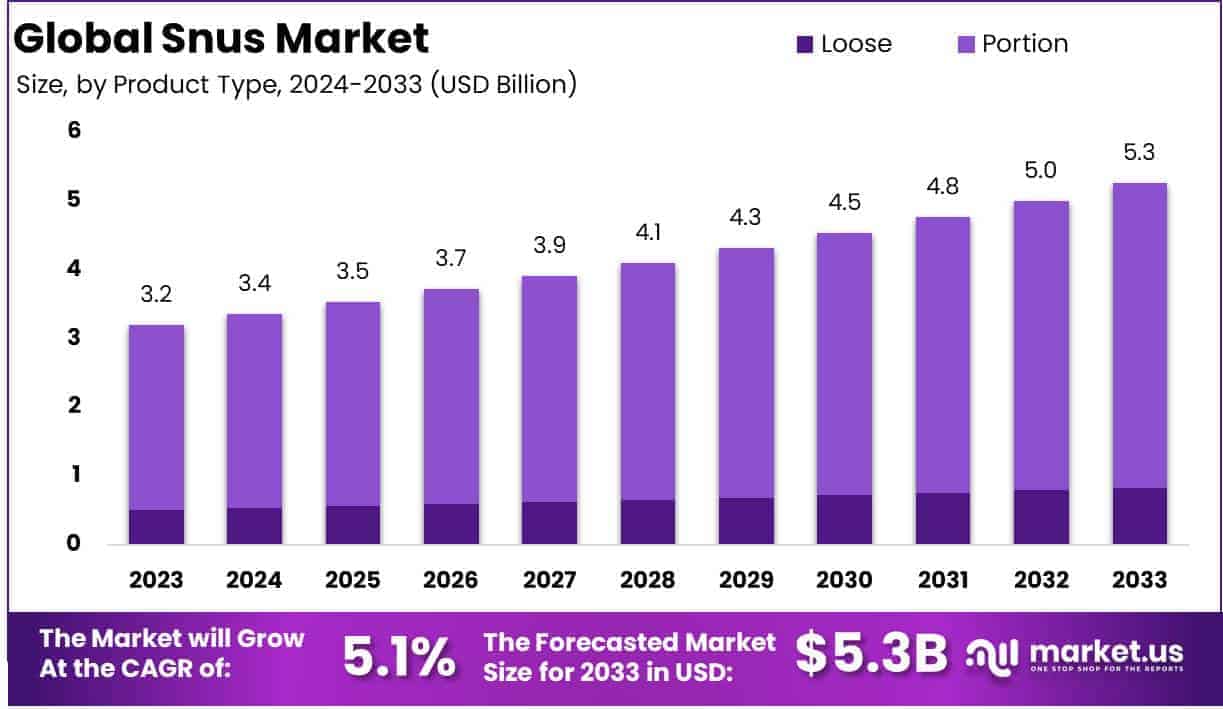

The Global Snus Market is projected to reach a value of approximately USD 5.3 billion by 2033, up from USD 3.2 billion in 2023, reflecting a compound annual growth rate (CAGR) of 5.1% over the forecast period from 2024 to 2033.

Snus is a smokeless tobacco product originating from Sweden, typically packaged in small pouches that are placed under the upper lip. Unlike traditional tobacco products such as cigarettes, snus does not require combustion, making it less harmful in terms of exposure to tar and harmful chemicals. Its use is prevalent in Scandinavia, and it has gained popularity in other regions due to its discrete consumption method and perceived reduced health risks compared to smoking.

The snus market refers to the commercial landscape surrounding the production, distribution, and consumption of snus products. This market encompasses a wide array of product types, including loose snus and portioned snus, catering to various consumer preferences.

Over the past decade, the market has expanded significantly, driven by shifting consumer attitudes towards smoking alternatives and regulatory environments that increasingly limit cigarette consumption. The snus market is largely driven by countries in Scandinavia, particularly Sweden, but has also experienced growing demand in North America and other regions as more consumers seek out alternatives to smoking.

The primary growth factors for the snus market are the increasing awareness of the health risks associated with smoking and the rising consumer shift towards smokeless tobacco alternatives. Snus is often marketed as a less harmful alternative to smoking due to the absence of combustion and the resultant reduction in exposure to carcinogens.

In addition, changing regulatory landscapes, such as tighter cigarette smoking bans and higher taxes on traditional tobacco products, have encouraged consumers to seek alternatives like snus. Furthermore, the rising number of smoking cessation initiatives and government-backed anti-smoking campaigns contribute to the growing appeal of snus as a viable alternative.

Demand for snus has been particularly strong in regions with high smoking rates, such as Scandinavia, where it is deeply ingrained in consumer culture. There is also growing demand in North America, driven by health-conscious individuals seeking tobacco alternatives and the increasing popularity of nicotine pouches.

The product’s discrete nature and the absence of smoke make it particularly appealing to younger generations and those in urban settings who prefer a less conspicuous consumption method. As smoking rates decline globally, snus is emerging as a preferred choice for tobacco users seeking to mitigate the negative health implications associated with cigarettes.

The snus market offers significant opportunities, particularly in regions outside its traditional strongholds. Market players can capitalize on the growing demand for smoking cessation products by positioning snus as a stepping stone for smokers transitioning to non-combustible alternatives. Innovation in flavor offerings, packaging, and product variations (e.g., nicotine pouches) also presents avenues for differentiation and growth.

Moreover, regulatory shifts that favor the reduction of smoking could open up new markets for snus, particularly in countries with stringent anti-smoking laws. As the global trend toward healthier lifestyles continues to gain momentum, the snus market stands poised to attract a wider consumer base, provided companies can overcome regulatory challenges and build consumer trust in the long-term health benefits of their products.

Key Takeaways

- The global snus market is projected to grow from USD 3.2 billion in 2023 to USD 5.3 billion by 2033, driven by increasing demand for smokeless tobacco, with a CAGR of 5.1%.

- Portion segment Dominated the market in 2023 with 84.2% share, favored for its convenience and discreet use.

- Flavored snus Held 84.2% of the market, with mint flavors accounting for over 40% of sales.

- Tobacco stores Captured 67.2% of the distribution channel share in 2023, benefiting from specialized offerings and strong consumer trust.

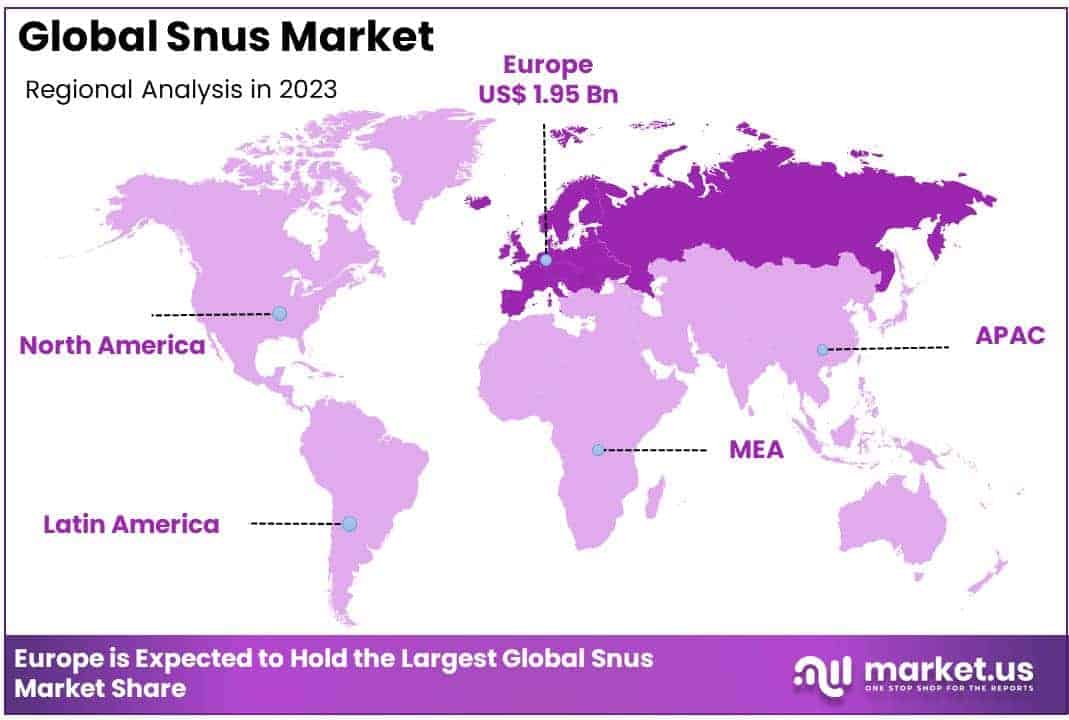

- Europe Led the global market with 61.2% share in 2023, driven by cultural acceptance in Scandinavia and supportive regulations.

Snus Statistics

- Snus is considered 95% to 99% less harmful than smoking.

- Unlike smoking, snus does not affect respiratory health. Smoking is responsible for nearly 46% of deaths due to diseases like lung cancer, COPD, and pneumonia.

- In 2021, 15% of individuals aged 16 to 74 used snus daily.

- Men use snus more than women, with 21% of men and 8% of women using it daily.

- Among those aged 25 to 34, one in three men uses snus daily, compared to one in six women in the same age group.

- The daily use of snus among young men (16-24 years) increased from 22% to 29% over the past year.

- Women’s snus use remains steady, hovering between 14% and 17%.

- Tobacco causes over 8 million deaths annually, including 1.3 million deaths from second-hand smoke exposure.

- Around 80% of the world’s tobacco users live in low- and middle-income countries, where the majority of tobacco-related illnesses occur.

- Of the 8 million tobacco-related deaths, 7 million are due to direct use, and 1.3 million are caused by second-hand smoke.

- Second-hand smoke causes cardiovascular and respiratory diseases, killing 1.3 million people prematurely each year.

- 1.5 billion people live in 36 countries with strong anti-tobacco mass media campaigns that have aired in the past two years.

- In the U.S., 38.4 million adults have diabetes, with 14.6% of them being smokers.

- Smokers are 30% to 40% more likely to develop type 2 diabetes due to various contributing factors.

- Adults aged 65 and older who smoke are twice as likely to have untreated cavities compared to non-smokers.

- Around 43% of smokers aged 65+ have lost all their teeth, a much higher rate than non-smokers in the same age group.

Emerging Trends

- Shift to Health-Conscious Consumption: Snus, once predominantly used by smokers seeking an alternative to cigarettes, is gaining popularity among health-conscious consumers who are looking for less harmful nicotine alternatives. This shift reflects broader societal trends towards wellness, with snus emerging as a cleaner, smoke-free option. As awareness grows about its reduced health risks compared to smoking, snus is increasingly perceived as a more acceptable way to consume nicotine.

- Flavored Variants Gaining Popularity: Flavor innovation in the snus market is another emerging trend. Traditional tobacco flavors are being supplemented with a wide variety of new options, including mint, citrus, and berry. This trend is driving snus consumption, particularly among younger demographics, who are more inclined toward variety and novelty in their nicotine products. Flavor diversification also appeals to those who may find the taste of traditional snus unappealing.

- E-commerce and Online Sales Surge: The growing acceptance of e-commerce has seen an increase in the online sale of snus products. Consumers are now able to purchase snus from the comfort of their homes, bypassing traditional retail channels. This trend is particularly strong in regions where traditional retail distribution for tobacco products is heavily regulated or restricted, allowing brands to access wider markets through digital platforms.

- Technological Advancements in Product Design: Technological innovation is shaping the development of snus products. Newer iterations are being designed for improved user experience, such as pouches that dissolve faster or are less noticeable when placed under the lip. These advances are making snus more convenient and discreet, appealing to users who prioritize convenience and discretion in their nicotine consumption habits.

- Sustainability and Eco-Friendly Packaging: As environmental concerns rise globally, snus manufacturers are responding with more sustainable practices. Companies are shifting towards biodegradable and recyclable packaging to reduce the environmental impact. This trend is in line with the broader push for sustainability in consumer goods, driven by increasing consumer demand for environmentally responsible products.

Top Use Cases

- Cigarette Replacement for Smokers: A primary use of snus remains as a substitute for traditional cigarettes. Smokers seeking to quit or reduce their smoking habit are turning to snus as a less harmful alternative. This is especially notable as health warnings related to smoking continue to push people toward smoke-free options. Studies suggest that people who use snus are often less likely to return to smoking compared to those who attempt quitting without alternatives.

- Nicotine Consumption for Non-Smokers: An emerging use case is snus as a lifestyle product for individuals who are not necessarily smokers but still want to consume nicotine. Many consumers in this category use snus for its stimulating effects, similar to those from coffee or energy drinks. This is especially prevalent among younger adults who may want an alternative to smoking or vaping.

- Improved Focus and Cognitive Function: Some users turn to snus for its potential cognitive benefits. Nicotine is a known stimulant, and snus is often used by individuals seeking increased focus, alertness, or productivity. Professionals, students, and people in high-stress environments may use snus as a tool to enhance concentration during long working hours or study sessions.

- Social and Cultural Usage: In regions like Scandinavia, snus has long been a part of social traditions and cultural identity. Its use is common in social gatherings, and it is often consumed in communal settings. This use case helps drive demand in areas with established snus consumption habits, where it has become ingrained in daily life.

- Stealth Nicotine Consumption: Snus is commonly used for its discreet nature. Unlike cigarettes or e-cigarettes, snus can be consumed without producing visible smoke or vapor. This makes it an appealing choice for individuals who wish to consume nicotine in places where smoking or vaping is prohibited, such as offices, public spaces, or on public transportation. The growing number of public smoking bans further boosts snus’s appeal for stealthy nicotine use.

Major Challenges

- Regulatory Hurdles and Legal Restrictions: One of the key challenges facing the snus market is strict regulations. In several countries, particularly outside of Scandinavia, snus faces significant legal barriers. The European Union, for example, has banned the sale of snus (except in Sweden) due to concerns over its health impact. This limits the potential for global market expansion, particularly in regions like the United States, where regulation is still evolving.

- Health and Safety Concerns: Although snus is considered less harmful than smoking, health concerns still persist. The nicotine content in snus can lead to addiction, and long-term use may be linked to oral health problems, including gum disease and mouth cancer. These health risks continue to create a challenge for the industry, particularly in educating consumers on the relative safety of snus compared to smoking.

- Stigma and Social Perception: Snus still faces social stigma in many parts of the world. While it is viewed as a more acceptable alternative to smoking in some countries, in others it is still associated with unhealthy habits. This stigma can deter new users and limit the appeal of snus in markets where smoking alternatives are still seen negatively, despite the product’s potential benefits.

- Competition from Other Nicotine Products: The growing popularity of other nicotine alternatives, such as vaping and nicotine pouches, poses a challenge for the snus market. Vaping, in particular, offers a wide range of flavors and options that appeal to younger consumers. This increased competition from newer products with less restrictive regulations could impact snus’s market share, especially in markets like North America.

- Limited Consumer Awareness: Despite its rising popularity, snus is still relatively unknown to a significant portion of the global population. In many countries, traditional smoking alternatives like cigarettes dominate the market, while newer alternatives such as snus remain niche. Expanding consumer education and awareness about the benefits and proper usage of snus remains a critical challenge for expanding its user base.

Top Opportunities

- Expansion into Emerging Markets: As global smoking rates continue to decline, the opportunity to expand snus into emerging markets where smoking remains prevalent is significant. Countries in Southeast Asia, the Middle East, and Latin America present untapped markets for snus, particularly as consumers seek less harmful alternatives. With tailored marketing and education, snus manufacturers could capitalize on these regions’ growing health-conscious populations.

- Rise in Nicotine-Free Alternatives: There is a growing trend of nicotine-free alternatives in the wellness and lifestyle markets. Snus brands could tap into this by developing nicotine-free or reduced-nicotine variants to appeal to a broader consumer base. This could attract individuals who are interested in oral stimulation without the addictive properties of nicotine, expanding the product’s potential audience.

- Partnerships with Tobacco Harm Reduction Campaigns: As public awareness of the dangers of smoking grows, partnerships with public health organizations and tobacco harm reduction campaigns could provide snus brands with an opportunity to position themselves as a safer alternative. By aligning with such initiatives, snus could improve its credibility and expand its consumer base among health-conscious individuals looking for alternatives to smoking.

- Customization and Personalization of Products: The increasing demand for personalized products offers snus manufacturers a chance to innovate. Offering a range of nicotine strengths, flavors, and packaging options could allow consumers to tailor their snus experience to their preferences. This level of customization would be particularly appealing to younger consumers who value choice and flexibility in their products.

- Sustainability as a Competitive Advantage: Sustainability initiatives can present a significant growth opportunity for snus manufacturers. With increasing environmental awareness, consumers are becoming more concerned about the sustainability of the products they buy. By adopting eco-friendly practices such as biodegradable pouches and sustainable sourcing, snus brands could differentiate themselves in the market and attract environmentally-conscious consumers.

Key Player Analysis

- Swedish Match AB: Swedish Match AB is a global leader in the snus market, with a significant presence in both the traditional and emerging markets. Known for its premium products, the company operates primarily in Sweden, Norway, and the US. Its popular brands include General and Göteborgs Rapé. The company has steadily increased its focus on the smokeless tobacco sector as part of its strategy to shift away from traditional tobacco products. Swedish Match was acquired by Philip Morris International in 2022, further consolidating its market position.

- British American Tobacco (BAT): British American Tobacco is another dominant player in the global snus market. With its diverse portfolio of tobacco products, including snus under the Velo and Ettan brands, BAT has expanded its reach beyond traditional cigarette sales. BAT’s global expansion strategy has also helped to solidify its strong foothold in the snus market, particularly in Europe and North America.

- Imperial Brands: Imperial Brands, a leading multinational tobacco company, has been making strong moves in the smokeless tobacco sector, including snus. The company’s Zyn brand, introduced in the US, has seen rapid growth in recent years, with a strong consumer base and increased market penetration. This expansion is aligned with Imperial Brands’ strategic focus on the reduction of smoking through alternatives like snus.

- US Smokeless Tobacco Co., Inc.: A subsidiary of Altria Group, US Smokeless Tobacco Co. is a key player in the American snus market. The company’s flagship snus product, Skoal, is among the most widely recognized brands in the US, contributing significantly to the parent company’s overall performance. US Smokeless continues to expand its product line to include newer innovations in smokeless products.

- Philip Morris International: Philip Morris International (PMI), primarily known for its traditional tobacco products, has increasingly shifted focus toward smokeless alternatives, including snus. The company’s acquisition of Swedish Match has solidified PMI’s position as a market leader in snus. PMI’s global presence, along with its commitment to reducing smoking rates through alternative products, has helped it maintain a competitive edge in the growing snus market.

Europe Snus Market

Europe remains the dominant region in the global snus market, capturing a substantial market share of 61.2% in 2023, with a market value of approximately USD 1.95 billion. This growth is primarily driven by the strong historical presence of snus in Nordic countries, where it is deeply ingrained in consumer culture, particularly in Sweden, Norway, and Denmark. In Sweden, for instance, snus consumption is a widespread and long-established tradition, bolstered by government regulations that have allowed the product to thrive, despite the ban on other forms of smokeless tobacco in the European Union.

The rising preference for smokeless alternatives to traditional cigarettes, coupled with increasing awareness about the potential health benefits of snus (when compared to smoking), has further contributed to the region’s market strength. Additionally, growing acceptance of snus as a reduced-risk product in public health discourse has bolstered demand among adult smokers looking for alternatives to combustible tobacco.

Sweden continues to lead the region’s market, but neighboring countries such as Norway have seen an uptick in consumption as well, with regulatory frameworks also favoring snus use. This regional trend is reflective of broader consumer behavior patterns, where there is a marked shift towards products that align with changing lifestyles, including health-conscious choices.

Recent Developments

- In 2023, Imperial Brands, a leading player in the global tobacco and nicotine industry, announced the acquisition of a variety of nicotine pouches from TJP Labs. This strategic move is designed to help Imperial Brands tap into the US modern oral market. The acquisition will allow ITG Brands, its US arm, to offer a broad portfolio of 14 high-performing product variants aimed at adult American consumers. After further consumer feedback, ITG Brands plans to reintroduce these products under a new brand in 2024, with full support from its existing US sales team. TJP Labs, a Canadian-based manufacturer, will continue producing the nicotine pouches for ITG Brands.

- In July 2024, Philip Morris International (PMI) announced a $600 million investment in a cutting-edge manufacturing facility located in Aurora, Colorado. The new plant is expected to create 500 direct jobs, generating a $550 million annual economic impact. Additionally, the facility will support the production of Swedish Match’s ZYN nicotine pouches, catering to the increasing global demand for smoke-free alternatives among legal-age consumers. The investment is part of PMI’s ongoing efforts to expand its smoke-free product offerings.

- In 2023, Imperial Brands made significant strides in expanding its portfolio of Next Generation Products (NGPs), which include tobacco and nicotine alternatives such as snus, nicotine pouches, e-cigarettes, and heated tobacco products (HTPs). This reflects the company’s focus on meeting evolving consumer preferences and identifying growth opportunities in markets where traditional tobacco consumption is declining. Imperial has highlighted the potential for volume growth in developed markets by offering products that provide alternative consumer experiences.

- In 2024, British American Tobacco (BAT) is set to launch a synthetic nicotine version of its Velo nicotine pouches in the United States. This move marks a shift from the traditional tobacco-derived nicotine to a lab-created alternative. BAT’s U.S. subsidiary, Reynolds American, sees this as an opportunity to broaden its portfolio of smoke-free alternatives, tapping into a growing demand for non-tobacco-based nicotine products in the market.

- In 2023, Altria Group reported strong business performance, reflecting its ongoing transition to smoke-free products. The company highlighted its success in expanding its smoke-free portfolio, which includes e-cigarettes and other reduced-risk products. Despite a challenging environment, Altria’s efforts resulted in a 2.3% increase in adjusted diluted earnings per share, alongside $7.8 billion in dividends and share repurchases, underscoring its commitment to delivering value to shareholders.

Conclusion

The snus market is poised for continued growth as consumers increasingly seek alternatives to traditional smoking, driven by health-conscious trends and the growing popularity of smokeless tobacco products. As snus is recognized for its reduced harm compared to combustible tobacco, it has garnered traction among those looking to mitigate the risks associated with smoking while still satisfying nicotine cravings.

The market’s expansion is further fueled by innovations in product offerings, such as new flavors and convenient packaging, as well as the rise of online sales platforms that make snus more accessible to a wider audience. Despite regulatory challenges and social stigma in certain regions, snus presents significant opportunities for expansion, particularly in emerging markets and among health-conscious consumers. As awareness and acceptance of smokeless alternatives continue to rise, snus is likely to play an increasingly prominent role in the broader tobacco industry.