Table of Contents

Introduction

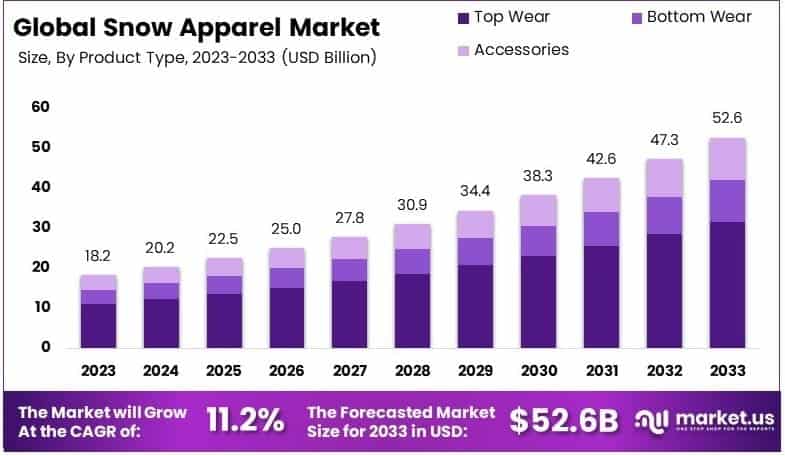

New York, NY – March 25 , 2025 – The Global Snow Apparel Market is projected to reach approximately USD 52.6 billion by 2033, rising from an estimated value of USD 18.2 billion in 2023. This growth reflects a compound annual growth rate (CAGR) of 11.2% during the forecast period from 2024 to 2033.

Snow apparel refers to specialized clothing designed to provide thermal insulation, weather resistance, and comfort in snowy and cold environments. This category typically includes jackets, pants, base layers, gloves, hats, and boots made with materials such as Gore-Tex, fleece, and synthetic insulation. Snow apparel is widely used in recreational snow sports such as skiing, snowboarding, and mountaineering, as well as in workwear for professionals operating in extreme cold climates.

The snow apparel market comprises the global demand, production, and sales of these garments across both consumer and industrial segments. The growth of this market is being driven by rising participation in winter sports, increasing disposable income in emerging economies, and greater awareness of high-performance technical wear. Moreover, the expansion of winter tourism and growing consumer preference for outdoor recreational activities are further contributing to the rising demand for premium, functional, and stylish snow apparel. Climate variability has also led to more frequent and intense snow events in certain regions, resulting in higher purchases of snow gear.

Additionally, the market is witnessing innovation in textile technologies, including moisture-wicking fabrics, sustainable materials, and lightweight insulation, which are creating differentiation and consumer appeal. From a business opportunity standpoint, manufacturers are capitalizing on e-commerce channels and direct-to-consumer strategies to enhance brand engagement and capture a broader demographic. Furthermore, the growing emphasis on eco-friendly and ethically produced apparel presents significant potential for companies that invest in sustainable sourcing and circular fashion models. Overall, the snow apparel market is positioned for stable growth supported by shifting lifestyle patterns, climate trends, and evolving consumer expectations.

Key Takeaways

- The global snow apparel market was valued at USD 18.2 billion in 2023 and is projected to reach USD 52.6 billion by 2033, expanding at a CAGR of 11.2% during the forecast period.

- In 2023, Top Wear emerged as the leading product type, accounting for 60.1% of the market share. This dominance is attributed to its essential role in providing warmth and protection in snowy environments.

- The Skiing segment led the application category with a 64.8% market share in 2023, highlighting its widespread global participation and the consistent demand for performance-oriented snow gear.

- The USD 101–200 price segment captured the largest share at 33.7% in 2023, indicating a strong consumer preference for products that strike a balance between affordability and quality.

- Specialty Stores accounted for the highest share of 38.7% among distribution channels in 2023, driven by their curated offerings and expert assistance tailored to snow apparel consumers.

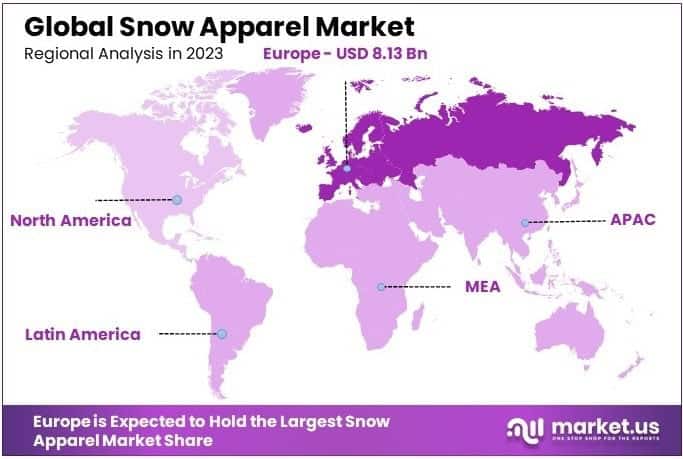

- Europe held the largest regional share of 44.7% in 2023, supported by its well-established winter sports infrastructure and a strong consumer base for high-quality, premium snow apparel.

Request a Sample Copy of This Report at https://market.us/report/snow-apparel-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 18.2 Billion |

| Forecast Revenue (2033) | USD 52.6 Billion |

| CAGR (2024-2033) | 11.2% |

| Segments Covered | By Product Type (Top Wear, Bottom Wear, Accessories), By Application (Skiing, Snowboarding, Hiking, Others), By Price Point (Up to USD 100, USD 101 to USD 200, USD 201 to USD 300, USD 301 to USD 400, USD 401 to USD 500, More than USD 500), By Distribution Channel (Sporting Goods Stores, National and Multi-door, Specialty Stores, Online Retailers, Others) |

| Competitive Landscape | The North Face, Patagonia, Columbia Sportswear, Arc’teryx, Burton Snowboards, Helly Hansen, Spyder Active Sports, Salomon Group, Marmot Mountain LLC, Rossignol Group, Obermeyer, Descente Ltd., Volcom, Quiksilver, Dakine |

Emerging Trends

- Integration of Fashion and Functionality: Consumers increasingly seek snow apparel that combines technical performance with contemporary fashion. This trend is driven by the desire for garments suitable both on and off the slopes, leading to collaborations between outdoor and fashion brands.

- Sustainable and Eco-Friendly Practices: There is a growing consumer preference for environmentally responsible products. Brands are responding by adopting sustainable manufacturing processes and utilizing eco-friendly materials in their snow apparel offerings.

- Advancements in Fabric Technology: Innovations in fabric technology have led to the development of materials that offer improved insulation, breathability, and moisture-wicking properties, enhancing comfort and performance for users.

- Growth of E-commerce Platforms: The expansion of online retail channels has made snow apparel more accessible to a global audience, allowing consumers to explore and purchase products from various brands conveniently.

- Rise of Women’s Participation in Winter Sports: The increasing involvement of women in winter sports has led to a higher demand for snow apparel tailored specifically for female athletes, prompting brands to expand their women’s product lines.

Top Use Cases

- Skiing: Specialized clothing designed to provide warmth, flexibility, and protection against the elements is essential for skiing activities.

- Snowboarding: Apparel tailored for snowboarding focuses on durability and freedom of movement, catering to the sport’s unique demands.

- Hiking in Snowy Conditions: Snow apparel suitable for hiking ensures safety and comfort in cold and snowy terrains.

- Casual Wear in Cold Climates: Beyond sports, snow apparel is utilized for everyday activities in regions experiencing cold weather, providing necessary warmth and protection.

- Après-Ski Activities: The demand for stylish and comfortable clothing suitable for social events after skiing has led to the development of specialized après-ski apparel.

Major Challenges

- Seasonal Demand Fluctuations: The snow apparel market experiences significant seasonal variations, with demand peaking during winter months, posing challenges for inventory management.

- Impact of Climate Change: Unpredictable weather patterns and warmer winters can reduce participation in snow sports, directly affecting apparel sales.

- High Cost of Quality Apparel: Premium snow apparel often comes with elevated prices due to specialized materials and technologies, potentially limiting accessibility for some consumers.

- Intense Market Competition: The presence of numerous brands in the market leads to heightened competition, necessitating continuous innovation and differentiation.

- Supply Chain Disruptions: Global events and logistical challenges can disrupt the supply chain, affecting the timely availability of products.

Top Opportunities

- Expansion into Emerging Markets: Rising disposable incomes in regions like Asia-Pacific and Latin America present opportunities for market growth as interest in winter tourism and adventure sports increases.

- Development of Eco-Friendly Products: Investing in sustainable materials and manufacturing processes can attract environmentally conscious consumers and align with global regulatory trends promoting green initiatives.

- Leveraging Digital Retail Channels: Enhancing online presence and utilizing e-commerce platforms can help brands reach a broader audience and provide personalized shopping experiences.

- Collaborations and Partnerships: Forming strategic alliances with fashion brands or influencers can create unique product offerings and tap into new customer segments.

- Focus on Women’s Apparel: Developing products that cater specifically to the growing segment of female winter sports enthusiasts can drive market expansion.

Purchase the Full Report Now at https://market.us/purchase-report/?report_id=133757

Key Player Analysis

The global snow apparel market in 2024 is characterized by the dominance of established players with strong brand equity and diversified product portfolios. Companies such as The North Face, Patagonia, and Columbia Sportswear continue to lead the market through innovation, sustainability initiatives, and effective global distribution networks.

These brands benefit from a high degree of customer loyalty and are frequently chosen for both recreational and professional winter sports. Arc’teryx, Burton Snowboards, and Helly Hansen are reinforcing their competitive positioning through technical performance gear and enhanced digital engagement, catering to a growing consumer base prioritizing functionality and style.

Meanwhile, performance-focused brands such as Spyder Active Sports, Salomon Group, and Marmot Mountain LLC maintain strong visibility in alpine and skiing communities. Traditional European brands like Rossignol Group, Descente Ltd., and Obermeyer continue to uphold premium quality and heritage appeal. Lifestyle-driven brands, including Volcom, Quiksilver, and Dakine, are leveraging youth-oriented designs and snowboarding culture to tap into the younger demographic, thereby supporting market expansion.

Top Key Players

- The North Face

- Patagonia

- Columbia Sportswear

- Arc’teryx

- Burton Snowboards

- Helly Hansen

- Spyder Active Sports

- Salomon Group

- Marmot Mountain LLC

- Rossignol Group

- Obermeyer

- Descente Ltd.

- Volcom

- Quiksilver

- Dakine

Regional Analysis

Europe Leads the Snow Apparel Market with the Largest Market Share of 44.7% in 2024

Europe emerged as the leading region in the global snow apparel market, accounting for the highest market share of 44.7% in 2024, valued at approximately USD 8.13 billion. This dominance can be attributed to a well-established winter sports culture, extensive participation in skiing and snowboarding activities, and the presence of prominent snow resorts across countries such as Switzerland, Austria, France, Germany, and Italy. The region’s strong inclination toward premium outdoor sportswear, coupled with high consumer purchasing power and a greater focus on functional as well as fashion-forward winter apparel, continues to drive market growth.

Moreover, the growing popularity of alpine tourism and winter adventure sports, supported by favorable government initiatives promoting winter tourism, has further reinforced Europe’s position in the global snow apparel landscape. Seasonal sporting events and a well-organized sports retail ecosystem also contribute to increased product penetration.

Leading global snow apparel brands maintain a robust retail presence across European countries, leveraging both physical and e-commerce platforms to capture a diverse customer base. In addition, technological advancements in performance wear and a strong demand for sustainable, eco-friendly winter clothing have gained notable traction in the region, further shaping the snow apparel demand dynamics across Europe.

Recent Developments

- In 2024, EssilorLuxottica confirmed its plan to acquire Supreme® from VF Corporation for $1.5 billion in cash. The agreement strengthens EssilorLuxottica’s presence in the lifestyle and fashion sector, blending high-performance optics with streetwear appeal. Supreme®, known for its bold identity and strong global following, is expected to benefit from the group’s retail and branding expertise.

- In 2023, Kering finalized the acquisition of a 30% stake in Valentino, following all required approvals from competition regulators. This strategic move enhances Kering’s presence in the luxury fashion market. The shareholding will now be reflected in its financial statements through the equity method, deepening its ties with a recognized Italian fashion house.

- In 2025, J.Crew began a partnership with U.S. Ski & Snowboard to develop new lifestyle apparel inspired by the spirit of winter sports. The collaboration will include stylish cold-weather wear such as loungewear, sweaters, and accessories. This three-year agreement aligns with preparations for the 2026 Winter Olympics, with J.Crew expected to feature at several key events, including a showcase at the World Cup finals in Sun Valley.

- In 2024, LVMH invested in Moncler through the acquisition of a 10% interest in Double R, a holding company connected to Ruffini Partecipazioni. Double R currently holds a significant share in Moncler and plans to raise it to 18.5%. LVMH’s funding support aims to further reinforce Moncler’s market position, while deepening strategic investment ties in the luxury outerwear segment.

Conclusion

The global snow apparel market is experiencing steady growth, driven by increasing participation in winter sports, advancements in fabric technology, and a rising emphasis on both functionality and style. Consumers are seeking apparel that offers protection against harsh weather conditions while aligning with contemporary fashion trends. The proliferation of e-commerce platforms has further facilitated market expansion by providing convenient access to a diverse range of products. However, challenges such as climate variability and the high cost of quality apparel may impact growth. Nonetheless, the market is poised for continued development, supported by innovations in sustainable materials and the growing popularity of winter recreational activities worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)