Table of Contents

Overview

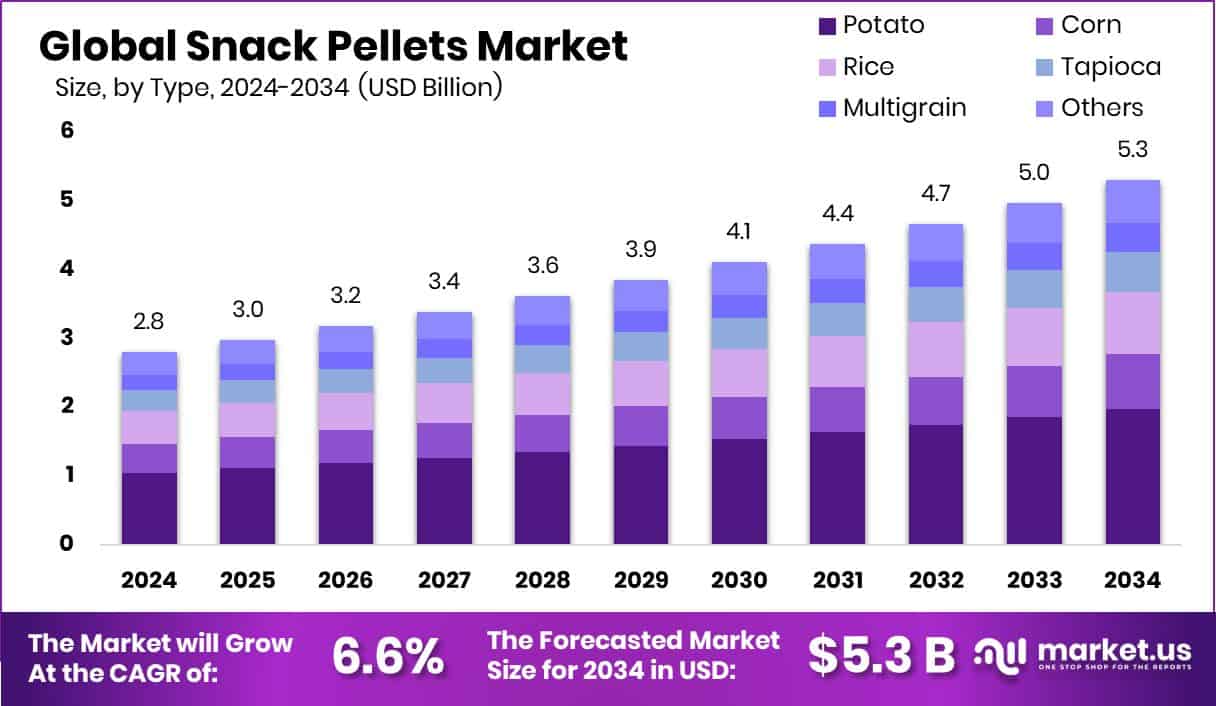

New York, NY – May 19, 2025 – The global Snack Pellets Market is growing fast, driven by rising demand for convenient and tasty snack options. In 2024, the market was valued at USD 2.8 billion, but it is expected to reach USD 5.3 billion by 2034, growing at a CAGR of 6.6%.

In 2024, potato-based snack pellets led the By Type segment of the Snack Pellets Market, commanding a 37.3% share. Their dominance stems from widespread consumer preference, versatile processing capabilities, and reliable quality in extrusion-based snack production. Laminated snack pellets dominated the By Form segment in 2024, securing a 56.1% market share.

Their leadership is driven by a distinctive layered texture and superior crunch, delivering a premium snacking experience. Plain-flavored snack pellets led the By Flavor segment in 2024, capturing a 58.2% market share. single-screw extruder techniques dominated the By Technique segment, holding a 63.9% share. Their widespread adoption is due to their cost-effectiveness, simplicity, and reliability, making them ideal for small- to mid-scale manufacturers.

US Tariff Impact on Market

The snack sector is facing a downturn as major companies like PepsiCo, Campbell, and J.M. Smucker report sales declines, with PepsiCo noting a 3% drop, Campbell a 2% decrease, and J.M. Smucker a 5% reduction, driven by consumers becoming more selective amid inflationary pressures and higher borrowing costs.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/global-snack-pellets-market/request-sample/

The Bureau of Labor Statistics (BLS), which highlights that snack prices have risen faster than most grocery items—exemplified by a 16-oz bag of potato chips increasing from USD 5.05 in 2021 to USD 6.50, a 29% jump, while overall grocery prices rose by 23% in the same period, prompting consumers to cut back on non-essentials and maximize value, as noted by NIQ VP Chris Cotalgi.

Key Takeaways

- Global Snack Pellets Market is expected to be worth around USD 5.3 billion by 2034, up from USD 2.8 billion in 2024, and grow at a CAGR of 6.6% from 2025 to 2034.

- Potato snack pellets held a 37.3% share, leading due to consumer preference for familiar taste profiles.

- Laminated snack pellets accounted for 56.1% share due to their layered texture and unique mouthfeel.

- Plain flavored pellets captured a 58.2% share, preferred for post-processing customization and regional taste adaptations.

- Single-screw extruder technology led with 63.9% due to cost-efficiency and widespread manufacturing compatibility.

- Snack pellets demand in Europe reached USD 1.09 Bn, contributing 39.2% globally.

Report Scope

| Market Value (2024) | USD 2.8 Billion |

| Forecast Revenue (2034) | USD 5.3 Billion |

| CAGR (2025-2034) | 6.6% |

| Segments Covered | By Type (Potato, Corn, Rice, Tapioca, Multigrain, Others), By Form (Laminated, Tridimensional, Die-Face, Gelatinized), By Flavor (Plain, Flavored, Nutritional), By Technique (Single-Screw Extruder, Twin-Screw Extruder) |

| Competitive Landscape | Limagrain Céréales Ingrédients, Liven S.A., Grupo Michel, Leng d’Or S.A., J. R. Short Milling, Pasta Foods Ltd, Bach Snacks s.a.l., Mafin Spa, Le Caselle S.p.A., Van Marcke Foods |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=147491

Key Market Segments

By Type Analysis

- In 2024, potato-based snack pellets led the By Type segment of the Snack Pellets Market, commanding a 37.3% share. Their dominance stems from widespread consumer preference, versatile processing capabilities, and reliable quality in extrusion-based snack production. Potato pellets serve as a neutral base, easily adaptable to diverse flavors and seasonings, appealing to both traditional and contemporary snacking trends.

By Form Analysis

- Laminated snack pellets dominated the By Form segment in 2024, securing a 56.1% market share. Their leadership is driven by a distinctive layered texture and superior crunch, delivering a premium snacking experience. The multi-layered structure enhances mouthfeel and seasoning retention, critical for flavor differentiation in a competitive market.

By Flavor Analysis

- Plain-flavored snack pellets led the By Flavor segment in 2024, capturing a 58.2% market share. Their dominance is driven by their versatility as a customizable base for post-processing flavor additions, allowing manufacturers to tailor seasonings to diverse regional preferences. The 58.2% share highlights robust demand from food processors and private-label brands using plain pellets as a flexible intermediate product.

By Technique Analysis

- In 2024, single-screw extruder techniques dominated the By Technique segment, holding a 63.9% share. Their widespread adoption is due to their cost-effectiveness, simplicity, and reliability, making them ideal for small- to mid-scale manufacturers. Single-screw extruders ensure uniform pellet shapes and sizes, critical for consistent downstream processing, particularly for potato- and cereal-based pellets.

Regional Analysis

- Europe led the global Snack Pellets Market in 2024, capturing a 39.2% share valued at USD 1.09 billion. This dominance is fueled by strong consumer demand for convenience snacks, a robust food processing industry, and a preference for customized potato- and cereal-based pellets that meet health-conscious and clean-label trends.

- North America follows, driven by flavor innovation and on-the-go snacking trends, though it trails Europe in market share. Asia Pacific shows steady growth due to urbanization and shifting dietary habits, while the Middle East & Africa and Latin America remain emerging markets with modest contributions. Europe’s advanced retail infrastructure and focus on quality snacks solidify its position as the market leader.

Top Use Cases

- Convenience Snacking: Snack pellets are ideal for busy consumers needing quick, on-the-go snacks. They’re semi-finished, allowing manufacturers to create ready-to-eat products like chips or puffs via frying or baking, meeting the rising demand for portable, easy-to-consume snacks that fit fast-paced lifestyles.

- Flavor Customization: Plain snack pellets serve as a versatile base for adding regional or exotic flavors post-processing. Manufacturers can tailor seasonings like spicy, cheesy, or sweet to suit local tastes, enabling brands to target diverse markets with customized flavor profiles efficiently.

- Health-Conscious Options: Snack pellets support the growing demand for healthier snacks. Using potato, rice, or multigrain bases, they can be air-popped or baked to reduce oil content, offering low-fat, gluten-free, or high-fiber options that appeal to wellness-focused consumers.

- Cost-Effective Production: Snack pellets are economical for manufacturers due to their long shelf life and ease of storage. Single-screw extruders, dominant in production, ensure uniform shapes and sizes, reducing waste and enabling small- to mid-scale producers to meet high demand affordably.

- Innovative Shapes and Textures: Laminated or tridimensional snack pellets allow creative shapes like rings or stars, enhancing visual appeal. Their layered textures improve crunch and seasoning retention, attracting consumers seeking novel snacking experiences and boosting brand differentiation.

Recent Developments

1. Limagrain Céréales Ingrédients

- Limagrain has expanded its snack pellet offerings with innovative, non-GMO, and gluten-free options, catering to the growing demand for healthier snacks. The company has introduced new textured vegetable protein (TVP) pellets, enhancing protein-rich snack alternatives. Their focus on sustainable sourcing and clean-label ingredients has strengthened their position in the European market.

2. Liven S.A.

- Liven S.A. has invested in advanced extrusion technology to improve the texture and flavor of its snack pellets. The company recently launched a high-fiber, low-carb pellet range targeting keto and diabetic consumers. Their R&D efforts emphasize natural colors and flavors, aligning with clean-label trends.

3. Grupo Michel

- Grupo Michel has introduced organic and non-GMO snack pellets, expanding its export market in Latin America and Europe. The company has partnered with food tech startups to develop functional pellets infused with probiotics and plant-based proteins. Their sustainable packaging initiatives have also gained attention.

4. Leng d’Or S.A.

- Leng d’Or has launched a new line of multigrain and ancient grain snack pellets, focusing on nutritional benefits. Their recent collaboration with European retailers ensures wider distribution of their organic and allergen-free pellet varieties. The company is also optimizing production for reduced energy consumption.

5. J. R. Short Milling

- J. R. Short Milling has developed a novel crispy pellet using alternative flours like chickpea and quinoa. Their recent expansion into the Asian market includes customized flavors tailored to regional tastes. The company emphasizes traceability and non-GMO verification for transparency.

Conclusion

The Snack Pellets Market thrives on versatility, affordability, and consumer demand for convenient, customizable snacks. Dominated by potato-based, laminated, and plain variants, it caters to diverse tastes and health trends. Europe leads with strong production and innovation, while single-screw extrusion ensures cost-effective scalability. With rising e-commerce and plant-based preferences, snack pellets are poised for sustained global growth.