Table of Contents

Introduction

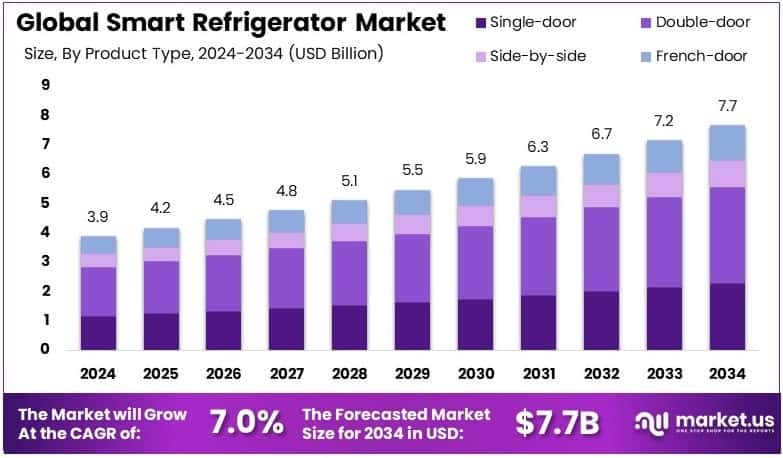

New York, NY – April 11, 2025 – The Global Smart Refrigerator Market is projected to reach approximately USD 7.7 billion by 2034, increasing from an estimated USD 3.9 billion in 2024. This growth is anticipated to occur at a compound annual growth rate (CAGR) of 7.0% during the forecast period spanning from 2025 to 2034.

A smart refrigerator is an advanced household appliance integrated with internet connectivity, sensors, and artificial intelligence to enhance food management, energy efficiency, and user convenience. These refrigerators enable remote monitoring, inventory tracking, automatic temperature adjustments, and even integration with voice assistants and other smart home devices. The smart refrigerator market refers to the global industry centered on the development, production, and distribution of these intelligent appliances, targeting both residential and commercial segments.

The market has been witnessing notable growth due to the increasing penetration of IoT and AI technologies in home appliances, coupled with rising consumer preference for energy-efficient and technologically advanced kitchen solutions. Furthermore, the demand is driven by urbanization, rising disposable incomes, and an increasing shift towards modular kitchens in both developed and emerging economies.

In addition, the growing awareness about food wastage and the need for efficient inventory management have amplified the adoption of smart refrigerators, particularly in North America, Europe, and parts of Asia-Pacific. A key growth factor includes the integration of smart features such as touchscreen interfaces, voice command systems, internal cameras, and food tracking software, which cater to tech-savvy consumers seeking convenience and lifestyle enhancement.

As the global consumer base becomes more digitally inclined, the demand for connected kitchen appliances is expected to accelerate. Moreover, the rise of smart homes and government incentives promoting energy conservation are creating opportunities for manufacturers to innovate and diversify their offerings. Emerging markets present untapped potential due to improving infrastructure and growing middle-class populations, making the smart refrigerator market poised for sustained expansion in the coming years.

Key Takeaways

- The Smart Refrigerator Market was valued at USD 3.9 billion in 2024 and is projected to reach USD 7.7 billion by 2034, expanding at a CAGR of 7.0% over the forecast period.

- In terms of product type, Double-door smart refrigerators accounted for the largest share at 42.6% in 2024, primarily due to their spacious storage capacity and increasing consumer preference for larger appliances.

- Based on technology, the Wi-Fi Enabled segment led the market in 2024 with a share of 58.2%, driven by growing demand for enhanced connectivity and integration with smart home systems.

- By end-user, the Residential segment dominated the market in 2024 with a share of 70.4%, supported by the rising adoption of smart appliances in household settings and increasing urbanization.

- In the distribution channel category, Offline retail accounted for 61.8% of the market in 2024, as consumers continue to prefer in-store purchases to assess product features and physical design before buying.

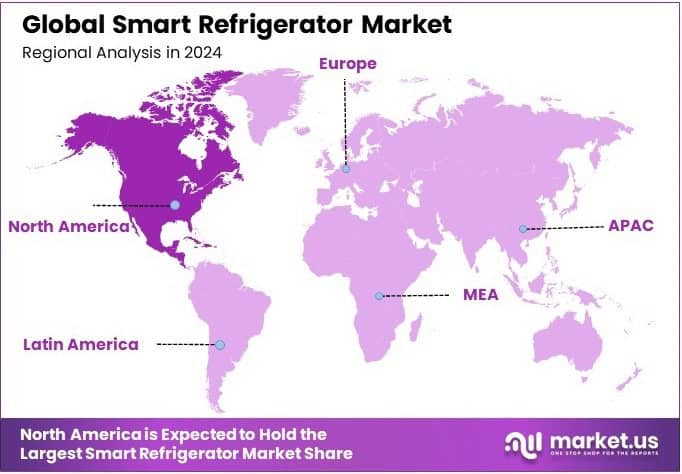

- North America emerged as the leading region in 2024, holding a 34.2% market share, equivalent to USD 1.33 billion, owing to the high penetration of smart homes and technologically advanced consumer base.

Trump Tariff Threat Assessment: Implications for Global Trade and Market Stability- Get Report Sample https://market.us/report/smart-refrigerator-market/request-sample/

Impact of U.S. Tariffs on the Smart Refrigerator Market

- Increased Production Costs and Consumer Prices: The 25% tariffs on imports from Mexico and Canada, along with a 10% tariff on Chinese goods, have led to higher production costs for smart refrigerators. This is due to the increased cost of imported components such as compressors, motors, and control boards. Consequently, consumer prices for these appliances are expected to rise by 5–20%, depending on the brand and model.

- Supply Chain Reconfiguration: Manufacturers like Samsung and LG are considering relocating their production facilities from Mexico to the United States to mitigate the impact of tariffs. For instance, Samsung is contemplating moving part of its dryer production from Querétaro, Mexico, to its facility in Newberry, South Carolina . Such shifts aim to reduce tariff-related costs and maintain competitiveness in the U.S. market.

- Competitive Advantage for Domestic Manufacturers: U.S.-based companies with substantial domestic manufacturing capabilities, such as Whirlpool, are better positioned to withstand the impact of tariffs. Their reliance on local production allows them to avoid additional costs associated with imported components, providing a competitive edge over foreign manufacturers.

- Market Share Shifts: The increased costs for foreign manufacturers due to tariffs may lead to a shift in market share towards domestic brands. As imported smart refrigerators become more expensive, consumers may opt for U.S.-made alternatives, potentially benefiting local manufacturers.

- Consumer Uncertainty and Demand Fluctuations: The tariffs have introduced uncertainty among consumers regarding appliance pricing. This confusion may lead to fluctuations in demand, as consumers delay purchases in anticipation of price changes, affecting overall market dynamics.

Top Use Cases

- Residential Convenience: In homes, smart refrigerators offer features such as remote monitoring, inventory tracking, and integration with other smart devices, enhancing daily convenience.

- Commercial Efficiency: Restaurants and grocery stores utilize smart refrigerators for inventory management, temperature monitoring, and energy consumption tracking, improving operational efficiency.

- Energy Consumption Monitoring: Real-time energy usage data helps users optimize consumption, contributing to cost savings and environmental conservation.

- Predictive Maintenance: AI-driven diagnostics alert users to potential issues before they escalate, reducing downtime and maintenance costs.

- Integration with E-commerce: Some smart refrigerators can automatically reorder groceries by connecting with online shopping platforms, streamlining the replenishment process.

Major Challenges

- High Initial Costs: The advanced features of smart refrigerators result in higher prices compared to traditional models, limiting accessibility for some consumers.

- Data Privacy Concerns: The collection and transmission of user data raise concerns about security and unauthorized access, necessitating robust cybersecurity measures.

- Complexity of Use: The multitude of features can be overwhelming for users unfamiliar with smart technology, potentially hindering adoption.

- Interoperability Issues: Lack of standardization across smart home devices can lead to compatibility problems, affecting the seamless integration of smart refrigerators into existing ecosystems.

- Infrastructure Limitations: In regions with unreliable internet connectivity, the functionality of smart refrigerators may be compromised, affecting user experience.

Key Player Analysis

The global smart refrigerator market in 2024 is being significantly shaped by the strategic initiatives and technological advancements of major players such as Samsung Electronics Co., Ltd., LG Electronics Inc., and Whirlpool Corporation. These companies are leveraging AI-powered features, IoT connectivity, and smart home integration to meet the rising consumer demand for convenience and energy efficiency. Samsung and LG continue to dominate through premium product portfolios and innovations such as voice-activated controls and food management systems.

Haier Smart Home Co., Ltd., through its subsidiaries including GE Appliances, is expanding its global footprint by focusing on localized manufacturing and consumer-centric features. Panasonic Corporation, Electrolux AB, and Bosch (BSH Hausgeräte GmbH) are reinforcing their market presence with sustainability-focused designs and smart grid compatibility. Hisense Co., Ltd., Midea Group Co., Ltd., Siemens AG, Liebherr Group, and Hitachi, Ltd. are enhancing competitiveness by integrating cloud platforms and AI algorithms, thereby contributing to the market’s technological evolution.

Top Companies in the Market

- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Whirlpool Corporation

- Haier Smart Home Co., Ltd.

- Panasonic Corporation

- Electrolux AB

- GE Appliances (a Haier company)

- Hisense Co., Ltd.

- Bosch (BSH Hausgeräte GmbH)

- Midea Group Co., Ltd.

- Siemens AG

- Liebherr Group

- Hitachi, Ltd.

Purchase The Full Report Now at https://market.us/purchase-report/?report_id=144394

Regional Analysis

North America Leads Smart Refrigerator Market with 34.2% Share in 2024

In 2024, North America emerged as the leading region in the global smart refrigerator market, commanding a substantial 34.2% share, equivalent to approximately USD 1.33 billion in revenue. This dominance is primarily driven by the United States, which alone contributed around USD 1.2 billion, reflecting the region’s strong consumer inclination towards smart home technologies and high purchasing power.

The market’s growth in North America is further bolstered by the widespread adoption of Wi-Fi-enabled appliances, which accounted for 58.2% of the technology segment in 2024. This trend underscores the region’s preference for connected devices that offer enhanced convenience and integration with existing smart home ecosystems.

However, the market faces potential challenges due to recent U.S. tariffs on imported appliances. These tariffs have introduced uncertainty among suppliers and consumers, with some manufacturers indicating possible price increases. For instance, at Abt Electronics, a major appliance retailer in the Chicago area, there has been notable confusion regarding potential price changes stemming from anticipated tariff-related cost increases. Additionally, companies like Electrolux have expressed concerns that U.S. tariffs could impact demand, despite recent improvements in their North American operations.

Recent Developments

- In 2025, BSH Home Appliances took center stage at CES 2025 by advancing its commitment to smart home innovation. The company showcased the Bosch 100 Series French Door Bottom Mount refrigerator, now enabled with Matter connectivity, marking a significant milestone in home automation. This product, following its earlier debut at IFA Berlin 2024, became the world’s first Matter-compatible home appliance available in the market. With this, BSH continues to lead in integrating global standards into everyday products, ensuring smarter and more seamless home experiences for users worldwide.

- In 2024, Haier Smart Home Co., Ltd. completed its acquisition of Carrier Commercial Refrigeration for around $775 million. This strategic move enhances Haier’s global footprint in the commercial refrigeration sector. The addition of Carrier’s advanced technologies, including its expertise in carbon dioxide refrigeration systems, is expected to support green business transformations and sustainable industry practices. Haier’s expanded product line now offers more innovative and environmentally focused refrigeration solutions.

- In 2024, LG Electronics India collaborated with fashion designers Gauri and Nainika to launch the LG MoodUP™ Refrigerator at Lakme Fashion Week. This model features up to 1.7 lakh color combinations, allowing users to reflect their mood and style through customizable panels. Designed to blend high-end technology with modern aesthetics, the refrigerator redefines personal expression in the kitchen. It also represents LG’s commitment to innovation tailored to the evolving preferences of Indian consumers.

- In 2023, Panasonic Life Solutions India introduced its new Prime Convertible refrigerator series, fully designed and manufactured in India. The launch included bottom-mounted freezer models offering better accessibility and large storage, with capacities of 401 and 357 litres starting at INR 55,490. A budget-friendly 260-litre frost-free version was also unveiled at INR 23,490. These new products are now available online and in retail stores nationwide, offering consumers more choice and convenience.

Conclusion

The smart refrigerator market is experiencing significant growth, driven by the increasing adoption of smart home technologies, rising consumer demand for energy-efficient appliances, and advancements in artificial intelligence and IoT integration. Manufacturers are focusing on developing innovative features such as remote monitoring, inventory tracking, and seamless connectivity with other smart devices to enhance user convenience and efficiency. While North America currently leads the market due to high disposable incomes and technological advancements, the Asia-Pacific region is expected to witness the fastest growth, propelled by rapid urbanization, increasing middle-class populations, and expanding e-commerce platforms. Despite challenges like high initial costs and data privacy concerns, the market is poised for sustained expansion as consumers increasingly seek connected and intelligent kitchen solutions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)