Table of Contents

Introduction

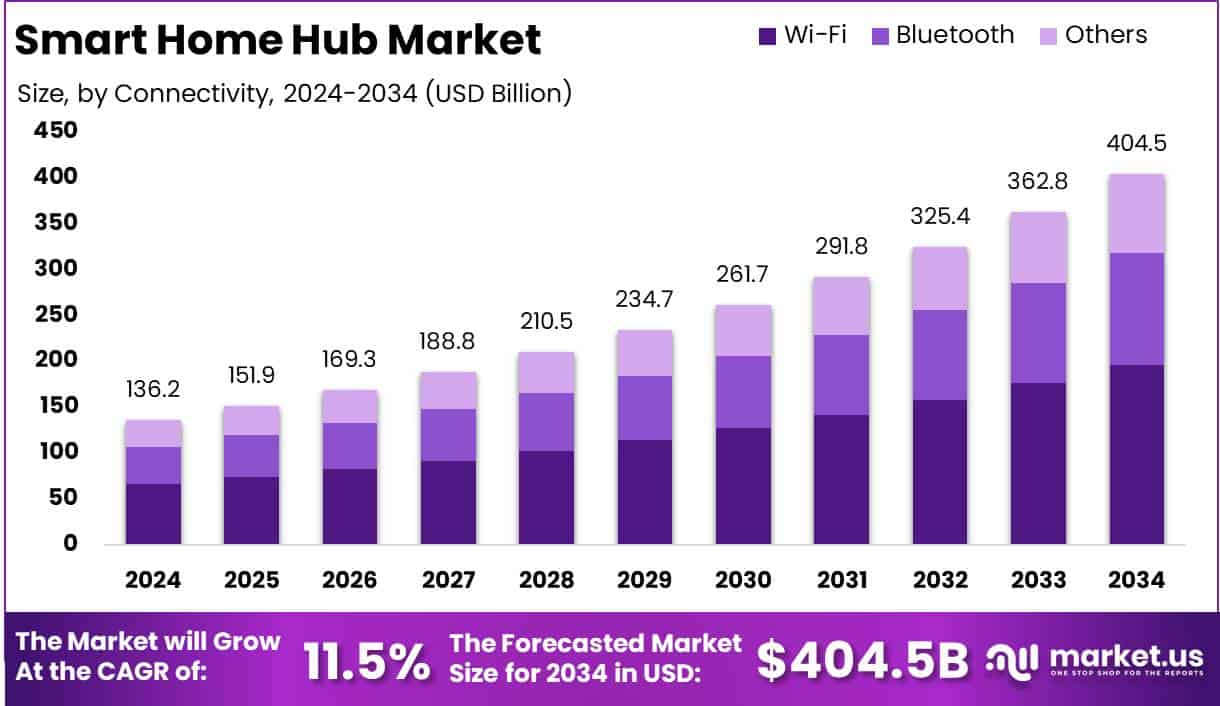

The Global Smart Home Hub Market is projected to reach a value of approximately USD 404.5 billion by 2034, up from USD 136.2 billion in 2024, representing a compound annual growth rate (CAGR) of 11.5% during the forecast period from 2025 to 2034.

The Smart Home Hub market refers to the ecosystem of devices designed to manage, integrate, and control various connected devices within a household, including lights, thermostats, security cameras, voice assistants, and entertainment systems. A Smart Home Hub acts as a central point that allows users to monitor and control these devices seamlessly through a unified platform, typically via a smartphone or voice-activated assistant.

The growth of the Smart Home Hub market can be attributed to several factors, including the increasing demand for automation in residential settings, the rising adoption of Internet of Things (IoT) technologies, and the growing consumer preference for convenience, energy efficiency, and enhanced security. Additionally, advancements in AI and machine learning have further fueled the development of smarter, more intuitive home management systems. The increasing disposable income and rising awareness about energy conservation are also contributing to the market’s expansion. With the rapid integration of 5G and the wider proliferation of smart appliances, demand for these hubs is expected to accelerate.

Opportunities in the market are emerging from the increasing penetration of smart homes in both developed and emerging markets, with significant growth potential in regions such as Asia-Pacific and Latin America. Moreover, the introduction of voice-activated hubs and the integration of multi-functional capabilities (e.g., controlling security systems, managing energy consumption, and streamlining home entertainment) are expected to open new avenues for growth. As consumers become more environmentally conscious, there is also a growing demand for hubs that optimize energy usage, presenting a strong opportunity for companies in the market.

Key Takeaways

- The global Smart Home Hub market is forecasted to experience significant growth, expanding from USD 136.2 billion in 2024 to USD 404.5 billion by 2034, reflecting a robust compound annual growth rate (CAGR) of 11.5% from 2025 to 2034.

- Wi-Fi continues to dominate the connectivity technology landscape, holding a share of over 48.6% of the market in 2024. This can be attributed to its wide adoption, proven reliability, and compatibility with a broad range of devices.

- The Home Security and Automation sub-segment commands the largest share, accounting for 41.3% of the market in 2024. This growth is driven by increasing consumer demand for integrated security solutions and automation capabilities that enhance convenience and safety.

- Specialty Retailers maintain the largest market share at 34.7%, benefiting from their specialized product offerings and strong retail presence, which enable them to cater to the growing demand for smart home technologies.

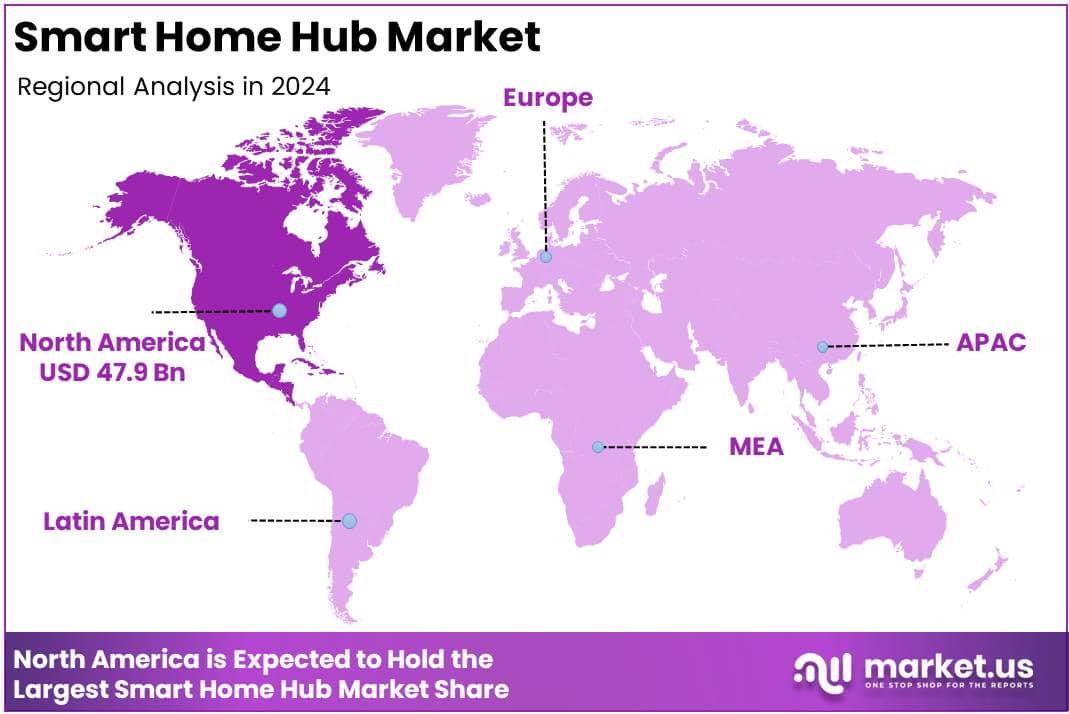

- North America is the leading region in the global Smart Home Hub market, holding a 35.2% market share, valued at USD 47.9 billion in 2024. This leadership is underpinned by the region’s technological advancements and high adoption rate of smart home solutions.

Smart Home Hub Statistics

Adoption and Consumer Behavior

- 78% of potential home buyers are willing to pay extra for a smart home.

- In the United States, 57% of consumers are forecasted to adopt smart home technology by 2025.

- Approximately 75% of U.S. buyers already have smart gadgets in their homes.

- 70% of home buyers are specifically seeking homes equipped with smart technologies.

- 53.9% of U.S. homes are projected to be automated by 2023.

- By 2025, 3 in 5 U.S. consumers are expected to adopt smart home devices.

Consumer Demographics

- 75% of smart home consumers are under the age of 55.

- 40% of smart home device owners are aged 18-34, although this group only makes up 30% of the population.

- 97% of smart home device owners report being at least somewhat satisfied with their devices.

- 71% of consumers found smart home devices more beneficial than expected.

- 46% of consumers adopt smart home technology for added convenience.

Security and Cost Concerns

- Nearly two-thirds of smart home consumers are concerned about the security of their data.

- 67% of American users find smart home devices too expensive.

- Over 50% of users face issues related to connectivity and worry about data security.

Popular Devices and Brands

- Samsung led the market in 2024, with 22% of respondents owning at least one of their smart home devices.

- 72% of Americans have adopted smart entertainment devices like TVs, speakers, and virtual reality headsets.

- 44% of smart home device owners have at least one connected entertainment system.

- Smart homes in the U.S. typically have an average of 8 smart devices.

Regional Insights

- Connecticut boasts the highest adoption rate in the U.S., with 28.2% of households using smart home devices.

- Utah follows closely at 27.8%, with Maryland at 27.6%.

- Globally, the number of smart homes reached approximately 411 million in 2024 and is expected to rise to 470 million by 2025.

Consumer Perception and Usage

- 57% of non-adopters do not see the need for smart home technology.

- According to 77% of device owners, smart technology is enhancing their quality of life.

- The global transaction value in eCommerce via voice assistants has grown to $19.4 billion, reflecting a 400% increase over the past two years.

Smart Home Ownership in the U.S.

- 23% of U.S. broadband consumers own three or more smart home devices.

- ⅔ of U.S. homeowners consider smart home devices essential for their daily lives.

- Over 60.4 million U.S. households had adopted smart home devices by 2023.

Emerging Trends

- Integration with Voice Assistants: The rise of voice-controlled technology has led to the increasing integration of smart home hubs with popular voice assistants like Amazon Alexa, Google Assistant, and Apple Siri. Consumers are increasingly opting for hubs that can easily synchronize with these platforms, enhancing usability and ease of control.

- Increased Interoperability: The growing demand for cross-platform integration between various IoT devices and smart home hubs is driving manufacturers to adopt open-source protocols like Zigbee, Z-Wave, and Thread. This shift facilitates the seamless connection of multiple devices from different brands, reducing fragmentation in the market.

- Smart Home Automation Features: The adoption of smart home automation is growing rapidly. Hubs are now enabling users to set routines and schedules for devices such as thermostats, lights, and security cameras. Automation is increasingly seen as a convenience and energy-saving feature.

- Enhanced Security Features: There is an increasing emphasis on smart hubs offering enhanced security features, including encryption, multi-factor authentication, and secure device communication. Consumers are becoming more concerned with privacy and data security, driving demand for secure and privacy-respecting devices.

- Rise of AI and Machine Learning Integration: Smart hubs are now incorporating AI and machine learning capabilities to enable more personalized and efficient home automation. These hubs can learn user preferences over time, optimizing control and reducing the need for manual adjustments.

Top Use Cases

- Home Security Systems: Smart home hubs are increasingly being used to control and integrate security devices such as smart cameras, motion detectors, and doorbell systems. Users can monitor their homes remotely and receive alerts about potential security breaches.

- Energy Management: Smart hubs are commonly used for energy management, allowing users to control heating, ventilation, and air conditioning (HVAC) systems, as well as lighting and appliances, to optimize energy consumption and reduce electricity costs.

- Entertainment Control: Many consumers use smart hubs to control their home entertainment systems, such as smart TVs, streaming devices, and audio systems. The hubs enable easy access to media content through voice or app-based commands.

- Health Monitoring: Some smart home hubs offer integration with health monitoring devices such as smartwatches, fitness trackers, and medical alert systems. This helps users track their health data and provides alerts for any abnormalities.

- Home Automation & Convenience: Smart home hubs enable full automation of home devices. This includes controlling smart locks, appliances, and lights, as well as monitoring the home environment (temperature, humidity, etc.) from a central interface.

Major Challenges

- Fragmentation of Standards: One of the biggest challenges facing the smart home hub market is the fragmentation of communication protocols. The lack of standardization between different brands and systems can create compatibility issues, limiting device integration and customer satisfaction.

- Privacy Concerns: As smart hubs collect data to optimize their functionality, privacy concerns are growing. Many consumers are worried about the security of personal data and how it is shared with third parties, potentially deterring some users from fully adopting smart home technologies.

- Connectivity Issues: Despite advancements in wireless technologies, connectivity remains a common issue for smart hubs. Problems like slow or intermittent connections can hinder the performance of smart devices and frustrate users.

- User Complexity: The complexity of setting up and managing multiple smart devices through a single hub can be overwhelming for some consumers. Many users struggle with navigating different interfaces and troubleshooting technical issues.

- High Initial Costs: While the prices of smart home devices have decreased over time, the initial cost of purchasing a smart home hub, along with compatible devices, can still be high. This may limit the accessibility of smart home technology for budget-conscious consumers.

Top Opportunities

- Increased Demand for Energy Efficiency: With growing awareness of climate change and rising energy costs, there is an opportunity for smart home hubs to capitalize on energy-efficient solutions. Hubs that optimize the energy use of various devices can appeal to eco-conscious consumers.

- Integration with Smart Cities: As cities become more digitally connected, there is an opportunity to integrate smart home hubs with smart city infrastructure. This could lead to new functionalities such as real-time traffic monitoring, air quality monitoring, and citywide safety alerts.

- Elderly Care and Aging in Place: The growing elderly population presents an opportunity for smart home hubs to provide valuable services such as health monitoring, emergency alerts, and medication reminders. Hubs that cater to this demographic can significantly improve the quality of life for older adults.

- Voice Control Adoption: With the rise of voice assistants, smart hubs that incorporate voice recognition features have a unique opportunity to attract users who prioritize hands-free control of their home environments.

- AI-Driven Personalization: As AI capabilities evolve, there is an opportunity for smart home hubs to provide more personalized experiences. Hubs that learn from user behavior and adjust device settings accordingly can offer a superior user experience, increasing demand.

Key Player Analysis

The global smart home hub market in 2024 is marked by intense competition, with key players leveraging advanced technologies and expanding ecosystems. Amazon, through its Amazon Echo platform, remains a dominant force, providing a comprehensive voice-controlled smart home experience, while Google’s Nest Hub continues to build on its seamless integration with Google Assistant, further strengthening its market position. LG Electronics and Samsung Electronics, with their SmartThings ecosystem, offer robust solutions that integrate not only home automation but also energy management and security.

Apple’s HomeKit, coupled with its strong brand loyalty, continues to attract consumers seeking privacy and seamless connectivity within its ecosystem. Other noteworthy players like Aeotec, Brilliant NextGen, and Vivint, with tailored offerings in home security and automation, enhance market diversity. Additionally, companies such as Xiaomi, Aqara, and Zipato, especially from the Asia-Pacific region, are increasingly capturing market share due to cost-effective, feature-rich solutions. This dynamic landscape highlights an ongoing trend toward consolidation and innovation within the industry.

Top Key Players in the Market

- Amazon.com, Inc. (Amazon Echo)

- Google LLC (Alphabet Inc.)

- Brilliant NextGen, Inc.

- Aeotec Group

- LG Electronics

- Logitech

- Apple Inc.

- Samsung Electronics (Samsung SmartThings)

- Vivint, Inc.

- Hubitat

- Control4 (Snap One, LLC)

- Zipato

- Aqara (Lumi United Technology Co., Ltd.)

- Microsoft Corporation

- Xiaomi

- Cozify Oy

- Crestron Electronics

- Insteon

Regional Analysis

North America – Smart Home Hub Market with Largest Market Share (35.2%) in 2024

The Smart Home Hub market in North America is poised to maintain a dominant position, accounting for 35.2% of the global market share in 2024, valued at approximately USD 47.9 billion. This significant market presence can be attributed to the region’s advanced technological infrastructure, high consumer adoption of smart home technologies, and a strong preference for home automation solutions. The United States, as a key player in the region, continues to lead the demand for smart home hubs, driven by both residential and commercial applications.

The increasing integration of voice-controlled assistants, such as Amazon Alexa and Google Assistant, along with rising consumer interest in enhancing home security, energy management, and overall convenience, is expected to further fuel market growth in North America. Additionally, robust investments from key industry players and the rapid expansion of 5G technology are anticipated to accelerate the adoption of smart home hubs in the region, consolidating its position as the leading market globally.

Recent Developments

- In 2024, Apple launched the HomePod mini in a new midnight color, crafted from fully recycled mesh fabric. Despite its compact 3.3-inch size, the speaker delivers impressive sound quality. Its sleek, acoustically transparent mesh design and backlit touch surface that lights up from edge to edge make it an elegant addition to any room. The HomePod mini is available in various colors, including yellow, orange, blue, white, and the new midnight shade, and became available on July 17, 2024.

- In August 2024, Lutron Electronics expanded its Caséta product range with the introduction of the Diva smart dimmer featuring ELV+ technology and five new color options for its Pico paddle remotes. These updates cater to professional installers by simplifying the completion of projects involving multiple load types, while offering clients more design choices in the paddle-style format.

- In 2023, ADT and Google launched the ADT Self Setup system, marking their first fully integrated DIY smart home security solution. This advanced system combines ADT’s security and life safety technologies with Google’s Nest smart home products. Through the ADT+ app, users can control their home security system, benefiting from both ease of setup and advanced monitoring features.

- In 2024, eufy Security introduced a groundbreaking range of dual-camera home security devices, marking a first in the industry with its AI-powered surveillance mesh. Each device features both wide-angle and telephoto lenses, enhancing its coverage and tracking capabilities. The new AI cross-camera tracking feature allows users to follow events across multiple devices, delivering consolidated video alerts.

Conclusion

The Smart Home Hub market is experiencing substantial growth, driven by increasing consumer demand for convenience, security, and energy efficiency in residential settings. As the adoption of Internet of Things (IoT) technologies continues to rise, smart hubs are evolving to offer greater interoperability, advanced automation features, and integration with voice assistants, which enhances user experience. While challenges such as fragmented standards and privacy concerns remain, there are significant opportunities for growth, especially in emerging markets and through the integration of smart home hubs with broader smart city initiatives. The market’s expansion is further supported by continuous advancements in artificial intelligence, machine learning, and 5G technologies, positioning smart home hubs as a central component of future home automation and security solutions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)