Table of Contents

Introduction

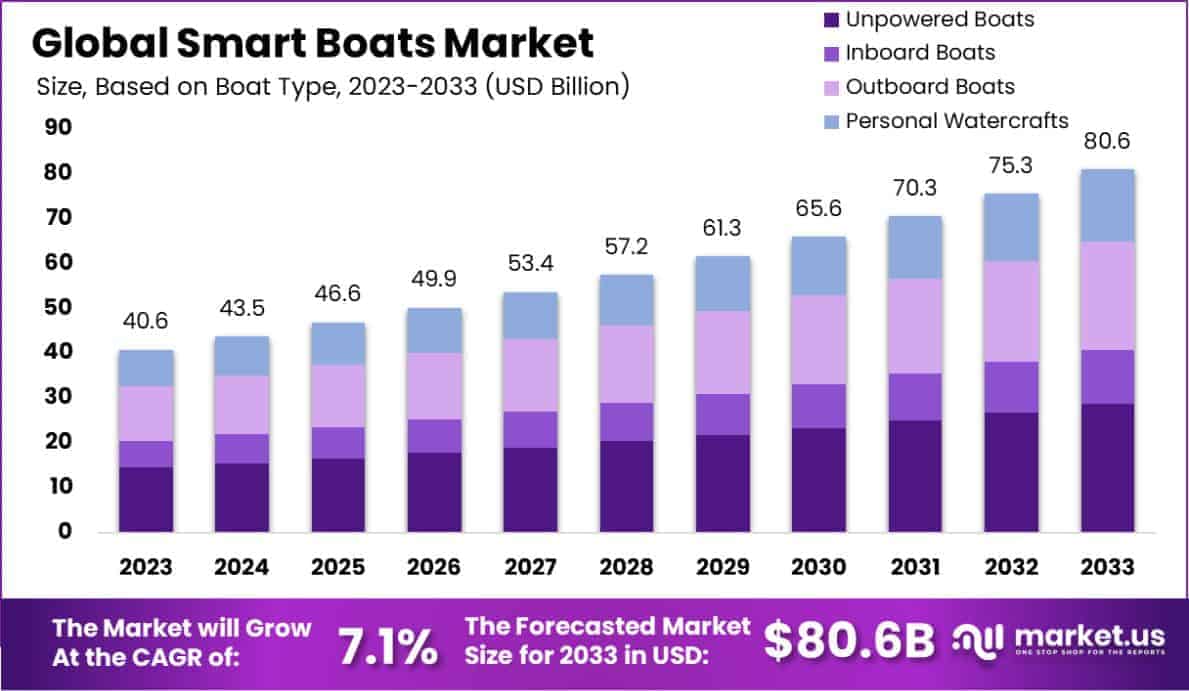

The Global smart boats market is projected to reach approximately USD 80.6 billion by 2033, increasing from USD 40.6 billion in 2023, representing a compound annual growth rate (CAGR) of 7.1% over the forecast period from 2024 to 2033.

The Smart Boats market refers to the segment within the maritime industry that involves vessels equipped with advanced technologies such as Internet of Things (IoT) devices, GPS, sensors, and automated systems. These technologies enhance the operational efficiency, safety, and environmental sustainability of boats, enabling real-time monitoring, predictive maintenance, autonomous navigation, and better communication systems. The growth of the Smart Boats market can be primarily attributed to advancements in digitalization and automation within the maritime industry, alongside increasing demand for more fuel-efficient and environmentally friendly solutions.

Moreover, the integration of AI-driven systems, machine learning algorithms, and cloud-based analytics is further driving market expansion by offering enhanced decision-making capabilities and operational cost reductions. The increasing demand for recreational and luxury smart yachts, alongside the growing adoption of smart systems in commercial vessels, is fueling market growth.

Additionally, there is a growing trend towards incorporating smart technologies in response to regulatory pressures focused on reducing emissions and improving fuel efficiency in the maritime sector. Opportunities within the Smart Boats market lie in the development of autonomous vessels, as well as the expansion of digital platforms that allow boat owners to monitor and control their vessels remotely.

The rising interest in sustainable and eco-friendly maritime solutions further supports market potential, with governments and private companies investing in innovation and infrastructure to accelerate the adoption of smart boating technologies. As the market evolves, it is expected that there will be significant advancements in connectivity and automation, creating opportunities for stakeholders across various sub-segments of the industry.

Key Takeaways

- The global Smart Boats Market is projected to grow from USD 40.6 billion in 2023 to USD 80.6 billion by 2033, reflecting a CAGR of 7.1% during the forecast period (2024-2033).

- In 2023, the Unpowered Boats segment led the market with a 35.6% share within the “Based on Boat Type” category.

- The Engine Powered Boats segment captured the largest share (43.2%) in the “Based on Power” category in 2023.

- Wood emerged as the leading raw material, accounting for 32.3% of the market share in 2023.

- Water Sports applications dominated the market with a 41.3% share in 2023.

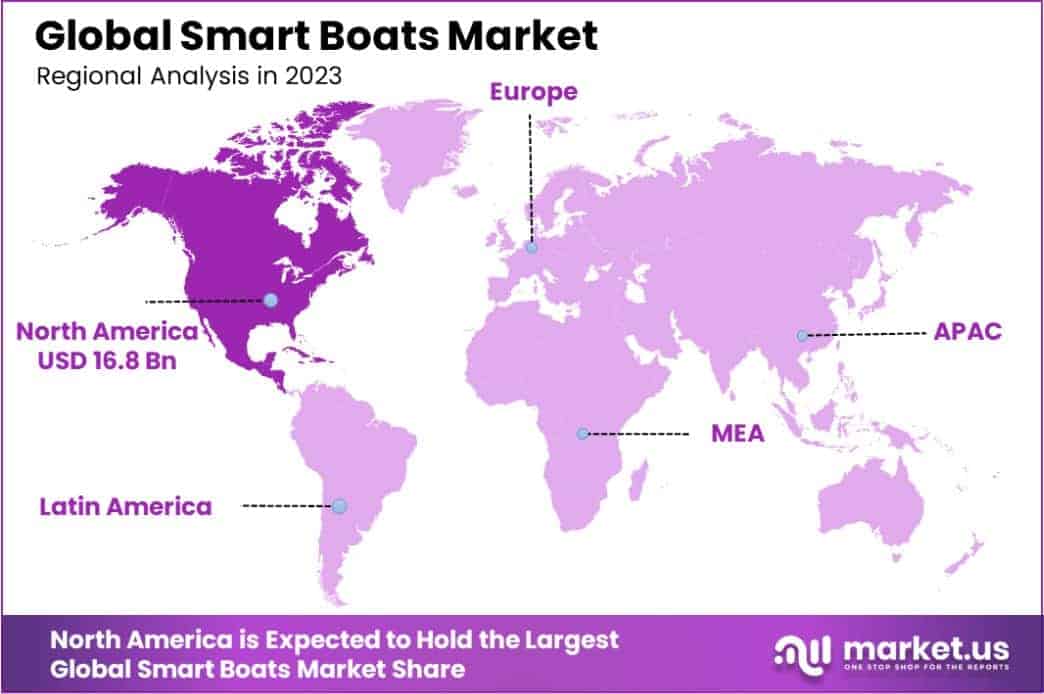

- North America held the largest regional market share in 2023, contributing USD 16.8 billion and a 41.5% share to the global Smart Boats Market.

Smart Boats Statistics

- Americans own approximately 18 million boats, used for both business and leisure.

- Over 1 million sailboats are in use in the US.

- Powerboats are the most popular, with over 12 million in the US.

- Over 1 million tons of marine debris enter the ocean annually.

- Electric boats are gaining popularity, with over 10% of new boat sales expected to be electric by 2025.

- More than 50% of boaters are adopting sustainable practices to minimize environmental impact.

- Around 140 million people globally participate in boating and watersports.

- Europe has 5.6 million recreational boats.

- The European boating industry comprises approximately 32,000 companies.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 40.6 Billion |

| Forecast Revenue (2033) | USD 80.6 Billion |

| CAGR (2024-2033) | 7.1% |

| Segments Covered | Based on Boat Type (Unpowered Boats, Inboard Boats, Outboard Boats, Personal Watercrafts), Based on Power (Sail Propelled Boats, Engine Powered Boats, Battery Powered Boats, Solar Boats), Based on Raw Material (Wood, GRP, Aluminium, Steel, Other Materials), Based on Application (Fishing, Water Sports, Sailing, Military Applications, Other applications) |

| Competitive Landscape | Brunswick Corporation, Groupe Beneteau, Azimut Benetti Group, Sunseeker International Ltd, Lund Boats, Tracker Boats, Ranger Boats, Hobie Cat Company, Marin Product Corporation, Bennington Marin LLC, Other Key Players |

Emerging Trends

- Increased Adoption of IoT (Internet of Things) Technologies: The integration of IoT technology in smart boats is growing rapidly, enabling real-time monitoring of vessel performance, navigation, and engine health. This trend is allowing boat owners to enhance the safety, efficiency, and maintenance of their vessels through connected systems and sensors.

- Electric and Hybrid Propulsion Systems: With increasing concerns about environmental sustainability, the market is seeing a rise in electric and hybrid-powered boats. These systems offer lower emissions, reduced fuel consumption, and quieter operations compared to traditional gasoline or diesel engines. As a result, more boat manufacturers are incorporating these systems into their designs.

- Automation and Autonomous Navigation: Autonomous boats, equipped with artificial intelligence (AI) and machine learning algorithms, are emerging as a key trend. These vessels can navigate without human intervention, reducing the risk of human error and improving operational efficiency. This trend is expected to significantly impact commercial shipping, recreational boating, and leisure industries.

- Integration of Augmented Reality (AR) and Virtual Reality (VR): The adoption of AR and VR technologies in smart boats is enhancing user experience, providing virtual navigation assistance, and improving training capabilities for boat operators. These technologies allow for better visualization of environmental hazards, navigation routes, and operational data.

- Sustainability and Eco-Friendly Materials: There is a notable trend toward using eco-friendly materials, such as recyclable composites, biodegradable paints, and energy-efficient systems, in boat manufacturing. These materials aim to reduce the environmental impact of boats throughout their lifecycle, aligning with the global shift toward sustainability.

Top Use Cases

- Recreational Boating and Leisure Activities: Smart boats are increasingly popular in recreational boating, offering advanced navigation tools, enhanced safety features, and increased comfort for users. Features such as automated systems, GPS tracking, and entertainment systems enhance the boating experience for leisure users.

- Commercial Shipping and Freight Transport: Smart boats equipped with advanced GPS, sensors, and autonomous navigation technologies are improving the efficiency of commercial shipping. Automation and remote monitoring reduce operational costs and increase safety in the transportation of goods over long distances.

- Fishing and Aquaculture: Smart boats are being used in the fishing industry, where sensors and GPS systems help track fish locations, monitor water quality, and ensure efficient operations. Additionally, these boats can collect data on marine ecosystems, aiding in sustainable fishing practices.

- Military and Defense Applications: The defense sector is increasingly adopting smart boats for surveillance, reconnaissance, and patrolling operations. These vessels, often autonomous or remotely controlled, are used for border security, monitoring territorial waters, and conducting search-and-rescue missions.

- Marine Research and Environmental Monitoring: Smart boats are instrumental in marine research, allowing scientists to collect real-time data on ocean conditions, marine life, and environmental changes. These vessels are equipped with sensors and data collection tools that help monitor the health of marine ecosystems.

Major Challenges

- High Initial Investment: The high cost of smart boats, driven by the integration of advanced technologies such as automation, IoT, and electric propulsion, remains a significant barrier for many potential consumers. The technology involved increases both the initial purchase price and maintenance costs.

- Limited Charging Infrastructure for Electric Boats: One of the major hurdles for electric and hybrid-powered smart boats is the lack of widespread charging infrastructure. Unlike traditional fuel stations, dedicated charging facilities for electric boats are still underdeveloped, limiting their range and practicality.

- Technological Integration Complexities: The integration of multiple technologies—ranging from navigation systems to IoT sensors—can be complex and requires specialized knowledge. Compatibility issues between systems from different manufacturers can also pose challenges, especially for boat owners seeking customization.

- Regulatory and Legal Issues: As smart boats become more prevalent, regulations surrounding their use, especially for autonomous vessels, are still evolving. Governments and maritime organizations are working to establish clear guidelines for safety, operational standards, and environmental impact, but these regulations can be slow to develop.

- Security Risks and Cybersecurity Threats: As smart boats rely on interconnected systems and data sharing, the risk of cyber-attacks increases. The security of onboard systems, including navigation, communications, and control systems, is critical to prevent unauthorized access, data breaches, or operational disruptions.

Top Opportunities

- Growing Demand for Sustainable Boating Solutions: With rising environmental awareness, there is an increasing demand for eco-friendly boats that incorporate electric propulsion, sustainable materials, and energy-efficient technologies. This provides opportunities for manufacturers to meet this demand with innovative green technologies.

- Expansion of Autonomous Maritime Operations: As autonomous navigation technologies continue to advance, there is a significant opportunity for smart boats in industries such as shipping, logistics, and defense. These technologies can reduce human error, lower operational costs, and improve safety.

- Advancements in Battery Technology: Improved battery technology is opening up new possibilities for electric boats, allowing for longer operational ranges and faster charging times. The development of high-capacity batteries will address one of the major limitations of electric boats, driving further adoption in the market.

- Integration with Smart Cities and Infrastructure: The increasing integration of smart boats with smart city infrastructure presents a significant opportunity. Boats that can interact with city grids, share data for navigation, and be part of larger transportation networks could transform how people and goods move across waterways.

- Data Analytics and Predictive Maintenance: The integration of data analytics into smart boats provides a promising opportunity for predictive maintenance. By analyzing real-time data from onboard sensors, boat owners and operators can predict maintenance needs, reduce downtime, and optimize operational efficiency.

Key Player Analysis

In 2024, the global smart boats market is poised for significant growth, driven by the innovative contributions of several key players. Brunswick Corporation remains a dominant force, with its extensive portfolio in marine technologies, focusing on advanced propulsion systems and smart connectivity. Groupe Beneteau and Azimut Benetti Group continue to lead in the luxury boat segment, integrating cutting-edge automation and IoT (Internet of Things) for superior customer experience. Sunseeker International Ltd has emphasized high-performance yachts, incorporating smart technologies to enhance navigation and onboard comfort.

Lund Boats, Tracker Boats, and Ranger Boats are pivotal in the freshwater boating segment, increasingly adopting smart features to improve safety, fuel efficiency, and user interface. Additionally, Hobie Cat Company and Marin Product Corporation offer specialized solutions with smart sailing and powerboat features. Bennington Marin LLC is strengthening its position in the pontoon sector, utilizing integrated smart systems for recreational boating. These players collectively reflect the market’s transition toward more intelligent, connected, and efficient boating solutions.

Top Key Players in the Market

- Brunswick Corporation

- Groupe Beneteau

- Azimut Benetti Group

- Sunseeker International Ltd

- Lund Boats

- Tracker Boats

- Ranger Boats

- Hobie Cat Company

- Marin Product Corporation

- Bennington Marin LLC

- Other Key Players

Regional Analysis

North America Leading Smart Boats Market with Largest Market Share of 41.5% in 2024

The North American smart boats market is anticipated to lead the global market with a dominant share of 41.5%, valued at approximately USD 16.8 billion in 2024. This region is expected to maintain its leadership due to significant technological advancements, a high concentration of key industry players, and growing consumer demand for innovative and connected boating solutions. The United States, in particular, holds a substantial market share, driven by a robust marine recreational sector, increased disposable income, and a high affinity for luxury and technologically advanced products.

Furthermore, the region benefits from a well-established infrastructure for both recreational and commercial boating, along with favorable government policies that support the growth of smart maritime technologies. The ongoing trend of integrating Internet of Things (IoT) and Artificial Intelligence (AI) in marine applications is anticipated to further propel market expansion in North America. This region is projected to continue holding the largest share in the global smart boats market through the forecast period, driven by the demand for enhanced safety features, fuel efficiency, and automation in marine vessels.

Recent Developments

- In 2024, Sea Machines secured a new $12 million investment to advance its autonomous maritime technology. The funding round, led by Emerald Technology Ventures and joined by partners like Nabtesco Technology Ventures and Chevron Technology Ventures, will support Sea Machines in enhancing its autonomous control systems for maritime vessels and expanding its market presence.

- In 2024, Roboat, a startup focused on transforming inland waterway transport, raised €550,000 to further develop fully autonomous boats. The company, a spin-off from MIT and the Amsterdam Institute for Advanced Metropolitan Solutions (AMS), aims to enhance safety, efficiency, and sustainability in urban waterway transport.

- In 2025, Damen Shipyards Group introduced a new series of Logistics Support Ships (LSS), designed to provide efficient logistical support for naval forces. These vessels will increase operational flexibility and help sustain long-term deployments in a cost-effective manner.

- In 2023, Nanyang Technological University (NTU) Singapore and Naval Group announced a collaboration to advance autonomous technologies for vehicle and vessel navigation. With a total funding of S$ 2.3 million, the partnership aims to drive innovation in unmanned vehicle systems for the maritime industry.

Conclusion

The Smart Boats market is positioned for substantial growth as technological advancements continue to shape the maritime industry. The increasing adoption of IoT, AI, and automation technologies is enhancing operational efficiency, safety, and environmental sustainability across various boat types, including recreational, commercial, and military vessels. While challenges such as high initial investments, limited infrastructure for electric boats, and regulatory uncertainties remain, these are being addressed through innovation and strategic investments. Furthermore, the growing demand for sustainable and eco-friendly solutions is driving market potential, with a strong focus on developing electric, hybrid, and autonomous vessels. As the industry continues to evolve, the market for smart boats is expected to expand significantly, providing new opportunities for manufacturers, service providers, and stakeholders to capitalize on emerging trends and technologies.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)