Table of Contents

Introduction

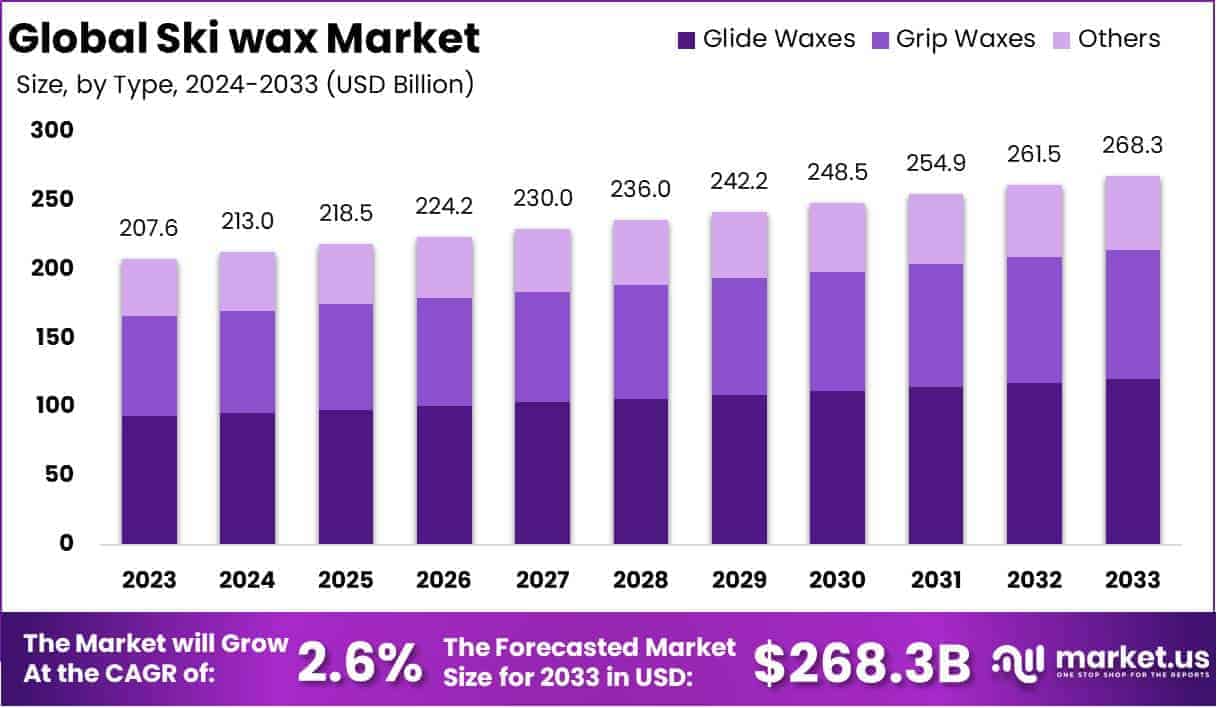

The Global Ski wax Market is projected to reach approximately USD 268.3 billion by 2032, up from USD 207.6 billion in 2023, reflecting a compound annual growth rate (CAGR) of 2.6% between 2024 and 2033.

Ski wax is a specialized product applied to the base of skis and snowboards to reduce friction with the snow, enhance speed, and improve control, depending on snow conditions. The ski wax market includes a variety of wax types, such as glide wax, grip wax, and hybrid formulations, catering to recreational and competitive skiing segments. Market growth is driven by increasing participation in winter sports, particularly skiing and snowboarding, as well as the rise in demand for high-performance products that offer better durability and speed.

Technological advancements in ski wax formulations, such as eco-friendly options, further contribute to market expansion. Additionally, the rising trend of winter sports tourism and growing consumer interest in premium products provide substantial growth opportunities. The market is also expected to benefit from innovations in automated waxing systems, which appeal to both professionals and enthusiasts. As winter sports continue to gain global popularity, the ski wax market presents promising potential for manufacturers and innovators.

Key Takeaways

- The global ski wax market is projected to increase from USD 207.6 billion in 2023 to USD 268.3 billion by 2032, growing at a consistent compound annual growth rate (CAGR) of 2.6% from 2024 to 2033.

- Glide waxes lead the market, accounting for over 45% of the total share in 2023. This dominance is attributed to the widespread preference for performance-enhancing waxes among skiers of all levels.

- Skis represent the largest segment, holding more than 67% of the market share in 2023. This reflects the essential role skis play in both recreational and competitive skiing, driving demand for regular maintenance and waxing.

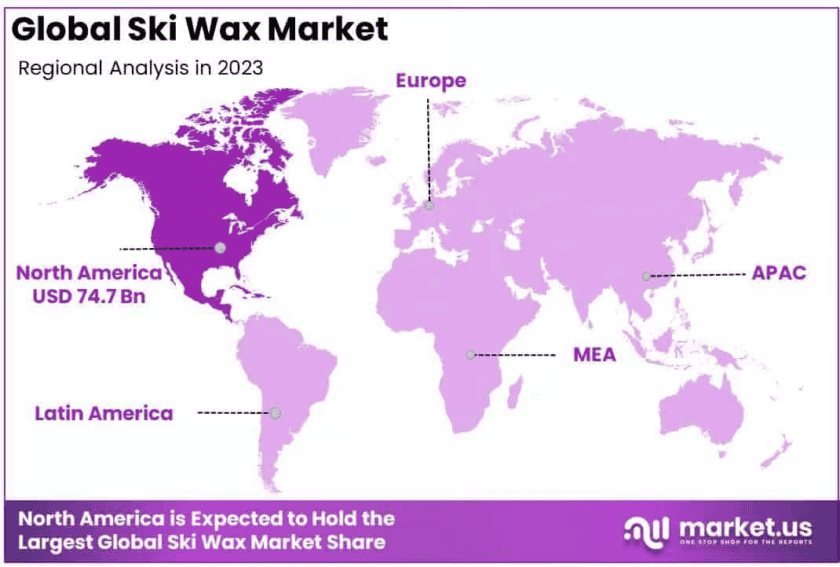

- North America holds the largest share, capturing 36% of the market in 2023. This is driven by a well-established skiing infrastructure and high levels of participation in winter sports across the region.

Key Segments Analysis

In 2023, Glide Waxes dominated the Ski Wax Market, holding over 45% of the share. Preferred for their speed and smooth performance, they are widely used by both professionals and recreational skiers. Their popularity is driven by a focus on performance enhancement, ease of application, and availability. Grip Waxes, the second-largest segment, are essential for cross-country skiing, offering better traction for uphill and mixed-terrain conditions. The ‘Others’ category, which includes specialized waxes like base preparation and training waxes, holds a smaller but growing share due to increasing interest in niche skiing activities and equipment maintenance.

In 2023, skis dominated the ski wax market, accounting for over 67% of the share, driven by the high demand for improved glide, speed, and surface protection for both recreational and professional skiers. Snowboards, the second-largest application segment, are also seeing growth due to the increasing popularity of snowboarding, particularly among younger audiences. Sleds, while a smaller segment, are gaining traction in regions like North America and Europe, driven by recreational users seeking enhanced performance. The “Others” category, including snowmobiles and backcountry equipment, holds a modest share but is experiencing steady growth due to the demand for specialized wax formulations.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | US$ 207.6 Bn |

| Forecast Revenue (2033) | US$ 268.3 Bn |

| CAGR (2024-2033) | 2.6% |

| Segments Covered | By Type (Glide Waxes , Grip Waxes, Others), By Application (Skis , Snowboards, Sleds, Others) |

| Competitive Landscape | Briko Maplus, Dominator, Start Ski Wax, Burton, Fast Wax, Holmenkol, Hertel Wax, Maxiglide Products, Darent Wax, Datawax, Rex, ONE-BALL, Other Key Players |

Emerging Trends

- Eco-Friendly and Sustainable Formulations: Sustainability has become a key focus in the ski wax industry. As environmental concerns grow, ski wax manufacturers are increasingly producing eco-friendly products. These waxes avoid harmful chemicals like fluorocarbons, which have been banned in certain regions. Consumers now seek out biodegradable waxes, leading to the rise of plant-based and natural alternatives. Ski resorts and athletes are also moving toward greener products to reduce environmental impact.

- Hydrophobic and Long-Lasting Wax: One of the latest trends in ski wax is the development of hydrophobic formulas that improve the water-repellent properties of skis and snowboards. These waxes help prevent snow from sticking to the base, improving glide and performance on wet and slushy snow. Additionally, long-lasting waxes reduce the frequency of re-waxing, which is more convenient for athletes who need to maintain peak performance during long ski days.

- Smart and Temperature-Specific Waxes: Technological innovation has led to the creation of specialized waxes for different temperature ranges. Smart waxes are formulated to optimize glide for specific snow conditions, such as cold, dry snow or warmer, wetter conditions. This precision allows skiers to experience better speed and control depending on the exact snow temperature, giving them a competitive edge.

- Expansion of DIY Ski Waxing Kits: With the growing interest in DIY ski maintenance, ski waxing kits are becoming more accessible to the average skier. These kits often come with multiple wax types and tools, allowing consumers to wax their skis at home and save on professional waxing costs. This trend has led to an increase in online sales and a broader market of recreational skiers who are taking maintenance into their own hands.

- Waxing Technology Integration with IoT Devices: The integration of the Internet of Things (IoT) into the ski wax industry is an emerging trend. Some companies are developing IoT-connected waxing tools that offer data-driven insights to skiers. These devices can monitor ski performance and provide feedback on the optimal wax types and application methods based on snow conditions. This technology is still in its infancy but could play a big role in the future of ski equipment maintenance.

Top Use Cases

- Enhancing Ski Performance in Competitive Sports: In professional skiing, the right wax can make a significant difference in performance. Ski wax is often used in competitive sports such as alpine racing, cross-country skiing, and ski jumping. By reducing friction between the skis and snow, wax ensures maximum speed and better control, which are crucial for high-level performance. Elite athletes typically have their skis waxed based on the specific snow conditions to optimize glide.

- Improving Glide for Recreational Skiers: For recreational skiers, applying the correct ski wax enhances the overall skiing experience. Wax helps the skis glide smoothly on the snow, reducing drag and making skiing easier and more enjoyable. This is particularly beneficial for skiers who frequent resorts and want a reliable and enjoyable day on the slopes. It ensures they have consistent performance regardless of snow quality or temperature.

- Preventing Base Damage and Prolonging Ski Life: Ski wax plays a protective role in prolonging the life of ski equipment. When applied correctly, wax helps to prevent the ski base from drying out and cracking. It also shields the base from dirt, grit, and other debris on the snow, which can cause scratches and permanent damage. Regular waxing helps maintain the structural integrity of skis and snowboards, allowing them to perform well for a longer period.

- Optimizing Ski Performance on Wet and Icy Snow: Specialized waxes are used to optimize skiing on wet, icy, or variable snow conditions. These waxes contain additives that reduce friction and improve glide on difficult snow conditions. Wet snow, in particular, can be challenging for skiers as it tends to stick to ski bases. Anti-wet waxes solve this problem, providing skiers with better control and speed in these specific conditions.

- Enhancing Snowboard Performance: Ski wax is also widely used for snowboards to enhance their glide on snow. Just like skis, snowboards benefit from the application of the right type of wax based on the snow conditions. Snowboarders use wax to ensure better performance on the slopes, including smoother landings and more efficient turns. Snowboard wax formulations are often designed for specific temperatures or snow types, ensuring the board works optimally.

Major Challenges

- Environmental Impact of Traditional Waxing Products: Despite the trend toward more sustainable options, many ski wax products still rely on harmful chemicals, particularly fluorocarbons, which contribute to environmental pollution. These chemicals are known to be persistent in nature and can have negative effects on ecosystems when they seep into the snow and water systems. Some regions have already implemented regulations to ban or restrict these ingredients, creating challenges for manufacturers to meet new standards.

- Difficulty in Identifying the Right Wax for Different Conditions: Choosing the right wax for various snow conditions can be confusing for both recreational skiers and professionals. Ski wax comes in multiple formulations for different snow temperatures and humidity levels, and not all skiers are equipped to choose the correct one. This leads to suboptimal performance, either by choosing wax that doesn’t provide enough glide or by causing skis to overheat.

- Price Volatility and Cost of High-Quality Wax: Premium ski waxes, especially those designed for competitive athletes, can be quite expensive. The cost of high-quality wax may deter some consumers from purchasing, particularly those who only ski occasionally. With rising raw material costs, such as for fluorinated compounds or biodegradable alternatives, maintaining price competitiveness while offering effective products presents a challenge for manufacturers.

- Limited Awareness of Maintenance Needs Among Consumers: Many skiers, particularly recreational ones, may not realize the importance of regular waxing and its impact on ski performance. They might not properly maintain their equipment, which can lead to performance issues or unnecessary wear and tear. Lack of awareness around the maintenance needs of skis and snowboards limits the overall market for ski wax products.

- Product Shelf Life and Storage Conditions: Ski wax products often have a limited shelf life, especially when exposed to heat, light, or air. Improper storage can degrade the wax’s effectiveness, leading to poor ski performance. Ensuring that wax products are stored under optimal conditions can be a challenge for both manufacturers and consumers, particularly in warmer regions where wax may soften or degrade quicker.

Top Opportunities

- Increasing Popularity of Eco-Friendly Products: As consumer awareness of environmental issues grows, there is a significant opportunity for ski wax brands to capitalize on the demand for eco-friendly products. Biodegradable, non-toxic, and natural ski waxes are gaining popularity, and brands can differentiate themselves by offering green alternatives. Eco-conscious skiers are willing to pay a premium for wax products that align with their values.

- Growth in Winter Sports Participation: The global rise in winter sports participation provides a significant growth opportunity for the ski wax market. As more people take up skiing and snowboarding, there is an increasing need for ski maintenance products, including wax. Emerging markets in regions like Asia-Pacific and Latin America are seeing growing interest in winter sports, presenting a new customer base for manufacturers.

- Technological Advancements in Ski Wax Composition: Advancements in materials science could lead to the development of new wax compositions that perform better and last longer. Waxes that are easier to apply, more durable, or tailored for specific snow types offer potential advantages. Brands that invest in research and development to improve the wax’s effectiveness and ease of use could tap into a growing market segment.

- Expansion of Online Retail and DIY Kits: The rise of online shopping and the growing trend of DIY ski maintenance present significant growth opportunities for the ski wax market. Brands can expand their online presence and offer comprehensive ski waxing kits that include instructions and all necessary tools. This enables customers to wax their own skis without professional help, expanding the market beyond traditional in-store purchases.

- Increasing Demand from Commercial Ski Resorts: Commercial ski resorts are an important market segment for ski wax manufacturers. Resorts increasingly offer ski and snowboard rentals, which require regular waxing to maintain performance and safety. As ski resorts become more specialized and attract a higher volume of tourists, they present a stable market for bulk purchases of ski wax.

Regional Analysis

North America: Dominating the Ski Wax Market with 36% Share in 2023

North America holds a commanding position in the global ski wax market, contributing approximately 36% of the total market share in 2023, valued at USD 74.7 billion. This dominance can be attributed to the region’s extensive winter sports infrastructure, particularly in countries like the United States and Canada, where skiing is a major recreational and competitive activity.

The high demand for ski wax in North America is further driven by the growing number of ski resorts, increased participation in winter sports, and a rising preference for high-performance ski equipment. In addition, the well-established distribution channels, including both online and physical retail outlets, contribute to the widespread availability of ski wax products across the region. This solid market foundation, paired with the region’s substantial consumer base, positions North America as a leading player in the ski wax industry.

Recent Developments

- In 2023, the International Ski and Snowboard Federation (FIS) initiated a ban on fluorinated ski waxes, starting in the 2023/2024 season. This decision applies to all FIS-sanctioned events and aims to safeguard both the health of athletes and the environment. The move seeks to eliminate the competitive advantage provided by fluorinated waxes, which have been linked to various health and environmental concerns.

- In August 2024, NANO-X IMAGING LTD, announced its second-quarter financial results, showcasing significant strides in expanding access to medical imaging. CEO Erez Meltzer highlighted the company’s focus on bringing affordable, AI-enhanced imaging technology to underserved healthcare sectors, including urgent care and orthopedic clinics, with the goal of improving patient care globally through smarter, more efficient diagnostic solutions.

- In 2024, SNOOW became the official ski wax sponsor for Team Ramudden. The partnership, which began in the previous season, focuses on the transition to non-fluorinated ski waxes, helping to promote more sustainable skiing practices. Team Ramudden, led by Gustaf Korsgren, will use SNOOW’s innovative wax products throughout the 2024-25 season.

- In 2023, FIS confirmed that its ban on fluorinated ski waxes would fully take effect for the 2023-2024 season. The decision was driven by concerns about the health risks and environmental impact of fluorine-based products. To ensure the ban’s success, FIS collaborated with Bruker and the International Biathlon Union (IBU) to develop an accurate and reliable testing method for enforcement.

- In 2025, Flexxit, a new ceramic-based ski glide coating, entered the market, offering a fluoride-free, environmentally friendly alternative to traditional ski waxes. Developed by Sinnotec Innovation Consulting GmbH, Flexxit promises superior performance on the slopes while being biodegradable and safe for the environment. Dr. Jörg Rathenow, the inventor of Flexxit, emphasized the product’s combination of sustainability and high performance.

Conclusion

The global ski wax market is poised for steady growth as the popularity of winter sports continues to rise, accompanied by advancements in product technology and consumer demand for eco-friendly alternatives. As skiers and snowboarders increasingly seek high-performance, sustainable, and user-friendly waxing solutions, manufacturers have an opportunity to innovate and expand their product offerings. Moreover, the growing interest in DIY ski maintenance and the increasing number of winter sports enthusiasts worldwide will further fuel market expansion. With North America maintaining a strong market share, and emerging regions showing promising potential, the ski wax industry is well-positioned to capitalize on these trends and continue its upward trajectory in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)