Table of Contents

Introduction

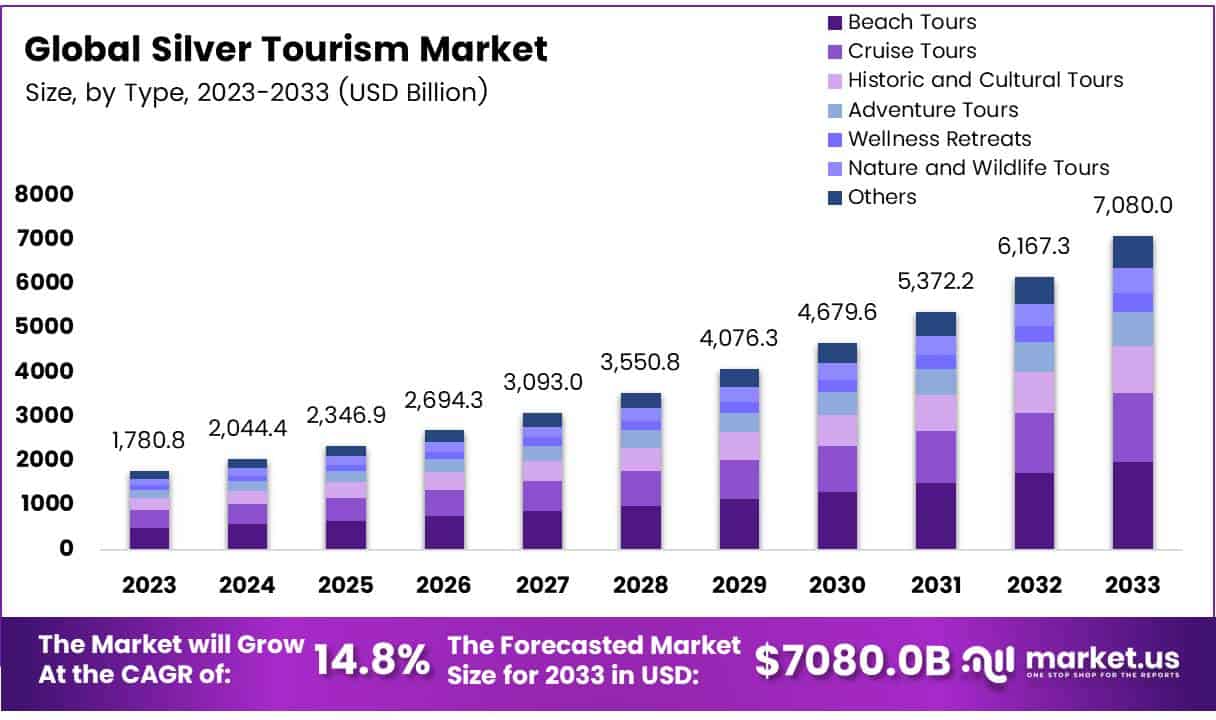

The Gobal Silver Tourism Market is projected to reach approximately USD 7,080.0 billion by 2033, rising from USD 1,780.8 billion in 2023. This growth is anticipated to occur at a compound annual growth rate (CAGR) of 14.8% during the forecast period from 2024 to 2033.

Silver tourism refers to the segment of the tourism industry that caters specifically to older adults, typically aged 55 and above, who are either retired or semi-retired and possess both the time and financial means to travel extensively. The silver tourism market comprises all services, experiences, and infrastructure tailored to meet the unique needs of senior travelers, including accessible accommodations, health and wellness packages, leisurely-paced tours, and culturally enriching experiences.

The growth of the silver tourism market is being driven by the steady rise in the global aging population, with the World Health Organization projecting that by 2050, one in six people in the world will be aged over 65. Increased life expectancy, improved health conditions, and higher disposable incomes among seniors have significantly enhanced their willingness and ability to engage in travel. Furthermore, this demographic values longer vacation durations, off-season travel, and personalized experiences, contributing to consistent demand across the year. Destinations that offer safety, healthcare access, comfortable mobility, and cultural relevance are witnessing increased interest.

A key opportunity within this market lies in the integration of digital technology, such as user-friendly travel planning platforms and health-monitoring tools, which are increasingly being adopted by tech-savvy senior travelers. Additionally, partnerships between the tourism sector and healthcare providers are emerging as a vital strategy to ensure senior-friendly services. As the senior demographic grows in both size and influence, the silver tourism market is positioned for sustained expansion, offering significant potential for stakeholders across the travel, hospitality, and wellness industries.

Key Takeaways

- The global silver tourism market is projected to expand significantly, rising from USD 1,780.8 billion in 2023 to USD 7,080.0 billion by 2033, registering a CAGR of 14.8% over the forecast period.

- Among various travel types, beach tours hold the largest market share at 23.8% in 2023, owing to their leisure appeal and ease of access, making them particularly attractive to older adults.

- In the gender analysis, female travelers represent the dominant segment, reflecting a higher rate of travel engagement among aging women compared to their male counterparts.

- Solo travel emerges as the leading category, indicating a growing preference among senior tourists for independent and personalized travel experiences.

- Travel agencies and agents facilitate 66.3% of bookings, underscoring the continued reliance of senior travelers on professional travel planning and support services.

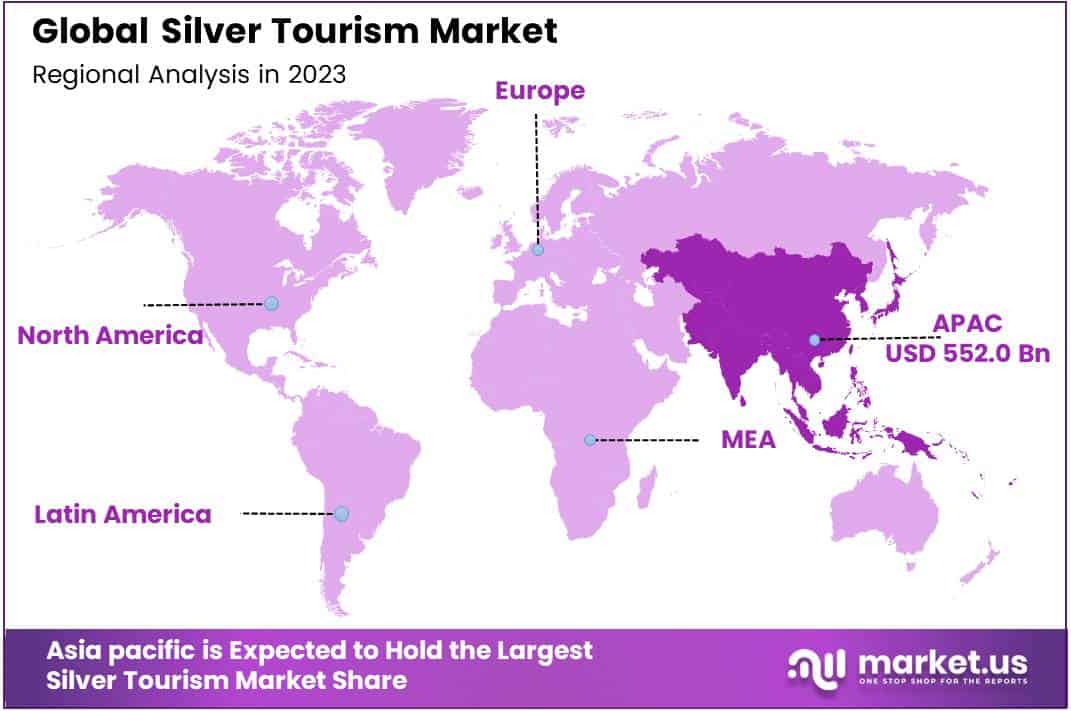

- The Asia Pacific region accounts for the largest share at 31.8%, driven by a rapidly aging population and rising affluence among seniors, particularly in Japan and China.

Request A Sample Copy Of This Report at https://market.us/report/silver-tourism-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 1,780.8 Billion |

| Forecast Revenue (2033) | USD 7080.0 Billion |

| CAGR (2024-2033) | 14.8% |

| Segments Covered | By Type (Beach Tours, Cruise Tours, Historic and Cultural Tours, Adventure Tours, Wellness Retreats, Nature and Wildlife Tours, Others), By Gender (Female, Male), By Age Group (60 – 70 Years, 50 – 60 Years, Above 70 Years), By Category (Solo, Group), By Destination (Domestic, International), By Booking Mode (Travel Agency/Agents, Direct Booking), |

| Competitive Landscape | SOTC Travel Limited, Flight Centre Travel Group Limited, Trip.com Travel Singapore Pte. Ltd, Expedia, Inc., Intrepid Travel, Liberty Travel, Collette Travel Service, Thomas Cook India Group, MAKEMYTRIP PVT. LTD., Tauck, Abercrombie & Kent USA, LLC, Travel Leaders, Yatra Online Limited, China Tourism Group Duty Free Corporation Limited, Kesari Tours Pvt Ltd. |

Emerging Trends

- Wellness and Health-Oriented Travel: Senior travelers are increasingly seeking destinations that offer wellness programs, including spa treatments, yoga retreats, and fitness activities. This trend reflects a growing emphasis on health and well-being among the aging population.

- Intergenerational Travel: A significant number of seniors prefer traveling with their children and grandchildren, leading to a rise in multi-generational travel packages. This trend fosters family bonding and creates demand for accommodations and activities suitable for all ages.

- Technology Integration: The adoption of technology among seniors is increasing, with many using mobile apps for booking and virtual reality tools for exploring destinations. This shift necessitates user-friendly digital platforms tailored to older adults.

- Sustainable and Eco-Friendly Travel: Seniors are showing a preference for destinations that prioritize sustainability and support local communities. Approximately 45% of senior travelers prefer eco-friendly destinations.

- Educational and Volunteer Tourism: Many seniors are seeking meaningful travel experiences that combine leisure with learning or volunteering opportunities, such as teaching English abroad or participating in cultural exchange programs.

Top Use Cases

- Pilgrimage and Spiritual Journeys: Religious and spiritual travel remains popular among seniors, with many undertaking pilgrimages or visiting sacred sites. In India, over 7 million elderly individuals traveled for pilgrimages and family visits.

- Cultural and Heritage Tours: Seniors often engage in cultural tourism, exploring historical sites, museums, and participating in local traditions, which enriches their travel experience.

- Cruise Vacations: Cruises offer a convenient and comfortable travel option for seniors, providing amenities and activities tailored to their needs. The cruise industry anticipates accommodating 30 million senior passengers by 2030.

- Nature and Wildlife Excursions: Nature-based tourism, including safaris and visits to natural landmarks, appeals to seniors seeking relaxation and a connection with the environment.

- Wellness Retreats: Destinations offering wellness retreats with activities like yoga, meditation, and spa treatments cater to seniors focusing on health and rejuvenation.

Major Challenges

- Health and Mobility Concerns: Physical limitations and health issues can restrict travel options for seniors, requiring destinations to provide appropriate medical facilities and accessible infrastructure.

- Financial Constraints: Despite having disposable income, some seniors may face financial limitations, affecting their ability to afford travel, especially in regions with inadequate pension systems.

- Digital Literacy: While technology use is increasing, a segment of the senior population may still struggle with digital tools, hindering their ability to plan and book travel online.

- Safety and Security Concerns: Safety is a paramount concern for senior travelers, influencing their choice of destinations and travel arrangements.

- Limited Tailored Services: A lack of travel services specifically designed for seniors can deter them from traveling, highlighting the need for more inclusive and customized offerings.

Top Opportunities

- Development of Senior-Friendly Infrastructure: Investing in accessible transportation, accommodations, and attractions can enhance the travel experience for seniors and attract this demographic.

- Customized Travel Packages: Creating travel packages that cater to the interests and needs of seniors, such as slower-paced itineraries and health-focused activities, can increase engagement.

- Government-Sponsored Travel Programs: Initiatives like Spain’s IMSERSO program, which offers subsidized vacations to retirees, demonstrate the potential of government support in promoting senior tourism.

- Leveraging Technology for Engagement: Developing user-friendly digital platforms and virtual experiences can facilitate travel planning and enhance the overall experience for tech-savvy seniors.

- Promotion of Off-Peak Travel: Encouraging seniors to travel during off-peak seasons can help manage tourist flow and provide cost-effective options for this demographic.

Key Player Analysis

The competitive landscape of the global silver tourism market in 2024 has been shaped by strategic initiatives, innovation in travel services, and a heightened focus on senior-friendly offerings. Key players such as SOTC Travel Limited, Thomas Cook India Group, and Kesari Tours Pvt. Ltd. have tailored domestic and international tour packages to accommodate the mobility, comfort, and medical needs of older travelers. Global operators like Flight Centre Travel Group Limited, Trip.com Travel Singapore Pte. Ltd., and Expedia, Inc. have leveraged digital platforms to offer personalized itinerary planning, leveraging AI-based recommendations and 24/7 support.

Niche and luxury-focused brands such as Tauck and Abercrombie & Kent USA, LLC have captured the premium segment by offering curated experiences and exclusive group tours. Meanwhile, players like Intrepid Travel and Collette Travel Service continue to strengthen their eco-tourism and culturally immersive tours for the senior demographic. The market has also seen regional diversification through the presence of Yatra Online Limited, MAKEMYTRIP PVT. LTD., and China Tourism Group, which are adapting to evolving preferences with age-inclusive services and accessible travel ecosystems.

Purchase The Full Report Now at https://market.us/purchase-report/?report_id=136248

Key Players in the Market

- SOTC Travel Limited

- Flight Centre Travel Group Limited

- Trip.com Travel Singapore Pte. Ltd

- Expedia, Inc.

- Intrepid Travel

- Liberty Travel

- Collette Travel Service

- Thomas Cook India Group

- MAKEMYTRIP PVT. LTD.

- Tauck

- Abercrombie & Kent USA, LLC

- Travel Leaders

- Yatra Online Limited

- China Tourism Group Duty Free Corporation Limited

- Kesari Tours Pvt Ltd.

Regional Analysis

Asia Pacific Leads Silver Tourism Market with Largest Market Share of 31.8% in 2024

Asia Pacific emerged as the dominant region in the global silver tourism market, securing the largest market share of 31.8% in 2024, valued at USD 552.0 billion. The region’s leadership can be attributed to its rapidly aging population, government-supported senior tourism initiatives, and the increasing affordability of travel in emerging economies such as China, India, and Thailand.

Japan, in particular, has been at the forefront with a high percentage of elderly citizens participating in domestic and international leisure travel, supported by senior-friendly infrastructure and specialized tour packages. Similarly, countries like South Korea and Australia are investing in tailored tourism services for older adults, including wellness retreats, cultural experiences, and accessible transportation systems.

The silver tourism sector in Asia Pacific continues to benefit from rising disposable incomes among the elderly population, coupled with a cultural emphasis on post-retirement leisure. The increasing integration of digital platforms has further enabled senior travelers to independently plan and book customized tours, thereby contributing to market expansion.

Additionally, cross-border collaboration for health-tourism packages—particularly in countries like Malaysia and Singapore—has enhanced the region’s appeal to elderly travelers seeking medical wellness and recovery experiences. However, the U.S. tariffs on select travel-related imports and services have slightly affected outbound tourism flows from Asia Pacific to the United States, especially in the luxury cruise and travel accessory segments.

This trade tension has led to a reorientation of travel preferences toward intra-regional destinations, further consolidating Asia Pacific’s leading position in the global silver tourism market. The market outlook remains cautiously optimistic as regional players continue to invest in age-inclusive infrastructure and accessible tourism solutions to accommodate the needs of the aging demographic.

Recent Developments

- In 2025, Saudi Arabia recorded a 20% growth in its asset management sector in 2024, reaching a milestone of SR1 trillion ($266 billion) in total assets. The sector is seeing consistent inflows, and by 2026, assets under management are expected to surpass SR1.3 trillion. This rise is supported by strong investor confidence and increased institutional participation.

- In 2024, Oman attracted 4 million visitors in 2023, the highest ever. The country plans to increase tourism’s GDP share to 9.8% by 2034, backed by a targeted investment of $31 billion by 2040. Major growth is expected in infrastructure and real estate, including resorts, hotels, and vacation homes, making tourism a key economic pillar.

- In 2024, Cumberland County awarded over $1.1 million in tourism grants through the Cumberland Valley Visitors Bureau. These grants supported 15 tourism projects with total costs near $1.9 million. The program aims to boost regional tourism and enhance visitor experiences through strategic local development.

- In 2024, Viking® Cruises introduced three exclusive cruise itineraries in China, set to sail between September and November. The voyages, ranging from 10 to 20 days, feature visits to cities like Beijing and Shanghai, plus rare coastal destinations. Operated by Viking Yi Dun, these journeys offer cultural immersion and are designed only for international travelers.

Conclusion

The silver tourism market is poised for sustained growth, driven by a rising global aging population, increasing disposable incomes among seniors, and a growing preference for personalized and wellness-focused travel experiences. Regions such as Asia Pacific are witnessing significant expansion due to supportive infrastructure and tailored services for older travelers. The integration of technology, including user-friendly booking platforms and health-monitoring tools, is enhancing accessibility and convenience for senior tourists. Furthermore, the emphasis on safety, healthcare access, and culturally enriching experiences is shaping travel offerings to meet the unique needs of this demographic. As travel companies continue to innovate and adapt to these evolving preferences, the silver tourism sector is expected to remain a vital and expanding segment of the global tourism industry.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)