Table of Contents

Introduction

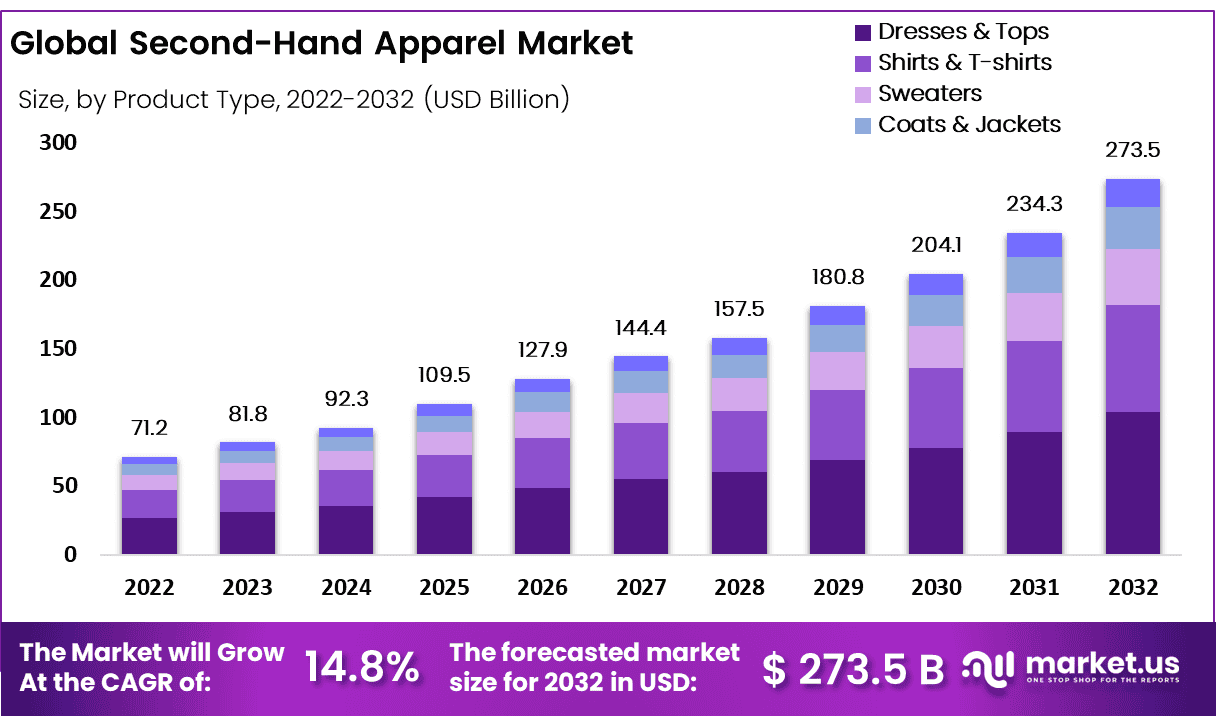

The Global Second-Hand Apparel Market is projected to reach approximately USD 273.5 billion by 2032, up from USD 81.8 billion in 2023, exhibiting a compound annual growth rate (CAGR) of 14.8% during the forecast period from 2023 to 2032.

The Second-Hand Apparel Market is witnessing significant growth, driven by increasing consumer awareness regarding sustainability, affordability, and the unique fashion choices available in the resale segment. Second-hand apparel refers to previously owned or pre-worn clothing that is resold through thrift stores, consignment shops, online resale platforms, or peer-to-peer marketplaces. The market itself encompasses a wide range of clothing categories, including vintage, luxury, casual wear, and designer apparel, catering to diverse consumer preferences.

The growth of the second-hand apparel market can be attributed to rising environmental concerns associated with fast fashion, as consumers seek eco-friendly alternatives to reduce textile waste and carbon footprints. Additionally, the expansion of digital resale platforms, such as ThredUp, Poshmark, and The RealReal, has facilitated easier access to second-hand clothing, making the market more organized and appealing to mainstream consumers.

Demand is particularly strong among millennials and Gen Z consumers, who prioritize sustainable fashion and cost-effective shopping solutions. Additionally, inflationary pressures and economic uncertainties are pushing consumers toward more budget-friendly fashion choices, further fueling demand. The opportunity within this market is vast, with key players investing in AI-driven resale platforms, authentication technologies for luxury second-hand goods, and sustainable fashion initiatives to tap into the growing circular economy.

Moreover, partnerships between fashion retailers and resale platforms are emerging as a strategic move to integrate second-hand clothing into mainstream retail channels. As awareness of ethical consumption increases, the second-hand apparel market is expected to experience continued expansion, positioning itself as a key player in the broader apparel industry.

Key Takeaways

- The second-hand apparel market is projected to expand from USD 81.8 billion in 2023 to USD 273.5 billion by 2032, achieving a CAGR of 14.8%, driven by increasing sustainability awareness and consumer demand for affordable fashion.

- Dresses & Tops lead the market, accounting for over 38.0% of the total share, driven by their versatility and high demand among eco-conscious consumers.

- Women’s apparel holds the largest share, representing more than 55.0% of the market, as female consumers prioritize sustainable and diverse fashion choices.

- E-commerce platforms dominate the distribution channel, benefiting from consumer preferences for convenience, variety, and digital shopping experiences.

- North America holds the largest market share at 30.0%, valued at USD 21.3 billion, driven by a strong sustainability culture and the dominance of online resale platforms.

Second-Hand Apparel Statistics

- Secondhand listings on eBay have increased by 31% over the past three years.

- Extending the use of a garment by nine months reduces its environmental impact by 20%.

- The secondhand fashion market is projected to reach $64 billion within five years.

- 80% of young consumers believe buying used fashion carries no stigma.

- 90% of Gen Z shoppers consider secondhand options, especially during financial constraints.

Emerging Trends

- Mainstream Adoption: Second-hand clothing has transitioned from niche markets to mainstream fashion. In the UK, one in ten Christmas gifts was pre-loved, amounting to approximately £2.05 billion in sales.

- Circular Economy Initiatives: Major brands are integrating circular economy principles, focusing on reworking and reselling vintage pieces. The UK’s circular economy sector has generated about £28 billion in revenue, employing nearly 120,000 individuals.

- Digital Platforms Expansion: Online resale platforms have experienced significant growth. For instance, Vinted reported a 61% year-on-year increase, with over 16 million accounts in the UK.

- Upcycling and Reworks: Designers are increasingly focusing on upcycling, transforming discarded materials into new fashion items. In Ghana, local designers are addressing textile waste by creating innovative designs from low-quality imported garments.

- Corporate Participation: Established brands such as Primark, Ikea, Adidas, and H&M are launching sustainability initiatives, including in-store exchanges and resale programs, to align with consumer demand for sustainable fashion.

Top Use Cases

- Affordable Fashion: Second-hand clothing offers cost-effective alternatives to new apparel, making fashion accessible to a broader audience.

- Environmental Sustainability: Purchasing pre-owned clothing reduces textile waste and conserves resources, contributing to environmental conservation.

- Unique Style: Consumers seek vintage and unique pieces in the second-hand market, allowing for individual expression beyond mass-produced fashion.

- Circular Business Models: Businesses are adopting circular models by reselling returned or unsold items, thereby minimizing waste and maximizing product lifecycle.

- Charitable Contributions: Many second-hand stores operate as charitable organizations, where purchases support various social causes.

Major Challenges

- Quality Control: Ensuring the quality and authenticity of second-hand items can be challenging, affecting consumer trust.

- Logistics and Inventory Management: Handling diverse and unpredictable inventory requires efficient logistics and inventory systems.

- Market Saturation: The influx of low-quality fast fashion items into second-hand markets, especially in countries like Ghana, leads to environmental pollution and challenges for local designers.

- Consumer Perception: Overcoming the stigma associated with wearing used clothing remains a barrier for some consumers.

- Regulatory Hurdles: Navigating varying regulations on used clothing imports and sales across different regions can be complex for businesses.

Top Opportunities

- Technological Integration: Utilizing AI and data analytics can enhance inventory management and personalize customer experiences.

- Collaborations with Designers: Partnering with designers to upcycle and reimagine second-hand clothing can attract fashion-forward consumers.

- Expansion into Emerging Markets: Tapping into emerging markets with growing middle classes presents opportunities for second-hand apparel businesses.

- Educational Campaigns: Educating consumers about the environmental and economic benefits of second-hand shopping can shift perceptions and increase adoption.

- Development of Sustainable Practices: Implementing sustainable practices in operations can appeal to environmentally conscious consumers and differentiate brands in the market.

Key Player Analysis

The Global Second-Hand Apparel Market in 2024 is witnessing strong competition among key players, driven by the growing demand for sustainable fashion and the increasing popularity of online resale platforms. ThredUP, Poshmark, and Depop continue to dominate the digital resale segment by leveraging AI-driven personalization, social commerce, and influencer-driven engagement. Vestiaire Collective and The RealReal maintain a strong foothold in the luxury resale sector, benefiting from authentication services and a growing consumer preference for high-end, pre-owned fashion.

Mercari and eBay remain competitive by offering flexible, peer-to-peer selling models that cater to a broad range of buyers and sellers. Meanwhile, ASOS Marketplace and Buffalo Exchange blend online and offline channels to attract both independent brands and vintage enthusiasts. Goodwill Industries International remains a key player in the nonprofit sector, sustaining a steady supply of second-hand clothing through donations. With increasing competition, other key players are focusing on technology-driven solutions and sustainability initiatives to gain market share.

Top Key Players in the Market

- ThredUP

- Poshmark

- Depop

- Vestiaire Collective

- Mercari

- The RealReal

- eBay

- ASOS Marketplace

- Goodwill Industries International

- Buffalo Exchange

- Other Key Players

Regional Analysis

North America Leads Second-Hand Apparel Market with Largest Market Share of 30.0% in 2024

North America is the dominant region in the global second-hand apparel market, accounting for 30.0% of the total market share in 2024. The market in this region is valued at USD 21.3 billion, driven by growing consumer preference for sustainable fashion, increasing penetration of online resale platforms, and a shift towards circular economy practices.

The United States remains the key contributor to the regional market, with a strong presence of established resale platforms such as ThredUp, Poshmark, and The RealReal. Millennials and Gen Z consumers are increasingly driving demand for pre-owned fashion due to affordability, uniqueness, and environmental consciousness.

Additionally, the rising adoption of digital platforms and social media-driven resale trends further bolster market growth. The presence of major retail players entering the second-hand segment, along with collaborations between brands and resale marketplaces, has also contributed to market expansion in North America.

Recent Developments

- In 2023, Frasers Group acquired a 5% stake in Boohoo, investing £22 million as part of its broader expansion in online retail. The company, known for owning Sports Direct and Flannels, has been actively increasing its presence in digital marketplaces. This investment followed its recent 9% stake purchase in Currys, reinforcing its strategy of acquiring shares in well-known retailers. Over the years, Frasers Group has built a reputation for acquiring struggling brands and revitalizing them.

- In 2024, Fleek secured $20.4 million in funding to boost its second-hand fashion marketplace. The funding included a $14.8 million Series A round led by HV Capital and a $5.6 million seed round. Investors included Andreesen Horowitz (a16z), Y Combinator, and industry leaders such as Shopify’s President, Harley Finkelstein. The company aims to reshape the upcycled fashion industry by making sustainable fashion more accessible worldwide.

- In October 2024, Vinted completed a €340 million secondary share sale, reaching a valuation of €5 billion. The transaction, led by TPG, a global asset management firm, highlights the company’s growth in the second-hand fashion sector. The deal attracted new investors, broadened its financial backing, and rewarded early investors and employees for their contributions to its expansion.

- In 2024, Frasers Group announced the acquisition of Twin Sport, a leading Dutch sporting goods retailer. The deal aligns with its ambition to become the top sports retailer in Europe, the Middle East, and Africa. Twin Sport operates under the Intersport franchise, previously managed by EKS Netherlands. This acquisition strengthens Frasers Group’s presence in the European sports retail market.

Conclusion

The second-hand apparel market is expanding rapidly, driven by growing consumer demand for sustainable and budget-friendly fashion. The rise of online resale platforms, increasing environmental consciousness, and a shift toward circular economy practices are key factors fueling market growth. Millennials and Gen Z consumers are leading this trend, favoring pre-owned clothing for its affordability, uniqueness, and lower environmental impact. Fashion brands and retailers are increasingly integrating resale initiatives to tap into this growing segment, while technological advancements, such as AI-driven authentication and personalized recommendations, enhance the shopping experience. With ongoing innovations and strategic partnerships, the second-hand apparel market is expected to remain a key force in the fashion industry, offering new opportunities for businesses and consumers alike.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)