Table of Contents

Introduction

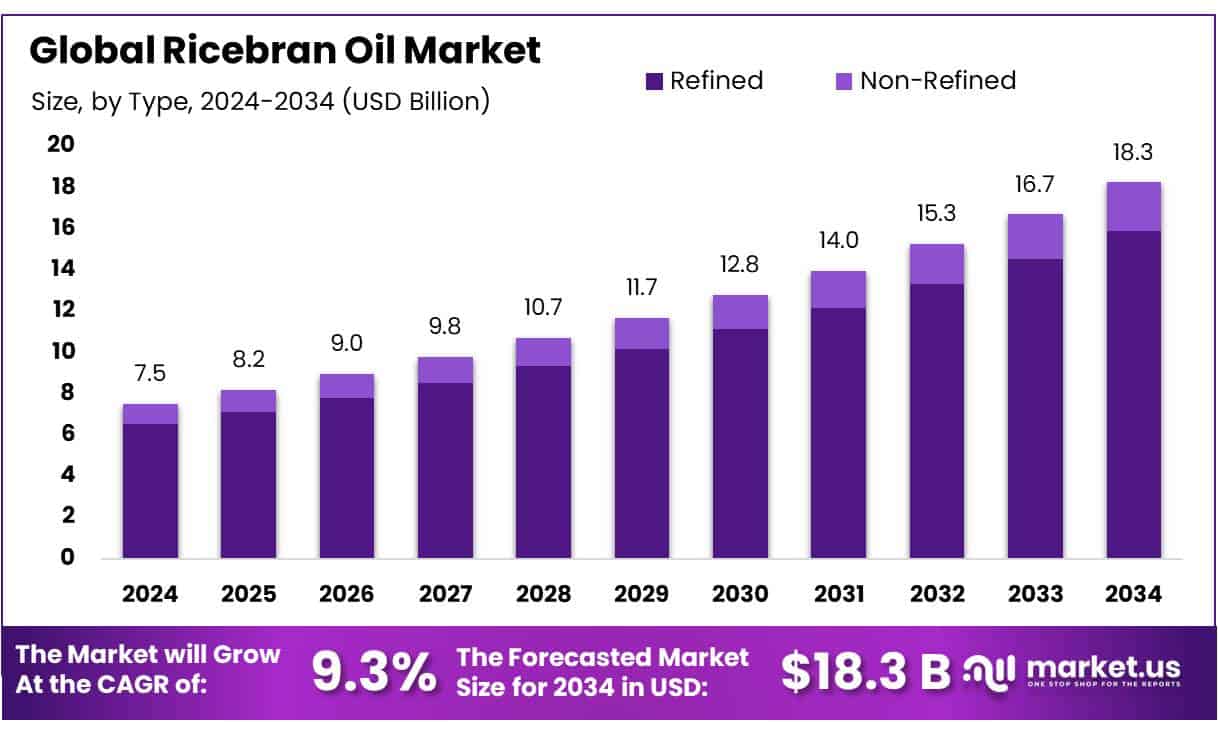

The global rice bran oil market is projected to reach approximately USD 18.3 billion by 2034, rising from USD 7.5 billion in 2024, growing at a CAGR of 9.3% from 2025 to 2034. In 2024, the Asia-Pacific region led the market with a dominant 48.2% share, generating USD 3.6 billion in revenue. Rice bran oil, derived from the outer layer of milled rice, is known for its high smoke point (~232°C) and balanced fatty acid composition—around 38% monounsaturated, 37% polyunsaturated, and 25% saturated fats.

It also contains bioactives such as γ-oryzanol, tocopherols, and tocotrienols, which offer antioxidant and cholesterol-lowering properties. Technological advancements in extraction methods are enhancing oil quality and reducing solvent residues, supporting the shift toward premium product positioning. India plays a central role in global production, accounting for about 46.8% of output and processing over 1.2 million tons of rice bran annually, contributing to nearly 60% of refined rice bran oil globally.

The country’s domestic production increased from 920 kt in 2014–15 to 1,031 kt in 2016–17. With a projected edible oil supply of 70.2 million tonnes by 2047, rice bran oil is seen as a strategic resource. To boost self-sufficiency, India’s Ministry of Food & Public Distribution launched NAFED-fortified rice bran oil in June 2021 and targeted expanding production capacity to 1.8 million metric tonnes, with support for upgrading rice milling technology.

Market Scope & Forecast

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 7.5 Bn |

| Forecast Revenue (2034) | USD 18.3 Bn |

| CAGR (2025-2034) | 9.3% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Report Coverage | Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments |

| Segments Covered | By Type (Refined, Non-Refined), By Category (Organic, Conventional), By Application (Food Processing, Cosmetics, Pharmaceuticals, Others), By Distribution Channel (Supermarket/Hypermarket, Convenience Stores, Online Retail Stores, Others) |

Emerging Trends

Health and Nutritional Benefits Driving Demand: Rice bran oil is gaining popularity due to its health benefits, including high levels of monounsaturated fats, antioxidants like oryzanol, and vitamin E. These properties contribute to heart health and cholesterol management, attracting health-conscious consumers. The oil’s mild flavor and high smoke point make it suitable for various cooking methods, further enhancing its appeal.

Technological Advancements in Extraction Processes: Advancements in extraction technologies, such as cold pressing and solvent extraction, are enhancing oil yield and quality. These innovations improve efficiency and preserve the nutritional content of rice bran oil. Additionally, AI-driven automation in production processes is optimizing yield and reducing waste, contributing to more sustainable practices.

Expansion in Industrial Applications: Beyond culinary uses, rice bran oil is finding applications in cosmetics, pharmaceuticals, and nutraceuticals. Its antioxidant properties make it valuable in skincare products, while its nutritional benefits are being leveraged in dietary supplements. This diversification is opening new revenue streams for producers and expanding the oil’s market reach.

Pricing Trends and Market Volatility: Rice bran oil prices are subject to fluctuations influenced by factors such as raw material costs, supply chain dynamics, and geopolitical events. For instance, in March 2025, prices in the United States reached USD 5,427 per metric ton, while in India, they were USD 1,832 per metric ton. These variations impact production costs and retail pricing strategies.

Use Cases

High-Temperature Cooking: Rice bran oil is renowned for its high smoke point of 232°C (450°F), making it ideal for high-heat cooking methods such as stir-frying, deep-frying, and sautéing. Its stability at elevated temperatures reduces the formation of harmful compounds, ensuring healthier cooking outcomes.

Nutritional Profile: RBO boasts a balanced fatty acid composition: approximately 38% monounsaturated fats, 37% polyunsaturated fats, and 25% saturated fats. It also contains significant levels of vitamin E and γ-oryzanol, contributing to its antioxidant properties.

Cholesterol Management: Clinical studies have demonstrated that RBO consumption can lead to a reduction in total cholesterol and low-density lipoprotein (LDL) cholesterol levels. A meta-analysis of randomized controlled trials indicated a significant decrease in serum lipid profiles among adults consuming RBO.

Antioxidant and Anti-Inflammatory Effects: The presence of γ-oryzanol and tocotrienols in RBO imparts antioxidant and anti-inflammatory properties. These compounds have been shown to suppress enzymes that promote inflammation, potentially reducing the risk of chronic diseases.

Dietary Supplements: Isolated γ-oryzanol from RBO is available as a dietary supplement in various countries. While marketed for its potential health benefits, evidence supporting its efficacy for treating medical conditions remains limited.

Functional Foods: RBO is incorporated into functional foods, such as fortified snacks and beverages, to enhance their nutritional profile. Its antioxidant properties contribute to the stability and shelf life of these products.

Major Challenges

Rapid Deterioration of Raw Material: Rice bran is highly perishable due to its high lipase activity, leading to rapid hydrolytic rancidity. Without proper stabilization, the oil extracted from rice bran can have elevated free fatty acid (FFA) levels, affecting its quality and shelf life. Studies have shown that delayed stabilization can significantly reduce the oil’s quality, with FFA levels increasing by up to 2% within a short period.

Inefficient Oil Extraction Methods: Traditional mechanical pressing methods result in low oil extraction efficiency, leaving 8–14% of oil in the cake. Given that rice bran contains only 10–15% oil, this inefficiency leads to considerable oil loss. While solvent extraction methods offer higher yields, they come with challenges such as solvent residue and higher operational costs.

High Production Costs: The advanced technologies required for efficient extraction and stabilization of rice bran oil involve significant capital investment. For instance, solvent extraction units and stabilization equipment can cost several million dollars, making it challenging for small-scale producers to enter the market. Additionally, the high cost of raw materials and energy-intensive processes further escalate production expenses.

Supply Chain Instability: The availability of rice bran is closely tied to rice production cycles, leading to seasonal fluctuations in supply. In 2022, the U.S. rice bran market faced supply chain disruptions due to fluctuating rice production and international trade barriers. Such instability can lead to inconsistent production schedules and pricing challenges.

Regulatory and Safety Concerns: The rice bran oil industry must adhere to stringent food safety regulations to ensure product quality and consumer safety. Non-compliance can lead to product recalls and damage to brand reputation. Additionally, the presence of contaminants such as pesticides and heavy metals in rice bran can pose health risks, necessitating rigorous testing and quality control measures.

Market Growth Opportunities

Health Benefits Driving Consumer Demand: Rice bran oil is rich in monounsaturated and polyunsaturated fatty acids, antioxidants, and vitamin E, which contribute to its health benefits, including cholesterol reduction and heart health support. These properties are increasingly appealing to health-conscious consumers, particularly in regions with rising awareness of lifestyle diseases.

Expanding Applications Across Industries: Beyond culinary uses, rice bran oil is gaining popularity in the cosmetics, pharmaceuticals, and nutraceutical industries due to its antioxidant properties and skin health benefits. This diversification is opening new revenue streams and broadening the market’s appeal.

Technological Advancements in Extraction Processes: Advancements in extraction technologies, such as cold pressing and solvent-free methods, are improving the yield and quality of rice bran oil. These innovations are enhancing product appeal and enabling producers to meet the growing demand efficiently.

Sustainable and Clean Label Trends: Consumers are increasingly favoring products with clean labels and sustainable sourcing. Rice bran oil’s natural extraction process and health benefits align with these trends, making it an attractive option for brands aiming to meet consumer expectations for transparency and sustainability.

Market Challenges and Strategic Considerations: While the market presents numerous opportunities, challenges such as fluctuating raw material prices and competition from other vegetable oils exist. Companies need to focus on efficient supply chain management, product innovation, and strategic partnerships to navigate these challenges and capitalize on growth prospects.

Key Market Segments

By Type

- Refined

- Non-Refined

By Category

- Organic

- Conventional

By Application

- Food Processing

- Cosmetics

- Pharmaceuticals

- Others

By Distribution Channel

- Supermarket/Hypermarket

- Convenience Stores

- Online Retail Stores

- Others

Key Players Analysis

King Rice Oil Group is a prominent Thai company specializing in rice bran oil production. With over 40 years of experience, the group offers a diverse range of products, including rice bran oil, shortening, and non-dairy creamer. In 2024, King Rice Oil Group reported sales of approximately 8.3 billion baht, with 46% of revenue derived from rice bran oil. The company’s commitment to quality and innovation has established it as a leading player in the Southeast Asian edible oil market.

Ricela Group of Companies is India’s leading exporter of refined rice bran oil, with a turnover exceeding ₹1,800 crore. Established in 1992, Ricela utilizes a patented physical refining process to produce oil rich in oryzanol, offering health benefits such as cholesterol reduction. The company has garnered multiple national awards for innovation and technology. Ricela’s commitment to quality and sustainability positions it as a significant player in the global rice bran oil market.

Cargill, Inc. is a global leader in the edible oil industry, offering a range of products including rice bran oil under its Gemini brand. In 2018, Cargill India launched Gemini rice bran oil, aiming to capture a 10% market share in Maharashtra within one year. The company sources rice bran oil from a third-party facility in Dhuri, Punjab, and positions the product as a heart-healthy option, rich in oryzanol and fortified with vitamins A, D, and E.

TSUNO Group Co., Ltd. is a Japanese company founded in 1947, specializing in rice bran oil production and its derivatives. In 2021, TSUNO launched a premium expeller-pressed rice bran oil, produced without solvents, preserving the oil’s natural nutrients. This product caters to health-conscious consumers and is certified under the Cosmetic Organic Standard. Additionally, TSUNO has developed a stable sunscreen formulation using high concentrations of ferulic acid derived from rice bran, showcasing its innovation in utilizing rice bran components .

Modi Naturals Ltd. is a prominent Indian company specializing in rice bran oil production. In FY24, the company reported a consolidated revenue of approximately ₹399.82 crore, a slight decline from the previous year’s ₹417.96 crore. This decrease was primarily due to lower edible oil prices leading to inventory losses. Despite the challenges, Modi Naturals continues to be a significant player in the rice bran oil sector, leveraging its established brand presence and diversified product portfolio.

Rice King Oil Group, based in Thailand, has over four decades of experience in rice bran oil production. The company offers a wide range of products, including rice bran oil, shortening, non-dairy creamer, and rice bran flour. In 2024, Rice King Oil Group aimed to achieve a revenue target of 10 billion baht by 2573, investing 1.5 billion baht to expand its production capacity to over 5 tons. The company’s commitment to quality and innovation has solidified its position in the global rice bran oil market.

Sethia Oils Ltd. is an Indian company specializing in the extraction and refining of rice bran oil. Established in 1986, it operates from Bardhaman, West Bengal, with an extraction capacity of 15,000 MT and refining capacity of 30,000 MT. The company supplies rice bran oil primarily for reputed brands on an order basis, institutional sales, and a small quantity under its own brand, ‘RiceGold’. Additionally, Sethia Oils exports de-oiled cake to countries like Vietnam and Thailand for cattle feed.

TSUNO Group Co., Ltd. is a Japanese company renowned for its high-quality rice bran oil. The company offers a range of products, including rice bran oil, shortening, non-dairy creamer, and rice bran flour. In 2024, TSUNO Group aimed to achieve a revenue target of 10 billion baht by 2573, investing 1.5 billion baht to expand its production capacity to over 5 tons. The company’s commitment to quality and innovation has solidified its position in the global rice bran oil market.

Top Key Players Outlook

- 3F Industries Ltd

- A.P. Refinery Private Limited

- BCL Industries Limited

- Cargill, Inc.

- Ricela Group of Companies

- King Rice Oil Group

- Modi Naturals Ltd.

- Rice King Oil Group

- Sethia Oils Ltd.

- TSUNO Group Co., Ltd

- Vaighai Agro Products Ltd.

Conclusion

In conclusion, rice bran oil is poised for sustained growth, underpinned by its health benefits, culinary applications, and expanding market presence. Stakeholders in the industry can capitalize on these trends by focusing on product innovation, quality enhancement, and strategic market expansion to meet the evolving consumer preferences and global demand.

Culinarily, rice bran oil is favored for its high smoke point of 232°C (450°F), making it suitable for high-temperature cooking methods like stir-frying and deep-frying. Its mild flavor profile further enhances its appeal in various cuisines, particularly in Asian countries where it is traditionally used.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)