Table of Contents

Introduction

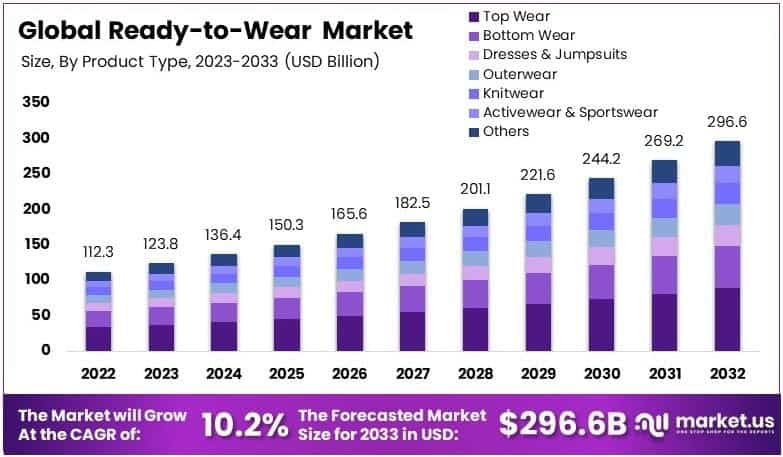

New York, NY – March 24 , 2025 – The Global Ready-to-Wear Market is projected to reach approximately USD 296.6 billion by 2033, up from an estimated USD 112.3 billion in 2023. This growth reflects a compound annual growth rate (CAGR) of 10.2% over the forecast period from 2024 to 2033.

Ready-to-Wear (RTW), also known as off-the-rack clothing, represents a segment of the apparel industry that encompasses factory-made garments sold in standardized sizes, as opposed to custom or tailor-made clothing. The Ready-to-Wear Market comprises a broad array of clothing categories including formal wear, casual wear, activewear, and fashion apparel, distributed through various retail channels such as brick-and-mortar stores, e-commerce platforms, and multi-brand outlets.

The market is witnessing steady growth, driven by a combination of factors such as rising urbanization, increasing disposable incomes, evolving fashion sensibilities, and the growing influence of social media and celebrity culture. Consumers, particularly in emerging economies, are exhibiting a stronger preference for affordable fashion and quick wardrobe turnover, which has amplified the demand for ready-to-wear apparel. Additionally, the rise of fast fashion brands, improved textile manufacturing capabilities, and shorter production cycles have contributed to the accessibility and scalability of RTW offerings.

Market dynamics are further influenced by changing consumer lifestyles, with an increasing emphasis on comfort, convenience, and individual style preferences, particularly among the younger demographic. The proliferation of e-commerce and direct-to-consumer models has expanded market reach and enhanced product visibility, offering significant growth opportunities for brands to capture new customer segments. Moreover, sustainability is emerging as a crucial trend, encouraging innovation in eco-friendly fabrics, ethical sourcing, and circular fashion models.

Strategic partnerships, digital transformation, and brand differentiation are expected to play pivotal roles in capitalizing on the evolving landscape. Overall, the Ready-to-Wear Market is positioned for sustained expansion, supported by consumer-centric trends and continuous innovation across the fashion value chain.

Key Takeaways

- The global Ready-to-Wear market was valued at USD 112.3 billion in 2023 and is projected to reach USD 296.6 billion by 2033, expanding at a CAGR of 10.2% during the forecast period.

- In 2023, Tops & T-Shirts emerged as the leading product segment. Their versatility, comfort, and status as essential wardrobe items contributed significantly to their widespread global adoption.

- Cotton dominated the material segment in 2023, attributed to its comfort, breathability, and rising consumer preference for sustainable and organic fabrics.

- The women’s segment led the market in 2023, driven by a wider spectrum of clothing needs and greater responsiveness to fashion trends and seasonal collections.

- Mid-range pricing captured the largest market share in 2023, offering an optimal balance of affordability and quality, making it attractive to a broad consumer base.

- North America accounted for 38.4% of the global market share in 2023, supported by its developed retail infrastructure, higher disposable incomes, and strong consumer inclination toward branded fashion apparel.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 112.3 Billion |

| Forecast Revenue (2033) | USD 296.6 Billion |

| CAGR (2024-2033) | 10.2% |

| Segments Covered | By Product Type (Top Wear, Bottom Wear, Dresses and Jumpsuits, Outerwear, Knitwear, Activewear and Sportswear, Others), By Material (Cotton, Wool, Silk, Denim, Synthetic Fabrics, Others), By End-User (Men, Women, Children), By Price Range (Low (< USD 50), Medium (USD 50–150), Premium (USD 150–500), Luxury (> USD 500)) |

| Competitive Landscape | Inditex (Zara), LVMH (Louis Vuitton Moët Hennessy), Fast Retailing (Uniqlo), H&M Group, Gap Inc., Kering (Gucci, Saint Laurent), PVH Corp. (Calvin Klein, Tommy Hilfiger), Ralph Lauren Corporation, VF Corporation (The North Face, Timberland), Prada Group, Hermès International, Burberry Group, Chanel, Dolce & Gabbana, Armani Group |

Request a Sample Copy of This Report at https://market.us/report/ready-to-wear-market/request-sample/

Emerging Trends

- Integration of Artificial Intelligence (AI): AI is being utilized to analyze consumer behavior and predict fashion trends, enabling brands to offer personalized shopping experiences.

- Sustainability Initiatives: There is a growing emphasis on sustainable practices within the fashion industry, with brands focusing on eco-friendly materials and ethical production methods.

- Resale and Circular Fashion: The resale market is expanding, with consumers showing increased interest in secondhand luxury items, promoting a circular economy in fashion.

- Technological Advancements in Design: Luxury brands are incorporating AI to innovate in design processes, addressing both traditional and new challenges in the fashion industry.

- Omnichannel Retailing: Brands are integrating online and offline channels to provide seamless shopping experiences, adapting to evolving consumer behaviors.

Top Use Cases

- AI-Driven Demand Forecasting: AI systems analyze past sales data and market conditions to generate accurate demand predictions, helping brands optimize inventory and reduce waste.

- Personalized Styling Services: Brands are leveraging AI to provide personalized fashion recommendations, enhancing customer engagement and satisfaction.

- Sustainable Fashion Lines: Companies are developing eco-friendly clothing lines to meet the increasing consumer demand for sustainable products.

- Resale Platforms: Luxury brands are entering the secondhand market, offering authenticated pre-owned items to cater to the growing interest in sustainable fashion.

- Collaborative Collections: Brands are partnering with influencers and other companies to create unique collections, attracting diverse consumer segments.

Major Challenges

- Competition from Low-Cost Retailers: The rise of low-cost e-commerce platforms presents significant challenges to traditional retailers, affecting their market share.

- Sustainability Pressures: Brands face increasing pressure to adopt sustainable practices, requiring significant changes in sourcing and production.

- Rapidly Changing Consumer Preferences: Keeping up with fast-evolving fashion trends demands agility in design and production processes.

- Economic Uncertainties: Economic fluctuations can impact consumer spending on fashion, affecting sales and profitability.

- Technological Adaptation: Integrating advanced technologies like AI requires substantial investment and poses implementation challenges.

Top Opportunities

- AI Integration: Implementing AI can enhance various aspects of retail, from inventory management to personalized customer experiences.

- Sustainable Fashion: Investing in sustainable practices can attract environmentally conscious consumers and open new market segments.

- Resale Market Participation: Engaging in the secondhand market can provide additional revenue streams and appeal to value-driven customers.

- Technological Innovation: Adopting new technologies can streamline operations and enhance design capabilities, keeping brands competitive.

- Omnichannel Strategies: Developing integrated online and offline shopping experiences can meet diverse consumer preferences and boost sales.

Unlock Expert Insights: Purchase This Report Now! https://market.us/purchase-report/?report_id=133754

Key Player Analysis

In 2024, the global ready-to-wear market continues to be shaped by the strategic positioning and brand equity of key players. Inditex (Zara) maintains a stronghold through agile supply chain operations and trend-responsive collections. LVMH leverages its diversified luxury portfolio, with brands like Louis Vuitton sustaining high desirability. Fast Retailing (Uniqlo) remains competitive through minimalist design and functional apparel, expanding its global footprint. H&M Group emphasizes sustainability while balancing affordability.

Gap Inc. faces restructuring pressures but retains relevance in core markets. Kering benefits from robust demand for Gucci and Saint Laurent, while PVH Corp. drives growth via Calvin Klein and Tommy Hilfiger’s global appeal. Ralph Lauren Corporation upholds brand prestige through premium positioning. VF Corporation strengthens its casual and outdoor segments via The North Face and Timberland. Prada Group and Hermès International continue to capitalize on luxury momentum. Burberry, Chanel, Dolce & Gabbana, and Armani preserve market share by reinforcing heritage and exclusivity.

Top Key Players

- Inditex (Zara)

- LVMH (Louis Vuitton Moët Hennessy)

- Fast Retailing (Uniqlo)

- H&M Group

- Gap Inc.

- Kering (Gucci, Saint Laurent)

- PVH Corp. (Calvin Klein, Tommy Hilfiger)

- Ralph Lauren Corporation

- VF Corporation (The North Face, Timberland)

- Prada Group

- Hermès International

- Burberry Group

- Chanel

- Dolce & Gabbana

- Armani Group

Recent Developments

- In 2025, Bluestar Alliance LLC completed the acquisition of Palm Angels®, a well-known luxury streetwear brand. This move strengthens Bluestar’s presence in the global streetwear and premium fashion segment. Following its recent purchase of Off-White, the company continues to expand its portfolio of modern and high-demand labels. With Palm Angels added, Bluestar enhances its leadership in the premium fashion industry.

- In 2023, Aditya Birla Fashion and Retail Ltd (ABFRL) acquired a 51% controlling interest in TCNS Clothing. With this acquisition, ABFRL has officially become the promoter of the women’s fashion brand. The transaction aligns with ABFRL’s strategy to expand its footprint in the women’s wear segment by partnering with leading domestic apparel labels.

- In 2025, Prada Group reported a 17% rise in total revenue, reaching €5.4 billion. The company marked its fourth straight year of double-digit growth, despite challenges in the broader luxury sector. Retail sales reached €4.6 billion, up 18%. Prada brand sales increased by 4%, while Miu Miu showed significant momentum, nearly doubling its performance. Talks of a possible Versace acquisition also reflect Prada’s growth ambitions.

- In 2023, Kering finalized the purchase of a 30% stake in Valentino. The transaction was confirmed after receiving approval from regulatory bodies. The acquired stake will now be recorded under the equity method. This strategic investment strengthens Kering’s position in the global luxury fashion sector and may pave the way for future collaborations with Valentino.

- In 2023, Frasers Group, led by Mike Ashley, acquired a 5% stake in Boohoo, valued at £22 million. This investment is part of Frasers Group’s ongoing expansion into online retail. The group, known for owning brands like Sports Direct and Flannels, also recently increased its stake in Currys. These moves reflect a broader strategy to grow in digital and fashion-forward retail sectors.

Conclusion

The global Ready-to-Wear (RTW) market is poised for significant growth, driven by factors such as increasing urbanization, rising disposable incomes, and evolving fashion preferences. The expansion of e-commerce platforms has enhanced accessibility, allowing consumers worldwide to engage with a diverse array of apparel options. Additionally, the industry’s shift towards sustainability is gaining momentum, with brands incorporating eco-friendly materials and ethical production practices to meet the growing demand for responsible fashion. As the market evolves, companies that effectively integrate technological innovations, respond to changing consumer behaviors, and commit to sustainability initiatives are well-positioned to capitalize on emerging opportunities within the RTW sector.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)