Table of Contents

Overview

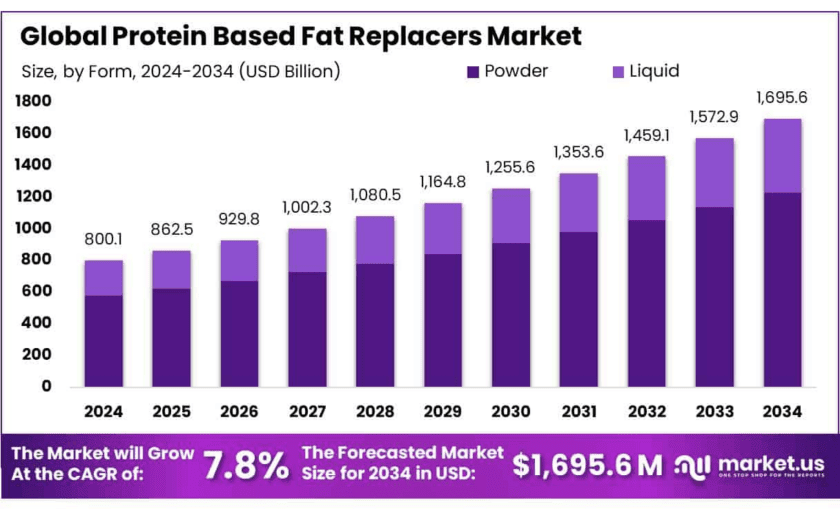

The global Protein-Based Fat Replacers Market is anticipated to experience substantial growth, projected to reach USD 1695.6 billion by 2034, up from USD 800.1 billion in 2024, expanding at a CAGR of 7.8%. This surge is driven by increasing consumer awareness regarding health and wellness, coupled with rising concerns over obesity and cardiovascular diseases. Protein-based fat replacers are formulated to mimic the texture and mouthfeel of conventional fats while reducing calorie content, making them increasingly popular in food and beverage applications.

Powdered forms held a dominant 72.4% share in 2024, attributed to their versatility in various applications and extended shelf life. Plant-based sources command a significant 76.2% share, reflecting a growing consumer preference for sustainable, allergen-free products. The food and beverage sector continues to lead, capturing 65.5% of the market, as manufacturers increasingly reformulate products to align with clean-label, low-fat, and nutrient-rich demands. Europe emerged as the largest regional market in 2024, accounting for 43.1% of the global revenue, driven by stringent regulatory frameworks and a strong focus on dietary health.

Experts Review

Government incentives and regulatory frameworks play a pivotal role in shaping the protein-based fat replacers market. Policies in Europe and North America are particularly focused on promoting low-fat, nutrient-dense formulations to combat rising obesity rates. Technological innovations, such as advanced extraction techniques and microencapsulation, are enabling the development of fat replacers that closely replicate the sensory properties of traditional fats while maintaining nutritional integrity. Investment opportunities are primarily concentrated in the plant-based segment, driven by escalating demand for vegan, allergen-free, and sustainable ingredients.

However, challenges persist in terms of high production costs and stringent regulatory requirements. Compliance costs can account for 15-20% of overall operational expenses, especially in markets like Europe and North America, where ingredient labeling and health claims are closely monitored. Despite these challenges, the increasing prevalence of chronic health conditions, coupled with rising consumer awareness of low-fat diets, continues to fuel demand for protein-based fat replacers.

➤ 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐑𝐞𝐪𝐮𝐞𝐬𝐭: 𝐔𝐧𝐥𝐨𝐜𝐤 𝐕𝐚𝐥𝐮𝐚𝐛𝐥𝐞 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝐘𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬:

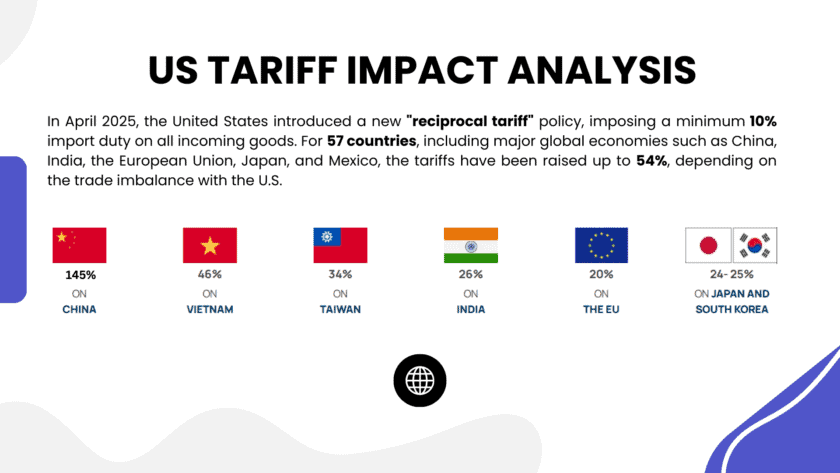

US Tariff Impact on Protein-Based Fat Replacers Market

On April 5, the U.S. government, aiming to address trade imbalances and perceived unfair trade practices, imposed an additional 18% tariff on imported protein-based fat replacers, impacting key trading partners, including China, Canada, and the European Union. This action follows earlier tariffs on agricultural commodities and plant-based ingredients, significantly affecting supply chains and cost structures for food manufacturers relying on imported protein sources like soy, pea, and chickpea.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/global-protein-based-fat-replacers-market/free-sample/

Our economic analysis estimates that these tariffs could lead to a 4.5%–5.2% reduction in global trade of protein-based fat replacers, with the U.S. market potentially contracting by 1.4%–1.7% in GDP due to higher import costs and decreased export competitiveness. The impact is expected to be more pronounced for plant-based fat replacers, as producers face escalating raw material prices and disrupted supply chains. The ripple effects will likely extend to food and beverage sectors, where reformulated products utilizing imported protein sources may see increased retail prices.

Report Segmentation

By Form, the market is divided into Powder and Liquid. Powder forms dominate the market with a 72.4% share in 2024, driven by their ease of integration into processed foods, bakery products, and ready-to-eat meals. The extended shelf life and ease of storage further position powders as a cost-effective solution for manufacturers. Liquid forms, though accounting for a smaller share, are gaining traction in beverage applications, where they provide consistent mouthfeel and texture.

By Source, the market is categorized into Plant-Based and Animal-Based. Plant-based fat replacers lead with a substantial 76.2% share, reflecting a global shift towards sustainable, allergen-free, and vegan ingredients. Soy, pea, and chickpea proteins are key sources, extensively utilized in dairy alternatives, meat substitutes, and baked goods. Animal-based fat replacers hold a minor share but maintain relevance in specialty food applications, including meat processing and dairy products.

By Application, the market is segmented into Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Animal Feed, and Others. The Food & Beverages segment commands the largest market share at 65.5%, driven by reformulation efforts aimed at reducing fat content in processed foods, dairy products, and snacks. Cosmetics & Personal Care represent a growing segment, leveraging protein-based fat replacers for their emulsifying and texturizing properties. Pharmaceuticals and animal feed are emerging segments, utilizing these ingredients for nutrient fortification and texture enhancement.

Key Market Segments

By Form

- Powder

- Liquid

By Source

- Animal

- Plant

By Application

- Food and Beverages

- Cosmetics and Personal Care

- Pharmaceuticals

- Animal Feed

- Others

➤ 𝐁𝐮𝐲 𝐍𝐨𝐰 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 𝐭𝐨 𝐆𝐫𝐨𝐰 𝐲𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/purchase-report/?report_id=148160

Regional Analysis

Europe leads the market with a 43.1% share, valued at USD 344.8 million in 2024. The region’s dominance is attributed to stringent regulatory frameworks promoting healthier food formulations and consumer awareness regarding dietary health. North America follows, driven by increasing demand for plant-based alternatives and advanced processing techniques. Asia-Pacific is poised to exhibit the fastest growth, fueled by expanding middle-class populations and evolving dietary preferences. Latin America and the Middle East & Africa are emerging as potential markets, with growing investments in plant-based nutrition and clean-label products.

Key Drivers:

The rising prevalence of obesity and related health concerns is a primary driver in the Protein-Based Fat Replacers Market. According to the World Health Organization, over 1 billion individuals were classified as obese in 2022, intensifying the demand for low-fat and healthier food alternatives. Consumers are actively seeking food products that offer similar taste and texture as conventional fats but with reduced caloric content. This trend is prompting food manufacturers to invest in protein-based fat replacers, particularly in segments like bakery, dairy, and snacks.

Government initiatives aimed at promoting healthier diets and reducing saturated fat intake further bolster market growth. Regulatory bodies in Europe and North America are implementing strict guidelines to limit trans fats in processed foods, creating significant opportunities for protein-based fat replacers. Furthermore, technological advancements in protein extraction, emulsification, and microencapsulation are enhancing the sensory properties of fat replacers, allowing them to closely mimic traditional fats while maintaining nutritional value.

Plant-based innovation is another critical growth driver. With rising consumer preference for sustainable and allergen-free ingredients, plant-derived fat replacers, particularly from soy, pea, and chickpea, are gaining traction. Companies are increasingly focusing on the development of plant-based alternatives to meet clean-label and vegan product demands. The growing emphasis on nutrient fortification also fuels demand for protein-based fat replacers, as they offer dual functionality—reducing fat content while enhancing nutritional profiles.

Restraints:

Despite its growth potential, the Protein-Based Fat Replacers Market faces several restraints. High production costs remain a significant barrier, particularly for plant-based fat replacers, which require advanced processing techniques for protein extraction and refinement. The cost of sourcing quality raw materials, such as soy and pea protein, is also rising due to increased demand and supply chain disruptions. Consequently, smaller manufacturers may struggle to compete, limiting overall market penetration.

Regulatory challenges further complicate market expansion. Compliance with stringent ingredient labeling and health claims regulations varies across regions, creating complexities for companies aiming to introduce new products. In Europe, for example, the European Food Safety Authority mandates comprehensive ingredient transparency and nutrient labeling, increasing operational costs for manufacturers.

Sensory limitations present another restraint. While technological advancements have improved the texture and taste of protein-based fat replacers, achieving the same mouthfeel and creaminess as conventional fats remains challenging. Consumer acceptance is highly dependent on taste, and products that fail to replicate the sensory attributes of traditional fats risk losing market share. Additionally, market competition is intensifying as established food brands invest in advanced formulations, making it difficult for new entrants to gain traction.

Opportunities:

The Protein-Based Fat Replacers Market presents substantial growth opportunities driven by shifting consumer preferences toward plant-based and clean-label products. The rise of veganism and flexitarian diets is fueling demand for plant-derived fat replacers that align with ethical, sustainable, and health-conscious consumer lifestyles. Asia-Pacific and Latin America are emerging as key regions for market expansion, where rising disposable incomes and evolving dietary habits are creating a conducive environment for plant-based product adoption.

Technological integration also offers promising opportunities. Advancements in microencapsulation, enzymatic processing, and protein isolation are enabling manufacturers to develop fat replacers that closely mimic the sensory attributes of conventional fats while maintaining nutritional integrity. Additionally, the clean-label movement is driving demand for natural, minimally processed ingredients, encouraging companies to innovate using plant proteins and functional fibers.

Collaborations and partnerships with food processors and ingredient suppliers can further accelerate market growth. By leveraging established distribution networks, emerging brands can effectively expand their market reach and gain a foothold in the competitive landscape. Furthermore, investments in R&D to develop multifunctional fat replacers that offer both fat reduction and nutritional enhancement can provide a competitive edge in a crowded market.

Key Player Analysis

- Cargill: Cargill is a global leader in food and agriculture, offering a wide range of products and services. In 2024, the company reported revenues of $160 billion, reflecting its expansive operations . Cargill’s investments in alternative proteins, including the establishment of a Protein Innovation Hub in France, demonstrate its commitment to developing healthier food options. The company’s focus on innovation and sustainability positions it as a key player in the protein-based fat replacers market.

- ADM: Archer Daniels Midland (ADM) is a prominent name in the global food supply chain, providing a broad portfolio of food and beverage solutions . ADM’s emphasis on plant-based alternatives, such as meat and dairy substitutes, aligns with the growing consumer demand for healthier and sustainable food options. The company’s extensive experience and resources enable it to contribute significantly to the development and distribution of protein-based fat replacers.

- Associated British Foods plc: Associated British Foods (ABF) is a diversified international food, ingredients, and retail group. In 2024, ABF reported revenues of £4.242 billion, with an adjusted operating profit of £511 million . The company’s ingredients division plays a crucial role in supplying essential components for various food products, including those aimed at reducing fat content. ABF’s commitment to innovation and quality supports its position in the protein-based fat replacers sector.

- DSM: DSM-Firmenich is a global science-based company active in health, nutrition, and bioscience. In 2024, the company reported sales of €12.799 billion, showcasing its significant presence in the industry . DSM’s focus on sustainable and innovative solutions contributes to the advancement of protein-based fat replacers, catering to the evolving needs of health-conscious consumers.

- AAK AB: AAK AB specializes in plant-based oils and fats, serving various industries, including food and cosmetics. In 2024, AAK reported an 11% growth in operating profit, reflecting its strong performance and strategic initiatives . The company’s expertise in developing functional ingredients supports the production of effective fat replacers, aligning with the demand for healthier food products.

- Ingredion: Ingredion is a global ingredient solutions provider, offering a diverse range of products to various industries. In 2023, the company achieved net sales of $8.2 billion, marking a 3% increase from the previous year . Ingredion’s commitment to innovation and sustainability drives its development of protein-based fat replacers, meeting the growing demand for health-conscious food alternatives.

- Glanbia PLC: Glanbia PLC is a global nutrition company, delivering nutritional and functional ingredients to various markets. In 2024, Glanbia reported revenues of $2.0 billion, with a revenue growth of 10.9% . The company’s focus on high-quality protein products supports the development of effective fat replacers, catering to the health and wellness trends in the food industry.

- Burcon: Burcon NutraScience Corporation specializes in developing plant-based proteins for the food and beverage industry. In 2024, the company announced the launch of its high-purity canola protein, with expected production and sales by the latter half of the year . Burcon’s innovative approach to protein development contributes to the advancement of fat replacers that meet consumer demands for healthier options.

- Roquette: Roquette is a family-owned company and a global leader in plant-based ingredients. In 2024, Roquette continued to expand its presence in the protein-based fat replacers market, leveraging its expertise in plant-based solutions . The company’s commitment to innovation and sustainability supports the development of effective fat replacers, aligning with consumer preferences for healthier and more natural food products.

Recent Developments

In Q4 2024, AAK reported an 11% increase in operating profit, reaching SEK 1,268 million, driven by strong demand for its plant-based fat replacers in bakery and dairy applications. ADM launched a new line of pea protein isolates in March 2025, targeting low-fat formulations in the food and beverage sector. Cargill announced plans to expand its production facility in Germany, focusing on soy and chickpea proteins to cater to the growing demand for sustainable, plant-based fat replacers.

Conclusion

The protein-based fat replacers market is poised for substantial growth, driven by rising consumer demand for healthier, low-fat products and government initiatives promoting nutritional health. Technological advancements in plant protein extraction and emulsification are further propelling market expansion, with Europe and North America leading in market share. Companies investing in clean-label, plant-based, and functional protein ingredients are well-positioned to capitalize on emerging trends. However, high production costs and regulatory complexities present challenges that necessitate strategic planning and continued innovation to maintain market competitiveness.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)