Table of Contents

Overview

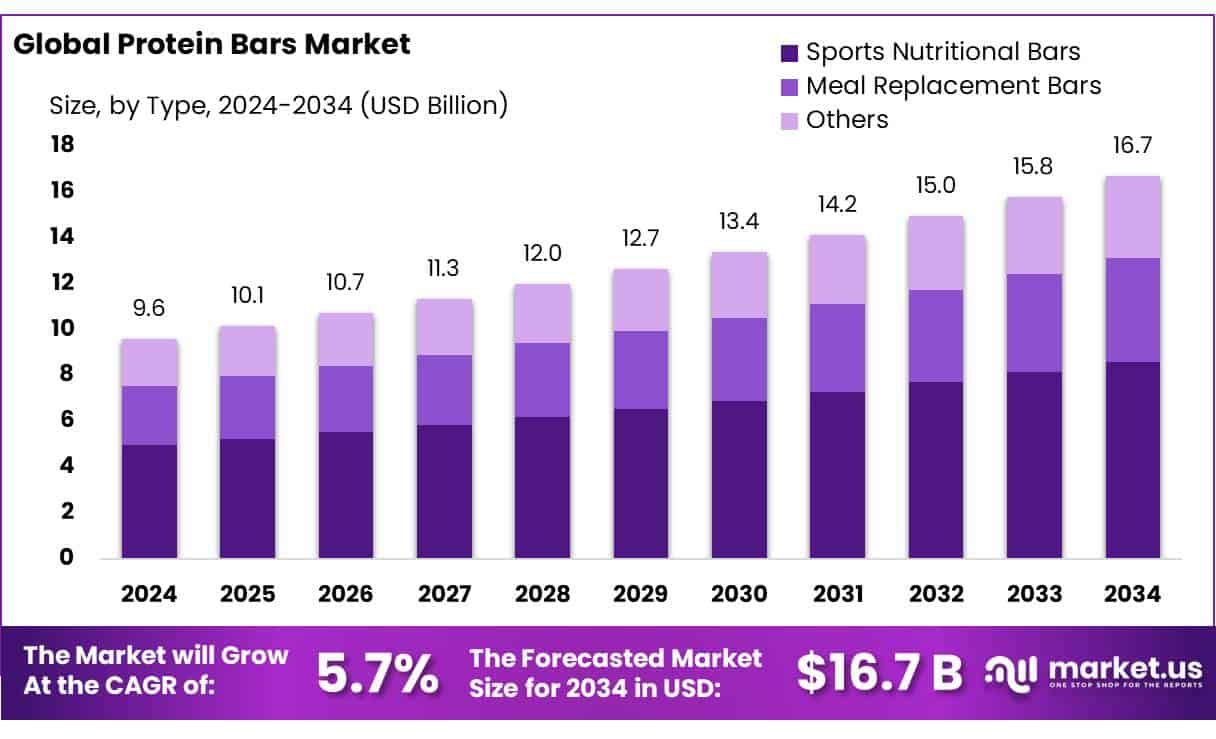

New York, NY – May 15, 2025 – The global Protein Bars Market is growing fast, driven by rising health awareness and increasing demand for convenient, nutritious snacks. In 2024, the market was valued at USD 9.6 billion and is expected to reach USD 16.7 billion by 2034, growing at a 5.7% CAGR from 2025 to 2034.

Sports Nutritional Bars led with a 51.5% market share in 2024, fueled by growing fitness trends. Their dominance stems from heightened health awareness and demand from athletes, gym-goers, and active individuals seeking convenient, protein-rich snacks. Animal-Based Protein Bars commanded a 76.3% share in 2024, driven by trust in whey and casein for their complete amino acid profiles and muscle recovery benefits.

US Tariff Impact on Market

The U.S. has increased tariffs on imports, raising the tax on Chinese goods from 10% to 20% and imposing a 25% tariff on most Mexican and Canadian products. In response, Canada’s outgoing Prime Minister Justin Trudeau announced a 25% retaliatory tariff on over USD 100M of U.S. goods, effective within three weeks.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/global-protein-bars-market/request-sample/

China introduced a 10-15% tax on various food imports, and Mexico’s President, Claudia Sheinbaum, plans to unveil tariffs on U.S. products this weekend. President Trump hinted at a 25% tariff on EU imports and new levies on external agricultural goods starting next month.

Rising inflation, exemplified by record-high U.S. egg prices, underscores the potential of plant-based alternatives. However, these tariffs may hinder the alternative protein industry’s ability to address food shortages and escalating costs. The Tariffs would impact alternative protein companies, too.

Key Takeaways

- Protein Bars Market size is expected to be worth around USD 16.7 billion by 2034, from USD 9.6 Billion in 2024, growing at a CAGR of 5.7%.

- Sports Nutritional Bars held a dominant market position, capturing more than a 51.5% share.

- Animal-Based Protein Bars held a dominant market position, capturing more than a 76.3% share of the total protein bars market.

- Hypermarkets & Supermarkets held a dominant market position, capturing more than a 41.3% share in the global protein bars market.

- North America emerged as the leading region in the global protein bars market, commanding a substantial 45.2% share, equivalent to approximately USD 4.3 billion in revenue.

Report Scope

| Market Value (2024) | USD 9.6 Billion |

| Forecast Revenue (2034) | USD 16.7 Billion |

| CAGR (2025-2034) | 5.7% |

| Segments Covered | By Type (Sports Nutritional Bars, Meal Replacement Bars, Others), By Protein Source (Animal-Based Protein Bars, Plant-Based Protein Bars), By Distribution Channel (Hypermarkets and Supermarkets, Convenience stores, Online, Others) |

| Competitive Landscape | Abbott Laboratories Inc., Atkins Nutritionals Inc., Clif Bar & Company, General Mills Inc., General Nutrition Corporation, Kellogg Company, Larabar, Mars Incorporated, MusclePharm, Natural Balance Foods Ltd., Naturells India Pvt. Ltd., Orgain, PowerBar, Quest Nutrition, The Nature’s Bounty Co., ThinkThin |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=147542

Key Market Segments

By Type

- Sports Nutritional Bars led with a 51.5% market share in 2024, fueled by growing fitness trends. Their dominance stems from heightened health awareness and demand from athletes, gym-goers, and active individuals seeking convenient, protein-rich snacks. Post-pandemic gym participation and diverse offerings—vegan, gluten-free, low-sugar—widened their appeal. In 2024, brands emphasized clean labels and premium ingredients, with new products targeting endurance athletes expected to sustain this trend into 2025.

By Protein Source

- Animal-Based Protein Bars commanded a 76.3% share in 2024, driven by trust in whey and casein for their complete amino acid profiles and muscle recovery benefits. Popular among athletes and fitness enthusiasts, these bars gained traction through clean, high-protein formulas without added sugars or artificial flavors. Expanded retail and online availability boosted accessibility. In 2025, flavor innovations and added functional ingredients like collagen are set to maintain strong consumer preference.

By Distribution Channel

- Hypermarkets & Supermarkets held a 41.3% share in 2024, driven by high foot traffic and strong in-store visibility. Shoppers favor these stores for routine grocery purchases, with strategic product placement near health aisles or checkouts spurring impulse buys. In 2024, expanded health food sections and promotions like sampling campaigns attracted new buyers. This channel remains dominant in 2025, especially in urban areas, for its convenience and variety in bulk purchasing.

Regional Analysis

- North America led the global protein bars market, capturing a 45.2% share, roughly USD 4.3 billion in revenue. This dominance stems from a focus on health and wellness, fast-paced lifestyles requiring convenient nutrition, and increased awareness of protein’s benefits for weight management and overall well-being. The U.S. drives this trend, with many using protein bars as meal replacements or post-workout snacks, supported by the widespread growth of fitness centers and health clubs.

Top Use Cases

- Post-Workout Nutrition: Protein bars are a go-to snack for athletes and gym-goers, providing quick protein to aid muscle recovery after exercise. Their portability and high protein content make them ideal for immediate consumption, supporting fitness goals like muscle growth and repair, especially for busy individuals.

- Meal Replacement for Busy Lifestyles: For professionals and students with tight schedules, protein bars serve as convenient meal replacements. They offer balanced nutrients, including protein, carbs, and fats, helping maintain energy levels without needing to cook or stop for a full meal.

- Weight Management Support: Protein bars help with weight control by promoting satiety and reducing cravings. Low-sugar, high-protein options are popular among dieters, as they provide a filling snack that aligns with calorie-conscious goals, making them a staple for health-focused consumers.

- On-the-Go Snacking: Protein bars are perfect for travelers, hikers, or anyone needing a quick, nutritious snack. Their compact size and long shelf life make them easy to carry, offering a healthier alternative to sugary snacks or fast food.

- Dietary Preference Catering: Vegan, gluten-free, and keto-friendly protein bars meet diverse dietary needs. These options attract consumers with specific restrictions, like plant-based eaters or those with allergies, expanding the market by appealing to niche groups.

Recent Developments

1. Abbott Laboratories Inc.

- Abbott has expanded its Ensure and Glucerna protein bar lines to cater to medical nutrition and diabetic consumers. Their latest products focus on high protein, low sugar, and added vitamins for better health management. Abbott is also investing in research for specialized nutrition bars targeting aging populations and patients with muscle loss.

2. Atkins Nutritionals Inc.

- Atkins has introduced new plant-based protein bars under its Endulge line, featuring flavors like Peanut Butter Fudge and Chocolate Caramel. The company emphasizes low-net-carb and keto-friendly formulations to align with current diet trends. They have also improved packaging sustainability.

3. Clif Bar & Company

- Clif Bar launched organic, plant-based protein bars with improved texture and taste. Their Clif Builders line now includes protein per bar with non-GMO ingredients. The company is also focusing on recyclable packaging and reducing environmental impact.

4. General Mills Inc. (Lärabar, RxBar)

- General Mills rebranded RxBar with simpler ingredients and new flavors like Oatmeal Chocolate Chip. They also expanded Lärabar’s protein offerings with nut-based bars. The company is leveraging its supply chain to enhance distribution in emerging markets.

5. General Nutrition Corporation (GNC)

- GNC introduced new high-protein, low-sugar bars under its Pro Performance AMP line, targeting fitness enthusiasts. They also partnered with influencers to promote vegan and whey-based protein bars, enhancing online and in-store sales.

Conclusion

The Protein Bars Market thrives due to rising health awareness, busy lifestyles, and diverse consumer needs. Their convenience, nutritional benefits, and variety catering to fitness buffs, dieters, and niche dietary preferences drive strong demand. With ongoing innovations in flavors, clean labels, and functional ingredients, protein bars are set to maintain their dominance in the global snack market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)