Table of Contents

Introduction

The global primary cementing equipment market is projected to reach approximately USD 6,810 million by 2033, up from USD 3,628 million in 2023, reflecting a compound annual growth rate (CAGR) of 6.5% during the forecast period from 2024 to 2033.

The Primary Cementing Equipment Market plays a critical role in the oil and gas industry, ensuring well integrity by securing casing to the wellbore and preventing fluid migration between geological formations. Primary cementing equipment includes casing centralizers, float equipment, stage cementing tools, and other components designed to enhance zonal isolation, support casing, and improve wellbore stability.

The market for this equipment is driven by rising global energy demand, increasing exploration and production (E&P) activities, and stringent well safety regulations. Growth is further fueled by advancements in cementing technologies, such as self-healing cements and enhanced centralization techniques, which improve efficiency and reduce operational risks.

Additionally, the increasing focus on deepwater and ultra-deepwater drilling, particularly in regions such as the Gulf of Mexico, North Sea, and offshore Brazil, is generating substantial demand for high-performance cementing solutions. The growing adoption of unconventional resources, including shale gas and tight oil, further amplifies market expansion, as these formations require robust cementing practices for well integrity.

Opportunities exist in the development of cost-effective and environmentally sustainable cementing solutions, as well as digitalization trends, including real-time monitoring of cementing operations through data analytics and automation.

Emerging markets in Asia-Pacific, the Middle East, and Latin America also present significant growth potential due to increasing drilling activities and investments in oilfield infrastructure. While fluctuating oil prices and regulatory complexities pose challenges, the market is expected to witness steady growth, driven by technological advancements and the continuous need for efficient wellbore integrity solutions.

Key Takeaways

- The global primary cementing equipment market is projected to reach USD 6,810 million by 2033, growing from USD 3,628 million in 2023, at a compound annual growth rate (CAGR) of 6.5% during the forecast period from 2024 to 2033.

- Floating equipment holds the largest market share at 42.3%, driven by its essential role in deepwater and ultra-deepwater drilling, particularly in offshore environments.

- Offshore operations account for the majority of the market, representing a 64% share, supported by the increasing complexity and technical requirements of offshore drilling activities.

- The Asia-Pacific region leads the market with a 33.4% share, propelled by expanding oil and gas exploration efforts. North America follows, holding a 28.2% share.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 3628 Million |

| Forecast Revenue (2033) | USD 6,810 Million |

| CAGR (2024-2033) | 6.5% |

| Segments Covered | By Type (Floating Equipment, Casing Accessories, Cementing Plugs And Others), By Application (Offshore, Onshore) |

| Competitive Landscape | Schlumberger Limited, Halliburton Company, Forum Energy Technologies, BJ Services, ACC Corporate, Botil Oil Tools India Private Limited, Rubicon Oilfield International Holdings, L.P, Seenopex, VULCAN Completion Products, Tangent Oil & Gas Equipment and Supply |

Emerging Trends

- Technological Advancements: The integration of advanced technologies, such as real-time monitoring systems and automated cementing equipment, is enhancing operational efficiency and precision in cementing processes.

- Environmental Sustainability: There is a growing emphasis on developing eco-friendly cementing materials and techniques to minimize environmental impact, aligning with global sustainability goals.

- Deepwater Exploration: The expansion of oil and gas exploration into deep and ultra-deepwater regions necessitates specialized cementing equipment capable of withstanding high-pressure and high-temperature conditions.

- Enhanced Safety Protocols: Improved safety standards are driving the adoption of equipment designed to ensure well integrity and prevent incidents such as blowouts or leaks.

- Digitalization: The incorporation of digital technologies, including data analytics and predictive maintenance, is optimizing equipment performance and reducing downtime.

Top Use Cases

- Well Integrity Assurance: Primary cementing equipment is essential for securing casing strings within the wellbore, preventing fluid migration between geological formations.

- Zonal Isolation: Effective cementing isolates different zones within the well, ensuring that hydrocarbons are safely and efficiently extracted without contamination.

- Well Abandonment: During the decommissioning of wells, cementing equipment is used to seal the wellbore, preventing any future environmental hazards.

- High-Pressure, High-Temperature (HPHT) Wells: Specialized cementing equipment is required to handle the extreme conditions encountered in HPHT wells, ensuring durability and safety.

- Unconventional Resource Development: In shale gas and tight oil formations, cementing equipment facilitates the hydraulic fracturing process by providing necessary wellbore stability.

Major Challenges

- Complex Geologies: Navigating complex subsurface conditions can complicate cementing operations, requiring advanced equipment and techniques.

- Regulatory Compliance: Adhering to stringent environmental and safety regulations can increase operational costs and necessitate continuous equipment upgrades.

- Cost Management: Balancing the high costs of advanced cementing equipment with budget constraints poses a significant challenge for operators.

- Skilled Workforce Shortage: A deficit of trained personnel can hinder the effective operation and maintenance of sophisticated cementing equipment.

- Market Volatility: Fluctuations in oil and gas prices can impact investment in exploration activities, subsequently affecting demand for cementing equipment.

Top Opportunities

- Technological Innovation: Investing in research and development to create more efficient and reliable cementing equipment can provide a competitive edge.

- Emerging Markets: Expanding into developing regions with increasing energy demands offers significant growth potential for cementing equipment manufacturers.

- Collaborative Ventures: Forming strategic partnerships can facilitate access to new technologies and markets, enhancing business prospects.

- Training and Development: Implementing comprehensive training programs can address the skilled workforce shortage, ensuring optimal equipment operation.

- Sustainable Practices: Developing environmentally friendly cementing solutions can meet regulatory requirements and appeal to environmentally conscious stakeholders.

Key Player Analysis

The Global Primary Cementing Equipment Market in 2024 is characterized by the dominance of key players that leverage technological innovation, extensive service portfolios, and strategic partnerships to strengthen their market positions.

Schlumberger Limited and Halliburton Company remain industry leaders, driven by their global reach, cutting-edge cementing technologies, and comprehensive well integrity solutions. Their ability to integrate digital solutions and automation into primary cementing processes provides a competitive edge, ensuring operational efficiency and wellbore stability.

Forum Energy Technologies and BJ Services continue to play a significant role, particularly in providing specialized cementing equipment and pumping services. Their focus on product differentiation and customized solutions enhances their standing among operators seeking cost-effective and efficient cementing operations.

ACC Corporate and Botil Oil Tools India Private Limited cater to regional demands, capitalizing on their strong manufacturing capabilities and expertise in supplying high-quality cementing equipment. Their agility in responding to market shifts allows them to maintain a steady presence, particularly in emerging markets.

Rubicon Oilfield International Holdings L.P., Seenopex, and VULCAN Completion Products are gaining traction by expanding their product lines and focusing on performance-driven cementing solutions. Their emphasis on R&D and advanced materials enhances the durability and reliability of cementing tools, positioning them favorably in competitive bidding processes.

Tangent Oil & Gas Equipment and Supply is strengthening its foothold through strategic alliances and an expanding global distribution network, supporting its growth in both established and emerging oil and gas markets. These companies, collectively, shape the competitive landscape of the primary cementing equipment sector, ensuring continuous advancements in wellbore integrity and operational efficiency.

Market Key Players

- Schlumberger Limited

- Halliburton Company

- Forum Energy Technologies

- BJ Services

- ACC Corporate

- Botil Oil Tools India Private Limited

- Rubicon Oilfield International Holdings

- L.P

- Seenopex

- VULCAN Completion Products

- Tangent Oil & Gas Equipment and Supply

Regional Analysis

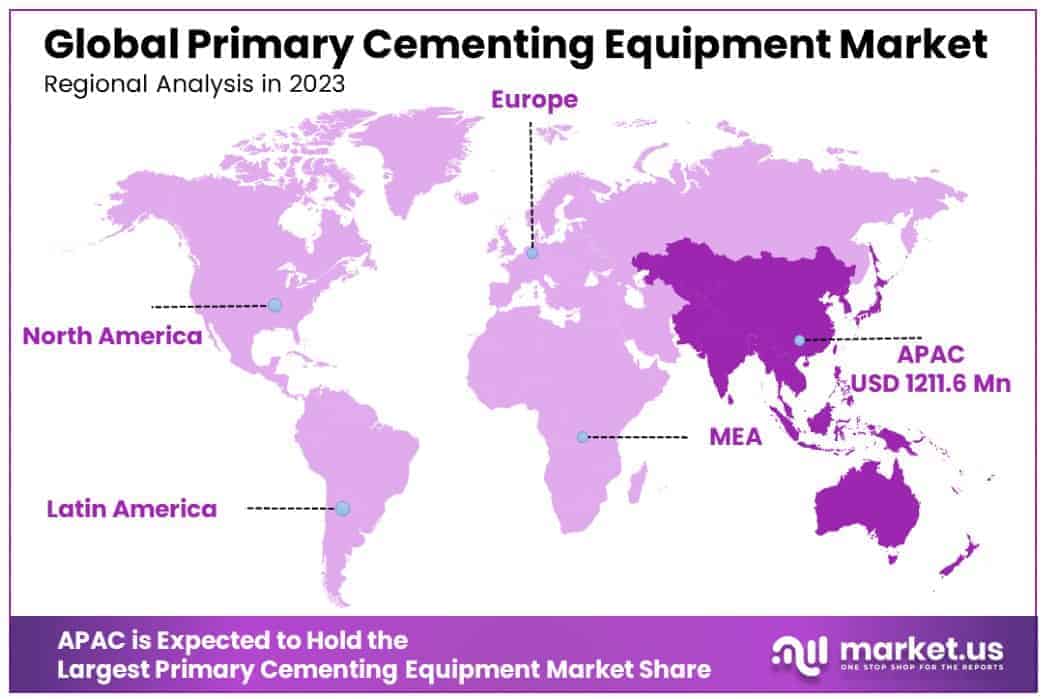

Asia-Pacific Leads the Primary Cementing Equipment Market with the Largest Market Share of 33.4% in 2024

The Asia-Pacific region dominates the Primary Cementing Equipment Market, accounting for 33.4% of the global share in 2024, with a market valuation of USD 1,211.6 million. This leadership is driven by the rapid expansion of oil and gas exploration activities, particularly in China, India, and Australia. The region benefits from increasing investments in deepwater and ultra-deepwater drilling projects, coupled with a surge in shale gas production.

Government initiatives supporting energy security and the rising demand for efficient well construction technologies further bolster market growth. Additionally, the presence of leading oilfield service providers and manufacturers contributes to market expansion. The robust infrastructure development and growing energy consumption across emerging economies further reinforce Asia-Pacific’s position as the leading regional market for primary cementing equipment.

Recent Developments

- In Feb. 15, 2025 – CRH plc (NYSE: CRH), a global leader in building materials, announced the successful completion of its acquisition of a major aggregates and cement producer in Texas for $3.8 billion. This acquisition expands CRH’s footprint in high-growth U.S. markets and strengthens its position in infrastructure development. The acquired assets include multiple quarries and cement plants, ensuring a steady supply of raw materials for future projects.

- In Jan. 22, 2025 – Buzzi Unicem USA, a key cement producer, finalized its acquisition of a strategic cement grinding unit in Florida for $1.2 billion. This acquisition aligns with the company’s long-term vision of enhancing supply chain efficiency and supporting sustainable construction practices. The acquired facility specializes in producing low-carbon cement, meeting increasing demand for eco-friendly building materials.

- In Oct. 30, 2024 – CEMEX (NYSE: CX), a global leader in the cement and construction materials industry, announced a definitive agreement to acquire a network of ready-mix concrete plants and distribution terminals across California for $2.5 billion. This acquisition will help CEMEX strengthen its regional market position and optimize logistics in one of the most dynamic construction markets in the U.S.

- In July 18, 2024 – Ash Grove Cement, a subsidiary of CRH, completed the acquisition of an advanced clinker production facility in Arizona. The deal, valued at $1.1 billion, enhances Ash Grove’s production capabilities and supports its commitment to sustainable manufacturing by integrating alternative fuels and energy-efficient technologies.

- In May 6, 2024 – Eagle Materials Inc. (NYSE: EXP), a leading producer of heavy construction materials, announced the acquisition of a high-performing aggregates business in Colorado for $800 million. The acquisition adds significant limestone reserves and strengthens Eagle Materials’ aggregates supply for infrastructure and commercial construction projects in the region.

- In March 12, 2024 – Lafarge Canada, a member of the Holcim Group, expanded its operations with the acquisition of a major concrete and asphalt producer in Ontario. The acquisition, valued at $600 million, increases Lafarge’s production capacity and enhances its ability to serve growing urban markets with sustainable construction solutions.

Conclusion

The primary cementing equipment market is expected to grow steadily, driven by increasing oil and gas exploration, particularly in deepwater and ultra-deepwater regions. Advancements in cementing technologies, such as real-time monitoring and automation, are improving efficiency and well integrity. The market is also influenced by rising demand for unconventional resources and the need for remediation of aging wells. While challenges such as regulatory complexities and market volatility persist, continued investments in innovation and sustainable solutions are expected to shape the future of the industry.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)