Table of Contents

Overview

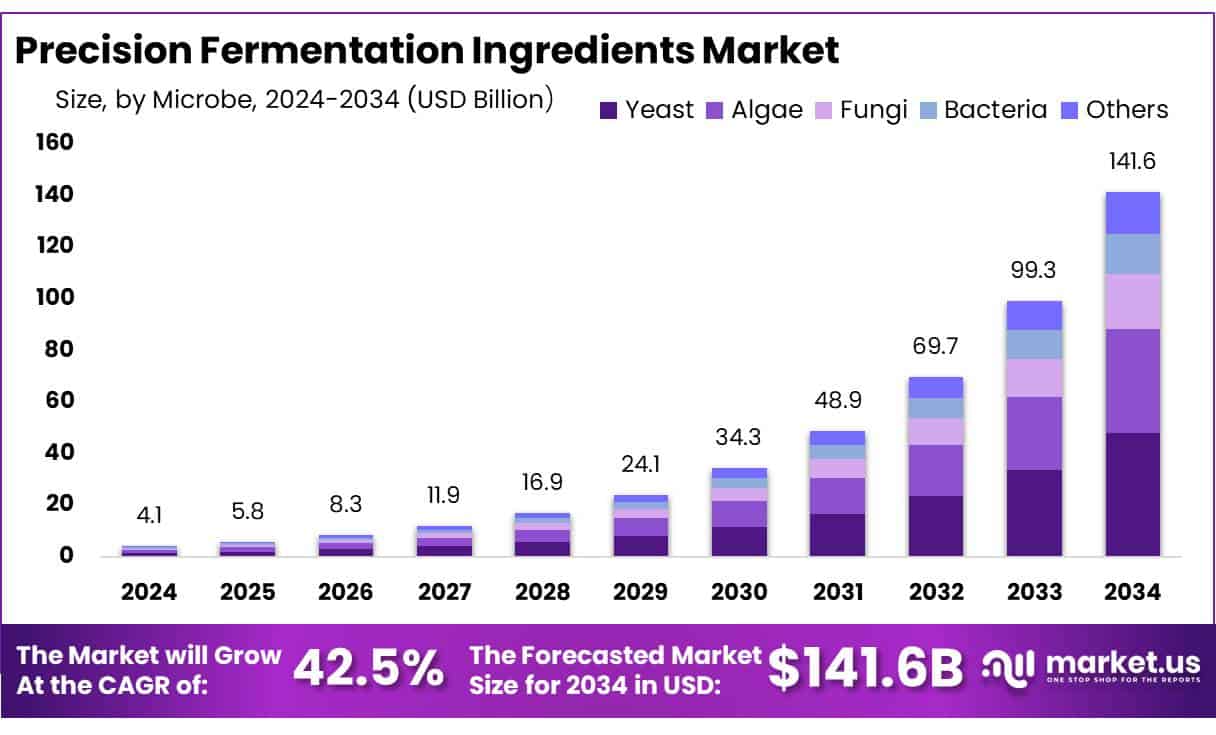

New York, NY – May 07, 2025 – The global Precision Fermentation Ingredients Market is set to grow significantly, reaching USD 141.6 billion by 2034, up from USD 4.1 billion in 2024, with a steady 42.5% CAGR from 2025 to 2034.

In 2024, Yeast secured a leading position in the precision fermentation ingredients market, holding a 34.4% share. Plant-based fermentation ingredients captured a 48.3% market share, fueled by growing consumer demand for sustainable, ethical products. Whey and casein protein accounted for a 31.2% share of the precision fermentation ingredients market. The food and beverages sector dominated the precision fermentation ingredients market with a 54.2% share.

Key Takeaways

- Precision Fermentation Ingredients Market size is expected to be worth around USD 141.6 Bn by 2034, from USD 4.1 Bn in 2024, growing at a CAGR of 42.5%.

- Yeast held a dominant market position within the precision fermentation ingredients sector, capturing more than a 34.4% share.

- plant-based fermentation ingredients held a dominant market position, capturing more than a 48.3% share.

- Whey and casein protein held a dominant market position in the precision fermentation ingredients sector, capturing more than a 31.2% share.

- The Food and Beverages segment held a dominant market position in the precision fermentation ingredients market, capturing more than a 54.2% share.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/precision-fermentation-ingredients-market/request-sample/

Analyst Viewpoint

The Precision Fermentation Ingredients Market is buzzing with opportunity in 2025. North America, with its 41.2% market share, is a hotspot, driven by robust biotech innovation and consumer demand for sustainable proteins. Opportunities abound for investors eyeing startups like Perfect Day or Impossible Foods, which are scaling up plant-based proteins like whey and casein.

Partnering with food and beverage giants to integrate fermentation-derived ingredients into snacks or dairy alternatives is another sweet spot. Yet, risks can’t be ignored, high initial costs for bioreactors and skilled labor can strain budgets, and scaling from lab to factory is no small feat. Consumer hesitancy around genetically modified microbes could also slow adoption if not addressed through clear, honest marketing.

Technologically, breakthroughs in AI-driven fermentation and synthetic biology are slashing costs and boosting yields, making products like vegan collagen or egg whites more accessible. However, the regulatory landscape is tricky. The U.S. FDA’s supportive stance, with no-questions letters for products like yeast-derived proteins, is a plus, but global rules vary, and lengthy approval processes can stall launches.

Report Scope

| Market Value (2024) | USD 4.1 Billion |

| Forecast Revenue (2034) | USD 141.6 Billion |

| CAGR (2025-2034) | 42.5% |

| Segments Covered | By Microbe (Yeast, Algae, Fungi, Bacteria, Others), By Ingredient Source (Plant-Based Fermentation Ingredients, Animal-Based Fermentation Ingredients, Microbial-Based Fermentation Ingredients), By Ingredients (Whey and Casein Protein, Egg White, Collagen Protein, Heme Protein, Enzymes, Others), By End Use (Food and Beverages, Pharmaceutical, Cosmetics, Others) |

| Competitive Landscape | Geltor, The Every Co., Motif FoodWorks, Inc., Imagindairy Ltd., Formo, Eden Brew, Change Foods, Myco Technology, Fybraworks Foods, Remilk Ltd., Melt&Marble, Nourish Ingredients Pty Ltd. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=145201

Key Market Segments

By Microbe

- In 2024, yeast secured a leading position in the precision fermentation ingredients market, holding a 34.4% share. Its dominance is driven by its versatility in producing sustainable products like bioethanol, pharmaceuticals, and food additives. Advances in biotechnology have boosted yeast’s efficiency and yield, making it the go-to microbe for eco-friendly, high-demand applications in precision fermentation.

By Ingredient Source

- In 2024, plant-based fermentation ingredients captured a 48.3% market share, fueled by growing consumer demand for sustainable, ethical products. These ingredients are key to creating vegan-friendly alternatives to animal-derived enzymes and proteins, appealing to plant-based diet enthusiasts. Innovations in fermentation technology and expanding applications in food, beverages, pharmaceuticals, and cosmetics drive this segment’s growth.

By Ingredients

- In 2024, whey and casein protein accounted for a 31.2% share of the precision fermentation ingredients market. Valued for their high-quality protein content, they are essential in infant formulas, sports nutrition, and dietary supplements. Their role in improving food texture and flavor, combined with innovations in fermentation, supports strong demand as consumers prioritize protein-rich, health-focused products.

By End Use

- In 2024, the food and beverages sector dominated the precision fermentation ingredients market with a 54.2% share. Fermentation ingredients enhance flavor, shelf life, and nutrition in food products, aligning with consumer demand for natural, minimally processed options. Cost-effective production through innovative fermentation technologies and rising health awareness continue to drive this segment’s robust growth.

Regional Analysis

- North America led the precision fermentation ingredients market in 2024, securing a 41.2% share, equivalent to roughly USD 1.6 billion in revenue. This leadership stems from the region’s advanced technological infrastructure, substantial investments in biotech and food tech R&D, and a supportive regulatory environment that fosters innovation in food technologies.

- The United States stands out as a key hub, home to numerous top companies and startups driving advancements in precision fermentation. These firms are innovating beyond traditional fermentation products, creating novel ingredients for dairy and meat alternatives, functional foods, and pharmaceuticals.

- Strong consumer demand for sustainable, ethical, and clean-label products, fueled by growing awareness of environmental and health concerns, further propels market growth. Government support also bolsters the industry, with initiatives promoting sustainable agriculture, food safety, and biotechnology research. Hawkins. These programs create a favorable climate for the precision fermentation sector’s expansion.

Top Use Cases

- Dairy Alternatives: Precision fermentation produces vegan whey and casein for dairy-free milk, cheese, and ice cream. These proteins mimic the taste and texture of cow-derived products, appealing to vegans and lactose-intolerant consumers. They use fewer resources, aligning with sustainable food trends and growing demand for plant-based diets.

- Meat Flavor Enhancers: Ingredients like heme, made through precision fermentation, add meaty flavor and color to plant-based burgers. This appeals to flexitarians seeking sustainable alternatives without sacrificing taste. The process is eco-friendly, reducing reliance on livestock and meeting consumer demand for ethical food options.

- Egg Replacers: Precision fermentation creates animal-free egg white proteins for baking and cooking. These proteins offer the same binding and foaming properties as eggs, ideal for vegan baked goods. They cater to allergy-conscious consumers and reduce environmental impact, supporting scalable, sustainable food production.

- Nutritional Supplements: Precision fermentation produces vitamins and proteins like B12 or collagen for dietary supplements. These ingredients support health-conscious consumers seeking vegan, high-quality nutrition. The controlled process ensures purity and consistency, meeting demand for clean-label, sustainable wellness products.

- Natural Colorants: Precision fermentation crafts natural pigments for food and beverages, replacing synthetic dyes. These vibrant, eco-friendly colorants appeal to consumers prioritizing health and sustainability. They’re used in candies, drinks, and snacks, aligning with clean-label trends and reducing environmental strain.

Recent Developments

1. Geltor

- Geltor, a leader in animal-free collagen and proteins, recently launched HumaColl21, a sustainable collagen for cosmetics and nutraceuticals. The company expanded its production capacity to meet growing demand in the skincare and health markets. Geltor also partnered with global beauty brands to integrate bio-designed collagen into anti-aging products.

2. The Every Co.

- The Every Co. (formerly Clara Foods) specializes in animal-free egg proteins. In 2024, they debuted PepClear, a clear egg white protein for beverages. The company secured new funding to expand into foodservice and CPG markets. Their tech converts yeast into real egg proteins, reducing reliance on poultry farming. Partnerships with major food brands aim to bring fermented egg proteins to retail soon.

3. Motif FoodWorks, Inc.

- Motif FoodWorks, known for plant-based and fermented ingredients, launched APPETEX, a bio-fermented fat for meat alternatives, improving juiciness and texture. They also partnered with food manufacturers to enhance plant-based burgers and dairy. Motif focuses on taste and mouthfeel innovation, leveraging precision fermentation to compete with traditional meat.

4. Imagindairy Ltd.

- Imagindairy, an animal-free dairy protein startup, scaled production of whey and casein using microbial fermentation. In 2024, they partnered with European food brands to launch fermented dairy products. Their tech delivers real milk proteins without cows, targeting lactose-free and vegan markets. Expansion into B2B ingredients is a key focus.

5. Formo

- Formo, a German precision fermentation dairy company. They plan to launch fermented casein-based mozzarella in Europe. Formo collaborates with chefs and foodtech firms to perfect melt-and-stretch properties, aiming to disrupt traditional dairy.

Conclusion

The Precision Fermentation Ingredients Market is set for massive growth, driven by rising demand for sustainable, animal-free alternatives in food, cosmetics, and pharmaceuticals. The sector is fueled by advancements in biotech, consumer shift toward eco-friendly products, and increasing investments. Companies like Geltor, The Every Co., and Formo are leading the way with innovative proteins, dairy, and collagen, proving that lab-grown ingredients can match (or even surpass) traditional ones in taste, nutrition, and functionality.