Table of Contents

Overview

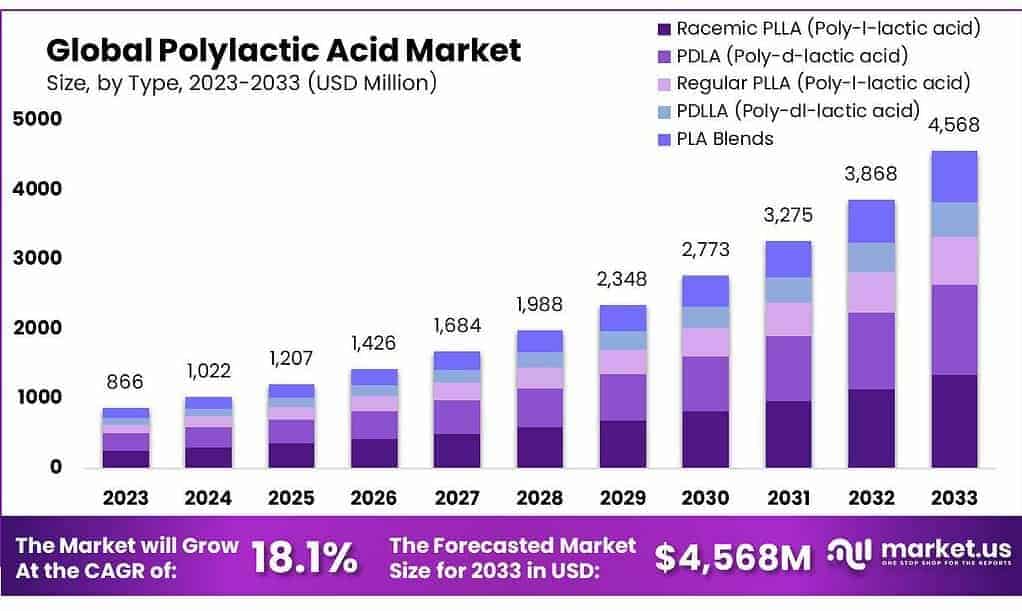

New York, NY – January 7, 2025 – The Polylactic Acid Market is witnessing rapid growth, with its value estimated at USD 866 million in 2023 and expected to climb to USD 4,568 million by 2033. This growth, reflecting a strong CAGR of 18.10%, is primarily fueled by the packaging industry. The sector’s expansion is driven by increasing legislative measures against single-use plastics and a rising consumer shift towards eco-friendly products.

North America and Europe are at the forefront of Polylactic Acid adoption, supported by their well-established recycling infrastructures and stringent environmental policies. In contrast, the Asia-Pacific region is quickly emerging as a promising market for Polylactic Acid due to its rapid industrialization and growing awareness of sustainable materials.

The Polylactic Acid demand is largely influenced by a global drive towards sustainability and efforts to reduce carbon footprints. Governments worldwide are imposing strict regulations to phase out non-biodegradable plastics, significantly boosting the market for Polylactic Acid alternatives. For example, the European Union’s initiative to ban single-use plastics by 2025 has markedly increased Polylactic Acid adoption rates. Additionally, the rising popularity of organic and eco-friendly food products has spurred demand for PLA in food and beverage packaging.

The Polylactic Acid market is evolving with the development of high-performance Polylactic Acid grades that boast improved mechanical and thermal properties. This advancement is prompting companies to invest in research and development to extend Polylactic Acid’s application range, particularly into the automotive and electronics sectors. Moreover, there is an increasing trend towards blending Polylactic Acid with other biopolymers, enhancing its durability and making it more cost-effective.

Key Takeaways

- The global PLA market is projected to grow from USD 866 million in 2023 to USD 4,568 million by 2033, at a CAGR of 18.10%.

- Standard PLA Accounted for 54.3% of the market in 2023, driven by its extensive use in packaging and disposable products.

- Films & Sheets Applications Led the market with a 35.6% share in 2023, primarily used in food and agricultural packaging.

- Thermoforming Grade PLA Held a 27.8% market share in 2023, showcasing strong demand.

- Corn Starch Dominated the raw material segment with a 56.8% share in the PLA sector.

- Packaging Sector Represented 44.5% of the PLA market in 2023, driven by eco-friendly packaging demand.

- North America led the market with a 36.5% share, valued at USD 315.9 million in 2023.

Key Market Segments

In 2023, Standard PLA dominated the market, holding over 54.3% of the share, driven by its cost-effectiveness and widespread use in packaging, disposable utensils, and consumer products. Advanced PLA composites accounted for 30.2%, with enhanced mechanical properties making them suitable for automotive parts and durable goods. Specialty grades of PLA covered the remaining share, catering to niche industrial applications.

By grade, Thermoforming PLA led the market with a 27.8% share due to its versatility in creating complex shapes for packaging. Injection Molding PLA and Extrusion-grade PLA also held significant portions, serving diverse applications such as cutlery, automotive parts, films, and medical supplies. Blow Molding PLA accounted for hollow products like bottles, while specialty PLA grades addressed 3D printing and textiles.

In raw materials, Corn Starch dominated with a 56.8% share, favored for its cost-effectiveness and renewable nature. Sugarcane followed as a sustainable option, reducing carbon footprints. Cassava gained traction in regions prioritizing biodegradable materials, while beet and wheat served as alternative sources in regions seeking diversity in bio-based production.

By application, Films & Sheets led the market with 35.6%, widely used in food packaging and agricultural films. Bottles were another key segment, benefiting from PLA’s safety and eco-friendly attributes for beverages and personal care products. Rigid Thermoforms, used for disposable food service items, and specialty applications like 3D printing, textiles, and cutlery further expanded PLA’s utility.

In end-use sectors, Packaging dominated with a 44.5% share, driven by demand for sustainable solutions in food, beverages, and consumer goods. Agriculture utilized PLA in mulch films and planting containers to enhance sustainability. Consumer Goods relied on PLA for eco-friendly tableware, toys, and hygiene products. Textiles valued PLA for its use in sustainable fibers for clothing and upholstery.

Regional Analysis

In 2023, North America dominated the Polylactic Acid (PLA) market with a 36.5% share, valued at approximately USD 315.9 million. Europe followed closely, driven by stringent environmental regulations and widespread adoption of PLA in packaging and agriculture. Asia Pacific emerged as the fastest-growing region, with significant growth in China and India due to industrialization, urbanization, and increased use of PLA in textiles and consumer goods. The Middle East & Africa and Latin America contributed smaller shares but showed gradual growth, supported by rising interest in sustainable agricultural practices and eco-friendly packaging solutions.

Top Use Cases of Polylactic Acid Market

Sustainable Packaging: PLA is extensively used in food packaging, including biodegradable containers, wrappers, and films. Its compostability and strength make it a preferred choice for single-use packaging, aligning with global sustainability goals and regulatory mandates.

Disposable Utensils and Tableware: PLA is widely utilized in manufacturing biodegradable plates, cups, cutlery, and straws, catering to the growing demand for eco-friendly alternatives in the food service industry.

Agricultural Films: PLA-based mulch films and planting containers are used in agriculture to improve sustainability and reduce soil pollution, offering an eco-friendly alternative to conventional plastic films.

3D Printing: PLA is a popular material in 3D printing due to its ease of use, affordability, and biodegradability. It is commonly used for prototypes, models, and even medical devices like prosthetics.

Textiles and Fibers: PLA is used in creating eco-friendly textiles for clothing, upholstery, and non-woven fabrics. Its renewable origin and low environmental impact make it suitable for sustainable fashion and industrial applications.

Bottles and Containers: PLA is increasingly used in manufacturing biodegradable bottles and containers for beverages, cosmetics, and medical products, owing to its safety for consumables and environmental benefits.

Medical Applications: PLA is used in biocompatible applications such as surgical implants, drug delivery systems, and medical sutures, as it safely degrades in the body over time.

Durable Goods: Advanced PLA composites are employed in durable goods, including automotive components, electronics casings, and consumer products, due to their enhanced strength and thermal resistance.

Recent Developments

In 2023, BASF focused on expanding its PLA production capabilities and partnerships to meet rising demand for sustainable materials. The company launched new initiatives to enhance the performance and cost-efficiency of PLA, which is widely used in packaging, textiles, and medical applications. They aim to boost their PLA production to over 150,000 metric tons annually by 2025.

In 2023, COFCO’s subsidiary, COFCO Biochemical, ramped up efforts to produce PLA from renewable agricultural resources. They are part of a broader push to enhance China’s PLA production capacity, aiming to reach 100,000 tons annually by 2025. In 2024, COFCO’s PLA output is expected to increase by 10-15% as part of the company’s commitment to reducing plastic waste and expanding its presence in the global green economy.

In 2024, Danimer is focusing on scaling up production to meet the rising global demand for sustainable packaging solutions. The company plans to increase its PLA production capacity to around 250 million pounds annually by 2025, marking a strong commitment to sustainability.

In 2023, Dow introduced new PLA formulations designed to offer better durability and heat resistance, making it a more attractive option for a wider range of applications. Dow’s PLA capacity is expected to grow by 15% in 2024 as part of its broader strategy to expand its sustainable product offerings. The company’s total investment in renewable and bioplastic technologies reached approximately $1.5 billion by the end of 2023, signaling its commitment to increasing sustainable material production.

The Futerro PLA production capacity reached 75,000 tons annually by the end of 2023, and in 2024, they plan to increase this by 10-15% as demand for biodegradable plastics continues to rise. Futerro’s efforts are aimed at providing high-quality, renewable, and biodegradable plastics to replace petroleum-based alternatives in packaging and other sectors.

Conclusion

In conclusion, the polylactic acid (PLA) sector has seen significant growth in recent years, driven by increasing demand for sustainable and biodegradable alternatives to traditional plastics. Companies like BASF, Danimer Scientific, COFCO, Dow Chemicals, and Futerro are investing heavily in expanding production capacities and improving PLA’s performance in various applications, including packaging, textiles, and medical products.

As of 2023 and 2024, global PLA production capacity is on track to exceed 500,000 tons annually, with further expansion expected to meet growing consumer demand for eco-friendly products. However, challenges such as cost competitiveness and scalability remain, but continued technological advancements and strategic partnerships are likely to drive further innovation. Overall, the PLA market is expected to maintain strong growth, offering promising opportunities for both producers and end-users in industries committed to sustainability.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)