Table of Contents

Introduction

The Global Plastic Pallets Market is projected to reach a value of approximately USD 12.8 billion by 2033, increasing from USD 7.5 billion in 2023. This growth represents a compound annual growth rate (CAGR) of 5.5% during the forecast period from 2024 to 2033.

Plastic pallets are durable, lightweight, and reusable platforms primarily used for the transportation, storage, and handling of goods in various industries, including manufacturing, retail, and logistics. The plastic pallets market refers to the industry involved in the production, distribution, and sale of these pallets, which are increasingly favored over traditional wood pallets due to their enhanced hygiene, lower maintenance requirements, and longer lifespan.

The growth of the plastic pallets market can be attributed to several factors, including the increasing demand for sustainable and cost-effective packaging solutions, stricter regulations on hygiene and product safety, and the shift towards automation in supply chains. Additionally, the growing e-commerce sector and the expansion of global trade have amplified the need for efficient and durable logistics solutions. Opportunities in the market lie in the development of eco-friendly plastic pallets made from recycled materials, as well as innovations in lightweight and customizable pallet designs that cater to specific industry needs.

Key Takeaways

- The Plastic Pallets Market was valued at USD 7.5 billion in 2023 and is projected to reach USD 12.8 billion by 2033, growing at a CAGR of 5.5%.

- In 2023, High-Density Polyethylene (HDPE) was the leading material, commanding a 66.8% market share, owing to its strength and durability.

- Nestable pallets led the market in 2023 with a 42% share, driven by their space-saving and cost-efficient design.

- The Food & Beverages sector was the largest end-use industry in 2023, representing 22.8% of the market, primarily due to stringent hygiene and safety requirements.

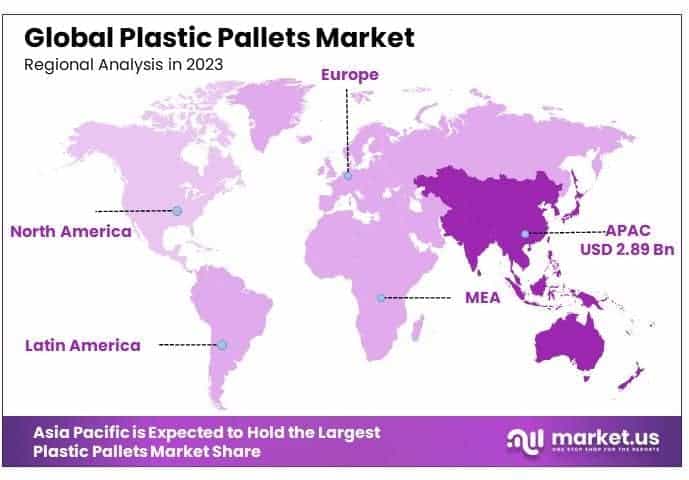

- Asia Pacific held the largest regional share in 2023 at 38.6%, contributing USD 2.89 billion, supported by rapid industrialization and robust growth in the manufacturing sector.

Key Segments Analysis

The Plastic Pallets Market is primarily dominated by High-Density Polyethylene (HDPE), which holds a 66.8% market share due to its strength, durability, and resistance to impact, chemicals, and moisture, making it ideal for heavy-duty applications. Other materials, such as Low-Density Polyethylene (LDPE), Polypropylene (PP), and recycled or composite materials, also contribute to the market, though to a lesser extent. LDPE pallets, being softer and more flexible, are suited for lighter loads, while PP pallets are favored in high-temperature environments. Sustainable material options continue to gain traction, offering niche solutions with a focus on cost-efficiency and environmental impact.

Nestable pallets dominate the market with a 42% share, primarily due to their space-saving design and cost-efficiency. These pallets, which fit into one another when empty, are highly valued in industries where storage space and transportation costs are a concern. Rackable and stackable pallets also maintain significant market presence, with rackable pallets designed for heavy loads in racking systems and stackable pallets offering efficient floor stacking solutions. Additionally, specialized pallet types cater to niche industries, such as those requiring custom solutions for the chemical sector or hazardous materials, though they hold a smaller market share.

The Plastic Pallets Market is primarily driven by the food and beverages sector, which holds the largest market share at 22.8%. This dominance is attributed to the sector’s high demand for hygienic, safe, and durable storage solutions, particularly for perishable goods. Plastic pallets are favored for their ease of cleaning, moisture resistance, and compliance with food safety regulations, reducing shipping costs. Other key industries include chemicals, pharmaceuticals, and petroleum & lubricants, where plastic pallets’ durability, resistance to chemicals, and ability to withstand extreme conditions are crucial. Additionally, sectors like retail, automotive, and electronics contribute to the market by leveraging plastic pallets to enhance supply chain efficiency and product safety.

Emerging Trends

- Sustainability and Eco-friendly Materials: The increasing demand for sustainable packaging solutions has driven the growth of plastic pallets made from recyclable materials. Manufacturers are focusing on developing products that reduce environmental impact, particularly through the use of recycled plastic. As sustainability becomes a key driver in various industries, plastic pallets are being optimized for better recyclability and reduced carbon footprints.

- Integration with Automation Systems: The use of plastic pallets in automated warehouse environments is gaining traction. Automated systems require standardized, durable, and lightweight pallets, which plastic pallets can easily provide. This trend is largely driven by the increasing adoption of robotics, automated guided vehicles (AGVs), and automated storage and retrieval systems (ASRS) in logistics operations.

- Customization for Specific Industries: Plastic pallets are being customized to meet the unique needs of different industries. For example, in the food and beverage sector, plastic pallets with antimicrobial properties are becoming more common. Similarly, pharmaceutical companies are investing in plastic pallets that meet stringent hygiene standards. The growing need for tailored solutions is helping to drive the development of specialized plastic pallet designs.

- Growing Popularity of Pooling Systems: Pallet pooling systems, where companies share or rent plastic pallets rather than owning them, are becoming more popular. This trend is particularly prevalent in industries such as retail, automotive, and agriculture. Pooling offers cost-effective solutions by reducing the need for upfront investments and by promoting the efficient use of resources.

- Enhanced Durability and Longevity: Advancements in plastic pallet manufacturing are improving the strength and longevity of these products. New materials and designs are making plastic pallets more resistant to wear and tear, cracking, and breaking. This improvement in durability ensures a longer lifespan for plastic pallets, thereby providing cost savings in the long run for users across industries.

Top Use Cases

- Logistics and Supply Chain Management: Plastic pallets are widely used in logistics to streamline the supply chain process. Their light weight and durability reduce shipping costs, and they can easily fit into automated systems, ensuring faster handling times. For instance, the average weight of a plastic pallet is about 30-50% lighter than a traditional wooden pallet, making it an ideal choice for reducing transport expenses.

- Food and Beverage Industry: Plastic pallets are increasingly being adopted in the food and beverage sector due to their hygienic properties. They are easier to clean compared to wooden pallets, and their smooth surfaces reduce the risk of contamination. This is especially important for industries adhering to strict hygiene standards, as plastic pallets are not prone to absorbing moisture or harboring bacteria.

- Pharmaceutical Sector: In the pharmaceutical industry, plastic pallets are gaining importance due to their ability to meet regulatory requirements for cleanliness and durability. The pharmaceutical supply chain often requires pallets that can be easily sanitized, and plastic pallets fulfill this requirement more effectively than wood. They also reduce the risk of contamination during storage and transportation of sensitive medical products.

- Retail and Consumer Goods: In the retail sector, plastic pallets are increasingly used for transportation and display purposes. Their uniform design and sturdy construction allow them to be stacked easily for efficient storage in warehouses and on retail floors. Their strength supports heavy product loads, with plastic pallets being capable of carrying 1,000 to 2,500 kilograms of goods, depending on the design.

- Automotive Industry: The automotive industry uses plastic pallets for parts storage and transportation due to their durability and compatibility with automated systems. These pallets are often used in assembly lines where parts need to be moved efficiently from one stage to the next. The ability to withstand harsh conditions and offer superior weight tolerance makes them an ideal choice for automotive parts logistics.

Major Challenges

- Higher Initial Cost: Despite their long-term durability, plastic pallets have a higher upfront cost compared to traditional wooden pallets. This can be a significant barrier for small and medium-sized businesses, where initial capital expenditure is crucial. While the cost is justified over time due to reduced replacement needs, the initial investment remains a challenge for many companies.

- Material Durability in Extreme Conditions: Plastic pallets, while generally durable, can face challenges when exposed to extreme temperatures or heavy industrial environments. In particularly cold or hot conditions, some types of plastic may become brittle or warp, limiting their lifespan in certain industries. This poses a challenge for applications in cold storage or outdoor settings where temperature fluctuations are extreme.

- Limited Load Capacity for Heavy Loads: While plastic pallets are strong, their load capacity can still be a limiting factor compared to metal pallets, especially for industries handling extremely heavy loads. Typically, plastic pallets can carry weights between 1,000 and 2,500 kilograms, but they may not be suitable for larger, heavier items, which restricts their use in certain heavy-duty applications.

- Vulnerability to UV Degradation: Plastic pallets exposed to prolonged sunlight may experience UV degradation. This can lead to a reduction in the strength and structural integrity of the pallets, particularly for those made from lower-grade plastics. As UV radiation can weaken plastic materials over time, industries that use plastic pallets outdoors or in unprotected environments may face increased maintenance costs.

- Recycling and Disposal Concerns: Although plastic pallets are recyclable, the actual recycling rate is still lower than desired, especially when compared to other materials like metal or cardboard. Not all plastic pallets are made from recyclable plastics, and some may not be efficiently processed after their lifecycle ends. As sustainability becomes a growing concern, improving the recycling process and developing better disposal practices will be a challenge for the industry.

Top Opportunities

- Expansion of E-commerce: The continued expansion of e-commerce is driving demand for plastic pallets in the retail and logistics sectors. As online shopping continues to rise, there is an increasing need for efficient, durable, and cost-effective shipping solutions. Plastic pallets, being lightweight and compatible with automated systems, are well-positioned to serve this growing demand.

- Advancements in Recycling Technology: The development of advanced recycling technologies offers opportunities for reducing the environmental footprint of plastic pallets. Innovations in materials recycling and closed-loop systems could lead to the creation of more sustainable plastic pallets, thereby appealing to eco-conscious consumers and businesses. This could also help reduce costs associated with raw material procurement.

- Rising Demand for Hygiene Standards: The increasing focus on hygiene, particularly in food, pharmaceuticals, and healthcare industries, is creating opportunities for plastic pallets that meet stringent sanitary standards. Their easy-to-clean surface and resistance to bacterial growth position plastic pallets as a prime choice for industries requiring high hygiene levels.

- Adoption of Circular Economy Practices: The shift towards circular economy models presents an opportunity for plastic pallet manufacturers. By focusing on product reuse, recycling, and refurbishment, companies can reduce waste and offer more sustainable solutions to industries. As the focus on the circular economy grows, plastic pallets could become integral in reducing logistics waste across supply chains.

- Technological Integration with IoT: The integration of Internet of Things (IoT) technology with plastic pallets is opening up new growth opportunities. By embedding sensors in plastic pallets, companies can track their location, monitor their condition, and optimize supply chain efficiency. This increased traceability could lead to better inventory management, enhanced supply chain visibility, and reduced losses.

Key Player Analysis

- Orbis Corporation: Orbis Corporation is a leading player in the global plastic pallets market, specializing in reusable plastic packaging solutions. The company’s offerings include a wide range of plastic pallets, bins, and containers, catering to industries like retail, automotive, and food and beverage. Orbis’ innovative pallet solutions are designed to be durable and cost-effective, reducing the need for wood pallets.

- Monoflo International: Monoflo International is another key player in the plastic pallets industry, providing innovative plastic pallet solutions to a wide range of industries, including food, beverage, and logistics. The company is known for its strong focus on sustainability, offering products made from recycled materials. Monoflo’s plastic pallets are highly durable, designed to reduce overall transport costs by being lightweight and stackable.

- CABKA Group: CABKA Group, headquartered in Germany, is a prominent manufacturer of plastic pallets, bins, and containers. Known for its emphasis on quality and sustainability, CABKA offers products that are used in various industries, including logistics, automotive, and pharmaceuticals. The company has expanded its operations globally, with manufacturing plants in Europe, North America, and Asia. The company is a recognized leader in Europe and is increasingly gaining traction in other regions.

- Rehrig Pacific Company: Rehrig Pacific Company is a well-established player in the plastic pallets market, offering a wide array of sustainable solutions to industries such as food and beverage, retail, and supply chain management. The company is committed to creating environmentally-friendly products with long-term durability. Rehrig Pacific operates across North America, with some international reach.

- Allied Plastics Inc.: Allied Plastics is a major supplier of plastic pallets, containers, and other packaging solutions, serving industries such as retail, logistics, and agriculture. The company focuses on delivering high-quality plastic pallet solutions with an emphasis on performance and environmental benefits. The company is headquartered in the U.S. and serves clients across the globe.

Regional Analysis

Asia Pacific: Dominating the Plastic Pallets Market with the Largest Market Share of 38.6%

The Asia Pacific region is projected to maintain its leadership in the global plastic pallets market, accounting for a substantial market share of 38.6% in 2023. Valued at approximately USD 2.89 billion, the region’s dominance can be attributed to several key factors. The rapid industrialization, coupled with the growing demand for advanced logistics solutions, particularly in countries such as China, India, Japan, and South Korea, has significantly boosted the adoption of plastic pallets in various sectors, including retail, food and beverage, and automotive.

Furthermore, the region’s strong manufacturing base, low-cost labor, and increasing demand for sustainable packaging solutions have contributed to the market’s robust growth. Asia Pacific’s prominence is further supported by the rising emphasis on automation in supply chains and the need for more durable, hygienic, and eco-friendly pallet options. As the largest market for plastic pallets, Asia Pacific’s growth trajectory remains favorable, driven by both regional demand and global export activities.

Recent Developments

- In July 2023, Nefab, a prominent global provider of industrial packaging and logistics services, inaugurated a new manufacturing plant in Chihuahua, Mexico. This new facility aims to meet the growing demand for wood and plywood crating, as well as thermoformed and corrugated solutions in the region.

- On September 20, 2023, Brambles published its 2023 Sustainability Review, detailing the company’s significant achievements in Environmental, Social, and Governance (ESG) areas for the fiscal year ending June 30, 2023. The report highlights Brambles’ ongoing commitment to sustainability and its efforts to build resilient, circular supply chains globally.

- In April 2024, Rehrig Pacific, a leading company in logistics and material handling solutions, acquired QTEK Design. This acquisition, which specializes in pallet splitting, exchanging, and dispensing machinery, strengthens Rehrig Pacific’s portfolio and enhances its ability to provide innovative, efficiency-driven solutions to its customers.

- In 2024, Schoeller Allibert announced that its VP of Sustainability and Strategic MarCom, Britta Wyss Bisang, will be speaking at the Smithers Sustainability in Packaging Europe 2024 event in Barcelona. This major event, scheduled for October 8–10, will focus on sustainable packaging innovations and attract industry leaders to discuss new eco-friendly packaging solutions.

Conclusion

The global plastic pallets market is poised for substantial growth, driven by a combination of factors including the increasing demand for sustainable packaging solutions, stringent hygiene standards, and the ongoing adoption of automation across industries. As businesses across various sectors recognize the long-term cost-saving potential and operational efficiencies offered by plastic pallets, the shift away from traditional wooden pallets is becoming more pronounced.